UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of August 2024

Commission File Number: 001-36397

Weibo Corporation

(Registrant’s Name)

8/F, QIHAO Plaza, No. 8 Xinyuan S. Road

Chaoyang District, Beijing 100027

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXPLANATORY NOTE

On August 22, 2024, Hong Kong time, we

published our unaudited financial results for the second quarter and six months ended June 30, 2024 as our interim report for the

six months ended June 30, 2024 (the “HK Interim Report”) under Rule 13.48(1) of the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Hong Kong Listing Rules”) on the website of The Stock

Exchange of Hong Kong Limited. Pursuant to the Hong Kong Listing Rules, our HK Interim Report contains supplemental disclosure of reconciliation

of the material differences between our consolidated financial statements prepared under the U.S. GAAP and International Financial Reporting

Standards, which is attached hereto as exhibit 99.1.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

WEIBO CORPORATION |

| |

|

| Date: August 22, 2024 |

By: |

/s/ Fei Cao |

| |

|

Fei Cao |

| |

|

Chief Financial Officer |

Exhibit 99.1

Reconciliation between U.S. GAAP and International Financial Reporting

Standards

PricewaterhouseCoopers was

engaged by the Company to conduct limited assurance engagement in accordance with International Standard on Assurance Engagements 3000

(Revised) “Assurance Engagements Other Than Audits or Reviews of Historical Financial Information” (“ISAE 3000 (Revised)”)

on the reconciliation statement of the unaudited financial information of the Company, its subsidiaries, VIEs and VIEs’ subsidiaries

(collectively referred to as “the Group”) setting out the differences between the unaudited interim condensed consolidated

financial information for the six months ended June 30, 2024 prepared under U.S. GAAP and the International Financial Reporting Standards

(“IFRS”) (the “Reconciliation Statement”).

The extent of procedures

selected depends on the PricewaterhouseCoopers’s judgment and their assessment of the risk. These procedures included:

(i) comparing the amounts

in the columns “Amounts as reported under U.S. GAAP” as set out in the Reconciliation Statement with the corresponding amounts

set out in the unaudited interim condensed consolidated financial information of the Group prepared under U.S. GAAP for the six months

ended June 30, 2024;

(ii) assessing the appropriateness

of the adjustments made in arriving at the “Amounts as reported under IFRS” as set out in the Reconciliation Statement, which

included evaluating the differences between the Group’s accounting policies adopted under U.S. GAAP and IFRS for the six months

ended June 30, 2024, and examining evidence supporting the adjustments made in arriving at the “Amounts as reported under IFRS”;

and

(iii) checking the arithmetic

accuracy of the calculation of the amounts in the columns “Amounts as reported under IFRS” as set out in the Reconciliation

Statement.

The procedures performed

by PricewaterhouseCoopers in this limited assurance engagement vary in nature and timing from, and are less in extent than for, a reasonable

assurance engagement. Consequently, the level of assurance obtained in a limited assurance engagement is substantially lower than the

assurance that would have been obtained had a reasonable assurance engagement been performed. For the purposes of this engagement, PricewaterhouseCoopers

is not responsible for updating or reissuing any reports or opinions on any historical financial information used in compiling the Reconciliation

Statement. PricewaterhouseCoopers’s engagement was intended solely for the use of the Directors in connection with this Reconciliation

Statement and may not be suitable for another purpose.

Based on the procedures performed

and evidence obtained, PricewaterhouseCoopers have concluded that nothing has come to their attention that causes them to believe that:

(i) the amounts in

the column “Amounts as reported under U.S. GAAP” as set out in the Reconciliation Statement are not in agreement with

the corresponding amounts in the unaudited interim condensed consolidated financial information of the Group prepared under U.S.

GAAP for the six months ended June 30, 2024;

(ii) the Reconciliation

Statement is not prepared, in all material respects, in accordance with the basis of preparation; and

(iii) the calculation

of the amounts in the columns “Amounts as reported under IFRS” as set out in the Reconciliation Statement are not arithmetically

accurate.

The unaudited condensed consolidated

financial information are prepared in accordance with U.S. GAAP, which differ in certain respects from IFRS. The effects of material differences

between the unaudited condensed consolidated financial information of the Group prepared under U.S. GAAP and IFRS are as follows:

Reconciliation of unaudited condensed consolidated

statements of operations (in US$ thousands):

| | |

| | |

For the Six Months Ended June 30, 2023 IFRS adjustments | | |

| |

| | |

Amounts as reported under U.S. GAAP | | |

Convertible

debts

(Note (i)) | | |

Leases

(Note (ii)) | | |

Investments

measured at

fair value

(Note (iii)) | | |

Share-based

compensation

(Note (iv)) | | |

Redeemable

non-controlling

interests

(Note (v)) | | |

Amounts as reported under IFRS | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 180,125 | | |

| — | | |

| (202 | ) | |

| — | | |

| (1,196 | ) | |

| — | | |

| 178,727 | |

| Sales and marketing | |

| 211,919 | | |

| — | | |

| (353 | ) | |

| — | | |

| (1,593 | ) | |

| — | | |

| 209,973 | |

| Product development | |

| 183,621 | | |

| — | | |

| (283 | ) | |

| — | | |

| (6,905 | ) | |

| — | | |

| 176,433 | |

| General and administrative | |

| 58,410 | | |

| — | | |

| (434 | ) | |

| — | | |

| (2,112 | ) | |

| — | | |

| 55,864 | |

| Total costs and expenses | |

| 634,075 | | |

| — | | |

| (1,272 | ) | |

| — | | |

| (11,806 | ) | |

| — | | |

| 620,997 | |

| Investment related income (loss),

net | |

| 1,965 | | |

| — | | |

| — | | |

| 1,046 | | |

| — | | |

| — | | |

| 3,011 | |

| Interest and other income (loss), net | |

| 14,039 | | |

| — | | |

| (1,569 | ) | |

| — | | |

| — | | |

| — | | |

| 12,470 | |

| Financial expense | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (1,358 | ) | |

| (1,358 | ) |

| Income before income tax expenses | |

| 235,947 | | |

| — | | |

| (297 | ) | |

| 1,046 | | |

| 11,806 | | |

| (1,358 | ) | |

| 247,144 | |

| Net income | |

| 188,645 | | |

| — | | |

| (297 | ) | |

| 1,046 | | |

| 11,806 | | |

| (1,358 | ) | |

| 199,842 | |

| Less: Net income attributable to non-controlling interests | |

| 813 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 3,859 | | |

| 4,672 | |

| Accretion to redeemable non-controlling interests | |

| 5,953 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (5,953 | ) | |

| — | |

| Net income attributable to Weibo's shareholders | |

| 181,879 | | |

| — | | |

| (297 | ) | |

| 1,046 | | |

| 11,806 | | |

| 736 | | |

| 195,170 | |

| | |

| | |

For the Six Months Ended June 30, 2024 IFRS adjustments | | |

| |

| | |

Amounts as reported under U.S. GAAP | | |

Convertible

debts

(Note (i)) | | |

Leases

(Note (ii)) | | |

Investments

measured at

fair value

(Note (iii)) | | |

Share-based

compensation

(Note (iv)) | | |

Redeemable

non-controlling

interests

(Note (v)) | | |

Amounts as reported under IFRS | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 176,611 | | |

| — | | |

| (143 | ) | |

| — | | |

| (1,239 | ) | |

| — | | |

| 175,229 | |

| Sales and marketing | |

| 217,859 | | |

| — | | |

| (577 | ) | |

| — | | |

| (2,225 | ) | |

| — | | |

| 215,057 | |

| Product development | |

| 152,415 | | |

| — | | |

| (234 | ) | |

| — | | |

| (7,530 | ) | |

| — | | |

| 144,651 | |

| General and administrative | |

| 51,363 | | |

| — | | |

| (329 | ) | |

| — | | |

| (2,580 | ) | |

| (1,986 | ) | |

| 46,468 | |

| Total costs and expenses | |

| 598,248 | | |

| — | | |

| (1,283 | ) | |

| — | | |

| (13,574 | ) | |

| (1,986 | ) | |

| 581,405 | |

| Investment related income (loss),

net | |

| (4,725 | ) | |

| — | | |

| — | | |

| (2,266 | ) | |

| — | | |

| — | | |

| (6,991 | ) |

| Interest and other income (loss), net | |

| (7,429 | ) | |

| 3,876 | | |

| (1,301 | ) | |

| — | | |

| — | | |

| — | | |

| (4,854 | ) |

| Fair value changes of convertible senior notes | |

| — | | |

| 33,885 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 33,885 | |

| Financial expense | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,355 | ) | |

| (2,355 | ) |

| Income before income tax expenses | |

| 222,968 | | |

| 37,761 | | |

| (18 | ) | |

| (2,266 | ) | |

| 13,574 | | |

| (369 | ) | |

| 271,650 | |

| Less: Income tax expenses | |

| 58,319 | | |

| — | | |

| — | | |

| (248 | ) | |

| — | | |

| — | | |

| 58,071 | |

| Net income | |

| 164,649 | | |

| 37,761 | | |

| (18 | ) | |

| (2,018 | ) | |

| 13,574 | | |

| (369 | ) | |

| 213,579 | |

| Less: Net income attributable to non-controlling interests | |

| 1,019 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,913 | | |

| 2,932 | |

| Accretion to redeemable non-controlling interests | |

| 2,261 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,261 | ) | |

| — | |

| Net income attributable to Weibo's shareholders | |

| 161,369 | | |

| 37,761 | | |

| (18 | ) | |

| (2,018 | ) | |

| 13,574 | | |

| (21 | ) | |

| 210,647 | |

Reconciliation of unaudited condensed consolidated

balance sheets (in US$ thousands):

| | |

| | |

As of December 31, 2023 IFRS adjustments | | |

| |

| | |

Amounts as reported under U.S. GAAP | | |

Convertible

debts

(Note (i)) | | |

Leases

(Note (ii)) | | |

Investments

measured at

fair value

(Note (iii)) | | |

Share-based

compensation

(Note (iv)) | | |

Redeemable

non-controlling

interests

(Note (v)) | | |

Amounts as reported under IFRS | |

| Goodwill and intangible assets, net | |

| 300,565 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (11,104 | ) | |

| 289,461 | |

| Long-term investments | |

| 1,320,386 | | |

| — | | |

| — | | |

| 55,921 | | |

| — | | |

| — | | |

| 1,376,307 | |

| Other non-current assets | |

| 926,028 | | |

| — | | |

| (2,256 | ) | |

| — | | |

| — | | |

| — | | |

| 923,772 | |

| Total assets | |

| 7,280,358 | | |

| — | | |

| (2,256 | ) | |

| 55,921 | | |

| — | | |

| (11,104 | ) | |

| 7,322,919 | |

| Accrued expenses and other current liabilities | |

| 666,833 | | |

| (336 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| 666,497 | |

| Convertible senior notes | |

| 317,625 | | |

| 38,920 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 356,545 | |

| Financial liability | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 79,623 | | |

| 79,623 | |

| Other long-term liabilities | |

| 112,430 | | |

| — | | |

| — | | |

| 11,861 | | |

| — | | |

| — | | |

| 124,291 | |

| Total liabilities | |

| 3,762,742 | | |

| 38,584 | | |

| — | | |

| 11,861 | | |

| — | | |

| 79,623 | | |

| 3,892,810 | |

| Redeemable non-controlling interests | |

| 68,728 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (68,728 | ) | |

| — | |

| Weibo shareholders' equity | |

| 3,398,735 | | |

| (38,584 | ) | |

| (2,256 | ) | |

| 44,060 | | |

| — | | |

| (63,261 | ) | |

| 3,338,694 | |

| Non-controlling interests | |

| 50,153 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 41,262 | | |

| 91,415 | |

| Total shareholders' equity | |

| 3,448,888 | | |

| (38,584 | ) | |

| (2,256 | ) | |

| 44,060 | | |

| — | | |

| (21,999 | ) | |

| 3,430,109 | |

| Total liabilities, redeemable non-controlling interests and shareholders' equity | |

| 7,280,358 | | |

| — | | |

| (2,256 | ) | |

| 55,921 | | |

| — | | |

| (11,104 | ) | |

| 7,322,919 | |

| | |

| | |

As of June 30, 2024 IFRS adjustments | | |

| |

| | |

Amounts as reported under U.S. GAAP | | |

Convertible

debts

(Note (i)) | | |

Leases

(Note (ii)) | | |

Investments

measured at

fair value

(Note (iii)) | | |

Share-based

compensation

(Note (iv)) | | |

Redeemable

non-controlling

interests

(Note (v)) | | |

Amounts as reported under IFRS | |

| Goodwill and intangible assets, net | |

| 283,646 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (10,869 | ) | |

| 272,777 | |

| Long-term investments | |

| 1,281,402 | | |

| — | | |

| — | | |

| 52,683 | | |

| — | | |

| — | | |

| 1,334,085 | |

| Other non-current assets | |

| 1,300,437 | | |

| — | | |

| (2,225 | ) | |

| — | | |

| — | | |

| — | | |

| 1,298,212 | |

| Total assets | |

| 7,102,285 | | |

| — | | |

| (2,225 | ) | |

| 52,683 | | |

| — | | |

| (10,869 | ) | |

| 7,141,874 | |

| Accrued expenses and other current liabilities | |

| 625,542 | | |

| (375 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| 625,167 | |

| Convertible senior notes | |

| 319,232 | | |

| 1,198 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 320,430 | |

| Financial liability | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 47,000 | | |

| 47,000 | |

| Other long-term liabilities | |

| 112,553 | | |

| — | | |

| — | | |

| 11,362 | | |

| — | | |

| — | | |

| 123,915 | |

| Total liabilities | |

| 3,688,718 | | |

| 823 | | |

| — | | |

| 11,362 | | |

| — | | |

| 47,000 | | |

| 3,747,903 | |

| Redeemable non-controlling interests | |

| 38,217 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (38,217 | ) | |

| — | |

| Weibo shareholders' equity | |

| 3,325,636 | | |

| (823 | ) | |

| (2,225 | ) | |

| 41,321 | | |

| — | | |

| (47,174 | ) | |

| 3,316,735 | |

| Non-controlling interests | |

| 49,714 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 27,522 | | |

| 77,236 | |

| Total shareholders' equity | |

| 3,375,350 | | |

| (823 | ) | |

| (2,225 | ) | |

| 41,321 | | |

| — | | |

| (19,652 | ) | |

| 3,393,971 | |

| Total liabilities, redeemable non-controlling interests and shareholders' equity | |

| 7,102,285 | | |

| — | | |

| (2,225 | ) | |

| 52,683 | | |

| — | | |

| (10,869 | ) | |

| 7,141,874 | |

Notes:

Basis of Preparation

The Directors of the Company are responsible for preparation of the

Reconciliation Statement in accordance with the relevant requirements of the Hong Kong Listing Rules and relevant guidance in HKEX-GL111-22.

The Reconciliation Statement was prepared based on the Group’s unaudited interim condensed consolidated financial information for

the six months ended June 30, 2024 prepared under U.S. GAAP, with adjustments made (if any) thereto in arriving at the unaudited

financial information of the Group prepared under IFRS. The adjustments reflect the differences between the Group’s accounting policies

under U.S. GAAP and IFRS.

| (i) | Convertible senior notes |

Under U.S. GAAP, the convertible senior

notes were measured at amortized cost, with any difference between the initial carrying value and the repayment amount recognized as interest

expenses using the effective interest method over the period from the issuance date to the maturity date. Under IFRS, the Group’s

convertible senior notes were designated as at fair value through profit or loss such that the convertible senior notes were initially

recognized at fair values. Subsequent to initial recognition, the Group considered that the amounts of changes in fair value of the convertible

senior notes which were attributed to changes in own credit risk of the convertible senior notes recognized in other comprehensive income

were insignificant. Therefore, the amounts of changes in fair value of the convertible senior notes were recognized in the profit or loss.

Under U.S. GAAP, the amortization of

the right-of-use assets and interest expense related to the lease liabilities are recorded together as lease cost to produce a straight-line

recognition effect in the income statement. Under IFRS, the amortization of the right-of-use asset is on a straight-line basis while the

interest expense related to the lease liabilities are the amount that produces a constant periodic rate of interest on the remaining balance

of the lease liability. The amortization of the right-of-use assets is recorded as lease expense and the interest expense is required

to be presented in separate line items.

| (iii) | Investments measured at fair value |

Under U.S. GAAP, convertible redeemable

preferred shares and ordinary shares with preferential rights issued by privately-held companies without readily determinable fair values

could elect an accounting policy choice. The Group elects the measurement alternative to record these equity investments without readily

determinable fair values at cost, less impairment, and plus or minus subsequent adjustments for observable price changes. Under IFRS,

these investments were classified as financial assets at fair value through profit or loss and measured at fair value with changes in

fair value recognized through profit or loss. Fair value changes of these long-term investments were recognized in the profit or loss.

| (iv) | Share-based compensation |

Under U.S. GAAP, companies are permitted

to make an accounting policy election regarding the attribution method for awards with service-only conditions and graded vesting features.

The valuation method that the company uses (single award or multiple tranches of individual awards) is not required to align with the

choice in attribution method used (straight-line or accelerated tranche by tranche). Under IFRS, companies are not permitted to choose

how the valuation or attribution method is applied to awards with graded-vesting features. Companies should treat each installment of

the award as a separate grant. This means that each installment would be separately measured and attributed to expense over the related

vesting period, which would accelerate the expense recognition.

| (v) | Redeemable non-controlling interests |

On October 31, 2020, the Group

entered into a series of share purchase agreements with then existing shareholders of Shanghai Jiamian Information Technology Co., Ltd.

or JM Tech, to acquire the majority of JM Tech’s equity interest. The Group agreed to redeem the non-controlling interests (“NCI”)

held by founders and CEO of JM Tech under certain circumstances. Under US GAAP, the Group determined that the NCI with redemption rights

should be bundled and classified as redeemable NCI and mezzanine classified on the balance sheet, since they are contingently redeemable

upon the occurrence of certain conditional events, which are not solely within the control of the Group. The redeemable NCI is recognized

at fair value on the acquisition date taking into account the probability of future redemption as well as estimated redemption amount,

and such fair value includes the right of redemption, which is viewed as part of the accounting purchase price when applying acquisition

accounting. Subsequently, the Group records accretion on the redeemable NCI as a whole to the redemption value over the period from the

date of the acquisition to the date of earliest redemption. The accretion using the effective interest method, is recorded as deemed dividends

to NCI holders. Under IFRS, as it is considered that the Group undertakes the obligation to purchase the remaining equity of JM Tech held

by the founders and CEO at fair value, the risk and reward of the shares reside with non-controlling interests in the consolidated statements.

Therefore, the Company recognized the NCI at fair value as permanent equity on acquisition date, and the fair value of such permanent

equity NCI does not consider the redemption right. IFRS requires the fair value of NCI redemption right (present value of the estimated

redemption amount) to be recognized as a separate financial liability on the balance sheet because the Group has an obligation to pay

cash in the future to purchase the NCI shares. This separate financial liability is not viewed as part of accounting purchase price when

applying acquisition accounting, which resulted in lower purchase price and therefore, a lower goodwill being recognized from the acquisition.

The initial recognition of this financial liability is a reduction of the parent’s equity. Subsequent changes in the carrying amount

of the financial liability are recognized as finance charges in the income statement.

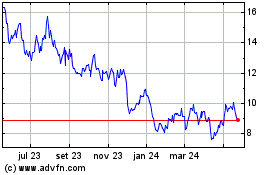

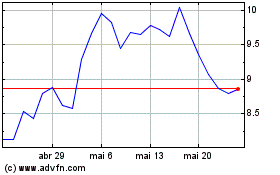

Weibo (NASDAQ:WB)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Weibo (NASDAQ:WB)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024