Form 425 - Prospectuses and communications, business combinations

18 Setembro 2024 - 9:12AM

Edgar (US Regulatory)

Filed by Vista Outdoor Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Exchange Act of 1934

Subject Company: Revelyst, Inc.

Commission File No.: 001-41793

Vista Outdoor Recommends CSG Transaction and Rejects Last Proposal from MNC September 18, 2024

Forward-Looking

Statements 2 Some of the statements made and information contained in these materials, excluding historical information, are “forward-looking statements,” including those that discuss, among other things: Vista Outdoor Inc.’s (“Vista Outdoor”, “we”,

“us” or “our”) plans, objectives, expectations, intentions, strategies, goals, outlook or other non-historical matters; projections with respect to future revenues, income, earnings per share or other financial measures for Vista Outdoor; and the

assumptions that underlie these matters. The words “believe,” “expect,” “anticipate,” “intend,” “aim,” “should” and similar expressions are intended to identify such forward-looking statements. To the extent that any such information is

forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities Litigation Reform Act of 1995. Numerous risks, uncertainties and other factors could cause our actual results to differ

materially from the expectations described in such forward-looking statements, including the following: risks related to the previously announced transaction among Vista Outdoor, Revelyst, Inc. (“Revelyst”), CSG Elevate II Inc., CSG Elevate III Inc.

and CZECHOSLOVAK Group a.s. (the “Transaction”), including (i) the failure to receive, on a timely basis or otherwise, the required approval of the Transaction by our stockholders, (ii) the possibility that any or all of the various conditions to the

consummation of the Transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals),

(iii) the possibility that competing offers or acquisition proposals may be made, (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement relating to the Transaction, including in

circumstances which would require Vista Outdoor to pay a termination fee, (v) the effect of the announcement or pendency of the Transaction on our ability to attract, motivate or retain key executives and employees, our ability to maintain

relationships with our customers, vendors, service providers and others with whom we do business, or our operating results and business generally, (vi) risks related to the Transaction diverting management’s attention from our ongoing business

operations and (vii) that the Transaction may not achieve some or all of any anticipated benefits with respect to either business segment and that the Transaction may not be completed in accordance with our expected plans or anticipated timelines, or

at all; risks related to the review of strategic alternatives announced on July 30, 2024 (“Review”), including (i) the terms, structure, benefits and costs of any transaction that may result from the Review, (ii) the timing of any such transaction

that may result from the Review and whether any such transaction will be consummated at all, (iii) the effect of the announcement of the Review on our ability to attract, motivate or retain key executives and employees, our ability to maintain

relationships with our customers, vendors, service providers and others with whom we do business, or our operating results and business generally, (iv) risks related to the Review diverting management’s attention from our ongoing business operations,

(v) the costs or expenses resulting from the Review, (vi) any litigation relating to the Review and (vii) the Review may not achieve some or all of any anticipated benefits of the Review; impacts from the COVID-19 pandemic on our operations, the

operations of our customers and suppliers and general economic conditions; supplier capacity constraints, production or shipping disruptions or quality or price issues affecting our operating costs; the supply, availability and costs of raw materials

and components; increases in commodity, energy, and production costs; seasonality and weather conditions; our ability to complete acquisitions, realize expected benefits from acquisitions and integrate acquired businesses; reductions in or unexpected

changes in or our inability to accurately forecast demand for ammunition, accessories, or other outdoor sports and recreation products; disruption in the service or significant increase in the cost of our primary delivery and shipping services for

our products and components or a significant disruption at shipping ports; risks associated with diversification into new international and commercial markets, including regulatory compliance; our ability to take advantage of growth opportunities in

international and commercial markets; our ability to obtain and maintain licenses to third-party technology; our ability to attract and retain key personnel; disruptions caused by catastrophic events; risks associated with our sales to significant

retail customers, including unexpected cancellations, delays, and other changes to purchase orders; our competitive environment; our ability to adapt our products to changes in technology, the marketplace and customer preferences, including our

ability to respond to shifting preferences of the end consumer from brick and mortar retail to online retail; our ability to maintain and enhance brand recognition and reputation; others’ use of social media to disseminate negative commentary about

us, our products, and boycotts; the outcome of contingencies, including with respect to litigation and other proceedings relating to intellectual property, product liability, warranty liability, personal injury, and environmental remediation; our

ability to comply with extensive federal, state and international laws, rules and regulations; changes in laws, rules and regulations relating to our business, such as federal and state ammunition regulations; risks associated with cybersecurity and

other industrial and physical security threats; interest rate risk; changes in the current tariff structures; changes in tax rules or pronouncements; capital market volatility and the availability of financing; foreign currency exchange rates and

fluctuations in those rates; general economic and business conditions in the United States and our markets outside the United States, including as a result of the war in Ukraine and the imposition of sanctions on Russia, the COVID-19 pandemic,

conditions affecting employment levels, consumer confidence and spending, conditions in the retail environment, and other economic conditions affecting demand for our products and the financial health of our customers. You are cautioned not to place

undue reliance on any forward-looking statements we make, which are based only on information currently available to us and speak only as of the date hereof. A more detailed description of risk factors that may affect our operating results can be

found in Part 1, Item 1A, Risk Factors, of our Annual Report on Form 10-K for fiscal year 2024, and in the filings we make with the Securities and Exchange Commission (the “SEC”) from time to time. We undertake no obligation to update any

forward-looking statements, except as otherwise required by law.

No Offer or

Solicitation This communication is neither an offer to sell, nor a solicitation of an offer to buy any securities, the solicitation of any vote, consent or approval in any jurisdiction pursuant to or in connection with the Transaction or otherwise,

nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act

of 1933, as amended, and otherwise in accordance with applicable law. Additional Information and Where to Find It These materials may be deemed to be solicitation material in respect of the Transaction. In connection with the Transaction, Revelyst, a

subsidiary of Vista Outdoor, filed with the SEC on January 16, 2024 a registration statement on Form S-4 in connection with the proposed issuance of shares of common stock of Revelyst to Vista Outdoor stockholders pursuant to the Transaction, which

Form S-4 includes a proxy statement of Vista Outdoor that also constitutes a prospectus of Revelyst (the “proxy statement/prospectus”). INVESTORS AND STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING OUR PROXY

STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The registration statement was declared effective by the SEC on March 22, 2024, and we have mailed the definitive proxy

statement/prospectus to each of our stockholders entitled to vote at the meeting relating to the approval of the Transaction. Investors and stockholders may obtain the proxy statement/prospectus and any other documents free of charge through the

SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Vista Outdoor are available free of charge on our website at www.vistaoutdoor.com. Participants in Solicitation Vista Outdoor, Revelyst, CSG Elevate II Inc., CSG Elevate III

Inc. and CZECHOSLOVAK GROUP a.s. and their respective directors, executive officers and certain other members of management and employees, under SEC rules, may be deemed to be “participants” in the solicitation of proxies from our stockholders in

respect of the Transaction. Information about our directors and executive officers is set forth in our proxy statement on Schedule 14A for our 2024 Annual Meeting of Stockholders, which was filed with the SEC on July 24, 2024, and subsequent

statements of changes in beneficial ownership on file with the SEC. These documents are available free of charge through the SEC’s website at www.sec.gov. Additional information regarding the interests of potential participants in the solicitation of

proxies in connection with the Transaction, which may, in some cases, be different than those of our stockholders generally, is also included in the proxy statement/prospectus relating to the Transaction.

Non-GAAP

Financial Measures 4 Non-GAAP financial measures such as adjusted EBITDA and adjusted EBITDA margin as included in this presentation are supplemental measures that are not calculated in accordance with Generally Accepted Accounting Principles

(“GAAP”). Adjusted EBITDA is defined as net income before other income/(expense), interest, taxes, and depreciation and amortization, excluding certain non-recurring and non-cash items. We calculate adjusted EBITDA margin as adjusted EBITDA divided

by net sales. Vista Outdoor management believes adjusted EBITDA and adjusted EBITDA margin provide investors with an important perspective on Vista Outdoor’s core profitability and help investors analyze underlying trends in its business and evaluate

its performance on an absolute basis and relative to its peers. Adjusted EBITDA and adjusted EBITDA margin should be considered in addition to, and not as substitutes for, GAAP net income and GAAP net income margin. Vista Outdoor’s definitions may

differ from those used by other companies. Vista Outdoor has not reconciled adjusted EBITDA or adjusted EBITDA margin guidance to GAAP net income or GAAP net income margin guidance because Vista Outdoor does not provide guidance for net income, which

is a reconciling item for Adjusted EBITDA. GAAP net income is also a reconciling item between GAAP net income margin and non-GAAP Adjusted EBITDA margin. Accordingly, a reconciliation to net income and net income margin is not available without

unreasonable effort.

Today’s

Announcements 5 Vista Outdoor recommends the CSG Transaction Delivers $28 in cash and one share of Revelyst per share of Vista Prepared to close in October Vista Outdoor rejects MNC’s last proposal of $43 per share in cash Significantly undervalues

Vista Outdoor, including undervaluing The Kinetic Group by ~$250MM relative to the CSG Transaction MNC failed to submit a best and final proposal on September 17 as requested by Vista Outdoor Private Equity Firm Partnered with MNC (“Private Equity

Firm”) approached Vista Outdoor without participation of MNC Vista Outdoor Board in active discussions with the Private Equity Firm regarding sale of Revelyst An agreement could be reached in conjunction with or independent of the CSG Transaction

Vista Outdoor urges stockholders to vote FOR the CSG Transaction Delivers immediate cash for Kinetic at $2.15Bn valuation, ~$250MM higher than MNC’s implied ~$1.9Bn valuation Stockholders retain optionality to realize change of control premium for

Revelyst Vote FOR CSG Transaction to be able to close ahead of October 15th termination date

Strategic Alternatives Review Yields Superior Value for Stockholders 6 ✓ CSG to invest $150MM in Revelyst for 7.5% pro forma ownership, valuing

Revelyst at $2.0Bn ✓ CSG’s investment is in addition to their existing $2.15Bn transaction for The Kinetic Group, which is ~$250MM higher than the implied valuation of MNC’s

last proposal CSG has agreed to make a $150MM investment in Revelyst, in addition to their existing agreement to acquire The Kinetic Group for $2.15Bn, delivering cash consideration of $28 per share to stockholders ✓ After six additional weeks of diligence, MNC’s last proposal to acquire Vista Outdoor for $43 per share in cash undervalues The Kinetic Group by ~$250MM relative to the CSG Transaction and does not

represent an increase in enterprise value since their prior proposal in June ✓ MNC transaction unlikely to close until 2025 Vista Outdoor continued to engage extensively with

MNC, accommodated MNC’s diligence requests and provided access to management The CSG Transaction, which can be terminated after October 15, 2024, provides stockholders with superior value for The Kinetic Group and continued optionality to realize a

change of control premium for Revelyst ✓ While no agreement has been reached, the Vista Outdoor Board will continue its discussions with the Private Equity Firm, and an

agreement could be reached in conjunction with or independent of the CSG Transaction

The CSG

Transaction Provides More Compelling Value than MNC’s Last Proposal 7 Source: Company Filings Sum-of-the-Parts Implied Enterprise Value $ Billion CSG Transaction MNC Last Proposal Note:1. Represents implied enterprise values based on information

submitted to Vista Outdoor as part of MNC’s last proposal (1) The CSG Transaction delivers $2.15Bn cash value for The Kinetic Group, ~$250MM more value vs. MNC Stockholders receive superior value via $28 per share in cash plus a share of Revelyst The

CSG Transaction provides stockholders opportunity to participate in the upside potential of Revelyst and optionality to realize a change of control premium for Revelyst, including via a transaction with the Private Equity Firm$1.9 $1.2 $3.1 Vista

Outdoor rejects MNC’s last proposal due to its significant undervaluation relative to the CSG Transaction $ billion MNC Last Proposal CSG Transaction $3.1 $1.2 $1.9 $4.1 $2.0 $2.15

Sale of

Kinetic to CSG Maximizes Stockholder Value, While MNC’s Last Proposal Significantly Undervalues Vista Outdoor 8 CSG Transaction MNC’s Last Proposal Maximizes stockholder value by providing $28 per share in cash and opportunity to participate in

upside and potential change of control premium for Revelyst Significantly undervalues Vista Outdoor Crystalizes value for The Kinetic Group that is ~$250MM higher than the value implied in MNC’s last proposal and values Revelyst at $2.0Bn Despite

extensive due diligence access, does not represent an increase in enterprise value versus prior proposal Prepared to close in October, given all requiredregulatory approvals have been received Multiple months to close given regulatory approvals and

financing structure; unlikely to close until 2025 Opportunity to continue review of alternatives for Revelyst, including potential transaction with the Private Equity Firm Deprives stockholders the ability to participate in the upside potential of

Revelyst and potential change of control premium

Vista Outdoor Has Extensively Engaged with MNC in Good Faith 9 MNC failed to submit a best and final proposal by September 17 as requested by Vista Outdoor Over Entire Engagement Access to~5,800 Documents Responded to

~1,300 Data Requests Held50+ Diligence Meetings Access to~900 Documents Responded to~270 Data Requests Held 12 Diligence Meetings Over Last Six Weeks MNC’s proposal implies an enterprise value of ~$1.9Bn for The Kinetic Group, ~$250MM lower than the

enterprise value of $2.15Bn as part of the CSG Transaction

Revelyst

Remains On Track to Deliver Financial Objectives 10 GEAR Up Org Structure: ~$20MM Real Estate: ~$2MM-$3MM Supply Chain & Ops: ~$5MM Direct / Indirect Costs: ~$2MM-$3MM ✓ New

product and partnership launches are driving demand, leading to increased sales and sequential EBITDA momentum in the quarters ahead ✓ On track to double standalone Adj.

EBITDA: $90MM of standalone Adj. EBITDA across Revelyst Recent Momentum Driving Near-Term and Long-Term Value FY25 GEAR Up Focus Areas and FY25 Est. Savings FY25 Target (1) $1.26Bn Net Sales $90MM Standalone Adj. EBITDA ~7% Standalone Adj. EBITDA

Margin Actual Net Realized Cost Savings Q1 FY25 $5MM Expected Net Realized Cost Savings Expected Run-Rate Cost Savings FY25 $25MM - $30MM FY27 $100MM FY27 $100MM

Transforming

Revelyst Long-Term Financial Outcomes: 2027 Targets 11 ✓ Unlock new markets through world-class licensing opportunities ✓ Expand consumer opportunities with engaging digital gaming and Esports content ✓ Opportunistic M&A that enables strategic priorities

✓ Further business transformation through GEAR Up initiatives ✓ Optionality from flexible balance

sheet and deployable capital ✓ Improve cost structureSupply chain consolidation, systems optimization and platform integration ✓ Optimize channel mix ✓ Scaling streamlined infrastructure ✓ Sales

volume flow through ✓ Revelyst Adventure SportsPower brand growth, emphasis on DTC and international expansion ✓ Revelyst Outdoor PerformanceUnified, digital first approach and innovation roadmap ✓ Revelyst Precision Sports TechnologyNew production

introductions, TAM expansion and engaging digital gaming and esports content

Re-invent,

re-ignite and re-imagine our brands through a strong consumer-first framework DRIVE POWER BRANDS NURTURE CHALLENGER BRANDS BUILD DEFENSIBLE IP PROTECTION AROUND TRADEMARKS AND TECHNOLOGIES Driving Share Gain Across Platforms REVELYST ADVENTURE SPORTS

REVELYST OUTDOOR PERFORMANCE REVELYST PRECISION SPORTS TECHNOLOGY Revelyst is a Leading “House of Brands” in the Outdoor Industry 12

Revelyst is Well-Positioned to Drive Superior Value Creation for Vista Stockholders Relative to MNC’s Last Proposal 13 2 Reaffirming guidance and confident in GEAR Up transformation program to double standalone Adj.

EBITDA in FY25 with clear path to $100MM+ in run-rate cost savings by FY27 and low-teens standalone adj. EBITDA margins in FY27 1 House of category-leading outdoor brands provides opportunity for long-term value creation 3 Enhanced ability to attract

a stockholder base aligned with Revelyst’s clear standalone value proposition Stockholders retain potential future upside from a change of control premium 4 Stockholders realize separation benefit immediately and own upside value at Revelyst, which

CSG valued at $2Bn

In Closing 14

Vista Outdoor recommends the CSG Transaction Delivers $28 in cash and one share of Revelyst per share of Vista Prepared to close in October Vista Outdoor rejects MNC’s last proposal of $43 per share in cash Significantly undervalues Vista Outdoor,

including undervaluing The Kinetic Group by ~$250MM relative to the CSG Transaction MNC failed to submit a best and final proposal on September 17 as requested by Vista Outdoor Private Equity Firm approached Vista Outdoor without participation of MNC

Vista Outdoor Board in active discussions with the Private Equity Firm regarding sale of Revelyst An agreement could be reached in conjunction with or independent of the CSG Transaction Vista Outdoor urges stockholders to vote FOR the CSG Transaction

Delivers immediate cash for Kinetic at $2.15Bn valuation, ~$250MM higher than MNC’s implied ~$1.9Bn valuation Stockholders retain optionality to realize change of control premium for Revelyst Vote FOR CSG Transaction to be able to close ahead of

October 15th termination date

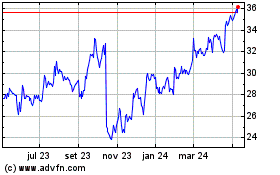

Vista Outdoor (NYSE:VSTO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

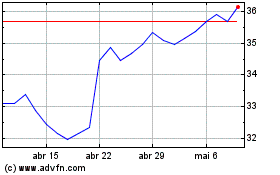

Vista Outdoor (NYSE:VSTO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024