0000320187false00003201872024-10-012024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

October 1, 2024

Date of Report (date of earliest event reported)

NIKE, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Oregon | 1-10635 | 93-0584541 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

ONE BOWERMAN DRIVE

BEAVERTON, OR 97005-6453

(Address of principal executive offices and zip code)

(503) 671-6453

Registrant's telephone number, including area code

NO CHANGE

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Class B Common Stock | NKE | New York Stock Exchange |

| (Title of each class) | (Trading Symbol) | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02 Results of Operations and Financial Condition

Today NIKE, Inc. issued a press release disclosing financial results for the fiscal quarter ended August 31, 2024. The text of the release is furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

The following exhibits are furnished with this Form 8-K:

| | | | | | | | |

| Exhibit No. | | Exhibit |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

NIKE, Inc.

(Registrant) |

| | | |

| Date: | October 1, 2024 | By: | /s/ Matthew Friend |

| | | Matthew Friend |

| | | Executive Vice President and Chief Financial Officer |

| | | |

| | | | | | | | |

| Investor Contact: | | Media Contact: |

| Paul Trussell | | Virginia Rustique-Petteni |

investor.relations@nike.com | | media.relations@nike.com

|

NIKE, INC. REPORTS FISCAL 2025 FIRST QUARTER RESULTS

BEAVERTON, Ore., Oct. 1, 2024 — NIKE, Inc. (NYSE:NKE) today reported fiscal 2025 financial results for its first quarter ended August 31, 2024.

•First quarter revenues were $11.6 billion, down 10 percent on a reported basis compared to the prior year and down 9 percent on a currency-neutral basis*

•NIKE Direct revenues were $4.7 billion, down 13 percent on a reported basis and down 12 percent on a currency-neutral basis

•Wholesale revenues were $6.4 billion, down 8 percent on a reported basis and down 7 percent on a currency-neutral basis

•Gross margin increased 120 basis points to 45.4 percent

•Diluted earnings per share was $0.70 for the first quarter, down 26 percent

On September 19, 2024, NIKE, Inc. announced that the Board of Directors of the Company appointed Elliott Hill as President and CEO of the Company, effective as of October 14, 2024. Given the Company is reporting Q1 results in the midst of a CEO transition, it will address its approach to guidance on the conference call. In addition, the Company's previously announced Investor Day is being postponed.

"NIKE's first quarter results largely met our expectations. A comeback at this scale takes time, but we see early wins — from momentum in key sports to accelerating our pace of newness and innovation," said Matthew Friend, Executive Vice President and Chief Financial Officer, NIKE, Inc. "Our teams are energized as Elliott Hill returns to lead NIKE's next stage of growth."

First Quarter Income Statement Review

•Revenues for NIKE, Inc. were $11.6 billion, down 10 percent on a reported basis compared to the prior year and down 9 percent on a currency-neutral basis.

◦NIKE Brand Revenues were $11.1 billion, down 10 percent on a reported basis and down 9 percent on a currency-neutral basis, due to declines across all geographies.

◦NIKE Direct revenues were $4.7 billion, down 13 percent on a reported basis and down 12 percent on a currency-neutral basis, primarily due to a 20 percent decrease in NIKE Brand Digital, partially offset by a 1 percent increase in NIKE-owned stores.

◦Wholesale revenues were $6.4 billion, down 8 percent on a reported basis and down 7 percent on a currency-neutral basis.

◦Revenues for Converse were $501 million, down 15 percent on a reported basis and down 14 percent on a currency-neutral basis, due to declines across all territories.

•Gross margin increased 120 basis points to 45.4 percent, primarily due to lower NIKE Brand product costs, lower warehousing and logistics costs, and benefits from strategic pricing actions from the prior year.

•Selling and administrative expense decreased 2 percent to $4.0 billion.

◦Demand creation expense was $1.2 billion, up 15 percent, primarily due to an increase in brand marketing expense, reflecting investment in key sports events.

◦Operating overhead expense decreased 7 percent to $2.8 billion, primarily due to lower wage-related expenses.

•The effective tax rate was 19.6 percent compared to 12.0 percent for the same period last year, primarily due to a one-time item benefit in the first quarter of the prior year provided by the delay of the effective date of U.S. foreign tax credit regulations.

•Net income was $1.1 billion, down 28 percent, and Diluted earnings per share was $0.70, a decrease of 26 percent.

August 31, 2024 Balance Sheet Review

•Inventories for NIKE, Inc. were $8.3 billion, down 5 percent compared to the prior year, reflecting product mix shifts and lower product input costs.

•Cash and equivalents and short-term investments were $10.3 billion, up approximately $1.5 billion from last year, as cash generated by operations was partially offset by share repurchases, cash dividends and capital expenditures.

Shareholder Returns

NIKE continues to have a strong track record of consistently increasing returns to shareholders, including 22 consecutive years of increasing dividend payouts.

In the first quarter, the Company returned approximately $1.8 billion to shareholders, including:

•Dividends of $558 million, up 6 percent from the prior year.

•Share repurchases of $1.2 billion, reflecting 14.8 million shares retired as part of the Company’s four-year, $18 billion program approved by the Board of Directors in June 2022.

As of August 31, 2024, a total of 99.7 million shares have been repurchased under the program for a total of approximately $10.2 billion.

Conference Call

NIKE, Inc. management will host a conference call beginning at approximately 2:00 p.m. PT on October 1, 2024, to review fiscal first quarter results. The conference call will be broadcast live via the Internet and can be accessed at https://investors.nike.com. For those unable to listen to the live broadcast, an archived version will be available at the same location through approximately 9:00 p.m. PT, October 22, 2024.

About NIKE, Inc.

NIKE, Inc., based near Beaverton, Oregon, is the world's leading designer, marketer and distributor of authentic athletic footwear, apparel, equipment and accessories for a wide variety of sports and fitness activities. Converse, a wholly-owned NIKE, Inc. subsidiary brand, designs, markets and distributes athletic lifestyle footwear, apparel and accessories. For more information, NIKE, Inc.’s earnings releases and other financial information are available on the Internet at http://investors.nike.com. Individuals can also visit http://news.nike.com and follow @NIKE.

Forward-Looking Statements

This press release contains forward-looking statements, which involve risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties are detailed from time to time in reports filed by NIKE with the U.S. Securities and Exchange Commission (SEC), including Forms 8-K, 10-Q and 10-K.

| | | | | |

| * | Non-GAAP financial measure. See additional information in the accompanying Divisional Revenues. |

(Tables Follow)

| | | | | | | | | | | | | | |

| NIKE, Inc. |

| CONSOLIDATED STATEMENTS OF INCOME |

| (Unaudited) |

| | | |

| | | | | |

| THREE MONTHS ENDED | % | | |

| (In millions, except per share data) | 8/31/2024 | 8/31/2023 | Change | | | |

| Revenues | $ | 11,589 | | $ | 12,939 | | -10 | % | | | |

| Cost of sales | 6,332 | | 7,219 | | -12 | % | | | |

| Gross profit | 5,257 | | 5,720 | | -8 | % | | | |

| Gross margin | 45.4 | % | 44.2 | % | | | | |

| | | | | | |

| Demand creation expense | 1,226 | | 1,069 | | 15 | % | | | |

| Operating overhead expense | 2,822 | | 3,047 | | -7 | % | | | |

| Total selling and administrative expense | 4,048 | | 4,116 | | -2 | % | | | |

| % of revenues | 34.9 | % | 31.8 | % | | | | |

| | | | | | |

| Interest expense (income), net | (43) | | (34) | | — | | | | |

| Other (income) expense, net | (55) | | (10) | | — | | | | |

| Income before income taxes | 1,307 | | 1,648 | | -21 | % | | | |

| Income tax expense | 256 | | 198 | | 29 | % | | | |

| Effective tax rate | 19.6 | % | 12.0 | % | | | | |

| | | | | | |

| NET INCOME | $ | 1,051 | | $ | 1,450 | | -28 | % | | | |

| | | | | | |

| Earnings per common share: | | | | | | |

| Basic | $ | 0.70 | | $ | 0.95 | | -26 | % | | | |

| Diluted | $ | 0.70 | | $ | 0.94 | | -26 | % | | | |

| | | | | | |

| Weighted average common shares outstanding: | | | | | | |

| Basic | 1,497.7 | | 1,528.4 | | | | | |

| Diluted | 1,502.0 | | 1,543.3 | | | | | |

| | | | | | |

| Dividends declared per common share | $ | 0.370 | | $ | 0.340 | | | | | |

| | | | | | | | | | | |

| NIKE, Inc. |

| CONSOLIDATED BALANCE SHEETS |

| (Unaudited) |

| | | |

| | | |

| August 31, | August 31, | % Change |

| (Dollars in millions) | 2024 | 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and equivalents | $ | 8,485 | | $ | 6,178 | | 37 | % |

| Short-term investments | 1,809 | | 2,612 | | -31 | % |

| Accounts receivable, net | 4,764 | | 4,749 | | 0 | % |

| Inventories | 8,253 | | 8,698 | | -5 | % |

| Prepaid expenses and other current assets | 1,729 | | 2,013 | | -14 | % |

| Total current assets | 25,040 | | 24,250 | | 3 | % |

| Property, plant and equipment, net | 4,948 | | 5,109 | | -3 | % |

| Operating lease right-of-use assets, net | 2,792 | | 2,939 | | -5 | % |

| Identifiable intangible assets, net | 259 | | 272 | | -5 | % |

| Goodwill | 240 | | 281 | | -15 | % |

| Deferred income taxes and other assets | 4,588 | | 3,935 | | 17 | % |

| TOTAL ASSETS | $ | 37,867 | | $ | 36,786 | | 3 | % |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 1,000 | | $ | — | | 100 | % |

| Notes payable | 12 | | 6 | | 100 | % |

| Accounts payable | 3,357 | | 2,738 | | 23 | % |

| Current portion of operating lease liabilities | 491 | | 435 | | 13 | % |

| Accrued liabilities | 5,075 | | 4,987 | | 2 | % |

| Income taxes payable | 693 | | 295 | | 135 | % |

| Total current liabilities | 10,628 | | 8,461 | | 26 | % |

| Long-term debt | 7,998 | | 8,929 | | -10 | % |

| Operating lease liabilities | 2,625 | | 2,807 | | -6 | % |

| Deferred income taxes and other liabilities | 2,672 | | 2,618 | | 2 | % |

| Redeemable preferred stock | — | | — | | — | |

| Shareholders’ equity | 13,944 | | 13,971 | | 0 | % |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 37,867 | | $ | 36,786 | | 3 | % |

| | | | | | | | | | | | | | | | | | |

| NIKE, Inc. |

| DIVISIONAL REVENUES |

| (Unaudited) |

| | | | | | | | |

| | | | | | | | |

| | | | % Change Excluding Currency Changes1 | | | | |

| THREE MONTHS ENDED | % | | |

| (Dollars in millions) | 8/31/2024 | 8/31/2023 | Change | | | |

| North America | | | | | | | | |

| Footwear | $ | 3,212 | | $ | 3,733 | | -14 | % | -14 | % | | | | |

| Apparel | 1,331 | | 1,479 | | -10 | % | -10 | % | | | | |

| Equipment | 283 | | 211 | | 34 | % | 34 | % | | | | |

| Total | 4,826 | | 5,423 | | -11 | % | -11 | % | | | | |

| Europe, Middle East & Africa | | | | | | | | |

| Footwear | 1,952 | | 2,260 | | -14 | % | -12 | % | | | | |

| Apparel | 993 | | 1,137 | | -13 | % | -11 | % | | | | |

| Equipment | 198 | | 213 | | -7 | % | -6 | % | | | | |

| Total | 3,143 | | 3,610 | | -13 | % | -12 | % | | | | |

| Greater China | | | | | | | | |

| Footwear | 1,246 | | 1,287 | | -3 | % | -2 | % | | | | |

| Apparel | 360 | | 401 | | -10 | % | -9 | % | | | | |

| Equipment | 60 | | 47 | | 28 | % | 29 | % | | | | |

| Total | 1,666 | | 1,735 | | -4 | % | -3 | % | | | | |

| Asia Pacific & Latin America | | | | | | | | |

| Footwear | 1,052 | | 1,141 | | -8 | % | -3 | % | | | | |

| Apparel | 348 | | 371 | | -6 | % | -2 | % | | | | |

| Equipment | 62 | | 60 | | 3 | % | 9 | % | | | | |

| Total | 1,462 | | 1,572 | | -7 | % | -2 | % | | | | |

Global Brand Divisions2 | 14 | | 13 | | 8 | % | 20 | % | | | | |

| TOTAL NIKE BRAND | 11,111 | | 12,353 | | -10 | % | -9 | % | | | | |

| Converse | 501 | | 588 | | -15 | % | -14 | % | | | | |

Corporate3 | (23) | | (2) | | — | | — | | | | | |

| TOTAL NIKE, INC. REVENUES | $ | 11,589 | | $ | 12,939 | | -10 | % | -9 | % | | | | |

| | | | | | | | |

| TOTAL NIKE BRAND | | | | | | | | |

| Footwear | $ | 7,462 | | $ | 8,421 | | -11 | % | -10 | % | | | | |

| Apparel | 3,032 | | 3,388 | | -11 | % | -9 | % | | | | |

| Equipment | 603 | | 531 | | 14 | % | 15 | % | | | | |

Global Brand Divisions2 | 14 | | 13 | | 8 | % | 20 | % | | | | |

| TOTAL NIKE BRAND REVENUES | $ | 11,111 | | $ | 12,353 | | -10 | % | -9 | % | | | | |

1The percent change has been calculated using actual exchange rates in use during the comparative prior year period and is provided to enhance the visibility of the underlying business trends by excluding the impact of translation arising from foreign currency exchange rate fluctuations, which is considered a non-GAAP financial measure. Management uses this non-GAAP financial measure when evaluating the Company's performance, including when making financial and operating decisions. Additionally, management believes this non-GAAP financial measure provides investors with additional financial information that should be considered when assessing the Company's underlying business performance and trends. References to this measure should not be considered in isolation or as a substitute for other financial measures calculated and presented in accordance with U.S. GAAP and may not be comparable to similarly titled non-GAAP measures used by other companies. |

2 Global Brand Divisions revenues include NIKE Brand licensing and other miscellaneous revenues that are not part of a geographic operating segment. |

3 Corporate revenues primarily consist of foreign currency hedge gains and losses related to revenues generated by entities within the NIKE Brand geographic operating segments and Converse, but managed through the Company's central foreign exchange risk management program. |

| | | | | | | | | | | | | | |

| NIKE, Inc. |

EARNINGS BEFORE INTEREST AND TAXES1 |

| (Unaudited) |

| | | | | |

| | | | | |

| THREE MONTHS ENDED | % | | |

| (Dollars in millions) | 8/31/2024 | 8/31/2023 | Change | | | |

| North America | $ | 1,216 | | $ | 1,434 | | -15 | % | | | |

| Europe, Middle East & Africa | 792 | | 930 | | -15 | % | | | |

| Greater China | 502 | | 525 | | -4 | % | | | |

| Asia Pacific & Latin America | 402 | | 414 | | -3 | % | | | |

Global Brand Divisions2 | (1,227) | | (1,205) | | -2 | % | | | |

TOTAL NIKE BRAND1 | 1,685 | | 2,098 | | -20 | % | | | |

| Converse | 121 | | 167 | | -28 | % | | | |

Corporate3 | (542) | | (651) | | 17 | % | | | |

TOTAL NIKE, INC. EARNINGS BEFORE INTEREST AND TAXES1 | 1,264 | | 1,614 | | -22 | % | | | |

EBIT margin1 | 10.9 | % | 12.5 | % | | | | |

| Interest expense (income), net | (43) | | (34) | | — | | | | |

| TOTAL NIKE, INC. INCOME BEFORE INCOME TAXES | $ | 1,307 | | $ | 1,648 | | -21 | % | | | |

1 The Company evaluates the performance of individual operating segments based on earnings before interest and taxes (commonly referred to as "EBIT"), which represents Net income before Interest expense (income), net and Income tax expense. Total NIKE Brand EBIT, Total NIKE, Inc. EBIT and EBIT margin are considered non-GAAP financial measures. Management uses these non-GAAP financial measures when evaluating the Company's performance, including when making financial and operating decisions. Additionally, management believes these non-GAAP financial measures provide investors with additional financial information that should be considered when assessing the Company’s underlying business performance and trends. EBIT margin is calculated as total NIKE, Inc. EBIT divided by total NIKE, Inc. Revenues. References to EBIT and EBIT margin should not be considered in isolation or as a substitute for other financial measures calculated and presented in accordance with U.S. GAAP and may not be comparable to similarly titled non-GAAP measures used by other companies. |

2 Global Brand Divisions primarily represent demand creation and operating overhead expense, including product creation and design expenses that are centrally managed for the NIKE Brand, as well as costs associated with NIKE Direct global digital operations and enterprise technology. Global Brand Divisions revenues include NIKE Brand licensing and other miscellaneous revenues that are not part of a geographic operating segment. |

3 Corporate consists primarily of unallocated general and administrative expenses, including expenses associated with centrally managed departments; depreciation and amortization related to the Company’s corporate headquarters; unallocated insurance, benefit and compensation programs, including stock-based compensation; and certain foreign currency gains and losses, including certain hedge gains and losses. |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

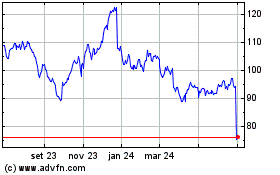

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

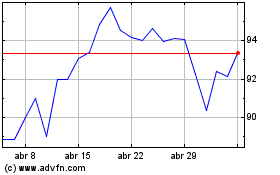

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025