0000766421false00007664212024-09-302024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

September 30, 2024

(Date of earliest event reported)

ALASKA AIR GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation) | | | | | | | | |

| 1-8957 | | 91-1292054 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 19300 International Boulevard | Seattle | Washington | | 98188 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(206) 392-5040

(Registrant's Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Ticker Symbol | Name of each exchange on which registered |

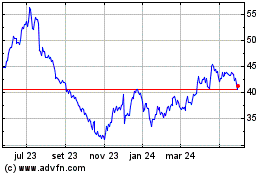

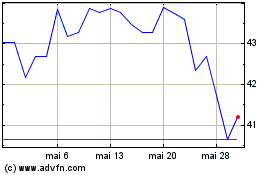

| Common stock, $0.01 par value | ALK | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This document is also available on our website at http://investor.alaskaair.com

Item 8.01 Other Events.

Senior Secured Notes Offering

On September 30, 2024, Alaska Air Group, Inc. (the “Company”) issued a press release announcing that it launched a private offering (the “Offering”) of senior secured notes due 2029 and senior secured notes due 2031 (together, the “Notes”) by AS Mileage Plan IP Ltd. (“Loyalty Issuer”), an exempted company incorporated with limited liability under the laws of the Cayman Islands and an indirect, wholly-owned subsidiary of the Company.

The Notes will be (i) fully and unconditionally guaranteed on a senior secured basis, jointly and severally, by Alaska Airlines, Inc. (“Alaska”) and AS Mileage Plan Holdings Ltd. and on an unsecured basis by the Company (together, the “Guarantors”) and (ii) secured, on a senior, first-priority basis by the Guarantors’ (other than the Company) right, title and interest in certain collateral associated with Alaska’s customer loyalty program, Alaska Airlines Mileage Plan™.

Contemporaneously with the closing of the Offering, the Company expects to enter into a new credit agreement for a senior secured Term Loan B due 2031 (the “Loyalty Term Loan Facility”). The Loyalty Term Loan Facility will be secured by the same collateral that secures the Notes on an equal and ratable basis with the lien on the Notes and will rank pari passu in right of payment with the Notes. The closing of the Offering is not contingent upon the closing of the Loyalty Term Loan Facility.

Loyalty Issuer intends to use the net proceeds received from the Offering, together with borrowings under the Loyalty Term Loan Facility, in each case, after deducting fees and expenses payable by the Company, (i) to fund the reserve account for the Notes and the Loyalty Term Loan Facility and (ii) to fund a collection account, and the proceeds deposited into the collection account will be used to make an intercompany loan to Alaska on the closing date of the Offering (the “Intercompany Loan”). Alaska intends to use the proceeds from the Intercompany Loan (i) to redeem certain outstanding debt acquired or assumed in the Merger (as defined below) including to redeem Hawaiian Airlines, Inc.’s (“Hawaiian”) 11.000% senior secured notes due 2029 at par and its 5.750% senior secured notes due 2026, and (ii) for general corporate purposes and to support its liquidity position.

This report does not constitute an offer to sell or a solicitation of an offer to buy the Notes or any other securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to the registration and qualification under the securities laws of such state or jurisdiction. The Notes are being offered only to persons reasonably believed to be “qualified institutional buyers” in an offering exempt from registration in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and outside the United States in reliance on Regulation S under the Securities Act. The Notes proposed to be offered will not be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States without registration or an applicable exemption from the registration requirements of the Securities Act or any applicable state securities laws.

A copy of the press release is filed herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

As previously disclosed, on December 2, 2023, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Hawaiian Holdings, Inc., a Delaware corporation, and Marlin Acquisition Corp., a Delaware corporation and a wholly owned subsidiary of Alaska (“Merger Sub”). On September 18, 2024, pursuant to the Merger Agreement, Merger Sub merged with and into Hawaiian, with Hawaiian surviving as a wholly owned subsidiary of the Company (the “Merger”). The Company is making available the following information.

The unaudited pro forma condensed combined financial information of the Company, which give effect to the Merger, including the unaudited pro forma condensed combined balance sheet as of June 30, 2024 and the unaudited pro forma condensed combined statements of operations for the year ended December 31, 2023 and the six months ended June 30, 2024 and the notes related thereto, are filed as Exhibit 99.2 to this report and incorporated herein by reference.

(d) Exhibits

| | | | | | | | |

| | Press Release of Alaska announcing the Notes, dated September 30, 2024. |

| | Unaudited pro forma condensed combined financial information of the Company for the year ended December 31, 2023 and as of and for the six months ended June 30, 2024. |

| 104 | | Cover Page Interactive Data File - embedded within the Inline XBRL Document |

Forward-Looking Statements

Forward-Looking Statements in this report and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Forward-looking statements include, without limitation, statements regarding the Company’s intentions and expectations regarding revenues as well as statements regarding the Offering described in this report. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements.

Factors include, among others, risks include competition, labor costs, relations and availability, general economic conditions including those associated with pandemic recovery, increases in operating costs including fuel, inability to meet cost reduction, ESG and other strategic goals, seasonal fluctuations in demand and financial results, supply chain risks, events that negatively impact aviation safety and security, and changes in laws and regulations that impact our business and other factors, as described in the Company’s filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and the Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2024 and June 30, 2024.

All forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date of the Offering. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results. Additional information concerning certain factors is contained in the Company’s Securities and Exchange Commission filings, including but not limited to the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

ALASKA AIR GROUP, INC.

Registrant

Date: September 30, 2024

/s/ KYLE B LEVINE

Kyle B. Levine

Senior Vice President, Legal, General Counsel and Corporate Secretary

Alaska Air Group Announces Proposed Senior Secured Notes Offering

SEATTLE, September 30, 2024 – Alaska Air Group, Inc. (the “Company”) today announced that it has launched a private offering (the “Offering”) of senior secured notes due 2029 and senior secured notes due 2031 (together, the “Notes”) by AS Mileage Plan IP Ltd. (“Loyalty Issuer”), an exempted company incorporated with limited liability under the laws of the Cayman Islands and an indirect, wholly-owned subsidiary of the Company.

The Notes will be (i) fully and unconditionally guaranteed on a senior secured basis, jointly and severally, by Alaska Airlines, Inc. (“Alaska”) and AS Mileage Plan Holdings Ltd. and on an unsecured basis by the Company (together, the “Guarantors”) and (ii) secured, on a senior, first-priority basis by the Guarantors’ (other than the Company) right, title and interest in certain collateral associated with Alaska’s customer loyalty program, Alaska Airlines Mileage Plan™.

Loyalty Issuer intends to use the net proceeds received from the Offering, together with borrowings under a loyalty term loan facility, in each case, after deducting fees and expenses payable by the Company, (i) to fund the reserve account for the Notes and the loyalty term loan facility and (ii) to fund a collection account, and the proceeds deposited into the collection account will be used to make an intercompany loan to Alaska on the closing date of the Offering (the “Intercompany Loan”). Alaska intends to use the proceeds from the Intercompany Loan (i) to redeem certain outstanding debt acquired or assumed in the merger of the Company with Hawaiian Airlines pursuant to the Agreement and Plan of Merger dated as of December 2, 2023, including to redeem Hawaiian’s 11.000% senior secured notes due 2029 at par and its 5.750% senior secured notes due 2026, and (ii) for general corporate purposes and to support its liquidity position.

This press release does not constitute an offer to sell or a solicitation of an offer to buy the Notes or any other securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to the registration and qualification under the securities laws of such state or jurisdiction. The Notes are being offered only to persons reasonably believed to be “qualified institutional buyers” in an offering exempt from registration in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and outside the United States in reliance on Regulation S under the Securities Act. The Notes proposed to be offered will not be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States without registration or an applicable exemption from the registration requirements of the Securities Act or any applicable state securities laws.

Forward-Looking Statements

Forward-looking statements in this press release and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Forward-looking statements include, without limitation, statements regarding the Company’s intentions and expectations regarding revenues as well as statements regarding the Offering described in this press release. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements.

Factors include, among others, risks include competition, labor costs, relations and availability, general economic conditions including those associated with pandemic recovery, increases in operating costs including fuel, inability to meet cost reduction, ESG and other strategic goals, seasonal fluctuations in demand and financial results, supply chain risks, events that negatively impact aviation safety and security, and changes in laws and regulations that impact our business and other factors, as described in the Company’s filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and the Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2024 and June 30, 2024.

All forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date of the Offering. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results. Additional information concerning certain factors is contained in the Company’s Securities and Exchange Commission filings, including but not limited to the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

About Alaska Air Group

Alaska Air Group, Inc. is based in Seattle and comprised of subsidiaries Alaska Airlines, Hawaiian Holdings, Inc., Horizon Air and McGee Air Services. With our recent acquisition of Hawaiian Airlines, we now serve more than 140 destinations throughout North America, Central America, Asia and across the Pacific. We are committed to safety, remarkable customer care, operational excellence, financial performance and sustainability. Alaska Airlines is a member of the oneworld Alliance. With oneworld and our additional global partners, our guests have more choices than ever to purchase, earn or redeem on alaskaair.com across 30 airlines and more than 1,000 worldwide destinations. Book travel throughout the Pacific on Hawaiian Airlines at hawaiianairlines.com. Learn more about Alaska Airlines at news.alaskaair.com and Hawaiian Airlines at newsroom.hawaiianairlines.com/blog. Alaska Air Group is traded on the New York Stock Exchange (NYSE) as “ALK.”

SOURCE Alaska Airlines

For further information: Media Relations, (206) 304-0008, newsroom@alaskaair.com

Exhibit 99.2

Unaudited Pro Forma Condensed Combined Financial Information

Unaudited Pro Forma Information

The following financial information and related notes present the unaudited pro forma condensed combined balance sheets and statements of operations based upon the combined historical financial statements of Alaska Air Group, Inc., ("Air Group") and Hawaiian Holdings, Inc., (“Hawaiian”), after giving effect to Air Group’s purchase of all the issued and outstanding shares of Hawaiian by means of a merger (the “Merger”). The information is intended to reflect the impact of the Merger on Air Group on a pro forma basis as of and for the periods indicated. Historical financial and operating data of Air Group and Hawaiian for the year ended December 31, 2023 are derived from their respective audited consolidated financial statements for the year then ended. Historical financial and operating data of Air Group and Hawaiian for the six months ended June 30, 2024 are derived from their unaudited consolidated financial statements for the six-month period then ended. In this pro forma condensed combined financial information, Air Group and Hawaiian, after giving effect to the Merger, are collectively referred to as “the Combined Company.”

The unaudited pro forma condensed combined balance sheet as of June 30, 2024 shows the combined financial position of Air Group and Hawaiian as if the Merger had been consummated on June 30, 2024. The unaudited pro forma condensed combined statements of operations for the year ended December 31, 2023 and the six months ended June 30, 2024 reflect the Merger as if it had occurred on January 1, 2023, the beginning of the earliest period presented. This unaudited pro forma condensed combined financial information was prepared using the acquisition method of accounting with Air Group considered the acquirer of Hawaiian for accounting purposes.

The unaudited pro forma condensed combined financial information was prepared in accordance with Article 11 of Regulation S-X. The unaudited pro forma adjustments reflecting the Merger were prepared in accordance with business combination accounting guidance in Accounting Standards Codification ("ASC") 805, Business Combinations. These adjustments reflect the preliminary allocation of the purchase price to the acquired assets and liabilities based upon provisional estimates of fair values. The assumptions used are set forth in the notes to the unaudited pro forma condensed combined financial information. These adjustments are provisional and subject to further adjustment as additional information becomes available, additional analyses are performed and as warranted by changes in current conditions and future expectations. Differences between these preliminary estimates and the final acquisition accounting will occur and these differences could have a material impact on the unaudited pro forma condensed combined financial information and the Combined Company’s future results of operations.

The unaudited pro forma condensed combined financial information is based upon, and should be read in conjunction with:

•the accompanying notes to the unaudited condensed combined pro forma financial information;

•the separate historical audited consolidated financial statements of Air Group as of and for the fiscal year ended December 31, 2023, the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in its Annual Report on Form 10-K as filed with the Securities and Exchange Commission (“SEC”) on February 14, 2024;

•the separate historical audited consolidated financial statements of Hawaiian as of and for the fiscal year ended December 31, 2023, the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in its Annual Report on Form 10-K as filed with the SEC on February 15, 2024, portions of which are incorporated herein by reference;

•the separate historical unaudited consolidated interim financial statements of Air Group as of and for the six months ended June 30, 2024 included in its Quarterly Report on Form 10-Q as filed with the SEC on August 2, 2024;

•the separate historical unaudited consolidated interim financial statements of Hawaiian as of and for the six months ended June 30, 2024 included in its Quarterly Report on Form 10-Q as filed with the SEC on July 31, 2024, portions of which are incorporated herein by reference.

The unaudited pro forma condensed combined financial information has been prepared to reflect adjustments to the combined historical consolidated financial statements that are (i) directly attributable to the Merger, and (ii) considered reasonable and supportable. Until the Merger was completed, Alaska and Hawaiian were limited in their ability to share certain information. As of the date of this offering memorandum, Alaska has not completed the detailed valuation study necessary to arrive at the required final estimates of the fair value of the assets to be acquired and the liabilities to be assumed and the related allocations of purchase price, nor has it identified all adjustments necessary to conform Hawaiian’s accounting policies to Alaska’s accounting policies. The assumptions and estimates used to make the preliminary pro forma adjustments are described in the notes accompanying these unaudited pro forma condensed combined financial information.

The unaudited pro forma condensed combined financial information is presented for informational purposes only. Such information is not necessarily indicative of the operating results or financial position that actually would have been achieved if the Merger had been consummated on the dates indicated or that the Combined Company may achieve in future periods. Specifically, the unaudited pro forma condensed combined financial information does not include any projected synergies expected to be achieved as a result of the Merger or any associated costs that may be incurred to achieve any projected synergies. The unaudited pro forma condensed combined financial information also exclude the costs associated with any integration activities that may result from the Merger.

ALASKA AIR GROUP

Unaudited Pro Forma Condensed Combined Balance Sheet

As of June 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(in millions) | Historical Alaska Air Group | | Historical Hawaiian | | Reclassification and Policy Adjustments | | Pro Forma Adjustments | | Condensed Combined

Pro Forma |

| ASSETS | | | | | | | | | |

| Current Assets | | | | | | | | | |

| Cash and cash equivalents | $ | 1,115 | | | $ | 510 | | | $ | — | | | $ | (997) | | (a) | $ | 628 | |

| Restricted cash | — | | | 17 | | | 17 | | (a) | — | | | 34 | |

| Marketable securities | 1,394 | | | 746 | | | — | | | — | | | 2,140 | |

| Total cash and marketable securities | 2,509 | | | 1,273 | | | 17 | | | (997) | | | 2,802 | |

| Receivables – net | 370 | | | 111 | | | 3 | | (b) | — | | | 484 | |

| Income taxes receivable | — | | | 3 | | | (3) | | (b) | — | | | — | |

| Inventories and supplies – net | 106 | | | 71 | | | — | | | — | | | 177 | |

| Prepaid expenses | 179 | | | 79 | | | (9) | | (c) | — | | | 249 | |

| Other current assets | 212 | | | — | | | 4 | | (d) | — | | | 216 | |

| Total Current Assets | 3,376 | | | 1,537 | | | 12 | | | (997) | | | 3,928 | |

| | | | | | | | | |

| Property and Equipment | | | | | | | | | |

| Aircraft and other flight equipment | 10,734 | | | — | | | 2,757 | | | (395) | | (b) | 13,096 | |

| Other property and equipment | 1,941 | | | — | | | 432 | | | (8) | | (b) | 2,365 | |

| Deposits for future flight equipment | 383 | | | — | | | 208 | | | — | | | 591 | |

| 13,058 | | | — | | | 3,397 | | | (403) | | (b) | 16,052 | |

| Less accumulated depreciation and amortization | (4,537) | | | — | | | (1,192) | | | — | | | (5,729) | |

| Total Property and Equipment - Net | 8,521 | | | 2,200 | | | 5 | | (e) | (403) | | | 10,323 | |

| | | | | | | | | |

| Other Assets | | | | | | | | | |

| Assets held-for-sale | — | | | 1 | | | (1) | | (f) | — | | | — | |

| Operating lease assets | 1,142 | | | 372 | | | — | | | (22) | | (c) | 1,492 | |

| Goodwill and intangible assets | 2,033 | | | 14 | | | — | | | 720 | | (d) | 3,498 | |

| 731 | (e) |

| Long-term prepayments and other | — | | | 119 | | | (119) | | (g) | — | | | — | |

| Other noncurrent assets | 270 | | | — | | | 120 | | (h) | (29) | | (f) | 344 | |

| | (17) | | (a) |

| Total Other Assets | 3,445 | | | 506 | | | (17) | | | 1,400 | | | 5,334 | |

| | | | | | | | | |

| Total Assets | $ | 15,342 | | | $ | 4,243 | | | $ | — | | | $ | — | | | $ | 19,585 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | |

| Current Liabilities | | | | | | | | | |

| Accounts payable | $ | 203 | | | $ | 200 | | | $ | (163) | | (i) | $ | 35 | | (g) | $ | 275 | |

| Accrued wages, vacation and payroll taxes | 513 | | | — | | | 135 | | (j) | — | | | 648 | |

| Air traffic liability | 1,576 | | | — | | | 574 | | (k) | — | | | 2,150 | |

| Other accrued liabilities | 852 | | | 173 | | | 16 | | (l) | 4 | | (h) | 1,045 | |

| Deferred revenue | 1,312 | | | — | | | 223 | | (m) | — | | | 1,535 | |

| Current portion of operating lease liabilities | 153 | | | 75 | | | — | | | 2 | | (i) | 230 | |

| Current maturities of finance lease obligations | — | | | 9 | | | (9) | | (n) | — | | | — | |

| Current portion of long-term debt and finance leases | 359 | | | 132 | | | 9 | | (n) | (9) | | (j) | 491 | |

| Air traffic liability and current frequent flyer deferred revenue | — | | | 793 | | | (793) | | (o) | — | | | — | |

| Total Current Liabilities | 4,968 | | | 1,382 | | | (8) | | | 32 | | | 6,374 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Long-Term Debt, Net of Current Portion | 2,313 | | | 2,068 | | | 54 | | (p) | (143) | | (j) | 4,292 | |

| | | | | | | | | |

| Noncurrent Liabilities | | | | | | | | | |

| Noncurrent finance lease obligations | — | | | 54 | | | (54) | | (p) | — | | | — | |

| Long-term operating lease liabilities, net of current portion | 1,050 | | | 267 | | | — | | | 6 | | (i) | 1,323 | |

| Deferred income taxes | 746 | | | 53 | | | — | | | 68 | | (k) | 867 | |

| Deferred revenue | 1,329 | | | 296 | | | 5 | | (q) | — | | | 1,630 | |

| Obligation for pension and post-retirement medical benefits | 358 | | | 144 | | | 8 | | (r) | — | | | 510 | |

| Other liabilities | 352 | | | 84 | | | (5) | | (q) | (13) | | (l) | 418 | |

| Total Noncurrent Liabilities | 3,835 | | | 898 | | | (46) | | | 61 | | | 4,748 | |

| | | | | | | | | |

| Commitments and Contingencies | | | | | | | | | |

| | | | | | | | | |

| Shareholders' Equity | | | | | | | | | |

| Common stock | 1 | | | 1 | | | — | | | (1) | | (m) | 1 | |

| Capital in excess of par value | 757 | | | 296 | | | — | | | (296) | | (m) | 757 | |

| Treasury stock | (868) | | | — | | | — | | | — | | | (868) | |

| Accumulated other comprehensive loss | (287) | | | (77) | | | — | | | 77 | | (m) | (287) | |

| Retained earnings | 4,623 | | | (325) | | | — | | | 270 | | (m) | 4,568 | |

| 4,226 | | | (105) | | | — | | | 50 | | | 4,171 | |

| Total Liabilities and Shareholders' Equity | $ | 15,342 | | | $ | 4,243 | | | $ | — | | | $ | — | | | $ | 19,585 | |

ALASKA AIR GROUP

Unaudited Pro Forma Condensed Combined Statement of Operations

Six Months Ended June 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per-share amounts) | Historical Alaska Air Group | | Historical Hawaiian | | Reclassification and Policy Adjustments | | Pro Forma Adjustments | | Condensed Combined

Pro Forma |

| | | | | Note 3 | | Note 4 | | |

| Operating Revenue | | | | | | | | | |

| Passenger revenue | $ | 4,655 | | | $ | 1,249 | | | $ | — | | | $ | — | | | $ | 5,904 | |

| Mileage Plan other revenue | 338 | | | — | | | 57 | | (a) | — | | | 395 | |

| Cargo and other revenue | 136 | | | — | | | 70 | | (b) | — | | | 206 | |

| Other revenue | — | | | 128 | | | (128) | | (b) | — | | | — | |

| Total Operating Revenue | 5,129 | | | 1,377 | | | (1) | | | — | | | 6,505 | |

| | | | | | | | | |

| Operating Expenses | | | | | | | | | |

| Wages and benefits | 1,586 | | | 527 | | | (10) | | (c) | (1) | | (n) | 2,102 | |

| Variable incentive pay | 93 | | | — | | | 10 | | (c) | — | | | 103 | |

| Aircraft fuel, including hedging gains and losses | 1,180 | | | 368 | | | 12 | | (d) | — | | | 1,560 | |

| Aircraft maintenance | 251 | | | 141 | | | 10 | | (e) | — | | | 402 | |

| Aircraft rent | 93 | | | 59 | | | (12) | | (f) | — | | | 140 | |

| Landing fees and other rentals | 338 | | | 88 | | | 8 | | (g) | — | | | 434 | |

| Contracted services | 203 | | | — | | | 19 | | (h) | — | | | 222 | |

| Selling expenses | 161 | | | 57 | | | 4 | | (i) | — | | | 222 | |

| Depreciation and amortization | 254 | | | 68 | | | 3 | | (j) | 15 | | (o) | 340 | |

| Food and beverage service | 125 | | | — | | | 45 | | (k) | — | | | 170 | |

| Third-party regional carrier expense | 118 | | | — | | | 53 | | (l) | — | | | 171 | |

| Other | 391 | | | 87 | | | 31 | | (m) | — | | (p) | 509 | |

| Special items - operating | 180 | | | — | | | 15 | | (n) | — | | | 195 | |

| Aircraft and passenger servicing | — | | | 93 | | | (93) | | (o) | — | | | — | |

| Purchased services | — | | | 78 | | | (78) | | (p) | — | | | — | |

| Special items | — | | | 15 | | | (15) | | (n) | — | | | — | |

| Total Operating Expenses | 4,973 | | | 1,581 | | | 2 | | | 14 | | | 6,570 | |

| Operating Loss | 156 | | | (204) | | | (3) | | | (14) | | | (65) | |

| | | | | | | | | |

| Non-operating Income (Expense) | | | | | | | | | |

| Interest income | 41 | | | 21 | | | — | | | — | | | 62 | |

| Interest expense | (71) | | | (53) | | | 1 | | (q) | (13) | | (r) | (136) | |

| Interest capitalized | 12 | | | 6 | | | — | | | — | | | 18 | |

| Gains (losses) on fuel derivatives | — | | | (2) | | | 2 | | (d) | — | | | — | |

| Other components of net periodic benefit cost | — | | | (2) | | | 2 | | (r) | — | | | — | |

| Gains (losses) on foreign debt, net | — | | | 15 | | | (15) | | (r) | — | | | — | |

| Other - net | 0 | | (1) | | | 13 | | (r) | — | | | 12 | |

| Total Non-operating Income (Expense) | (18) | | | (16) | | | 3 | | | (13) | | | (44) | |

| Income (Loss) Before Income Tax | 138 | | | (220) | | | — | | | (27) | | | (109) | |

| Income tax expense | 50 | | | (15) | | | — | | | (7) | | (s) | 28 | |

| Net Loss | $ | 88 | | | $ | (205) | | | $ | — | | | $ | (20) | | | $ | (137) | |

| | | | | | | | | |

| Basic Loss Per Share: | $ | 0.70 | | | | | | | | | $ | (1.09) | |

| Diluted Loss Per Share: | $ | 0.69 | | | | | | | | | $ | (1.07) | |

| Weighted Average Shares Outstanding used for computation: | | | | | | | | | |

| Basic | 126.153 | | | | | | | | | 126.153 | |

| Diluted | 127.857 | | | | | | | | | 127.857 | |

ALASKA AIR GROUP

Unaudited Pro Forma Condensed Combined Statement of Operations

Year Ended December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per-share amounts) | Historical Alaska Air Group | | Historical Hawaiian | | Reclassification and Policy Adjustments | | Pro Forma Adjustments | | Condensed Combined

Pro Forma |

| | | | | Note 3 | | Note 4 | | |

| Operating Revenue | | | | | | | | | |

| Passenger revenue | $ | 9,526 | | | $ | 2,460 | | | $ | — | | | $ | — | | | $ | 11,986 | |

| Mileage Plan other revenue | 648 | | | — | | | 124 | | (a) | — | | | 772 | |

| Cargo and other revenue | 252 | | | — | | | 130 | | (b) | — | | | 382 | |

| Other revenue | — | | | 256 | | | (256) | | (b) | — | | | — | |

| Total Operating Revenue | 10,426 | | | 2,716 | | | (2) | | | — | | | 13,140 | |

| | | | | | | | | |

| Operating Expenses | | | | | | | | | |

| Wages and benefits | 3,041 | | | 951 | | | (37) | | (c) | (9) | | (n) | 3,946 | |

| Variable incentive pay | 200 | | | — | | | 20 | | (d) | — | | | 220 | |

| Aircraft fuel, including hedging gains and losses | 2,641 | | | 766 | | | 32 | | (e) | — | | | 3,439 | |

| Aircraft maintenance | 488 | | | 244 | | | 12 | | (f) | — | | | 744 | |

| Aircraft rent | 208 | | | 110 | | | (14) | | (g) | — | | | 304 | |

| Landing fees and other rentals | 680 | | | 171 | | | 14 | | (h) | — | | | 865 | |

| Contracted services | 389 | | | — | | | 36 | | (i) | — | | | 425 | |

| Selling expenses | 303 | | | 117 | | | 10 | | (j) | — | | | 430 | |

| Depreciation and amortization | 451 | | | 134 | | | 5 | | (k) | 31 | | (o) | 621 | |

| Food and beverage service | 241 | | | — | | | 86 | | (l) | — | | | 327 | |

| Third-party regional carrier expense | 218 | | | — | | | 102 | | (m) | — | | | 320 | |

| Other | 729 | | | 184 | | | 50 | | (n) | (1) | | (p) | 962 | |

| Special items - operating | 392 | | | — | | | 11 | | (o) | 55 | | (q) | 458 | |

| Special items - labor and related | 51 | | | — | | | 17 | | (c) | — | | | 68 | |

| Aircraft and passenger servicing | — | | | 177 | | | (177) | | (p) | — | | | — | |

| Purchased services | — | | | 145 | | | (145) | | (q) | — | | | — | |

| Special items | — | | | 11 | | | (11) | | (o) | — | | | — | |

| Total Operating Expenses | 10,032 | | | 3,010 | | | 11 | | | 76 | | | 13,129 | |

| Operating Income | 394 | | | (294) | | | (13) | | | (76) | | | 11 | |

| | | | | | | | | |

| Non-operating Income (Expense) | | | | | | | | | |

| Interest income | 80 | | | 57 | | | — | | | — | | | 137 | |

| Interest expense | (121) | | | (90) | | | 1 | | (r) | (26) | | (r) | (236) | |

| Interest capitalized | 27 | | | 9 | | | — | | | — | | | 36 | |

| Special items - net non-operating | (18) | | | — | | | — | | | — | | | (18) | |

| Other components of net periodic benefit cost | — | | | (7) | | | 7 | | (s) | — | | | — | |

| Gains (losses) on fuel derivatives | — | | | (12) | | | 12 | | (e) | — | | | — | |

| Gains (losses) on investments, net | — | | | (1) | | | 1 | | (s) | — | | | — | |

| Gains (losses) on foreign debt, net | — | | | 12 | | | (12) | | (s) | — | | | — | |

| Other - net | (39) | | | (1) | | | 4 | | (s) | 0 | | (36) | |

| Total Non-operating Income (Expense) | (71) | | | (33) | | | 13 | | | (26) | | | (117) | |

| Income (Loss) Before Income Tax | 323 | | | (327) | | | — | | | (102) | | | (106) | |

| Income tax expense | 88 | | | (67) | | | — | | | (16) | | (s) | $ | 5 | |

| Net Income | $ | 235 | | | $ | (260) | | | $ | — | | | $ | (86) | | | $ | (111) | |

| | | | | | | | | |

| Basic Earnings Per Share | $ | 1.84 | | | | | | | | | $ | (0.87) | |

| Diluted Earnings Per Share | $ | 1.83 | | | | | | | | | $ | (0.86) | |

| Weighted Average Shares Outstanding used for computation: | | | | | | | | | |

| Basic | 127.375 | | | | | | | | | 127.375 | |

| Diluted | 128.708 | | | | | | | | | 128.708 | |

ALASKA AIR GROUP

Notes to Unaudited Pro Forma Condensed Combined Balance Sheet and Statements of Operations

Note 1. Basis of Pro Forma Presentation

The unaudited pro forma condensed combined financial information is based on Air Group’s and Hawaiian’s historical consolidated financial statements as adjusted to give effect to the Merger. The unaudited pro forma condensed combined statements of operations for the six months ended June 30, 2024 and for the year ended December 31, 2023 give effect to the Merger as if it had occurred on January 1, 2023. The unaudited condensed combined pro forma balance sheet as of June 30, 2024 gives effect to the Merger as if it had occurred on June 30, 2024.

The unaudited pro forma condensed combined financial information should be read in conjunction with the audited and unaudited consolidated financial statements of Hawaiian filed with the SEC, portions of which are included herein and incorporated by reference herein, as well as the audited and unaudited consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in Air Group's Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in its Quarterly Report on Form 10-Q for the six months ended June 30, 2024.

The unaudited pro forma condensed combined financial information included herein has been prepared pursuant to the rules and regulations of the SEC. Pursuant to such rules and regulations, certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles have been condensed or omitted; however, management believes that the disclosures provided are adequate to make the information presented not misleading.

Note 2. Calculation of Purchase Price Consideration and Provisional Purchase Price Allocation

The fair value of consideration transferred on the closing date includes the value of the cash consideration, accelerated and vested equity awards attributable to pre-acquisition service, and change in control payments. The purchase price is as follows:

| | | | | |

| (in millions, except per share price) | Purchase Price Consideration |

| Number of shares of Hawaiian common stock issued and outstanding as of September 18, 2024 | 52 | |

| Multiplied by cash consideration for each share of common stock per the merger agreement | $ | 18 | |

| Cash consideration paid for common stock issued and outstanding as of September 18, 2024 | $ | 936 | |

| Cash consideration paid for settlement of accelerated and vested awards and change in control payments | 41 | |

| Total | $ | 977 | |

Under the acquisition method of accounting, the identifiable assets acquired and liabilities assumed of Hawaiian are recorded at the acquisition date fair values and added to those of Air Group. The pro forma adjustments are provisional and based on estimates of the fair value and useful lives of the assets acquired and liabilities assumed as of June 30, 2024, and have been prepared to illustrate the estimated effect of the Merger. The allocation is dependent upon certain valuation and other analyses that have not yet been finalized. Accordingly, the pro forma purchase price allocation is subject to further adjustment as additional information becomes available and as additional analyses and final valuations are completed. There can be no assurances that these additional analyses and final valuations will not result in significant changes to the estimates of fair value set forth below.

The following table sets forth a provisional allocation of the purchase consideration to the identifiable tangible and intangible assets acquired and liabilities assumed of Hawaiian based on Hawaiian’s June 30, 2024 balance sheet after the impacts of reclassifications to align with Air Group's financial statement presentation, with the excess recorded as goodwill:

| | | | | | | | | | | | | | | | | |

(in millions) | Book Value - Historical Hawaiian as adjusted for Reclassification | | Adjustments | | Fair Value |

| Cash and cash equivalents | $ | 510 | | | — | | | $ | 510 | |

| Restricted cash | 17 | | | — | | | 17 | |

| Marketable securities | 746 | | | — | | | 746 | |

| Receivables – net | 114 | | | — | | | 114 | |

| Inventories and supplies – net | 71 | | | — | | | 71 | |

| Prepaid expenses | 70 | | | — | | | 70 | |

| Other current assets | 4 | | | — | | | 4 | |

| Property and equipment, net | 2,205 | | | (403) | | | 1,802 | |

| Operating lease assets | 372 | | | (22) | | | 350 | |

| Goodwill and intangible assets | 14 | | | 731 | | | 745 | |

| Other noncurrent assets | 120 | | | (29) | | | 91 | |

| Total Assets | $ | 4,243 | | | $ | 277 | | | $ | 4,520 | |

| Accounts payable | 37 | | | — | | | 37 | |

| Accrued wages, vacation and payroll taxes | 135 | | | — | | | 135 | |

| Air traffic liability | 574 | | | — | | | 574 | |

| Other accrued liabilities | 189 | | | 4 | | | 193 | |

| Deferred revenue | 223 | | | — | | | 223 | |

| Current portion of operating lease liabilities | 75 | | | 2 | | | 77 | |

| Current portion of long-term debt and finance leases | 141 | | | (9) | | | 132 | |

| Long-Term Debt, Net of Current Portion | 2,122 | | | (143) | | | 1,979 | |

| Long-term operating lease liabilities, net of current portion | 267 | | | 6 | | | 273 | |

| Deferred income taxes | 53 | | | 68 | | | 121 | |

| Deferred revenue | 301 | | | — | | | 301 | |

| Obligation for pension and post-retirement medical benefits | 152 | | | — | | | 152 | |

| Other liabilities | 79 | | | (13) | | | 66 | |

| Total Liabilities | $ | 4,348 | | | $ | (85) | | | $ | 4,263 | |

| Net assets acquired (a) | | | | | $ | 257 | |

| Estimated purchase consideration (b) | | | | | 977 |

| Estimated goodwill (b) - (a) | | | | | $ | 720 | |

Provisional identifiable intangible assets consist of anticipated intangibles derived from trademarks, customer relationships, and contract assets. The amortization related to those intangible assets that have finite useful lives is reflected as a pro forma adjustment to the pro forma statements of operations, as further described in Note 4(e).

The deferred income taxes of Hawaiian represent an overall deferred tax liability primarily related to property, plant, and equipment. However, Hawaiian also has deferred tax assets primarily related to Hawaiian's net operating loss carryforwards and other tax attributes. The fair market value adjustments to the overall deferred tax liability is based on the tax effect of amortizable identified intangibles, as amortization of such intangibles will not be deductible for tax purposes.

Goodwill represents the excess of the purchase price over the fair value of the underlying net assets acquired and largely results from expected future synergies from combining operations as well as an assembled workforce, which does not qualify for separate recognition. Goodwill is not amortized but is reviewed for impairment at least annually. Goodwill recognized in the Merger is not expected to be deductible for tax purposes.

The amounts above are considered provisional and are subject to change up to one year following the acquisition date and additional adjustments to record fair value of all assets acquired and liabilities assumed may be required.

Note 3. Reclassification and Accounting Policy Adjustments

The column "Reclassification and Policy Adjustments" reflects accounting policy and financial statement presentation reclassification adjustments made to align Hawaiian's accounting policies and historical financial statement presentation to those of Air Group.

Upon consummation of the Merger, Hawaiian adopted Air Group’s accounting policies. Certain procedures were performed to identify material differences in significant accounting policies between Air Group and Hawaiian and any accounting

adjustments that would be required to align such policies and related disclosures. These procedures involved a review of Hawaiian’s summary of significant accounting policies, including those disclosed in Hawaiian’s historical audited financial statements for the year ended December 31, 2023, and historical unaudited financial statements for the six months ended June 30, 2024. Procedures performed also involved preliminary discussions with Hawaiian management regarding Hawaiian’s significant accounting policies.

Adjustments to the Balance Sheet as of June 30, 2024

The unaudited pro forma adjustments included in the unaudited pro forma condensed combined balance sheets are as follows:

(a)Adjust “Restricted cash” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Other noncurrent assets | $ | 17 | |

| Total Reclassification Adjustment | $ | 17 | |

(b)Adjust “Receivables - net” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Income tax receivables | $ | 3 | |

| Total Reclassification Adjustment | $ | 3 | |

(c)Adjust “Prepaid expense” as follows:

| | | | | |

| (in millions) | Adjustment |

| To Other noncurrent assets | $ | (6) | |

| To Other current assets | (3) | |

| Total Reclassification Adjustment | $ | (9) | |

(d)Adjust “Other current assets” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Prepaid expense | $ | 3 | |

| From Assets held-for-sale | 1 | |

| Total Reclassification Adjustment | $ | 4 | |

(e) Adjust “Property and Equipment - Net” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Long-term prepayments and other | $ | 5 | |

| Total Reclassification Adjustment | $ | 5 | |

(f) Adjust “Asset held-for-sale” as follows:

| | | | | |

| (in millions) | Adjustment |

| To Other current assets | $ | (1) | |

| Total Reclassification Adjustment | $ | (1) | |

(g) Adjust “Long-term prepayments and other” as follows:

| | | | | |

| (in millions) | Adjustment |

| To Property and Equipment - Net | $ | (5) | |

| To Other noncurrent assets | (114) | |

| Total Reclassification Adjustment | $ | (119) | |

(h) Adjust “Other noncurrent assets” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Prepaid expense | $ | 6 | |

| From Long-term prepayments and other | 114 | |

| Total Reclassification Adjustment | $ | 120 | |

(i) Adjust “Accounts payable” as follows:

| | | | | |

| (in millions) | Adjustment |

| To Other accrued liabilities | $ | (127) | |

| To Accrued wages, vacation and payroll taxes | (36) | |

| Total Reclassification Adjustment | $ | (163) | |

(j) Adjust “Accrued wages, vacation and payroll taxes” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Other accrued liabilities | $ | 99 | |

| From Accounts payable | 36 | |

| Total Reclassification Adjustment | $ | 135 | |

(k) Adjust “Air traffic liability” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Air traffic liability and current frequent flyer deferred revenue | $ | 574 | |

| Total Reclassification Adjustment | $ | 574 | |

(l) Adjust “Other accrued liabilities” as follows:

| | | | | |

| (in millions) | Adjustment |

| To Accrued wages, vacation and payroll taxes | $ | (99) | |

| To Obligation for pension and post-retirement medical benefits | (8) | |

| To Deferred revenue | (4) | |

| From Accounts payable | 127 | |

| Total Reclassification Adjustment | $ | 16 | |

(m) Adjust “Deferred revenue” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Other accrued liabilities | $ | 4 | |

| From Air traffic liability and current frequent flyer deferred revenue | 219 | |

| Total Reclassification Adjustment | $ | 223 | |

(n) Adjust “Current portion of long-term debt and finance leases” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Current maturities of finance lease obligations | $ | 9 | |

| Total Reclassification Adjustment | $ | 9 | |

(o) Adjust “Air traffic liability and current frequent flyer deferred revenue” as follows:

| | | | | |

| (in millions) | Adjustment |

| To Deferred revenue | $ | (219) | |

| To Air traffic liability | (574) | |

| Total Reclassification Adjustment | $ | (793) | |

(p) Adjust “Long-Term Debt, Net of Current Portion” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Noncurrent finance lease obligations | $ | 54 | |

| Total Reclassification Adjustment | $ | 54 | |

(q) Adjust “Deferred revenue” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Other liabilities | $ | 5 | |

| Total Reclassification Adjustment | $ | 5 | |

(r) Adjust “Obligation for pension and post-retirement medical benefits” as follows:

| | | | | |

| (in millions) | Adjustment |

| From Other accrued liabilities | $ | 8 | |

| Total Reclassification Adjustment | $ | 8 | |

Adjustments to the Statement of Operations for the Six Months Ended June 30, 2024

The unaudited pro forma adjustments included in the unaudited pro forma condensed combined statement of operations for the six months ended June 30, 2024 are as follows:

(a) Adjust "Mileage Plan other revenue" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Selling expenses | $ | (1) | |

| To Other revenue | 58 | |

| Total Reclassification Adjustment | $ | 57 | |

(b) Adjust "Other revenue" as follows:

| | | | | |

| (in millions) | Adjustment |

| To Mileage Plan other revenue | $ | (58) | |

| To Cargo and other revenue | (70) | |

| Total Reclassification Adjustment | $ | (128) | |

(c) Adjust "Variable incentive pay" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Wages and benefits | $ | 10 | |

| Total Reclassification Adjustment | $ | 10 | |

(d) Adjust "Aircraft fuel, including hedging gains and losses" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft and passenger servicing | $ | 10 | |

| From Gains (losses) on fuel derivatives | 2 | |

| Total Reclassification Adjustment | $ | 12 | |

(e) Adjust "Aircraft maintenance" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft rent | $ | 12 | |

| To Landing fees and other rentals | (1) | |

| To Contracted services | (1) | |

| Total Reclassification Adjustment | $ | 10 | |

(f) Adjust "Aircraft rent" as follows:

| | | | | |

| (in millions) | Adjustment |

| To Aircraft maintenance | $ | (12) | |

| Total Reclassification Adjustment | (12) | |

(g) Adjust "Landing fees and other rentals" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Purchased services | $ | 7 | |

| From Aircraft maintenance | 1 | |

| Total Reclassification Adjustment | $ | 8 | |

(h) Adjust "Contracted services" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft maintenance | $ | 1 | |

| From Aircraft and passenger servicing | 3 | |

| From Purchased services | 13 | |

| From Other | 2 | |

| Total Reclassification Adjustment | $ | 19 | |

(i) Adjust "Selling expenses" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft and passenger servicing | $ | 2 | |

| From Purchased services | 4 | |

| To Food and beverage service | (1) | |

| To Mileage Plan other revenue | (1) | |

| Total Reclassification Adjustment | $ | 4 | |

(j) Adjust "Depreciation and amortization" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Other | $ | 3 | |

| Total Reclassification Adjustment | $ | 3 | |

(k) Adjust "Food and beverage service" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft and passenger servicing | $ | 44 | |

| From Selling expenses | 1 | |

| Total Reclassification Adjustment | $ | 45 | |

(l) Adjust "Third-party regional carrier expense" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft and passenger servicing | $ | 30 | |

| From Purchased services | 23 | |

| Total Reclassification Adjustment | $ | 53 | |

(m) Adjust "Other" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft and passenger servicing | $ | 4 | |

| From Purchased services | 31 | |

| From Interest expense | 1 | |

| To Contracted services | (2) | |

| To Depreciation and amortization | (3) | |

| Total Reclassification Adjustment | $ | 31 | |

(n) Adjust "Special items - operating" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Special items | $ | 15 | |

| Total Reclassification Adjustment | $ | 15 | |

(o) Adjust "Aircraft and passenger servicing" as follows:

| | | | | |

| (in millions) | Adjustment |

| To Aircraft fuel, including hedging gains and losses | $ | (10) | |

| To Selling expenses | (2) | |

| To Contracted services | (3) | |

| To Food and beverage service | (44) | |

| To Third-party regional carrier expense | (30) | |

| To Other | (4) | |

| Total Reclassification Adjustment | $ | (93) | |

(p) Adjust "Purchased services" as follows:

| | | | | |

| (in millions) | Adjustment |

| To Contracted services | $ | (13) | |

| To Selling expenses | (4) | |

| To Third-party regional carrier expense | (23) | |

| To Other | (31) | |

| To Landing fees and other rentals | (7) | |

| Total Reclassification Adjustment | $ | (78) | |

(q) Adjust "Interest expense" as follows:

| | | | | |

| (in millions) | Adjustment |

| To Other | $ | 1 | |

| Total Reclassification Adjustment | $ | 1 | |

(r) Adjust "Other - net" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Gains (losses) on foreign debt, net | $ | 15 | |

| From Other components of net periodic benefit cost | (2) | |

| Total Reclassification Adjustment | $ | 13 | |

Adjustments to the Statement of Operations for the Year Ended December 31, 2023

The unaudited pro forma adjustments included in the unaudited pro forma condensed combined statement of operations for the year ended December 31, 2023 are as follows:

(a) Adjust "Mileage Plan other revenue" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Selling expenses | $ | (2) | |

| To Other revenue | 126 | |

| Total Reclassification Adjustment | $ | 124 | |

(b) Adjust "Other revenue" as follows:

| | | | | |

| (in millions) | Adjustment |

| To Mileage Plan other revenue | $ | (126) | |

| To Cargo and other revenue | (130) | |

| Total Reclassification Adjustment | $ | (256) | |

(c) Adjust "Wages and benefits" as follows:

| | | | | |

| (in millions) | Adjustment |

| To Variable incentive pay | $ | (20) | |

| To Special items - labor and other | (17) | |

| Total Reclassification Adjustment | $ | (37) | |

(d) Adjust "Variable incentive pay" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Wages and benefits | $ | 20 | |

| Total Reclassification Adjustment | $ | 20 | |

(e) Adjust "Aircraft fuel, including hedging gains and losses" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft and passenger servicing | $ | 20 | |

| From Gains (losses) on fuel derivatives | 12 | |

| Total Reclassification Adjustment | $ | 32 | |

(f) Adjust "Aircraft maintenance" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft rent | $ | 14 | |

| To Contracted services | (2) | |

| Total Reclassification Adjustment | $ | 12 | |

(g) Adjust "Aircraft rent" as follows:

| | | | | |

| (in millions) | Adjustment |

| To Aircraft maintenance | $ | (14) | |

| Total Reclassification Adjustment | $ | (14) | |

(h) Adjust "Landing fees and other rentals" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Purchased services | $ | 14 | |

| Total Reclassification Adjustment | $ | 14 | |

(i) Adjust "Contracted services" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft maintenance | $ | 2 | |

| From Aircraft and passenger servicing | 7 | |

| From Purchased services | 22 | |

| From Other | 5 | |

| Total Reclassification Adjustment | $ | 36 | |

(j) Adjust "Selling expenses" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft and passenger servicing | $ | 4 | |

| From Purchased services | 10 | |

| To Food and beverage service | (2) | |

| To Mileage Plan other revenue | (2) | |

| Total Reclassification Adjustment | $ | 10 | |

(k) Adjust "Depreciation and amortization" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Other | $ | 5 | |

| Total Reclassification Adjustment | $ | 5 | |

(l) Adjust "Food and beverage service" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft and passenger servicing | $ | 84 | |

| From Selling expenses | 2 | |

| Total Reclassification Adjustment | $ | 86 | |

(m) Adjust "Third-party regional carrier expense" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft and passenger servicing | $ | 54 | |

| From Purchased services | 48 | |

| Total Reclassification Adjustment | $ | 102 | |

(n) Adjust "Other" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Aircraft and passenger servicing | $ | 8 | |

| From Purchased services | 51 | |

| From Interest expense | 1 | |

| To Contracted services | (5) | |

| To Depreciation and amortization | (5) | |

| Total Reclassification Adjustment | $ | 50 | |

(o) Adjust "Special items - operating" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Special items | $ | 11 | |

| Total Reclassification Adjustment | $ | 11 | |

(p) Adjust "Aircraft and passenger servicing" as follows:

| | | | | |

| (in millions) | Adjustment |

| To Aircraft fuel, including hedging gains and losses | $ | (20) | |

| To Selling expenses | (4) | |

| To Contracted services | (7) | |

| To Food and beverage service | (84) | |

| To Third-party regional carrier expense | (54) | |

| To Other | (8) | |

| Total Reclassification Adjustment | $ | (177) | |

(q) Adjust "Purchased services" as follows:

| | | | | |

| (in millions) | Adjustment |

| To Contracted services | $ | (22) | |

| To Selling expenses | (10) | |

| To Third-party regional carrier expense | (48) | |

| To Other | (51) | |

| To Landing fees and other rentals | (14) | |

| Total Reclassification Adjustment | $ | (145) | |

(r) Adjust "Interest expense" as follows:

| | | | | |

| (in millions) | Adjustment |

| To Other | $ | 1 | |

| Total Reclassification Adjustment | $ | 1 | |

(s) Adjust "Other - net" as follows:

| | | | | |

| (in millions) | Adjustment |

| From Gains (losses) on foreign debt, net | $ | (12) | |

| From Gains (losses) on investments, net | 1 | |

| From Other components of net periodic benefit cost | 7 | |

| Total Reclassification and Policy Adjustment | $ | (4) | |

The accounting policy adjustment on the unaudited pro forma financial information to conform Hawaiian’s policies to those of Air Group pertain to the property tax accrual in timing of expense recognition to align to Alaska's accounting policy.

Note 4. Pro Forma Adjustments

Balance Sheet Adjustments

The unaudited pro forma adjustments related to Hawaiian included in the unaudited pro forma condensed combined balance sheets are as follows:

(a)Cash and cash equivalents

Reflects total cash purchase price, adjusted for cash provided for payment of consideration, change in control payments, and accelerated vesting of awards:

| | | | | |

| (in millions) | June 30, 2024 |

| Cash consideration paid for settlement of accelerated and vested awards and change in control payments | $ | 977 | |

| Cash paid for accelerated RSU settlement and double trigger payments | 20 |

| Total pro forma adjustments to Cash and cash equivalents | $ | 997 | |

(b)Property and Equipment - Net

Reflects the estimated adjustment to record Hawaiian's property and equipment at its provisional fair value. This adjustment included elimination of all of Hawaiian's accumulated depreciation, as well as the remeasurement of Hawaiian's finance lease assets at the same amount as acquired lease liabilities.

| | | | | |

| (in millions) | June 30, 2024 |

| To eliminate the historical net book value of Hawaiian's property and equipment | $ | (2,205) | |

| Aircraft and other flight equipment | 1,373 | |

| Other property and equipment | 220 |

| Deposit for future equipment | 209 |

| Total pro forma adjustments to Property and Equipment - Net | $ | (403) | |

(c)Operating lease assets

Reflects an adjustment to remeasure Hawaiian's right of use operating lease assets at the same amount as acquired lease liabilities.

| | | | | |

| (in millions) | June 30, 2024 |

| To eliminate pre-existing Operating lease assets from Hawaiian books | $ | (372) | |

| To record Operating lease assets remeasurement | 350 |

| Total pro forma adjustments to Operating lease assets | $ | (22) | |

(d)Goodwill

Reflects provisional goodwill for the purchase consideration in excess of the fair value of net assets acquired in connection with the Hawaiian acquisition. Refer to Note 2 for the calculation.

(e)Intangible assets

Reflects the provisional estimates of fair values of the following intangible assets identified in the acquisition:

| | | | | | | | | | | |

| (in millions) | June 30, 2024 | | Weighted average useful life |

| To eliminate the historical net book value of Hawaiian's intangible assets | $ | (14) | | | |

| Fair Value: | | | |

| Trademark | 380 | | | indefinite |

| Customer relationships | 220 | | | 18 |

| Slots | 2 | | | indefinite |

| Contract assets | 143 | | | 3 |

| Total pro forma adjustments to Intangible assets | $ | 731 | | | |

The fair value of intangible assets is based on management’s provisional valuation as of June 30, 2024. Trademarks will be accounted for as an indefinite-lived intangible asset. The useful life of customer relationships is based on the related estimated economic lives. The useful life of the contract asset is based on the calculation and application of an attrition rate, which is estimated based upon historical trends and is used to project the expected decline anticipated from the agreements.

(f)Other noncurrent assets

Reflects the adjustment for the write off of certain start up costs and unamortized debt costs.

| | | | | |

| (in millions) | June 30, 2024 |

| To write off Hawaiian's start up costs | $ | (28) | |

| To write off Hawaiian's unamortized debt costs | (1) | |

| Total pro forma adjustments to Other noncurrent assets | $ | (29) | |

(g)Accounts payable

Reflects the transaction accounting adjustment to record estimated nonrecurring transaction costs of approximately $35 million that are expected to be incurred by Alaska and are not reflected in the historical financial statements. These transaction costs are based on preliminary estimates and the final amounts and resulting effect on Alaska’s financial position and results of operations may differ significantly.

(h)Other accrued liabilities

Reflects an adjustment of approximately $4 million to record Hawaiian's property taxes accrual after the effects of the policy adjustment discussed in Note 3 to reflect the property tax accrual in Other accrued liability.

(i)Operating lease liabilities

Reflects an adjustment to remeasure Hawaiian's operating lease liabilities. The adjustment is made based on the remeasurement of the present value of remaining lease payments as if the acquired leases were new leases of Air Group at the acquisition date using Alaska's discount rate.

| | | | | | | | | | | |

| (in millions) | June 30, 2024 |

| Current | | Noncurrent |

| To eliminate pre-existing Operating lease liability from Hawaiian books | $ | (75) | | | $ | (267) | |

| To record Operating lease liability remeasurement | 77 | | 273 |

| Total pro forma adjustments to Operating lease liability | $ | 2 | | | $ | 6 | |

(j)Debt

Reflects the adjustments to record Hawaiian's debt at provisional estimates of fair value and the remeasurement of Hawaiian's finance lease liabilities as follows:

| | | | | | | | | | | |

| (in millions) | June 30, 2024 |

| Current | | Noncurrent |

| To eliminate the historical value of third-party debt of Hawaiian | $ | (132) | | | $ | (2,068) | |

| To record provisional estimate of fair value of Hawaiian's third-party debt | 123 | | | 1,926 |

| To remeasure Hawaiian's finance lease liabilities | — | | | (1) | |

| Total pro forma adjustments to Debt | $ | (9) | | | $ | (143) | |

(k)Deferred income taxes

Reflects the adjustment to record deferred income tax assets at provisional estimates of fair value as follows:

| | | | | |

| (in millions) | June 30, 2024 |

| To eliminate the historical deferred tax liability of Hawaiian | $ | (53) | |

| To record provisional estimate of fair value of Hawaiian's deferred tax liability | 121 | |

| Total pro forma adjustments to Deferred income taxes | $ | 68 | |

This estimate of deferred taxes was determined based on Air Group's expected ability to use Hawaiian's net operating loss carryforwards and other tax attributes in future periods, as well as the excess of the fair values of the acquired assets and liabilities over the tax basis of the assets and liabilities to be acquired. Hawaiian’s tax attributes will be subject to change in control limitations under current tax law, but such limitations are not expected to require additional valuation adjustments based upon preliminary estimates. Air Group has made no adjustments to Hawaiian’s historical deferred tax asset valuation and will continue to assess for realizability which could change upon consolidation. The statutory tax rate was applied, as appropriate, to each adjustment based on the jurisdiction in which the adjustment is expected to occur.

(l)Other liabilities

Reflects adjustments of approximately $13 million to other liabilities to write off the unamortized Amazon start-up costs.

(m)Shareholders' Equity

Eliminates Hawaiian's historical shareholders' equity including capital in excess of par value, accumulated other comprehensive loss, and retained earnings, and records the effect of estimated transaction costs and accelerated compensation settlement.

Retained earnings were adjusted as follows:

| | | | | |

| (in millions) | June 30, 2024 |

| To eliminate common stock and paid in capital of Hawaiian | $ | (297) | |

| To eliminate the AOCI of Hawaiian | 77 |

| To eliminate the historical retained earnings of Hawaiian | 325 |

| To record estimated transaction costs that have been incurred after 6/30/2024 | (35) | |

| To record accelerated compensation settlement | (20) | |

| Total pro forma adjustments to Shareholders' Equity | $ | 50 | |

Statement of Operations Adjustments

The unaudited pro forma adjustments included in the unaudited pro forma condensed combined statements of operations are as follows:

(n) Wages and benefits

Reflects the elimination of any prior stock compensation expense recorded in the historical financials related to Hawaiian Restricted Stock Unit (RSU) and Performance Stock Unit (PSU) awards. The amounts eliminated were $1 million and $9 million for the six months ended June 30, 2024 and for the year ended December 31, 2023, respectively.

(o) Depreciation and amortization

Reflects depreciation and amortization expense related to property and equipment and identifiable intangible assets calculated on a straight-line basis. The amortization of intangible assets is based on the periods over which the economic benefits of the intangible assets are expected to be realized and are discussed in Note (e) above.

The net adjustment for depreciation and amortization is as follows:

| | | | | | | | | | | |

| (in millions) | Six Months Ended June 30, 2024 | | Year Ended December 31, 2023 |

To record the impact of adjusting depreciation expense related to the fair value adjustments and remaining useful life adjustments of PP&E as part of purchase accounting

| $ | (15) | | | $ | (29) | |

| To record the net impact for elimination of historical amortization and adjusting for amortization related to the fair value of intangibles | 30 | | | 60 | |

| Total pro forma adjustments to Depreciation and amortization | $ | 15 | | | $ | 31 | |

(p) Other

Reflects the impact of property tax accrual that is not reflected in Hawaiian's historical financial statements as Hawaiian did not historically accrue for property taxes. Based on Alaska's accounting policy, property tax is accrued for on a monthly basis, and hence the subsequent impact shall be recorded as a pro forma adjustment. Additionally, reflects the elimination of any prior stock compensation expense recorded in the historical financials related to Hawaiian Restricted Stock Unit (RSU) and Performance Stock Unit (PSU) awards.

| | | | | | | | | | | |

| (in millions) | Six Months Ended June 30, 2024 | | Year Ended December 31, 2023 |

| To eliminate historical property tax expense | $ | (3) | | | $ | (8) | |

| To record property tax recognized as a result of accounting policy adjustment | 4 | | | 8 | |

| Pro forma adjustment to Other to eliminate historical compensation expense | (1) | | | (1) | |

| Total pro forma adjustments to Other | $ | — | | | $ | (1) | |

(q) Special items—operating

Reflects transaction accounting adjustments to estimate nonrecurring transaction costs of approximately $35 million that are expected to be incurred by Alaska, including advisory, legal, regulatory, accounting, valuation and other professional fees. The transaction costs are reflected within the condensed combined consolidated statement of operations for the year ended December 31, 2023. These transaction costs are based on preliminary estimates and the final amounts and resulting effect on Alaska’s financial position and results of operations may differ significantly.

Additionally, reflects stock compensation expense of approximately $20 million related to accelerated vesting of Hawaiian Restricted Stock Unit (RSU) and Performance Stock Unit (PSU) awards due to the terms of the Merger Agreement for the year ended December 31, 2023.

(r) Interest expense

Reflects the effect to Interest expense associated with the preliminary fair value of long-term debt.

| | | | | | | | | | | |

| (in millions) | Six Months Ended June 30, 2024 | | Year Ended December 31, 2023 |

| To eliminate the historical amortization of debt fees & discount | $ | 5 | | | $ | 9 | |

| To record the impact for interest expense related to the fair value adjustments of debt | (18) | | | (35) | |

| Total pro forma adjustments to Interest expense | $ | (13) | | | $ | (26) | |

(s) Income tax expense

Reflects the application of the statutory tax rate to each pro forma adjustment based on the jurisdiction in which the adjustment was expected to occur with adjustments for estimated non-deductible transaction costs and compensation adjustments. Although not reflected in the pro forma financial information, the effective tax rate of the Combined Company could be significantly different depending on post-acquisition activities, such as the geographical mix of taxable income affecting state taxes, permanently non-deductible expenses, and valuation of deferred tax assets,among other factors. The impact for income tax expense related to pro forma adjustments was a benefit of $7 million and $16 million for the six months ended June 30, 2024 and for the year ended December 31, 2023 respectively.

Note 5. Subsequent Event

On July 26, 2024, Hawaiian completed its private exchange offer ("Exchange Offer") for its outstanding 5.750% senior secured notes due 2026 with 11.0% senior secured notes due 2029 and cash. In connection with the Exchange Offer, Hawaiian issued $984.8 million aggregate principal amount of New Notes. The impact of the Exchange Offer is not reflected in the historical unaudited financial statements and is excluded from the unaudited pro forma condensed combined financial information as this is not related to the Merger.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |