0001632127false00016321272024-09-232024-09-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________________

FORM 8-K

_________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 23, 2024

_________________________________________________________

Cable One, Inc.

(Exact Name of Registrant as Specified in Its Charter)

_________________________________________________________

| | | | | | | | |

| Delaware | 001-36863 | 13-3060083 |

(State or Other Jurisdiction of

Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | |

210 E. Earll Drive, Phoenix, Arizona | 85012 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (602) 364-6000

Not applicable

(Former name or former address, if changed since last report.)

_________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | | CABO | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| | | | | | | | |

| Item 2.02 | | Results of Operations and Financial Condition. |

The information appearing below under Item 4.02 regarding Cable One, Inc.'s (the "Company") previously reported fiscal years ended December 31, 2022 and December 31, 2023 and fiscal quarters ended June 30, 2022, September 30, 2022, March 31, 2023, June 30, 2023, September 30, 2023, March 31, 2024 and June 30, 2024 are incorporated herein by reference.

The information appearing below under Item 4.02 refers to certain financial statements that the Company intends to restate. The restatement is not expected to affect the Company's previously reported revenues, capital expenditures, cash flows from operating activities or Adjusted EBITDA.

| | | | | | | | |

| Item 4.02 | | Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review. |

On September 23, 2024, the Audit Committee of the Board of Directors (the “Audit Committee”) of the Company, in consultation with management, concluded that the following previously issued consolidated financial statements of the Company (and related earnings releases, press releases, shareholder communications, investor presentations or other materials describing relevant portions of such financial statements) should no longer be relied on because of an error in such financial statements related to the Company’s equity method accounting of its investment in Clearwave Fiber LLC, a joint venture in which the Company contributed certain fiber operations and third-party investors contributed cash:

•the audited consolidated financial statements for the fiscal years ended December 31, 2022 and December 31, 2023, contained within the Annual Reports on Form 10-K for such years (and the associated audit reports of the Company’s independent registered public accounting firm); and

•the unaudited condensed consolidated financial statements contained within the Quarterly Reports on Form 10-Q for the quarterly periods ended June 30, 2022, September 30, 2022, March 31, 2023, June 30, 2023, September 30, 2023, March 31, 2024 and June 30, 2024.

Accordingly, the Company intends to restate these financial statements by amending its Annual Report on Form 10-K for the year ended December 31, 2023 and its quarterly reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024 (the “Restated Filings”) as soon as reasonably practicable.

Subsequent to the issuance of the Company’s condensed consolidated financial statements as of and for the three and six months ended June 30, 2024, the Company identified errors in the equity method accounting for its partial ownership of Clearwave Fiber LLC. Specifically, the Company did not appropriately allocate the losses generated by Clearwave Fiber LLC amongst the joint venture partners after considering the liquidation preference and preferred return feature held by the third-party investors. As a result, equity method investment loss was understated, income tax provision was overstated and net income was overstated in the Company's consolidated statements of operations and comprehensive income, which had a corresponding impact on the related balance sheet items. This identification of errors is preliminary, unaudited and may be subject to change (including the potential identification of additional errors) as we complete our procedures and prepare the Restated Filings.

The Audit Committee, along with management, discussed with PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm, the matters disclosed in this filing pursuant to this Item 4.02(a).

The Company plans to file amendments to the previously issued consolidated financial statements listed above on Forms 10-K/A and 10-Q/A, respectively, with the U.S. Securities and Exchange Commission (the "SEC"). The Company intends to amend at least the following sections within the respective reports:

•Annual Report on Form 10-K for the fiscal year ended December 31, 2023: Cautionary Statement Regarding Forward-Looking Statements; Part I, Item 1A, Risk Factors; Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations; Part II, Item 8, Financial Statements and Supplementary Data; Part II, Item 9A, Controls and Procedures; Part IV, Item 15, Exhibits and Financial Statement Schedules;

•Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024: Cautionary Statement Regarding Forward-Looking Statements; Part I, Item 1, Condensed Consolidated Financial Statements; Part I, Item 2, Management's Discussion and Analysis of Financial Condition and Results of Operations; Part I, Item 4, Controls and Procedures; Part II, Item 6, Exhibits; and

•Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024: Cautionary Statement Regarding Forward-Looking Statements; Part I, Item 1, Condensed Consolidated Financial Statements; Part I, Item 2, Management's Discussion and Analysis of Financial Condition and Results of Operations; Part I, Item 4, Controls and Procedures; Part II, Item 6, Exhibits.

Summary of Impacts

The tables appearing below under the heading "Supplemental Schedules" summarize the restatement's estimated impact on the Company's consolidated financial statements.

The restatement is not expected to affect the Company's previously reported revenues, capital expenditures, cash flows from operating activities or Adjusted EBITDA. The restatement is also not expected to affect any equity method accounting for the Company’s other investments or joint ventures. In connection with the restatement in the Restated Filings, the Company expects to also reflect the correction of other immaterial errors also impacting the Company's investment in Clearwave Fiber LLC which relate to periods solely within the year-ended 2022 and was correctly presented in the consolidated financial statements for the year ended December 31, 2022.

Controls and Procedures

The errors described above and the related restatement were the result of a material weakness in the Company's internal control over financial reporting due to the lack of an effectively designed control activity related to the evaluation of the capital structure of equity method investments when determining the proportionate share of earnings or losses. As a result, management concluded that the Company’s internal control over financial reporting was not effective as of December 31, 2023, and the Company’s disclosure controls and procedures were not effective as of December 31, 2023, March 31, 2024 and June 30, 2024. Accordingly, the Audit Committee concluded that management’s report on internal control over financial reporting as of December 31, 2023, and PricewaterhouseCoopers LLP’s opinion on the effectiveness of the Company’s internal control over financial reporting as of December 31, 2023, should no longer be relied upon.

Supplemental Schedules

The following tables summarize the previously reported amounts impacted by the errors described herein, as well as the preliminary adjustments and the estimated restated amounts. The restated amounts shown herein are preliminary and unaudited estimates and may be subject to change as we complete our restatement procedures and prepare the Restated Filings. Additional information will be provided in the Company's Form 10-K/A filing regarding the quarterly periods impacted in 2022 and 2023 that are not disclosed herein.

The following tables do not address the immaterial errors referenced above which will also be reflected in the Restated Filings once made.

As of and for the year ended December 31, 2022

Consolidated Balance Sheet

| | | | | | | | | | | | | | | | | |

| As of December 31, 2022 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Equity investments | $ | 1,195,221 | | | $ | (27,743) | | | $ | 1,167,478 | |

| Total assets | $ | 6,913,890 | | | $ | (27,743) | | | $ | 6,886,147 | |

| Deferred income taxes | $ | 966,821 | | | $ | (6,682) | | | $ | 960,139 | |

| Total liabilities | $ | 5,155,917 | | | $ | (6,682) | | | $ | 5,149,235 | |

| Retained earnings | $ | 1,624,406 | | | $ | (21,061) | | | $ | 1,603,345 | |

| Total stockholders' equity | $ | 1,757,973 | | | $ | (21,061) | | | $ | 1,736,912 | |

| Total liabilities and stockholders' equity | $ | 6,913,890 | | | $ | (27,743) | | | $ | 6,886,147 | |

Consolidated Statement of Operations and Comprehensive Income

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2022 |

| (dollars in thousands, except per share data) | As Reported | | Adjustment | | As Restated |

| Income tax provision | $ | 126,332 | | | $ | (6,682) | | | $ | 119,650 | |

| Income before equity method investment income (loss), net | $ | 249,031 | | | $ | 6,682 | | | $ | 255,713 | |

| Equity method investment income (loss), net | $ | (14,913) | | | $ | (27,743) | | | $ | (42,656) | |

| Net income | $ | 234,118 | | | $ | (21,061) | | | $ | 213,057 | |

| | | | | |

| Comprehensive income | $ | 366,944 | | | $ | (21,061) | | | $ | 345,883 | |

| | | | | |

Net Income per Common Share: | | | | | |

| Basic | $ | 39.73 | | | $ | (3.57) | | | $ | 36.16 | |

| Diluted | $ | 38.06 | | | $ | (3.33) | | | $ | 34.73 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Consolidated Statement of Stockholders' Equity

| | | | | | | | | | | | | | | | | |

| As of and For the Year Ended December 31, 2022 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Net income | $ | 234,118 | | | $ | (21,061) | | | $ | 213,057 | |

| Retained earnings | $ | 1,624,406 | | | $ | (21,061) | | | $ | 1,603,345 | |

| Total stockholders' equity | $ | 1,757,973 | | | $ | (21,061) | | | $ | 1,736,912 | |

Consolidated Statement of Cash Flows

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2022 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Net income | $ | 234,118 | | | $ | (21,061) | | | $ | 213,057 | |

| Change in deferred income taxes | $ | 68,378 | | | $ | (6,682) | | | $ | 61,696 | |

| Equity method investment (income) loss, net | $ | 14,913 | | | $ | 27,743 | | | $ | 42,656 | |

| Net cash provided by operating activities | $ | 738,040 | | | $ | — | | | $ | 738,040 | |

As of and for the year ended December 31, 2023

Consolidated Balance Sheet

| | | | | | | | | | | | | | | | | |

| As of December 31, 2023 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Equity investments | $ | 1,125,447 | | | $ | (87,423) | | | $ | 1,038,024 | |

| Total assets | $ | 6,846,933 | | | $ | (87,423) | | | $ | 6,759,510 | |

| Deferred income taxes | $ | 974,467 | | | $ | (23,548) | | | $ | 950,919 | |

| Total liabilities | $ | 4,973,788 | | | $ | (23,548) | | | $ | 4,950,240 | |

| Retained earnings | $ | 1,825,542 | | | $ | (63,875) | | | $ | 1,761,667 | |

| Total stockholders' equity | $ | 1,873,145 | | | $ | (63,875) | | | $ | 1,809,270 | |

| Total liabilities and stockholders' equity | $ | 6,846,933 | | | $ | (87,423) | | | $ | 6,759,510 | |

Consolidated Statement of Operations and Comprehensive Income

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 |

| (dollars in thousands, except per share data) | As Reported | | Adjustment | | As Restated |

| Income tax provision | $ | 89,704 | | | $ | (16,866) | | | $ | 72,838 | |

| Income before equity method investment income (loss), net | $ | 321,692 | | | $ | 16,866 | | | $ | 338,558 | |

| Equity method investment income (loss), net | $ | (54,256) | | | $ | (59,679) | | | $ | (113,935) | |

| Net income | $ | 267,436 | | | $ | (42,813) | | | $ | 224,623 | |

| | | | | |

| Comprehensive income | $ | 254,150 | | | $ | (42,813) | | | $ | 211,337 | |

| | | | | |

Net Income per Common Share: | | | | | |

| Basic | $ | 47.34 | | | $ | (7.58) | | | $ | 39.76 | |

| Diluted | $ | 45.14 | | | $ | (7.06) | | | $ | 38.08 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Consolidated Statement of Stockholders' Equity

| | | | | | | | | | | | | | | | | |

| As of and For the Year Ended December 31, 2023 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Net income | $ | 267,436 | | | $ | (42,813) | | | $ | 224,623 | |

| Retained earnings | $ | 1,825,542 | | | $ | (63,875) | | | $ | 1,761,667 | |

| Total stockholders' equity | $ | 1,873,145 | | | $ | (63,875) | | | $ | 1,809,270 | |

Consolidated Statement of Cash Flows

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Net income | $ | 267,436 | | | $ | (42,813) | | | $ | 224,623 | |

| Change in deferred income taxes | $ | 11,479 | | | $ | (16,866) | | | $ | (5,387) | |

| Equity method investment (income) loss, net | $ | 54,256 | | | $ | 59,679 | | | $ | 113,935 | |

| Net cash provided by operating activities | $ | 663,170 | | | $ | — | | | $ | 663,170 | |

As of and for the three months ended March 31, 2024

Condensed Consolidated Balance Sheet

| | | | | | | | | | | | | | | | | |

| As of March 31, 2024 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Equity investments | $ | 1,117,220 | | | $ | (100,946) | | | $ | 1,016,274 | |

| Total assets | $ | 6,840,183 | | | $ | (100,946) | | | $ | 6,739,237 | |

| Deferred income taxes | $ | 978,032 | | | $ | (27,079) | | | $ | 950,953 | |

| Total liabilities | $ | 4,913,442 | | | $ | (27,079) | | | $ | 4,886,363 | |

| Retained earnings | $ | 1,856,054 | | | $ | (73,867) | | | $ | 1,782,187 | |

| Total stockholders' equity | $ | 1,926,741 | | | $ | (73,867) | | | $ | 1,852,874 | |

| Total liabilities and stockholders' equity | $ | 6,840,183 | | | $ | (100,946) | | | $ | 6,739,237 | |

Condensed Consolidated Statement of Operations and Comprehensive Income

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| (dollars in thousands, except per share data) | As Reported | | Adjustment | | As Restated |

| Income tax provision | $ | 21,108 | | | $ | (3,530) | | | $ | 17,578 | |

| Income before equity method investment income (loss), net | $ | 55,855 | | | $ | 3,530 | | | $ | 59,385 | |

| Equity method investment income (loss), net | $ | (8,513) | | | $ | (13,523) | | | $ | (22,036) | |

Net income | $ | 47,342 | | | $ | (9,993) | | | $ | 37,349 | |

| | | | | |

| Comprehensive income | $ | 65,616 | | | $ | (9,993) | | | $ | 55,623 | |

| | | | | |

Net Income per Common Share: | | | | | |

| Basic | $ | 8.43 | | | $ | (1.78) | | | $ | 6.65 | |

| Diluted | $ | 8.11 | | | $ | (1.66) | | | $ | 6.45 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Condensed Consolidated Statement of Stockholders' Equity

| | | | | | | | | | | | | | | | | |

| As of and For the Three Months Ended March 31, 2024 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Net income | $ | 47,342 | | | $ | (9,993) | | | $ | 37,349 | |

| Retained earnings | $ | 1,856,054 | | | $ | (73,867) | | | $ | 1,782,187 | |

| Total stockholders' equity | $ | 1,926,741 | | | $ | (73,867) | | | $ | 1,852,874 | |

Condensed Consolidated Statement of Cash Flows

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Net income | $ | 47,342 | | | $ | (9,993) | | | $ | 37,349 | |

| Change in deferred income taxes | $ | (2,220) | | | $ | (3,530) | | | $ | (5,750) | |

| Equity method investment (income) loss, net | $ | 8,513 | | | $ | 13,523 | | | $ | 22,036 | |

| Net cash provided by operating activities | $ | 164,750 | | | $ | — | | | $ | 164,750 | |

As of and for the three and six months ended June 30, 2024

Condensed Consolidated Balance Sheet

| | | | | | | | | | | | | | | | | |

| As of June 30, 2024 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Equity investments | $ | 1,128,363 | | | $ | (114,148) | | | $ | 1,014,215 | |

| Total assets | $ | 6,827,641 | | | $ | (114,148) | | | $ | 6,713,493 | |

| Deferred income taxes | $ | 972,144 | | | $ | (30,784) | | | $ | 941,360 | |

| Total liabilities | $ | 4,864,017 | | | $ | (30,784) | | | $ | 4,833,233 | |

| Retained earnings | $ | 1,886,596 | | | $ | (83,364) | | | $ | 1,803,232 | |

| Total stockholders' equity | $ | 1,963,624 | | | $ | (83,364) | | | $ | 1,880,260 | |

| Total liabilities and stockholders' equity | $ | 6,827,641 | | | $ | (114,148) | | | $ | 6,713,493 | |

Condensed Consolidated Statements of Operations and Comprehensive Income

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 |

| (dollars in thousands, except per share data) | As Reported | | Adjustment | | As Restated |

| Income tax provision | $ | 17,774 | | | $ | (3,705) | | | $ | 14,069 | |

| Income before equity method investment income (loss), net | $ | 56,758 | | | $ | 3,705 | | | $ | 60,463 | |

| Equity method investment income (loss), net | $ | (9,109) | | | $ | (13,201) | | | $ | (22,310) | |

Net Income | $ | 47,649 | | | $ | (9,496) | | | $ | 38,153 | |

| | | | | |

| Comprehensive income | $ | 46,956 | | | $ | (9,496) | | | $ | 37,460 | |

| | | | | |

Net Income per Common Share: | | | | | |

| Basic | $ | 8.48 | | | $ | (1.69) | | | $ | 6.79 | |

| Diluted | $ | 8.16 | | | $ | (1.57) | | | $ | 6.59 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2024 |

| (dollars in thousands, except per share data) | As Reported | | Adjustment | | As Restated |

| Income tax provision | $ | 38,882 | | | $ | (7,235) | | | $ | 31,647 | |

| Income before equity method investment income (loss), net | $ | 112,613 | | | $ | 7,235 | | | $ | 119,848 | |

| Equity method investment income (loss), net | $ | (17,622) | | | $ | (26,724) | | | $ | (44,346) | |

| Net income | $ | 94,991 | | | $ | (19,489) | | | $ | 75,502 | |

| | | | | |

| Comprehensive income | $ | 112,572 | | | $ | (19,489) | | | $ | 93,083 | |

| | | | | |

Net Income per Common Share: | | | | | |

| Basic | $ | 16.90 | | | $ | (3.46) | | | $ | 13.44 | |

| Diluted | $ | 16.27 | | | $ | (3.23) | | | $ | 13.04 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Condensed Consolidated Statements of Stockholders' Equity

| | | | | | | | | | | | | | | | | |

| As of and For the Three Months Ended June 30, 2024 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Net income | $ | 47,649 | | | $ | (9,496) | | | $ | 38,153 | |

| Retained earnings | $ | 1,886,596 | | | $ | (83,364) | | | $ | 1,803,232 | |

| Total stockholders' equity | $ | 1,963,624 | | | $ | (83,364) | | | $ | 1,880,260 | |

| | | | | | | | | | | | | | | | | |

| As of and For the Six Months Ended June 30, 2024 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Net income | $ | 94,991 | | | $ | (19,489) | | | $ | 75,502 | |

| Retained earnings | $ | 1,886,596 | | | $ | (83,364) | | | $ | 1,803,232 | |

| Total stockholders' equity | $ | 1,963,624 | | | $ | (83,364) | | | $ | 1,880,260 | |

Condensed Consolidated Statement of Cash Flows

| | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2024 |

| (dollars in thousands) | As Reported | | Adjustment | | As Restated |

| Net income | $ | 94,991 | | | $ | (19,489) | | | $ | 75,502 | |

| Change in deferred income taxes | $ | (7,848) | | | $ | (7,235) | | | $ | (15,083) | |

| Equity method investment (income) loss, net | $ | 17,622 | | | $ | 26,724 | | | $ | 44,346 | |

| Net cash provided by operating activities | $ | 320,298 | | | $ | — | | | $ | 320,298 | |

Non-GAAP Measures

The Company uses certain measures that are not defined by generally accepted accounting principles in the United States (“GAAP”) to evaluate various aspects of its business. Adjusted EBITDA is a non-GAAP financial measure and should be considered in addition to, not as superior to, or as a substitute for, net income reported in accordance with GAAP.

“Adjusted EBITDA” is defined as net income plus net interest expense, income tax provision, depreciation and amortization, equity-based compensation, severance and contract termination costs, acquisition-related costs, net (gain) loss on asset sales and disposals, system conversion costs, rebranding costs, net equity method investment (income) loss, net other (income) expense and any special items. As such, it eliminates the significant non-cash depreciation and amortization expense that results from the capital-intensive nature of the Company’s business as well as other non-cash or special items and is unaffected by the Company’s capital structure or investment activities. This measure is limited in that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenues and the Company’s cash cost of debt financing. These costs are evaluated through other financial measures.

The Company uses Adjusted EBITDA to assess its performance. In addition, Adjusted EBITDA generally correlates to the measure used in the leverage ratio calculations under the Company’s credit agreement and the indenture governing the Company’s non-convertible senior unsecured notes to determine compliance with the covenants contained in the credit agreement and the ability to take certain actions under the indenture governing the non-convertible senior unsecured notes. Adjusted EBITDA does not take into account cash used for mandatory debt service requirements or other non-discretionary expenditures, and thus does not represent residual funds available for discretionary uses.

The Company believes that Adjusted EBITDA is useful to investors in evaluating the operating performance of the Company.

Adjusted EBITDA and similar measures with a similar title are common measures used by investors, analysts and peers to compare performance in the Company’s industry, although the Company’s measure of Adjusted EBITDA may not be directly comparable to similarly titled measures reported by other companies.

Cautionary Statement Regarding Forward-Looking Statements

This current report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those expressed or implied by these statements. You can generally identify forward-looking statements by the words “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,” “objective,” “outlook,” “plan,” “potential,” “predict,” “projection,” “seek,” “should,” “target,” “trend,” “will,” “would” or the negative version of these words or other comparable words. These forward-looking statements include, among others, the anticipated timing of the filing of the Restated Filings; the financial statements to be restated and the filings in which such restated financial statements will appear; and the Company's intent to report a material weakness in its internal control over financial reporting. Such forward-looking statements are subject to various risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors include, but are not limited to, the risk that the Company might not be able to complete the restatement and Restated Filings as currently planned or within the time periods currently anticipated, the risk that additional information may become known prior to the expected filing with the SEC of the Restated Filings or that other subsequent events may occur that would require the Company to make additional adjustments to its financial statements, which could be material, or delay the filing of the corrected or future periodic reports with the SEC, risks related to the timing and results of the Company’s review of the effectiveness of internal control over financial reporting and related disclosure controls and procedures, remediation of the control deficiencies identified and our ability to implement and maintain effective internal control over financial reporting in the future, which may adversely affect the accuracy and timeliness of our financial reporting, identification of errors in our financial reporting in the future that require us to restate previously issued financial statements, which may subject us to unanticipated costs or regulatory penalties and could cause investors to lose confidence in the accuracy and completeness of our financial statements, the factors described under “Risk Factors” in the Company’s annual report on Form 10-K for the period ended December 31, 2023 and the Company’s other filings with the SEC, uncertainties, assumptions and changes in circumstances that may cause the Company’s actual results, performance or achievements to differ materially from those expressed or implied in any forward-looking statement. Each forward-looking statement contained herein speaks only as of the date of this current report, and the Company undertakes no obligation to update or revise any forward-looking statements whether as a result of new information, future developments or otherwise, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Cable One, Inc. | |

| | |

| By: | /s/ Peter N. Witty |

| | Name: | Peter N. Witty |

| | Title: | Chief Legal and Administrative Officer |

| | | |

Date: September 23, 2024 | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

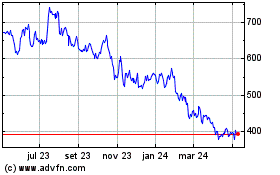

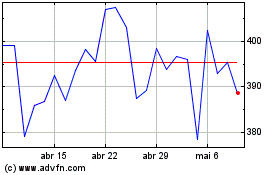

Cable One (NYSE:CABO)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Cable One (NYSE:CABO)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024