UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

VIASAT, INC.

(Name of Issuer)

Common

Stock, par value $0.0001 per share

(Title of Class of Securities)

92552V100

(CUSIP Number)

Jeff Davis

Chief Legal & Corporate Affairs Officer

Ontario Teachers’ Pension Plan Board

160 Front Street West, Suite 3200

Toronto, Ontario M5J 0G4

Canada

(416) 228-5900

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

August 12, 2024

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-l(e),

240.13d-l(f) or 240.13d-l(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240 13d-7 for other parties to whom copies are to be sent.

1 The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

| * | The information required on the remainder of this cover page shall not be deemed to be “filed”

for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that

section of the Act but shall be subject to all other provisions of the Act (however, see the Notes). |

1. |

Names of Reporting Persons

Ontario Teachers’ Pension Plan Board

|

| 2. |

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☒ (b) ☐

|

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO

|

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items

2(d) or 2(e)

|

| 6. |

Citizenship or Place of Organization

Ontario, Canada

|

Number of Shares

Beneficially Owned

By Each Reporting

Person With |

7. |

Sole Voting Power

0

|

| 8. |

Shared Voting Power

8,545,334

|

| 9. |

Sole Dispositive Power

0

|

| 10. |

Shared Dispositive Power

8,545,334

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

8,545,334

|

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) [_] |

| 13. |

Percent of Class Represented by Amount in Row (11)

6.69%(1)

|

| 14. |

Type of Reporting Person (See Instructions)

OO

|

| |

|

|

|

| (1) | Calculated based on 127,779,170 shares of Common Stock outstanding as of July 26, 2024, as

disclosed by Viasat, Inc. (the “Issuer”) in its Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission

(the “SEC”) on August 9, 2024. |

Item

1. Security and Issuer

This Amendment No. 1 (this “Statement”)

amends and supplements the Schedule 13D, originally filed on June 9, 2023, as amended (the “Schedule 13D”). Except as set

forth herein, the Schedule 13D remains in full force and effect. Each capitalized term used but not defined herein has the meaning ascribed

to such term in the Schedule 13D.

Item

2. Identity and Background

This Amendment amends and restates Item 2(b) - (c) of

the Original Schedule 13D in its entirety as set forth below:

(b) The address of the principal business and principal

office of the Reporting Person is 160 Front Street West, Suite 3200, Toronto, Ontario M5J 0G4.

(c) The Reporting Person’s principal business

is administering, investing and managing the pension funds of active and retired teachers in Ontario, Canada. The name, business address,

present principal occupation and citizenship of each director and executive officer of the Reporting Person are set forth on Schedule

A, respectively.

Item

4. Purpose of Transaction

Item 4 of the Schedule 13D is amended to

add the following at the end thereof:

Rule 144 Sale

On August 12, 2024, certain of the Investor Sellers sold

an aggregate of 11,245,769 shares of Common Stock in an unregistered block sale transaction pursuant to Rule 144 under the Securities

Act of 1933, as amended, at a net price per share of $19.90 (the “Block Sale”). The Reporting Persons sold an aggregate

of 2,811,442 shares of Common Stock pursuant to the Block Sale.

The Block Sale was consummated as part of the Reporting Persons

normal course evaluation of its investment. The Reporting Persons intend to monitor and evaluate their investment on an ongoing basis

and expect regularly to review and consider alternative ways of maximizing their return on such investment. Subject to market conditions,

valuations, regulatory approvals and any other approvals, the Reporting Persons may acquire additional securities of the Issuer or dispose

of any or all securities of the Issuer in open market transactions, privately negotiated transactions or otherwise.

In exploring ways to maximize the return on its investment,

and as part of its ongoing investment activities, the Reporting Persons may engage in discussions with representatives of the Issuer and/or

with other holders of the Issuer’s securities and, from time to time, suggest or take a position regarding, or participate in, a

variety of matters relating to the Issuer, which may include, among other things, the Issuer’s operations, management, corporate

governance, capital structure or its control, strategic alternatives and direction. To facilitate its consideration of such matters, the

Reporting Persons may retain consultants and advisors and may enter into discussions with potential sources of capital and other third

parties. The Reporting Persons may exchange information with any such persons pursuant to appropriate confidentiality or similar agreements.

The Reporting Persons will likely take some or all of the foregoing steps at preliminary stages in their consideration of various possible

courses of action, before forming any intention to pursue any particular plan or direction.

Each Reporting Person may, at any time, and from time to

time, (i) review or reconsider its position and/or change its purpose and/or formulate plans or proposals with respect thereto and

(ii) consider or propose one or more of the actions described in subparagraphs (a) - (j) of Item 4 of the instructions

to Schedule 13D.

Item

5. Interest in Securities of the Issuer

The information contained in Items 5(a) - (d) is hereby amended

and restated in its entirety.

(a) The responses to

Item 7-13 on each of the cover pages of this statement on Schedule 13D are incorporated herein by reference.

(b) After giving effect

to closing of the Block Sale, OTPP directly holds 8,545,334 shares of Common Stock.

As a result of the Coordination

Agreement described in Item 6, the Investor Sellers may be deemed to be members of a “group” within the meaning of Section 13(d)(3)

of the Exchange Act. Such “group” would beneficially own an aggregate of 34,181,334 shares of Common Stock, representing 26.75%

shares of Common Stock outstanding as of July 26, 2024, based on information provided by the Issuer. The securities reported herein by

the Reporting Persons do not include any Common Stock beneficially owned by the other parties to the Stockholders Agreement or the Coordination

Agreement not included as Reporting Persons on this Schedule 13D (the “Other Shares” and “Other Parties,” respectively).

The Other Parties have been notified that they may need to file separate beneficial ownership reports with the SEC related to their beneficial

ownership of the Other Shares and membership in the “group” described herein. Neither the filing of this Schedule 13D nor

any of its contents, however, shall be deemed to constitute an admission by the Reporting Persons that any of them is the beneficial owner

of any of Other Shares for purposes of Section 13(d) of the Act or for any other purpose, and such beneficial ownership is expressly

disclaimed.

(c) The information set forth in Item 3 above is incorporated

by reference into this Item 5(c).

(d) Pursuant to the Coordination Agreement among OTPP,

the Reporting Persons and Other Parties, the Reporting Persons collectively sold 11,245,769 shares of Common Stock in the Block Sale for

$19.90 per share. The Reporting Persons have not otherwise transacted in the Issuer’s securities within the prior 60 days.

To the best knowledge of the Reporting

Person, no person other than the Reporting Person has the right to receive or the power to direct the receipt of dividends from, or the

proceeds from the sale of, the securities beneficially owned by the Reporting Person identified in this Item 5.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

The information set forth in Item 5 of this Statement is

herein incorporated to the Schedule 13D.

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 14, 2024

| |

ONTARIO TEACHERS’ PENSION PLAN BOARD |

| |

|

|

| |

By: |

/s/ Jonathan Law |

| |

Name: |

Jonathan Law |

| |

Title: |

Managing Director, Corporate & Investments Compliance |

Schedule A

Board of Directors

| Name |

Business Address |

Principal Occupation or Employment |

Citizenship |

| Cindy Lou Forbes |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| Cathryn Elizabeth Cranston |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| Patricia Anne Croft |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| Steven Robert McGirr |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| Melville George Lewis |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| Gene Lewis |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| Monika Federau |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| Deborah Stein |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| Timothy Hodgson |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| Thomas Wellner |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| Martine Irman |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| Jaqui Parchment |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Board Member |

Canadian |

| |

|

|

|

| Executive Officers |

| |

|

|

|

| Name |

Business Address |

Principal Occupation or Employment |

Citizenship |

| Tracy Lee Abel |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Chief Operations Officer |

Canadian |

| Gillian Margaret Boyd Brown |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Chief Investment Officer, Public and Private Investments |

Canadian |

| William Dale Burgess |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Executive Managing Director, Infrastructure & Natural Resources |

Canadian |

| Jeffrey Michael Davis |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Chief Legal & Corporate Affairs Officer |

Canadian |

| Stephen Frederick James McLennan |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Chief Investment Officer, Asset Allocation |

Canadian |

| Mabel Wong |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Chief Financial Officer |

Canadian |

| Olivia Penelope Steedman |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Executive Managing Director, Teachers’ Venture Growth |

Canadian |

| Andrew Jonathan Mark Taylor |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

President & Chief Executive Officer |

United Kingdom |

| Beth Ellen Tyndall |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Chief People Officer |

Canadian |

| Kathryn Ruth Fric |

160 Front Street West, Suite

3200, Toronto, ON M5J 0G4 |

Chief Risk Officer |

Canadian |

| Nicolas Jansa |

160 Front Street West, Suite 3200, Toronto, ON M5J 0G4 |

Executive Managing Director, Europe, the Middle East and Africa |

United Kingdom |

| Sharon Lynn Chilcott |

160 Front Street West, Suite 3200, Toronto, ON M5J 0G4 |

Chief of Staff |

Canadian |

| Jonathan Hausman |

160 Front Street West, Suite 3200, Toronto, ON M5J 0G4 |

Chief Strategy Officer |

Canadian |

| Charley Butler |

160 Front Street West, Suite 3200, Toronto, ON M5J 0G4 |

Chief Pension Officer |

United Kingdom |

| Romeo Leemrijse |

160 Front Street West, Suite 3200, Toronto, ON M5J 0G4 |

Executive Managing Director, Equities |

Canadian |

| Stephen Saldanha |

160 Front Street West, Suite 3200, Toronto, ON M5J 0G4 |

Executive Managing Director, Total Fund Management |

Canadian |

| Bernard Luis Grzinic |

160 Front Street West, Suite 3200, Toronto, ON M5J 0G4 |

Executive Managing Director, Capital Markets |

Canadian |

| Pierre Cherki |

160 Front Street West, Suite 3200, Toronto, ON M5J 0G4 |

Executive Managing Director, Real Estate |

Canadian |

| Bruce Ross Crane |

160 Front Street West, Suite 3200, Toronto, ON M5J 0G4 |

Executive Managing Director, Asia Pacific |

American |

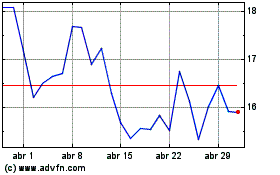

ViaSat (NASDAQ:VSAT)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

ViaSat (NASDAQ:VSAT)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024