false

0001389545

0001389545

2024-10-29

2024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of earliest event reported: October 29, 2024

|

NovaBay Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Charter)

|

| |

|

|

|

Delaware

(State of Other Jurisdiction of Incorporation)

|

001-33678

(Commission File Number)

|

68-0454536

(I.R.S. Employer Identification No.)

|

| |

|

|

|

2000 Powell Street, Suite 1150, Emeryville, CA 94608

(Address of Principal Executive Offices) (Zip Code)

|

| |

|

(510) 899-8800

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

Common Stock, par value $0.01 per share

|

Trading Symbol(s)

NBY

|

Name of Each Exchange On Which Registered

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

As previously disclosed, on September 19, 2024, NovaBay Pharmaceuticals, Inc. (the “Company”) entered into an Asset Purchase Agreement (the “PRN APA”) with PRN Physician Recommended Nutriceuticals, LLC (“PRN”), pursuant to which the Company would sell all of its eyecare products sold under the Avenova brand and the related assets (the “Avenova Assets”) to PRN, subject to meeting certain closing conditions including receiving stockholder approval (the “PRN Transaction”). Additional information regarding the PRN Transaction and the PRN APA is included in the Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission (the “SEC”) on September 20, 2024 and in the Company’s definitive proxy statement on Schedule 14A for a special meeting of the Company’s stockholders (the “Special Meeting”) filed with the SEC on October 16, 2024 (the “Special Meeting Proxy Statement”).

On October 29, 2024, the Company announced that its Board of Directors (the “Board”) determined that an unsolicited and non-binding acquisition proposal from Refresh Acquisitions BidCo LLC (“Refresh”) to purchase the Avenova Assets (the “Refresh Unsolicited Offer”) is a “Superior Proposal” (as defined in the PRN APA). As a result, the Company notified PRN of the Board’s determination and the Company’s intention to terminate the PRN APA pursuant to its terms, unless the Company receives a revised proposal from PRN by 11:59 p.m. Pacific Time on November 4, 2024 such that the Board determines the Refresh Unsolicited Offer is no longer a Superior Proposal, all in accordance with the process provided in the PRN APA.

The Refresh Unsolicited Offer provides for terms that are substantially similar to the PRN Transaction, except that the Company would receive a base purchase price of $11.5 million (as compared to $9.5 million in the PRN APA), subject to a downside net working capital adjustment. The Refresh Unsolicited Offer also includes Refresh providing a secured term loan to the Company in the principal amount of $2.0 million, with an interest rate of 10.0% per annum (the “Secured Loan”) in connection with entering into a transaction with Refresh, which is expected to be repaid upon closing and deducted from the purchase price. The Secured Loan would continue to be outstanding until the earlier to occur of a transaction with Refresh closing or a purchase agreement with Refresh being terminated.

Notwithstanding the Refresh Unsolicited Offer and the Board determination, in accordance with the PRN APA process, the PRN APA remains in full force and effect, and the Board has not withdrawn or modified its recommendation regarding the pending PRN Transaction as disclosed in the Special Meeting Proxy Statement, to allow for the 5-day review period by PRN and opportunity to provide a counteroffer during such time.

A copy of the press release issued by the Company is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Additional Information and Where to Find It

In connection with the solicitation of proxies, on October 16, 2024, the Company filed the Special Meeting Proxy Statement with the SEC with respect to the Special Meeting in connection with the PRN Transaction and a potential voluntary liquidation and dissolution of the Company (the “Dissolution”). Promptly after filing the Special Meeting Proxy Statement with the SEC, the Company mailed the Special Meeting Proxy Statement and a proxy card to each stockholder entitled to vote at the Special Meeting to consider the PRN Transaction and the Dissolution. STOCKHOLDERS ARE URGED TO READ THE SPECIAL MEETING PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS, INCLUDING IN CONNECTION WITH THE PRN TRANSACTION AND THE DISSOLUTION, THAT THE COMPANY HAS FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, THE PRN TRANSACTION AND THE DISSOLUTION. Stockholders may obtain, free of charge, the Special Meeting Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by the Company with the SEC in connection with the PRN Transaction and the Dissolution at the SEC’s website (http://www.sec.gov) or at the Company’s investor relations website (https://novabay.com/investors/) or by writing to NovaBay Pharmaceuticals, Inc., Investor Relations, 2000 Powell Street, Suite 1150, Emeryville, CA 94608. Our website address is provided as an inactive textual reference only. The information provided on, or accessible through, our website is not part of this Current Report on Form 8-K, and, therefore, is not incorporated herein by reference.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed PRN Transaction and the proposed Dissolution. A list of the names of the directors and executive officers of the Company and information regarding their interests in the PRN Transaction and the Dissolution, including their respective ownership of the Company’s common stock and other securities is contained in the Special Meeting Proxy Statement for the proposed PRN Transaction and the proposed Dissolution. In addition, information about the Company’s directors and executive officers and their ownership in the Company is set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and filed with the SEC on March 26, 2024, as amended on March 29, 2024 and as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing.

Cautionary Language Concerning Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. These forward-looking statements are based upon the Company and its management’s current expectations, assumptions, estimates, projections and beliefs. Such statements include, but are not limited to, statements regarding the PRN Transaction, the Refresh Unsolicited Offer, the Dissolution and related matters such as the impact of the PRN Transaction and the Refresh Unsolicited Offer on the Company. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in, or implied by, these forward-looking statements. Other risks relating to the Company’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this Current Report, are detailed in the Company’s latest Form 10-K, subsequent Forms 10-Q and/or Form 8-K filings with the SEC and the Special Meeting Proxy Statement, especially under the heading “Risk Factors.” The forward-looking statements speak only as of this date, and the Company disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NovaBay Pharmaceuticals, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Justin M. Hall

|

|

|

|

|

Justin M. Hall

|

|

|

|

|

Chief Executive Officer and General Counsel

|

|

Dated: October 29, 2024

Exhibit 99.1

NovaBay Pharmaceuticals Board Determines Unsolicited Offer is Superior to Asset Purchase Agreement with PRN Physician Recommended Nutriceuticals, LLC

EMERYVILLE, Calif. (October 29, 2024) – NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY) (“NovaBay” or the “Company”) announces that the Company’s board of directors has determined that an unsolicited and non-binding offer from Refresh Acquisitions BidCo LLC (“Refresh”) for an affiliate of Refresh to acquire the Company’s Avenova® brand and related assets is a “Superior Proposal” to the Company’s asset purchase agreement with PRN Physician Recommended Nutriceuticals, LLC (“PRN”).

Refresh’s unsolicited offer provides for terms that are substantially similar to the contemplated transaction with PRN, except that the Company would receive a purchase price of up to $11.5 million (compared with $9.5 million in the transaction with PRN), subject to a downside net working capital adjustment. Refresh’s unsolicited offer also includes Refresh providing a secured term loan to the Company in the principal amount of $2.0 million, which is expected to be repaid upon closing and deducted from the purchase price.

The Company has notified PRN of the board of directors’ determination and that the Company intends to terminate its asset purchase agreement with PRN unless the Company receives a revised proposal from PRN by 11:59 p.m. Pacific time on November 4, 2024, such that the Company’s board of directors determines that Refresh’s unsolicited offer is no longer a Superior Proposal, in accordance with the process provided in the asset purchase agreement with PRN.

“After careful consideration, our board of directors determined that the unsolicited offer by Refresh represents greater value for our stockholders while also placing Avenova in highly capable commercial hands,” said Justin Hall, NovaBay CEO. “Refresh is an affiliate company of RVL Pharmaceuticals, which is commercializing Upneeq® (oxymetazoline hydrochloride ophthalmic solution), 0.1%, the first and only FDA-approved prescription eye drops for adults with low-lying eyelids, also known as acquired blepharoptosis or ptosis. Our Avenova products are highly complementary to this non-surgical solution that quickly lifts eyelids for more awake-looking eyes. Further, RVL Pharmaceuticals and NovaBay are aligned in our shared passion for commercializing products that improve patients’ lives.”

The Company’s asset purchase agreement with PRN, in accordance with such agreement, remains in full force and effect, and the Company’s board of directors has not withdrawn or modified its recommendation regarding stockholders approving the pending transaction with PRN. The Company’s transaction with PRN remains subject to certain closing conditions, including receiving stockholder approval.

Consistent with its fiduciary duties, the Company’s board of directors conducted a comprehensive evaluation of the Refresh unsolicited offer with assistance from independent financial and legal advisors, before making its determination.

About NovaBay Pharmaceuticals, Inc.

NovaBay's leading product Avenova® Lid & Lash Cleansing Spray is often recommended by eyecare professionals for blepharitis and dry eye disease. Manufactured in the U.S., Avenova spray is formulated with NovaBay's patented, proprietary, stable and pure form of hypochlorous acid. All Avenova products are available directly to consumers through online distribution channels such as Amazon.com and Avenova.com.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. These forward-looking statements are based upon the Company and its management’s current expectations, assumptions, estimates, projections and beliefs. Such statements include, but are not limited to, statements regarding the contemplated transaction with PRN, the unsolicited offer by Refresh and related matters. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in, or implied by, these forward-looking statements. Other risks relating to NovaBay's business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this press release, are detailed in the Company's latest Form 10-K, subsequent Forms 10-Q and/or Form 8-K filings with the Securities and Exchange Commission (the “SEC”) and the Special Meeting Proxy Statement (as defined below), especially under the heading "Risk Factors." The forward-looking statements in this release speak only as of this date, and the Company disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

Additional Information and Where to Find It

In connection with the solicitation of proxies, on October 16, 2024, NovaBay filed a definitive proxy statement with the SEC with respect to the special meeting to be held in connection with the proposed asset sale to PRN and a potential voluntary liquidation and dissolution of the Company (the “Special Meeting Proxy Statement”). Promptly after filing the Special Meeting Proxy Statement with the SEC, NovaBay mailed the Special Meeting Proxy Statement and a proxy card to each stockholder entitled to vote at the special meeting to consider the contemplated asset sale to PRN and potential dissolution. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT NOVABAY HAS FILED OR WILL FILE WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the Special Meeting Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by NovaBay with the SEC in connection with the contemplated asset sale to PRN and potential dissolution at the SEC's website (http://www.sec.gov) or at the Company’s investor relations website https://novabay.com/investors/) or by writing to NovaBay Pharmaceuticals, Inc., Investor Relations, 2000 Powell Street, Suite 1150, Emeryville, CA 94608. The information provided on, or accessible through, our website is not part of this communication, and therefore is not incorporated herein by reference.

Participants in the Solicitation

NovaBay and its directors and executive officers may be deemed to be participants in the solicitation of proxies from NovaBay's stockholders in connection with the contemplated asset sale to PRN and the potential dissolution. A list of the names of the directors and executive officers of the Company and information regarding their interests in the contemplated asset sale to PRN and the potential dissolution, including their respective ownership of the Company’s common stock and other securities is contained in the Special Meeting Proxy Statement. In addition, information about the Company’s directors and executive officers and their ownership in the Company is set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and filed with the SEC on March 26, 2024, as amended on March 29, 2024 and as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing.

Socialize and Stay Informed on NovaBay’s Progress

Like us on Facebook

Follow us on X

Connect with NovaBay on LinkedIn

Visit NovaBay’s Website

Avenova Purchasing Information

For NovaBay Avenova purchasing information:

Please call 800-890-0329 or email sales@avenova.com

Avenova.com

NovaBay Contact

Justin Hall

Chief Executive Officer and General Counsel

510-899-8800

jhall@novabay.com

Investor Contact

Alliance Advisors IR

Jody Cain

310-691-7100

jcain@allianceadvisors.com

# # #

v3.24.3

Document And Entity Information

|

Oct. 29, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NovaBay Pharmaceuticals, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 29, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-33678

|

| Entity, Tax Identification Number |

68-0454536

|

| Entity, Address, Address Line One |

2000 Powell Street, Suite 1150

|

| Entity, Address, City or Town |

Emeryville

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94608

|

| City Area Code |

510

|

| Local Phone Number |

899-8800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NBY

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001389545

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

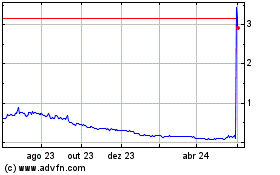

NovaBay Pharmaceuticals (AMEX:NBY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

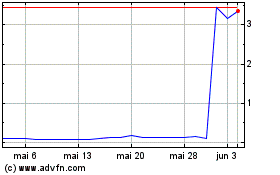

NovaBay Pharmaceuticals (AMEX:NBY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024