UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-33107

CANADIAN SOLAR INC.

545 Speedvale Avenue West, Guelph,

Ontario, Canada N1K 1E6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

CANADIAN SOLAR INC.

Form 6-K

TABLE OF CONTENTS

Explanatory Note

CSI Solar Co., Ltd. (“CSI Solar”), a majority-owned

subsidiary of Canadian Solar Inc. (“Canadian Solar”) with its shares listed on the Shanghai Stock Exchange (“SSE”)’s

Sci-Tech Innovation Board, has filed with the SSE its report regarding the third quarter of 2024 (the “2024 Third Quarter Report”).

Currently, Canadian Solar owns approximately 63% of CSI Solar.

Exhibit 99.1 provides an English translation of the 2024 Third

Quarter Report of CSI Solar.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CANADIAN SOLAR INC. |

| |

|

| |

By: |

/s/ Shawn (Xiaohua) Qu |

| |

Name: |

Shawn (Xiaohua) Qu |

| |

Title: |

Chairman and Chief Executive Officer |

Date: October 29, 2024

EXHIBIT INDEX

Exhibit 99.1 — CSI Solar Co., Ltd. 2024 Third Quarter Report

Exhibit 99.1

| SSE Stock Code: 688472 |

SSE Stock Abbreviation: CSI Solar |

|

CSI Solar Co., Ltd.

2024 Third Quarter Report

| The board of directors of CSI Solar Co., Ltd. (the “Company”) and all members of the board of directors guarantee that the information of this public announcement contains no misrepresentations, misleading statements or material omissions, and they are legally responsible for the truthfulness, accuracy and completeness of the information contained herein. |

Important Notice:

The board of directors, the supervisory committee, the directors, supervisors, and senior management members of the Company guarantee that the information contained in this quarterly report is true, accurate, and complete without any false information, misleading statements or material omissions, and severally and jointly accept legal responsibility for the above.

The person in charge of the Company, person in charge of accounting function, and the person in charge of accounting institution (head of accounting department) guarantee that the financial statements contained in this quarterly report are true, accurate, and complete.

Whether the financial statements for the third quarter have been audited:

¨ Yes

x No

For the first three quarters of 2024, the Company achieved operating revenue of 34.18 billion yuan and net profit attributable to shareholders

of the Company of 1.95 billion yuan. Among these, operating revenue for the third quarter of 2024 was 12.22 billion yuan, and net profit

attributable to shareholders of the Company for the third quarter of 2024 was 0.72 billion yuan, up 8.3% quarter-over-quarter (“qoq”),

marking three consecutive quarters of qoq growth. Thanks to its first-mover advantage in utility-scale energy storage, latecomer advantage

in advanced manufacturing capacity, and top-tier international network and culture, the Company has successfully maintained its profit

levels and sustained positive operating cash flow. The Company generated net cash flow from operating activities of approximately 2.5

billion yuan for the first three quarters of 2024.

Module business: From January to September 2024, the Company

achieved module shipments of 22.9 GW, representing a slight year-over-year (“yoy”) growth. Among these, module shipment

for the third quarter of 2024 was 8.4 GW, up 2.4% qoq. Regarding sales strategy, the Company continues to adhere to its

“profit-first” principle, ensuring the profitability of its module business. The Company’s shipment to the premium

North American market continued to increase, accounting for over 30% of module shipments in the third quarter of 2024.

Energy storage business: From January to September 2024, the

Company’s utility-scale battery energy storage shipments was 4.4 GWh, with 1.8 GWh shipped in the third quarter of

2024—a record high for a single quarter. The energy storage segment achieved rapid growth in net profit compared to the second quarter of 2024, making a

significant contribution to the Company’s overall performance in the third quarter.

For the past 23 years, the Company has been

deeply committed to the photovoltaic industry, prioritizing technological innovation and R&D. Backed by a skilled research team

and robust development capabilities, the Company is a global leader in renewable energy technology. It places strong emphasis on

intellectual property and is dedicated to driving innovation independently. As of September 30, 2024, the Company had applied for

4,761 patents and maintained 2,242 valid major patents, an industry-leading quantity.

1. Key Financial Data

(1) Key Accounting Data and Financial Indicators

Unit: Yuan Currency: RMB

| Item | |

Current Reporting Period | | |

Increase/Decrease Over the

Same Period Last Year (%) | | |

For the Period from the

Beginning of the Year to the

End of the Current Reporting

Period | | |

Increase/Decrease Over the

Same Period Last Year (%) | |

| Operating revenue | |

| 12,220,252,179.07 | | |

| -6.10 | | |

| 34,178,266,448.31 | | |

| -12.63 | |

| Net profit attributable to the shareholders of the Company | |

| 715,612,604.49 | | |

| -21.99 | | |

| 1,954,902,080.37 | | |

| -31.17 | |

| Net profit attributable to the shareholders of the Company after deducting non-recurring gains and losses | |

| 655,954,690.32 | | |

| -21.97 | | |

| 1,884,137,824.29 | | |

| -26.56 | |

| Net cash flow from operating activities | |

| Not applicable | | |

| Not applicable | | |

| 2,475,514,077.10 | | |

| -55.81 | |

| Basic earnings per share (RMB/share) | |

| 0.20 | | |

| -20.00 | | |

| 0.53 | | |

| -39.08 | |

| Diluted earnings per share (RMB/share) | |

| 0.20 | | |

| -20.00 | | |

| 0.53 | | |

| -39.08 | |

Weighted average return on equity

(%) | |

| 3.23 | | |

| Decreased by 1.27% | | |

| 8.79 | | |

| Decreased by 9.94% | |

| Total R&D expenditure | |

| 216,076,911.45 | | |

| 4.46 | | |

| 639,037,847.32 | | |

| 31.62 | |

| R&D expenditure as a percentage of operating revenue (%) | |

| 1.77 | | |

| Increased by 0.18% | | |

| 1.87 | | |

| Increased by 0.63% | |

| | |

End of Current Reporting

Period | | |

End of Previous Year |

| |

Increase/Decrease at the

End of Current Reporting

Period over the End of

Previous Year (%) | |

| Total assets | |

| 66,825,840,889.84 | | |

65,775,366,984.02 |

| |

| 1.60 | |

| Equity attributable to the shareholders of the Company | |

| 22,721,645,685.77 | | |

21,418,275,846.30 |

| |

| 6.09 | |

Note: "Current reporting period" refers to the three-month

period from the beginning to the end of the quarter, unless otherwise stated.

(2) Non-recurring Gain and Loss Items and Amounts

x Applicable

¨ Not applicable

Unit: Yuan Currency: RMB

| Non-recurring Gain and Loss Items | |

Amount for the Current

Reporting Period | | |

Amount from the Beginning

of the Year to the End of the

Reporting Period | | |

Explanation | |

| Gains and losses on disposal of non-current assets, including the written-off portion of asset impairment provisions made | |

| 2,377,788.17 | | |

| 1,858,450.89 | | |

| |

| Government grants included in the current profit and loss, except for those which are closely related to the Company’s ordinary operations, comply with national policies and regulations, and continuously received in certain standard amounts or quantities | |

| 27,240,680.67 | | |

| 104,959,238.67 | | |

| |

| Gains and losses from changes in fair value of financial assets and liabilities by non-financial enterprise, and gains and losses on disposal of financial assets and liabilities, except for effective hedging transactions related to the Company’s ordinary operations | |

| 46,477,438.00 | | |

| -2,605,996.64 | | |

| |

| Profits and losses from entrusting investment or management of assets to others | |

| 6,259,231.38 | | |

| 15,447,476.01 | | |

| |

| Reversal of provision for impairment of accounts receivable and contract assets that are individually tested for impairment | |

| 2,768,650.17 | | |

| 8,175,293.85 | | |

| |

| Other non-operating gains and losses other than the above | |

| -276,970.92 | | |

| -27,582,767.12 | | |

| |

| Less: Effect of income tax | |

| 25,189,088.34 | | |

| 29,426,198.30 | | |

| |

| Effect of minority interests (after tax) | |

| -185.04 | | |

| 61,241.28 | | |

| |

| Total | |

| 59,657,914.17 | | |

| 70,764,256.08 | | |

| |

Explanations shall be given on significant items classified as non-recurring

gains and losses by the Company that are not set out in the “Explanatory Announcement No. 1 on Information Disclosure by Companies

Offering Securities to the Public - Non-recurring Gain and Loss”, and on non-recurring gains and losses items set out in the “Explanatory

Announcement No. 1 on Information Disclosure by Companies Offering Securities to the Public - Non-recurring Gain and Loss”

but classified as ordinary gains and losses by the Company.

¨ Applicable

x Not Applicable

(3) Changes in Key Accounting Data and Financial Indicators and

the Reasons Thereof

x Applicable

¨ Not Applicable

| Item |

Change (%) |

Main Reason |

| Net profit attributable to the shareholders of the Company_From beginning of the year to the end of current reporting period |

-31.17 |

Mainly due to the decrease of module ASP, which resulted in a decrease in operating revenue compared to the same period last year. At the same time, inventory write-downs increased yoy as a result of expected module ASP decrease. The above, combined with the impact of factors such as increased tariff costs, resulted in lowered overall profitability of the module business.

The rapid operating revenue growth of the Company’s higher-margin utility-scale energy storage business and its profits contribution partially offset the lowered profits from its module business. |

| Net cash flow from operating activities_From beginning of the year to the end of current reporting period |

-55.81 |

Mainly due to lowered profits and lengthened cash conversion cycle, resulting in a decrease in net cash flow from operating activities compared to the same period last year. |

| Basic earnings per share (RMB/share) _From beginning of the year to the end of current reporting period |

-39.08 |

Mainly attributable to the increase in total shares due to the IPO of the Company, and a decrease in net profit, resulting in a decrease in basic earnings per share compared to the same period last year. |

| Diluted earnings per share (RMB/share) _From beginning of the year to the end of current reporting period |

-39.08 |

Mainly attributable to the increase in total shares due to the IPO of the Company, and a decrease in net profit, resulting in a decrease in diluted earnings per share compared to the same period last year. |

| Total R&D expenditure _From beginning of the year to the end of current reporting period |

31.62 |

The Company continues to increase its research and development expenditure in advanced technologies fields, such as high-efficiency solar cells. |

2. Shareholder Information

(Omitted)

3. Other Reminders

Other important information about the Company’s operations during

the Reporting Period that should be brought to the attention of investors

¨ Applicable

x Not Applicable

4. Quarterly Financial Statements

(1) Type of audit opinion

¨ Applicable

x Not Applicable

(2) Financial Statements

Consolidated Balance

Sheet

September 30, 2024

Prepared by: CSI Solar Co., Ltd.

Unit : Yuan Currency : RMB

Audit Type: Unaudited

| Item | |

September 30, 2024 | | |

December 31, 2023 | |

| Current assets: | |

| | | |

| | |

| Monetary funds | |

| 15,090,761,852.82 | | |

| 18,949,975,864.91 | |

| Financial assets held for trading | |

| 881,887,584.62 | | |

| 107,584,139.28 | |

| Derivative financial assets | |

| 82,271,433.73 | | |

| 24,279,992.77 | |

| Notes receivable | |

| 900,916,275.11 | | |

| 1,591,499,100.65 | |

| Accounts receivable | |

| 7,513,556,856.24 | | |

| 5,584,675,329.10 | |

| Receivables financing | |

| 263,030,530.58 | | |

| 631,593,246.37 | |

| Prepayments | |

| 788,623,903.37 | | |

| 1,157,651,526.69 | |

| Other receivables | |

| 574,007,214.05 | | |

| 789,995,454.98 | |

| Inventories | |

| 8,804,949,282.76 | | |

| 7,798,877,135.39 | |

| Contract assets | |

| 1,555,570,746.61 | | |

| 1,100,211,428.91 | |

| Other current assets | |

| 1,646,906,858.37 | | |

| 1,246,531,869.56 | |

| Total current assets | |

| 38,102,482,538.26 | | |

| 38,982,875,088.61 | |

| Non-current assets: | |

| | | |

| | |

| Long-term equity investments | |

| 391,079,424.76 | | |

| 344,356,440.13 | |

| Other equity investments | |

| 118,467,265.57 | | |

| 110,284,070.13 | |

| Other non-current financial assets | |

| 551,977,384.50 | | |

| 461,977,384.50 | |

| Fixed assets | |

| 17,865,466,561.86 | | |

| 16,758,691,214.48 | |

| Construction in progress | |

| 3,653,522,820.05 | | |

| 4,266,415,193.99 | |

| Right-of-use assets | |

| 1,046,876,776.36 | | |

| 1,165,868,864.37 | |

| Intangible assets | |

| 820,931,988.51 | | |

| 829,021,496.29 | |

| Long-term prepaid expenses | |

| 1,353,599,639.21 | | |

| 311,753,993.90 | |

| Deferred tax assets | |

| 2,142,877,552.45 | | |

| 1,563,550,141.36 | |

| Other non-current assets | |

| 778,558,938.31 | | |

| 980,573,096.26 | |

| Total non-current assets | |

| 28,723,358,351.58 | | |

| 26,792,491,895.41 | |

| Total assets | |

| 66,825,840,889.84 | | |

| 65,775,366,984.02 | |

| Current liabilities: | |

| | | |

| | |

| Short-term loan | |

| 8,305,304,163.57 | | |

| 6,886,978,231.29 | |

| Derivative financial liabilities | |

| 22,818,678.67 | | |

| 37,284,365.42 | |

| Notes payable | |

| 4,259,960,013.27 | | |

| 6,220,629,091.16 | |

| Accounts payable | |

| 6,205,194,736.21 | | |

| 5,917,826,241.73 | |

| Contract liabilities | |

| 4,009,958,431.45 | | |

| 5,605,350,999.96 | |

| Employee benefits payables | |

| 383,191,127.93 | | |

| 439,343,416.49 | |

| Taxes payable | |

| 1,024,062,960.27 | | |

| 598,186,184.97 | |

| Other payables | |

| 7,150,089,568.18 | | |

| 8,994,676,771.44 | |

| Non-current liabilities due within one year | |

| 2,680,526,337.70 | | |

| 2,336,322,662.71 | |

| Other current liabilities | |

| 60,184,826.15 | | |

| 53,117,625.08 | |

| Total current liabilities | |

| 34,101,290,843.40 | | |

| 37,089,715,590.25 | |

| Non-current liabilities: | |

| | | |

| | |

| Long-term loan | |

| 6,001,846,961.32 | | |

| 3,422,559,883.62 | |

| Lease liabilities | |

| 968,202,497.68 | | |

| 1,117,244,542.70 | |

| Long-term payables | |

| 560,000.00 | | |

| 90,743,084.41 | |

| Estimated liabilities | |

| 679,720,229.29 | | |

| 747,629,975.95 | |

| Deferred income | |

| 1,208,563,806.86 | | |

| 1,133,164,993.64 | |

| Deferred income tax liabilities | |

| 219,580,518.00 | | |

| 122,268,975.70 | |

| Other non-current liabilities | |

| 887,375,577.12 | | |

| 572,265,135.60 | |

| Total non-current liabilities | |

| 9,965,849,590.27 | | |

| 7,205,876,591.62 | |

| Total Liabilities | |

| 44,067,140,433.67 | | |

| 44,295,592,181.87 | |

| Owner’s equity (or shareholders’ equity): | |

| | | |

| | |

| Paid-in capital (or equity) | |

| 3,688,217,324.00 | | |

| 3,688,217,324.00 | |

| Capital reserve | |

| 7,829,571,113.63 | | |

| 7,621,773,553.61 | |

| Less: Treasury stocks | |

| 552,793,132.47 | | |

| - | |

| Other comprehensive income | |

| -83,028,251.76 | | |

| -212,004,557.64 | |

| Surplus reserve | |

| 113,943,414.51 | | |

| 113,943,414.51 | |

| Undistributed profits | |

| 11,725,735,217.86 | | |

| 10,206,346,111.82 | |

| Total equity attributable to the Company (or shareholders’ equity) | |

| 22,721,645,685.77 | | |

| 21,418,275,846.30 | |

| Minority interests | |

| 37,054,770.40 | | |

| 61,498,955.85 | |

| Total owners’ equity (or shareholders’ equity) | |

| 22,758,700,456.17 | | |

| 21,479,774,802.15 | |

| Total liabilities and owners’ equity (or shareholders’ equity) | |

| 66,825,840,889.84 | | |

| 65,775,366,984.02 | |

Person in charge of the Company: Qu Xiaohua

Person in charge of accounting function: Gao Linhong

Person in charge of accounting institution: Pan Naihong

Consolidated Income Statement

January-September 2024

Prepared by: CSI Solar Co., Ltd.

Unit : Yuan Currency : RMB

Audit Type: Unaudited

| Item | |

First

three quarters

of 2024

(January –

September) | | |

First

three quarters

of 2023

(January –

September) | |

| I. Total operating revenue | |

| 34,178,266,448.31 | | |

| 39,118,820,264.21 | |

| Including: Operating revenue | |

| 34,178,266,448.31 | | |

| 39,118,820,264.21 | |

| 2. Total operating costs | |

| 31,747,559,230.75 | | |

| 35,790,235,618.93 | |

| Including: Operating costs | |

| 29,066,240,967.29 | | |

| 33,517,077,602.00 | |

| Taxes and surcharges | |

| 99,702,041.26 | | |

| 109,461,529.60 | |

| Selling expenses | |

| 788,092,278.70 | | |

| 647,207,739.64 | |

| Administrative expenses | |

| 1,088,017,006.27 | | |

| 1,118,113,614.76 | |

| R&D expenses | |

| 639,037,847.32 | | |

| 485,533,805.63 | |

| Financial expenses | |

| 66,469,089.91 | | |

| -87,158,672.70 | |

| Including: Interest expense | |

| 359,902,865.73 | | |

| 330,525,067.48 | |

| Interest income | |

| 232,448,958.09 | | |

| 194,180,165.29 | |

| Add: Other income | |

| 552,583,525.76 | | |

| 410,812,773.59 | |

| Investment income (losses indicated by “-”) | |

| -22,669,782.44 | | |

| -167,006,468.56 | |

| Including: Gains from investment in associates and joint ventures | |

| 22,064,271.87 | | |

| 26,774,488.13 | |

| Gains from changes in fair value (losses indicated by “-”) | |

| 60,767,152.45 | | |

| 143,295,483.05 | |

| Credit impairment losses (losses indicated by “-”) | |

| -78,926,735.30 | | |

| -51,353,129.43 | |

| Impairment loss on assets (losses indicated by “-”) | |

| -794,549,025.88 | | |

| -547,513,698.23 | |

| Gain on disposal of assets (losses indicated by “-”) | |

| 679,612.11 | | |

| 36,310,695.73 | |

| 3. Operating profit (losses indicated by “-”) | |

| 2,148,591,964.26 | | |

| 3,153,130,301.43 | |

| Add: non-operating income | |

| 149,384,961.27 | | |

| 17,720,331.02 | |

| Less: Non-operating expenses | |

| 43,278,846.22 | | |

| 19,009,074.09 | |

| 4. Total profits (total losses indicated by “-” ) | |

| 2,254,698,079.31 | | |

| 3,151,841,558.36 | |

| Less: Income tax expense | |

| 324,240,184.39 | | |

| 312,808,648.86 | |

| 5. Net profit (net loss indicated by “-”) | |

| 1,930,457,894.92 | | |

| 2,839,032,909.50 | |

| (1) Classified by continuity of operations | |

| | | |

| | |

| 1. Net profit from continuing operations (net loss indicated by “-”) | |

| 1,930,457,894.92 | | |

| 2,839,032,909.50 | |

| 2. Net profit from discontinued operations (net loss indicated by “-”) | |

| - | | |

| - | |

| (2) Classified by ownership | |

| | | |

| | |

| 1. Net profit attributable to the shareholders of the Company (net loss indicated by “-”) | |

| 1,954,902,080.37 | | |

| 2,840,152,349.58 | |

| 2. Profit and loss attributable to minority shareholders (net loss indicated by “-”) | |

| -24,444,185.45 | | |

| -1,119,440.08 | |

| 6. Other comprehensive income, net of tax | |

| 128,976,305.88 | | |

| -83,260,593.82 | |

| (1) Other comprehensive income attributable to owners of the Company, net of tax | |

| 128,976,305.88 | | |

| -83,260,593.82 | |

| 1. Other comprehensive income that cannot be reclassified into profit or loss | |

| 6,748,851.18 | | |

| -1,268,238.11 | |

| (1) Changes in fair value of other equity instrument investments | |

| 6,748,851.18 | | |

| -1,268,238.11 | |

| 2. Other comprehensive income to be reclassified into profit and loss | |

| 122,227,454.70 | | |

| -81,992,355.71 | |

| (1) Exchange difference arising from translation of foreign currency financial statements | |

| 122,227,454.70 | | |

| -81,992,355.71 | |

| (2) Other comprehensive income attributable to minority shareholders, net of tax | |

| - | | |

| - | |

| 7. Total comprehensive income | |

| 2,059,434,200.80 | | |

| 2,755,772,315.68 | |

| (1) Total comprehensive income attributable to owners of the Company | |

| 2,083,878,386.25 | | |

| 2,756,891,755.76 | |

| (2) Total comprehensive income attributable to minority shareholders | |

| -24,444,185.45 | | |

| -1,119,440.08 | |

| 8. Earnings per share: | |

| | | |

| | |

| (1) Basic earnings per share (RMB/share) | |

| 0.53 | | |

| 0.87 | |

| (2) Diluted earnings per share (RMB/share) | |

| 0.53 | | |

| 0.87 | |

In the current reporting period, for enterprises under the same control,

the net profit achieved by the merged entity before the merger was nil, and the net profit achieved by the merged entity in the previous

period was nil.

Person in charge of the Company: Qu Xiaohua

Person in charge of accounting function: Gao Linhong

Person in charge of accounting institution: Pan Naihong

Consolidated Cash Flow Statement

January-September 2024

Prepared by: CSI Solar Co., Ltd.

Unit : Yuan Currency : RMB

Audit Type: Unaudited

| Item | |

First

three quarters

of 2024

(January –

September) | | |

First

three quarters

of 2023

(January –

September) | |

| 1. Cash flow from operating activities: | |

| | | |

| | |

| Cash received from sale of goods and provision of services | |

| 49,438,069,242.80 | | |

| 44,676,706,083.13 | |

| Tax refunds received | |

| 9,291,725.05 | | |

| 44,078,729.12 | |

| Other cash received related to operating activities | |

| 5,405,799,653.31 | | |

| 3,194,088,168.67 | |

| Subtotal of cash inflow from operating activities | |

| 54,853,160,621.16 | | |

| 47,914,872,980.92 | |

| Cash paid for purchase of goods and services rendered | |

| 41,335,127,875.63 | | |

| 32,654,252,519.27 | |

| Cash paid to and on behalf of employees | |

| 2,925,155,515.80 | | |

| 2,718,031,527.34 | |

| Various taxes paid | |

| 1,643,802,924.04 | | |

| 1,235,820,113.98 | |

| Other cash payments related to operating activities | |

| 6,473,560,228.59 | | |

| 5,705,421,480.43 | |

| Subtotal cash outflow from operating activities | |

| 52,377,646,544.06 | | |

| 42,313,525,641.02 | |

| Net cash flow from operating activities | |

| 2,475,514,077.10 | | |

| 5,601,347,339.90 | |

| 2. Cash flows from investing activities: | |

| | | |

| | |

| Cash received from disposal of investments | |

| 128,144,694.67 | | |

| 3,598,356.00 | |

| Cash received from return of investments | |

| 148,085,284.71 | | |

| 301,574,786.92 | |

| Net cash received from disposal of fixed assets, intangible assets and other long-term assets | |

| 51,966,963.67 | | |

| 32,416,487.01 | |

| Net cash received from disposal of subsidiaries and other business units | |

| 18,554,068.43 | | |

| 260,000.00 | |

| Subtotal of cash inflows from investing activities | |

| 346,751,011.48 | | |

| 337,849,629.93 | |

| Cash paid for the acquisition and construction of fixed assets, intangible assets and other long-term assets | |

| 6,361,028,568.44 | | |

| 6,034,731,043.00 | |

| Cash paid for investments | |

| 1,243,921,996.53 | | |

| 819,258,273.71 | |

| Subtotal of cash outflows from investing activities | |

| 7,604,950,564.97 | | |

| 6,853,989,316.71 | |

| Net cash flows from investing activities | |

| -7,258,199,553.49 | | |

| -6,516,139,686.78 | |

| 3. Cash flow from financing activities: | |

| | | |

| | |

| Cash received from investments | |

| - | | |

| 6,738,551,933.54 | |

| Including: Proceeds received by subsidiaries from minority shareholders’ investments | |

| - | | |

| 1,980,000.00 | |

| Proceeds from loans | |

| 11,303,215,874.64 | | |

| 8,467,461,570.65 | |

| Other cash received from financing activities | |

| 4,129,008,695.17 | | |

| 788,273,027.77 | |

| Subtotal of cash inflows from financing activities | |

| 15,432,224,569.81 | | |

| 15,994,286,531.96 | |

| Cash paid for repayment of loans | |

| 6,914,794,953.60 | | |

| 7,302,157,254.66 | |

| Cash paid for dividends, profits or interest payments | |

| 734,493,032.55 | | |

| 322,755,735.05 | |

| Other cash paid for other financing activities | |

| 4,191,237,642.35 | | |

| 1,439,033,926.65 | |

| Subtotal of cash outflows from financing activities | |

| 11,840,525,628.50 | | |

| 9,063,946,916.36 | |

| Net cash flow from financing activities | |

| 3,591,698,941.31 | | |

| 6,930,339,615.60 | |

| 4. Effect of changes in exchange rate on cash and cash equivalents | |

| 6,178,898.76 | | |

| 42,752,925.43 | |

| 5. Net increase in cash and cash equivalents | |

| -1,184,807,636.32 | | |

| 6,058,300,194.15 | |

| Add: Beginning balance of cash and cash equivalents | |

| 11,855,203,184.55 | | |

| 5,128,773,756.03 | |

| 6. Ending balance of cash and cash equivalents | |

| 10,670,395,548.23 | | |

| 11,187,073,950.18 | |

Person in charge of the Company: Qu Xiaohua

Person in charge of accounting function: Gao Linhong

Person in charge of accounting institution : Pan Naihong

Adjustments to the financial statements at the beginning of the year

upon initial adoption of new accounting standards or interpretation of standards since 2024

¨ Applicable x Not

Applicable

We hereby announce the above.

Board of Directors of CSI

Solar Co., Ltd.

October 30, 2024

Safe Harbor/Forward-Looking Statements

Certain statements in this press release, including those regarding

Canadian Solar Inc. (“Canadian Solar”)’s expected future shipment volumes, revenues, gross margins, and project sales

are forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially.

These statements are made under the “Safe Harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

In some cases, you can identify forward-looking statements by such terms as “believes,” “expects,” “anticipates,”

“intends,” “estimates,” the negative of these terms, or other comparable terminology. Factors that could cause

actual results to differ include general business, regulatory and economic conditions and the state of the solar power and battery energy

storage market and industry; geopolitical tensions and conflicts, including impasses, sanctions and export controls; volatility, uncertainty,

delays and disruptions related to global pandemics; supply chain disruptions; governmental support for the deployment of solar power and

battery energy storage; future available supplies of silicon, solar wafers and lithium cells; demand for end-use products by consumers

and inventory levels of such products in the supply chain; changes in demand from significant customers; changes in demand from major

markets such as China, the U.S., Europe, Brazil and Japan; changes in effective tax rates; changes in customer order patterns; changes

in product mix; changes in corporate responsibility, especially environmental, social and governance (“ESG”) requirements;

capacity utilization; level of competition; pricing pressure and declines in or failure to timely adjust average selling prices; delays

in new product introduction; delays in utility-scale project approval process; delays in utility-scale project construction; delays in

the completion of project sales; the pipeline of projects and timelines related to them; the ability of the parties to optimize value

of that pipeline; continued success in technological innovations and delivery of products with the features that customers demand; shortage

in supply of materials or capacity requirements; availability of financing; exchange and inflation rate fluctuations; litigation and other

risks as described in Canadian Solar’s filings with the Securities and Exchange Commission (the “SEC”), including its

annual report on Form 20-F filed on April 26, 2024. Although Canadian Solar believes that the expectations reflected in the

forward-looking statements are reasonable, it cannot guarantee future results, level of activity, performance, or achievements. Investors

should not place undue reliance on these forward-looking statements. All information provided in this press release is as of today’s

date, unless otherwise stated, and Canadian Solar undertakes no duty to update such information, except as required under applicable law.

Inherent Uncertainty of the Forecast

The forecast should be read in conjunction with the assumptions and

qualifications set forth herein. The forecast is based on numerous assumptions, many of which are beyond the control of the Company and

Canadian Solar, and some or all of which may not materialize.

Additionally, to the extent that the assumptions inherent in the forecast

are based upon future business decisions and objectives, they are subject to change. Although the forecast is presented with numerical

specificity and is based on reasonable expectations developed by the Company’s management, the assumptions and estimates underlying

the forecast are subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which

are beyond the control of the Company and Canadian Solar. Accordingly, the forecast is only an estimate and is necessarily speculative

in nature. It is expected that some or all of the assumptions in the forecast will not be realized and that actual results will vary from

the forecast. Such variations may be material and may increase over time. In light of the foregoing, readers are cautioned not to place

undue reliance on the forecast. The forecast should not be regarded as a representation or warranty by Canadian Solar, the Company or

any other person that the forecast can or will be achieved.

Chinese GAAP

The Company’s financial statements were prepared in accordance

with Chinese GAAP, whereas Canadian Solar’s financial statements are prepared in accordance with generally accepted accounting principles

in the United States (“U.S. GAAP”). Chinese GAAP differs materially from U.S. GAAP. The Company has not prepared a reconciliation

of the financial statements between Chinese GAAP and U.S. GAAP and has not quantified such differences. In addition, Canadian Solar’s

financial statements eliminate all intercompany transactions between Canadian Solar and The Company and Recurrent Energy (formerly Global

Energy) subsidiaries. As a result, the Company’s financial statements are not directly comparable to the corresponding consolidated

financial performance of Canadian Solar. Investors should consult their own professional advisors for an understanding of the differences

between Chinese GAAP and U.S. GAAP and how those differences might affect the information contained in the financial statements.

Some of the applicable differences between Chinese GAAP and U.S. GAAP

include the presentation of the income statement, recognition of share-based compensation, the intraperiod income taxes, the accumulated

and unappropriated profits, and the specific standard on assets held for sale.

No Audit or Review

The financial statements have not been audited or reviewed by the independent

public accountants of Canadian Solar or the Company. The financial statements should not be relied upon by investors to provide the same

type or quality of information as information that has been subject to an audit or review by independent auditors.

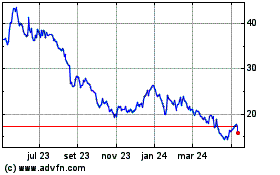

Canadian Solar (NASDAQ:CSIQ)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

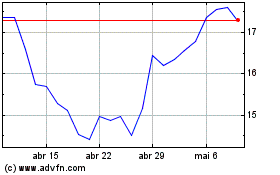

Canadian Solar (NASDAQ:CSIQ)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024