false

0000812074

0000812074

2024-09-04

2024-09-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

September 4, 2024

Date of Report (Date of earliest event reported)

O-I

GLASS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-9576 |

|

22-2781933 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

One Michael Owens Way

Perrysburg,

Ohio

(Address

of principal executive offices) |

43551-2999

(Zip

Code) |

(567)

336-5000

(Registrant’s telephone number, including

area code)

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which

registered |

| Common

stock, $.01 par value |

OI |

The New

York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 7.01. | REGULATION FD DISCLOSURE. |

O-I Glass, Inc. (the “Company”)

has approved the closure of four furnaces, which includes a single-furnace plant, in the Americas segment. These closures are part of

the Company’s previously communicated Fit to Win initiative to reduce redundant capacity and begin to optimize its network. Additional

furnace closures and other restructuring actions are expected later in 2024.

The furnace and plant closures are expected to

occur within the next six months. The Company intends to facilitate the closures in a respectful manner for the approximately 200 people

impacted. Current customers of the impacted plants will continue to be served by the same plant or by other plants in the Company’s

network.

Subject to finalization of certain estimates,

the Company expects to record charges associated with the above closures of approximately $20 million in the third quarter of 2024. Major

components of the charges include approximately $14 million for impairment of plant-related assets, such as furnaces and machinery, and

$6 million for one-time employee separation benefits and other costs related to the closings (of which approximately $5 million relate

to future cash expenditures).

In addition, the Company’s Chief Executive Officer, Gordon Hardie,

and Chief Financial Officer, John Haudrich, are scheduled to present at the UBS Global Materials Conference (the “Conference”)

on Wednesday, September 4, 2024 at 3:30 p.m., Eastern Time.

A

live webcast of the presentation will be available at the following link: https://event.webcasts.com/viewer/event.jsp?ei=1685068&tp_key=3c947d5317. The

replay from the Conference will be posted within 24 hours of the presentation and will be archived through this link for 90 days following

the completion of the Conference. A copy of the presentation slides, which will be discussed at the Conference, is attached hereto as

Exhibit 99.1 and will also be available on the Company’s website, www.o-i.com/investors.

The

information contained in this Item 7.01 and in Exhibit 99.1 hereto is furnished and

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference

into any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except

as expressly set forth by specific reference in such a filing.

Forward-Looking Statements

This Current Report on Form 8-K contains

“forward-looking” statements related to the Company within the meaning of Section 21E of the Exchange Act and Section 27A

of the Securities Act. Forward-looking statements reflect the Company’s current expectations and projections about future events

at the time, and thus involve uncertainty and risk. The words “expect,” “intend,” “will,” “anticipate”

and other similar expressions generally identify forward-looking statements.

It is possible that the Company’s future

results may differ from expectations due to a variety of factors including, but not limited to: (1) the general political, economic

and competitive conditions in markets and countries where the Company has operations, including uncertainties related to economic and

social conditions, trade disputes, disruptions in the supply chain, competitive pricing pressures, inflation or deflation, changes in

tax rates and laws, war, civil disturbance or acts of terrorism, natural disasters, public health issues and weather, (2) cost and

availability of raw materials, labor, energy and transportation (including impacts related to the current Ukraine-Russia and Israel-Hamas

conflicts and disruptions in supply of raw materials caused by transportation delays), (3) competitive pressures from other glass

container producers and alternative forms of packaging or consolidation among competitors and customers, (4) changes in consumer

preferences or customer inventory management practices, (5) the continuing consolidation of the Company’s customer base, (6) the

Company’s ability to improve its glass melting technology, known as the MAGMA program, and implement it within the timeframe expected,

(7) unanticipated supply chain and operational disruptions, including higher capital spending, (8) the Company’s ability

to achieve expected benefits from margin expansion and profitability initiatives, such as its Fit to Win program, including expected impacts

from production curtailments and furnace closures, (9) seasonality of customer demand, (10) the failure of the Company’s

joint venture partners to meet their obligations or commit additional capital to the joint venture, (11) labor shortages, labor cost increases

or strikes, (12) the Company’s ability to acquire or divest businesses, acquire and expand plants, integrate operations of acquired

businesses and achieve expected benefits from acquisitions, divestitures or expansions, (13) the Company’s ability to generate sufficient

future cash flows to ensure the Company’s goodwill is not impaired, (14) any increases in the underfunded status of the Company’s

pension plans, (15) any failure or disruption of the Company’s information technology, or those of third parties on which the Company

relies, or any cybersecurity or data privacy incidents affecting the Company or its third-party service providers, (16) risks related

to the Company’s indebtedness or changes in capital availability or cost, including interest rate fluctuations and the ability of

the Company to generate cash to service indebtedness and refinance debt on favorable terms, (17) risks associated with operating in foreign

countries, (18) foreign currency fluctuations relative to the U.S. dollar, (19) changes in tax laws or U.S. trade policies, (20) the Company’s

ability to comply with various environmental legal requirements, (21) risks related to recycling and recycled content laws and regulations,

(22) risks related to climate-change and air emissions, including related laws or regulations and increased ESG scrutiny and changing

expectations from stakeholders, and the other risk factors discussed in the Company’s filings with the SEC.

It is not possible to foresee or identify all

such factors. Any forward-looking statements in this Current Report on Form 8-K are based on certain assumptions and analyses made

by the Company in light of its experience and perception of historical trends, current conditions, expected future developments, and other

factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance, and actual

results or developments may differ materially from expectations. The Company does not assume any obligation to update or supplement any

particular forward-looking statements contained in this Current Report on Form 8-K.

| ITEM 9.01. | FINANCIAL STATEMENTS AND EXHIBITS. |

| | |

| (d) | Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

O-I GLASS, INC. |

| |

|

|

| Date: September 4, 2024 |

By: |

/s/ John A. Haudrich |

| |

Name: |

John A. Haudrich |

| |

Title: |

Senior Vice President and Chief Financial Officer |

Exhibit 99.1

| CAPITAL MARKETS

PRESENTATION

SEPTEMBER 4, 2024 |

| PRESENTERS

2

Gordon Hardie

President and CEO

John Haudrich

SVP and CFO |

| SAFE HARBOR COMMENTS

3

This presentation contains “forward-looking” statements related to O-I Glass, Inc. (“O-I Glass” or the “Company”) within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements reflect the company’s current expectations and projections about future events at the time, and thus

involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,” “potential,” “continue,” and the negatives of these words

and other similar expressions generally identify forward-looking statements.

It is possible that the Company’s future financial performance may differ from expectations due to a variety of factors including, but not limited to the following: (1) the general political, economic and competitive

conditions in markets and countries where the Company has operations, including uncertainties related to economic and social conditions, trade disputes, disruptions in the supply chain, competitive pricing

pressures, inflation or deflation, changes in tax rates and laws, war, civil disturbance or acts of terrorism, natural disasters, public health issues and weather, (2) cost and availability of raw materials, labor, energy

and transportation (including impacts related to the current Ukraine-Russia and Israel-Hamas conflicts and disruptions in supply of raw materials caused by transportation delays), (3) competitive pressures from

other glass container producers and alternative forms of packaging or consolidation among competitors and customers, (4) changes in consumer preferences or customer inventory management practices, (5) the

continuing consolidation of the Company’s customer base, (6) the Company’s ability to improve its glass melting technology, known as the MAGMA program, and implement it within the timeframe expected, (7)

unanticipated supply chain and operational disruptions, including higher capital spending, (8) the Company’s ability to achieve expected benefits from margin expansion and profitability initiatives, such as its Fit to

Win program, including expected impacts from production curtailments and furnace closures, (9) seasonality of customer demand, (10) the failure of the Company’s joint venture partners to meet their obligations

or commit additional capital to the joint venture, (11) labor shortages, labor cost increases or strikes, (12) the Company’s ability to acquire or divest businesses, acquire and expand plants, integrate operations of

acquired businesses and achieve expected benefits from acquisitions, divestitures or expansions, (13) the Company’s ability to generate sufficient future cash flows to ensure the Company’s goodwill is not

impaired, (14) any increases in the underfunded status of the Company’s pension plans, (15) any failure or disruption of the Company’s information technology, or those of third parties on which the Company

relies, or any cybersecurity or data privacy incidents affecting the Company or its third-party service providers, (16) risks related to the Company’s indebtedness or changes in capital availability or cost, including

interest rate fluctuations and the ability of the Company to generate cash to service indebtedness and refinance debt on favorable terms, (17) risks associated with operating in foreign countries, (18) foreign

currency fluctuations relative to the U.S. dollar, (19) changes in tax laws or U.S. trade policies, (20) the Company’s ability to comply with various environmental legal requirements, (21) risks related to recycling

and recycled content laws and regulations, (22) risks related to climate-change and air emissions, including related laws or regulations and increased ESG scrutiny and changing expectations from stakeholders, and

the other risk factors discussed in the Company's filings with the Securities and Exchange Commission.

It is not possible to foresee or identify all such factors. Any forward-looking statements in this document are based on certain assumptions and analyses made by the Company in light of its experience and

perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future

performance, and actual results or developments may differ materially from expectations. While the Company continually reviews trends and uncertainties affecting the Company’s results of operations and

financial condition, the Company does not assume any obligation to update or supplement any particular forward-looking statements contained in this document.

Additionally, certain forward-looking and other statements in this presentation or other locations, such as the Company’s corporate website, regarding ESG matters are informed by various ESG standards and

frameworks (which may include standards for the measurement of underlying data) and the interests of various stakeholders. Accordingly, such information may not be, and should not be interpreted as

necessarily being “material” under the federal securities laws for SEC reporting purposes, even if the Company uses the word “material” or “materiality” in such discussions. ESG information is also often reliant on

third-party information or methodologies that are subject to evolving expectations and best practices, and the Company’s approach to and discussion of these matters may continue to evolve as well. For example,

the Company’s disclosures may change due to revisions in framework requirements, availability of information, changes in our business or applicable governmental policies, or other factors, some of which may be

beyond its control. |

| O-I AT A GLANCE

4

GLOBAL LEADER IN GLASS PACKAGING FOCUSED ON WINNING WITH CUSTOMERS,

IMPROVING ECONOMIC PROFIT, AND INCREASING THE VALUE OF THE COMPANY

Glass is the

preferred choice

for premium and

health-oriented

products

~23,000

employees

across 68 plants

in 19 countries #1

global leader in

glass packaging

customers across a

broad product portfolio

$1.22 $1.83 $2.30 $3.09

5.5x

4.4x

3.5x

2.9x

0.0x

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x

2020 2021 2022 2023

ADJUSTED EPS & FINANCIAL LEVERAGE

FY 2023

36

BILLION

glass containers

manufactured in 2023

$7.1B NET SALES

FIT TO WIN

Economic profit mindset to

improve competitiveness and

boost results

6,000 Sustainability

Leadership

is driving

customer demand

BREAKTHROUGH

INNOVATION

MAGMA

& ULTRA |

| O-I SERVES THE BRANDS YOU TRUST AND LOVE

5

LEADING CUSTOMER RELATIONSHIPS, DESIGN CAPABILITIES AND SERVICE LEVELS |

| PORTFOLIO OVERVIEW

6 O-I’s non-reportable segment includes operations in Asia as well as machine part sales and engineering services

1) 2023-2028 Euromonitor estimates for one way domestic + imported consumption.

AMERICAS EU

Net Sales ($B) $3.9 $3.1 $7.1

# Plants 32 34 68

# Countries 7 10 19

Long Term Contracts 75% 35% 55%

Long Term CAGR1

-1% to +2% 0% to 1% 0% to 1%

Beer 32%

Wine 19%

Food 17%

NAB 16%

Spirits 16%

Category Mix

PRIVILEGED FOOTPRINT WITH DEEP TECHNICAL AND MANUFACTURING CAPABILITIES

2023 |

| COMPETITIVE GLASS OFFERING LEVERAGES MEGA TRENDS

7

Increased demand

for premium

beverages

Health and

wellness favors

glass over plastics

CPG innovation

and diversification

of product portfolios

Glass is the most

sustainable rigid

packaging

Favorable Neutral Unfavorable

Glass

Metal

Plastics |

| VALUE CREATION ROADMAP

8

EARNINGS IMPROVEMENT AND VALUE CREATION OPPORTUNITY

SUPPORTED MORE BY SELF HELP RATHER THAN SIGNIFICANT

MARKET RECOVERY

Horizon 1

(Thru 2025)

FIT TO WIN

Horizon 2

(2026-2027)

BUILD VALUE

MOMENTUM

Horizon 3

(2028+)

STRATEGIC

OPTIONALITY

CURRENT

O-I EP

CAPTURE

FUTURE

O-I EP

CAPTURE

-3%

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

7%

8%

-$200

-$100

$0

$100

$200

$300

$400

$500

2022 2023 1H24 LTM

ES %

EP ($M)

EP ES %

REVERSE TREND IN

ECONOMIC PROFIT

ECONOMIC PROFIT MINDSET

CAPTURING MORE OF THE ECONOMIC PROFIT

IN THE PACKAGING VALUE CHAIN

Economic profit (EP) refers to net earnings (loss) attributable to the Company, excluding interest expense, net, and non-cash goodwill impairment charges, minus the product of the Company’s average invested capital and its weighted average cost of capital.

Economic spread percentage (ES %) refers to economic profit divided by the Company’s average invested capital.

Preliminary Targets¹ (2027)

• Sustainable aEBITDA ≥ $1.45B

• FCF ≥ 5% of Sales

• ES % ≥ 2% above WACC |

| HORIZON 1: FIT TO WIN

ENHANCE COMPETITIVENESS

DRIVE CAPITAL DISCIPLINE AND CASH GENERATION

CONSISTENT FINANCIAL PERFORMANCE

PILLARS ACTIONS AND NEXT STEPS

• Decentralize business model to align accountability

• End-to-end supply chain review / network optimization

• Deliver economically profitable mix and growth

• Incorporate an economic profit (EP) model

• Increased capital accountability

• Economic profit will be a key financial KPI

• Evaluate aligning incentives with economic profit

PERFORMANCE = POTENTIAL MINUS INTERFERENCE

9 FIT TO WIN TO ADDRESS THE INTERFERENCE

• 24% capacity temporarily curtailed QTD 3Q24 due to slow demand / reduce IDS

• Announced closure of 4 furnaces as part of program to close 6+ furnaces

• In 3Q24 earnings call: Detail furnace closure program & 2025 SG&A savings plan

• Initiated analysis of EP performance across all countries, plants, customers, and SKUs

• All discretionary capital halted at EP negative operations pending further review

• In 2H24: Develop draft restructuring and CapEx plan based on EP analysis

• Shared enterprise EP and ES % for 2022, 2023 and YTD 2024 (see previous page)

• In 2H24: Integrate EP as an element into future incentive plan structure

FIT TO WIN WILL DRIVE A STEP CHANGE IN O-I’S COMPETITIVE POSITION |

| MONETIZING MAGMA

10

GEN 2 MAGMA GREENFIELD

(Bowling Green, KY)

MAGMA CORE TECHNOLOGY WORKS

RAMPING UP MAGMA GEN 2 GREENFIELD IN BOWLING GREEN

• Finalizing cold commissioning activities

• Began producing glass in August and ramping up production during 3Q

ACCELERATING MAGMA TO ECONOMIC PROFIT

• Gen 1 evaluating targeted legacy furnace replacement at end of life

• Gen 2 proving the industrial model at scale

• Gen 3 consideration as part of Horizon 3 priorities

►

►

MAGMA CONTINUES TO ADVANCE WITH INCREASED

FOCUS ON ACCELERATING ECONOMIC PROFIT

► |

| 100%

2023

Unencumbered cash

DISCIPLINED CAPITAL

ALLOCATION

11

GET FIT TO WIN

IMPROVE CAPITAL STRUCTURE

RETURN VALUE TO SHAREHOLDERS

FCF PROFILE (PRIOR TO ASBESTOS PAYMENTS)

FOLLOWING FINAL AND FAIR RESOLUTION OF ASBESTOS-RELATED LEGACY LIABILITIES IN 2022, A SIGNIFICANT

PORTION OF CASH FLOW IS NO LONGER ENCUMBERED

AND IS INCREASINGLY ALLOCATED TO ENHANCING

SHAREHOLDER VALUE

48% 52%

2013 - 2022

Asbestos-related payments

Unencumbered cash

More than $1.5B

was spent on

asbestos-related

payments |

| CURRENT MARKET UPDATE

12

O-I IS NOT UPDATING GUIDANCE

DEMAND REMAINS SLUGGISH BUT CONTINUE TO EXPECT MODEST SALES VOLUME GROWTH IN 3Q24 GIVEN EASIER PY COMPS

REFINING EXPECTED MULTI-YEAR COMPETITIVENESS PROGRAM, MORE DETAILS ON 3Q24 EARNINGS CALL

EXPECT PERFORMANCE WILL REBOUND AS O-I IMPLEMENTS THE FIT TO WIN PROGRAM AND DRIVES EP GROWTH |

| O-I IS THE GLOBAL LEADER IN GLASS PACKAGING, SERVING THE STABLE

AND GROWING FOOD AND BEVERAGE INDUSTRY

STRONG CUSTOMER RELATIONSHIPS REFLECT O-I’S SERVICE LEVEL

CAPABILITIES, PRIVILEGED FOOTPRINT AND MANUFACTURING KNOW HOW

LONG-TERM MEGA TRENDS FAVOR GLASS, WHICH IS WELL POSITIONED

TO WIN IN THE NEW GREEN ECONOMY

FIT TO WIN WILL MAKE O-I MORE COMPETITIVE, IMPROVE PERFORMANCE

AND ENABLE ECONOMIC PROFITABLE GROWTH AS MARKETS RECOVER

CONCLUSION

13

1

2

3

4

5 TAKING RAPID ACTION TO STAGE O-I FOR SUCCESS IN 2025 AND BEYOND

KEY CATALYSTS

• Execute Fit to Win Program

• Drive Capital Discipline

• Deliver Profitable Growth |

| APPENDIX |

| HISTORIC FINANCIAL PERFORMANCE

15

$1.22

$1.83

$2.30

$3.09

2020 2021 2022 2023

aEPS

$6,091 $6,357 $6,856 $7,105

2020 2021 2022 2023

SALES ($B)

$146

$282 $236 $130

$311

$398

$539

$688

$-

$100

$200

$300

$400

$500

$600

$700

$800

2020 2021 2022 2023

FCF AND CAPEX ($M)

~ 50%

Strategic

CapEx

5.5

4.4

3.5

2.9

2.5

2020 2021 2022 2023 LT Target

FINANCIAL LEVERAGE |

| OUR SUSTAINABILITY GOALS

Increase recycled content to 50% average by 2030. O-I

is taking a tailored approach to increase recycled

content rates across its enterprise network as rates

vary significantly by geography.

50% TARGET

Reduce the amount of natural resources used, reduce

the generation of waste by reuse and recycling as we

drive towards a “Zero Waste” organization.

ZERO WASTE

We are committed to reducing our global water usage

25% by 2030, prioritizing operations in higher risk areas.

25% WATER REDUCTION

Renewable energy is a pillar in our strategy to lower

carbon emissions. Our goal is to reach 40% renewable

electricity use by 2030 and to reduce total energy

consumption by 9%.

40% RENEWABLE

As part of our journey toward zero injuries, we are

committed to a 50% improvement of our Total

Recordable Incident Rate (TRIR) by 2030.

ZERO INJURIES

We see tremendous opportunity to positively impact

the planet and communities where we operate. We will

collaborate with customers, NGOs, suppliers and local

leaders with an aim to make glass recycling available in

100% of our locations.

SOCIAL IMPACT

Approved SBTi target to reduce GHG emissions

25% by 2030 (interim target of 10% by 2025).

25% GHG REDUCTION

At O-I, we are better when we reflect the diverse

world we serve, feel welcome, and have equal access to

opportunities. We are focused on increasing all aspects

of diversity, equity and inclusion across our team.

DIVERSITY, EQUITY & INCLUSION

Reinvent and reimagine glass-making so the circularity of

glass meets the potential of our MAGMA melting

technology, low-carbon alternative fuels, and light-weighted glass packaging.

R&D TRANSFORMATION

Achieve sustainability balance, together, by aligning

our supply chain with our 2030 sustainability vision

and goals.

SUPPLY CHAIN SUSTAINABILITY

16 |

| NON-GAAP FINANCIAL MEASURES

17

The company uses certain non-GAAP financial measures, which are measures of its historical or future financial performance that are not calculated and presented in

accordance with GAAP, within the meaning of applicable SEC rules. Management believes that its presentation and use of certain non-GAAP financial measures, including

adjusted earnings, adjusted earnings per share, free cash flow, total financial leverage, net debt leverage, EBITDA, adjusted EBITDA, economic profit and economic

spread percentage, provide relevant and useful supplemental financial information that is widely used by analysts and investors, as well as by management in assessing

both consolidated and business unit performance. These non-GAAP measures are reconciled to the most directly comparable GAAP measures and should be considered

supplemental in nature and should not be considered in isolation or be construed as being more important than comparable GAAP measures.

Adjusted earnings relates to net earnings (loss) attributable to the company, exclusive of items management considers not representative of ongoing operations and other

adjustments because such items are not reflective of the company’s principal business activity, which is glass container production. Adjusted earnings are divided by

weighted average shares outstanding (diluted) to derive adjusted earnings per share. EBITDA refers to net earnings, excluding gains or losses from discontinued

operations, interest expense, net, provision for income taxes, depreciation and amortization of intangibles. Adjusted EBITDA refers to EBITDA, exclusive of items

management considers not representative of ongoing operations and other adjustments. Total financial leverage refers to the sum of total debt less cash, plus unfunded

pension liability, plus the asbestos liability or Paddock liability divided by Adjusted EBITDA. Net debt leverage refers to total debt less cash divided by Adjusted

EBITDA. Economic Profit refers to net earnings (loss) attributable to the Company, excluding interest expense, net, and non-cash goodwill impairment charges, minus the

product of the Company’s average invested capital and its weighted average cost of capital. Economic Spread percentage refers to Economic Profit divided by the

Company’s average invested capital. Management uses adjusted earnings, adjusted earnings per share, EBITDA, Adjusted EBITDA, total financial leverage, net debt

leverage, economic profit and economic spread percentage to evaluate its period-over-period operating performance because it believes these provide useful supplemental

measures of the results of operations of its principal business activity by excluding items that are not reflective of such operations. The above non-GAAP financial

measures may be useful to investors in evaluating the underlying operating performance of the company’s business as these measures eliminate items that are not

reflective of its principal business activity.

Further, free cash flow relates to cash provided by operating activities plus cash payments to fund the Paddock 524(g) trust and related expenses less cash payments for

property, plant and equipment. Management has historically used free cash flow to evaluate its period-over-period cash generation performance because it believes these

have provided useful supplemental measures related to its principal business activity. It should not be inferred that the entire free cash flow amount is available for

discretionary expenditures, since the company has mandatory debt service requirements and other non-discretionary expenditures that are not deducted from these

measures. Management uses non-GAAP information principally for internal reporting, forecasting, budgeting and calculating compensation payments.

The company routinely posts important information on its website – www.o-i.com/investors. |

| RECONCILIATION TO ADJUSTED EARNINGS

18

The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP measure, adjusted earnings and adjusted earnings per share, for periods beyond the year ended December 31, 2023 to its most directly

comparable GAAP financial measure, Net earnings (loss) attributable to the Company, because management cannot reliably predict all of the necessary components of this GAAP financial measure without unreasonable efforts. Net earnings

(loss) attributable to the Company includes several significant items, such as restructuring charges, asset impairment charges, charges for the write-off of finance fees, and the income tax effect on such items. The decisions and events that

typically lead to the recognition of these and other similar items are complex and inherently unpredictable, and the amount recognized for each item can vary significantly. Accordingly, the Company is unable to provide a reconciliation of

adjusted earnings and adjusted earnings per share to net earnings (loss) attributable to the Company or address the probable significance of the unavailable information, which could be material to the Company's future financial results. |

| RECONCILIATION FOR SEGMENT OPERATING PROFIT

19 |

| RECONCILIATION TO NET DEBT AND FINANCIAL LEVERAGE RATIOS

20 |

| RECONCILIATION TO ADJUSTED EBITDA

21

For the year ending December 31, 2024, the Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP measure, adjusted EBITDA, to its most directly comparable U.S. GAAP financial

measure, net earnings (loss), because management cannot reliably predict all of the necessary components of this U.S. GAAP financial measure without unreasonable efforts. Net earnings (loss) includes several significant

items, such as restructuring, asset impairment and other charges, charges for the write-off of finance fees, and the income tax effect on such items. The decisions and events that typically lead to the recognition of these

and other similar non-GAAP adjustments are inherently unpredictable as to if and when they may occur. The inability to provide a reconciliation is due to that unpredictability and the related difficulties in assessing the

potential financial impact of the non-GAAP adjustments. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to the Company’s future

financial results. |

| RECONCILIATION TO ECONOMIC PROFIT AND ECONOMIC SPREAD PERCENTAGE

22 |

| FREE CASH FLOW PROFILE (PRIOR TO ASBESTOS PAYMENTS) RECONCILIATION

23 |

| ADDITIONAL RECONCILIATION

24

RECONCILIATION TO FREE CASH FLOW

RECONCILIATION TO FINANCIAL AND NET DEBT LEVERAGE RATIOS

For the periods ending after December 31, 2023, the Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP measures, total financial leverage ratio and net debt leverage ratio, which are

defined as the sum of total debt less cash, unfunded pension liability and asbestos/Paddock liability divided by Adjusted EBITDA and total debt less cash divided by Adjusted EBITDA, respectively, to its most directly comparable

U.S. GAAP financial measure, Net earnings (loss), because management cannot reliably predict all of the necessary components of this U.S. GAAP financial measure without unreasonable efforts. Net earnings (loss) includes

several significant items, such as restructuring, asset impairment and other charges, charges for the write-off of finance fees, and the income tax effect on such items. The decisions and events that typically lead to the

recognition of these and other similar non-GAAP adjustments are inherently unpredictable as to if and when they may occur. The inability to provide a reconciliation is due to that unpredictability and the related difficulties in

assessing the potential financial impact of the non-GAAP adjustments. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to the

Company’s future financial results. |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

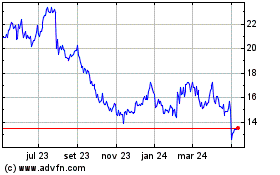

OI Glass (NYSE:OI)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

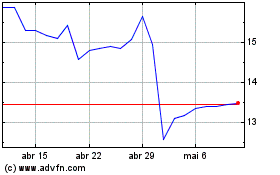

OI Glass (NYSE:OI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024