0001856365FALSE00018563652024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 24, 2024

FINWISE BANCORP

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Utah | 001-40721 | 83-0356689 |

| (State or other jurisdiction of incorporation or organization) | (Commission file number) | (I.R.S. employer identification no.) |

| | | | | | | | | | | | | | | | | |

756 East Winchester St., Suite 100 | | 84107 |

| Murray, | Utah | | |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (801) 501-7200

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common Stock, par value $0.001 per share | FINW | The NASDAQ Stock Market LLC |

Item 2.02Results of Operations and Financial Condition.

Attached and incorporated herein by reference as Exhibit 99.1 is a copy of the press release of FinWise Bancorp (the "Company"), dated October 24, 2024, reporting the Company's financial results for the fiscal quarter ended September 30, 2024.

The information set forth under this “Item 2.02 Results of Operations and Financial Condition,” including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, FinWise Bancorp has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

DATE: October 24, 2024 | FINWISE BANCORP |

| |

| /s/ Robert Wahlman |

| Robert Wahlman |

| Chief Financial Officer and Executive Vice President |

Exhibit 99.1

FINWISE BANCORP REPORTS THIRD QUARTER 2024 RESULTS

- Net Income of $3.5 Million -

- Diluted Earnings Per Share of $0.25 -

- Loan Originations Increase to $1.4 Billion -

MURRAY, UTAH — October 24, 2024 (GLOBE NEWSWIRE) — FinWise Bancorp (NASDAQ: FINW) (“FinWise” or the “Company”), parent company of FinWise Bank (the “Bank”), today announced results for the quarter ended September 30, 2024.

Third Quarter 2024 Highlights

•Loan originations increased to $1.4 billion, compared to $1.2 billion for the quarter ended June 30, 2024, and $1.1 billion for the third quarter of the prior year

•Net interest income was $14.8 million, compared to $14.6 million for the quarter ended June 30, 2024, and $14.4 million for the third quarter of the prior year

•Net income was $3.5 million, compared to $3.2 million for the quarter ended June 30, 2024, and $4.8 million for the third quarter of the prior year

•Diluted earnings per share (“EPS”) were $0.25 for the quarter, compared to $0.24 for the quarter ended June 30, 2024, and $0.37 for the third quarter of the prior year

•Efficiency ratio1 was 67.5%, compared to 66.3% for the quarter ended June 30, 2024, and 50.4% for the third quarter of the prior year

•Annualized return on average equity was 8.3%, compared to 7.9% for the quarter ended June 30, 2024, and 12.8% for the third quarter of the prior year

•The recorded balances of nonperforming loans were $30.6 million as of September 30, 2024, compared to $27.9 million as of June 30, 2024, and $10.7 million as of September 30, 2023. The balance of nonperforming loans guaranteed by the Small Business Administration (“SBA”) was $17.8 million, $16.0 million, and $4.7 million as of September 30, 2024, June 30, 2024, and September 30, 2023, respectively

“Our results during the third quarter reflect the resiliency of our existing business as well as the actions we’ve taken to enhance long-term growth,” said Kent Landvatter, CEO of FinWise. “We saw a notable step-up in loan originations and generated solid revenue coupled with a deceleration of our expense growth. Additionally, we continued to gain traction with new strategic programs, as we announced one new lending program in the quarter, which brings the total new lending programs to three so far this year. Overall, I am pleased with the operational performance of our company and I am excited about the outlook. We will remain laser focused on continuing to grow our business and will strive to continue to deliver long-term value for all our stakeholders.”

1 See “Reconciliation of Non-GAAP to GAAP Financial Measures” for a reconciliation of this non-GAAP measure.

Selected Financial and Other Data

| | | | | | | | | | | | | | | | | |

( $ in thousands, except per share amounts and FTEs) | As of and for the Three Months Ended |

| | 9/30/2024 | | 6/30/2024 | | 9/30/2023 |

| Amount of loans originated | $ | 1,448,251 | | | $ | 1,170,904 | | | $ | 1,061,327 | |

| Net income | $ | 3,454 | | | $ | 3,180 | | | $ | 4,804 | |

Diluted EPS | $ | 0.25 | | | $ | 0.24 | | | $ | 0.37 | |

| Return on average assets | 2.1 | % | | 2.1 | % | | 3.7 | % |

| Return on average equity | 8.3 | % | | 7.9 | % | | 12.8 | % |

| Yield on loans | 14.16 | % | | 14.89 | % | | 17.40 | % |

| Cost of interest-bearing deposits | 4.85 | % | | 4.80 | % | | 4.34 | % |

| Net interest margin | 9.70 | % | | 10.31 | % | | 11.77 | % |

Efficiency ratio(1) | 67.5 | % | | 66.3 | % | | 50.4 | % |

Tangible book value per share(2) | $ | 12.90 | | | $ | 12.61 | | | $ | 12.04 | |

Tangible shareholders’ equity to tangible assets(2) | 24.9 | % | | 26.8 | % | | 27.1 | % |

Leverage ratio (Bank under CBLR) | 20.3 | % | | 20.8 | % | | 22.1 | % |

| Full-time equivalent (“FTEs”) | 194 | | 191 | | 158 |

(1) This measure is not a measure recognized under United States generally accepted accounting principles, or GAAP, and is therefore considered to be a non-GAAP financial measure. See “Reconciliation of Non-GAAP to GAAP Financial Measures” for a reconciliation of this measure to its most comparable GAAP measure. The efficiency ratio is defined as total non-interest expense divided by the sum of net interest income and non-interest income. The Company believes this measure is important as an indicator of productivity because it shows the amount of revenue generated for each dollar spent.

(2) Tangible shareholders’ equity to tangible assets is considered a non-GAAP financial measure. Tangible shareholders’ equity is defined as total shareholders’ equity less goodwill and other intangible assets. The most directly comparable GAAP financial measure is total shareholder’s equity to total assets. The Company had no goodwill or other intangible assets at the end of any period indicated. The Company has not considered loan servicing rights or loan trailing fee assets as intangible assets for purposes of this calculation. As a result, tangible shareholders’ equity is the same as total shareholders’ equity at the end of each of the periods indicated.

Net Interest Income

Net interest income was $14.8 million for the third quarter of 2024, compared to $14.6 million for the prior quarter and $14.4 million for the prior year period. The increase from the prior quarter was primarily due to average balance increases in the loans held-for-sale and loans held for investment portfolios and was partially offset by yield decreases in both the loans held-for-sale and loans held for investment portfolios. The increase from the prior year period was primarily due to increases in the average balances of the Company’s loans held-for-sale and loans held for investment portfolios and was partially offset by yield decreases on those same portfolios as well as increased rates and volumes on the certificate of deposit balances. Third quarter 2024 net interest income includes a $0.5 million one-time decrease for accrued interest not previously reversed at the time loans were deemed nonperforming.

Loan originations totaled $1.4 billion for the third quarter of 2024, compared to $1.2 billion for the prior quarter and $1.1 billion for the prior year period. Originations through the first three weeks of October 2024 are tracking at a pace modestly lower than third quarter 2024 originations, which included an expected seasonal increase from the Company’s student loan strategic program.

Net interest margin for the third quarter of 2024 was 9.70%, compared to 10.31% for the prior quarter and 11.77% for the prior year period. The decrease in net interest margin from the prior quarter is primarily attributable to the Company’s strategy to reduce the average credit risk in the loan portfolio by increasing its investment in higher quality but lower yielding loans and the previously described one-time decrease in net interest income. The net interest margin decrease from the prior year period resulted primarily from the Company’s strategy to reduce average credit risk in the portfolio combined with the increased cost of funds as the Bank competed in the national market for funds to support the asset growth.

Provision for Credit Losses

The Company’s provision for credit losses was $2.2 million for the third quarter of 2024, compared to $2.4 million for the prior quarter and $3.1 million for the prior year period. The provision for credit losses decreased when compared to the prior quarter due primarily to the Company’s periodic assessment of the qualitative factors resulting in the removal of the qualitative factor related to COVID, partially offset by an increase in other qualitative factors and slightly higher charge-offs. The decrease from the prior year period was primarily related to qualitative factors which had been adjusted upward in the third quarter of 2023 due to an increase in special mention, non-accrual and nonperforming assets primarily related to the SBA portfolio.

Non-interest Income

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| ($ in thousands) | 9/30/2024 | | 6/30/2024 | | 9/30/2023 |

| Non-interest income | | | | | |

| Strategic Program fees | $ | 4,862 | | | $ | 4,035 | | | $ | 3,945 | |

| Gain on sale of loans | 393 | | | 356 | | | 357 | |

| SBA loan servicing fees and servicing asset amortization | 87 | | | 204 | | | (138) | |

| Change in fair value on investment in BFG | (100) | | | (200) | | | (500) | |

| Other miscellaneous income | 812 | | | 771 | | | 1,228 | |

| Total non-interest income | $ | 6,054 | | | $ | 5,166 | | | $ | 4,892 | |

The increase in non-interest income from the prior quarter was primarily due to an increase in originations related to the Company’s Strategic Programs. The increase in non-interest income from the prior year period was primarily due to increased fees associated with originations of Strategic Program loans, partially offset by a decrease in other miscellaneous income related to a gain on the resolution of a forbearance agreement in the Company’s SBA lending program recognized in the third quarter of 2023.

Non-interest Expense

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| ($ in thousands) | 9/30/2024 | | 6/30/2024 | | 9/30/2023 |

| Non-interest expense | | | | | |

| Salaries and employee benefits | $ | 9,659 | | | $ | 8,609 | | | $ | 6,416 | |

| Professional services | 1,331 | | | 1,282 | | | 750 | |

| Occupancy and equipment expenses | 1,046 | | | 1,121 | | | 958 | |

| | | | | |

| Other operating expenses | 2,013 | | | 2,206 | | | 1,609 | |

| Total non-interest expense | $ | 14,048 | | | $ | 13,218 | | | $ | 9,733 | |

The increase in non-interest expense from the prior quarter was primarily due to an increase in salaries and employee benefits, including a catch-up in bonus accrual expense of $0.4 million to reflect updated performance award estimates, a full quarter of amortization of the second quarter deferred compensation awards, and a full quarter of compensation and benefits for employees hired during the second quarter. The increase in non-interest expense from the prior year period was primarily due to an increase in salaries and employee benefits due mainly to increasing headcount and increases in professional services and other operating expenses driven by increased spending to support the growth in the Company’s business infrastructure.

Reflecting the expenses incurred to develop the Company’s business infrastructure, the Company’s efficiency ratio was 67.5% for the third quarter of 2024, compared to 66.3% for the prior quarter and 50.4% for the prior year period. As a result of the infrastructure build, the Company anticipates the efficiency ratio will remain elevated until the Company begins to realize the revenues associated with the new programs being developed.

Tax Rate

The Company’s effective tax rate was 25.1% for the third quarter of 2024, compared to 23.9% for the prior quarter and 26.1% for the prior year period. The increase from the prior quarter was due primarily to more favorable resolution of historical state tax matters during the second quarter of 2024. The decrease from the prior year period was primarily due to a reduction in permanent differences impacting income tax expense.

Net Income

Net income was $3.5 million for the third quarter of 2024, compared to $3.2 million for the prior quarter and $4.8 million for the prior year period. The changes in net income for the three months ended September 30, 2024 compared to the prior quarter and prior year period are the result of the factors discussed above.

Balance Sheet

The Company’s total assets were $683.0 million as of September 30, 2024, an increase from $617.8 million as of June 30, 2024 and $555.1 million as of September 30, 2023. The increase in total assets from June 30, 2024 was primarily due to an increase of $30.5 million in investment securities available-for-sale and continued growth in the Company’s loans held for investment, net, and loans held-for-sale portfolios of $19.6 million and $17.5 million, respectively. The increase in total assets compared to September 30, 2023 was primarily due to increases in the Company’s loans held for investment, net, and loans held-for-sale portfolios of $93.9 million and $38.3 million, respectively, as well as an increase in investment securities available-for-sale of $30.5 million, partially offset by a decrease of $48.3 million in interest-bearing cash deposits.

The following table shows the gross loans held for investment balances as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 9/30/2024 | | 6/30/2024 | | 9/30/2023 |

($ in thousands) | Amount | | % of total loans | | Amount | | % of total loans | | Amount | | % of total loans |

| SBA | $ | 251,439 | | | 57.9 | % | | $ | 249,281 | | | 60.2 | % | | $ | 219,305 | | | 64.9 | % |

| Commercial leases | 64,277 | | | 14.8 | % | | 56,529 | | | 13.7 | % | | 31,466 | | | 9.3 | % |

| Commercial, non-real estate | 3,025 | | | 0.7 | % | | 1,999 | | | 0.5 | % | | 2,578 | | | 0.8 | % |

| Residential real estate | 41,391 | | | 9.5 | % | | 42,317 | | | 10.2 | % | | 34,891 | | | 10.3 | % |

| Strategic Program loans | 19,409 | | | 4.5 | % | | 17,861 | | | 4.3 | % | | 20,040 | | | 5.9 | % |

| Commercial real estate: | | | | | | | | | | | |

| Owner occupied | 32,480 | | | 7.5 | % | | 28,340 | | | 6.8 | % | | 17,092 | | | 5.1 | % |

| Non-owner occupied | 2,736 | | | 0.7 | % | | 2,134 | | | 0.5 | % | | 4,588 | | | 1.4 | % |

| Consumer | 19,206 | | | 4.4 | % | | 15,880 | | | 3.8 | % | | 7,675 | | | 2.3 | % |

Total period end loans | $ | 433,963 | | | 100.0 | % | | $ | 414,341 | | | 100.0 | % | | $ | 337,635 | | | 100.0 | % |

Note: SBA loans as of September 30, 2024, June 30, 2024 and September 30, 2023 include $156.3 million, $147.8 million and $112.5 million, respectively, of SBA 7(a) loan balances that are guaranteed by the SBA. The held for investment balance on Strategic Program loans with annual interest rates below 36% as of September 30, 2024, June 30, 2024 and September 30, 2023 was $3.2 million, $2.6 million and $4.4 million, respectively.

Total gross loans held for investment as of September 30, 2024 were $434.0 million, an increase from $414.3 million and $337.6 million as of June 30, 2024 and September 30, 2023, respectively. The increase compared to June 30, 2024 was primarily due to increases in the commercial leases, owner occupied commercial real estate, consumer and SBA loan portfolios. The increase compared to September 30, 2023 was primarily due to increases in the commercial leases, SBA, commercial real estate owner occupied, and consumer loan portfolios.

The following table shows the Company’s deposit composition as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| 9/30/2024 | | 6/30/2024 | | 9/30/2023 |

($ in thousands) | Amount | | Percent | | Amount | | Percent | | Amount | | Percent |

Noninterest-bearing demand deposits | $ | 142,785 | | | 29.2 | % | | $ | 107,083 | | | 24.9 | % | | $ | 94,268 | | | 24.4 | % |

Interest-bearing deposits: | | | | | | | | | | | |

Demand | 58,984 | | | 12.1 | % | | 48,319 | | | 11.3 | % | | 87,753 | | | 22.7 | % |

Savings | 9,592 | | | 1.9 | % | | 9,746 | | | 2.3 | % | | 8,738 | | | 2.3 | % |

Money market | 15,027 | | | 3.1 | % | | 9,788 | | | 2.3 | % | | 15,450 | | | 3.9 | % |

Time certificates of deposit | 262,271 | | | 53.7 | % | | 254,259 | | | 59.2 | % | | 180,544 | | | 46.7 | % |

Total period end deposits | $ | 488,659 | | | 100.0 | % | | $ | 429,195 | | | 100.0 | % | | $ | 386,753 | | | 100.0 | % |

The increase in total deposits from June 30, 2024 was driven primarily by increases in noninterest-bearing demand deposits and interest-bearing demand deposits and brokered time certificates of deposits. The increase in total deposits from September 30, 2023 was driven primarily by an increase in brokered time certificate of deposits and noninterest-bearing demand deposits. As of September 30, 2024, 35.4% of deposits at the Bank were uninsured, compared to 31.3% as of June 30, 2024, and 31.7% as of September 30, 2023. Uninsured deposits at the Bank as of September 30, 2024 includes 8.5% of total deposits contractually required to be maintained at the Bank pursuant to the Company’s Strategic Program agreements and an additional 9.4% of total deposits associated with the parent holding company or the Bank.

Total shareholders’ equity as of September 30, 2024 increased $4.6 million to $170.4 million from $165.8 million at June 30, 2024. Compared to September 30, 2023, total shareholders’ equity increased by $20.0 million from $150.4 million. The increase from June 30, 2024 was primarily due to the Company’s net income. The increase from September 30, 2023 was primarily due to the Company’s net income as well as the additional capital issued in exchange for the Company’s increased ownership in BFG, partially offset by the repurchase of common stock under the Company’s share repurchase program.

Bank Regulatory Capital Ratios

The following table presents the leverage ratios for the Bank as of the dates indicated as determined under the Community Bank Leverage Ratio Framework of the Federal Deposit Insurance Corporation:

| | | | | | | | | | | | | | | | | | | | | | | |

| As of | | |

Capital Ratios | 9/30/2024 | | 6/30/2024 | | 9/30/2023 | | Well-Capitalized Requirement |

Leverage ratio | 20.3% | | 20.8% | | 22.1% | | 9.0% |

The leverage ratio decrease from the prior quarter resulted primarily from assets growing at a faster pace than earnings generated by operations. The leverage ratio decrease from the prior year period resulted primarily from the growth in the loan portfolio. The Bank’s capital levels remain significantly above well-capitalized guidelines as of September 30, 2024.

Share Repurchase Program

Since the share repurchase program’s inception in March 2024 through September 30, 2024, the Company has repurchased a total of 44,608 shares for $0.5 million. There were no shares repurchased during the third quarter of 2024.

Asset Quality

The recorded balances of nonperforming loans were $30.6 million, or 7.1% of total loans held for investment, as of September 30, 2024, compared to $27.9 million, or 6.5% of total loans held for investment, as of June 30, 2024 and $10.7 million, or 3.2% of total loans held for investment, as of September 30, 2023. The balances of nonperforming loans guaranteed by the SBA were $17.8 million, $16.0 million, and $4.7 million as of September 30, 2024, June 30, 2024 and September 30, 2023, respectively. The increase in nonperforming loans from the prior quarter was primarily attributable to two SBA 7(a) loans totaling $5.7 million classified as nonperforming during the third quarter of 2024 of which $4.4 million was guaranteed by the SBA. The increase in nonperforming loans from the prior year period was primarily attributable to loans in the SBA 7(a) loan portfolio being classified as non-accrual mainly due to the negative impact of elevated interest rates on the Company’s small business borrowers. The Company’s allowance for credit losses to total loans held for investment was 2.9% as of September 30, 2024 compared to 3.2% as of June 30, 2024 and 3.8% as of September 30, 2023. The decrease in the ratio from the prior quarter and prior year periods was primarily due to the Company’s increased retention of most of the originated guaranteed portions in its SBA 7(a) loan program as well as removal of the qualitative factor related to COVID and its subsequent implications due to improving economic conditions.

The Company’s net charge-offs were $2.4 million, $1.9 million and $2.2 million for the three months ended September 30, 2024, June 30, 2024, and September 30, 2023, respectively. The increase from the prior quarter is primarily due to increased net charge-offs in the Strategic Program loans portfolio. The increase from the prior year period is primarily due to resolution of a large small business recovery that reduced net charge-offs in the third quarter of 2023.

The following table presents a summary of changes in the allowance for credit losses and asset quality ratios for the periods indicated:

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

($ in thousands) | 9/30/2024 | | 6/30/2024 | | 9/30/2023 |

Allowance for credit losses: | | | | | |

Beginning balance | $ | 13,127 | | | $ | 12,632 | | | $ | 12,321 | |

| | | | | |

| | | | | |

Provision for credit losses(1) | 1,944 | | | 2,393 | | | 2,910 | |

Charge offs | | | | | |

| | | | | |

| Residential real estate | (27) | | | — | | | — | |

| | | | | |

| Commercial real estate | | | | | |

| Owner occupied | (103) | | | — | | | (31) | |

| Non-owner occupied | (221) | | | — | | | — | |

| Commercial and industrial | (96) | | | (184) | | | (107) | |

| Consumer | (15) | | | (18) | | | (28) | |

| Lease financing receivables | (113) | | | (69) | | | — | |

| Strategic Program loans | (2,360) | | | (1,962) | | | (2,748) | |

Recoveries | | | | | |

| | | | | |

| Residential real estate | 3 | | | 3 | | | 3 | |

| | | | | |

| Commercial real estate | | | | | |

| Owner occupied | 219 | | | — | | | 389 | |

| | | | | |

| Commercial and industrial | 2 | | | 15 | | | 18 | |

| Consumer | 4 | | | 1 | | | 2 | |

| Lease financing receivables | 8 | | | 7 | | | — | |

| Strategic Program loans | 289 | | | 309 | | | 257 | |

Ending Balance | $ | 12,661 | | | $ | 13,127 | | | $ | 12,986 | |

| | | | | |

Asset Quality Ratios | As of and For the Three Months Ended |

($ in thousands, annualized ratios) | 9/30/2024 | | 6/30/2024 | | 9/30/2023 |

Nonperforming loans(2) | $ | 30,648 | | | $ | 27,907 | | | $ | 10,703 | |

Nonperforming loans to total loans held for investment | 7.1 | % | | 6.5 | % | | 3.2 | % |

Net charge offs to average loans held for investment | 2.3 | % | | 1.9 | % | | 2.8 | % |

Allowance for credit losses to loans held for investment | 2.9 | % | | 3.2 | % | | 3.8 | % |

Net charge offs | $ | 2,409 | | | $ | 1,898 | | | $ | 2,245 | |

(1) Excludes the provision for unfunded commitments.(2) Nonperforming loans as of September 30, 2024, June 30, 2024, and September 30, 2023 include $17.8 million, $16.0 million, and $4.7 million, respectively, of SBA 7(a) loan balances that are guaranteed by the SBA.

Webcast and Conference Call Information

FinWise will host a conference call today at 5:30 PM ET to discuss its financial results for the third quarter of 2024. A simultaneous audio webcast of the conference call will be available at https://investors.finwisebancorp.com/.

The dial-in number for the conference call is (877) 423-9813 (toll-free) or (201) 689-8573 (international). The conference ID is 13748730. Please dial the number 10 minutes prior to the scheduled start time.

A webcast replay of the call will be available at investors.finwisebancorp.com for six months following the call.

Website Information

The Company intends to use its website, www.finwisebancorp.com, as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. Such disclosures will be included in the Company’s website’s Investor Relations section. Accordingly, investors should monitor the Investor Relations portion of the Company’s website, in addition to following its press releases, filings with the Securities and Exchange Commission (“SEC”), public conference calls, and webcasts. To subscribe to the Company’s e-mail alert service, please click the “Email Alerts” link in the Investor Relations section of its website and submit your email address. The information contained in, or that may be accessed through, the Company’s website is not incorporated by reference into or a part of this document or any other report or document it files with or furnishes to the SEC, and any references to the Company’s website are intended to be inactive textual references only.

About FinWise Bancorp

FinWise Bancorp is a Utah bank holding company headquartered in Murray, Utah which wholly owns FinWise Bank, a Utah chartered state bank, and FinWise Investment LLC (together “FinWise”). FinWise provides Banking and Payments solutions to fintech brands. 2024 is a key expansion year for the company as it expands and diversifies its business model by launching and incorporating Payments Hub and BIN Sponsorship offerings into its current platforms. FinWise’s existing Strategic Program Lending business, conducted through scalable API-driven infrastructure, powers deposit, lending and payments programs for leading fintech brands. In addition, FinWise manages other Lending programs such as SBA 7(a), Owner Occupied Real Estate, and Leasing, which provides flexibility for disciplined balance sheet growth. Through its compliance oversight and risk management-first culture, the Company is well positioned to guide fintechs through a rigorous process to facilitate regulatory compliance. For more information about FinWise visit https://investors.finwisebancorp.com.

Contacts

investors@finwisebank.com

media@finwisebank.com

"Safe Harbor" Statement Under the Private Securities Litigation Reform Act of 1995

This release contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect the Company’s current views with respect to, among other things, future events and its financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “might,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “projection,” “forecast,” “budget,” “goal,” “target,” “would,” “aim” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about the Company’s industry and management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond the Company’s control. The inclusion of these forward-looking statements should not be regarded as a representation by the Company or any other person that such expectations, estimates and projections will be achieved. Accordingly, the Company cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

There are or will be important factors that could cause the Company’s actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: (a) the success of the financial technology industry, as well as the continued evolution of the regulation of this industry; (b) the ability of the Company’s Strategic Program or Fintech Banking and Payments Solutions service providers to comply with regulatory regimes, and the Company’s ability to adequately oversee and monitor its Strategic Program and Fintech Banking and Payments Solutions service providers; (c) the Company’s ability to maintain and grow its relationships with its service providers; (d) changes in the laws, rules, regulations, interpretations or policies relating to financial institutions, accounting, tax, trade, monetary and fiscal matters, including the application of interest rate caps or maximums; (e) the Company’s ability to keep pace with rapid technological changes in the industry or implement new technology effectively; (f) system failure or cybersecurity breaches of the Company’s network security; (g) potential exposure to fraud, negligence, computer theft and cyber-crime and other disruptions in the Company’s computer systems relating to its development and use of new technology platforms; (h) the Company’s reliance on third-party service providers for core systems support, informational website hosting, internet services, online account opening and other processing services; (i) general economic and business conditions, either nationally or in the Company’s market areas; (j) increased national or regional competition in the financial services industry; (k) the Company’s ability to measure and manage its credit risk effectively and the potential deterioration of the business and economic conditions in the Company’s primary market areas; (l) the adequacy of the Company’s risk management framework; (m) the adequacy of the Company’s allowance for credit losses (“ACL”); (n) the financial soundness of other financial institutions; (o) new lines of business or new products and services; (p) changes in Small Business Administration (“SBA”) rules, regulations and loan products, including specifically the Section 7(a) program or changes to the status of the Bank as an SBA Preferred Lender; (q) the value of collateral securing the Company’s loans; (r) the Company’s levels of nonperforming assets; (s) losses from loan defaults; (t) the Company’s ability to protect its intellectual property and the risks it faces with respect to claims and litigation initiated against the Company; (u) the Company’s ability to implement its growth strategy; (v) the Company’s ability to launch new products or services successfully; (w) the concentration of the Company’s lending and depositor relationships through Strategic Programs in the financial technology industry generally; (x) interest-rate and liquidity risks; (y) the effectiveness of the Company’s internal control over financial reporting and its ability to remediate any future material weakness in its internal control over financial reporting; (z) dependence on the Company’s management team and changes in management composition; (aa) the sufficiency of the Company’s capital; (bb) compliance with laws and

regulations, supervisory actions, the Dodd-Frank Act, capital requirements, the Bank Secrecy Act and other anti-money laundering laws, predatory lending laws, and other statutes and regulations; (cc) results of examinations of the Company by its regulators; (dd) the Company’s involvement from time to time in legal proceedings; (ee) natural disasters and adverse weather, acts of terrorism, pandemics, an outbreak of hostilities or other international or domestic calamities, and other matters beyond the Company’s control; (ff) future equity and debt issuances; (gg) that the anticipated benefits of new lines of business that the Company may enter or investments or acquisitions the Company may make are not realized within the expected time frame or at all as a result of such things as the strength or weakness of the economy and competitive factors in the areas where the Company and such other businesses operate; and (hh) other factors listed from time to time in the Company’s filings with the Securities and Exchange Commission, including, without limitation, its Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent reports on Form 10-Q and Form 8-K.

The timing and amount of purchases under the Company’s share repurchase program will be determined by the Share Repurchase Committee based upon market conditions and other factors. Purchases may be made pursuant to a program adopted under Rule 10b5-1 under the Securities Exchange Act of 1934, as amended. The program does not require the Company to purchase any specific number or amount of shares and may be suspended or reinstated at any time in the Company’s discretion and without notice.

Any forward-looking statement speaks only as of the date of this release, and the Company does not undertake any obligation to publicly update or review any forward-looking statement, whether because of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence. In addition, the Company cannot assess the impact of each risk and uncertainty on its business or the extent to which any risk or uncertainty, or combination of risks and uncertainties, may cause actual results to differ materially from those contained in any forward-looking statements.

FINWISE BANCORP

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

($ in thousands; Unaudited)

| | | | | | | | | | | | | | | | | |

| As of |

| | 9/30/2024 | | 6/30/2024 | | 9/30/2023 |

ASSETS | | | | | |

| Cash and cash equivalents | | | | | |

Cash and due from banks | $ | 7,705 | | | $ | 5,158 | | | $ | 379 | |

Interest-bearing deposits | 78,063 | | 83,851 | | 126,392 |

Total cash and cash equivalents | 85,768 | | 89,009 | | 126,771 |

Investment securities available-for-sale, at fair value | 30,472 | | — | | — |

Investment securities held-to-maturity, at cost | 13,270 | | 13,942 | | 15,840 |

Investment in Federal Home Loan Bank (“FHLB”) stock, at cost | 349 | | 349 | | 476 |

| Strategic Program loans held-for-sale, at lower of cost or fair value | 84,000 | | 66,542 | | 45,710 |

Loans held for investment, net | 418,065 | | 398,512 | | 324,197 |

Premises and equipment, net | 17,099 | | 15,665 | | 14,181 |

Accrued interest receivable | 3,098 | | 3,390 | | 2,711 |

| | | | | |

SBA servicing asset, net | 3,261 | | 3,689 | | 4,398 |

Investment in Business Funding Group (“BFG”), at fair value | 7,900 | | 8,000 | | 4,000 |

Operating lease right-of-use (“ROU”) assets | 3,735 | | 3,913 | | 4,481 |

| Income tax receivable, net | 3,317 | | 2,103 | | 1,134 |

Other assets | 12,697 | | 12,706 | | 11,157 |

Total assets | $ | 683,031 | | | $ | 617,820 | | | $ | 555,056 | |

| | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | |

Liabilities | | | | | |

Deposits | | | | | |

Noninterest-bearing | $ | 142,785 | | | $ | 107,083 | | | $ | 94,268 | |

Interest-bearing | 345,874 | | 322,112 | | 292,485 |

Total deposits | 488,659 | | 429,195 | | 386,753 |

Accrued interest payable | 647 | | 601 | | 581 |

| | | | | |

Deferred taxes, net | 1,036 | | 1,154 | | 234 |

PPP Liquidity Facility | 106 | | 127 | | 221 |

Operating lease liabilities | 5,542 | | 5,788 | | 6,545 |

Other liabilities | 16,671 | | 15,159 | | 10,320 |

Total liabilities | 512,661 | | 452,024 | | 404,654 |

| | | | | |

Shareholders’ equity | | | | | |

Common stock | 13 | | 13 | | 12 |

Additional paid-in-capital | 56,214 | | 55,441 | | 50,703 |

Retained earnings | 113,801 | | 110,342 | | 99,687 |

Accumulated other comprehensive income, net of tax | 342 | | — | | — |

Total shareholders’ equity | 170,370 | | 165,796 | | 150,402 |

Total liabilities and shareholders’ equity | $ | 683,031 | | | $ | 617,820 | | | $ | 555,056 | |

FINWISE BANCORP

CONSOLIDATED STATEMENTS OF INCOME

($ in thousands, except per share amounts; Unaudited)

| | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | 9/30/2024 | | 6/30/2024 | | 9/30/2023 |

Interest income | | | | | |

Interest and fees on loans | $ | 17,590 | | | $ | 16,881 | | | $ | 15,555 | |

Interest on securities | 298 | | | 97 | | | 88 | |

Other interest income | 1,036 | | | 1,444 | | | 1,569 | |

Total interest income | 18,924 | | | 18,422 | | | 17,212 | |

| | | | | | |

Interest expense | | | | | |

Interest on deposits | 4,161 | | | 3,807 | | | 2,801 | |

| | | | | |

Total interest expense | 4,161 | | | 3,807 | | | 2,801 | |

Net interest income | 14,763 | | | 14,615 | | | 14,411 | |

| | | | | | |

Provision for credit losses | 2,157 | | | 2,385 | | | 3,070 | |

Net interest income after provision for credit losses | 12,606 | | | 12,230 | | | 11,341 | |

| | | | | | |

Non-interest income | | | | | |

Strategic Program fees | 4,862 | | | 4,035 | | | 3,945 | |

Gain on sale of loans, net | 393 | | | 356 | | | 357 | |

SBA loan servicing fees, net | 87 | | | 204 | | | (138) | |

Change in fair value on investment in BFG | (100) | | | (200) | | | (500) | |

Other miscellaneous income | 812 | | | 771 | | | 1,228 | |

Total non-interest income | 6,054 | | | 5,166 | | | 4,892 | |

| | | | | | |

Non-interest expense | | | | | |

Salaries and employee benefits | 9,659 | | | 8,609 | | | 6,416 | |

Professional services | 1,331 | | | 1,282 | | | 750 | |

Occupancy and equipment expenses | 1,046 | | | 1,121 | | | 958 | |

| | | | | |

Other operating expenses | 2,013 | | | 2,206 | | | 1,609 | |

Total non-interest expense | 14,049 | | | 13,218 | | | 9,733 | |

Income before income taxes | 4,611 | | | 4,178 | | | 6,500 | |

| | | | | | |

Provision for income taxes | 1,157 | | | 998 | | | 1,696 | |

Net income | $ | 3,454 | | | $ | 3,180 | | | $ | 4,804 | |

| | | | | |

Earnings per share, basic | $ | 0.26 | | | $ | 0.25 | | | $ | 0.38 | |

Earnings per share, diluted | $ | 0.25 | | | $ | 0.24 | | | $ | 0.37 | |

| | | | | |

Weighted average shares outstanding, basic | 12,658,557 | | 12,627,800 | | 12,387,392 |

Weighted average shares outstanding, diluted | 13,257,835 | | 13,109,708 | | 12,868,207 |

Shares outstanding at end of period | 13,211,160 | | 13,143,560 | | 12,493,565 |

FINWISE BANCORP

AVERAGE BALANCES, YIELDS, AND RATES

($ in thousands; Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| 9/30/2024 | | 6/30/2024 | | 9/30/2023 |

| Average Balance | | Interest | | Average Yield/Rate | | Average Balance | | Interest | | Average Yield/Rate | | Average Balance | | Interest | | Average Yield/Rate |

Interest earning assets: | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | $ | 78,967 | | | $ | 1,036 | | | 5.22 | % | | $ | 105,563 | | | $ | 1,444 | | | 5.50 | % | | $ | 116,179 | | | $ | 1,569 | | | 5.36 | % |

Investment securities | 33,615 | | 298 | | 3.53 | % | | 14,795 | | 97 | | 2.65 | % | | 14,958 | | 88 | | 2.34 | % |

Strategic Program loans held-for-sale | 70,123 | | 4,913 | | 27.87 | % | | 49,000 | | 4,020 | | 33.00 | % | | 38,410 | | 3,823 | | 39.49 | % |

Loans held for investment | 422,820 | | 12,677 | | 11.93 | % | | 400,930 | | 12,861 | | 12.90 | % | | 316,220 | | 11,732 | | 14.72 | % |

Total interest earning assets | 605,525 | | 18,924 | | 12.43 | % | | 570,288 | | 18,422 | | 12.99 | % | | 485,767 | | 17,212 | | 14.06 | % |

Noninterest-earning assets | 56,290 | | | | | | 46,531 | | | | | | 27,240 | | | | |

Total assets | $ | 661,815 | | | | | | | $ | 616,819 | | | | | | | $ | 513,007 | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | |

Demand | $ | 55,562 | | | $ | 547 | | | 3.92 | % | | $ | 47,900 | | | $ | 441 | | | 3.70 | % | | $ | 48,303 | | | $ | 483 | | | 3.96 | % |

Savings | 9,538 | | 18 | | 0.76 | % | | 10,270 | | 19 | | 0.75 | % | | 9,079 | | 17 | | 0.74 | % |

Money market accounts | 13,590 | | 127 | | 3.72 | % | | 9,565 | | 112 | | 4.71 | % | | 15,140 | | 142 | | 3.73 | % |

Certificates of deposit | 262,537 | | 3,469 | | 5.26 | % | | 251,142 | | 3,235 | | 5.18 | % | | 183,273 | | 2,159 | | 4.67 | % |

Total deposits | 341,227 | | 4,161 | | 4.85 | % | | 318,877 | | 3,807 | | 4.80 | % | | 255,795 | | 2,801 | | 4.34 | % |

Other borrowings | 112 | | — | | 0.35 | % | | 142 | | — | | 0.35 | % | | 235 | | — | | 0.35 | % |

Total interest-bearing liabilities | 341,339 | | 4,161 | | 4.85 | % | | 319,019 | | 3,807 | | 4.80 | % | | 256,030 | | 2,801 | | 4.34 | % |

Noninterest-bearing deposits | 127,561 | | | | | | 108,520 | | | | | | 92,077 | | | | |

Noninterest-bearing liabilities | 25,536 | | | | | | 27,700 | | | | | | 16,299 | | | | |

Shareholders’ equity | 167,379 | | | | | | 161,580 | | | | | | 148,601 | | | | |

Total liabilities and shareholders’ equity | $ | 661,815 | | | | | | | $ | 616,819 | | | | | | | $ | 513,007 | | | | | |

Net interest income and interest rate spread | | | $ | 14,763 | | | 7.58 | % | | | | $ | 14,615 | | | 8.19 | % | | | | $ | 14,411 | | | 9.72 | % |

Net interest margin | | | | | 9.70 | % | | | | | | 10.31 | % | | | | | | 11.77 | % |

Ratio of average interest-earning assets to average interest- bearing liabilities | | | | | 177.40 | % | | | | | | 178.76 | % | | | | | | 189.73 | % |

Reconciliation of Non-GAAP to GAAP Financial Measures

| | | | | | | | | | | | | | | | | |

Efficiency ratio | Three Months Ended |

| | 9/30/2024 | | 6/30/2024 | | 9/30/2023 |

($ in thousands) | | | | | |

| Non-interest expense | $ | 14,049 | | | $ | 13,218 | | | $ | 9,733 | |

| | | | | |

| Net interest income | 14,763 | | | 14,615 | | | 14,411 | |

| Total non-interest income | 6,054 | | | 5,166 | | | 4,892 | |

Adjusted operating revenue | $ | 20,817 | | | $ | 19,781 | | | $ | 19,303 | |

| Efficiency ratio | 67.5 | % | | 66.8 | % | | 50.4 | % |

v3.24.3

Cover

|

Oct. 24, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 24, 2024

|

| Entity Registrant Name |

FINWISE BANCORP

|

| Entity Incorporation, State or Country Code |

UT

|

| Entity File Number |

001-40721

|

| Entity Tax Identification Number |

83-0356689

|

| Entity Address, Address Line One |

756 East Winchester St., Suite 100

|

| Entity Address, State or Province |

UT

|

| Entity Address, City or Town |

Murray,

|

| Entity Address, Postal Zip Code |

84107

|

| City Area Code |

801

|

| Local Phone Number |

501-7200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

FINW

|

| Security Exchange Name |

NASDAQ

|

| Entity Central Index Key |

0001856365

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

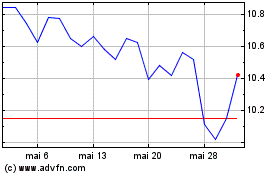

FinWise Bancorp (NASDAQ:FINW)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

FinWise Bancorp (NASDAQ:FINW)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025