UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

October

15, 2024

Commission

File Number: 001-37968

YATRA

ONLINE, INC.

Gulf

Adiba, Plot No. 272,

4th

Floor, Udyog Vihar, Phase-II,

Sector-20,

Gurugram-122008, Haryana

India

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Amendment

to MAK Cooperation Agreement

On

October 16, 2024, Yatra Online, Inc. (the “Company”) entered into the Second Amendment to the Cooperation Agreement (“Second

Amendment”) amending the Cooperation Agreement dated July 17, 2022 with MAK Capital One L.L.C. and MAK CAPITAL FUND LP, as earlier

amended by the First Amendment dated August 29, 2023 (as amended, the “MAK Cooperation Agreement”). The Second Amendment,

among other things, extends the Standstill Period (as defined in the MAK Cooperation Agreement) to the period commencing on October 16,

2024, and ending on the date that is the earlier to occur of (i) 30 calendar days prior to the date of the Company’s 2025 annual

general meeting or (ii) 60 calendar days following the resignation of the Investor Group Designee (as defined in the MAK Cooperation

Agreement).

The

foregoing description of the Second Amendment is only a summary and is qualified in its entirety by reference to the Second Amendment

attached hereto as Exhibit 99.1, which is incorporated herein by reference.

Update

on Material Litigation against TSI Yatra Private Limited (“TSI”), a wholly owned subsidiary of Yatra Online Limited, an indirect

subsidiary of the Company

An

operational creditor of TSI, Ezeego Travels & Tours Ltd. (“Ezeego”) (currently under liquidation) had filed a petition

(“Petition”) for initiation of the Corporate Insolvency Resolution Process under the Insolvency and Bankruptcy Code, 2016

(“IBC”) against TSI before the Hon’ble National Company Law Tribunal, New Delhi (“NCLT”). The Petition

alleged unpaid dues amounting to INR 219.77 million (consisting of INR 148.69 million as principal outstanding and INR 71.08 million

as interest) from TSI pursuant to a certain Bank Confirmation Agreement entered with Ezeego, whereby Ezeego was to provide discounts

on the invoices raised by TSI.

TSI

had sought dismissal of the claim before the NCLT primarily on the grounds that the alleged claim is a subject matter of reconciliation

and that the date of default falls in the period of section 10A of the IBC. On October 15, 2024, the NCLT issued an order (“Impugned

Order”) to admit the Petition.

On

October 17, 2024, TSI filed an appeal challenging the Impugned Order to the Hon’ble National Company Law Appellate Tribunal, New

Delhi (“Appellate Tribunal”). The Appellate Tribunal has stayed the operation of the Impugned Order by an order pronounced

on October 18, 2024. TSI intends to vigorously defend against the claim brought by Ezeego, but the Company is unable to predict the final

outcome of this matter.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

YATRA

ONLINE, INC. |

| |

|

|

| Date:

October 18, 2024 |

By: |

/s/

Dhruv Shringi |

| |

|

Dhruv

Shringi |

| |

|

Chief

Executive Officer |

Exhibit

99.1

SECOND

AMENDMENT TO THE COOPERATION AGREEMENT

This

Second Amendment to the Cooperation Agreement (this “Amendment”), dated Oct. 16, 2024 is by and among Yatra Online,

Inc., a Cayman Islands exempted company (the “Company”) and the entities and individuals set forth on the signatures

pages hereto (collectively with each of their respective affiliates, the “Investor Group”). The Cooperation Agreement,

dated July 17, 2022, was entered into by and among the Company and the Investor Group and was amended by the First Amendment to the Cooperation

Agreement dated August 29, 2023 (as amended, the “Cooperation Agreement”). Capitalized terms used and not otherwise

defined in this Amendment shall have the meanings ascribed to them in the Cooperation Agreement.

Pursuant

to Section 17 of the Cooperation Agreement, the Cooperation Agreement may be amended, modified or waived only by an agreement in writing

signed by the Company and the Investor Group.

In

consideration of the foregoing and the mutual covenants and agreements contained herein, and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Investor Group and the Company, intending to be legally bound hereby,

agree as follows:

| 1. | Amendment

of Section 11(a) of the Cooperation Agreement. Section 11(a) of the Cooperation Agreement

is amended and replaced in its entirety by the following language and all references to the

defined term “Standstill Period” in the Cooperation Agreement shall take account

of such amendment: |

(a)

Except as otherwise provided in this Section 11, this Agreement shall remain in full force and effect for the period (the “Standstill

Period”) commencing on the date of this Agreement and ending on the date that is the earlier to occur of (i) 30 calendar days

prior to the date of the 2025 Annual General Meeting or (ii) 60 calendar days following the resignation of the Investor Group Designee;

provided, however, that, without affecting any other right or remedy available to it, a non-breaching party may terminate this Agreement

prior to the expiration of the Standstill Period where the other party commits a material breach of any term of this Agreement and (if

such breach is remediable) fails to remedy that breach within 15 days of receipt of written notice of such determination.

| 2. | Amendment

of Exhibits to the Cooperation Agreement to add Exhibit B. The Exhibits to the Cooperation

Agreement are amended and updated as a new Exhibit B in the form attached to this

Amendment. |

| | |

| 3. | Resignation

Letter. Notwithstanding anything contained in the Cooperation Agreement to the contrary,

simultaneous with the execution and delivery of this Amendment, the Investor Group Designee,

Michael A. Kaufman, has executed and delivered to the Company an irrevocable conditional

letter of resignation from the Board in the form attached hereto as Exhibit B (Resignation

Letter (Termination)) to this Amendment. |

| | |

| 4. | No

Other Modifications. Except as provided in Sections 1, 2 and 3 of this Amendment,

no other modification of the Cooperation Agreement is intended to be effected by this Amendment

and the Cooperation Agreement, as amended by this Amendment, shall remain in full force and

effect. |

| | |

| 5. | Representations

and Warranties of the Company. The Company hereby represents and warrants that it

has full power and authority to execute, deliver and carry out the terms and provisions of

this Amendment and to consummate the transactions contemplated hereby, and that this Amendment

has been duly and validly authorized, executed and delivered by the Company, constitutes

a valid and binding obligation and agreement of the Company and is enforceable against the

Company in accordance with its terms. The Company represents and warrants that the execution

of this Amendment, the consummation of any of the transactions contemplated hereby, and the

fulfillment of the terms hereof, in each case in accordance with the terms hereof, will not

conflict with, or result in a breach or violation of the organizational documents of the

Company as currently in effect, and that the execution, delivery and performance of this

Amendment by the Company does not and will not violate or conflict with (i) any law, rule,

regulation, order, judgment or decree applicable to the Company or (ii) result in any breach

or violation of or constitute a default (or an event which with notice or lapse of time or

both could constitute such a breach, violation or default) under or pursuant to, or result

in the loss of a material benefit under, or give any right of termination, amendment, acceleration

or cancellation of, any organizational document, agreement, contract, commitment, understanding

or arrangement to which the Company is a party or by which it is bound. |

| 6. | Representations

and Warranties of the Investor Group. Each member of the Investor Group represents

and warrants that it has full power and authority to execute, deliver and carry out the terms

and provisions of this Amendment and to consummate the transactions contemplated hereby,

and that this Amendment has been duly and validly executed and delivered by it, constitutes

a valid and binding obligation and agreement of it and is enforceable against it in accordance

with its terms. Each member of the Investor Group represents and warrants that the execution

of this Amendment, the consummation of any of the transactions contemplated hereby, and the

fulfillment of the terms hereof, in each case in accordance with the terms hereof, will not

conflict with, or result in a breach or violation of any organizational documents of it as

currently in effect, and that the execution, delivery and performance of this Amendment by

it does not and will not violate or conflict with (i) any law, rule, regulation, order, judgment

or decree applicable to it or (ii) result in any breach or violation of or constitute a default

(or an event which with notice or lapse of time or both could constitute such a breach, violation

or default) under or pursuant to, or result in the loss of a material benefit under, or give

any right of termination, amendment, acceleration or cancellation of, any organizational

document, agreement, contract, commitment, understanding or arrangement to which it is a

party or by which it is bound. |

| | |

| 7. | Governing

Law; Jurisdiction. This Amendment and any dispute, claim, suit, action or proceeding

of whatever nature arising out of or in any way related to this Amendment (including any

non-contractual disputes or claims) shall be governed by, and shall be construed in accordance

with, the laws of the Cayman Islands. The courts of the Cayman Islands shall have exclusive

jurisdiction to hear and determine any claim, suit, action or proceeding, and to settle any

disputes, which may arise out of or are in any way related to or in connection with this

Amendment, and, for such purposes, each party submits to the non-exclusive jurisdiction of

such courts. |

| | |

| 8. | Representation

by Counsel. Each of the parties acknowledges that it has been represented by counsel

of its choice throughout all negotiations that have preceded the execution of this Amendment,

and that it has executed this Amendment with the advice of such counsel. Each party and its

counsel cooperated and participated in the drafting and preparation of this Amendment, and

any and all drafts relating thereto exchanged among the parties will be deemed the work product

of all of the parties and may not be construed against any party by reason of its drafting

or preparation. Accordingly, any rule of law or any legal decision that would require interpretation

of any ambiguities in this Amendment against any party that drafted or prepared it is of

no application and is hereby expressly waived by each of the parties, and any controversy

over interpretations of this Amendment will be decided without regard to events of drafting

or preparation. |

| | |

| 9. | Counterparts.

This Amendment may be executed in one or more textually identical counterparts, each of which

shall be deemed an original, but all of which together shall constitute one and the same

agreement. Signatures to this Amendment transmitted by facsimile transmission, by electronic

mail in “portable document format” (“.pdf’) form, or by any other

electronic means intended to preserve the original graphic and pictorial appearance of a

document, shall have the same effect as physical delivery of the paper document bearing the

original signature. Sections 8 and 19(3) of the Electronic Transactions Act (As Revised)

of the Cayman Islands shall not apply to this Amendment. |

| | |

| 10. | No

Third-Party Beneficiaries. A person who is not a party to this Amendment has no right

under the Contracts (Rights of Third Parties) Act (As Revised) of the Cayman Islands to enforce

any term of this Amendment. |

| | |

| 11. | Entire

Understanding; Amendment. This Amendment, the Cooperation Agreement and the Confidentiality

Agreement contain the entire agreement between the parties with respect to the subject matter

hereof and supersedes any and all prior and contemporaneous agreements, memoranda, arrangements

and understandings, both written and oral, between the parties, or any of them, with respect

to the subject matter of this Amendment. Any amendment or modification of the terms and conditions

set forth herein or any waiver of such terms and conditions must be agreed to in a writing

signed by each party. |

[Signature

page follows]

IN

WITNESS WHEREOF, each of the parties has executed and delivered this Amendment, or caused the same to be executed and delivered by its

duly authorized representative, as a deed on the date first above written.

| THE

COMPANY: |

|

| |

|

| YATRA

ONLINE, INC. |

|

| |

|

|

| By: |

/s/

Dhruv Shringi |

|

| |

Dhruv

Shringi |

|

| |

Chief

Executive Officer and Director |

|

| INVESTOR

GROUP |

|

| |

|

| MAK

CAPITAL ONE L.L.C. |

|

| |

|

|

| By: |

/s/

Michael A. Kaufman |

|

| |

Michael

A. Kaufman |

|

| |

Managing

Member |

|

| |

|

|

| MAK

CAPITAL FUND LP |

|

| |

|

| By: |

MAK

GP L.L.C., General Partner |

|

| |

|

|

| By: |

/s/

Michael A. Kaufman |

|

| |

Michael

A. Kaufman |

|

| |

Managing

Member |

|

| |

|

| MICHAEL

A. KAUFMAN |

|

SIGNATURE

PAGE TO SECOND AMENDMENT TO THE COOPERATION AGREEMENT

EXHIBIT

B

Form

of Resignation Letter (Termination)

[●],

2024

Board

of Directors Yatra Online, Inc.

Gulf

Adiba, Plot No. 272

4th

Floor, Udyog Vihar, Phase-II

Sector-20,

Gurugram-122008, Haryana, India

Re:

Resignation

Ladies

and Gentlemen:

Reference

is made to that certain Cooperation Agreement, dated July 17, 2022, as amended by the First Amendment and Second Amendment to the Cooperation

Agreement (as amended, the “Agreement”), by and among Yatra Online, Inc., a Cayman Islands exempted company (the “Company”),

and the entities and individuals set forth on the signature pages thereto. Capitalized terms used herein but not defined shall have the

meaning set forth in the Agreement.

I

hereby irrevocably offer to resign from my position as a director of the Company and from any and all committees of the Board on which

I serve, subject to acceptance of such resignation by the Board, if and as required pursuant to Section 1(g) of the Agreement.

| Very

truly yours, |

|

| |

|

|

| By: |

|

|

| Name: |

Michael

A. Kaufman |

|

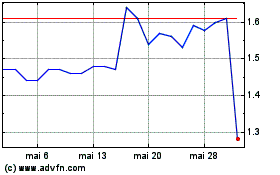

Yatra Online (NASDAQ:YTRA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

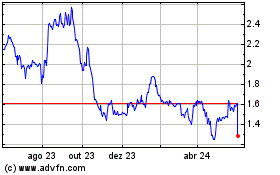

Yatra Online (NASDAQ:YTRA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024