|

PROSPECTUS SUPPLEMENT

|

Filed Pursuant to Rule 424(b)(5)

|

|

(To Prospectus dated March 1, 2024)

|

Registration No. 333-277585

|

GeoVax Labs, Inc.

1,360,731 Shares of Common Stock

339,269 Pre-Funded Warrants to Purchase up to 339,269 Shares of Common Stock

339,269 Shares of Common Stock underlying such Pre-Funded Warrants

We are offering 1,360,731 shares of our common stock, par value $0.001 per share, and prefunded warrants (the “Pre-Funded Warrants”) to purchase 339,269 shares of common stock to investors pursuant to this prospectus supplement and the accompanying prospectus. The per share offering price of the common stock is $5.00 and the offering price per Pre-Funded Warrant is $4.99999 (and each share of common stock and Pre-Funded Warrant shall be coupled with one Common Warrant (as defined below), each to purchase one share of our common stock).

We are offering Pre-Funded Warrants to investors whose purchase of shares of common stock in this offering would otherwise result in such purchasers, together with their affiliates and certain related parties, beneficially owning more than 9.99% of our outstanding shares of common stock immediately following the closing of this offering. Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially own in excess of 9.99% of the number of shares of common stock outstanding immediately after giving effect to such exercise. This offering also relates to the shares of common stock issuable upon exercise of any Pre-Funded Warrants sold in this offering. Each Pre-Funded Warrant is immediately exercisable for one share of common stock at an exercise price of $0.00001 per share and may be exercised at any time until exercised in full.

In a concurrent private placement, we are also offering to the investors common warrants to purchase an aggregate of up to 1,700,000 shares of our common stock (the “Common Warrants”) at an exercise price of $5.00 per share. The Common Warrants are immediately exercisable and will expire five years from the date of issuance. Subject to limited exceptions, a holder of Common Warrants will not have the right to exercise any portion of its Common Warrants if the holder, together with its affiliates, would beneficially own in excess of 9.99% of the number of shares of common stock outstanding immediately after giving effect to such exercise. The Common Warrants and the shares of common stock issuable upon exercise of such warrants are not being registered under the Securities Act of 1933, as amended (the “Securities Act”), and are not being offered pursuant to this prospectus supplement and accompanying prospectus and are being offered pursuant to an exemption from the registration requirements of the Securities Act provided in Section 4(a)(2) of the Securities Act and Rule 506(b) promulgated thereunder.

Our common stock is listed on the Nasdaq Capital Market under the symbol “GOVX.” On August 19, 2024, the last reported sale price for our common stock on the Nasdaq Capital Market was $7.15 per share. We do not intend to apply for the listing of the Pre-Funded Warrants on any national securities exchange or other trading market.

As of August 19, 2024, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $41,501,524, which was calculated based on 5,804,409 shares of outstanding common stock held by non-affiliates, at a price per share of $7.15, the closing price of our common stock on August 19, 2024, the highest closing price of the Company's common stock on the Nasdaq Capital Market during the preceding sixty (60) day trading period. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell the securities described in this prospectus in a public primary offering with a value exceeding more than one-third (1/3) of the aggregate market value of our common stock held by non-affiliates in any twelve (12)-month period, so long as the aggregate market value of our outstanding common stock held by non-affiliates remains below $75,000,000. During the twelve (12) calendar months prior to and including the date of this prospectus supplement, we have offered and sold aggregate gross proceeds of approximately $4,547,686 of our securities pursuant to General Instruction I.B.6 of Form S-3.

| |

|

Per Share

|

|

|

Per Pre-Funded

Warrant

|

|

|

Total

|

|

|

Offering Price

|

|

$ |

5.00 |

|

|

$ |

4.99999 |

|

|

$ |

8,499,996.61 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Placement Agent Fees (1)

|

|

$ |

0.35 |

|

|

$ |

0.35 |

|

|

$ |

595,000.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds to us before offering expenses

|

|

$ |

4.65 |

|

|

$ |

4.64999 |

|

|

$ |

7,904,996.61 |

|

|

(1)

|

Includes a cash fee of 7.0% of the aggregate gross proceeds in this offering. In addition, we have agreed to pay up to $75,000 in expenses (with supporting invoices/receipts) and customary out-of-pocket expense and to reimburse certain expenses of the placement agent. See “Plan of Distribution” beginning on page S-27 of this prospectus supplement for additional information with respect to the compensation we will pay the placement agent.

|

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” appearing on page S-9 of this prospectus supplement and elsewhere in this prospectus supplement and the accompanying base prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

We have engaged Roth Capital Partners, LLC (the “Placement Agent”), as our exclusive placement agent in connection with this offering. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay the Placement Agent the placement agent fees set forth in the table above. See “Plan of Distribution” beginning on page S-27 of this prospectus supplement for more information regarding these arrangements.

Delivery of the securities being offered pursuant to this prospectus supplement and the accompanying prospectus is expected to be made on or about August 21, 2024, subject to satisfaction of customary closing conditions.

Roth Capital Partners

The date of this prospectus supplement is August 20, 2024

TABLE OF CONTENTS

Prospectus Supplement

|

ABOUT THIS PROSPECTUS SUPPLEMENT

|

S-1

|

|

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

|

S-2

|

|

PROSPECTUS SUPPLEMENT SUMMARY

|

S-3

|

|

RISK FACTORS

|

S-9

|

|

USE OF PROCEEDS

|

S-21

|

|

CAPITALIZATION

|

S-22

|

|

DILUTION

|

S-23

|

|

DESCRIPTION OF SECURITIES WE ARE OFFERING

|

S-24

|

|

PLAN OF DISTRIBUTION

|

S-27

|

|

CONCURRENT PRIVATE PLACEMENT

|

S-27

|

|

LEGAL MATTERS

|

S-28

|

|

EXPERTS

|

S-28

|

|

INTEREST OF NAMED EXPERTS AND COUNSEL

|

S-28

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

S-29

|

|

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

|

S-29

|

Prospectus

|

ABOUT THIS PROSPECTUS

|

1

|

|

CAUTIONARY STATEMENT CONCERNING FORWARD LOOKING STATEMNTS

|

2

|

|

PROSPECTUS SUMMARY

|

3

|

|

RISK FACTORS

|

7

|

|

USE OF PROCEEDS

|

7

|

|

DESCRIPTION OF SECURITIES

|

8

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

14

|

|

THE SECURITIES WE MAY OFFER

|

15

|

|

DILUTION

|

17

|

|

SELLING STOCKHOLDERS

|

17

|

|

PLAN OF DISTRIBUTION

|

19

|

|

LEGAL MATTERS

|

22

|

|

EXPERTS

|

22

|

|

INTERESTS OF NAMED EXPERTS AND COUNSEL

|

22

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

22

|

|

INCORPORATION OF CERTAIN DOCUMENTS REFERENCE

|

22

|

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which adds to and updates information contained in the accompanying prospectus. The second part, the prospectus, provides more general information, some of which may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus, you should rely on the information in this prospectus supplement.

This prospectus supplement and the accompanying prospectus relate to the offering of shares of our common stock and warrants to purchase shares of our common stock. Before buying the shares of common stock and warrants to buy shares of common stock offered hereby, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with the information incorporated herein by reference as described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” These documents contain important information that you should consider when making your investment decision. This prospectus supplement contains information about the common stock and warrants offered hereby and may add, update or change information in the accompanying prospectus.

You should rely only on the information that we have provided or incorporated by reference in this prospectus supplement and the accompanying prospectus and in any free writing prospectus we have authorized for use in connection with this offering. Neither we nor the placement agent (or any of our or its respective affiliates) have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

We and the placement agent are not making offers to sell or solicitations to buy our securities in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information in this prospectus supplement and the accompanying prospectus or any related free writing prospectus we have authorized for use in connection with this offering is accurate only as of the date on the front of the document and that any information that we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus or such related free writing prospectus, or any sale of a security.

This prospectus supplement and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been or will be filed as exhibits to the registration statement of which this prospectus supplement is a part or as exhibits to documents incorporated by reference herein, and you may obtain copies of those documents as described below under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

When used herein, “GeoVax,” “we,” “us” or “our” refers to GeoVax Labs, Inc., a Delaware corporation, and our subsidiaries.

CAUTIONARY STATEMENT CONCERNING FORWARD LOOKING STATEMENTS

Some of the statements in this prospectus supplement, the base prospectus, and in the documents incorporated herein by reference contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our ability to control or predict and that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these identifying words. Our forward-looking statements may include, among other things, statements about:

| |

●

|

our ability to continue as a going concern and our history of losses;

|

| |

●

|

our ability to obtain additional financing;

|

| |

●

|

our use of the net proceeds from this offering;

|

| |

●

|

our ability to prosecute, maintain or enforce our intellectual property rights;

|

| |

●

|

the accuracy of our estimates regarding expenses, future revenues and capital requirements;

|

| |

●

|

the implementation of our business model and strategic plans for our business and technology;

|

| |

●

|

the successful development and regulatory approval of our technologies and products;

|

| |

●

|

the potential markets for our products and our ability to serve those markets;

|

| |

●

|

the rate and degree of market acceptance of our products and any future products;

|

| |

●

|

our ability to retain key management personnel; and

|

| |

●

|

regulatory developments and our compliance with applicable laws.

|

Forward-looking statements are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions at the time made, we can give no assurance that such expectations will be achieved. Actual events or results may differ materially. Readers are cautioned not to place undue reliance on forward-looking statements. We have no duty to update or revise any forward-looking statements after the date of this prospectus or to conform them to actual results, new information, future events or otherwise.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of these forward-looking statements.

You should read the risk factors and the other cautionary statements made in this prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

PROSPECTUS SUPPLEMENT SUMMARY

The following information below is only a summary of more detailed information included elsewhere in, or incorporated by reference in, this prospectus supplement and the accompanying base prospectus, and should be read together with the information contained or incorporated by reference in other parts of this prospectus supplement and the accompanying base prospectus. This summary highlights selected information about us and this offering. This summary may not contain all of the information that may be important to you. Before making a decision to invest in our common stock, you should read carefully all of the information contained in or incorporated by reference into this prospectus supplement and the accompanying base prospectus, including the information set forth under the caption “Risk Factors” in this prospectus supplement and the accompanying base prospectus as well as the documents incorporated herein by reference, which are described under “Where you can Find More Information” and “Incorporation of Certain Documents by Reference” in this prospectus supplement.

Company Overview

GeoVax Labs, Inc. (“GeoVax” or “the Company”) is a clinical-stage biotechnology company developing human vaccines and immunotherapies against infectious diseases and solid tumor cancers using novel proprietary platforms. GeoVax’s product pipeline includes ongoing human clinical trials for a next-generation COVID-19 vaccine and a gene-directed therapy against advanced head and neck cancers. Additional research and development programs include preventive vaccines against Mpox (formerly known as monkeypox) and smallpox, hemorrhagic fever viruses (Ebola Zaire, Ebola Sudan and Marburg), Zika virus and malaria, as well as immunotherapies for multiple solid tumors. The Company’s portfolio of wholly owned, co-owned, and in-licensed intellectual property, stands at over 155 granted or pending patent applications spread over 24 patent families.

Our Product Development Pipeline

The table below summarizes the status of our product development programs, which are in various stages of development, the most significant of which are described further below along with recent developments.

Clinical Development Programs

|

Product

|

Indication

|

Clinical Trial

|

Status

|

|

|

|

BARDA Project NextGen

10,000 Patient Comparison Study

|

Phase 2b

Initiation pending

|

| GEO-CM04S1 |

COVID-19 |

Primary Vaccine for

Immunocompromised/Stem Cell Transplant Patients (NCT04977024)

|

Phase 2

Currently enrolling

|

| |

|

Booster Vaccine for

Immunocompromised/Chronic Lymphocytic Patients (NCT05672355)

|

Phase 2

Currently enrolling

|

| |

|

Booster Vaccine for

Healthy Adults (NCT04639466)

|

Phase 2

Enrollment closed

|

|

Gedeptin®

|

Advanced Head &

Neck Cancer*

|

Effect on Targeted Tumors (NCT03754933)

|

Phase 1b/2a

Completed

|

| |

Squamous Cell Head & Neck Cancer

|

First Recurrence Therapy in Combination

with Immune Checkpoint Inhibitor

|

Phase 2

Planning

|

Preclinical Development Programs

|

Product

|

Indication

|

Status

|

|

GEO-MVA-MUC1

|

Solid Tumor Cancers

|

Humanized Mouse Model (completed)

|

|

GEO-CM02

|

Pan-Coronavirus Vaccine

|

Humanized Mouse Model (completed)

|

|

GEO-EM01-Z

|

Ebola Zaire Vaccine**

|

Non-Human Primate (completed)

|

|

GEO-EM01-S

|

Ebola Sudan Vaccine**

|

Non-Human Primate (completed)

|

|

GEO-MM01

|

Marburg Vaccine**

|

Non-Human Primate (completed)

|

|

GEO-ZM02

|

Zika Vaccine**

|

Mouse Model (completed)

|

|

GEO-MVA

|

Mpox & Smallpox Vaccine

|

Regulatory Discussions &

Manufacturing Scale-up

|

-------

* Orphan Drug status granted

** Indication within FDA Priority Review Voucher program

Our programs are in various stages of development, the most significant of which are summarized below along with recent developments. We have not generated any revenues from the sale of the products we are developing, and we do not expect to generate any such revenues for at least the next several years. Our product candidates will require significant additional research and development efforts, including extensive preclinical and clinical testing. All product candidates that we advance to clinical testing will require regulatory approval prior to commercial use and will require significant costs for commercialization. We may not be successful in our research and development efforts, and we may never generate sufficient product revenue to be profitable.

Strategy

Our corporate strategy is to advance, protect and exploit our differentiated vaccine and oncology platforms leading to the successful development of preventive and therapeutic interventions against infectious diseases and various cancers. With our design and development capabilities, we are progressing and validating an array of cancer treatment and infectious disease vaccine product candidates. Our goal is to advance products through to human clinical testing, registration and commercialization in the U.S, and to seek partnership or licensing arrangements for achieving regulatory approval and commercialization outside of the U.S. We also leverage third party resources through collaborations and partnerships for preclinical and clinical testing with multiple government, academic and corporate entities.

Recent Development – BARDA Project NextGen Award – GEO-CM04S1 Phase 2b Trial

On June 18, 2024, we announced our receipt of an award through the Rapid Response Partnership Vehicle (RRPV) to advance development of GEO-CM04S1, our dual-antigen next-generation COVID-19 vaccine, in a Phase 2b clinical trial Under the agreement, GeoVax will sponsor a 10,000-participant, randomized, Phase 2b double-blinded study to assess the clinical efficacy, safety, and immunogenicity of GEO-CM04S1 compared with a U.S. Food and Drug Administration (FDA)-approved mRNA COVID-19 vaccine. The RRPV is a Consortium funded by the Biomedical Advanced Research and Development Authority (BARDA), part of the Administration for Strategic Preparedness and Response (ASPR) in the U.S. Department of Health and Human Services (HHS).

Preparations for the Phase 2b study are underway, and execution of the study will be fully funded by BARDA under its Clinical Studies Network. The direct award to GeoVax of $24.3 million, which may increase to as much as $45 million, will fund the manufacturing of clinical materials and support for the Phase 2b clinical trial, including regulatory activities. BARDA has made a separate award of $343 million from the Project NextGen program to Allucent, a global clinical research organization (CRO), to execute the clinical trial as part of BARDA’s Clinical Studies Network. The combined value of the awards to GeoVax and Allucent toward the clinical evaluation of GEO-CM04S1 is expected to be $367-388

million.

GEO-CM04S1 – Immunocompromised/Cell Transplant Phase 2 Trial

| |

●

|

GEO-CM04S1 is undergoing a Phase 2 multi-site clinical trial (ClinicalTrials.gov Identifier: NCT04977024), evaluating its safety and efficacy, compared to either the Pfizer/BioNTech or Moderna mRNA-based vaccine, as a preventive COVID-19 vaccine in high-risk immunocompromised patients (e.g. patients with blood cancers who have previously received either an allogeneic hematopoietic cell transplant, an autologous hematopoietic cell transplant or chimeric antigen receptor (CAR) T cell therapy). Data published from the open-label safety lead-in portion of the trial indicates that GEO-CM04S1 is highly immunogenic, inducing broad and durable neutralizing antibody and T cell responses.

|

GEO-CM04S1 – Healthy Adult Booster Phase 2 Trial

| |

●

|

A Phase 2 trial of GEO-CM04S1 (ClinicalTrials.gov Identifier: NCT04639466), evaluating two vaccine does levels as a heterologous COVID-19 booster vaccine to current FDA-approved mRNA vaccines from Pfizer/BioNTech and Moderna

|

| |

●

|

In September 2023, we announced completion of enrollment. The trial protocol requires the subjects be followed for 12 months and the last data collection points are scheduled towards the end September 2024. Safety and immune response readouts from this study should be available towards the end of 2024 or early 2025.

|

| |

●

|

In February 2024, we announced positive interim safety and immune responses findings following vaccine administration. Consolidated data (blinded to vaccine dose) from all subjects tested one-month post-vaccination, documented statistically significant increases in neutralizing antibody responses against multiple SARS-CoV-2 variants, ranging from the original Wuhan strain through Delta and Omicron XBB 1.5.

|

GEO-CM04S1 – Immunocompromised/CLL Trial Phase 2 Trial

| |

●

|

GEO-CM04S1 is undergoing an investigator-initiated Phase 2 clinical trial (ClinicalTrials.gov Identifier: NCT05672355), evaluating its use as a COVID-19 vaccine booster in patients with chronic lymphocytic leukemia (CLL), compared to the Pfizer/BioNTech mRNA-based vaccine. Interim data results are scheduled for Q3 2024.

|

Gedeptin® – Advanced Head and Neck Cancer Phase 1b/2a Trial

| |

●

|

Gedeptin® recently completed a Phase 1b/2a clinical trial (PNP-002) (ClinicalTrials.gov Identifier: NCT03754933) for treatment of patients with advanced head and neck squamous cell carcinoma (HNSCC). This trial was being funded in part by the U.S. Food & Drug Administration (FDA) pursuant to its Orphan Products Clinical Trials Grants Program.

|

| |

●

|

We recently convened a special clinical advisory board to conduct a comprehensive review of the PNP-002 trial results, together with the previously completed Phase 1 trial (PNP-001). This review concluded that Gedeptin demonstrated an acceptable safety and efficacy profile to support continued development. In addition, the therapy has demonstrated sufficient tumor stabilization/reduction activity to support plans to advance clinical development of Gedeptin therapy in an expanded Phase 2 clinical trial.

|

| |

●

|

We have initiated activities in support of a Phase 2 trial in first-recurrence head and neck cancer. The primary goal of this trial will be to establish efficacy of neoadjuvant Gedeptin therapy combined with an immune checkpoint inhibitor in squamous cell head and neck cancer. This trial is anticipated to be a single cycle trial with surgery to follow in approximately 36 patients with pathologic response rate as the primary endpoint. We have initiated the necessary planning activities, including protocol development, manufacturing and CRO selection, with the trial activation anticipated during the first half of 2025.

|

MVA-Based Vaccine Manufacturing Process Development

| |

●

|

In March 2024, we announced a significant milestone toward implementation of a validated chicken embryonic fibroblast (CEF) based production system for our MVA-based vaccines, with the release of the first lot of GEO-CM04S1 produced with a commercial manufacturing platform. This marked the successful completion of the transfer and scale-up of manufacturing to Oxford Biomedica, the Company’s cGMP (current Good Manufacturing Procedures) manufacturing partner.

|

Intellectual Property Development

| |

●

|

In January 2024, the U.S. Patent and Trademark Office issued Patent No. 11,857,611 to GeoVax, pursuant to patent application No. 17/726,254 titled “Compositions and Methods for Generating an Immune Response to Treat or Prevent Malaria”. The allowed claims cover compositions comprising GeoVax’s modified vaccinia Ankara (MVA) vector expressing Plasmodium antigens and methods of inducing an immune response to malaria utilizing the compositions. The compositions and methods covered in the allowed claims are useful both prophylactically and therapeutically and may be used to prevent and/or treat malaria.

|

| |

●

|

In February 2024, the U.S. Patent and Trademark Office issued Patent No. 11,896,657 to GeoVax, pursuant to patent application No. 17/584,231 titled “Replication Deficient Modified Vaccina Ankara (MVA) Expressing Marburg Virus Glycoprotein (GP) and Matrix Protein (VP40).” The allowed claims generally cover GeoVax’s vector platform for expressing Marburg virus antigens in virus-like particles (VLPs) utilizing an MVA viral vector.

|

| |

●

|

In February 2024, the U.S Patent and Trademark Office issued Patent No. 11,897,919 to GeoVax, pursuant to patent application No. 17/409,574 titled “Multivalent HIV Vaccine Boost Compositions and Methods of Use.” The allowed claims generally cover a priming vaccination with a DNA vector encoding multiple HIV antigens in virus-like particles (VLPs), followed by a boost vaccination with GeoVax’s vector platform for expressing HIV-1 antigens in VLPs utilizing an MVA viral vector.

|

| |

●

|

In February 2024, the Japanese Patent Office issued a Decision of Grant notifying GeoVax of the allowance of the Company’s Patent Application No. 2022-153352 titled “Compositions and Methods for Generating an Immune Response to a Tumor Associated Antigen.” The allowed claims are directed to recombinant MVA viral vectors comprising specific MUC-1 nucleic sequences used in GeoVax’s MUC-1 tumor-associated antigen immunotherapy program. Pharmaceutical compositions for inducing immune responses, preventing or reducing neoplasm growth, or treating cancer are also covered by the granted claims. This represents an extension of the GeoVax MVA-VLP platform that was originally developed for vaccines targeting infectious diseases.

|

Recent Developments

Registered Direct Offering

On July 11, 2024, the Company entered into a placement agency agreement (the “Placement Agency Agreement”) with Roth Capital Partners, LLC (“Roth”) and a securities purchase agreement (the “Purchase Agreement”) with a purchaser pursuant to which the Company agreed to sell, in a registered direct offering (the “Registered Direct Offering”), an aggregate of (i) 458,632 shares of the Company’s common stock, and (ii) pre-funded warrants to purchase up to an aggregate of 626,368 shares of common stock (the “July Pre-Funded Warrants,” and the Shares issuable upon exercise thereof, the “July Pre-Funded Warrant Shares”). In a concurrent private placement, the Company offered Common Warrants to the purchaser, with each warrant exercisable to purchase one share of Common Stock (the “July Common Warrants”), with two July Common Warrants to accompany each share of common stock or July Pre-Funded Warrant sold in the Offering, and to purchase in the aggregate up to 2,170,000 shares of common stock (the “July Common Warrant Shares”). The public offering price for each share was $2.86 and the public offering price for each July Pre-Funded Warrant was $2.85999. The July Pre-Funded Warrants have an exercise price of $0.0001 per share, are exercisable immediately and may be exercised at any time until exercised in full. The July Common Warrants have an exercise price of $2.86 per share, are immediately exercisable upon stockholder approval and will expire five years from the date of such stockholder approval. The net proceeds of the offering, after deducting Roth’s fees and expenses and other offering expenses payable by the Company and excluding the net proceeds, if any, from the exercise of the July Common Warrants, is approximately $2.8 million. The Company intends to use the net proceeds from the offering for working capital and general corporate purposes. The offering closed on July 12, 2024.

Resale of Common Stock by Selling Stockholder

On August 6, 2024, the Company filed a registration statement on Form S-1 for the resale of the July Common Warrant Shares, issuable upon the exercise of the July Common Warrants issued in a private placement on July 12, 2024 to a purchaser (the “Selling Stockholder”). We will not receive any proceeds from the sale of the July Common Warrant Shares covered by that prospectus by the Selling Stockholder. All net proceeds from the sale of the July Common Warrant Shares covered by that prospectus will go to the Selling Stockholder. However, we will receive the proceeds from any cash exercise of the July Common Warrants.

Summary of Risk Factors

Any investment in our securities involves a high degree of risk. You should consider carefully the risks described below, and the more detailed information at “Risk Factors” on page S-9 of this prospectus supplement, together with all of the other information contained in or incorporated by reference into this prospectus and the applicable prospectus supplement, before you decide whether to purchase our securities:

Risks Related to Our Business and Capital Requirements

| |

●

|

We have a history of operating losses, and we expect losses to continue for the foreseeable future.

|

| |

●

|

We have received a going concern opinion from our auditors.

|

| |

●

|

Our business will require continued funding. If we do not receive adequate funding, we may not be able to continue our operations.

|

| |

●

|

Significant disruptions of information technology systems or breaches of information security systems could adversely affect our business.

|

Risks Related to Development and Commercialization of Product Candidates and Dependence on Third Parties

| |

●

|

Our products are still being developed and are unproven. These products may not be successful.

|

| |

●

|

We depend upon key personnel who may terminate their employment with us at any time. If we were to lose the services of any of these individuals, our business and operations may be adversely affected.

|

| |

●

|

Regulatory and legal uncertainties could result in significant costs or otherwise harm our business.

|

| |

●

|

We face intense competition and rapid technological change that could result in products that are superior to, or earlier to the market than, the products we will be commercializing or developing.

|

| |

●

|

Our product candidates are based on new medical technology and, consequently, are inherently risky. Concerns about the safety and efficacy of our products could limit our future success.

|

| |

●

|

We may experience delays in our clinical trials that could adversely affect our financial results and our commercial prospects.

|

| |

●

|

Failure to obtain timely regulatory approvals required to exploit the commercial potential of our products could increase our future development costs or impair our future sales.

|

| |

●

|

State pharmaceutical marketing compliance and reporting requirements may expose us to regulatory and legal action by state governments or other government authorities.

|

| |

●

|

Changes in healthcare law and implementing regulations, as well as changes in healthcare policy, may impact our business in ways that we cannot currently predict, and may have a significant adverse effect on our business and results of operations.

|

| |

●

|

We may not be successful in establishing collaborations for product candidates we seek to commercialize, which could adversely affect our ability to discover, develop, and commercialize products.

|

| |

●

|

We do not have manufacturing, sales or marketing experience.

|

| |

●

|

Our products under development may not gain market acceptance.

|

| |

●

|

We may be required to defend lawsuits or pay damages for product liability claims.

|

| |

●

|

Reimbursement decisions by third-party payors may have an adverse effect on pricing and market acceptance. If there is not sufficient reimbursement for our products, it is less likely that they will be widely used.

|

Risks Related to Our Intellectual Property

| |

●

|

Our success depends on our ability to obtain, maintain, protect and enforce our intellectual property and our proprietary technologies.

|

| |

●

|

We could lose our license rights to our important intellectual property if we do not fulfill our contractual obligations to our licensors.

|

| |

●

|

Other parties may claim that we infringe their intellectual property or proprietary rights, which could cause us to incur significant expenses or prevent us from selling products.

|

| |

●

|

Any inability to protect our or our licensors’ intellectual property rights in the United States and foreign countries could limit our ability to prevent others from manufacturing or selling our products.

|

| |

●

|

Changes in United States patent law could diminish the value of patents in general, thereby impairing our ability to protect our product candidates.

|

| |

●

|

The patent protection and patent prosecution for our product candidates is dependent in part on third parties.

|

Risks Related to Our Common Stock

| |

●

|

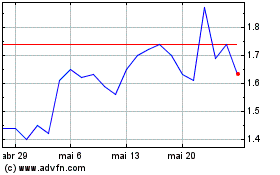

The market price of our common stock is highly volatile.

|

| |

●

|

The sale or issuance of additional shares of our common stock or other equity securities could result in additional dilution to our stockholders.

|

| |

●

|

Certain provisions of our certificate of incorporation which authorize the issuance of shares of preferred stock may make it more difficult for a third party to effect a change in control.

|

| |

●

|

We have never paid dividends and have no plans to do so.

|

| |

●

|

Public company compliance may make it more difficult for us to attract and retain officers and directors.

|

| |

●

|

Our Certificate of Incorporation and Bylaws may be amended by the affirmative vote of a majority of our stockholders.

|

| |

●

|

Broker-dealers may be discouraged from effecting transactions in shares of our common stock if we are considered to be a penny stock and thus subject to the penny stock rules.

|

| |

●

|

We may be delisted from the Nasdaq Capital Market LLC due to noncompliance with Nasdaq Listing Rules.

|

Corporate Information

We are incorporated under the laws of the State of Delaware. Our principal corporate offices are located at 1900 Lake Park Drive, Suite 380, Smyrna, Georgia 30080 (metropolitan Atlanta). Our telephone number is (678) 384-7220. The address of our website is www.geovax.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, are available to you free of charge through the “Investors” section of our website as soon as reasonably practicable after such materials have been electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). Information contained on our website does not form a part of this prospectus.

Summary of the Offering

|

Issuer:

|

|

GeoVax Labs, Inc.

|

| |

|

|

|

Common Stock offered:

|

|

1,360,731 shares of our common stock

|

| |

|

|

|

Pre-Funded Warrants offered

|

|

We are also offering the Pre-Funded Warrants to purchase up to 339,269 shares of Common Stock in lieu of shares of common stock because the purchase of shares of Common Stock in this offering would otherwise result in the investor, together with its affiliates, beneficially owning more than 9.99% of our outstanding common stock immediately following the consummation of this offering. Each Pre-Funded Warrant is exercisable for one share of our common stock at an exercise price of $0.00001 per share. The Pre-Funded Warrants are exercisable immediately upon issuance and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. This prospectus supplement and the accompanying base prospectus also relate to the offering of the shares of common stock issuable upon exercise of the Pre-Funded Warrants.

|

| |

|

|

|

Concurrent Private Placement

|

|

In a concurrent private placement, we are selling to the purchasers of shares of our common stock and Pre-Funded Warrants in this offering Common Warrants to purchase 1,700,000 shares of our common stock at an exercise price of $5.00 per share. We will receive gross proceeds from the concurrent private placement transaction solely to the extent such warrants are exercised for cash. The Common Warrants and the shares of our common stock issuable upon the exercise of such warrants are not being offered pursuant to this prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder. See “Private Placement Transaction.”

|

| |

|

|

|

Shares of common stock outstanding prior to the offering:

|

|

5,849,098 shares

|

| |

|

|

|

Shares of common stock outstanding after the offering:

|

|

7,209,829 shares (assuming no exercise of the Pre-Funded Warrants). Assuming all of the Pre-Funded Warrants were immediately exercised, there would be 7,549,098 shares of our common stock outstanding after this offering (and no exercise of the Common Warrants issued in the concurrent private placement).

|

| |

|

|

|

Trading symbols:

|

|

Our common stock and warrants are listed on The Nasdaq Capital Market under the symbols “GOVX” and “GOVXW”, respectively. There is no established trading market for the Pre-Funded Warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Pre-Funded Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited.

|

| |

|

|

|

Use of proceeds:

|

|

We estimate that we will receive net proceeds of approximately $7,855,000 from this offering, after deducting placement agent fees and estimated offering expenses payable by us. We intend to use the net proceeds from this offering to advance our product candidates, including research and technical development, manufacturing, clinical studies, capital expenditures, and working capital. We may also use the net proceeds from this offering to acquire and invest in complementary products, technologies or businesses; however, we currently have no agreements or commitments to complete any such transaction.

|

| |

|

|

|

Risk factors:

|

|

Investing in our securities involves substantial risks. You should carefully review and consider the “Risk Factors” section of this prospectus supplement beginning on page S-9 and page 7 of the accompanying prospectus, and the other information in this prospectus supplement for a discussion of the factors you should consider before you decide to invest in this offering.

|

|

(1)

|

The number of shares of our common stock outstanding after the completion of this offering is based on 5,849,098 shares of our common stock outstanding as of August 19, 2024, and excludes the following:

|

| |

●

|

339,269 shares of common stock issuable upon the exercise of the Pre-Funded Warrants with an exercise price of $0.00001 per share;

|

| |

●

|

1,700,000 shares of common stock issuable upon the exercise of the Common Warrants with an exercise price of $5.00 per share;

|

| |

●

|

3,942,137 shares of common stock issuable upon the exercise of other outstanding warrants with a weighted average exercise price of $5.63 per share; and

|

| |

●

|

333,648 shares of common stock which are reserved for issuance under our 2020 and 2023 Stock Incentive Plans, of which 328,648 shares of common stock are issuable upon exercise of outstanding options at a weighted average exercise price of $12.83 per share.

|

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider and evaluate all of the information contained in this prospectus supplement, the accompanying base prospectus and in the documents we incorporate by reference into this prospectus supplement and the accompanying base prospectus before you decide to purchase our securities. In particular, you should carefully consider and evaluate the risks and uncertainties described under the heading “Risk Factors” in this prospectus supplement and the accompanying base prospectus. Any of the risks and uncertainties set forth in this prospectus supplement and the accompanying base prospectus, as updated by annual, quarterly and other reports and documents that we file, or we are deemed to have filed, with the SEC and incorporate by reference into this prospectus supplement or the accompanying base prospectus could materially and adversely affect our business, results of operations and financial condition, which in turn could materially and adversely affect the value of our common stock. As a result, you could lose all or part of your investment.

Risks Related to this Offering of Securities

We have broad discretion in determining how to use the proceeds from this offering and we cannot assure you that we will be successful in spending the proceeds in ways which increase our profitability or market value, or otherwise yield favorable returns.

We plan to utilize the proceeds of this offering for general working capital. Nevertheless, we will have broad discretion in determining specific expenditures. You will be entrusting your funds to our management, upon whose judgment you must depend, with limited information concerning the purposes to which the funds will ultimately be applied. We may not be successful in spending the proceeds of this offering in ways which increase our profitability or market value, or otherwise yield favorable returns.

Fluctuations in the price of our common stock, including as a result of actual or anticipated sales of shares by stockholders, may make our common stock more difficult to resell.

The market price and trading volume of our common stock have been and may continue to be subject to significant fluctuations due not only to general stock market conditions, but also to changes in sentiment in the market regarding the industry in which we operate, our operations, business prospects or liquidity or this offering. In addition to the risk factors discussed in our periodic reports and in this prospectus supplement, the price and volume volatility of our common stock may be affected by actual or anticipated sales of common stock by existing stockholders, including of shares purchased in this offering, whether in the market or in subsequent public offerings. Stock markets in general may experience extreme volatility that is unrelated to the operating performance of listed companies. These broad market fluctuations may adversely affect the trading price of our common stock, regardless of our operating results. As a result, these fluctuations in the market price and trading volume of our common stock may make it difficult to predict the market price of our common stock in the future, cause the value of your investment to decline and make it more difficult to resell our common stock.

If we are not able to comply with the applicable continued listing requirements or standards of the Nasdaq Capital Market, Nasdaq could delist our common stock and the related warrants.

Our common stock (GOVX) and related warrants (GOVXW) are currently listed on the Nasdaq Capital Market. In order to maintain that listing, we must satisfy minimum financial and other continued listing requirements and standards, including those regarding director independence and independent committee requirements, minimum stockholders’ equity, minimum share price, and certain corporate governance requirements. There can be no assurances that we will be able to continue to comply with the applicable listing standards.

On May 23, 2024, the Company received a notice from the Listing Qualifications Department of Nasdaq notifying the Company that it no longer complied with the $2,500,000 minimum stockholders’ equity required for continued listing pursuant to Nasdaq Listing Rule 5550(b)(1) (the “Stockholders’ Equity Requirement”), because the Company’s stockholders’ equity as reported in its Form 10-Q for the period ended March 31, 2024 did not meet the required minimum, and as of the date of the Notice, the Company did not meet the alternatives of market value of listed securities or net income from continuing operations (together with the Stockholders’ Equity Requirement, the “Listing Rule”).

We are currently reviewing potential transactions that, if implemented, could remedy the shortfall in our stockholders’ equity. We do not know at this time, however, whether we will be able to remedy the non-compliance. If we are unable to maintain compliance with these Nasdaq Capital Market requirements, our common stock will be delisted from the Nasdaq Capital Market. In that event, and if our common stock is not then eligible for quotation on another market or exchange, trading of our common stock could be conducted in the over-the-counter market or on an electronic bulletin board established for unlisted securities such as the OTC Pink. In such event, it could become more difficult to dispose of, or obtain accurate price quotations for, our common stock, and there would likely also be a reduction in our coverage by securities analysts and the news media, which could cause the price of our common stock to decline further. Also, it may be difficult for us to raise additional capital if we are not listed on an exchange.

Investors will incur immediate and substantial dilution as a result of this offering.

Investors purchasing securities in this offering will incur immediate and substantial dilution in net tangible book value per share. Based on the per share common stock offering price of $5.00, purchasers of the shares will effectively incur dilution of approximately $4.06 per share in the net tangible book value of their purchased shares of common stock, or approximately 81% at the offering price of the shares. Furthermore, you may experience further dilution to the extent that shares of our common stock are issued upon the exercise of outstanding warrants or stock options. See “Dilution.”

If securities or industry analysts do not publish or cease publishing research or reports about us, our business or our market, or if they change their recommendations regarding our common stock adversely, our common stock price and trading volume could decline.

The trading market for our shares of common stock will be influenced by many factors, including without limitation, the research and reports that industry or securities analysts may publish about us, our business, our market or our competitors. If any of the analysts who may cover us change their recommendation regarding our common stock adversely, or provide more favorable relative recommendations about our competitors, our share price would likely decline. If any analyst who may cover us were to cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our common stock price or trading volume to decline.

In making your investment decision, you should understand that we and the underwriter have not authorized any other party to provide you with information concerning us or this offering.

You should carefully evaluate all of the information in this prospectus supplement before investing in our company. We may receive media coverage regarding our company, including coverage that is not directly attributable to statements made by our officers, that incorrectly reports on statements made by our officers or employees, or that is misleading as a result of omitting information provided by us, our officers or employees. We and the underwriter have not authorized any other party to provide you with information concerning us or this offering, and you should not rely on this information in making an investment decision.

An active, liquid trading market for our common stock may not develop, which may cause our common stock to trade at a discount from the offering price and make it difficult for you to sell the common stock you purchase.

Our common stock is currently listed on the Nasdaq Capital Market. However, there can be no assurance that there will be an active market for our common stock either now or in the future. If an active and liquid trading market does not develop or if developed cannot be sustained, you may have difficulty selling any of our common stock that you purchase. The market price of our common stock may decline below the initial offering price, and you may not be able to sell your shares of our common stock at or above the price you paid, or at all.

Risks Related to Our Business and Capital Requirements

We have a history of operating losses, and we expect losses to continue for the foreseeable future.

As a research and development-focused company, we have had no product revenue to date and revenues from our government grants and other collaborations have not generated sufficient cash flows to cover operating expenses. Since our inception, we have incurred operating losses each year due to costs incurred in connection with research and development activities and general and administrative expenses associated with our operations. We incurred a net loss of approximately $26 million for the year ended December 31, 2023 and of approximately $10.9 million for the six months ended June 30, 2024. We expect to incur additional operating losses and expect cumulative losses to increase as our research and development, preclinical, clinical, and manufacturing efforts expand. Our ability to generate revenue and achieve profitability depends on our ability to successfully complete the development of our product candidates, conduct preclinical tests and clinical trials, obtain the necessary regulatory approvals, and manufacture and market or otherwise commercialize our products. Unless we are able to successfully meet these challenges, we will not be profitable and may not remain in business.

We have received a going concern opinion from our auditors.

We have received a "going concern" opinion from our independent registered public accounting firm, reflecting substantial doubt about our ability to continue as a going concern. Our consolidated financial statements contemplate that we will continue as a going concern and do not contain any adjustments that might result if we were unable to continue as a going concern. Our ability to continue as a going concern is dependent upon our ability to raise additional capital and implement our business plan. If we are unable to achieve or sustain profitability or to secure additional financing on acceptable terms, we may not be able to meet our obligations as they come due, raising substantial doubts as to our ability to continue as a going concern. Any such inability to continue as a going concern may result in our stockholders losing their entire investment. There is no guarantee that we will become profitable or secure additional financing on acceptable terms.

Our business will require continued funding. If we do not receive adequate funding, we may not be able to continue our operations.

To date, we have financed our operations principally through the sale of our equity securities and through government grants and clinical trial support. We will require substantial additional financing at various intervals for our operations, including clinical trials, operating expenses, intellectual property protection and enforcement, for pursuit of regulatory approvals, and for establishing or contracting out manufacturing, marketing and sales functions. There is no assurance that such additional funding will be available on terms acceptable to us or at all. If we are not able to secure the significant funding that is required to maintain and continue our operations at current levels, or at levels that may be required in the future, we may be required to delay clinical studies or clinical trials, curtail operations, or obtain funds through collaborative arrangements that may require us to relinquish rights to some of our products or potential markets.

We may pursue additional support from the federal government for our vaccine and immunotherapy development programs; however, as we progress to the later stages of our development activities, government financial support may be more difficult to obtain, or may not be available at all. Therefore, it will be necessary for us to look to other sources of funding to finance our development activities.

We will need to raise additional funds to significantly advance our vaccine development programs and to continue our operations. In order to meet our operating cash flow needs we plan to seek sources of non-dilutive capital through government grant programs and clinical trial support. We may also plan additional offerings of our equity securities, debt, or convertible debt instruments. Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, the consequences could have a material adverse effect on our business, operating results, financial condition and prospects.

Significant disruptions of information technology systems or breaches of information security systems could adversely affect our business.

We rely upon a combination of information technology systems and traditional recordkeeping to operate our business. In the ordinary course of business, we collect, store, and transmit confidential information (including, but not limited to, personal information and intellectual property). We have also outsourced elements of our operations to third parties, including elements of our information technology systems and, as a result, we manage a number of independent vendor relationships with third parties who may or could have access to our confidential information. Our information technology and information security systems and records are potentially vulnerable to security breaches, service interruptions, or data loss from inadvertent or intentional actions by our employees or vendors. Our information technology and information security systems and records are also potentially vulnerable to malicious attacks by third parties. Such attacks are of ever-increasing levels of sophistication and are made by groups and individuals with a wide range of expertise and motives (including, but not limited to, financial crime, industrial espionage, and market manipulation).

While we have invested, and continue to invest, a portion of our limited funds in our information technology and information security systems, there can be no assurance that our efforts will prevent security breaches, service interruptions, or data losses. Any security breaches, service interruptions, or data losses could adversely affect our business operations and/or result in the loss of critical or sensitive confidential information or intellectual property, and could result in financial, legal, business, and reputational harm to us or allow third parties to gain material, inside information that they may use to trade in our securities.

Risks Related to Development and Commercialization of Product Candidates and Dependence on Third Parties

Our products are still being developed and are unproven. These products may not be successful.

To become profitable, we must generate revenue through sales of our products. However, our products are in varying stages of development and testing. Our products have not been proven in human clinical trials and have not been approved by any government agency for sale. If we cannot successfully develop and prove our products and processes, or if we do not develop other sources of revenue, we will not become profitable and at some point, we would discontinue operations.

We depend upon key personnel who may terminate their employment with us at any time. If we were to lose the services of any of these individuals, our business and operations may be adversely affected.

The success of our business strategy will depend to a significant degree upon the continued services of key management, technical and scientific personnel and our ability to attract and retain additional qualified personnel and managers. Competition for qualified personnel is intense among companies, academic institutions and other organizations. The ability to attract and retain personnel is adversely affected by our financial challenges. If we are unable to attract and retain key personnel and advisors, it may negatively affect our ability to successfully develop, test, commercialize and market our products and product candidates.

Regulatory and legal uncertainties could result in significant costs or otherwise harm our business.

To manufacture and sell our products, we must comply with extensive domestic and international regulation. In order to sell our products in the United States, approval from the U.S. Food and Drug Administration (the “FDA”) is required. Satisfaction of regulatory requirements, including FDA requirements, typically takes many years, and if approval is obtained at all, it is dependent upon the type, complexity and novelty of the product, and requires the expenditure of substantial resources. We cannot predict whether our products will be approved by the FDA. Even if they are approved, we cannot predict the time frame for approval. Foreign regulatory requirements differ from jurisdiction to jurisdiction and may, in some cases, be more stringent or difficult to meet than FDA requirements. As with the FDA, we cannot predict if or when we may obtain these regulatory approvals. If we cannot demonstrate that our products can be used safely and successfully in a broad segment of the patient population on a long-term basis, our products would likely be denied approval by the FDA and the regulatory agencies of foreign governments.

We face intense competition and rapid technological change that could result in products that are superior to, or earlier to the market than, the products we will be commercializing or developing.

The market for vaccines that protect against or treat human infectious diseases is intensely competitive and is subject to rapid and significant technological change. We have numerous competitors in the United States and abroad, including, among others, large companies with substantially greater resources than us. If any of our competitors develop products with efficacy or safety profiles significantly better than our products, we may not be able to commercialize our products, and sales of any of our commercialized products could be harmed. Some of our competitors and potential competitors have substantially greater product development capabilities and financial, scientific, marketing and human resources than we do. Competitors may develop products earlier, obtain FDA approvals for products more rapidly, or develop products that are more effective than those under development by us. We will seek to expand our technological capabilities to remain competitive; however, research and development by others may render our technologies or products obsolete or noncompetitive or result in treatments or cures superior to ours.

Our product candidates are based on new medical technology and, consequently, are inherently risky. Concerns about the safety and efficacy of our products could limit our future success.

We are subject to the risks of failure inherent in the development of product candidates based on new medical technologies. These risks include the possibility that the products we create will not be effective, that our product candidates will be unsafe or otherwise fail to receive the necessary regulatory approvals, and that our product candidates will be difficult to manufacture on a large scale or will be uneconomical to market.

Many pharmaceutical products cause multiple potential complications and side effects, not all of which can be predicted with accuracy and many of which may vary from patient to patient. Long-term follow-up data may reveal previously unidentified complications associated with our products. The responses of potential physicians and others to information about complications could materially adversely affect the market acceptance of our products, which in turn would materially harm our business.

We may experience delays in our clinical trials that could adversely affect our financial results and our commercial prospects.

We do not know whether planned pre-clinical and clinical trials will begin on time or whether we will complete any of our trials on schedule, if at all. Product development costs will increase if we have delays in testing or approvals, or if we need to perform more or larger clinical trials than planned. Significant delays may adversely affect our financial results and the commercial prospects for our products and delay our ability to become profitable.

We rely heavily on independent clinical investigators, vaccine manufacturers, and other third-party service providers for successful execution of our clinical trials, but do not control many aspects of their activities. We are responsible for ensuring that each of our clinical trials is conducted in accordance with the general investigational plan and protocols for the trial. Moreover, the FDA requires us to comply with standards, commonly referred to as Good Clinical Practices, for conducting, recording, and reporting the results of clinical trials to assure that data and reported results are credible and accurate and that the rights, integrity and confidentiality of trial participants are protected. Our reliance on third parties that we do not control does not relieve us of these responsibilities and requirements. Third parties may not complete activities on schedule or may not conduct our clinical trials in accordance with regulatory requirements or our stated protocols. The failure of these third parties to carry out their obligations could delay or prevent the development, approval and commercialization of our product candidates.

Failure to obtain timely regulatory approvals required to exploit the commercial potential of our products could increase our future development costs or impair our future sales.

None of our vaccines are approved by the FDA for sale in the United States or by other regulatory authorities for sale in foreign countries. To exploit the commercial potential of our technologies, we are conducting and planning to conduct additional pre-clinical studies and clinical trials. This process is expensive and can require a significant amount of time. Failure can occur at any stage of testing, even if the results are favorable. Failure to adequately demonstrate safety and efficacy in clinical trials could delay or preclude regulatory approval and restrict our ability to commercialize our technology or products. Any such failure may severely harm our business. In addition, any approvals we obtain may not cover all of the clinical indications for which approval is sought or may contain significant limitations in the form of narrow indications, warnings, precautions or contraindications with respect to conditions of use, or in the form of onerous risk management plans, restrictions on distribution, or post-approval study requirements.

State pharmaceutical marketing compliance and reporting requirements may expose us to regulatory and legal action by state governments or other government authorities.

Several states have enacted legislation requiring pharmaceutical companies to establish marketing compliance programs and file periodic reports on sales, marketing, pricing and other activities. Similar legislation is being considered in other states. Many of these requirements are new and uncertain, and available guidance is limited. Unless we are in full compliance with these laws, we could face enforcement action, fines, and other penalties and could receive adverse publicity, all of which could harm our business.

Changes in healthcare law and implementing regulations, as well as changes in healthcare policy, may impact our business in ways that we cannot currently predict, and may have a significant adverse effect on our business and results of operations.

In the United States and foreign jurisdictions, there have been, and continue to be, several legislative and regulatory changes and proposed changes regarding the healthcare system that could prevent or delay marketing approval of product candidates, restrict or regulate post-approval activities, and affect our ability to profitably sell any product candidates for which we obtain marketing approval. Among policy makers and payors in the United States and elsewhere, including in the European Union, there is significant interest in promoting changes in healthcare systems with the stated goals of containing healthcare costs, improving quality and/or expanding access. In the United States, the pharmaceutical industry has been a particular focus of these efforts and has been significantly affected by major legislative initiatives.

The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010 (collectively, the “Affordable Care Act”), substantially changed the way healthcare is financed by both the government and private insurers, and significantly impacts the U.S. pharmaceutical industry. The Affordable Care Act includes a number of provisions that are intended to lower healthcare costs, including provisions relating to prescription drug prices and government spending on medical products.

Since its enactment, there have also been judicial and Congressional challenges to certain aspects of the Affordable Care Act, as well as efforts by the former Trump administration to repeal or replace certain aspects of the statute. We continue to evaluate the effect that the Affordable Care Act and subsequent changes to the statute has on our business. It is uncertain the extent to which any such changes may impact our business or financial condition.

There has also been heightened governmental scrutiny recently over the manner in which drug manufacturers set prices for their marketed products. There have been several Congressional inquiries and proposed bills, as well as state efforts, designed to, among other things, bring more transparency to product pricing, review the relationship between pricing and manufacturer patient programs, and reform government program reimbursement methodologies for drug products. In June 2017, the FDA issued a Drug Competition Action plan intended to lower prescription drug prices by encouraging competition from generic versions of existing products. In July 2018, the FDA issued a Biosimilar Action Plan, intended to similarly promote competition to prescription biologics from biosimilars.

Individual states in the United States have also become increasingly aggressive in passing legislation and implementing regulations designed to control pharmaceutical and biological product pricing, including price or patient reimbursement constraints, discounts, restrictions on certain product access and marketing cost disclosure and transparency measures. For example, in September 2017, the California State Assembly approved SB17, which requires pharmaceutical companies to notify health insurers and government health plans at least 60 days before any scheduled increases in the prices of their products if they exceed 16% over a two-year period, and further requiring pharmaceutical companies to explain the reasons for such increase. Effective in 2016, Vermont passed a law requiring certain manufacturers identified by the state to justify their price increases.

We expect that these, and other healthcare reform measures that may be adopted in the future, may result in more rigorous coverage criteria and lower reimbursement, and in downward pressure on the price that we receive for any approved product. Any reduction in reimbursement from Medicare or other government-funded programs may result in a similar reduction in payments from private payors. The implementation of cost containment measures or other healthcare reforms may prevent us from being able to generate revenue, attain profitability or commercialize our drugs, once marketing approval is obtained.

We may not be successful in establishing collaborations for product candidates we seek to commercialize, which could adversely affect our ability to discover, develop, and commercialize products.

We expect to seek collaborations for the development and commercialization of product candidates in the future. The timing and terms of any collaboration will depend on the evaluation by prospective collaborators of the clinical trial results and other aspects of a product’s safety and efficacy profile. If we are unable to reach agreements with suitable collaborators for any product candidate, we will be forced to fund the entire development and commercialization of such product candidates, ourselves, and we may not have the resources to do so. If resource constraints require us to enter into a collaboration agreement early in the development of a product candidate, we may be forced to accept a more limited share of any revenues the product may eventually generate. We face significant competition in seeking appropriate collaborators. Moreover, these collaboration arrangements are complex and time-consuming to negotiate and document. We may not be successful in our efforts to establish collaborations or other alternative arrangements for any product candidate. Even if we are successful in establishing collaborations, we may not be able to ensure fulfillment by collaborators of their obligations or our expectations.

We do not have manufacturing, sales, or marketing experience.

We do not have experience in manufacturing, selling, or marketing. To obtain the expertise necessary to successfully manufacture, market, and sell our products, we must develop our own commercial infrastructure and/or collaborative commercial arrangements and partnerships. Our ability to execute our current operating plan is dependent on numerous factors, including, the performance of third-party collaborators with whom we may contract.

Our products under development may not gain market acceptance.

Our products may not gain market acceptance among physicians, patients, healthcare payers and the medical community. Significant factors in determining whether we will be able to compete successfully include:

| |

•

|

the efficacy and safety of our products;

|

| |

•

|

the time and scope of regulatory approval;

|

| |

•

|

reimbursement coverage from Medicare, Medicaid, insurance companies and others;

|

| |

•

|

the price and cost-effectiveness of our products, especially as compared to any competitive products; and

|

| |

•

|

the ability to maintain patent protection.

|

We may be required to defend lawsuits or pay damages for product liability claims.

Product liability is a major risk in testing and marketing biotechnology and pharmaceutical products. We may face substantial product liability exposure in human clinical trials and for products that we sell after regulatory approval. We carry product liability insurance and we expect to continue such policies. However, product liability claims, regardless of their merits, could exceed policy limits, divert management’s attention, and adversely affect our reputation and demand for our products.

Reimbursement decisions by third-party payors may have an adverse effect on pricing and market acceptance. If there is not sufficient reimbursement for our products, it is less likely that they will be widely used.