false

0001815974

0001815974

2024-09-25

2024-09-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 25, 2024

ANEBULO

PHARMACEUTICALS, INC

(Exact

name of Registrant as Specified in Its Charter)

| Delaware |

|

001-40388 |

|

85-1170950 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

Anebulo

Pharmaceuticals, Inc.

1017

Ranch Road 620 South, Suite 107

Lakeway,

TX |

|

78734 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

Telephone Number, Including Area Code: (512) 598-0931

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

ANEB |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02 Results of Operations and Financial Condition.

On

September 25, 2024, Anebulo Pharmaceuticals, Inc., a Delaware corporation (the “Company”), issued a press release announcing

its financial results for the quarter and fiscal year ended June 30, 2024 and providing a business update. A copy of the press release

is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The

information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as expressly set forth by specific reference in such a filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ANEBULO

PHARMACEUTICALS, INC. |

| |

|

|

| Date:

September 25, 2024 |

By: |

/s/

Richard Anthony Cunningham |

| |

|

Richard

Anthony Cunningham |

| |

|

Chief

Executive Officer (Principal Executive Officer) |

Exhibit

99.1

Anebulo

Pharmaceuticals Reports Fourth Quarter and Fiscal Year 2024

Financial

Results and Recent Updates

AUSTIN,

Texas (September 25, 2024) – Anebulo Pharmaceuticals, Inc. (Nasdaq: ANEB), a clinical-stage biopharmaceutical company developing

novel solutions for people suffering from acute cannabis-induced toxic effects (the “Company” or “Anebulo”),

today announced financial results for the three and twelve months ended June 30, 2024, and recent updates.

Fourth

Quarter Fiscal Year 2024 and Subsequent Highlights:

| |

● |

Anebulo

announced it has been awarded the first tranche of a two year cooperative grant of up to approximately $1.9 million from the National

Institute on Drug Abuse (“NIDA”), part of the National Institutes of Health (“NIH”) |

| |

|

|

| |

● |

With

the support of NIDA, Anebulo aims to complete IND-enabling activities and the scale up of its intravenous (“IV”)

formulation of selonabant around calendar year end 2024 as it prepares for clinical studies and the Company expects to enroll the

first healthy adult volunteer in the first half of calendar 2025 |

| |

|

|

| |

● |

Anebulo

prioritizes development of selonabant IV formulation for unintentional cannabis poisoning in children in response to the growing

medical need and impending change in Drug Enforcement Agency scheduling of marijuana from a Schedule I to a Schedule III controlled

substance supported by the United States Department of Justice |

“The

recently awarded grant from NIDA further enables our efforts to provide a rapid and clinically impactful emergency treatment for acute

cannabis-induced toxicities, including cannabis-induced Central Nervous System (“CNS”) depression in children,”

commented Richie Cunningham, Chief Executive Officer of Anebulo.

“We

believe this important grant from NIDA recognizes the progress we have already made with the successful Phase 2 proof of concept study

of oral selonabant and provides further momentum for advancing the intravenous formulation towards clinical testing. We also believe

this awarded grant further validates the significant and growing unmet medical need for an emergency antidote to cannabis toxicity. In

particular, acute cannabis exposure in children is a serious and potentially life-threatening condition that can result in CNS depression,

respiratory depression, coma, and in rare cases death. Research has shown that children are much more sensitive to the toxic effects

of cannabis, due in part to age-related differences in the abundance of cannabis receptors in their brains. As a direct consequence,

pediatric cannabis ingestion can result in much more serious outcomes than in adults, and a much greater risk of hospitalization and

admission to intensive care. If approved, we believe selonabant has the potential to offer a much-needed targeted therapy for rapidly

reversing the serious and life-threatening consequences of accidental cannabis ingestion in children.”

Financial

Results for the three months ended June 30, 2024

| |

● |

Operating

expenses in the fourth quarter of fiscal 2024 were $1.3 million compared with $2.5 million in the same period in fiscal 2023. |

| |

|

|

| |

● |

Net

loss in the fourth quarter of fiscal 2024 was $1.3 million, or $(0.05) per share, compared with a net loss of $2.5 million, or $(0.10)

per share, in the fourth quarter of fiscal 2023. Cash and cash equivalents were $3.1 million as of June 30, 2024. |

| |

|

|

| |

● |

The

Company has access to an additional $10 million in cash through the Loan and Security Agreement executed on November 13, 2023. |

Financial

Results for the twelve months ended June 30, 2024

| |

● |

Operating

expenses in fiscal year 2024 were $8.3 million compared with $11.8 million in the same period in fiscal 2023. Research and Development

expenses decreased approximately $2.1 million from the prior year, primarily due to the completion of the Company’s Phase 2

proof of concept clinical trial for acute cannabinoid intoxication (“ACI”) during the first half of the fiscal year ended

June 30, 2024, and prioritizing the advancement of a selonabant IV formulation, which resulted in a reduction in activities related

to pre-clinical, clinical studies, and direct third-party costs. General and Administrative expenses decreased $1.4 million from

the prior period, primarily due to an overall reduction in compensation and related benefits, including stock-based compensation,

professional and consultant fees, and a decrease in directors’ and officer’s insurance premiums. |

| |

|

|

| |

● |

Net

loss in fiscal year 2024 was $8.2 million, or $(0.32) per share, compared with a net loss of $11.7 million, or $(0.47) per share,

in fiscal year 2023. The decrease in the net loss and resulting net loss per share was the result of decreased operating expenses

as discussed above. |

About

Selonabant (ANEB-001)

The

Company’s lead product candidate is selonabant (ANEB-001), a potent, small molecule antagonist of the cannabinoid receptor type-1

(“CB1”), under development to address the unmet medical need for a specific antidote for cannabis toxicity, including

ACI and unintentional cannabis poisoning. Selonabant is an orally bioavailable, readily absorbed treatment candidate that the Company

anticipates will rapidly reverse key symptoms of cannabis toxicity. Selonabant is also under development as an IV treatment for unintentional

cannabis poisoning. Selonabant is protected by two issued patents covering various methods of use of the compound and composition of

matter of the crystalline form of selonabant. Anebulo also has multiple pending applications covering various methods of use of the compound

and delivery systems. An observational study in patients presenting to Emergency Departments with cannabis toxicity is currently ongoing.

The study will determine concentrations of cannabinoids and metabolites in plasma and gather information on signs and symptoms, patients’

disposition and selected subjective assessments.

About

Anebulo Pharmaceuticals, Inc.

Anebulo

Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company developing novel solutions for people suffering from acute cannabinoid

intoxication and unintentional cannabis intoxication. Its lead product candidate, selonabant, has completed dosing in a Phase 2 clinical

trial (www.clinicaltrials.gov/ct2/show/NCT05282797) evaluating its utility in blocking and reversing the negative effects of acute

cannabinoid intoxication. Rather than proceeding directly with the Phase 3 studies of oral selonabant in adults with ACI, the Company

is prioritizing the advancement of a selonabant IV formulation as a potential treatment for pediatric patients with unintentional

cannabis poisoning, which it believes offers the potential for a faster timeline to approval relative to the adult oral product.

Anebulo is currently scaling up the intravenous formulation for initial clinical safety studies. Selonabant is a competitive antagonist

at the human CB1. For further information about Anebulo, please visit www.anebulo.com.

Forward-Looking

Statements

Statements

contained in this press release that are not statements of historical fact are forward-looking statements as defined in Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, these forward-looking

statements can be identified by words such as “anticipate,” “designed,” “expect,” “may,”

“will,” “should” and other comparable terms. Forward-looking statements include statements regarding Anebulo’s

intentions, beliefs, projections, outlook, analyses or current expectations regarding: completion of IND-enabling activities and the

scale up of Anebulo’s intravenous formulation of selonabant around year end 2024 as Anebulo prepares for clinical studies; enrollment

of the first healthy adult volunteer in the first half of 2025; the decision by the United States Department of Justice to support

the change in Drug Enforcement Agency scheduling of marijuana from a schedule I to a schedule III controlled substance; the potential

of selonabant to offer a much-needed targeted therapy for rapidly reversing the serious and life-threatening consequences of accidental

cannabis ingestion in children; providing a rapid and clinically impactful emergency treatment for acute cannabis-induced toxicities,

including cannabis-induced CNS depression in children; the NIDA grant providing further momentum for advancing the intravenous formulation

of selonabant towards clinical testing and validating the significant and growing unmet medical need for an emergency antidote to cannabis

toxicity. You are cautioned that any such forward-looking statements are not guarantees

of future performance and are subject to a number of risks, uncertainties and assumptions, including, but not limited to: the Company’s

ability to pursue its regulatory strategy including completion of IND enabling activities and scale up of the intravenous formulation

of selonabant around year end 2024 and enrolling the first healthy adult volunteer in the first half of 2025, its ability to obtain

regulatory approvals for commercialization of product candidates or to comply with ongoing regulatory requirements, the Company’s

ability to obtain or maintain the capital or grants necessary to fund its research and development activities, its ability to complete

clinical trials on time and achieve desired results and benefits as expected, regulatory limitations relating to the ability to promote

or commercialize product candidates for specific indications, acceptance of product candidates in the marketplace and the successful

development, marketing or sale of Anebulo’s products, the Company’s ability to maintain its license agreements, the continued

maintenance and growth of its patent estate and the Company’s ability to retain its key employees or maintain its Nasdaq listing.

These risks should not be construed as exhaustive and should be read together with the other cautionary statements included in the Company’s

Annual Report on Form 10-K for the year ended June 30, 2024, and its subsequent filings with the SEC, including subsequent periodic reports

on Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. All forward-looking statements made in this press release speak only

as of the date of this press release and are based on management’s assumptions and estimates as of such date. Except as required

by law, Anebulo undertakes no obligation to update or revise forward-looking statements to reflect new information, future events, changed

conditions or otherwise after the date of this press release.

CONTACTS:

Anebulo

Pharmaceuticals, Inc.

Daniel

George

Part

time Chief Financial Officer

(512)

598-0931

Dan@anebulo.com

Condensed

Balance Sheets

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| Cash and cash equivalents | |

$ | 3,094,200 | | |

$ | 11,247,403 | |

| Total assets | |

| 4,073,114 | | |

| 11,670,151 | |

| Total liabilities | |

| 260,583 | | |

| 1,068,801 | |

| Total stockholders’ equity | |

| 3,812,531 | | |

| 10,601,350 | |

Condensed

Statements of Operations

| | |

Three months ended June 30, | | |

Year ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Research and development | |

$ | 467,706 | | |

$ | 1,417,159 | | |

$ | 3,548,937 | | |

$ | 5,600,197 | |

| General and administrative | |

| 872,661 | | |

| 1,077,230 | | |

| 4,759,818 | | |

| 6,183,402 | |

| Total operating expenses | |

| 1,340,367 | | |

| 2,494,389 | | |

| 8,308,755 | | |

| 11,783,599 | |

| Loss from operations | |

| (1,340,367 | ) | |

| (2,494,389 | ) | |

| (8,308,755 | ) | |

| (11,783,599 | ) |

| Other (income) expenses: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 59,696 | | |

| - | | |

| 151,230 | | |

| - | |

| Interest income | |

| (50,218 | ) | |

| (6 | ) | |

| (249,022 | ) | |

| (92,407 | ) |

| Other | |

| 124 | | |

| 1,197 | | |

| (9,260 | ) | |

| 41,146 | |

| Total other (income) expenses, net | |

| 9,602 | | |

| 1,191 | | |

| (107,052 | ) | |

| (51,261 | ) |

| Net loss | |

$ | (1,349,969 | ) | |

$ | (2,495,580 | ) | |

$ | (8,201,703 | ) | |

$ | (11,732,338 | ) |

| Weighted average common shares outstanding, basic and diluted | |

| 25,933,217 | | |

| 25,633,217 | | |

| 25,822,258 | | |

| 25,074,481 | |

| Net loss per share, basic and diluted | |

$ | (0.05 | ) | |

$ | (0.10 | ) | |

$ | (0.32 | ) | |

$ | (0.47 | ) |

v3.24.3

Cover

|

Sep. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 25, 2024

|

| Entity File Number |

001-40388

|

| Entity Registrant Name |

ANEBULO

PHARMACEUTICALS, INC

|

| Entity Central Index Key |

0001815974

|

| Entity Tax Identification Number |

85-1170950

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Anebulo

Pharmaceuticals, Inc.

|

| Entity Address, Address Line Two |

1017

Ranch Road 620 South

|

| Entity Address, Address Line Three |

Suite 107

|

| Entity Address, City or Town |

Lakeway

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78734

|

| City Area Code |

(512)

|

| Local Phone Number |

598-0931

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

ANEB

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

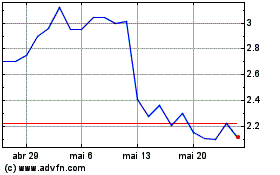

Anebulo Pharmaceuticals (NASDAQ:ANEB)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Anebulo Pharmaceuticals (NASDAQ:ANEB)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025