0001541401--12-31false2024Q1truexbrli:shares00015414012024-01-012024-03-310001541401us-gaap:CommonClassAMember2024-01-012024-03-310001541401us-gaap:CommonClassBMember2024-01-012024-03-310001541401us-gaap:CommonClassAMember2024-05-020001541401us-gaap:CommonClassBMember2024-05-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

(Amendment No. 1)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2024

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36105

EMPIRE STATE REALTY TRUST, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

Maryland | | 37-1645259 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

111 West 33rd Street, 12th Floor

New York, New York 10120

(Address of principal executive offices) (Zip Code)

(212) 687-8700

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A Common Stock, par value $0.01 per share | ESRT | The New York Stock Exchange |

| Class B Common Stock, par value $0.01 per share | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 2, 2024, there were 164,037,161 shares of Class A Common Stock, $0.01 par value per share, outstanding and 982,176 shares of Class B Common Stock, $0.01 par value per share, outstanding.

| | | | | | | | |

| EMPIRE STATE REALTY TRUST, INC. | |

| FORM 10-Q/A FOR THE QUARTER ENDED MARCH 31, 2024 | |

| TABLE OF CONTENTS | PAGE |

| EXPLANATORY NOTE | |

| | |

| PART I. | FINANCIAL INFORMATION | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| ITEM 4. | CONTROLS AND PROCEDURES | |

| | |

| PART II. | OTHER INFORMATION | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| ITEM 6. | EXHIBITS | |

| | |

| SIGNATURES | |

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-Q/A (this “amended Quarterly Report”) amends the Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024 (the “Original Form 10-Q”), filed by Empire State Realty Trust, Inc. (“our Company,” “we,” “us,” “our,” and “ESRT”) with the SEC on May 7, 2024. Unless otherwise indicated or unless the context requires otherwise, all references herein to this Quarterly Report on Form 10-Q, this Form 10-Q, this Quarterly Report and similar names refer to the Original Form 10-Q, as amended by this amended Quarterly Report.

This amended Quarterly Report is being filed to amend Part I, Item 4—Controls and Procedures to address management’s re-evaluation of disclosure controls and procedures and reflect the identification of a material weaknesses in internal control over financial reporting.

Part II, Item 6—Exhibits, Financial Statement and Schedules also has been amended to include currently dated certifications from our Chief Executive Officer and Principal Financial Officer as required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002. The certifications are attached to this amended Quarterly Report as Exhibits 31.1, 31.2, 32.1 and 32.2.

This amended Quarterly Report is limited in scope to the portions of this amended Quarterly Report set forth above. This amended Quarterly Report does not modify, amend, or update in any way any other items or disclosures contained in the Original Form 10-Q, including the condensed consolidated financial statements set forth in the Original Form 10-Q or XBRL data filed in Exhibit 101.

Except as noted herein, this amended Quarterly Report has not been updated for other events or information subsequent to the date of the filing of the Original Form 10-Q, and should be read in conjunction with the Original Form 10-Q and our other filings with the SEC.

Material Weakness

In August 2024, Ernst & Young LLP (“EY”), our independent registered public accounting firm, informed us that following EY’s internal post audit quality review of its audit of our consolidated financial statements for the fiscal year ended December 31, 2023, EY had identified control deficiencies in the design of certain information technology (“IT”) general controls (“ITGCs”) for our information systems and applications which were relevant to the preparation of the consolidated financial statements as of December 31, 2023. In particular, the Company’s ITGCs included: (i) controls to approve and monitor changes within information systems and related applications, but the monitoring controls were not designed to ensure a complete population of changes were subject to the control procedures across all relevant IT components, and (ii) controls to approve and monitor user access to information systems and related applications, but the monitoring controls were not designed to review the appropriateness of permissions granted to approved users. As a result, business process controls (automated and manual) that are dependent on the ineffective ITGCs, or that rely on data produced from systems impacted by the ineffective ITGCs, were also deemed ineffective. In consideration of this, management, after discussion with EY, concluded there was a material weakness resulting from those ITGCs as the compensating business process controls in place to mitigate this control deficiency were impacted by the ineffective ITGCs.

As a result, we reevaluated the effectiveness of our disclosure controls and our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls were not effective at a reasonable level of assurance for the periods presented in our Annual Report on Form 10-K for the year ended December 31, 2023 (the “Original Form 10-K”), filed by the Company with the SEC on February 28, 2024. As described in the amended Form 10-K filed with the SEC on the date hereof, despite the finding of the material weakness, we concluded that our consolidated financial statements and related notes thereto included in our Original Form 10-K fairly present in all material respects the financial condition, results of operations and cash flows of the Company as of, and for, the periods presented in the Original Form 10-K. In addition, EY issued an unqualified opinion on our financial statements, which is included in the amended Annual Report.

Our Chief Executive Officer and Chief Financial Officer have concluded that the material weakness remained ongoing as of the quarter ended March 31, 2024, and thus this amended Quarterly Report is being filed to amend Part I, Item 4 of the Original Form 10-Q. Despite our finding that the material weakness remained ongoing as of the quarter ended March 31, 2024, we have concluded that our condensed consolidated financial statements and related notes thereto included in our Original Form 10-Q fairly present in all material respects the financial condition, results of operations and cash flows of the Company as of, and for, the periods presented in the Original Form 10-Q. We have developed a remediation plan for the material weakness, which is described below.

Management’s Remediation Efforts

We are in the process of implementing changes associated with the design, implementation and monitoring of ITGCs in the areas of logical access and change management for IT applications that support our financial statement preparation and reporting processes to ensure that internal controls are designed and operating effectively. Our remediation plans will include:

•Enhancing the current change monitoring control to use an appropriate system source to help ensure a complete population of changes are reviewed to detect if any changes were made outside the Company’s established change control process across all relevant IT components.

•Adding controls to manage the appropriate assignment and maintenance of permission configurations within access groups and the users they are assigned to.

•Increasing the frequency of periodic re-evaluation of user access privileges.

•Training of relevant personnel on the design and operation of our ITGCs over financial reporting.

We believe that these actions, collectively, will remediate the material weakness identified. However, we will not be able to conclude that we have completely remediated the material weakness until the applicable controls are fully implemented and operated for a sufficient period of time and management has concluded, through formal testing, that the remediated controls are operating effectively. We will continue to monitor the design and effectiveness of these and other processes, procedures, and controls and will make any further changes management deems appropriate.

PART I. FINANCIAL INFORMATION

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures (as such term is defined in Rule 13a-15(e) and 15d-15(e) under the Exchange Act) that are designed to ensure that information required to be disclosed in our reports under the Exchange Act is processed, recorded, summarized and reported within the time periods specified in the SEC’s rules and regulations and that such information is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow for timely decisions regarding required disclosure. In designing and evaluating the disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

As of March 31, 2024, the end of the period covered by this report, we carried out an evaluation, under the supervision and with the participation of management, including our Chief Executive Officer and our Chief Financial Officer, regarding the effectiveness of our disclosure controls and procedures at the end of the period covered by this report. Based on the foregoing, at the time we filed our Original Form 10-Q, our Chief Executive Officer and our Chief Financial Officer concluded, as of that time, that our disclosure controls and procedures were effective in ensuring that information required to be disclosed by us in reports filed or submitted under the Exchange Act (i) is processed, recorded, summarized and reported within the time periods specified in the SEC’s rules and forms and (ii) is accumulated and communicated to our management, including our Chief Executive Officer and our Chief Financial Officer, as appropriate to allow for timely decisions regarding required disclosure.

As discussed in the Explanatory Note to this amended Quarterly Report, subsequent to the filing of the Original Form 10-Q, under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, we reevaluated the effectiveness of our disclosure controls, and our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls were not effective at a reasonable level of assurance as of March 31, 2024 because of a material weakness identified in the design of certain ITGCs.

A material weakness (as defined in Rule 12b-2 under the Exchange Act) is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. We identified a material weakness in the design of ITGCs related to IT systems and applications relevant to preparation of our financial statements. In particular, the Company's ITGCs included: (i) controls to approve and monitor changes within information systems and related applications, but the monitoring controls were not designed to ensure a complete population of changes were subject to the control procedures across all relevant IT components and (ii) the controls to approve and monitor user access to information systems and related applications, but the monitoring controls were not designed to review the appropriateness of permissions

granted to approved users. As a result, business process controls (automated and manual) that are dependent on the ineffective ITGCs, or that rely on data produced from systems impacted by the ineffective ITGCs, were also deemed ineffective.

Despite the finding of the material weakness, management has concluded that our condensed consolidated financial statements and related notes thereto included in the Original Form 10-Q fairly present in all material respects the financial condition, results of operations and cash flows of the Company as of, and for, the periods presented.

Remediation of the Material Weakness in Internal Control Over Financial Reporting

The Company is in the process of implementing changes associated with the design, implementation and monitoring of ITGCs in the areas of logical access and change management for IT applications that support the Company’s financial statement preparation and reporting processes to ensure that internal controls are designed and operating effectively. Our remediation plans will include:

•Enhancing the current change monitoring control to use an appropriate system source to help ensure a complete population of changes are reviewed to detect if any changes were made outside the Company’s established change control process across all relevant IT components.

•Adding controls to manage the appropriate assignment and maintenance of permission configurations within access groups and the users they are assigned to.

•Increasing the frequency of periodic re-evaluation of user access privileges.

•Training of relevant personnel on the design and operation of our ITGCs over financial reporting.

We believe that these actions, collectively, will remediate the material weakness identified. However, we will not be able to conclude that we have completely remediated the material weakness until the applicable controls are fully implemented and operated for a sufficient period of time and management has concluded, through formal testing, that the remediated controls are operating effectively. We will continue to monitor the design and effectiveness of these and other processes, procedures, and controls and will make any further changes management deems appropriate.

Changes in Internal Control Over Financial Reporting

Except for the unremediated material weaknesses noted above, there were no changes to our internal control over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II. OTHER INFORMATION

ITEM 6. EXHIBITS | | | | | |

| Exhibit No. | Description |

| Second Amended and Restated Credit Agreement, dated March 8, 2024, among Empire State Realty OP, L.P., as borrower, Empire State Realty Trust, Inc., Bank of America, N.A., as administrative agent and the lenders and letter of credit issuers party thereto. |

| Third Amendment to Credit Agreement, dated March 13, 2024, among Empire State Realty OP, L.P., as borrower, Empire State Realty Trust, Inc., the subsidiary guarantors party thereto, Wells Fargo National Association, as administrative agent and the lenders party thereto. |

| |

| |

| |

| |

| |

| |

| 101.INS^ | XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| 101.SCH^ | XBRL Taxonomy Extension Schema Document |

| 101.CAL^ | XBRL Taxonomy Extension Calculation Document |

| 101.DEF^ | XBRL Taxonomy Extension Definitions Document |

| 101.LAB^ | XBRL Taxonomy Extension Labels Document |

| 101.PRE^ | XBRL Taxonomy Extension Presentation Document |

| 104 | Cover Page Interactive Data File (contained in Exhibit 101) |

| Notes: | |

| * Filed herewith. |

| ^ Previously filed with our Original Form 10-Q, originally filed with the SEC on May 7, 2024, which is being amended hereby. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

EMPIRE STATE REALTY TRUST, INC.

| | | | | | | | | | | |

| By: | /s/ Stephen V. Horn | |

Date: October 8, 2024 | | Stephen V. Horn Executive Vice President, Chief Financial Officer & Chief Accounting Officer (Principal Financial and Accounting Officer) |

EXHIBIT 31.1

Certification of Chief Executive Officer pursuant to Rule 13a-14(a)/15d-14(a) of the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

I, Anthony E. Malkin, certify that:

1. I have reviewed this Amendment No.1 to the Quarterly Report on Form 10-Q/A of Empire State Realty Trust, Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a. Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b. Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c. Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d. Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a. All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b. Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| | | | | | | | | | | |

| By: | /s/ Anthony E. Malkin | |

Date: October 8, 2024 | | Anthony E. Malkin Chairman and Chief Executive Officer |

EXHIBIT 31.2

Certification of Chief Financial Officer pursuant to Rule 13a-14(a)/15d-14(a) of the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

I, Stephen V. Horn, certify that:

1. I have reviewed this Amendment No.1 to the Quarterly Report on Form 10-Q/A of Empire State Realty Trust, Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a. Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b. Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c. Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d. Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a. All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b. Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| | | | | | | | | | | |

| By: | /s/ Stephen V. Horn | |

Date: October 8, 2024 | | Stephen V. Horn Executive Vice President, Chief Financial Officer & Chief Accounting Officer |

EXHIBIT 32.1

CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER

PURSUANT TO

18 U.S.C. SECTION 1350

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

Pursuant to 18 U.S.C. Section 1350, adopted pursuant to Section 906 of The Sarbanes-Oxley Act of 2002, the undersigned Chief Executive Officer of Empire State Realty Trust, Inc. (the "Company"), hereby certifies, to his knowledge that the Amendment No.1 to the Quarterly Report on Form 10-Q/A for the period ended March 31, 2024 (the "Report"), as filed with the Securities and Exchange Commission on the date hereof, fully complies with the requirements of Section 13(a) or 15(d), as applicable, of the Securities Exchange Act of 1934, as amended, and that the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| | | | | | | | | | | |

| By: | /s/ Anthony E. Malkin | |

Date: October 8, 2024 | | Anthony E. Malkin Chairman and Chief Executive Officer |

EXHIBIT 32.2

CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER

PURSUANT TO

18 U.S.C. SECTION 1350

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

Pursuant to 18 U.S.C. Section 1350, adopted pursuant to Section 906 of The Sarbanes-Oxley Act of 2002, the undersigned, Executive Vice President, Chief Financial Officer & Chief Accounting Officer of Empire State Realty Trust, Inc. (the "Company"), hereby certifies, to his knowledge that the Amendment No.1 to the Quarterly Report on Form 10-Q/A for the period ended March 31, 2024 (the "Report"), as filed with the Securities and Exchange Commission on the date hereof, fully complies with the requirements of Section 13(a) or 15(d), as applicable, of the Securities Exchange Act of 1934, as amended, and that the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| | | | | | | | | | | |

| By: | /s/ Stephen V. Horn | |

Date: October 8, 2024 | | Stephen V. Horn Executive Vice President, Chief Financial Officer & Chief Accounting Officer |

v3.24.3

Cover - shares

|

3 Months Ended |

|

Mar. 31, 2024 |

May 02, 2024 |

| Document Information [Line Items] |

|

|

| Document Type |

10-Q/A

|

|

| Document Quarterly Report |

true

|

|

| Document Period End Date |

Mar. 31, 2024

|

|

| Document Transition Report |

false

|

|

| Entity File Number |

001-36105

|

|

| Entity Registrant Name |

EMPIRE STATE REALTY TRUST, INC.

|

|

| Entity Incorporation, State or Country Code |

MD

|

|

| Entity Tax Identification Number |

37-1645259

|

|

| Entity Address, Address Line One |

111 West 33rd Street

|

|

| Entity Address, Address Line Two |

12th Floor

|

|

| Entity Address, City or Town |

New York

|

|

| Entity Address, State or Province |

NY

|

|

| Entity Address, Postal Zip Code |

10120

|

|

| City Area Code |

212

|

|

| Local Phone Number |

687-8700

|

|

| Entity Current Reporting Status |

Yes

|

|

| Entity Interactive Data Current |

Yes

|

|

| Entity Filer Category |

Large Accelerated Filer

|

|

| Entity Small Business |

false

|

|

| Entity Emerging Growth Company |

false

|

|

| Entity Shell Company |

false

|

|

| Entity Central Index Key |

0001541401

|

|

| Current Fiscal Year End Date |

--12-31

|

|

| Amendment Flag |

false

|

|

| Document Fiscal Year Focus |

2024

|

|

| Document Fiscal Period Focus |

Q1

|

|

| Class A Common Stock |

|

|

| Document Information [Line Items] |

|

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.01 per share

|

|

| Trading Symbol |

ESRT

|

|

| Security Exchange Name |

NYSE

|

|

| Entity Common Stock, Shares Outstanding |

|

164,037,161

|

| Class B Common Stock |

|

|

| Document Information [Line Items] |

|

|

| Title of 12(b) Security |

Class B Common Stock, par value $0.01 per share

|

|

| Entity Common Stock, Shares Outstanding |

|

982,176

|

| No Trading Symbol Flag |

true

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

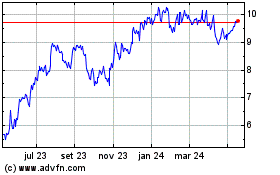

Empire State Realty (NYSE:ESRT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Empire State Realty (NYSE:ESRT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025