Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

16 Outubro 2024 - 6:09PM

Edgar (US Regulatory)

| | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 23)*

| | |

Guess?, Inc.

(Name of Issuer) |

Common Stock

(Title of Class of Securities)

401617 10 5

(CUSIP Number)

Maurice Marciano

Guess?, Inc.

1444 South Alameda Street

Los Angeles, CA 90021

(213) 765-3100

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

| | |

October 14, 2024

(Date of Event Which Requires Filing of this Statement) |

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. ❑

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| | | | | | | | | | | | | | | | | |

| CUSIP No. 401617 10 5 |

|

| 1. | Names of Reporting Persons Maurice Marciano |

| | |

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) |

| | (a) | ❑ |

| | (b) | ❑ |

| | |

| 3. | SEC Use Only |

| | |

| | |

| 4. | Source of Funds (See Instructions) |

| | |

| | |

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) |

| | Item 2(d) | ❑ |

| | Item 2(e) | ❑ |

| | |

| 6. | Citizenship or Place of Organization Republic of France |

| | |

| Number of Shares Beneficially Owned by Each Reporting Person With | 7. | Sole Voting Power None |

| | |

| 8. | Shared Voting Power 4,947,179 |

| | |

| 9. | Sole Dispositive Power None |

| | |

| 10. | Shared Dispositive Power 4,358,309 |

| | | | |

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person

4,947,179 (1) |

| | |

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ❑ |

| | |

| 13. | Percent of Class Represented by Amount in Row (11) 9.6% (2) |

| | |

| 14. | Type of Reporting Person (See Instructions) IN |

| | | | | |

| ____________________________ | |

| (1) Includes 4,663,979 shares which are also deemed to be beneficially owned by the Reporting Person’s brother, Paul Marciano, and includable in reports on Schedule 13D filed by Paul Marciano. |

| (2) Based on 51,422,316 shares of Common Stock of the Issuer, par value $0.01 ("Common Stock"), outstanding on September 3, 2024, as reported by the Issuer in its Form 10-Q for the quarter ended August 3, 2024 filed with the Securities and Exchange Commission (the “SEC”) on September 6, 2024. |

This Amendment No. 23 to Schedule 13D amends, or amends and restates, where indicated, the statement on Schedule 13D relating to the Common Stock filed by the Reporting Person with the SEC on June 10, 2003, as amended by filings on June 21, 2004, July 8, 2004, October 21, 2004, May 15, 2006, February 20, 2007, July 23, 2007, October 18, 2007, April 23, 2008, January 29, 2010, April 27, 2010, August 8, 2011, September 19, 2012, February 6, 2014, August 5, 2014, May 14, 2019, September 2, 2020, March 28, 2022, July 1, 2022, April 17, 2023, October 5, 2023, December 27, 2023 and April 2, 2024. Capitalized terms used in this Amendment No. 23 but not otherwise defined herein have the meanings given to them in the initial Schedule 13D.

This Amendment No. 23 is being made to reflect a decrease in the percentage of shares of Common Stock beneficially owned by the Reporting Person due to the Reporting Person ceasing to have voting or investment power with respect to certain trusts and entities through which shares are held as a result of changes in the administration of such trusts and entities, and does not reflect a sale or disposition of shares by the Reporting Person. Except as otherwise set forth herein, this Amendment No. 23 does not modify any of the information previously reported by the Reporting Person in the Schedule 13D as amended to date.

Item 5. Interest in Securities of the Issuer

(a)As of October 16, 2024, the Reporting Person may be deemed to beneficially own 4,947,179 shares of Common Stock which represents 9.6% of the 51,422,316 shares of Common Stock outstanding. The aggregate number of shares beneficially owned by the Reporting Person includes 4,663,979 shares which are also deemed to be beneficially owned by the Reporting Person’s brother, Paul Marciano, and includable in reports on Schedule 13D filed by Paul Marciano.

(b)The breakdown of voting and investment power is as follows:

| | | | | | | | | | | | | | | | | | | | |

| Holder | | Number of Shares | | Voting Power | | Investment Power |

| | | | | | |

Maurice Marciano Trust | | 4,025,109 (1) | | Shared | | Shared |

Maurice Marciano Family Foundation | | 283,200 (2) | | Shared | | Shared |

| Maurice & Paul Marciano Art Foundation | | 50,000 (1)(2) | | Shared | | Shared |

Carolem Capital, LLC | | 300,000 (1) | | Shared | | None |

| | | | | | |

| | | | | | |

Next Step Capital, LLC | | 11,400 (1) | | Shared | | None |

Next Step Capital II, LLC | | 277,470 (1) | | Shared | | None |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

(1)Includes shares which are also deemed to be beneficially owned by the Reporting Person’s brother, Paul Marciano, and includable in reports on Schedule 13D filed by Paul Marciano.

(2)The Reporting Person has no pecuniary interest in these shares, which are owned by a non-profit corporation.

(c)During the past sixty days, the Reporting Person has not acquired or disposed of any shares of Common Stock of the Issuer.

(d)See Item 5(b).

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| | | | | | | | | | | |

Date: | October 16, 2024 | |

| | |

| | | /s/ Jason T. Miller |

| | | JASON T. MILLER (attorney in fact)

|

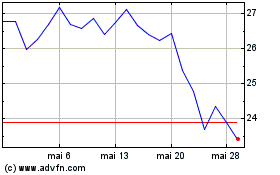

Guess (NYSE:GES)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Guess (NYSE:GES)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024