Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

17 Outubro 2024 - 8:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-36430

Tuniu Corporation

6, 8-12th Floor, Building 6-A, Juhuiyuan

No. 108 Xuanwudadao, Xuanwu District

Nanjing, Jiangsu Province 210023

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Tuniu Corporation |

| |

|

| |

By: |

/s/ Anqiang Chen |

| |

Name: |

Anqiang Chen |

| |

Title: |

Financial Controller |

Date: October 17, 2024

Exhibit 99.1

Tuniu Has Regained Compliance

with Nasdaq’s Minimum Bid Price Requirement

NANJING, China, October 17, 2024 -- Tuniu Corporation (Nasdaq:

TOUR) (“Tuniu” or the “Company”), a leading online leisure travel company in China, today announced that it has

received a notification letter (the “Compliance Notice”) from the Listing Qualifications Department of the Nasdaq Stock Market

Inc. (“Nasdaq”) dated October 16, 2024, informing the Company that it has regained compliance with the Nasdaq Listing

Rule 5450(a)(1) (the “Minimum Bid Price Requirement”).

As previously

announced, Tuniu received a notification letter (the “Deficiency

Notice”) from the Nasdaq dated August 6, 2024, indicating that the closing bid price for the Company’s American depositary

shares (the “ADSs”) was, for the past 31 consecutive business days, below the minimum bid price of $1.00 required for continued

listing under the Nasdaq Listing Rule 5450(a)(1). According to the Deficiency Notice, if at any time during the 180-day compliance

period, the closing bid price of the Company’s ADSs is at least $1.00 for a minimum of ten consecutive business days, the Nasdaq

will provide the Company written confirmation of compliance and the matter will be closed. According to the Compliance Notice,

the closing bid price of the Company’s ADSs has been at $1.00 per ADS or greater for over 10 consecutive business days, and the

Company has regained compliance with the Minimum Bid Price Requirement and the matter is closed.

About Tuniu

Tuniu (Nasdaq: TOUR) is a leading online leisure

travel company in China that offers integrated travel service with a large selection of packaged tours, including organized and self-guided

tours, as well as travel-related services for leisure travelers through its website tuniu.com and mobile platform. Tuniu provides one-stop

leisure travel solutions and a compelling customer experience through its online platform and offline service network, including a dedicated

team of professional customer service representatives, 24/7 call centers, extensive networks of offline retail stores and self-operated

local tour operators. For more information, please visit http://ir.tuniu.com.

Safe Harbor Statement

This press release contains forward-looking

statements made under the "safe harbor" provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and

the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will,"

"expects," "anticipates," "future," "intends," "plans," "believes," "estimates,"

"confident" and similar statements. Tuniu may also make written or oral forward-looking statements in its reports filed with

or furnished to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or employees to third parties. Any statements that are not historical

facts, including statements about Tuniu's beliefs and expectations, are forward-looking statements that involve factors, risks and uncertainties

that could cause actual results to differ materially from those in the forward-looking statements. Such factors and risks include, but

are not limited to the following: Tuniu's goals and strategies; the growth of the online leisure travel market in China; the demand for

Tuniu’s products and services; its relationships with customers and travel suppliers; Tuniu’s ability to offer competitive

travel products and services; Tuniu’s future business development, results of operations and financial condition; competition in

the online travel industry in China; government policies and regulations relating to Tuniu’s structure, business and industry; the

impact of health epidemics on Tuniu’s business operations, the travel industry and the economy of China and elsewhere generally;

and the general economic and business condition in China and elsewhere. Further information regarding these and other risks, uncertainties

or factors is included in the Company's filings with the U.S. Securities and Exchange Commission. All information provided in this press

release is current as of the date of the press release, and Tuniu does not undertake any obligation to update such information, except

as required under applicable law.

For investor and media inquiries, please

contact:

China

Mary Chen

Investor Relations Director

Tuniu Corporation

Phone: +86-25-6960-9988

E-mail: ir@tuniu.com

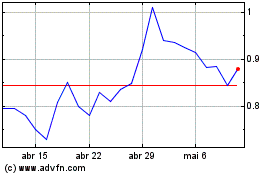

Tuniu (NASDAQ:TOUR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

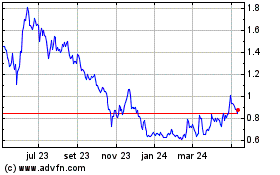

Tuniu (NASDAQ:TOUR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025