false

0001270436

0001270436

2024-09-23

2024-09-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

| Registrant Name |

Cohen

& Co Inc. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 23, 2024

Cohen & Company

Inc.

(Exact name of registrant as specified in its

charter)

| Maryland |

|

1-32026 |

|

16-1685692 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

Cira Centre

2929 Arch Street, Suite 1703

Philadelphia,

Pennsylvania |

|

19104 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (215) 701-9555

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

COHN |

|

The NYSE

American Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Redemption Agreement

As previously reported, on October 3, 2016, Cohen & Company, LLC (the “Operating LLC”), a Delaware limited liability company

and a controlled subsidiary of Cohen & Company Inc., a Maryland corporation (the “Company”), entered into that certain

Investment Agreement (as amended, the “Investment Agreement”), by and between the Operating LLC and JKD Capital Partners I

LTD (the “Investor”). The Investor is owned by Jack J. DiMaio, Jr., who is a member of the Company’s Board of Directors,

and his spouse.

Pursuant to the Investment Agreement, the Investor agreed to invest

up to $12,000,000 into the Operating LLC (the “Investment”). In exchange for the Investment, the Operating LLC agreed to pay

to the Investor, (i) upon a termination of the Investment Agreement, an amount equal to Investor’s aggregate Investment

balance; and (ii) following each calendar quarter during the term of the Investment Agreement, certain revenues generated by the

activities of the Institutional Corporate Trading business of J.V.B. Financial Group, LLC, the Operating LLC’s wholly owned broker

dealer subsidiary. As of the Effective Date (as defined below), the Investor’s aggregate Investment balance under the Investment

Agreement was $7,718,890 (the “Outstanding Amount”).

On September 23, 2024 (the “Closing Date”) and effective

September 1, 2024 (the “Effective Date”), the Operating LLC and the Investor entered into that certain Redemption Agreement

(the “Redemption Agreement”), pursuant to which, the Investment Agreement was redeemed and terminated in its entirety effective

as of the Effective Date.

Pursuant

to the terms and conditions of the Redemption Agreement, on the Closing Date, the Operating LLC (i) paid to the Investor $2,572,963.33

of the Outstanding Amount in cash; and (ii) the Company delivered to the Investor a Senior Promissory Note (the “Note”)

in the aggregate principal amount of $5,145,926.67 (representing the remaining balance of the Outstanding Amount) and dated as of the

Effective Date.

The Redemption Agreement contains customary representations and warranties

on the part of each of the Operating LLC and the Investor.

The foregoing description of the Redemption Agreement does not purport

to be complete and is qualified in its entirety by reference to the full text of the Redemption Agreement, a copy of which is attached

hereto as Exhibit 10.1 and is incorporated herein by reference.

Senior Promissory Note

The

Note evidences the Operating LLC’s obligation to repay to the Investor the original principal amount of $5,145,926.67.

Pursuant to the Note, the unpaid principal amount and all accrued but unpaid interest thereunder will be due and payable as follows: (i) $2,572,963.33

of the principal amount will be due and payable on August 31, 2025, and (ii) $2,572,963.34 will be due and payable on August 31,

2026.

The Note accrues interest on the unpaid principal amount from

the Effective Date until maturity at a rate equal to 12% per year. Interest on the Note is payable in cash quarterly on each January 1,

April 1, July 1, and October 1, commencing on October 1, 2024. Under the Note, upon the occurrence or existence of

any “Event of Default” thereunder, the outstanding principal amount is (or in certain instances, at the option of the holder

thereof, may be) immediately accelerated. Further, upon the occurrence of any “Event of Default” under the Note and for

so long as such Event of Default continues, all principal, interest and other amounts payable under the Note will bear interest at

a rate equal to 13% per year.

The Note may not be prepaid in whole or in part prior to January 31,

2025. The Note may, with at least 31 days’ prior written notice from the Operating LLC to the holder thereof, be prepaid in

whole or in part at any time following January 31, 2025 without the prior written consent of the holder and without penalty or premium.

The Note and the payment of all principal, interest and any other

amounts payable thereunder are senior obligations of the Operating LLC and will be senior to any Indebtedness (as defined in the Note)

of the Operating LLC outstanding as of and issued following the Effective Date. Pursuant the Note, following the Effective Date, the Operating

Company may not incur any Indebtedness that is a senior obligation to the Note.

The foregoing description of the Note does not purport to be complete

and is qualified in its entirety by reference to the full text of the Note, a copy of which is attached hereto as Exhibit 10.2 and

is incorporated herein by reference.

| Item 1.02 |

Termination of a Material Definitive Agreement. |

See Item 1.01 above for information concerning the termination of the

Investment Agreement, which information is incorporated by reference in response to this Item 1.02.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

See Item 1.01 above for information concerning the Note, which information

is incorporated by reference in response to this Item 2.03.

| Item 9.01 |

Financial Statements and Exhibits. |

| (d) |

Exhibits. |

| |

|

|

Exhibit

Number |

|

Description |

| 10.1* |

|

Redemption Agreement, dated September 23, 2024 and effective September 1, 2024, by and between Cohen & Company, LLC and JKD Capital Partners I LTD. |

| |

|

|

| 10.2* |

|

Senior Promissory Note, dated September 1, 2024, issued by Cohen & Company, LLC to JKD Capital Partners I LTD in the aggregate principal amount of $5,145,926.67. |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (Embedded within the inline XBRL document.) |

* Filed electronically herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

COHEN & COMPANY INC. |

| |

|

|

| Date: September 24, 2024 |

By: |

/s/ Joseph W. Pooler, Jr. |

| |

|

Name: |

Joseph W. Pooler, Jr. |

| |

|

Title: |

Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 10.1

REDEMPTION AGREEMENT

This REDEMPTION AGREEMENT

(this “Agreement”), is entered into as of September 23, 2024 and is effective as of September 1, 2024 (the

“Effective Date”), by and between Cohen & Company, LLC, a Delaware limited liability company (the “Company”),

and JKD Capital Partners I LTD, a New York corporation (“JKD”). Each of the Company and JKD may be referred to herein,

individually, as a “Party,” and, together, as the “Parties.” Capitalized terms used herein but otherwise

not defined shall have the meanings ascribed to such terms in the Investment Agreement (as defined below).

RECITALS:

WHEREAS, on October 3,

2016, the Company and JKD entered into that certain Investment Agreement (as amended from time to time, the “Investment Agreement”),

pursuant to which, among other things, JKD agreed to invest up to $12,000,000 into the Company in return for (i) the Company’s

agreement to repay such investments to JKD in accordance with the terms and conditions of the Investment Agreement, and (ii) the

payment by the Company to JKD of the Investment Return;

WHEREAS, as of the Effective

Date, the aggregate Investment Balance payable by the Company to JKD under the Investment Agreement was $7,718,890 (the “Outstanding

Amount”); and

WHEREAS, subject to the terms

and conditions herein, the Parties desire to enter into this Agreement to redeem the Outstanding Amount and terminate the Investment Agreement.

NOW, THEREFORE, in consideration

of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the Parties, intending to be legally bound, hereby agree as follows:

1. Definitions.

The following terms have the meanings specified or referred to in this Section 1:

(a) “Affiliate”

of a Person means any other Person that directly or indirectly, through one (1) or more intermediaries, controls, is controlled by,

or is under common control with, such Person. The term “control” (including the terms “controlled by” and “under

common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management

and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

(b) “Business

Day” means a day other than a Saturday, Sunday, or other day on which commercial banks in the State of New York are authorized

or required by Law to close.

(c) “Encumbrance”

means any lien, pledge, mortgage, deed of trust, security interest, charge, claim, easement, encroachment, restriction or other similar

encumbrance.

(d) “Governmental

Authority” means any federal, state, local or foreign government or political subdivision thereof, or any agency or instrumentality

of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental

authority (to the extent that the rules, regulations or orders of such organization or authority have the force of law), or any arbitrator,

court or tribunal of competent jurisdiction.

(e) “Law”

means any statute, law, ordinance, regulation, rule, code, order, constitution, treaty, common law, judgment, decree, other requirement

or rule of law of any Governmental Authority.

(f) “Person”

means an individual, corporation, partnership, joint venture, limited liability company, Governmental Authority, unincorporated organization,

trust, association or other entity.

(g) “Securities

Act” means the Securities Act of 1933, as amended.

2. Redemption

of Investment Balance. Notwithstanding anything to the contrary in the Investment Agreement (including, without limitation, Section 6

(Redemption Rights) of the Investment Agreement), on the date hereof, the Company shall redeem, which redemption shall be effective as

of the Effective Date, the entire Outstanding Amount as follows:

(a) The

Company shall pay to JKD $2,572,963.33 of the Outstanding Amount in cash (the “Cash Amount”) via wire of immediately

available funds to such account as JKD shall specify in writing to the Company; and

(b) The

Company pay to JKD the remaining $5,145,926.67 of the Outstanding Amount by issuing and delivering to JKD the Senior Promissory Note in

the aggregate amount of $5,145,926.67, a copy of which is attached hereto as Exhibit A (the “Note”).

3. Termination

of the Investment Agreement. Notwithstanding anything to the contrary in the Investment

Agreement (including, without limitation, Section 3 (Termination) of the Investment Agreement), upon the Company’s delivery

to JKD of the Cash Amount and the Note on the date hereof, the Investment Agreement shall, effective as of the Effective Date, automatically

terminate in its entirety and shall be of no further force or effect, and neither of the Parties shall have

any further rights or obligations under the Investment Agreement; provided, however, that Section 11 (Confidentiality) of the Investment

Agreement shall survive the termination of the Investment Agreement pursuant to this Section 3.

4. Representations

and Warranties of the Company. The Company hereby represents and warrants to JKD as follows:

(a) Organization

and Authority; Enforceability. The Company is a limited liability company duly organized, validly existing and in good standing under

the Laws of the State of Delaware. The Company has full limited liability company power and authority to enter into this Agreement and

the documents to be delivered hereunder (including the Note), to carry out its obligations hereunder and thereunder and to consummate

the transactions contemplated hereby and thereby. The execution, delivery, and performance by the Company of this Agreement and the documents

to be delivered hereunder (including the Note) and the consummation of the transactions contemplated hereby and thereby have been duly

authorized by all requisite limited liability company action on the part of the Company. This Agreement and the documents to be delivered

hereunder (including the Note) have been duly executed and delivered by the Company, and (assuming due authorization, execution, and delivery

by JKD) this Agreement and the documents to be delivered hereunder (including the Note) constitute legal, valid, and binding obligations

of the Company, enforceable against the Company in accordance with their respective terms, except as may be limited by any bankruptcy,

insolvency, reorganization, moratorium, fraudulent conveyance, or other similar Laws affecting the enforcement of creditors’ rights

generally or by general principles of equity.

(b) Noncontravention.

The execution, delivery and performance by the Company of this Agreement and the Note and the consummation of the transactions contemplated

hereby and thereby do not and will not, except as could not reasonably be expected to have a material adverse effect on the Company, (i) violate

any provision of the Company’s Amended and Restated Limited Liability Company Agreement, dated December 16, 2009, as amended,

(ii) violate any material order, writ, injunction, judgment or decree of any Governmental Authority applicable to the Company or

any material mortgage, indenture, agreement, instrument or contract to which the Company is a party or by which it is bound, or (iii) result

in the creation or imposition of any Encumbrance (other than arising under this Agreement and the Note) upon any assets of the Company.

The execution and delivery by the Company of this Agreement and the Note and the performance by the Company of the transactions contemplated

hereunder and thereunder do not conflict with, violate or result in the breach of any agreement, instrument, order, judgment, decree,

Law or governmental regulation to which the Company is a party or is bound or require the consent, notice or other action by any other

Person.

(c) Litigation.

There are no actions, suits, claims, investigations or other legal proceedings pending or by or, to the Company’s knowledge, threatened

against, the Company that challenge or seek to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement.

(d) Brokers.

No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the

transactions contemplated by this Agreement based upon arrangements made by or on behalf of the Company.

5. Representations

and Warranties of JKD. JKD hereby represents and warrants to the Company as follows:

(a) Organization

and Authority; Enforceability. JKD is a corporation duly organized, validly existing and in good standing under the Laws of the State

of New York. JKD has full corporate power and authority to enter into this Agreement and the documents to be delivered hereunder (including

the Note), to carry out JKD’s obligations hereunder and thereunder and to consummate the transactions contemplated hereby and thereby.

This Agreement and the documents to be delivered hereunder (including the Note) have been duly executed and delivered by JKD, and (assuming

due authorization, execution, and delivery by the Company) this Agreement and the documents to be delivered hereunder constitute legal,

valid, and binding obligations of JKD, enforceable against JKD in accordance with their respective terms, except as may be limited by

any bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, or other similar laws affecting the enforcement of creditors’

rights generally or by general principles of equity.(b) Nonontravention. The execution, delivery

and performance by JKD of this Agreement and the Note and the consummation of the transactions contemplated hereby and thereby do not

and will not, except as could not reasonably be expected to have a material adverse effect on JKD, (i) violate any provision of JKD’s

certificate of incorporation, bylaws or other organizational documents, (ii) violate any material order, writ, injunction, judgment

or decree of any Governmental Authority applicable to JKD or any material mortgage, indenture, agreement, instrument or contract to which

JKD is a party or by which it is bound, or (iii) result in the creation or imposition of any Encumbrance upon any assets of JKD.

The execution and delivery by JKD of this Agreement and the Note and the performance by JKD of the transactions contemplated hereunder

and thereunder do not conflict with, violate or result in the breach of any agreement, instrument, order, judgment, decree, Law or governmental

regulation to which JKD is a party or is bound or require the consent, notice or other action by any other Person.

(c) Evaluation

of and Ability to Bear Risks; Independent Analysis; Related Matters.

(i) JKD

is aware of the Company’s business affairs and financial condition and has acquired sufficient information about the Company and

its subsidiaries to reach an informed and knowledgeable decision to acquire the Note. JKD has such knowledge and experience in financial

affairs to be capable of evaluating the merits and risks of purchasing the Note and of making an informed investment decision with respect

thereto, and JKD has not relied in connection with this Agreement and the transactions contemplated hereby upon any oral or written representations,

warranties or agreements made by the Company, any Affiliate thereof or any officer, employee, agent or representative of any of the foregoing,

other than those representations, warranties or agreements made by the Company in this Agreement. JKD’s financial situation is such

that JKD can afford to bear the economic risk of buying the Note, JKD understands that the purchase of the Note involves certain significant

risks, and JKD can afford to suffer the complete loss of its investment concerning the purchase of the Note. JKD has the capacity to protect

its own interests in connection with the purchase of the Note.

(ii) JKD

has consulted with its own professional legal, tax and other advisors, to the extent deemed appropriate by JKD, as to the financial, tax,

legal and other matters concerning the transactions contemplated hereby.

(iii) JKD

acknowledges that it is relying solely upon the advice of its own professional legal, tax and other advisors with respect to any and all

aspects of the transactions contemplated hereby, and neither the Company nor any of its Affiliates, representatives or agents has made

any representation or warranty regarding the appropriateness of JKD’s participation in the transactions contemplated hereby.

(iv) JKD

acknowledges it has obtained all information JKD requires regarding the transactions contemplated hereby. JKD acknowledges it has had

an opportunity to ask questions and receive answers from the Company’s representatives regarding the terms and conditions of the

Note and the business, management, properties and financial condition of the Company.

(v) JKD

is acquiring the Note for its own account and not with a view to, or intention of, distribution thereof in violation of the Securities

Act, or any applicable state securities Laws, and the Note will not be disposed of in contravention of the Securities Act or any applicable

state securities Laws. JKD does not presently have any contract, undertaking, agreement or arrangement with any Person to transfer the

Note or any interest therein to such Person or to any third Person.

(vi) JKD

acknowledges that the Note has not been registered under the Securities Act or under any state securities Laws, and agrees that JKD will

not sell or otherwise transfer the Note or any interest therein unless such sale or transfer is made pursuant to an effective registration

statement under the Securities Act and any applicable state securities Laws or is exempt from the registration requirements under the

Securities Act and such state securities Laws and also such sale or transfer is made in compliance with the terms and conditions of the

Note, including the transfer restrictions set forth therein.

(vii) JKD

understands that the Note will be a “restricted security” as that term is defined in Rule 144 under the Securities Act,

and that the Note must be held indefinitely unless (i) it is subsequently registered pursuant to an effective registration statement

under the Securities Act and any applicable securities Laws, or (ii) exemptions from the registration requirements under the Securities

Act and such state securities Laws are available, in each case, subject to the transfer restrictions set forth in the Note. JKD understands

that the Company is not under any obligation to register the Note under the Securities Act.

(d) Accredited

Investor. JKD is an “accredited investor” as such term is defined in Rule 501 of Regulation D promulgated under the

Securities Act. To the extent that any look-through rules apply to JKD under the Securities Act, any Person who holds an equity interest

in JKD is, and any Person who at any time in the future holds an equity interest in JKD will be, an “accredited investor.”

In addition, JKD meets any additional or different suitability standards imposed by the securities and similar Laws of the state or other

jurisdiction of its principal place of business or domicile in connection with the purchase by JKD of the Note.

(e) Litigation.

There are no actions, suits, claims, investigations or other legal proceedings pending or by or, to JKD’s knowledge, threatened

against, JKD that challenge or seek to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement.

(f) Brokers.

No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the

transactions contemplated by this Agreement based upon arrangements made by or on behalf of JKD.

6. Miscellaneous.

(a) Notices.

All notices of request, demand and other communications hereunder shall be addressed to the parties as follows:

| If to the Company: |

|

Cohen & Company, LLC

Cira Centre

2929 Arch Street, Suite 1703

Philadelphia, Pennsylvania 19104

Attn: Joseph W. Pooler, Jr.

Facsimile: (215) 701-8279

E-mail: jpooler@cohenandcompany.com

and to: |

| |

|

Cohen & Company Inc.

3 Columbus Circle, 24th Floor,

New York, New York 10019

Attn: Dennis Crilly

Facsimile: (866) 543-2907

E-mail: dcrilly@ cohenandcompany.com |

| |

|

|

| With a copy to: |

|

Duane Morris LLP

30 South 17th Street

Philadelphia, Pennsylvania 19103

Attn: Darrick M. Mix

Facsimile: (215) 405-2906

Email: dmix@duanemorris.com |

| |

|

|

| If to JKD: |

|

At the applicable address set forth on the books and records of the Company. |

unless the address is changed by the Party by

like notice given to the other Parties. Notice shall be in writing and shall be deemed delivered: (i) if mailed by certified mail,

return receipt requested, postage prepaid and properly addressed to the address above, then three (3) Business Days after deposit

of same in a regularly maintained U.S. Mail receptacle; or (ii) if mailed by Federal Express (FedEx), the United Parcel Service (UPS),

or another nationally recognized overnight courier service, next business morning delivery, then one (1) Business Day after deposit

of same in a regularly maintained receptacle of such overnight courier; or (iii) if hand delivered, then upon hand delivery thereof

to the address indicated on or prior to 5:00 p.m., New York City time, on a business day. Any notice hand delivered after 5:00 p.m. New

York City time, shall be deemed delivered on the following business day. Notwithstanding the foregoing, notices, consents, waivers or

other communications referred to in this Agreement may be sent by facsimile, e-mail, or other method of delivery, but shall be deemed

to have been delivered only when the sending Party has confirmed (by reply e-mail or some other form of written confirmation from the

receiving Party) that the notice has been received by the other Party.

(b) Expenses.

Each Party shall pay all of such Party’s own costs and expenses (including attorney’s fees and disbursements) that such Party

incurs with respect to the negotiation, execution and delivery of this Agreement.

(c) Governing

Law; Submission to Jurisdiction; Waiver of Jury Trial.

(i) This

Agreement and all acts and transactions pursuant hereto and the rights and obligations of the parties hereto shall be governed, construed

and interpreted in accordance with the Laws of the State of New York without regard to its conflicts of law principles or the conflicts

of law principles of any other state in either case that would result in the application of the Laws of any other state.

(ii) ANY

LEGAL SUIT, ACTION OR PROCEEDING ARISING OUT OF OR BASED UPON THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY MAY BE INSTITUTED

IN THE FEDERAL COURTS OF THE UNITED STATES OF AMERICA OR THE COURTS OF THE STATE OF NEW YORK IN EACH CASE LOCATED IN THE CITY OF NEW YORK,

AND EACH PARTY IRREVOCABLY SUBMITS TO THE EXCLUSIVE JURISDICTION OF SUCH COURTS IN ANY SUCH SUIT, ACTION OR PROCEEDING. SERVICE OF PROCESS,

SUMMONS, NOTICE OR OTHER DOCUMENT BY MAIL TO SUCH PARTY’S ADDRESS SET FORTH HEREIN SHALL BE EFFECTIVE SERVICE OF PROCESS FOR ANY

SUIT, ACTION OR OTHER PROCEEDING BROUGHT IN ANY SUCH COURT. THE PARTIES IRREVOCABLY AND UNCONDITIONALLY WAIVE ANY OBJECTION TO THE LAYING

OF VENUE OF ANY SUIT, ACTION OR ANY PROCEEDING IN SUCH COURTS AND IRREVOCABLY WAIVE AND AGREE NOT TO PLEAD OR CLAIM IN ANY SUCH COURT

THAT ANY SUCH SUIT, ACTION OR PROCEEDING BROUGHT IN ANY SUCH COURT HAS BEEN BROUGHT IN AN INCONVENIENT FORUM.

(iii) EACH

PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS AGREEMENT IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT

ISSUES AND, THEREFORE, EACH SUCH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT

OF ANY LEGAL ACTION ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY. EACH PARTY CERTIFIES AND ACKNOWLEDGES

THAT (A) NO REPRESENTATIVE OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT SEEK TO ENFORCE

THE FOREGOING WAIVER IN THE EVENT OF A LEGAL ACTION, (B) SUCH PARTY HAS CONSIDERED THE IMPLICATIONS OF THIS WAIVER, (C) SUCH

PARTY MAKES THIS WAIVER VOLUNTARILY, AND (D) SUCH PARTY HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE

MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 6(c).

(d) Entire

Agreement. This Agreement and the Note constitute the sole and entire agreement of the Parties with respect to the subject matter

contained herein and therein, and supersede all prior and contemporaneous understandings and agreements, both written and oral, with respect

to such subject matter.

(e) Successors

and Assigns. Neither Party may assign, by operation of law or otherwise, in whole or in part, any of its rights, interests or obligations

hereunder without the prior written consent of the other Party. Subject to the restrictions on transfer described herein, the provisions

hereof shall inure to the benefit of, and be binding upon, the respective successors, permitted assigns, heirs, executors, administrators

and transferees of the Parties. Nothing herein, express or implied, is intended to confer upon any Party other than the Parties or their

respective successors, permitted assigns, heirs, executors and administrators any rights, duties or obligations under or by reason of

this Agreement, except as expressly provided herein.

(f) Interpretation.

Capitalized terms shall be equally applicable to both the singular and plural forms of the terms defined. For purposes of this Agreement,

(x) words “include,” “includes” and “including” shall be deemed to be followed by the words “without

limitation,” (y) the word “or” is not exclusive, and (z) the words “herein,” “hereof,”

“hereby,” “hereto,” “hereunder” and words of similar import refer to this Agreement as a whole. Unless

the context otherwise requires, references herein: (i) to a Section or an Exhibit mean a Section or an Exhibit of,

or attached to, this Agreement; (ii) to agreements, instruments and other documents shall be deemed to include all subsequent amendments,

supplements and other modifications thereto; (iii) to statutes or regulations are to be construed as including all statutory and

regulatory provisions consolidating, amending or replacing the statute or regulation referred to; (iv) to any Person includes such

Person’s successors and assigns, but, if applicable, only if such successors and assigns are not prohibited by this Agreement; and

(v) to any gender includes each other gender. The Exhibits attached hereto shall be construed with, and as an integral part of, this

Agreement to the same extent as if they were set forth verbatim herein. This Agreement shall be construed without regard to any presumption

or rule requiring construction or interpretation against the Party drafting an instrument or causing any instrument to be drafted.

(g) Headings.

The headings in this Agreement are for reference only and shall not affect the interpretation of this Agreement.

(h) No

Waiver; Cumulative Remedies. No failure to exercise and no delay in exercising, on the part of either Party, of any right, remedy,

power, or privilege hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power,

or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power, or privilege.

The rights, remedies, powers, and privileges herein provided are cumulative and not exclusive of any rights, remedies, powers, and privileges

provided by Law.

(i) Amendments

and Waivers. Any provision of this Agreement may be amended or waived upon the written consent of the Parties. No waivers of, or exceptions

to, any term, condition or provision hereof, in any one or more instances, shall be deemed to be, or construed as, a further or continuing

waiver of, or exception to, any such term, condition or provision.

(j) Severability.

If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction, such invalidity, illegality or unenforceability

shall not affect any other term or provision of this Agreement or invalidate or render unenforceable such term or provision in any other

jurisdiction. Upon such determination that any term or other provision is invalid, illegal or unenforceable, the Parties shall negotiate

in good faith to modify this Agreement so as to effect the original intent of the Parties as closely as possible in a mutually acceptable

manner in order that the transactions contemplated hereby be consummated as originally contemplated to the greatest extent possible.

(k) Further

Assurances. Each Party shall cooperate fully with the other Party hereto and to execute and deliver, or cause to be executed and delivered,

such further agreements, instruments and documents and to give such further written assurance and take such further acts as may be reasonably

requested by any other Party to evidence and reflect the transactions contemplated by this Agreement and to carry into effect the intents

and purposes hereof.

(l) Survival.

The representations, warranties, covenants and agreements made herein shall survive the execution and delivery hereof and the Closing.

(m) Counterparts.

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to

be one and the same agreement. The exchange of copies hereof, including signature pages hereto, by facsimile, e-mail or other means

of electronic transmission shall constitute effective execution and delivery hereof as to the Parties and may be used in lieu of the original

Agreement for all purposes. Signatures transmitted by facsimile, e-mail or other means of electronic transmission shall be deemed to be

original signatures for all purposes.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, the undersigned

have executed this Redemption Agreement, effective as of the Effective Date.

| |

COMPANY: |

| |

|

| |

Cohen &

Company, LLC |

| |

By: |

/s/

Joseph W. Pooler, Jr. |

| |

Name: |

Joseph

W. Pooler, Jr. |

| |

Title: |

Executive

Vice President, Chief Financial Officer and Treasurer |

| |

JKD: |

| |

|

| |

JKD

Capital Partners I LTD |

| |

By: |

/s/

Jack J. DiMaio, Jr. |

| |

Name: |

Jack

J. DiMaio, Jr. |

| |

Title: |

Authorized

Person |

[Signature Page to Redemption Agreement]

Exhibit A

Form of Note

See Exhibit 10.2.

Exhibit 10.2

THIS NOTE HAS NOT BEEN

REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES LAWS OF ANY JURISDICTION.

THIS NOTE MAY NOT BE SOLD, TRANSFERRED, ASSIGNED OR HYPOTHECATED IN THE ABSENCE OF SUCH REGISTRATION OR AN EXEMPTION THEREFROM.

BY ACQUIRING THIS NOTE, THE HOLDER REPRESENTS THAT THE HOLDER WILL NOT SELL OR OTHERWISE DISPOSE OF THIS NOTE WITHOUT REGISTRATION OR

EXEMPTION THEREFROM.

SENIOR PROMISSORY NOTE

| $5,145,926.67 | | September 1,

2024 |

For value received Cohen & Company, LLC, a Delaware limited

liability company (together with its successors and assigns, the “Company”), promises to pay to JKD Capital Partners I LTD,

a New York corporation (the “Holder”), the principal amount of $5,145,926.67, together with all accrued and unpaid

interest thereon. This Senior Promissory Note (this “Note”) is being issued by the Company to Holder in accordance

with the terms and conditions of the Redemption Agreement, dated as of September 23, 2024 and effective as of September 1,

2024, by and between the Company and the Holder.

This Senior Promissory Note (this “Note”) is subject

to the following terms and conditions:

1. Defined

Terms. The following terms used in this Note shall have the following meanings:

(a) “Affiliate”

means, with respect to a Person, any other Person directly or indirectly controlling, controlled by, or under common control with, such

Person at any time during the period for which the determination of affiliation is being made. For purposes of this definition,

the terms “control,” “controlling,” “controlled” and words of similar import, when used in this context,

mean, with respect to any Person, the possession, directly or indirectly, of the power to direct, or cause the direction of, management

policies of such Person, whether through the ownership of voting securities, by contract or otherwise.

(b) “Assets”

means all of the properties and assets of the Company or of any subsidiary of the Company, whether real, personal or mixed, tangible

or intangible, wherever located, whether now owned or hereafter acquired.

(c) “Change

in Control” shall mean any one of the following events: (i) any Person or group (other than the Holder, Daniel G. Cohen,

any member of Daniel G. Cohen’s immediate family, the DGC Family Fintech

Trust, Cohen Bros. Financial, LLC, Lester R. Brafman and any controlled Affiliates of the foregoing) is or becomes a beneficial

owner, directly or indirectly, of more than 50% of the aggregate voting power represented by all issued and outstanding units of membership

interests of the Company or the outstanding capital stock of Parent, or (ii) the members of the Company approve a plan of liquidation

or dissolution of the Company or Parent or a sale of all or substantially all of the Company’s or Parent’s assets.

(d) “Encumbrance”

means any lien, security interest, pledge, mortgage, easement, leasehold, assessment, tax, covenant, reservation, conditional sale, prior

assignment, or any other encumbrance, claim, burden or charge of any nature whatsoever.

(e) “Governmental

Authority” means any foreign, federal, state or local government, or any political subdivision thereof, or any court, agency

or other body, organization, group, stock market or exchange exercising any executive, legislative, judicial, quasi-judicial, regulatory

or administrative function of government.

(f) “Indebtedness”

means, with respect to a specified Person: (a) all indebtedness of such Person for borrowed money; (b) all obligations of such

Person for the deferred purchase price of property or services (other than current accounts payable and accrued expenses incurred in

the ordinary course of business irrespective of when paid); (c) all obligations of such Person evidenced by bonds, debentures, notes,

loan agreements, credit agreements or other similar instruments; (d) all obligations and liabilities of such Person created or arising

under any conditional sales or other title retention agreements with respect to property used and/or acquired by such Person; (e) all

capitalized lease obligations of such Person; (f) all aggregate mark-to-market exposure of such Person under hedging agreements;

(g) all obligations in respect of letters of credit (whether drawn or supporting obligations that constitute Indebtedness) and bankers’

acceptances; (h) all obligations referred to in clauses (a) through (g) of this definition of another Person guaranteed

by the specified Person or secured by (or for which the holder of such Indebtedness has an existing right, contingent or otherwise, to

be secured by) an Encumbrance upon property owned by the specified Person, whether or not the specified Person has assumed or become

liable for the payment of such Indebtedness; provided, however, that any amounts loaned under the JVB Loan Facility shall not be considered

Indebtedness of the Company for purposes hereof.

(g) “Judgment”

means any order, ruling, writ, injunction, fine, citation, award, decree, or any other judgment of any nature whatsoever of any Governmental

Authority.

(h) “JVB

Loan Facility” means the Third Amended and Restated Loan Agreement, dated June 9, 2023, by and between Byline Bank, as

lender, and J.V.B. Financial Group, LLC, as borrower, as the same may be amended and/or restated from time to time, and any successor

agreement(s) thereto.

(i) “Parent”

means Cohen & Company Inc., a Maryland corporation.

(j) “Person”

means any individual, sole proprietorship, joint venture, partnership, company, corporation, association, cooperation, trust, estate,

Governmental Authority, or any other entity of any nature whatsoever.

(k) “Proceeding”

means any demand, claim, suit, action, litigation, investigation, audit, study, arbitration, administrative hearing, or any other proceeding

of any nature whatsoever.

(l) “Senior”

means that, in the event of any default in the payment of the obligations represented by this Note or of any liquidation, insolvency,

bankruptcy, reorganization or similar proceedings relating to the Company, all amounts payable under this Note shall first be paid in

full before any payment is made upon any other Indebtedness incurred following September 1, 2024 (including any Indebtedness guaranteed

by the Company) or any subordinated or junior subordinated Indebtedness of the Company outstanding as of September 1, 2024, and,

in any such event, any payment or distribution of any character which shall be made in respect of any other Indebtedness of the Company

shall be paid to the Holder for application to the payment hereof, unless and until the obligations under this Note shall have been paid

and satisfied in full.

2. Note.

(a) Maturity.

The unpaid principal amount and all accrued but unpaid interest hereunder shall be due and payable as follows: (i) $2,572,963.33

of the principal amount shall be due and payable on August 31, 2025, and (ii) $2,572,963.34 shall be due and payable on August 31,

2026 (the “Second Maturity Date”).

(b) Interest.

Interest shall accrue from the Effective Date of this Note on the unpaid principal amount at a rate equal to twelve percent (12%) per

annum, computed on the basis of the actual number of days elapsed and a year of 365 days from the date of this Note until the principal

amount and all interest accrued but unpaid thereon are paid. Interest shall be payable in cash quarterly on each January 1, April 1,

July 1, and October 1 (each, an “Interest Payment Date”) until the Second Maturity Date, commencing on October 1,

2024. Upon the occurrence of any Event of Default and after any applicable cure period as described in Section 6 and for so long

as such Event of Default continues, all principal, interest and other amounts payable under this Note shall bear interest at a rate equal

to thirteen percent (13%) per annum (the “Default Rate”).

(c) Prepayment

Without Consent. This Note may not be prepaid in whole or in part at any time or from time to time prior to January 31, 2025.

This Note may, with at least thirty-one (31) days’ prior written notice from the Company to the Holder, be prepaid in whole or

in part at any time or from time to time following January 31, 2025 and until the Second Maturity Date without the prior written

consent of the Holder and without penalty or premium by paying the principal amount to be prepaid together with accrued interest thereon

to the date of prepayment.

3. Covenants

of the Company. The Company covenants to the Holder that, from the date hereof until all principal, interest and other amounts

payable under this Note have been paid in full, the Company shall, except as otherwise agreed in writing by the Holder:

(a) punctually

pay the principal and interest payable on this Note, and any other amount due and payable under this Note in the manner specified in

this Note;

(b) give

written notice promptly to the Holder of any condition or event that constitutes, or is reasonably expected to constitute, an Event of

Default;

(c) not

avoid or seek to avoid the observance or performance of any of the terms of this Note through any reorganization, recapitalization, transfer

of assets or other voluntary action; and

(d) not

create or incur any Encumbrance in or on its property or Assets, whether now owned or hereinafter acquired, or upon any income or revenues

or rights therefrom, except:

(i) Encumbrances

existing on the date hereof and previously disclosed to the Holder;

(ii) Encumbrances

for property taxes and assessments or other governmental charges or levies and liens that are not overdue for more than ninety (90) days;

or

(iii) Encumbrances

of or resulting from any Judgment, the time for appeal or petition for rehearing of which shall not have expired or in respect of which

the Company shall in good faith be prosecuting an appeal or other Proceeding for a review and in respect of which a stay of execution

pending such appeal or Proceeding shall have been secured.

4. Form of

Payment. Except as otherwise set forth herein, all payments due hereunder shall be made in lawful money of the United States

of America to such account or accounts as may be designated in writing by the Holder from time to time. Payment shall be credited first

to the accrued interest then due and payable and the remainder applied to principal.

5. Priorities.

The indebtedness evidenced by this Note and the payment of all principal, interest

and any other amounts payable hereunder is a senior obligation of the Company and shall be Senior to any Indebtedness of the Company

outstanding as of and incurred following September 1, 2024.

6. Events

of Default. An “Event of Default” shall be deemed to have occurred if:

(a) subject

to the accrual of interest as provided in Section 1(b) hereof, the Company shall fail to pay as and when due any principal

or interest hereunder and such nonpayment shall continue uncured for a period of five (5) business days;

(b) except

for an event described in Section 6(a), the Company fails to perform any covenant or agreement hereunder, and such failure continues

or is not cured within five (5) business days after written notice by the Holder to the Company;

(c) the

Company or any significant subsidiary (as such term is defined in Rule 1-02(w) of Regulation S-X) of the Company (each, a “Significant

Subsidiary”) applies for or consents to the appointment of a receiver, trustee, liquidator or custodian of itself or of all

or a substantial part of its property, (ii) makes a general assignment for the benefit of itself or any of its creditors, or (iii) commences

a voluntary case or other proceeding seeking liquidation, reorganization or other relief with respect to itself or its debts under any

bankruptcy, insolvency or other similar law now or hereafter in effect;

(d) proceedings

for the appointment of a receiver, trustee, liquidator or custodian of the Company or any Significant Subsidiary, or of all or a substantial

part of the property thereof, or an involuntary case or other proceedings seeking liquidation, reorganization or other relief with respect

to the Company or any Significant Subsidiary, or the debts thereof under any bankruptcy, insolvency or other similar law now or hereafter

in effect are commenced and an order for relief entered or such proceeding is not dismissed or discharged within ninety (90) days of

commencement;

(e) there

is entered against the Company or any subsidiary of the Company a final Judgment for the payment of money in an aggregate amount exceeding

$300,000 and such Judgment shall remain unsatisfied or without a stay in respect thereof for a period of thirty (30) days;

(f) the

Company or any subsidiary of the Company shall fail to pay when due any obligation, whether direct or contingent, for Indebtedness exceeding

$300,000, or shall breach or default with respect to any term of any loan agreement, mortgage, indenture or other agreement pursuant

to which such obligation for Indebtedness was created or securing such obligation if the effect of such breach or default is to cause,

or to permit the holder or holders of that Indebtedness (or a trustee on behalf of such holder or holders), to cause that Indebtedness

to become or be declared due and payable (or redeemable) prior to its stated maturity or the stated maturity of any underlying obligation,

as the case may be; or

(g) a

Change in Control shall have occurred.

Upon the occurrence or existence of any Event of Default described

in Section 6(a), Section 6(b), Section 6(e), Section 6(f) or Section 6(g) and at any time thereafter

during the continuance of such Event of Default, the Holder may, by written notice to the Company, declare the entire unpaid principal

amount outstanding and all interest accrued and unpaid on the Note to be immediately due and payable without presentment, demand, protest

or any other notice or demand of any kind. Upon the occurrence or existence of any Event of Default described in Section 6(c) or

Section 6(d), immediately and without notice, the entire unpaid principal amount outstanding and all interest accrued and unpaid

on the Note shall automatically become immediately due and payable, without presentment, demand, protest or any other notice or demand

of any kind. Upon the occurrence of any Event of Default and after any applicable cure period as described herein and for so long as

such Event of Default continues, all principal, interest and other amounts payable under this Note shall bear interest at the Default

Rate. In addition to the foregoing remedies, upon the occurrence or existence of any Event of Default, the Holder may exercise any other

right power or remedy granted to it by this Note or otherwise permitted to it by law, either by suit in equity or by action at law, or

both.

7. No

Senior Indebtedness. Following the date hereof, the Company shall not incur any Indebtedness that is a Senior obligation to this

Note.

8. Miscellaneous.

(a) This

Note and all acts and transactions pursuant hereto and the rights and obligations of the parties hereto shall be governed, construed

and interpreted in accordance with the laws of the State of New York without regard to its conflicts of law principles or the conflicts

of law principles of any other state in either case that would result in the application of the laws of any other state.

(b) All

notices of request, demand and other communications hereunder shall be addressed to the parties as follows:

| |

If to the Company: |

|

Cohen & Company, LLC

Cira Centre

2929 Arch Street, Suite 1703

Philadelphia, Pennsylvania 19104

Attn: Joseph W. Pooler, Jr.

Facsimile: (215) 701-8279

E-mail: jpooler@cohenandcompany.com

and to: |

| |

|

|

|

| |

|

|

Cohen & Company Inc.

3 Columbus Circle, 24th Floor,

New York, New York 10019

Attn: Dennis Crilly

E-mail: dcrilly@cohenandcompany.com |

| |

|

|

|

| |

With a copy to: |

|

Duane Morris LLP

30 South 17th Street

Philadelphia, Pennsylvania 19103

Attn: Darrick M. Mix

Facsimile: (215) 405-2906

Email: dmix@duanemorris.com |

| |

|

|

|

| |

If to Holder: |

|

At the address set forth on the books and records of the Company. |

unless the address is changed by the party by like notice given to

the other parties. Notice shall be in writing and shall be deemed delivered: (i) if mailed by certified mail, return receipt requested,

postage prepaid and properly addressed to the address above, then three (3) business days after deposit of same in a regularly maintained

U.S. Mail receptacle; or (ii) if mailed by Federal Express (FedEx), the United Parcel Service (UPS), or another nationally recognized

overnight courier service, next business morning delivery, then one (1) business day after deposit of same in a regularly maintained

receptacle of such overnight courier; or (iii) if hand delivered, then upon hand delivery thereof to the address indicated on or

prior to 5:00 p.m., New York City time, on a business day. Any notice hand delivered after 5:00 p.m. New York City time, shall be

deemed delivered on the following business day. Notwithstanding the foregoing, notices, consents, waivers or other communications referred

to in this Note may be sent by facsimile, e-mail, or other method of delivery, but shall be deemed to have been delivered only when the

sending party has confirmed (by reply e-mail or some other form of written confirmation from the receiving party) that the notice has

been received by the other party.

(c) In

the event any interest is paid on this Note which is deemed to be in excess of the then legal maximum rate, then that portion of the

interest payment representing an amount in excess of the then legal maximum rate shall be deemed a payment of principal and applied against

the principal of this Note.

(d) Amendments

to any provision of this Note may be made or compliance with any term, covenant, agreement, condition or provision set forth in this

Note may be waived (either generally or in a particular instance and either retroactively or prospectively) only upon written consent

of the Company and the Holder. Any amendment or waiver effected in accordance herewith shall apply to and be binding upon the Holder,

upon each future holder of this Note and upon the Company, whether or not this Note shall have been marked to indicate such amendment

or waiver. No such amendment or waiver shall extend to or affect any obligation not expressly amended or waived or impair any right consequent

thereon.

(e) This

Note may not be assigned by any holder (except that the Holder shall be permitted to assign this Note to Holder’s controlled Affiliates)

without the prior written approval of the Company.

(f) The

Company hereby waives diligence, presentment, protest and demand, notice of protest, notice of dishonor, notice of nonpayment and any

and all other notices and demands in connection with the delivery, acceptance, performance, default or enforcement of this Note. The

Company further waives, to the full extent permitted by law, the right to plead any and all statutes of limitations as a defense to any

demand on this Note.

(g) The

Company agrees to pay all reasonable costs and expenses actually incurred by the Holder in connection with an Event of Default, including

without limitation the fees and disbursements of counsel, advisors, consultants, examiners and appraisers for the Holder, in connection

with (i) any enforcement (whether through negotiations, legal process or otherwise) of this Note in connection with such Event of

Default, (ii) any workout or restructuring of this Note during the pendency of such Event of Default and (iii) any bankruptcy

case or proceeding of the Company or any appeal thereof.

(h) The

section and other headings contained in this Note are for reference purposes only and shall not affect the meaning or interpretation

of this Note.

(i) This

Note may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one

and the same instrument.

IN WITNESS WHEREOF, the Company has caused this

Note to be duly executed and delivered by its authorized officer, as of the date first above written.

| |

By: |

/s/

Joseph W. Pooler, Jr. |

| |

Name: |

Joseph

W. Pooler, Jr. |

| |

Title: |

Executive

Vice President, Chief Financial Officer and Treasurer |

[Signature

Page to Senior Promissory Note]

AGREED AND ACKNOWLEDGED:

JKD CAPITAL PARTNERS I LTD

| By: |

/s/

Jack J. DiMaio, Jr. |

|

| Name: |

Jack

J. DiMaio, Jr. |

|

| Title: |

Authorized

Person |

|

[Signature Page to Senior Promissory Note]

v3.24.3

Cover

|

Sep. 23, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 23, 2024

|

| Entity File Number |

1-32026

|

| Entity Registrant Name |

Cohen

& Co Inc.

|

| Entity Central Index Key |

0001270436

|

| Entity Tax Identification Number |

16-1685692

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

Cira Centre

|

| Entity Address, Address Line Two |

2929 Arch Street, Suite 1703

|

| Entity Address, City or Town |

Philadelphia

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19104

|

| City Area Code |

215

|

| Local Phone Number |

701-9555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

COHN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

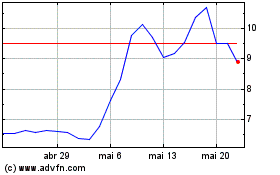

Cohen & (AMEX:COHN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Cohen & (AMEX:COHN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024