UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of August 2024 (Report No. 2)

Commission File Number: 001-40303

Inspira Technologies Oxy B.H.N. Ltd.

(Translation of registrant’s name into

English)

2 Ha-Tidhar St.

Ra’anana 4366504, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

☒ Form 20-F ☐ Form

40-F

CONTENTS

This

Report of Foreign Private Issuer on Form 6-K consists of Inspira Technologies Oxy B.H.N. Ltd.’s (the “Registrant”) (i)

Unaudited Interim Condensed Consolidated Financial Statements as of June 30, 2024, which is attached hereto as Exhibit 99.1; and (ii)

Management’s Discussion and Analysis of Financial Condition and Results of Operations for the six months ended June 30, 2024, which

is attached hereto as Exhibit 99.2.

The

Report on Form 6-K is incorporated by reference into the Registrant’s Registration

Statements on Form F-3

(Registration No. 333-266748) and Form S-8

(Registration Nos. 333-259057 and 333-277980), filed with the Securities and Exchange Commission,

to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently

filed or furnished.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Inspira Technologies Oxy B.H.N. Ltd. |

| |

|

|

| Date: August 15, 2024 |

By: |

/s/ Dagi Ben-Noon |

| |

|

Name: |

Dagi Ben-Noon |

| |

|

Title: |

Chief Executive Officer |

2

Exhibit 99.1

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

INTERIM

CONDENSED FINANCIAL STATEMENTS

AS

OF JUNE 30, 2024

UNAUDITED

_______________________

________________

____________

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

(UNAUDITED)

TABLE

OF CONTENTS

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

UNAUDITED

INTERIM CONDENSED BALANCE SHEETS

(U.S.

dollars in thousands)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | |

| |

| Current Assets: | |

| | |

| |

| Cash and cash equivalents | |

| 3,550 | | |

| 5,041 | |

| Deposits | |

| 3,708 | | |

| 2,320 | |

| Other current assets | |

| 450 | | |

| 432 | |

| Inventory | |

| 376 | | |

| - | |

| Total current assets | |

$ | 8,084 | | |

$ | 7,793 | |

| | |

| | | |

| | |

| Non-Current Assets: | |

| | | |

| | |

| Right of use assets, net | |

| 897 | | |

| 1,011 | |

| Property, plant and equipment, net | |

| 441 | | |

| 506 | |

| Total non-current assets | |

$ | 1,338 | | |

$ | 1,517 | |

| Total Assets | |

$ | 9,422 | | |

$ | 9,310 | |

The

accompanying notes are an integral part of the financial statements.

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

UNAUDITED

INTERIM CONDENSED BALANCE SHEETS

(U.S.

dollars in thousands)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | |

| |

| Current Liabilities: | |

| | |

| |

| Trade accounts payable | |

| 179 | | |

| 198 | |

| Other accounts payable | |

| 1,138 | | |

| 1,026 | |

| Lease liabilities | |

| 298 | | |

| 290 | |

| Financial liabilities at fair market value | |

| 2,009 | | |

| 1,470 | |

| Total current liabilities | |

$ | 3,624 | | |

$ | 2,984 | |

| | |

| | | |

| | |

| Non-Current Liabilities: | |

| | | |

| | |

| Lease liabilities | |

| 455 | | |

| 588 | |

| Total non- current liabilities | |

$ | 455 | | |

$ | 588 | |

| | |

| | | |

| | |

| Shareholders’ Equity: | |

| | | |

| | |

| Ordinary shares, no par value: Authorized 100,000,000 as of June 30, 2024 and December 31, 2023; issued and outstanding 18,438,917 shares as of June 30, 2024 and 15,652,176 shares as of December 31, 2023 | |

| - | | |

| - | |

| Share capital and additional paid-in capital | |

| 67,104 | | |

| 61,259 | |

| Accumulated losses | |

| (61,761 | ) | |

| (55,521 | ) |

| Total Shareholders’ Equity | |

$ | 5,343 | | |

$ | 5,738 | |

| Total Liabilities and Shareholders’ Equity | |

$ | 9,422 | | |

$ | 9,310 | |

The

accompanying notes are an integral part of the financial statements.

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

UNAUDITED

INTERIM CONDENSED STATEMENTS OF COMPREHENSIVE LOSS

(U.S.

dollars in thousands)

| | |

Six months ended

June 30, | | |

Six months ended

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Research and development expenses | |

| 3,270 | | |

| 4,022 | |

| Sales and marketing expenses | |

| 349 | | |

| 398 | |

| General and administrative expenses | |

| 2,182 | | |

| 2,089 | |

| Other expenses | |

| 5 | | |

| 4 | |

| Operating loss | |

| 5,806 | | |

| 6,513 | |

| Interest income from deposits | |

| (83 | ) | |

| (191 | ) |

| Finance expenses (income), net | |

| 517 | | |

| (138 | ) |

| Loss before tax | |

| 6,240 | | |

| 6,184 | |

| Taxes on income | |

| - | | |

| - | |

| Total comprehensive and net loss | |

| 6,240 | | |

| 6,184 | |

| | |

| | | |

| | |

Net loss per ordinary share, basic and diluted | |

| (0.38 | ) | |

| (0.53 | ) |

| Weighted average number of ordinary shares | |

| 16,628,582 | | |

| 11,692,017 | |

The

accompanying notes are an integral part of the financial statements.

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

UNAUDITED

INTERIM CONDENSED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(U.S.

dollars in thousands)

For

the six months ended June 30, 2024:

| | |

Ordinary Share Capital | | |

| | |

| |

| | |

Number of

shares | | |

Share capital and

Additional

Paid in

Capital | | |

Accumulated

deficit | | |

Total | |

| Balance at January 1, 2024: | |

| 15,652,176 | | |

| 61,259 | | |

| (55,521 | ) | |

| 5,738 | |

| Changes during the six months ended June 30, 2024: | |

| | | |

| | | |

| | | |

| | |

| Issuance of ordinary shares and pre-funded warrants, net | |

| 2,280,826 | | |

| 4,753 | | |

| - | | |

| 4,753 | |

| Exercise of options | |

| 19,048 | | |

| 2 | | |

| - | | |

| 2 | |

| Restricted share unit (“RSU”) vesting | |

| 441,867 | | |

| - | | |

| - | | |

| - | |

| Issuance of ordinary shares- Advisor fees | |

| 45,000 | | |

| 62 | | |

| - | | |

| 62 | |

| Share-based compensation | |

| - | | |

| 1,028 | | |

| - | | |

| 1,028 | |

| Comprehensive and net loss | |

| - | | |

| - | | |

| (6,240 | ) | |

| (6,240 | ) |

| Balance at June 30, 2024 | |

| 18,438,917 | | |

| 67,104 | | |

| (61,761 | ) | |

| 5,343 | |

For

the six months ended June 30, 2023:

| | |

Ordinary Share Capital | | |

| | |

| |

| | |

Number of

shares | | |

Share capital and

Additional

Paid in

Capital | | |

Accumulated

deficit | | |

Total | |

| Balance at January 1, 2023: | |

| 11,338,940 | | |

| 57,866 | | |

| (44,235 | ) | |

| 13,631 | |

| Changes during the six months ended June 30, 2023: | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| - | | |

| 1,017 | | |

| - | | |

| 1,017 | |

| Restricted share unit vesting | |

| 654,359 | | |

| - | | |

| - | | |

| - | |

| Comprehensive and net loss | |

| - | | |

| - | | |

| (6,184 | ) | |

| (6,184 | ) |

| Balance at June 30, 2023 | |

| 11,993,299 | | |

| 58,883 | | |

| (50,419 | ) | |

| 8,464 | |

The

accompanying notes are an integral part of the financial statements.

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

UNAUDITED

INTERIM CONDENSED STATEMENTS OF CASH FLOWS

(U.S.

dollars in thousands)

| | |

Six months ended

June 30,

2024 | | |

Six months ended

June 30,

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| |

| Net loss | |

| (6,240 | ) | |

| (6,184 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation | |

| 67 | | |

| 25 | |

| Increase (decrease) in other current assets | |

| (19 | ) | |

| 237 | |

| Increase (decrease) in trade accounts payable | |

| (19 | ) | |

| (3 | ) |

| Increase (decrease) in other accounts payable | |

| 112 | | |

| 156 | |

| Increase (decrease) in inventory | |

| (376 | ) | |

| - | |

| Share based compensation | |

| 1,028 | | |

| 1,017 | |

| Issuance of ordinary shares - advisor fees | |

| 62 | | |

| - | |

| Change in fair market value of financial liabilities at fair market value | |

| 539 | | |

| 3 | |

| Decrease (increase) in right of use assets | |

| (5 | ) | |

| (40 | ) |

| Prepayments of lease liabilities | |

| (6 | ) | |

| (7 | ) |

| Net cash used in operating activities | |

| (4,857 | ) | |

| (4,796 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property, plant and equipment | |

| (2 | ) | |

| (199 | ) |

| Change in deposits, net | |

| (1,388 | ) | |

| 1,538 | |

| Change in restricted deposits | |

| 1 | | |

| (2 | ) |

| Net cash provided by (used in) investing activities | |

| (1,389 | ) | |

| 1,337 | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Issuance of ordinary shares and pre-funded warrants, net | |

| 4,753 | | |

| - | |

| Exercise of option | |

| 2 | | |

| - | |

| Net cash provided by financing activities | |

| 4,755 | | |

| - | |

| | |

| | | |

| | |

| Net decrease in cash and cash equivalents and restricted cash | |

| (1,491 | ) | |

| (3,459 | ) |

| Cash, cash equivalents and restricted cash at the beginning of the period | |

| 5,130 | | |

| 6,839 | |

| Cash, cash equivalents and restricted cash at the end of the period | |

| 3,639 | | |

| 3,380 | |

APPENDIX

A – NON-CASH TRANSACTIONS:

| | |

Six months ended

June 30,

2024 | | |

Six months ended

June 30,

2023 | |

| Share based compensation- placement agent warrants against additional paid in capital (Note 5) | |

| 202 | | |

| - | |

APPENDIX

B - AMOUNT PAID DURING THE PERIOD:

| | |

Six months ended

June 30,

2024 | | |

Six months ended

June 30,

2023 | |

| Interest paid | |

| 38 | | |

| 50 | |

The

accompanying notes are an integral part of the financial statements.

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE

1 - GENERAL:

| 1. | Inspira

Technologies Oxy B.H.N. Ltd (formerly: Insense Medical Ltd.) (the “Company”) was incorporated in Israel and commenced its

operations on February 27, 2018. The Company operates in the medical technology industry in the field of respiratory support technology.

The Company is engaged in the research, development, manufacturing related and go-to-market activities of proprietary products and technologies.

The Company is developing the following products: |

| ● | The

INSPIRA ART (Gen 2) (Augmented Respiratory Technology), which is a respiratory support technology targeted toward utilizing direct blood

oxygenation to boost patient saturation levels within minutes while the patient is awake and spontaneously breathing. The aim is to reduce

the need for invasive mechanical ventilation, with the potential to reduce risks, complications and high costs. |

| | | |

| ● | The

HYLA blood sensor, which is a non-invasive optical blood sensor designed to perform real-time and continuous blood measurements, potentially

minimizing the need to take actual blood samples from patients. |

| | | |

| ● | The

INSPIRA ART100 Device, an advanced form of life support system better known by the medical industry as a cardiopulmonary bypass system

is being designed for use in surgical procedures requiring cardiopulmonary bypass for six hours or less. |

| 2. | The

Company’s INSPIRA™ ART100 system received U.S. Food and Drug Administration 510(k) clearance for Cardiopulmonary Bypass procedures

and AMAR certification for Extra-Corporeal Membrane Oxygenation and Cardiopulmonary Bypass procedures. The Company’s other products,

including the INSPIRA™ ART (Gen 2) and HYLA™ blood sensor, have not yet been tested or used in humans and have not been approved

by any regulatory entity. |

| 3. | On

December 26, 2023, the Company entered into a purchase agreement (the “December Purchase Agreement”) with an institutional

investor in a registered direct offering (the “December Offering”), pursuant to which the Company issued (i) an aggregate

of 1,375,000 of the Company’s ordinary shares (the “Ordinary Shares”) at a purchase price of $1.28 per share, and (ii)

pre-funded warrants, (“December Pre-Funded Warrants”), to purchase up to 1,656,250 Ordinary shares, at a purchase price of

$1.28, less $0.001 per December Pre-Funded Warrant which were immediately exercised). In addition, pursuant to the December Purchase

Agreement, the Company issued warrants to the institutional investor to purchase up to an aggregate of 3,031,250 Ordinary Shares at an

exercise price of $1.28 per share (“Private Warrants”). The aggregate proceeds received by the Company from the December Offering

were approximately $3,424, after deducting placement agent commissions and additional offering costs which totaled in approximately $454.

In addition, the Company issued the placement agent in the December Offering warrants equal to a total of 7.0% of the aggregate number

of Ordinary Shares sold in the December Offering to purchase up to 212,188 Ordinary Shares (the “December Placement Agent Warrants”).

The fair value of the December Placement Agent Warrants on the issuance date was $131 and it was recorded as part of the issuance costs

(see note 5). |

| 4. | On

April 1, 2024, the Company entered into a purchase agreement with two investors in a registered direct offering (the “April Offering”),

pursuant to which the Company issued an aggregate of 1,339,285 of the Company’s Ordinary Shares at a purchase price of $1.232 per

share. The aggregate proceeds received by the Company from the April Offering were approximately $1,651. |

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE

1 - GENERAL (Cont.):

| 5. | On

June 14, 2024, the Company entered into a purchase agreement with an individual private investor in a registered direct offering (the

“June Offering”), pursuant to which the Company issued (i) an aggregate of 941,541 of the Company’s Ordinary Shares

at a purchase price of $1.30 per share, and (ii) pre-funded warrants, (“June Pre-Funded Warrants”), to purchase up to 1,709,760

Ordinary shares, at a purchase price of $1.30, less $0.001 per June Pre-Funded Warrant. The aggregate proceeds received by the Company

from the June Offering were approximately $3,102, after deducting placement agent commissions and additional offering costs in cash which

totaled in approximately $343. In addition, the Company issued the placement agent in the June Offering warrants equal to a total of

7.0% of the aggregate number of Ordinary Shares sold in the transaction to purchase up to 185,591 Ordinary Shares (the “June Placement

Agent Warrants”). The fair value of the June Placement Agent Warrants on the issuance date was $202 and it was recorded as part

of the issuance costs. (see note 5). |

| 6. | The

accompanying unaudited condensed financial statements (the “Financial Statements”) have been prepared assuming that the Company

will continue as a going concern. To date, the Company is at its development stage. Therefore, the Company has suffered recurring losses

from operations and negative cash flows from operations since inception. As of June 30, 2024, the Company had incurred accumulated losses

of $61.8 million and expects to continue to fund its operations through certain financing, such as issuance of convertible securities,

Ordinary Shares and warrants and through Israeli government grants. There is no assurance that such financing will be obtained. Our dependency

on external funding for our operations raises a substantial doubt about our ability to continue as a going concern. The Financial Statements

do not include any adjustments that might result from the outcome of these uncertainties. |

| 7. | The

Company offices are located in Israel. On October 7, 2023, Hamas terrorists infiltrated Israel’s southern border from the Gaza

Strip and conducted a series of attacks on civilian and military targets. Following the attack, Israel declared war against Hamas and

the Israeli military began to call-up reservists for an active duty. At the same time, and because of the declaration of war against

Hamas, the clash between Israel and Hezbollah in Lebanon has escalated and there is a possibility that it will turn into a greater regional

conflict in the future. As of the date of these financial statements, these events have had no material impact on the Company’s

operations. |

| 8. | Although

we do not currently conduct business in Russia and Ukraine, the escalation of geopolitical instability in Russia and Ukraine as well

as currency fluctuations in the Russian Ruble has had a negative impact on worldwide markets. Such an impact may negatively impact our

supply chain, our operations and future growth prospects in that region. As a result of the crisis in Ukraine, both the U.S.

and other countries have implemented sanctions against certain Russian individuals and entities. Our global operations expose us to risks

that could adversely affect our business, financial condition, results of operations, cash flows or the market price of our securities,

including the potential for increased tensions between Russia and other countries resulting from the current situation involving Russia

and Ukraine, tariffs, economic sanctions and import-export restrictions imposed, and retaliatory actions, as well as the potential negative

impact on our potential business and sales in the region. Current geopolitical instability in Russia and Ukraine and related sanctions

by the U.S. and other governments against certain companies and individuals may hinder our ability to conduct business with potential

customers and vendors in these countries. |

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE

2 - SIGNIFICANT ACCOUNTING POLICIES:

Basis

of preparation

The

accompanying unaudited condensed financial statements have been prepared on the same basis as the annual financial statements. In the

opinion of management, the financial statements reflect all normal and recurring adjustments necessary to fairly state the financial

position and results of operations of the Company. The information included in this report should be read in conjunction with the financial

statements and accompanying notes included in the Company’s Annual Report on Form 20-F for the year ended December 31, 2023, as

filed with the Securities and Exchange Commission (“SEC”) on March 25, 2024. The year-end balance sheet data was derived

from the audited financial statements as of December 31, 2023, but not all disclosures required by generally accepted accounting principles

in the United States (“U.S. GAAP”) are included in this interim report.

Use

of Estimates in the Preparation of Financial Statements

The

preparation of the Company’s financial statements in conformity with U.S. GAAP requires us to make estimates, judgments and assumptions

that may affect the reported amounts of assets, liabilities, equity, expenses and related disclosure of contingent assets and liabilities.

On an ongoing basis, the Company evaluates its estimates, judgments and methodologies. The Company bases its estimates on historical

experience and on various other assumptions that it believes are reasonable, the results of which form the basis for making judgments

about the carrying values of assets, liabilities and equity (including share-based compensation) and the amount of expenses. Actual results

could differ from those estimates.

Impact

of accounting standards to be applied in future periods

In

November 2023, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update, or ASU, 2023-07, Segment Reporting

(Topic 280): Improvements to Reportable Segment Disclosures. This ASU expands public entities’ segment disclosures by requiring

disclosure of significant segment expenses that are regularly provided to the CODM and included within each reported measure of segment

profit or loss, an amount and description of its composition for other segment items, and interim disclosures of a reportable segment’s

profit or loss and assets. All disclosure requirements under ASU 2023-07 are also required for public entities with a single reportable

segment. The ASU’s amendments are effective for all public entities for fiscal years beginning after December 15, 2023, and interim

periods within fiscal years beginning after December 15, 2024, with early adoption permitted. We are currently evaluating the impact

of this pronouncement on our Financial Statements.

In

December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. Under this ASU, public

entities must annually (1) disclose specific categories in the rate reconciliation and (2) provide additional information for reconciling

items that meet a quantitative threshold (if the effect of those reconciling items is equal to or greater than five percent of the amount

computed by multiplying pretax income or loss by the applicable statutory income tax rate). This ASU’s amendments are effective

for all entities that are subject to Topic 740, Income Taxes, for annual periods beginning after December 15, 2024, with early adoption

permitted. We are currently evaluating the impact of this pronouncement on our disclosures.

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE

3 - FINACIAL LIABILITIES AT FAIR MARKET VALUE:

| | |

June 30, 2024 | | |

December 31, 2023 | |

| | |

| | |

| |

| Financial liability (1) | |

| 11 | | |

| 11 | |

| Non-tradable warrants (2) | |

| 1,998 | | |

| 1,459 | |

| Total | |

| 2,009 | | |

| 1,470 | |

Financial

liability to pay 7% fees on the fundings that will be received from exercises of tradable warrants. The financial liability is to be

measured at fair market value through profit or loss. The financial liability fair value as of December 31, 2023, and as of June 30,

2024 is $11 in the both periods.

On

December 26, 2023, the Company entered into the December Purchase Agreement (Note 1 and Note 5), pursuant to which it issued unregistered

warrants, to purchase up to an aggregate of 3,031,250 Ordinary Shares at an exercise of $1.28 per share. The Private Warrants were exercisable

immediately upon issuance and will expire three and a half years following their issuance. The Private Warrants include cashless exercise

mechanism, according to the terms specified in the agreement. The Private Warrants may create obligation to transfer cash to the investors

at fundamental transactions according to fair value of the Black-Scholes model that includes various inputs. Therefore, the Company assesses

the Private Warrants as financial liability instruments that are measured at fair value and recognized financial expenses or income through

profit and loss.

The

Private Warrants fair value as of the issuance date and December 31, 2023, were $1,750 and $1,459 respectively. The warrants fair value

as of the June 30, 2024, was $1,998.

The

key inputs that were used in the Private Warrants fair value were:

| | |

As of

June 30,

2024 | | |

As of

December 31,

2023 | |

| Risk-free interest rate | |

| 4.52 | % | |

| 4 | % |

| Expected volatility | |

| 62.23 | % | |

| 66.63 | % |

| Expected dividend yield of | |

| 0 | % | |

| 0 | % |

| Expected term of warrants | |

| 3 years | | |

| 3.5 years | |

NOTE

4 - RELATED PARTIES

The

following transactions arose with related parties:

Transactions

and balances with related parties:

| 1. | Shareholders

and other related parties’ benefits |

| | |

June 30,

2024 | | |

June 30,

2023 | |

| Salary and related expenses – officers and directors | |

| 881 | | |

| 907 | |

| Share based payment – officers and directors | |

| 652 | | |

| 712 | |

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE

4 - RELATED PARTIES (Cont.):

| 2. | Balances

with related parties |

| Name | | Nature of transaction | | June 30,

2024 | | | December 31,

2023 | |

| Officers | | Salaries and related | | | (374 | ) | | | (314 | ) |

| Directors | | Compensation for directors | | | (30 | ) | | | (40 | ) |

NOTE

5 - SHAREHOLDERS’ EQUITY:

A.

Share capital:

On

April 4, 2023, the Company entered into a sales agreement (the “Sales Agreement”) with Roth Capital Partners, LLC, as sales

agent, pursuant to which the Company could offer and sell, from time to time, through the sales agent, Ordinary Shares pursuant to an

At-The-Market facility (“ATM”). During 2023, the Company sold 17,566 Ordinary Shares under the ATM. On October 23, 2023,

the Company terminated the Sales Agreement and the associated ATM, effective immediately.

On

December 26, 2023, the Company completed the December Offering, whereby the Company sold (i) 1,375,000 Ordinary Shares at a purchase

price of $1.28 per share, (ii) December Pre-Funded Warrants, to purchase up to 1,656,250 Ordinary Shares, at a purchase price of $1.28,

less $0.001 per December Pre-Funded Warrant, and (iii) Private Warrants, to purchase up to an aggregate of 3,031,250 Ordinary Shares

at an exercise of $1.28 per share (Note 3.2).

The

December Pre-Funded Warrants were exercised on the same day and the day after the transaction in full in an exercise price of $0.001

per share and the Company issued 1,656,250 additional Ordinary Shares. The aggregate proceeds received by the Company from the

December Offering were approximately $3,424, after deducting underwriting discounts and commissions and additional cash offering

costs totaled in approximately $454.

The

Company issued the placement agent in the December Offering warrants to purchase a number of shares equal to a total of 7.0% of the

aggregate number of Ordinary Shares sold in the December Offering, or a warrant to purchase up to 212,188 Ordinary Shares, were

issued. The December Placement Agent Warrants were substantially on the same terms as the Private Warrants issued to the investor in

the December Offering, except an exercise price of $1.60 per share. The December Placement Agent Warrants were exercisable

immediately upon issuance and will expire five years following their issuance.

The Company accounts for the December Placement Agent

Warrants as equity-classified instruments (as part of additional paid in capital), based on an assessment of ASC 718. The fair value

of the December Placement Agent Warrants on the issuance date was $131. Those cash and non-cash issuance costs were accounted

proportionally to issuance expenses and decrease of additional paid in capital, according to the ratio of the liability versus

equity in the December Offering.

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE

5 - SHAREHOLDERS’ EQUITY (Cont.):

During

the year ended December 31, 2023, the Company issued an aggregate amount of 1,226,448 Ordinary Shares in connection with vested RSUs

and an additional 37,972 Ordinary Shares in connection with option exercises.

On

April 1, 2024, the Company completed its April Offering, whereby the Company sold 1,339,285 Ordinary Shares at a purchase price of $1.232

per share. The aggregate proceeds received by the Company from the April Offering were approximately $1,651.

On

May 20, 2024, the Company issued 220,000 Warrants Shares to a service provider, at an exercise price of $2.25 per share. the warrants

are immediately exercisable and will be expired following six months from the Initial issuance Date. The Company accounting treatment

for those warrants as equity-classified instruments (as part of additional paid in capital), based on an assessment of ASC 718. The fair

value of the warrants at the issuance date was $56.

On

June 14, 2024, the Company completed its June Offering, whereby the Company sold (i) 941,541 Ordinary Shares at a purchase price of $1.30

per share, and (ii) June Pre-Funded Warrants to purchase up to 1,709,760 Ordinary Shares, at a purchase price of $1.30, less $0.001 per

June Pre-Funded Warrant. Each June Pre-Funded Warrant is exercisable for one Ordinary Share at

an exercise price of $0.001 per share. The June Pre-Funded Warrants are immediately exercisable and may be exercised at any time

until all of the June Pre-Funded Warrants are exercised in full. As of June 30, 2024 none of the June Pre-Funded warrants were exercised.

The

aggregate proceeds received by the Company from the June Offering were approximately $3,102, after deducting underwriting discounts and

commissions and additional cash offering costs totaled in approximately $343.

The

Company issued the June Placement Agent in the agreement warrants equal to a total of 7.0% of the aggregate number of Ordinary Shares

sold in the transaction. A total to 185,591 warrants to purchase up to 185,591 Ordinary Shares were issued. The June Placement Agent

Warrants were at an exercise price of $1.56 per share. The June Placement Agent Warrants were exercisable immediately upon issuance and

will expire four years following their issuance.

The

Company accounting treatment for the June Placement Agent Warrants as equity-classified instruments (as part of additional paid in capital),

based on an assessment of ASC 718. The fair value of the June Placement Agent Warrants at the issuance date was $202.

The

cash and non-cash issuance costs were recorded against additional paid in capital, due to the classification of the ordinary shares and

the June Pre-Funded Warrants as equity in the June Offering.

On

June 30, 2024, the Company issued 45,000 ordinary shares to an advisor in connection with consulting service agreement.

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE

5 - SHAREHOLDERS’ EQUITY (Cont.):

| B. | Warrants

reserves - Composition and movements: |

| 1. | The

following table reconciles the movement in warrants outstanding at the beginning and end of the period: |

| | | Number of

Warrants | | | Weighted-average

exercise price | | | Weighted average

remaining

contractual term

(in years) | | | Aggregate

value USD | |

| Balance as of December 31, 2023 | | | 3,333,283 | | | | 5.47 | | | | 1.83 | | | | 4,799,470 | |

| Issuance of warrants | | | 220,000 | | | | 2.25 | | | | 0.5 | | | | 56,209 | |

| Issuance of - Pre-Funded Warrants | | | 1,709,760 | | | | 0.001 | | | | - | | | | 2,220,978 | |

| Issuance of Placement Agent Warrants | | | 185,591 | | | | 1.56 | | | | 4 | | | | 202,127 | |

| Exercised | | | - | | | | - | | | | - | | | | - | |

| Forfeited | | | - | | | | - | | | | - | | | | - | |

| Expired | | | - | | | | - | | | | - | | | | - | |

| Balance as of June 30, 2024 | | | 5,448,634 | | | | | | | | | | | | 7,278,784 | |

| 2. | The

following table summarizes information about the Company’s outstanding warrants as of June 30, 2024. |

| Exercise Price | | Warrants outstanding

as of

June 30, 2024 | | | Expiration

date | | | Aggregate

Intrinsic

value | |

| 5.5 | | | 1,640,455 | | | | 15/07/2026 | | | | 2,214,614 | |

| 5.5 | | | 1,057,350 | | | | 15/07/2024 | | | | 1,691,760 | |

| 5.5 | | | 277,835 | | | | 15/07/2025 | | | | 497,533 | |

| 6.875 | | | 145,455 | | | | 15/01/2027 | | | | 264,008 | |

| 1.6 | | | 212,188 | | | | 28/12/2028 | | | | 131,555 | |

| 2.25 | | | 220,000 | | | | 20/11/2024 | | | | 56,209 | |

| 1.56 | | | 185,591 | | | | 14/06/2027 | | | | 202,127 | |

| 0.001 | | | 1,709,760 | | | | - | | | | 2,220,978 | |

| | | | 5,448,634 | | | | | | | | 7,278,784 | |

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE

5 - SHAREHOLDERS’ EQUITY (Cont.):

Loss

per share has been calculated using the weighted average number of shares in issue during the relevant financial periods, the weighted

average number of equity shares in issue and profit for the period as follows:

| | |

Year ended

June 30,

2024 | | |

Year ended

June 30,

2023 | |

| | |

| | |

| |

| Loss for the period | |

| 6,240 | | |

| 6,184 | |

| Total number of Ordinary Shares | |

| 18,438,917 | | |

| 11,993,299 | |

| Weighted average number of Ordinary Shares | |

| 16,628,582 | | |

| 11,692,017 | |

Basic and diluted loss per share | |

| (0.38 | ) | |

| (0.53 | ) |

NOTE

6 - SHARE BASED COMPENSATION:

In

December 2019, the Company established a share option plan (the “Plan”). As of June 30, 2023, a total of 505,473 options

to purchase Ordinary Shares have been granted to employees, consultants and directors under the Plan, and a total of 3,707,542 RSUs have

been granted to employees, consultants and directors under the Plan, of which 2,550,166 RSUs are fully vested as of June 30, 2023.

On

January 22, 2024, the Company’s board of directors approved a grant of 320,000 RSUs to employees and a grant of options to purchase

80,000 shares to consultants. The RSUs represents the right to receive Ordinary Shares at a future time, 250,000 of which vest over a

period of three years, with a one-year cliff period and 70,000 vesting immediately on the grant date. 10,000 of the options were vested

immediately on the grant date, 25,000 option vest over a period of three years and 45,000 option vests over a period of one year and

nine months. The RSUs designated to employees were granted under Section 102 of the Israeli Tax Ordinance, which enables the employee

to pay a 25% capital gain tax upon exercise.

On

February 5, 2024, the Company’s board of directors approved a grant of 2,277,000 RSUs to officers, a grant of options to purchase

30,000 Ordinary Shares and 90,000 RSUs to directors. The RSUs and options represents the right to receive Ordinary Shares at a future

time and vest over a period of three years, with a one-year cliff. The RSUs designated to employees and directors were granted under

Section 102 of the Israeli Tax Ordinance, which enables the employee to pay a 25% capital gain tax upon exercise.

The

fair market value of all granted options was estimated by using the Black-Scholes model, aimed at modelling the value of the Company’s

assets over time. The simulation approach was designed to take into account the terms and conditions of the share options, as well as

the capital structure of the Company and the volatility of its assets, on the date of grant based on certain assumptions. Those conditions

are, among others:

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE

6 - SHARE BASED COMPENSATION (Cont.):

The

valuation was completed by the company based on the following assumptions:

| (i) | Risk-free

interest rate 4.11% |

| | | |

| (ii) | The

expected volatility is 63.23%; |

| | | |

| (iii) | The

dividend rate 0%; and |

| | | |

| (iv) | Expected

term – 0-3 years. |

During

the six months ended June 30, 2024, the Company recorded share-based payment expenses in the amount of $972.

The

options to services providers and advisers outstanding as of June 30, 2024, as follows:

| | |

Six months ended

June 30, 2024 | |

| | |

Number of

options | | |

Weighted average

Exercise price NIS | |

| | |

| | |

| |

| Outstanding at beginning of year | |

| 105,111 | | |

| 4.085 | |

| Granted | |

| 80,000 | | |

| 3.77 | |

| Exercised | |

| - | | |

| | |

| Forfeited | |

| - | | |

| | |

| Outstanding as of June 30, 2024 | |

| 185,111 | | |

| 4.03 | |

| Exercisable options | |

| 113,724 | | |

| | |

| Share-based payment expenses | |

$ | 37 | | |

| | |

The

RSUs to services providers and advisers outstanding as of June 30, 2024, as follows:

| | |

Number of

RSUs | |

| | |

| |

| Outstanding at beginning of year | |

| 7,433 | |

| Granted | |

| - | |

| Vested | |

| 5,835 | |

| Outstanding as of June 30, 2024 | |

| 1,598 | |

| Vested as of June 30, 2024 | |

| 30,902 | |

| Share-based payment expenses | |

$ | 1 | |

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE 6 - SHARE BASED COMPENSATION (Cont.):

The

options to employees and directors outstanding as of June 30, 2024, as follows:

| | |

Six months ended

June 30, 2024 | |

| | |

Number of

options | | |

Weighted average

Exercise price NIS | |

| | |

| | |

| |

| Outstanding at beginning of year | |

| 357,689 | | |

| 0.37 | |

| Granted | |

| 30,000 | | |

| 3.64 | |

| Exercised | |

| 19,048 | | |

| 0.37 | |

| Outstanding as of June 30, 2024 | |

| 368,641 | | |

| 1.56 | |

| Exercisable options as of June 30, 2024 | |

| 338,641 | | |

| 1.38 | |

| Share-based payment expenses | |

$ | 6 | | |

| | |

The

RSUs to employees and directors outstanding as of June 30, 2024, as follows:

| | |

Number of

RSUs | |

| | |

| |

| Outstanding at beginning of year | |

| 445,140 | |

| Granted | |

| 2,687,000 | |

| Forfeited | |

| (6,251 | ) |

| Vested | |

| (445,056 | ) |

| Outstanding as of June 30, 2024 | |

| 2,680,833 | |

| Vested as of June 30, 2024 | |

| 3,542,245 | |

| Share-based payment expenses | |

$ | 928 | |

NOTE

7 - COMMITMENTS AND CONTINGENCIES:

In

September 2019, the Israel Innovation Authority (“IIA”) approved an application that supports upgrading the Company’s

manufacturing capabilities for an aggregate budget of NIS 4,880,603 (approximately $1,500,000). The IIA committed to fund 60%

of the approved budget. Eventually the project budget concluded in the aggregate amount of NIS 4,623,142 (approximately $1,333) The program

is for the period beginning October 2019 through November 2020 and the Company received total funds in the amount of NIS 2,773,885 (approximately

$800) from the IIA.

According

to the agreements with the IIA, the Company will pay royalties of 3% to 3.5% of future sales up to an amount equal to the accumulated

grant received with the annual interest on such royalties the 12-month secured overnight financing rate (“SOFR”) of the

Federal Reserve or an alternative rate published by the Bank of Israel plus 0.71513% for grants approved prior to January 1, 2024. For

grants approved after January 1, 2024, the annual interest rate is the higher of the 12-month SOFR rate plus 1% or a fixed annual interest

rate of 4%. Repayment of the grant is contingent upon the successful completion of the Company’s research and development (“R&D”)

programs and generating sales. The Company has no obligation to repay these grants if the R&D programs fail, are unsuccessful or aborted

or if no sales are generated. The Company had not generated sales as of June 30, 2024; therefore, no liability was recorded in these unaudited

interim condensed Financial Statements. IIA grants are recorded as a reduction of R&D expenses, net.

During

October 2023, the IIA has approved a support of another development project of the Company at an aggregate budget of NIS 3,850,869

(approximately $1,062). The IIA committed to fund 40% of the approved budget.

As

of June 30, 2024, the maximum obligation with respect to the grants received from the IIA, contingent upon entitled future sales, is

$894. The Company has obligations regarding know-how, technology, or products, not to transfer the information, rights thereon and production

rights which derive from the research and development without the IIA Research Committee approval.

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE

7 - COMMITMENTS AND CONTINGENCIES (Cont.):

| B. | Lease

Commitments – Operating Leases: |

In

August 2022, the Company entered into a lease agreement for its facilities in Ra’anana, Israel. The lease agreement is for a period of

69 months commencing September 1, 2021, and the Company began to pay lease and related expenses after completing 3 months of lease. The

Company has the option to shorten the period and terminates the lease agreement after completing 45 months of rent by paying an amount

of NIS 500,000, (approximately $153). This amount of reimbursement will be deducted monthly in NIS 30,000, (approximately $9) if the

Company terminates the agreement after 45 months of rent. The annual lease payment, including management fees, as of June 30, 2024, is

approximately NIS 69,000 ($19) per month. As security for the obligations under this lease agreement, the Company provided a bank guarantee

in an amount equal to three monthly lease payments plus the Israeli value added tax and an unlimited guarantee according to the terms

specified in the contract.

The

right-of-use asset and lease liability are initially measured at the present value of the lease payments, discounted using the interest

rate implicit in the lease or, if that rate cannot be readily determined, the Company’s incremental borrowing rate based on the

information available at the date of determining the present value of the lease payments. The Company’s incremental borrowing rate

is estimated to approximate the interest rate on similar terms and payments and in economic environments where the leased asset is located.

The

Company has various operating leases for vehicles that expire through 2027. Below is a summary of the Company’s operating right-of-use

assets and operating lease liabilities as of June 30, 2024:

| | | June 30,

2024 | | | December 31,

2023 | |

| Operating lease liabilities, current | | | 298 | | | | 290 | |

| Operating lease liabilities long-term | | | 455 | | | | 588 | |

| Total operating lease liabilities | | | 753 | | | | 878 | |

| | | | | | | | | |

| Weighted Average of Remaining Lease Term | | | 2.93 | | | | 3.33 | |

| Weighted-average discount rate - operating leases | | | 9.34 | % | | | 9.6 | % |

INSPIRA

TECHNOLOGIES OXY B.H.N. LTD.

NOTES

TO THE UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

(U.S.

dollars in thousands)

NOTE

7 - COMMITMENTS AND CONTINGENCIES (Cont.):

Lease

payments for the Company’s right-of-use assets over the remaining lease periods as of June 30, 2024, are as follows:

| | |

June 30,

2024 | |

| 2024 | |

| 176 | |

| 2025 | |

| 302 | |

| 2026 | |

| 232 | |

| 2027 | |

| 143 | |

| Total undiscounted lease payment | |

| 853 | |

| Less: Interest* | |

| (100 | ) |

| Present value of lease liabilities | |

| 753 | |

In

the normal course of business, various legal claims and other contingent matters may arise. Management believes that any liability that

may arise from such matters would not have a material adverse effect on the Company’s results of operations or financial condition

as of and for the six month period ended June 30, 2024.

On

December 12, 2021, the Company terminated its employment agreement with Dr. Udi Nussinovitch, one of its founders who served as the Company’s

Chief Scientific Officer since March 2018. On February 24, 2022, the Company sued Mr. Nussinovitch for breach good faith and his fiduciary

duties as a shareholder and former officer of the Company. On November 9, 2022, the Company received notice of a complaint filed by Mr. Nussinovitch,

as well as a complaint filed with the regional labor court in Tel Aviv, Israel on November 8, 2022. Mr. Nussinovitch has alleged certain

deficiencies in the Company’s Extraordinary General Meeting of Shareholders held on Friday, December 17, 2021, resulting from

his status as a minority shareholder. In addition, with respect to the labor dispute, Mr. Nussinovitch is seeking renumeration and

the issuance of Ordinary Shares. A partial hearing was held in the regional labor court on July 19, 2023, and the parties were required

by the court to file their positions on a stay of the proceeding pending the decision on the case initiated by the Plaintiff in the District

Court.

A

pre-trial hearing was held in the district court on January 21, 2024. During the hearing, the court suggested that the parties consider

the possibility of resolving the case through an out-of-court arrangement or mediation. The parties agreed to a mediation process.

As

of the date of these Financial Statement, the Company believes that the claims will result in no payments by the Company.

NOTE

8 - SUBSEQUENT EVENTS:

In July

2024 the Company received NIS 539,122 (approximately $149,768) from the IIA as a pre-payment of the grant as approved in relation with

a development project. The grant creates an obligation with respect to the grants received from the IIA, contingent upon entitled future

sales.

As of June 30, 2024, there is

no impact on the financial statements.

-

17 -

0.38

0.53

0.38

0.53

false

--12-31

Q2

2024-06-30

0001837493

0001837493

2024-01-01

2024-06-30

0001837493

2024-06-30

0001837493

2023-12-31

0001837493

2023-01-01

2023-06-30

0001837493

us-gaap:CommonStockMember

2023-12-31

0001837493

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001837493

us-gaap:RetainedEarningsMember

2023-12-31

0001837493

us-gaap:CommonStockMember

2024-01-01

2024-06-30

0001837493

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-06-30

0001837493

us-gaap:RetainedEarningsMember

2024-01-01

2024-06-30

0001837493

us-gaap:CommonStockMember

2024-06-30

0001837493

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001837493

us-gaap:RetainedEarningsMember

2024-06-30

0001837493

us-gaap:CommonStockMember

2022-12-31

0001837493

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001837493

us-gaap:RetainedEarningsMember

2022-12-31

0001837493

2022-12-31

0001837493

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001837493

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001837493

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001837493

us-gaap:CommonStockMember

2023-06-30

0001837493

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001837493

us-gaap:RetainedEarningsMember

2023-06-30

0001837493

2023-06-30

0001837493

us-gaap:CommonStockMember

2023-12-26

2023-12-26

0001837493

us-gaap:CommonStockMember

2023-12-26

0001837493

iinn:PreFundedWarrantsMember

2023-12-26

2023-12-26

0001837493

iinn:PreFundedWarrantsMember

2023-12-26

0001837493

2023-12-26

0001837493

us-gaap:WarrantMember

iinn:PreFundedWarrantsMember

2023-12-26

2023-12-26

0001837493

2023-12-26

2023-12-26

0001837493

iinn:DecemberOfferingMember

2023-12-26

2023-12-26

0001837493

iinn:JunePlacementAgentWarrantsMember

2023-12-26

0001837493

iinn:JunePlacementAgentWarrantsMember

2023-12-26

2023-12-26

0001837493

iinn:PurchaseAgreementWithTwoInvestorsMember

2024-04-01

2024-04-01

0001837493

iinn:PurchaseAgreementWithTwoInvestorsMember

2024-04-01

0001837493

iinn:PreFundedWarrantsMember

2024-06-14

2024-06-14

0001837493

iinn:PreFundedWarrantsMember

2024-06-14

0001837493

iinn:PreFundedWarrantsMember

2024-06-14

2024-06-14

0001837493

2024-06-14

0001837493

2024-06-14

2024-06-14

0001837493

iinn:JunePlacementAgentWarrantsMember

2024-06-14

2024-06-14

0001837493

iinn:DecemberPurchaseAgreementMember

2023-12-26

2023-12-26

0001837493

iinn:PrivateWarrantsMember

2023-12-26

2023-12-26

0001837493

iinn:PrivateWarrantsMember

2023-12-31

2023-12-31

0001837493

iinn:PrivateWarrantsMember

2024-01-01

2024-06-30

0001837493

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

2024-06-30

0001837493

us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember

2023-12-31

0001837493

iinn:NonTradableWarrantsMember

2024-06-30

0001837493

iinn:NonTradableWarrantsMember

2023-12-31

0001837493

us-gaap:MeasurementInputRiskFreeInterestRateMember

2024-06-30

0001837493

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-12-31

0001837493

us-gaap:MeasurementInputOptionVolatilityMember

2024-06-30

0001837493

us-gaap:MeasurementInputOptionVolatilityMember

2023-12-31

0001837493

us-gaap:MeasurementInputExpectedDividendRateMember

2024-06-30

0001837493

us-gaap:MeasurementInputExpectedDividendRateMember

2023-12-31

0001837493

us-gaap:MeasurementInputExpectedTermMember

2024-06-30

0001837493

us-gaap:MeasurementInputExpectedTermMember

2023-12-31

0001837493

iinn:OfficersAndDirectorsMember

2024-01-01

2024-06-30

0001837493

iinn:OfficersAndDirectorsMember

2023-01-01

2023-06-30

0001837493

srt:OfficerMember

2024-01-01

2024-06-30

0001837493

srt:OfficerMember

2022-01-01

2022-12-31

0001837493

srt:DirectorMember

2024-01-01

2024-06-30

0001837493

srt:DirectorMember

2022-01-01

2022-12-31

0001837493

iinn:AtTheMarketFacilityMember

2023-01-01

2023-12-31

0001837493

iinn:DecemberOfferingMember

2023-12-26

2023-12-26

0001837493

iinn:DecemberOfferingMember

2023-12-26

0001837493

iinn:DecemberPreFundedWarrantsMember

2023-12-26

0001837493

srt:MaximumMember

iinn:PreFundedWarrantsMember

2023-12-26

0001837493

srt:MinimumMember

iinn:PreFundedWarrantsMember

2023-12-26

0001837493

iinn:PrivateWarrantsMember

us-gaap:CommonStockMember

2023-12-26

0001837493

iinn:PreFundedWarrantsMember

2023-12-26

2023-12-26

0001837493

iinn:PreFundedWarrantsMember

us-gaap:CommonStockMember

2023-12-26

2023-12-26

0001837493

iinn:PreFundedWarrantsMember

2023-12-26

0001837493

iinn:PlacementAgentWarrantsMember

2023-12-26

2023-12-26

0001837493

iinn:PlacementAgentWarrantsMember

2023-12-26

0001837493

iinn:PlacementAgentWarrantsMember

2024-06-30

0001837493

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-12-31

0001837493

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001837493

2024-04-01

2024-04-01

0001837493

iinn:PlacementAgentWarrantsMember

2024-04-01

0001837493

iinn:AprilOfferingMember

2024-04-01

2024-04-01

0001837493

us-gaap:WarrantMember

2024-05-20

2024-05-20

0001837493

2024-05-20

2024-05-20

0001837493

iinn:PreFundedWarrantsMember

2024-06-14

0001837493

iinn:JunePreFundedWarrantMember

2024-06-14

2024-06-14

0001837493

us-gaap:IPOMember

2024-06-14

2024-06-14

0001837493

us-gaap:CommonStockMember

2024-06-14

0001837493

iinn:JunePlacementAgentWarrantsMember

2024-06-14

2024-06-14

0001837493

iinn:PlacementAgentWarrantsMember

2024-06-14

2024-06-14

0001837493

iinn:JunePlacementAgentWarrantsMember

2024-01-01

2024-06-30

0001837493

us-gaap:WarrantMember

2023-12-30

0001837493

us-gaap:WarrantMember

2023-12-31

0001837493

us-gaap:WarrantMember

2023-12-31

2023-12-31

0001837493

us-gaap:WarrantMember

2024-01-01

2024-06-30

0001837493

us-gaap:WarrantMember

2024-06-30

0001837493

us-gaap:WarrantMember

iinn:PreFundedWarrantsMember

2024-01-01

2024-06-30

0001837493

us-gaap:WarrantMember

iinn:PreFundedWarrantsMember

2024-06-30

0001837493

us-gaap:WarrantMember

iinn:PlacementAgentWarrantsMember

2024-01-01

2024-06-30

0001837493

us-gaap:WarrantMember

iinn:PlacementAgentWarrantsMember

2024-06-30

0001837493

iinn:ExercisePrice55Member

2008-12-31

0001837493

iinn:ExercisePrice55Member

2023-07-01

2024-06-30

0001837493

iinn:ExercisePrice55Member

2008-01-01

2008-12-31

0001837493

iinn:ExercisePrice55OneMember

2008-12-31

0001837493

iinn:ExercisePrice55OneMember

2023-07-01

2024-06-30

0001837493

iinn:ExercisePrice55OneMember

2008-01-01

2008-12-31

0001837493

iinn:ExercisePrice55TwoMember

2008-12-31

0001837493

iinn:ExercisePrice55TwoMember

2023-07-01

2024-06-30

0001837493

iinn:ExercisePrice55TwoMember

2008-01-01

2008-12-31

0001837493

iinn:Exercise6875Member

2008-12-31

0001837493

iinn:Exercise6875Member

2023-07-01

2024-06-30

0001837493

iinn:Exercise6875Member

2008-01-01

2008-12-31

0001837493

iinn:Exercise16Member

2008-12-31

0001837493

iinn:Exercise16Member

2023-07-01

2024-06-30

0001837493

iinn:Exercise16Member

2008-01-01

2008-12-31

0001837493

iinn:ExercisePrice225Member

2008-12-31

0001837493

iinn:ExercisePrice225Member

2023-07-01

2024-06-30

0001837493

iinn:ExercisePrice225Member

2008-01-01

2008-12-31

0001837493

iinn:ExercisePrice156Member

2008-12-31

0001837493

iinn:ExercisePrice156Member

2023-07-01

2024-06-30

0001837493

iinn:ExercisePrice156Member

2008-01-01

2008-12-31

0001837493

iinn:ExercisePrice0001Member

2008-12-31

0001837493

iinn:ExercisePrice0001Member

2023-07-01

2024-06-30

0001837493

iinn:ExercisePrice0001Member

2008-01-01

2008-12-31

0001837493

2023-07-01

2024-06-30

0001837493

2008-12-31

0001837493

iinn:EmployeeMember

2023-06-30

0001837493

us-gaap:RestrictedStockUnitsRSUMember

2023-06-30

2023-06-30

0001837493

us-gaap:RestrictedStockUnitsRSUMember

2024-01-22

2024-01-22

0001837493

iinn:ConsultantsMember

2024-01-22

0001837493

srt:BoardOfDirectorsChairmanMember

us-gaap:RestrictedStockUnitsRSUMember

2024-01-22

0001837493

iinn:VestOverAPeriodOfThreeYearsMember

us-gaap:RestrictedStockUnitsRSUMember

2024-01-22

2024-01-22

0001837493

2024-01-22

2024-01-22

0001837493

us-gaap:RestrictedStockUnitsRSUMember

2024-01-22

0001837493

us-gaap:RestrictedStockUnitsRSUMember

2024-02-05

2024-02-05

0001837493

us-gaap:StockOptionMember

2024-02-05

0001837493

us-gaap:RestrictedStockUnitsRSUMember

2024-02-05

0001837493

us-gaap:EmployeeStockOptionMember

2024-02-05

2024-02-05

0001837493

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-06-30

0001837493

iinn:ServicesProvidersAndAdvisersMember

2023-12-31

0001837493

iinn:ServicesProvidersAndAdvisersMember

2024-01-01

2024-06-30

0001837493

iinn:ServicesProvidersAndAdvisersMember

2024-06-30

0001837493

iinn:EmployeesAndDirectorsMember

2023-12-31

0001837493

iinn:EmployeesAndDirectorsMember

2024-01-01

2024-06-30

0001837493

iinn:EmployeesAndDirectorsMember

2024-06-30

0001837493

iinn:ServicesProvidersAndAdvisersMember

us-gaap:RestrictedStockUnitsRSUMember

2023-06-30

0001837493

iinn:ServicesProvidersAndAdvisersMember

us-gaap:RestrictedStockUnitsRSUMember

2023-07-01

2024-06-30

0001837493

iinn:ServicesProvidersAndAdvisersMember

us-gaap:RestrictedStockUnitsRSUMember

2024-06-30

0001837493

iinn:EmployeesAndDirectorsMember

us-gaap:RestrictedStockUnitsRSUMember

2023-06-30

0001837493

iinn:EmployeesAndDirectorsMember

us-gaap:RestrictedStockUnitsRSUMember

2023-07-01

2024-06-30

0001837493

iinn:EmployeesAndDirectorsMember

us-gaap:RestrictedStockUnitsRSUMember

2024-06-30

0001837493

2019-09-01

2019-09-30

0001837493

srt:MinimumMember

2024-01-01

2024-06-30

0001837493

srt:MaximumMember

2024-01-01

2024-06-30

0001837493

2024-01-01

0001837493

2023-10-01

2023-10-31

0001837493

us-gaap:SubsequentEventMember

2024-07-01

2024-07-31

iso4217:USD

iso4217:USD

xbrli:shares

xbrli:shares

xbrli:pure

iso4217:ILS

xbrli:shares

iso4217:ILS

Exhibit 99.2

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND

RESULTS OF OPERATIONS

Cautionary Statement Regarding Forward-Looking Statements

Certain information included

herein may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act

of 1995 and other securities laws. Forward-looking statements are often characterized by the use of forward-looking terminology such as

“may,” “will,” “expect,” “anticipate,” “estimate,” “continue,”

“believe,” “should,” “intend,” “project” or other similar words, but are not the only

way these statements are identified.

These

forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements

that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating

to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that

address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking

statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements

on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current

conditions, expected future developments and other factors they believe to be appropriate.

Important

factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking

statements include, among other things:

| |

● |

our expectation regarding the sufficiency of our existing cash and cash equivalents to fund our current operations and our ability to obtain additional funding; |

| |

|

|

| |

● |

our ability to advance the development of our products and future potential product candidates; |

| |

|

|

| |

● |

our ability to commercialize and sell our products and future potential product candidates; |

| |

|

|

| |

● |

our assessment of the potential of our products and future potential product candidates to treat certain indications; |

| |

|

|

| |

● |

our planned level of revenues, capital expenditures and liquidity; |

| |

|

|

| |

● |

our plans to continue to invest in research and development to develop technology and intellectual property for new products; |

| |

|

|

| |

● |

anticipated actions of the U.S. Food and Drug Administration, state regulators, if any, or other similar foreign regulatory agencies, including approval to conduct clinical trials, the timing and scope of those trials and the prospects for regulatory approval or clearance of, or other regulatory action with respect to our products or services; |

| |

● |

the regulatory environment and changes in the health policies and regimes in the countries in which we intend to operate, including the impact of any changes in regulation and legislation that could affect the medical device industry; |

| |

|

|

| |

● |

our ability to meet our expectations regarding the commercial supply of our products and future product candidates; |

| |

|

|

| |

● |

our ability to retain key executive members; |

| |

|

|

| |

● |

our ability to maintain our relationships with suppliers, manufacturers, distributors and other partners; |

| |

|

|

| |

● |

the overall global economic environment; |

| |

|

|

| |

● |

the impact of competition and new technologies; |

| |

|

|

| |

● |

general market, political and economic conditions in the countries in which we operate, including those related to the conflict in Israel and other parts of the Middle East; |

| |

|

|

| |

● |

our ability to internally develop new inventions and intellectual property; |

| |

|

|

| |

● |

the possible impacts of cybersecurity incidents on our business and operations; |

| |

|

|

| |

● |

changes in our strategy; and |

| |

|

|

| |

● |

litigation. |

These

statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our

or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated

by the forward-looking statements. For a more detailed description of the risks and uncertainties affecting us, reference is made

to our annual report on Form 20-F for the fiscal year ended December 31, 2023, which we filed with the Securities and Exchange Commission,

or the SEC, on March 25, 2024, or the Annual Report, and the other risk factors discussed from time to time by us in reports filed or

furnished to the SEC.

Except

as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as a result of new information,

future events or otherwise, after the date of this prospectus.

Unless

otherwise indicated, all references to “we,” “us,” “our,” the “Company” and “Inspira”

refer to Inspira Technologies Oxy B.H.N. Ltd. References to “NIS” are to New Israeli Shekels and references to “dollars”

or “$” are to U.S. dollars. We prepare and report our financial statements in accordance with generally accepted accounting

principles in the United States.

A. Operating Results

The following discussion

and analysis of our financial condition and results of operations should be read in conjunction with our unaudited condensed financial

statements and the related notes thereto for the six months ended June 30, 2024, included elsewhere in this Report of Foreign Private

Issuer on Form 6-K. The discussion below contains forward-looking statements that are based upon our current expectations and are subject

to uncertainty and changes in circumstances. Actual results may differ materially from these expectations due to inaccurate assumptions

and known or unknown risks and uncertainties.

Overview

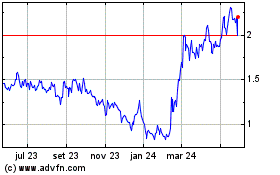

Since our inception in 2018,

we have incurred operating losses. Our operating losses for the six-months ended June 30, 2024 and 2023 were $5.8 million and $6.5 million,

respectively, and our net losses for the same period were $6.2 million and $6.2 million, respectively. As of June 30, 2024, we had an

accumulated deficit of $61.8 million. We expect to continue to incur significant expenses and operating losses for the foreseeable

future, and our losses may fluctuate significantly from year to year. We anticipate that our expenses will increase significantly in connection

with our ongoing activities, as we:

| |

● |

continue clinical development of our products; |

| |

|

|

| |

● |

file applications seeking regulatory approval for our products pursuant to the various regulatory pathways in the United States; |

| |

|

|

| |

● |

continue to invest in the preclinical research and development of any future product candidates; |

| |

|

|

| |

● |

establish the commercial infrastructure to support the marketing, sale and distribution of our products if they were to receive regulatory approval; |

| |

|

|

| |

● |

hire additional research and development and general and administrative personnel to support our operations; |

| |

|

|

| |

● |

maintain, expand and protect our intellectual property portfolio; and |

| |

|

|

| |

● |

continue to incur costs associated with operating as a public company. |

We have not yet generated

any revenue from product sales.

Current Outlook

On July 16, 2021, we completed

our initial public offering, or IPO, whereby we sold 2,909,091 ordinary shares, or Ordinary Shares, and 3,345,455 tradable warrants (inclusive

of 436,364 tradable warrants pursuant to the exercise of an over-allotment option granted to the underwriters). The aggregate net proceeds

received by us from the IPO were $16 million, before underwriting discounts and other offering costs. Prior to our IPO, we financed our

operations primarily through convertible debt, as well as grants from the Israel Innovation Authority, or the IIA.

In October 2021, investors

exercised 1,705,000 of our tradable warrants. The total proceeds we received from this exercise were approximately $9.4 million before

further expenses.

On April 4, 2023, we entered

into a sales agreement with Roth Capital Partners, LLC, as sales agent, or the Sales Agent, pursuant to which we were able to offer and

sell, from time to time, through the Sales Agent, our Ordinary Shares, no par value per share. The Ordinary Shares were offered and sold

pursuant to our Registration Statement on Form F-3 or the Registration Statement, filed with the Securities and Exchange Commission

on August 10, 2022 and the prospectus supplement to the Registration Statement. We paid the Sales Agent a commission equal to 3.0% of

the aggregate gross proceeds from the sale of Ordinary Shares. On October 23, 2023, notice was provided to the Sales Agent to terminate

the sales agreement, effective immediately. As of the date of termination, we sold an aggregate of approximately $26,000 of Ordinary Shares

pursuant to the sales agreement.

On December 26, 2023, we

entered into a securities purchase agreement with respect to a registered direct offering, or the December Offering, whereby we

sold: (i) 1,375,000 Ordinary Shares at a purchase price of $1.28 per share; (ii) pre-funded warrants to purchase up to 1,656,250

Ordinary Shares at a purchase price of $1.28, less $0.001 per pre-funded warrant; and (iii) private warrants, to purchase up to an

aggregate of 3,031,250 Ordinary Shares at an exercise of $1.28 per share. The pre-funded warrants were exercised subsequent to the

transaction in full and as a result, we issued 1,656,250 additional Ordinary Shares for such exercise. The

gross proceeds in connection with the December Offering were $3.88 million. In addition, we retained a placement agent with respect

to the December Offering and issued the placement agent warrants equal to a total of 7.0% of the aggregate number of Ordinary Shares

sold in the December Offering, or warrants to purchase up to 212,188 Ordinary Shares. The placement agent warrants were

substantially similar to the warrants issued to the investor in the December Offering and have an exercise price of $1.60 per share.

The placement agent warrants were exercisable immediately upon issuance and will expire five years following issuance.

On April 1, 2024, the Company

entered into a purchase agreement (the “Purchase Agreement”) with two investors in a registered direct offering, or the April

Offering, pursuant to which the Company issued an aggregate of 1,339,285 Ordinary Shares at a purchase price of $1.232 per share, The

aggregate proceeds received by the Company from the April Offering were approximately $1.65 million

On

June 14, 2024, we entered into a purchase agreement with a single, individual investor, providing for the issuance in a registered direct

offering, or the June Offering, of (i) an aggregate of 941,541 Ordinary Shares, at a purchase price of $1.30 per share, and (ii) pre-funded

warrants to purchase up to 1,709,760 Ordinary Shares, at a purchase price of $1.30, less $0.001 per pre-funded warrant. Each pre-funded

warrant is exercisable for one Ordinary Share at an exercise price of $0.001 per share. The pre-funded warrants are immediately exercisable

and may be exercised at any time until all of the pre-funded warrants are exercised in full. The June Offering resulted in gross proceeds

of $3.4 million. We issued placement agent in the agreement warrants equal to a total of 7.0% of the aggregate number of Ordinary

Shares sold in the transaction and 185,591 warrants to purchase up to 185,591 Ordinary Shares with an exercise price of $1.56 per share.

The placement agent warrants were exercisable immediately upon issuance and will expire four years following issuance.

We

have incurred losses and generated negative cash flows from operations since inception in 2018. Since inception, we have not generated

any revenue.

As

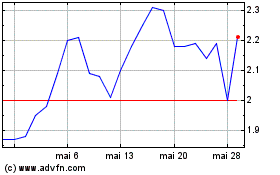

of June 30, 2024, our cash and cash equivalents and deposits were $7.3 million.

We

expect that our existing cash and cash equivalents as of June 30, 2024, will enable us to fund our operating expenses and capital expenditure

requirements for the next six months. We expect that we will require substantial additional capital to operate and to commercialize our

products and we expect to seek additional funds to enable us to fund our operations for the next twelve months.

Our

operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner

than planned. Our future capital requirements will depend on many factors, including:

| |

● |

the progress and costs of our research and development activities; |

| |

|

|

| |

● |

the costs of manufacturing and selling our products; |

| |

|

|

| |

● |

the costs of filing, prosecuting, enforcing and defending patent claims and other intellectual property rights; |

| |

|

|

| |

● |

the potential costs of contracting with third parties to provide marketing and distribution services for us or for building such capacities internally; and |

| |

|

|

| |

● |

the magnitude of our general and administrative expenses. |

Until we can generate significant

recurring revenues, we expect to satisfy our future cash needs through debt and/or equity financings. We cannot be certain that additional