false000152493112/2900015249312024-10-112024-10-1100015249312024-12-292024-12-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 11, 2024

CHUY’S HOLDINGS, INC.

(Exact Name Of Registrant As Specified In Its Charter)

| | | | | | | | |

| Delaware | 001-35603 | 20-5717694 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

1623 Toomey Rd.

Austin, Texas 78704

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (512) 473-2783

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | CHUY | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

On October 11, 2024 (the “Closing Date”), the transactions contemplated by the previously announced Agreement and Plan of Merger, dated as of July 17, 2024 (the “Merger Agreement”), by and among Chuy’s Holdings, Inc., a Delaware corporation, (the “Company”), Darden Restaurants, Inc., a Florida corporation (“Darden”), and Cheetah Merger Sub Inc., a Delaware corporation and an indirect, wholly-owned subsidiary of Darden (“Merger Sub”), that provided for the merger of Merger Sub with and into the Company (the “Merger”) with the Company surviving the Merger as an indirect, wholly-owned subsidiary of Darden (the “Surviving Corporation”) were completed.

Item 1.02. Termination of a Material Definitive Agreement.

In connection with the closing of the Merger, on the Closing Date, the Company terminated the Amended and Restated Credit Agreement (the “Credit Agreement”), dated as of September 27, 2023, by and among the Company, the guarantors party thereto, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent, swingline lender and issuing lender. The Credit Agreement is described in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on September 28, 2023, which description is incorporated by reference into this Item 1.02.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The information set forth in the Introductory Note of this Current Report on Form 8-K is incorporated by reference into this Item 2.01.

On the Closing Date, Darden completed its previously announced acquisition of the Company pursuant to the Merger Agreement through the merger of Merger Sub with and into the Company with the Company continuing as the Surviving Corporation, as an indirect, wholly-owned subsidiary of Darden.

As a result of the Merger, at the effective time of the Merger (the “Effective Time”), each share of common stock, par value $0.01 per share, of the Company (“Company Common Stock”) was automatically canceled and (other than shares of Company Common Stock that were (1) owned or held in treasury by the Company, (2) owned by Darden or Merger Sub (or any of their respective affiliates) or (3) owned by stockholders who properly exercised appraisal rights for such shares in accordance with Section 262 of the Delaware General Corporation Law, as amended) converted into the right to receive $37.50 in cash, without interest (the “Merger Consideration”).

Each restricted stock unit (the “Company RSUs”) outstanding as of immediately prior to the Effective Time was deemed to have been earned and became fully vested and was cancelled in exchange for the right to receive from Darden or the Surviving Corporation an amount in cash equal to the product obtained by multiplying (1) the number of shares of Company Common Stock subject to such Company RSU by (2) the Merger Consideration. There were no options to purchase shares of Company Common Stock outstanding as of the Effective Time.

The aggregate consideration paid by Darden to acquire the Company Common Stock was approximately $660 million (including amounts payable to the holders of the Company RSUs, as described above).

The foregoing description of the Merger Agreement and the transactions contemplated thereby, including the Merger, does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which is attached hereto as Exhibit 2.1.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

The information set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

On October 11, 2024, the Company notified the Nasdaq Global Select Market (“Nasdaq”) that the Merger had been completed. The Company also requested that Nasdaq suspend trading of the Company Common Stock and file a Form 25 with the SEC to delist all of the Company Common Stock from Nasdaq and deregister the Company Common Stock under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company also intends to file a Form 15 with the SEC requesting the termination of registration of the Company Common Stock under Section 12(g) of the Exchange Act and the suspension of the Company’s reporting obligations under Sections 13 and 15(d) of the Exchange Act.

Item 3.03. Material Modification to Rights of Security Holders.

The information set forth in the Introductory Note and Items 2.01, 3.01, 5.01 and 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

Item 5.01. Changes in Control of Registrant.

The information set forth in the Introductory Note and Items 2.01, 3.01, 3.03, 5.02 and 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

As a result of the completion of the Merger, a change of control of the Company occurred and, at the Effective Time, the Company became an indirect, wholly-owned subsidiary of Darden. The Merger Consideration was financed with a portion of the proceeds of two senior note offerings by Darden.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.02.

In connection with the consummation of the Merger, each of Steve Hislop, Jody Bilney, Randall DeWitt, Nancy Freda-Smith, Jon Howie, Saed Mohseni and Ira Zecher, the members of the board of directors of the Company immediately prior to the Effective Time, ceased to be directors of the Company at the Effective Time, and Anthony G. Morrow, the sole director of Merger Sub immediately prior to the Effective Time, became the sole director of the Company as of the Effective Time.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.03.

As of the Effective Time, the Certificate of Incorporation of the Company that was in effect immediately before the Effective Time was amended and restated to be in the form attached hereto as Exhibit 3.1 and is incorporated by reference into this Item 5.03. As of the Effective Time, the Bylaws of the Company that were in effect immediately before the Effective Time were amended and restated to be in the form attached hereto as Exhibit 3.2 and are incorporated by reference into this Item 5.03.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

Exhibit

Number | Description |

| Agreement and Plan of Merger, dated as of July 17, 2024, by and among Darden Restaurants, Inc., Cheetah Merger Sub Inc. and Chuy’s Holdings, Inc. (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K filed on July 17, 2024). |

| Amended and Restated Certificate of Incorporation of Chuy’s Holdings, Inc. |

| Amended and Restated Bylaws of Chuy’s Holdings, Inc. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| |

| |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | CHUY’S HOLDINGS, INC. |

| | |

| By: | /s/ Jon W. Howie |

| | Jon W. Howie

Vice President and Chief Financial Officer |

Date: October 11, 2024

__________________

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

CHUY’S HOLDINGS, INC.

__________________

FIRST: The name of the corporation is “Chuy’s Holdings, Inc.” (the “Corporation”).

SECOND: The registered office of the Corporation in the State of Delaware is located at 1521 Concord Pike, Suite 201, in the City of Wilmington, County of New Castle, Zip Code 19803. The name of the registered agent at such address upon which process against the Corporation may be served is Corporate Creations Network Inc.

THIRD: The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware.

FOURTH: The total amount of stock the Corporation is authorized to issue is 100 shares of common stock, with a par value of $0.01 per share.

FIFTH: In furtherance and not in limitation of the powers conferred by statute, the Board of Directors is expressly authorized to adopt, amend or repeal the Corporation’s bylaws without any action on the part of the stockholders, but this shall not divest the stockholders of the power, nor limit their power, to adopt, amend or repeal the Corporation’s bylaws.

SIXTH: Elections of directors need not be by written ballot unless the bylaws of the Corporation shall so provide, and the meetings of stockholders may be held within or without the State of Delaware, as the bylaws may provide.

SEVENTH: The Corporation reserves the right at any time, and from time to time, to amend, alter, change or repeal any provision contained in this Amended and Restated Certificate of Incorporation, and other provisions authorized by the laws of the State of Delaware at the time in force may be added or inserted, in the manner now or hereafter prescribed by law; and all rights, preferences and privileges of any nature conferred upon stockholders, directors, officers or any other persons by and pursuant to this Amended and Restated Certificate of Incorporation in its present form or as hereafter amended are granted subject to the rights reserved in this Article SEVENTH.

EIGHTH: Section 1. To the full extent permitted by the General Corporation Law of the State of Delaware or any other applicable law currently or hereafter in effect, no director of the Corporation will be personally liable to the Corporation or its stockholders for or with respect to any acts or omissions in the performance of his or her duties as a director of the Corporation.

Any repeal or modification of this Article EIGHTH will not adversely affect any right or protection of a director of the Corporation existing prior to such repeal or modification.

Section 2. No officer of the Corporation shall be personally liable to the Corporation or its stockholders for monetary damages for any breach of fiduciary duty as an officer. Notwithstanding the foregoing sentence, an officer shall be liable to the extent provided by applicable law: (A) for any breach of the officer’s duty of loyalty to the Corporation or its stockholders, (B) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (C) for any transaction from which such officer derived an improper personal benefit, or (D) in any action by or in the right of the Corporation. Solely for purposes of this Section 2 of Article EIGHTH, “officer” shall have the meaning provided in Section 102(b)(7) of the General Corporation Law of the State of Delaware as currently in effect and as it may hereafter be amended. Any repeal or modification of the foregoing provisions of this Section 2 of Article EIGHTH by the stockholders of the Corporation shall not adversely affect any right or protection of an officer of the Corporation existing at the time of such repeal or modification.

NINTH: Section 1. Each person who was or is a party or is threatened to be made a party to or is otherwise involved in any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (a “Proceeding”) by reason of the fact that the person is or was a director or an officer of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, including service with respect to an employee benefit plan (an “Indemnitee”), whether the basis of such Proceeding is alleged action in an official capacity as a director, officer, employee or agent or in any other capacity while serving as a director, officer, employee or agent, shall be indemnified and held harmless by the Corporation to the fullest extent permitted or required by the General Corporation Law of the State of Delaware, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Corporation to provide broader indemnification rights than such law permitted the Corporation to provide prior to such amendment), against all expense, liability and loss (including attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts paid in settlement) reasonably incurred or suffered by such Indemnitee in connection therewith; provided, however, that, except as provided in Section 3 of this Article NINTH with respect to Proceedings to enforce rights to indemnification, the Corporation shall indemnify any such Indemnitee in connection with a Proceeding (or part thereof) initiated by such Indemnitee only if such Proceeding (or part thereof) was authorized by the Board of Directors.

Section 2. The right to indemnification conferred in Section 1 of this Article NINTH shall include the right to be paid by the Corporation the expenses (including, without limitation, attorneys’ fees and expenses) incurred in defending any such Proceeding in advance of its final disposition (an “Advancement of Expenses”); provided, however, that, if the General Corporation Law of the State of Delaware so requires, an Advancement of Expenses incurred by an Indemnitee in such person’s capacity as a director or officer (and not in any other capacity in which service was or is rendered by such Indemnitee, including, without limitation, service to an

employee benefit plan) shall be made only upon delivery to the Corporation of an undertaking (an “Undertaking”), by or on behalf of such Indemnitee, to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal (a “Final Adjudication”) that such Indemnitee is not entitled to be indemnified for such expenses under this Section 2 or otherwise. The rights to indemnification and to the Advancement of Expenses conferred in Sections 1 and 2 of this Article NINTH shall be contract rights and such rights shall continue as to an Indemnitee who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the Indemnitee’s heirs, executors and administrators.

Section 3. If a claim under Section 1 or 2 of this Article NINTH is not paid in full by the Corporation within 60 calendar days after a written claim has been received by the Corporation, except in the case of a claim for an Advancement of Expenses, in which case the applicable period shall be 20 calendar days, the Indemnitee may at any time thereafter bring suit against the Corporation to recover the unpaid amount of the claim. If successful in whole or in part in any such suit, or in a suit brought by the Corporation to recover an Advancement of Expenses pursuant to the terms of an Undertaking, the Indemnitee shall be entitled to be paid also the expense of prosecuting or defending such suit. In (i) any suit brought by the Indemnitee to enforce a right to indemnification hereunder (but not in a suit brought by the Indemnitee to enforce a right to an Advancement of Expenses) it shall be a defense that, and (ii) any suit brought by the Corporation to recover an Advancement of Expenses pursuant to the terms of an Undertaking, the Corporation shall be entitled to recover such expenses upon a Final Adjudication that, the Indemnitee has not met any applicable standard for indemnification set forth in the General Corporation Law of the State of Delaware. Neither the failure of the Corporation (including its Board of Directors, independent legal counsel or stockholders) to have made a determination prior to the commencement of such suit that indemnification of the Indemnitee is proper in the circumstances because the Indemnitee has met the applicable standard of conduct set forth in the General Corporation Law of the State of Delaware, nor an actual determination by the Corporation (including its Board of Directors, independent legal counsel or stockholders) that the Indemnitee has not met such applicable standard of conduct, shall create a presumption that the Indemnitee has not met the applicable standard of conduct or, in the case of such a suit brought by the Indemnitee, be a defense to such suit. In any suit brought by the Indemnitee to enforce a right to indemnification or to an Advancement of Expenses hereunder, or brought by the Corporation to recover an Advancement of Expenses pursuant to the terms of an Undertaking, the burden of proving that the Indemnitee is not entitled to be indemnified, or to such Advancement of Expenses, under this Article NINTH or otherwise shall be on the Corporation.

Section 4. The rights to indemnification and to the Advancement of Expenses conferred in this Article NINTH shall not be exclusive of any other right which any person may have or hereafter acquire under any statute, the Corporation’s Amended and Restated Certificate of Incorporation, bylaws, any agreement, vote of stockholders or disinterested directors or otherwise.

Section 5. The Corporation may maintain insurance, at its expense, to protect itself and any person who is or was a director, officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in any such capacity, or arising out of such person’s status as such, whether or not the Corporation would have the power to indemnify such person against such liability under the General Corporation Law of the State of Delaware.

Section 6. The Corporation may, to the extent authorized from time to time by the Board of Directors, grant rights to indemnification and to the Advancement of Expenses to any employee or agent of the Corporation to the fullest extent of the provisions of this Article NINTH with respect to the indemnification and Advancement of Expenses of directors and officers of the Corporation.

AMENDED AND RESTATED BYLAWS

OF

CHUY’S HOLDINGS, INC.

ARTICLE I. Stockholders

Section 1.1. Annual Meetings. An annual meeting of stockholders shall be held for the election of directors at such date, time and place, either within or without the State of Delaware, as may be designated by resolution of the Board of Directors from time to time. Any other proper business may be transacted at the annual meeting.

Section 1.2. Special Meetings. Special meetings of stockholders may be called at any time by the Chairman of the Board, if any, the President or the Board of Directors, to be held at such time and place either within or without the State of Delaware as may be stated in the notice of the meeting. A special meeting of stockholders shall be called by the Secretary (or other appointed officer) upon the written request, stating the purpose of the meeting, of stockholders who together own of record 25% of the outstanding stock of any class entitled to vote at such meeting.

Section 1.3. Notice of Meetings. Whenever stockholders are required or permitted to take any action at a meeting, a written notice of the meeting shall be given which shall state the place, date and hour of the meeting, and, in the case of a special meeting, the purpose or purposes for which the meeting is called. Unless otherwise provided by law, the written notice of any meeting shall be given not less than ten nor more than sixty days before the date of the meeting to each stockholder entitled to vote at such meeting. If mailed, such notice shall be deemed to be given when deposited in the United States mail, postage prepaid, directed to the stockholder at such stockholder’s address as it appears on the records of the corporation.

Section 1.4. Adjournments. Any meeting of stockholders, annual or special, may adjourn from time to time to reconvene at the same or some other place, and notice need not be given of any such adjourned meeting if the time and place thereof are announced at the meeting at which the adjournment is taken. At the adjourned meeting, the corporation may transact any business which might have been transacted at the original meeting. If the adjournment is for more than thirty days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting.

Section 1.5. Quorum. At each meeting of stockholders, except where otherwise provided by law or the certificate of incorporation or these bylaws, the holders of a majority of the outstanding shares of each class of stock entitled to vote at the meeting, present in person or by proxy, shall constitute a quorum. In the absence of a quorum, the stockholders so present may, by majority vote, adjourn the meeting from time to time in the manner provided in Section 1.4 of these bylaws until a quorum shall attend.

Section 1.6. Organization. Meetings of stockholders shall be presided over by the Chairman of the Board, if any, or in such person’s absence by the President, or in such person’s absence by a Vice President, or in the absence of the foregoing persons by a chairman designated by the Board of Directors, or in the absence of such designation by a chairman chosen at the meeting. The Secretary shall act as secretary of the meeting, but in such person’s absence the chairman of the meeting may appoint any person to act as secretary of the meeting.

Section 1.7. Voting; Proxies. Unless otherwise provided in the certificate of incorporation, each stockholder entitled to vote at any meeting of stockholders shall be entitled to one vote for each share of stock held by such stockholder which has voting power upon the matter in question. Each stockholder entitled to vote at a meeting of stockholders or to express consent or dissent to corporate action in writing without a meeting may authorize another person or persons to act for such stockholder by proxy, but no such proxy shall be voted or acted upon after three years from its date, unless the proxy provides for a longer period. A duly executed proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A stockholder may revoke any proxy which is not irrevocable by attending the meeting and voting in person or by filing an instrument in writing revoking the proxy or another duly executed proxy bearing a later date with the Secretary of the corporation. Voting at meetings of stockholders need not be by written ballot and need not be conducted by inspectors unless the holders of a majority of the outstanding shares of all classes of stock entitled to vote thereon present in person or by proxy at such meeting shall so determine. At all meetings of stockholders for the election of directors, a plurality of the votes cast shall be sufficient to elect. All other elections and questions shall, unless otherwise provided by law or by the certificate of incorporation or these bylaws, be decided by the vote of the holders of a majority of the outstanding shares of all classes of stock entitled to vote thereon present in person or by proxy at the meeting.

Section 1.8. Fixing Date for Determination of Stockholders of Record. In order that the corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment thereof, or to express consent to corporate action in writing without a meeting, or entitled to receive payment of any dividend or other distribution or allotment of any rights, or entitled to exercise any rights in respect of any change, conversion or exchange of stock or for the purpose of any other lawful action, the Board of Directors may fix, in advance, a record date, which shall not be more than sixty nor less than ten days before the date of such meeting, nor more than sixty days prior to any other action. If no record date is fixed: (1) the record date for determining stockholders entitled to notice of or to vote at a meeting of stockholders shall be at the close of business on the day next preceding the day on which notice is given, or, if notice is waived, at the close of business on the day next preceding the day on which the meeting is held; (2) the record date for determining stockholders entitled to express consent to corporate action in writing without a meeting, when no prior action by the Board of Directors is necessary, shall be the day on which the first written consent is expressed; and (3) the record date for determining stockholders for any other purpose shall be at the close of business on the day on which the Board of Directors adopts the resolution relating thereto. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment of the meeting; provided, however, that the Board of Directors may fix a new record date for the adjourned meeting.

Section 1.9. List of Stockholders Entitled to Vote. The Secretary shall prepare and make, at least ten days before every meeting of stockholders, a complete list of the stockholders entitled to vote at the meeting, arranged in alphabetical order, and showing the address of each stockholder and the number of shares registered in the name of each stockholder. Such list shall be open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business hours, for a period of at least ten days prior to the meeting, either at a place within the city where the meeting is to be held, which place shall be specified in the notice of the meeting, or, if not so specified, at the place where the meeting is to be held. The list shall also be produced and kept at the time and place of the meeting during the whole time thereof and may be inspected by any stockholder who is present. Upon the willful neglect or refusal of the directors to produce such a list at any meeting for the election of directors, they shall be ineligible for election to any office at such meeting. The stock ledger shall be the only evidence as to

who are the stockholders entitled to examine the list of stockholders or to vote in person or by proxy at any meeting of stockholders.

Section 1.10. Written Consent of Stockholders. Any action required by law to be taken at any annual or special meeting of stockholders of the corporation, or any action which may be taken at any annual or special meeting of such stockholders, may be taken without a meeting, without prior notice and without a vote, if a consent in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Prompt notice of the taking of the corporate action without a meeting by less than unanimous written consent shall be given to those stockholders who have not consented in writing.

ARTICLE II. Board of Directors

Section 2.1. Number; Qualifications. The Board of Directors shall consist initially of the directors elected by the incorporator and, thereafter, of one or more directors, the number thereof to be determined from time to time by resolution of the Board of Directors. Directors need not be stockholders.

Section 2.2. Election; Resignation; Removal; Vacancies. Until the first annual meeting of stockholders or until successors or additional directors are duly elected and qualified, the Board of Directors shall consist of the persons elected as such by the incorporator. At the first annual meeting of stockholders and at each annual meeting thereafter, the stockholders shall elect directors, each to hold office until the next succeeding annual meeting or until such person’s successor is elected and qualified or until such person’s earlier resignation or removal. Any director may resign at any time upon written notice to the corporation. The stockholders may remove any director with or without cause at any time. Except as otherwise provided in the certificate of incorporation, any vacancy occurring in the Board of Directors for any cause may be filled by a majority of the remaining members of the Board of Directors, although such majority is less than a quorum, or by a plurality of the votes cast at a meeting of stockholders, and each director so elected shall hold office until the next succeeding annual meeting of stockholders or until such person’s successor is elected and qualified or until such person’s earlier resignation or removal.

Section 2.3. Regular Meetings. Regular meetings of the Board of Directors may be held at such places within or without the State of Delaware and at such times as the Board of Directors may from time to time determine, and if so determined notices thereof need not be given.

Section 2.4. Special Meetings. Special meetings of the Board of Directors may be held at any time or place within or without the State of Delaware whenever called by the Chairman of the Board, if any, by the President or by one-third of the members of the Board of Directors. Reasonable notice thereof shall be given by the person or persons calling the meeting.

Section 2.5. Telephonic Meetings Permitted. Members of the Board of Directors, or any committee designated by the Board of Directors, may participate in a meeting of the Board of Directors or such committee by means of conference telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other, and participation in a meeting pursuant to this bylaw shall constitute presence in persons at such meeting.

Section 2.6. Quorum; Vote Required for Action. At all meetings of the Board of Directors, a majority of the directors then in office shall constitute a quorum for the transaction of business; provided, however, that in no case shall a quorum consist of less than one third (1/3) of the total number of directors

established by resolution of the Board of Directors pursuant to Section 2.1 of these bylaws. Except in cases in which the certificate of incorporation or these bylaws otherwise provide, the vote of a majority of the directors present at a meeting at which a quorum is present shall be the act of the Board of Directors.

Section 2.7. Organization. Meetings of the Board of Directors shall be presided over by the Chairman of the Board, if any, or in such person’s absence by the President if the President is a director, or in their absence by a chairman chosen at the meeting. The Secretary shall act as secretary of the meeting, but in such person’s absence the chairman of the meeting may appoint any person to act as secretary of the meeting.

Section 2.8. Written Consent of Directors. Unless otherwise restricted by the certificate of incorporation or these bylaws, any action required or permitted to be taken at any meeting of the Board of Directors, or of any committee thereof, may be taken without a meeting if all members of the Board of Directors or such committee, as the case may be, consent thereto in writing, and the writing or writings are filed with the minutes of proceedings of the Board of Directors or committee.

Section 2.9. Chairman of the Board. The Board of Directors may, if it so determines, choose a Chairman of the Board from among its members.

ARTICLE III. Committees

Section 3.1. Committees. The Board of Directors may designate one or more committees, each committee to consist of one or more of the directors of the corporation. The Board of Directors may designate one or more directors as alternate members of any committee, who may replace any absent or disqualified member at any meeting of the committee. Unless otherwise prohibited by a resolution of the Board of Directors, in the absence or disqualification of a member of a committee, the member or members thereof present at any meeting and not disqualified from voting, whether or not such member or members constitute a quorum, may unanimously appoint another member of the Board of Directors to act at the meeting in place of any such absent or disqualified member. Any such committee, to the extent provided in the resolution of the Board of Directors, shall have and may exercise all the powers and authority of the Board of Directors in the management of the business and affairs of the corporation, and may authorize the seal of the corporation to be affixed to all papers which may require it; but no such committee shall have the power or authority in reference to the following matters: (i) approving or adopting, or recommending to the stockholders, any action or matter (other than the election or removal of directors) expressly required by law to be submitted to stockholders for approval or (ii) adopting, amending or repealing any bylaw of the corporation.

Section 3.2. Committee Rules. Unless the Board of Directors otherwise provides, each committee designated by the Board of Directors may make, alter and repeal rules for the conduct of its business. In the absence of such rules, each committee shall conduct its business in the same manner as the Board of Directors conducts its business pursuant to Article II of these bylaws.

ARTICLE IV. Officers

Section 4.1. Executive Officers; Election; Qualifications; Term of Office; Resignation; Removal; Vacancies. The Board of Directors shall choose a President and a Secretary. The Board of Directors may also choose one or more Vice Presidents, one or more Assistant Secretaries, a Treasurer, one or more Assistant Treasurers and such other officers as it may determine. Each such officer shall hold office until the first meeting of the Board of Directors after the annual meeting of stockholders next succeeding such officer’s election, and until such person’s successor is elected and qualified or until such

person’s earlier resignation or removal. Any officer may resign at any time upon written notice to the corporation. The Board of Directors may remove any officer with or without cause at any time, but such removal shall be without prejudice to the contractual rights of such officer, if any, with the corporation. Any number of offices may be held by the same person. Any vacancy occurring in any office of the corporation by death, resignation, removal or otherwise may be filled for the unexpired portion of the term by the Board of Directors at any regular or special meeting.

Section 4.2. Powers and Duties of Executive Officers. The officers of the corporation shall have such powers and duties in the management of the corporation as may be prescribed by the Board of Directors and, to the extent not so provided, as generally pertain to their respective offices, subject to the control of the Board of Directors. The Board of Directors may require any officer, agent or employee to give security for the faithful performance of such person’s duties.

ARTICLE V. Stock

Section 5.1. Certificates. The shares of capital stock of the corporation may be certificated or uncertificated. If certificated, the shares shall be evidenced by certificates in forms prescribed by the Board of Directors and executed in any manner permitted by law and stating thereon the information required by law. Transfer agents and/or registrars for one or more classes of shares of the corporation may be appointed by the Board of Directors and may be required to countersign certificates representing shares of such class or classes. If any officer whose signature or facsimile thereof shall have been used on a share certificate shall for any reason cease to be an officer of the corporation and such certificate shall not then have been delivered by the corporation, the Board of Directors may nevertheless adopt such certificate and it may then be issued and delivered as though such person had not ceased to be an officer of the corporation.

Section 5.2. Lost, Destroyed and Mutilated Certificates. Holders of the shares of the corporation shall notify the corporation of any loss, destruction or mutilation of the certificate therefor, and the Board of Directors may in its discretion cause one or more new certificates for the same number of shares in the aggregate to be issued to such stockholder upon the surrender of the mutilated certificate or upon satisfactory proof of such loss or destruction, and the deposit of a bond in such form and amount and with such surety as the Board of Directors may require.

ARTICLE VI. Miscellaneous

Section 6.1. Fiscal Year. The fiscal year of the corporation shall be determined by resolution of the Board of Directors.

Section 6.2. Offices. The corporation may have offices at such places within or without the State of Delaware as the Board of Directors may from time to time determine or as the business of the corporation may require.

Section 6.3. Seal. The corporate seal, if there be one, shall have the name of the corporation inscribed thereon and shall be in such form as may be approved from time to time by the Board of Directors.

Section 6.4. Waiver of Notice of Meetings of Stockholders, Directors and Committees. Any written waiver of notice, signed by the person entitled to notice, whether before or after the time stated therein, shall be deemed equivalent to notice. Attendance of a person at a meeting shall constitute a waiver of notice of such meeting, except when the person attends a meeting for the express purpose of

objecting, at the beginning of the meeting, to the transaction of any business because the meeting is not lawfully called or convened. Neither the business to be transacted at, nor the purpose of, any regular or special meeting of the stockholders, directors, or members of a committee of directors need be specified in any written waiver of notice.

Section 6.5. Form of Records. Any records maintained by the corporation in the regular course of its business, including its stock ledger, books of account and minute books, may be kept on, or be in the form of, punch cards, magnetic tape, photographs, microphotographs, or any other information storage device, provided that the records so kept can be converted into clearly legible form within a reasonable time. The corporation shall so convert any records so kept upon the request of any person entitled to inspect the same.

Section 6.6. Execution of Instruments. All corporate checks, demands for money, notes of the Corporation, instruments and documents, shall be signed or countersigned, executed, verified or acknowledged by such person or persons as the Board of Directors may, from time to time, designate.

Section 6.7. Dividends. Subject to the provisions of the certificate of incorporation relating thereto, if any, dividends may be declared by the Board of Directors at any regular or special meeting, in accordance with the General Corporation Law of the State of Delaware. Dividends may be paid in cash, bonds, property or in the shares of the capital stock of the corporation subject to any provisions of the certificate of incorporation. Before payment of any dividend, there may be set aside out of any funds of the corporation available for dividends, such sum or sums as the Board of Directors, from time to time, in its discretion, thinks proper as a reserve fund to meet contingencies, or for equalizing dividends, or for repairing or maintaining any property of the corporation or for such other purpose as the Board of Directors shall think conducive to the interest of the corporation, and the Board of Directors may modify or abolish any such reserve in the manner in which it was created.

Section 6.8. Amendment of Bylaws. These bylaws may be altered or repealed, and new bylaws made, by the Board of Directors or by the stockholders.

v3.24.3

Cover

|

Dec. 29, 2024 |

Oct. 11, 2024 |

| Cover [Abstract] |

|

|

| Document Type |

|

8-K

|

| Amendment Flag |

|

false

|

| Document Period End Date |

|

Oct. 11, 2024

|

| Entity Registrant Name |

|

CHUY’S HOLDINGS, INC.

|

| Entity Central Index Key |

|

0001524931

|

| Current Fiscal Year End Date |

--12-29

|

|

| Entity Incorporation, State or Country Code |

|

DE

|

| Entity File Number |

|

001-35603

|

| Entity Tax Identification Number |

|

20-5717694

|

| Entity Address, Address Line One |

|

1623 Toomey Rd.

|

| Entity Address, City or Town |

|

Austin

|

| Entity Address, State or Province |

|

TX

|

| Entity Address, Postal Zip Code |

|

78704

|

| City Area Code |

|

(512)

|

| Local Phone Number |

|

473-2783

|

| Written Communications |

|

false

|

| Soliciting Material |

|

false

|

| Pre-commencement Tender Offer |

|

false

|

| Pre-commencement Issuer Tender Offer |

|

false

|

| Title of 12(b) Security |

|

Common Stock, par value $0.01 per share

|

| Trading Symbol |

|

CHUY

|

| Security Exchange Name |

|

NASDAQ

|

| Entity Emerging Growth Company |

|

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

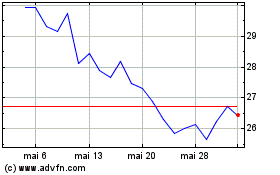

Chuy s (NASDAQ:CHUY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Chuy s (NASDAQ:CHUY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024