Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

30 Outubro 2024 - 12:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

| For the month of October, 2024. |

Commission File Number: 001-14446 |

The Toronto-Dominion Bank

(Translation of registrant's name into English)

c/o General Counsel’s Office

P.O. Box 1, Toronto Dominion Centre,

Toronto, Ontario, M5K 1A2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

| Form

20-F _________ |

Form

40-F √ |

This Form 6-K is incorporated by reference into all outstanding Registration

Statements of The Toronto-Dominion Bank filed with the U.S. Securities and Exchange Commission.

EXHIBIT INDEX

FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

THE TORONTO-DOMINION BANK |

| |

|

|

|

|

| |

|

|

|

|

| DATE: October 30, 2024 |

By: |

/s/ Caroline Cook |

|

| |

|

Name: |

Caroline Cook |

|

| |

|

Title: |

Associate Vice President, Legal Treasury and Corporate Securities |

|

EXHIBIT 99.1

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES

OR FOR DISSEMINATION IN THE UNITED STATES

TD Bank Group Issues Japanese Yen NVCC Subordinated

Debentures

October 30, 2024 - The Toronto-Dominion Bank

(“TD” or the “Bank”) (TSX, NYSE: TD) today announced the issuance of a private placement offering of JPY 20 billion

of Fixed Rate Reset Subordinated Notes (Non-Viability Contingent Capital (NVCC)) constituting subordinated indebtedness of the Bank (the

“Notes”).

The Notes will bear interest at a fixed rate of 1.601%

per annum (paid semi-annually) until October 30, 2029, and at the Japanese government bond yield plus 1.032% thereafter (paid quarterly)

until maturity on October 30, 2034. The Bank may, at its option, with the prior approval of the Superintendent of Financial Institutions

(Canada), redeem the Notes on October 30, 2029, in whole but not in part, at par plus accrued and unpaid interest on not more than 60

nor less than 10 days’ notice to holders.

Net proceeds from the issuance of the Notes will be

used for general corporate purposes, which may include the redemption of outstanding capital securities and/or the repayment of other

outstanding liabilities. The Notes are expected to qualify as Tier 2 capital of TD for regulatory purposes.

Nomura International plc and TD Securities are the

managers on the issue.

The Notes have not been and will not be registered

under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable

exemption from registration requirements. This press release shall not constitute an offer to sell securities in the United States.

About TD Bank Group

The

Toronto-Dominion Bank and its subsidiaries are collectively known as TD Bank Group ("TD" or the "Bank"). TD is the

sixth largest bank in North America by assets and serves over 27.5 million customers in four key businesses operating in

a number of locations in financial centres around the globe: Canadian Personal and Commercial Banking, including TD Canada Trust

and TD Auto Finance Canada; U.S. Retail, including TD Bank, America's Most Convenient Bank®, TD Auto Finance U.S.,

TD Wealth (U.S.), and an investment in The Charles Schwab Corporation; Wealth Management and Insurance, including TD Wealth (Canada), TD

Direct Investing, and TD Insurance; and Wholesale Banking, including TD Securities and TD Cowen. TD also ranks among the world's leading

online financial services firms, with more than 17 million active online and mobile customers. TD had $1.97 trillion in assets

on July 31, 2024. The Toronto-Dominion Bank trades under the symbol "TD" on the Toronto and New York Stock Exchanges.

For

further information: Brooke Hales, Vice President, Investor Relations, 416-307-8647, Brooke.hales@td.com; Elizabeth Goldenshtein, Senior

Manager, Corporate Communications, 416-994-4124, Elizabeth.goldenshtein@td.com.

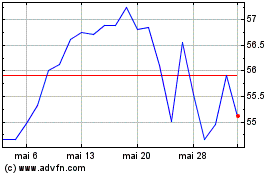

Toronto Dominion Bank (NYSE:TD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

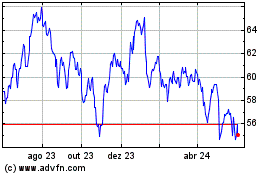

Toronto Dominion Bank (NYSE:TD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025