false

0001477845

0001477845

2024-10-15

2024-10-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

October 15, 2024

ANNOVIS BIO, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-39202 |

26-2540421 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

101

Lindenwood Drive, Suite 225

Malvern, PA

19355

(Address of Principal Executive Offices, and

Zip Code)

(484) 875-3192

Registrant’s Telephone Number, Including

Area Code

Not

Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name

of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

ANVS |

New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communication pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

8.01 Other Events.

On October 15, 2024, Annovis Bio, Inc. (the

“Registrant”) issued a press release containing an overview of its recent End-of-Phase 2 meeting with the U.S. Food and Drug

Administration (“FDA”). The meeting took place on October 10, 2024. A copy of the press release is attached as Exhibit 99.1

to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ANNOVIS BIO, INC. |

| |

|

|

| Date: October 15, 2024 |

By: |

/s/ Maria Maccecchini |

| |

|

Name: Maria Maccecchini |

| |

|

Title: President and Chief Executive Officer |

Exhibit 99.1

FDA Clears Annovis to Launch Pivotal Phase 3 Alzheimer’s Studies, Paving the Way to NDAs

MALVERN, Pa., October 15, 2024 (GLOBE NEWSWIRE) – Annovis

Bio Inc. (NYSE: ANVS) (“Annovis” or the “Company”), a late-stage clinical drug platform company developing transformative

therapies for neurodegenerative disorders such as Alzheimer’s disease (AD) and Parkinson’s disease (PD), announced today the

successful outcome of the End-of-Phase 2 meeting with the U.S. Food and Drug Administration (FDA) on October 10, 2024. During the meeting,

the FDA granted clearance to proceed with pivotal Phase 3 studies, based on the Company's Phase 2/3 clinical data showing symptomatic

improvement in early AD patients. Annovis and the FDA have now aligned on a development path for buntanetap towards the filing of New

Drug Applications (NDAs), one for short-term and one for long-term efficacy.

The Phase 3 program will investigate buntanetap in patients with early

AD and will consist of two trials: a 6-month study aimed at confirming buntanetap’s symptomatic effects and an 18-month study designed

to demonstrate potential disease-modifying effects. While the Company plans to run both studies, the completion of a well-designed and

well-executed 6-month trial may be sufficient to support an NDA filing, potentially within one year of the study’s initiation.

Additionally, the FDA raised no concerns about the Company’s

data on buntanetap’s safety, including liver enzymes, drug interactions, dose selection, pharmacokinetics, and population pharmacokinetics

and confirmed that development can proceed using the new crystal form of buntanetap.

“We are now ready to move into the highly anticipated Phase 3

stage,” said Maria Maccecchini, Ph.D., Founder, President, and CEO of Annovis Bio. “Our priority is to bring the treatment

to patients as early as possible, and we are committed to ensuring the next clinical trial is executed at the highest standards to attain

an expedited NDA submission. Our team is already preparing for trial initiation early next year and will continue to keep you updated

as we advance towards our goal.”

About Annovis Bio, Inc.

Headquartered in Malvern, Pennsylvania, Annovis Bio Inc. is dedicated

to addressing neurodegeneration in diseases such as AD and PD. The company’s innovative approach targets multiple neurotoxic proteins,

aiming to restore brain function and improve the quality of life for patients. For more information, visit www.annovisbio.com and

follow us on LinkedIn, YouTube, and X.

Investor Alerts

Interested investors and shareholders are encouraged to sign up for

press releases and industry updates by registering for Email Alerts at https://www.annovisbio.com/email-alerts. Additionally,

we invite you to explore our updated investor website, which provides comprehensive access to company news, financial reports,

and other key information.

Forward-Looking Statements

This press release contains "forward-looking" statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements include, but are not limited to, the Company's plans related to clinical trials. Forward-looking statements

are based on current expectations and assumptions and are subject to risks and uncertainties that could cause actual results to differ

materially from those projected. Such risks and uncertainties include, but are not limited to, those related to patient enrollment, the

effectiveness of Buntanetap, and the timing, effectiveness, and anticipated results of the Company's clinical trials evaluating the efficacy,

safety, and tolerability of Buntanetap. Additional risk factors are detailed in the Company's periodic filings with the SEC, including

those listed in the "Risk Factors" section of the Company's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. All

forward-looking statements in this press release are based on information available to the Company as of the date of this release. The

Company expressly disclaims any obligation to update or revise its forward-looking statements, whether as a result of new information,

future events, or otherwise, except as required by law.

Contact Information:

Annovis Bio Inc.

101 Lindenwood Drive

Suite 225

Malvern, PA 19355

www.annovisbio.com

Investor Contact:

Scott McGowan

InvestorBrandNetwork (IBN)

Phone: 310.299.1717

www.annovisbio.com/investors-relations

IR@annovisbio.com

v3.24.3

Cover

|

Oct. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 15, 2024

|

| Entity File Number |

001-39202

|

| Entity Registrant Name |

ANNOVIS BIO, INC.

|

| Entity Central Index Key |

0001477845

|

| Entity Tax Identification Number |

26-2540421

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

101

Lindenwood Drive

|

| Entity Address, Address Line Two |

Suite 225

|

| Entity Address, City or Town |

Malvern

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19355

|

| City Area Code |

484

|

| Local Phone Number |

875-3192

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ANVS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

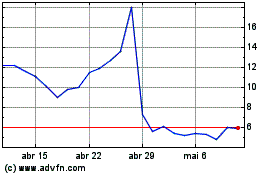

Annovis Bio (NYSE:ANVS)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Annovis Bio (NYSE:ANVS)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025