As filed with the U.S. Securities and Exchange

Commission on October 30, 2024

Registration No. 333-[●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

U Power Limited

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

Not Applicable |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

18/F,

Building 3, Science and Technology Industrial Park

Yijiang District, Wuhu City, Anhui Province

People’s

Republic of China, 241003

0086-21-6859-3598

(Address and telephone number of Registrant’s

principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

800-221-0102

(Name, address, and telephone number of agent for

service)

With a Copy to:

Ying Li, Esq.

Lisa Forcht, Esq.

Hunter Taubman Fischer & Li LLC

950 Third Avenue, 19th Floor

New York, NY 10022

212-530-2206

Approximate date of commencement of proposed sale

to the public: From time to time after the effective date of the registration statement.

If only securities being registered on this Form

are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

| † |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act, or until this registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant

to said Section 8(a), may determine.

The information in this

prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the U.S. Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting any offer to

buy these securities in any jurisdiction where such offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION

| DATED

October 30, 2024 |

U Power Limited

$50,000,000 of Class A Ordinary Shares

Debt Securities

Warrants

Rights

and

Units

This is an offering of the securities of U Power

Limited, a Cayman Islands holding company. We may, from time to time, in one or more offerings, offer and sell up to $50,000,000 of our

Class A ordinary shares of par value US$0.00001 each (“Class A Ordinary Shares”), debt securities, warrants, rights, and units,

or any combination thereof, together or separately as described in this prospectus. In this prospectus, references to the term “securities”

refers, collectively, to our Class A Ordinary Shares, debt securities, warrants, rights, and units. The prospectus supplement for each

offering of securities will describe in detail the plan of distribution for that offering. For general information about the distribution

of the securities offered, please see “Plan of Distribution” in this prospectus.

This prospectus provides a general description

of the securities we may offer. We will provide the specific terms of the securities offered in one or more supplements to this prospectus.

We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. You should read

this prospectus, any prospectus supplement, and any free writing prospectus before you invest in any of our securities. The prospectus

supplement and any related free writing prospectus may add, update, or change information in this prospectus. You should read carefully

this prospectus, the applicable prospectus supplement, and any related free writing prospectus, as well as the documents incorporated

or deemed to be incorporated by reference, before you invest in any of our securities. This prospectus may not be used to offer or sell

any securities unless accompanied by the applicable prospectus supplement.

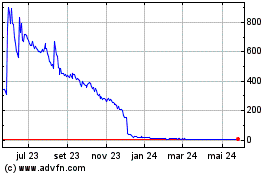

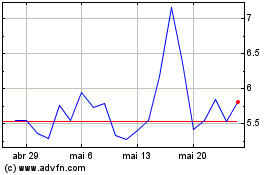

Our Class A Ordinary Shares are listed on the

Nasdaq Capital Market, or “Nasdaq,” under the symbol “UCAR.” On October 28, 2024, the last reported sale price

of our Class A Ordinary Shares on Nasdaq was $7.83 per share. The aggregate market value of our issued and outstanding Class A Ordinary

Shares held by non-affiliates, or public float, as of October 28, 2024, was approximately $15,808,190.6, which was calculated based on

2,018,926 Class A Ordinary Shares held by non-affiliates and the price of $7.83 per share, which was the closing price of our Class A

Ordinary Shares on the Nasdaq Capital Market on October 28, 2024. Pursuant to General Instruction I.B.5 of Form F-3, in no event

will we sell our securities in a public primary offering with a value exceeding more than one-third of our public float in any 12-month

period so long as our public float remains below $75 million. During the 12 calendar months prior to and including the date of this prospectus,

we have not offered or sold any securities pursuant to General Instruction I.B.5 of Form F-3.

Investing in our securities involves a high

degree of risk. Before making an investment decision, please read the information under the heading “Risk Factors” beginning

on page 13 of this prospectus and risk factors set forth in our most recent annual report on Form 20-F (the “2023 Annual Report”),

in other reports incorporated herein by reference, and in an applicable prospectus supplement under the heading “Risk Factors.”

We may offer and sell the securities from time

to time at fixed prices, at market prices, or at negotiated prices, to or through underwriters, to other purchasers, through agents, or

through a combination of these methods. If any underwriters are involved in the sale of any securities with respect to which this prospectus

is being delivered, the names of such underwriters and any applicable commissions or discounts will be set forth in a prospectus supplement.

The offering price of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus

supplement. See “Plan of Distribution” elsewhere in this prospectus for a more complete description of the ways in

which the securities may be sold.

We are not a Chinese

operating company, but rather a holding company incorporated in the Cayman Islands. As a holding company with no material operations of

our own, we conduct our operations through our operating entities established in the PRC. As such, our corporate structure involves unique

risks to investors. Investors of our Class A Ordinary Shares do not directly own any equity interests in our Chinese operating subsidiaries,

but will instead own shares of a Cayman Islands holding company. The Chinese regulatory authorities could intervene or influence the operations

of our Chinese operating subsidiaries, including disallowing our corporate structure, which would likely result in a material change in

our operations and/or a material change in the value of our Class A Ordinary Shares. For details, see “Item 3. Key Information —

D. Risk Factors — Risks Relating to Doing Business in China — Any actions by the Chinese government,

including any decision to intervene or influence the operations of the operating entities or to exert control over any offering of securities

conducted overseas and/or foreign investment in China-based issuers, may cause us to make material changes to the operations of the PRC

operating entities, may limit or completely hinder our ability to offer or continue to offer securities to investors, and may cause the

value of such securities to significantly decline or be worthless” on page 12 of the 2023 Annual Report.

We are subject to legal

and operational risks associated with being based in and having the majority of our operations in China. These risks may result in a material

change in our operations, or a complete hindrance of our ability to offer or continue to offer our securities to investors, and could

cause the value of such securities to significantly decline or become worthless. Recently, the PRC government initiated a series of regulatory

actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities

in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, and

adopting new measures to extend the scope of cybersecurity reviews. On July 6, 2021, the General Office of the Communist Party of China

Central Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal activities in the

securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental

authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based

companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. On December

28, 2021, the Cyberspace Administration of China (the “CAC”), together with 12 other governmental departments of the PRC,

jointly promulgated the Cybersecurity Review Measures, which became effective on February 15, 2022. The Cybersecurity Review Measures

require that an online platform operator which possesses the personal information of at least one million users must apply for a cybersecurity

review by the CAC if it intends to be listed in foreign countries. On September 30, 2024, the State Council of China published the Regulations

on Network Data Security Administration, which provides that data processing operators engaging in data processing activities that affect

or may affect national security must be subject to network data security review by the relevant cyberspace administration of the PRC.

The Regulations on Network Data Security Administration have not been fully implemented as of the date of this prospectus and will become

effective on January 1, 2025. As confirmed by our PRC counsel, Guantao Law Firm, since we are not an online platform operator that possesses

over one million users’ personal information, we are not subject to the cybersecurity review with the CAC under the Cybersecurity

Review Measures and the Regulations on Network Data Security Administration. There remains uncertainty, however, as to how the Cybersecurity

Review Measures will be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new laws, regulations,

rules, or detailed implementation and interpretation related to the Cybersecurity Review Measures and the Regulations on Network Data

Security Administration. For further details, see “Risk Factors -We may become subject to a variety of laws and regulations in the

PRC regarding privacy, data security, cybersecurity, and data protection” on page 13 of this prospectus. “

In addition, since 2021,

the Chinese government has strengthened its anti-monopoly supervision, mainly in three aspects: (1) establishing the National Anti-Monopoly

Bureau; (2) revising and promulgating anti-monopoly laws and regulations, including: the Anti-Monopoly Law (draft Amendment published

on October 23, 2021 for public opinion; the newly revised Anti-Monopoly Law was promulgated on June 24, 2022, and became effective on

August 1, 2022), the anti-monopoly guidelines for various industries, and the detailed Rules for the Implementation of the Fair Competition

Review System; and (3) expanding the anti-monopoly law enforcement targeting Internet companies and large enterprises. As of the date

of this prospectus, the Chinese government’s recent statements and regulatory actions related to anti-monopoly concerns have not

impacted our ability to conduct business, accept foreign investments, or list on a U.S. or other foreign exchange, because neither the

Company nor its PRC operating entities engage in monopolistic behaviors that are subject to these statements or regulatory actions.

On February 17, 2023,

the China Securities Regulatory Commission (the “CSRC”) released the Trial Administrative Measures of Overseas Securities

Offering and Listing by Domestic Companies, or the Trial Measures, and five supporting guidelines, which came into effect on March 31,

2023. The Trial Measures regulate both direct and indirect overseas offering and listing by PRC domestic companies by adopting a filing-based

regulatory regime. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, whether directly

or indirectly, should fulfill the filing procedures and report relevant information to the CSRC within three working days after submitting

listing applications and subsequent amendments. According to the Notice on the Administrative Arrangements for the Filing of the Overseas

Securities Offering and Listing by Domestic Companies from the CSRC, or the CSRC Notice, the domestic companies that have already been

listed overseas before the effective date of the Trial Measures (i.e. March 31, 2023) shall be deemed to be existing issuers (the “Existing

Issuers”). Existing Issuers are not required to complete the filing procedures immediately, and they shall be required to file with

the CSRC for any subsequent offerings. Our PRC counsel, Guantao Law Firm, advised us that, since we obtained approval from both the SEC

and The Nasdaq Capital Market (“Nasdaq”) to issue and list our ordinary shares on the Nasdaq prior to March 31, 2023, and

closed our initial public offering on April 24, 2023, we were not required to make the filing with the CSRC for our initial public offering

immediately pursuant to the Trial Measures. Our PRC counsel, Guantao Law Firm, has advised us that we are required to file with the CSRC

for any subsequent offerings in the same overseas market, including this offering, within 3 working days after the offering is completed.

Given the current PRC regulatory environment, it is uncertain whether we or our PRC subsidiaries will be required to obtain approvals

from the PRC government to offer securities to foreign investors in the future, and whether we would be able to obtain such approvals.

If we are unable to obtain such approvals if required in the future, or inadvertently conclude that such approvals are not required then

the value of our ordinary shares may depreciate significantly or become worthless. For details, see “Item 3. Key Information —

D. Risk Factors —Risks Relating to Doing Business in China — The PRC government exerts substantial influence over

the manner in which we and our PRC subsidiaries must conduct our business activities. We are currently not required to obtain approval

from Chinese authorities to list on U.S. exchanges, however, if we or our PRC subsidiaries are required to obtain approval in the

future and are denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchanges,

which would materially affect the interest of the investors” on page 24 of the 2023 Annual Report.

Our PRC counsel, Guantao

Law Firm, has advised us that, as of the date of this prospectus, we and our PRC subsidiaries have received from the PRC authorities all

requisite licenses, permissions, or approvals that are required and material for conducting our operations in China, such as business

licenses and auto dealer filings. However, it is uncertain whether we or our PRC subsidiaries will be required to obtain additional approvals,

licenses, or permits in connection with our business operations pursuant to evolving PRC laws and regulations, and whether we would be

able to obtain and renew such approvals on a timely basis or at all. Failing to do so could result in non-compliance and material change

in our operations, and the value of our Class A Ordinary Shares could depreciate significantly or become worthless.

Under Cayman Islands

law, a Cayman Islands company may pay a dividend on its shares out of either profit or share premium account, provided that in no circumstances

may a dividend be paid if this would result in the company being unable to pay its debts due in the ordinary course of business. As of

the date of this prospectus, (1) the Company transferred approximately $4.60 million and $5.30 million to a subsidiary, Energy U Limited,

in fiscal years 2024 and 2023, respectively, and no other cash transfers or transfers of other assets have occurred between the Company

and its subsidiaries, and (2) the Company and its subsidiaries have not made any dividends or distributions to investors. We intend to

keep any future earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the

foreseeable future. As of the date of this prospectus, we have not installed any cash management policies that dictate how funds are transferred

among the Company, its subsidiaries, or investors.

Our PRC operating entities

receive substantially all of our revenue in RMB. Under our current corporate structure, to fund any cash and financing requirements

we may have, we may rely on dividend payments from the PRC operating subsidiaries. Under existing PRC foreign exchange regulations, payment

of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign

currencies without prior approval from State Administration of Foreign Exchange (“SAFE”) by complying with certain procedural

requirements. Therefore, our PRC subsidiaries are able to pay dividends in foreign currencies to us without prior approval from SAFE,

subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC foreign exchange

regulations, such as the overseas investment registrations by our shareholders or the ultimate shareholders of our corporate shareholders

who are PRC residents. Approval from or registration with appropriate government authorities is, however, required where the RMB is to

be converted into foreign currency and remitted out of China to pay capital expenses, such as the repayment of loans denominated in foreign

currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions.

Current PRC regulations

permit our PRC subsidiaries to pay dividends to the Company only out of their accumulated profits, if any, determined in accordance with

Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside at least 10% of

its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each such

entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the

amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used,

among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies,

the reserve funds are not distributable as cash dividends except in the event of liquidation.

Cash dividends, if any,

on our Class A Ordinary Shares, will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes,

any dividends we pay to our overseas shareholders may be regarded as China-sourced income and, as a result, may be subject to PRC withholding

tax at a rate of up to 10.0%. Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region

for the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate

may be lowered to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC project. The 5% withholding tax rate, however,

does not automatically apply and certain requirements must be satisfied, including without limitation that (a) the Hong Kong

project must be the beneficial owner of the relevant dividends; and (b) the Hong Kong project must directly hold no less than

25% share ownership in the PRC project during the 12 consecutive months preceding its receipt of the dividends. In current practice,

a Hong Kong project must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding

tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you

that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential

withholding tax rate of 5% under the Double Taxation Arrangement with respect to any dividends paid by WFOE, Shandong Yousheng New Energy

Technology Development Co., Ltd, to its two direct Hong Kong holding companies. As of the date of this prospectus, we have not applied

for the tax resident certificate from the relevant Hong Kong tax authority. Our Hong Kong subsidiaries intend to apply for the

tax resident certificate if and when our PRC subsidiaries plan to declare and pay dividends to our Hong Kong subsidiaries.

As of the date of this

prospectus, there are no restrictions or limitations imposed by the Hong Kong government on the transfer of capital within, into and out

of Hong Kong (including funds from Hong Kong to the PRC), except for the transfer of funds involving money laundering and criminal activities.

For details, see “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China — To the

extent cash or assets of our business, or of our PRC or Hong Kong subsidiaries, is in PRC or Hong Kong, such cash or assets may not be

available to fund operations or for other use outside of the PRC or Hong Kong, due to interventions in or the imposition of restrictions

and limitations by the PRC government to the transfer of cash or assets” on page 8 of the 2023 Annual Report.

Our Class A Ordinary

Shares may be delisted under the Holding Foreign Companies Accountable Act (“HFCAA”) if the Public Company Accounting Oversight

Board of the United States (the “PCAOB”) is unable to inspect our auditors for three consecutive years beginning in 2021.

On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was signed into law as part of the Consolidated Appropriations

Act, which amended the HFCAA by reducing the number of consecutive non-inspection years required for triggering the prohibitions under

the HFCAA from three years to two.

On December 16, 2021, the PCAOB issued a report on its determinations

that it was unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in

Hong Kong, a Special Administrative Region of the PRC, because of positions taken by PRC authorities in those jurisdictions (the

“Determination”). On August 26, 2022, the China Securities Regulatory Commission (the “CSRC”), the Ministry of

Finance of the PRC (the “MOF”), and the PCAOB signed the Statement of Protocol (the “Protocol”), governing inspections

and investigations of audit firms based in China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and

investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect

to the Protocol disclosed by the U.S. Securities and Exchange Commission (the “SEC”), the PCAOB shall have independent discretion

to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December

15, 2022, the PCAOB determined that it was able to secure complete access to inspect and investigate registered public accounting firms

headquartered in mainland China and Hong Kong and vacated its previous determinations to the contrary. Onestop Assurance PAC, the independent

registered public accounting firm that issues the audit report included elsewhere in this prospectus, as an auditor of companies that

are traded publicly in the United States and a firm registered with the PCAOB, it is subject to laws in the United States pursuant to

which the PCAOB conducts regular inspections to assess our auditor’s compliance with the applicable professional standards. Our

auditor is headquartered in 10 Anson Road, #13-09 International Plaza, Singapore 079903, and has been inspected by the PCAOB on a regular

basis, with the last inspection in 2023. As such, as of the date of this annual, we are not affected by the HFCAA and related regulations.

However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB may consider

the need to issue a new determination. There is a risk that our auditor cannot be inspected by the PCAOB in the future, and if the PCAOB

determines that it cannot inspect or fully investigate our auditor for two consecutive years beginning in 2022, our securities will

be prohibited from trading on a national exchange or over-the-counter under the HFCAA, and, as a result, Nasdaq may determine to delist

our securities, which may cause the value of our securities to decline or become worthless. For details, see “Item 3. Key Information

— D. Risk Factors —Risk Factors — Risks Relating to Doing Business in China — The Holding

Foreign Companies Accountable Act and the Accelerating Holding Foreign Companies Accountable Act call for additional and more stringent

criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors

who are not inspected by the PCAOB of the United States. These developments could add uncertainties to our offering and listing on

the Nasdaq Capital Market, and Nasdaq may determine to delist our securities if the PCAOB determines that it cannot inspect or fully investigate

our auditor” on page 8 of the 2023 Annual Report.

We are a “foreign private issuer”

and we are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting

requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company” on page 12

of this prospectus for additional information.

The information contained or incorporated in

this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale

of our securities.

Neither the U.S. Securities and Exchange Commission

nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 30, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the SEC utilizing a “shelf” registration process. Under this shelf registration process, we may, from time

to time, sell the securities described in this prospectus in one or more offerings, up to a total offering amount of $50,000,000.

This prospectus provides you with a general description

of the securities we may offer. This prospectus and any accompanying prospectus supplement do not contain all the information included

in the registration statement. We have omitted parts of the registration statement in accordance with the rules and regulations of

the SEC. Statements in this prospectus and any accompanying prospectus supplement about the provisions or contents of any agreement or

other documents are not necessarily complete. If the SEC rules and regulations require that an agreement or other document be filed

as an exhibit to the registration statement, please see that agreement or document for a complete description of the matters. You should

read both this prospectus and any prospectus supplement or other offering materials together with additional information described under

the headings “Where You Can Find Additional Information” and “Incorporation of Documents by Reference”

before investing in any of the securities offered.

Each time we sell securities under this shelf

registration, we will provide a prospectus supplement that will contain certain specific information about the terms of that offering,

including a description of any risks related to the offering. A prospectus supplement may also add, update, or change information contained

in this prospectus (including documents incorporated herein by reference). If there is any inconsistency between the information in this

prospectus and the applicable prospectus supplement, you should rely on the information in the prospectus supplement. The registration

statement we filed with the SEC includes exhibits that provide more details on the matters discussed in this prospectus. You should read

this prospectus and the related exhibits filed with the SEC and the accompanying prospectus supplement together with additional information

described under the headings “Incorporation of Documents by Reference” before investing in any of the securities offered.

The information in this prospectus is accurate

as of the date on the front cover. The information incorporated by reference into this prospectus is accurate as of the date of the document

from which the information is incorporated. You should not assume that the information contained in this prospectus is accurate as of

any other date.

You should rely only on the information provided

or incorporated by reference in this prospectus or in the prospectus supplement. We have not authorized anyone to provide you with additional

or different information. This document may only be used where it is legal to sell these securities.

As permitted by SEC rules and regulations,

the registration statement of which this prospectus forms a part includes additional information not contained in this prospectus. You

may read the registration statement and the other reports we file with the SEC at its website or at its offices described under “Where

You Can Find Additional Information.”

COMMONLY USED DEFINED TERMS

Unless otherwise indicated or the context requires

otherwise, references in this prospectus or in a prospectus supplement to:

| |

● |

“AHYS” are to Anhui Yousheng New Energy Co., Ltd., a limited liability company established pursuant to PRC laws on May 16, 2013, which is controlled by WFOE (as defined below) with 100% equity ownership; |

| |

● |

“BVI” are to the British Virgin Islands; |

| |

● |

“China” and the “PRC” are to the People’s Republic of China; |

| |

● |

“CD Youyineng” are to Chengdu Youyineng Automobile Service Co., Ltd., a limited liability company established pursuant to PRC laws on October 29, 2020, and is wholly owned by AHYS (defined below); |

| |

● |

“Class A ordinary shares” are to our Class A ordinary shares, par value US$0.00001 per share; |

| |

● |

“Class B ordinary shares” are to our Class B ordinary shares, par value US$0.00001 per share; |

| |

● |

“EV” are to electric vehicle; |

| |

● |

“Hong Kong” or “HK” are to the Hong Kong Special Administrative Region of the PRC; |

| |

● |

“ISO” are to a series of quality management and quality assurance standards published by International Organization for standardization, a non-government organization based in Geneva, Switzerland, for assessing the quality systems of business organizations; |

| |

● |

“mainland China” are to the mainland China of the PRC, excluding Taiwan, the special administrative regions of Hong Kong and Macau for the purposes of this prospectus only; |

| |

● |

“our PRC subsidiaries”, or “PRC operating subsidiaries,” are to AHYS and its subsidiaries, including CD Youyineng, SH Youteng (defined below), SH Youxu (defined below), Youpin (defined below), Youpin SD (defined below), ZJ Youguan (defined blow), and their respective subsidiaries; |

| |

● |

“RMB” and “Renminbi” are to the legal currency of China; |

| |

● |

“shares,” “Shares,” or “Ordinary Shares” are to our Class A ordinary shares and our Class B ordinary shares, collectively; |

| |

● |

“SH Youteng” are to Shanghai Youteng Automobile Service Co., Ltd., a limited liability company established pursuant to PRC laws on November 3, 2020, and AHYS holds 70% of its equity interest; |

| |

● |

“SH Youxu” are to Shanghai Youxu New Energy Technology Co., Ltd., a limited liability company established pursuant to PRC laws on March 22, 2021, and AHYS holds 70% of its equity interest; |

| |

● |

“SME dealers” are to small and medium sized vehicle dealers; |

| |

● |

“UK” are to the United Kingdom, made up of England, Scotland, Wales and Northern Ireland; |

| |

● |

“U.S.”, “US” or “United States” are to United States of America, its territories, its possessions and all areas subject to its jurisdiction; |

| |

● |

“US$,” “$” and “U.S. dollars” are to the legal currency of the United States; |

| |

● |

“we,” “us,” “Company,” “our”, and “Upincar” are to U Power Limited, the Cayman Islands holding company, and its predecessor entity and its subsidiaries, as the context requires; |

| |

● |

“WFOE” are to our wholly owned Chinese subsidiary, Shandong Yousheng New Energy Technology Development Co., Ltd., a limited liability company established pursuant to PRC laws on January 27, 2022; |

| |

● |

“Youpin” are to Youpin Automobile Service Group Co., Ltd., a limited liability company established pursuant to PRC laws on July 18, 2013, and AHYS holds 53.1072% of its equity interest; |

| |

● |

“Youpin SD” are to Youpin Automobile Service (Shandong) Co., Ltd., a limited liability company established pursuant to PRC laws on June 30, 2020, and AHYS holds 87% of its equity interest; and |

| |

● |

“ZJ Youguan” are to Zhejiang Youguan Automobile Service Co., Ltd., a limited liability company established pursuant to PRC laws on May 21, 2020, and AHYS holds 80% of its equity interest. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any applicable prospectus supplement,

and our SEC filings that are incorporated by reference into this prospectus contain or incorporate by reference forward-looking statements

within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical

fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items, any statements

of the plans, strategies, and objectives of management for future operations, any statements concerning proposed new projects or other

developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals,

strategies, intentions, and objectives, and any statements of assumptions underlying any of the foregoing. The words “believe,”

“anticipate,” “estimate,” “plan,” “expect,” “intend,” “may,” “could,”

“should,” “potential,” “likely,” “projects,” “continue,” “will,”

and “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking

statements contain these identifying words. Forward-looking statements reflect our current views with respect to future events, are based

on assumptions, and are subject to risks and uncertainties. We cannot guarantee that we actually will achieve the plans, intentions, or

expectations expressed in our forward-looking statements and you should not place undue reliance on these statements. There are a number

of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking statements.

These important factors include those discussed under the heading “Risk Factors” contained or incorporated by reference in

this prospectus and in the applicable prospectus supplement and any free writing prospectus we may authorize for use in connection with

a specific offering. These factors and the other cautionary statements made in this prospectus should be read as being applicable to all

related forward-looking statements whenever they appear in this prospectus. Except as required by law, we undertake no obligation to update

publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Prospectus

Summary

Investors are cautioned that the Class A Ordinary

Shares offered under this prospectus are securities of U Power Limited, our Cayman Islands holding company, which is not a Chinese operating

company nor does it have any substantive business operations. U Power Limited conducts business in China through PRC operating entities.

The following summary highlights information

contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that

you need to consider in making your investment decision. We urge you to read this entire prospectus (as supplemented or amended), including

our consolidated financial statements, notes to the consolidated financial statements and other information incorporated by reference

in this prospectus from our other filings with the SEC, before making an investment decision.

Overview

We are a vehicle sourcing

service provider in China, with a vision to becoming an EV market player primarily focused on our proprietary battery-swapping technology,

or UOTTA technology, which is an intelligent modular battery-swapping technology designed to provide a comprehensive battery power solution

for EVs.

Since our commencement

of operations in 2013, we have principally engaged in the provision of vehicle sourcing services. We broker sales of vehicles between

automobile wholesalers and buyers, including SME dealers and individual customers primarily located in the lower-tier cities in China,

which are smaller and less developed than the tier-1 or tier-2 cities. To that end, we have focused on building business relationships

with our sourcing partners and have developed a vehicle sourcing network. As of the date of this prospectus, our vehicle sourcing network

consisted of approximately 100 wholesalers and 30 SME dealers located in lower-tier cities in China . For fiscal years ended December

31, 2021, 2022 and 2023, our revenues from the sourcing business were RMB1.4 million, RMB4.4 million and RMB 1.5 million, which constituted

17.4%, 56.8% and 7.7%, respectively, of our total revenue.

Beginning in 2020, we

gradually shifted our focus from the vehicle sourcing business to the development of our proprietary battery-swapping technology, or UOTTA

technology. According to Frost & Sullivan, the PRC government will focus on promoting the electrification of commercial vehicles

in the next few years, and it is expected that the sales volume of electric commercial vehicles will grow from 218.9 thousand units

in 2022 to 431.0 thousand units in 2026 at a CAGR of 18.5% in China, and with the increasing penetration rates of electric commercial

vehicles and the expanding battery-swapping infrastructure network, the market size by revenue of battery swapping solutions for electric

commercial vehicles is expected to increase from approximately RMB22,097.6 million in 2022 to RMB176,615.1 million in 2026,

representing a CAGR of 68.1%. In order to capture the opportunities arising from such growth, our plan is to develop a comprehensive EV

battery power solution based on UOTTA technology, which mainly consists of: (i) vehicle-mounted supervisory control units that monitor

the real-time status of an EV’s battery packs; (ii) customized vehicle control units (“VCUs”), which upload real-time

data of the electric vehicle, such as its battery status, real-time location and safety status, to our data platform, using Bluetooth

and/or Wi-Fi technologies; and (iii) our data management platform, which collects and synchronizes real-time information of the EVs

uploaded by their respective VCUs, as well as information on the availability and locations of compatible UOTTA battery-swapping stations

that assist drivers in locating the nearest compatible UOTTA battery-swapping station(s) available when the EV’s battery is

determined to be lower than a certain level; and (iv) UOTTA battery-swapping stations designed for precise positioning, rapid disassembly,

compact integration and flexible deployment of battery swapping for compatible EVs.

We have established in-house

capabilities in the innovation of EV battery-swapping technology. Through our research and development efforts, we are developing an intellectual

property portfolio. As of the date of this prospectus, we had 46 issued patents and 14 pending patent applications in China. Our research

and development team is committed to technology innovation. As of the date of this prospectus, our research and development team consisted

of 26 personnel and is led by Mr. Rui Wang and Mr. Zhanduo Hao, each of whom has experience of over 20 years in the electric

power sector.

In 2021, leveraging years

of automobile industry experience, we started cooperating with major automobile manufactures to jointly develop UOTTA-powered EVs, by

adapting selected EV models with our UOTTA technology. According to Frost & Sullivan, compared with passenger EV drivers, drivers

of commercial-use EVs experience more range anxiety and are more motivated to shorten, or even eliminate, time spent on recharging EVs,

therefore, we intend to primarily focus on developing commercial-use UOTTA-powered EVs, such as ride-hailing passenger EVs, small logistics

EVs, light electric trucks, and heavy electric trucks, and their compatible UOTTA battery-swapping stations. As of the date of this prospectus,

we have entered into cooperating agreements with two major Chinese automobile manufacturers, FAW Jiefang Qingdao Automotive Co., Ltd,

and HUBEI TRI-RING Motor Co., Ltd, to jointly develop UOTTA-powered electric trucks. We also have engaged with one battery-swapping station

manufacture to jointly develop and manufacture UOTTA battery-swapping stations that are compatible with UOTTA-powered EVs. Our UOTTA

battery-swapping stations are designed for precise positioning, rapid disassembly, compact integration and flexible deployment, allowing

battery replacement within several minutes. As of the date of this prospectus, we realized sales of eleven battery-swapping stations.

In August 2021, we completed the construction of our own battery-swapping station factory in Zibo City, Shandong Province (the “Zibo

Factory”), which commenced manufacturing UOTTA battery-swapping stations in January 2022. In January 2022, we started operating

a battery-swapping station, and in March 2023, we started operating a second battery-swapping station, both in Quanzhou City, Fujian Province,

pursuant to our cooperation agreement with Quanzhou Xinao. In order to provide a comprehensive battery power solution based on UOTTA technology,

we are in the process of developing a data management platform that connects UOTTA-powered EVs and stations, and assists the UOTTA-powered

EV drivers in locating the closest compatible UOTTA swapping-stations on their routes. We believe we have made significant progress in

entering into the EV market as of the date of this prospectus, however, there is no assurance that we will be able to execute our business

plan to expand into the EV market as we have planned. For fiscal years ended December 31 2021, 2022, and 2023, our revenues from the EV

business were RMB6.6 million, RMB3.1 million, and RMB17.1 million, which constituted 82.6%,39.2%, and 86.3%, respectively, of our total

revenue.

Recent Development

Variation of Share Capital

The 2024 annual general meeting of shareholders

(the “AGM”) of the “Company was held on August 13, 2024. At the AGM, the shareholders of the Company adopted the following

resolutions with respect to the variation of share capital:

| |

(a) |

re-designated all of the issued shares of a par value of US$0.00001 each (the “Shares”) in the capital of the Company (other than the 71,250 Shares held by U Create Limited, the 157,859 Shares held by U Trend Limited, the 149,435 Shares held by Upincar Limited and the 209,644 Shares held by Fortune Light Assets Ltd) into Class A Ordinary Shares of US$0.00001 each, with each Class A Ordinary Share entitled to one vote; |

| |

(b) |

re-designated the 71,250 Shares held by U Create Limited, the 157,859 Shares held by U Trend Limited, the 149,435 Shares held by Upincar Limited and the 209,644 Shares held by Fortune Light Assets Ltd into Class B Ordinary Shares of US$0.00001 each, with each Class B Ordinary Share entitled to 20 votes; |

| |

(c) |

re-designated 3,996,621,812 authorized but unissued Shares as Class A Ordinary Shares; and |

| |

(d) |

re-designated 1,000,000,000 authorized but unissued Shares as Class B Ordinary Shares, |

As a result, immediately following the AGM, the

authorized share capital of the Company was varied from US$50,000 divided into 5,000,000,000 Ordinary Shares of par value of US$0.00001

each to US$50,000 divided into 3,999,411,812 Class A Ordinary Shares of a par value of US$0.00001 each, and 1,000,588,188 Class B Ordinary

Shares of a par value of US$0.00001 each.

Entry Into two Material Definitive Agreements

with Fortune Light Assets Ltd.

On May 13, 2024, we entered into a subscription

agreement with Fortune Light Assets Ltd. (“FLA”). Pursuant to the subscription agreement, FLA agreed to subscribe for and

purchase, and the Company agreed to issue and sell to FLA, pursuant to Regulation S under the Securities Act of 1933, as amended, an aggregate

of 209,644 Ordinary Shares of the Company, par value US$0.00001 per share, at a purchase price of $4.77 per share, for an aggregate purchase

price of $1,000,001.88. The closing of the transaction took place on June 15, 2024. Pursuant to the subscription agreement, FLA is entitled

to the following: (i) one demand registration with respect to the 209,644 Ordinary Shares (such demand registration right will be terminated

on the six-month anniversary of the execution date of the subscription agreement); and (ii) the purchase of up to 492,611 Ordinary Shares

of the Company at a per share price of $6.09 for a total purchase price of up to $3,000,000, pursuant to an agreement which shall be in

customary form reasonably acceptable to the parties, and such right to purchase additional shares will be terminated on the two-year anniversary

of the execution date of the subscription agreement.

On June 24, 2024, we entered into a subscription

agreement with FLA. Pursuant to the subscription agreement, FLA agreed to subscribe for and purchase, and the Company agreed to issue

and sell to FLA, pursuant to Regulation S under the Securities Act of 1933, as amended, an aggregate of 209,644 Ordinary Shares of the

Company, par value US$0.00001 per share, at a purchase price of $4.77 per share, for an aggregate purchase price of $1,000,001.88. The

closing of the transaction took place on July 3, 2024. Pursuant to the subscription agreement, FLA is entitled to the following: (i) one

demand registration with respect to the 209,644 Ordinary Shares (such demand registration right will be terminated on the six-month anniversary

of the execution date of the subscription agreement); and (ii) the purchase of up to 164,204 Ordinary Shares of the Company at a per share

price of $6.09 for a total purchase price of up to $1,000,002.36, pursuant to an agreement which shall be in customary form reasonably

acceptable to the parties, and such right to purchase additional shares will be terminated on the two-year anniversary of the execution

date of this subscription agreement.

Entry Into a Material Definitive Agreements

with Big Benefit Ltd.

On May 23, 2024, we entered into a subscription

agreement with Big Benefit Ltd. (“BBL”). Pursuant to the subscription agreement, BBL agreed to subscribe for and purchase,

and the Company agreed to issue and sell to BBL, pursuant to Regulation S under the Securities Act of 1933, as amended, an aggregate of

419,289 Ordinary Shares of the Company, par value US$0.00001 per share, at a purchase price of $4.77 per ordinary share, for an aggregate

purchase price of $2,000,008.53.

The closing of the transaction took place on June

10, 2024. BBL is entitled to demand registration with respect to the 419,289 Ordinary Shares (such demand registration right will expire

on the six-month anniversary of the execution date of the subscription agreement).

Corporate Structure

We are a Cayman Islands

exempted company incorporated on June 17, 2021. Exempted companies are Cayman Island companies conducting business mainly outside

the Cayman Islands and, as such, are exempted from complying with certain provisions of the Companies Act (As Revised).

The following diagram

illustrates our corporate structure as of the date of this prospectus.

Regulatory Developments on Overseas-listing

On July 6, 2021, the relevant PRC governmental

authorities made public the Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law. These opinions

emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based

companies and proposed to take effective measures, such as promoting the construction of relevant regulatory systems to deal with the

risks and incidents faced by China-based overseas-listed companies. As these opinions are recently issued, official guidance and related

implementation rules have not been issued yet and the interpretation of these opinions remains unclear at this stage.

On December 24, 2021, the China Securities Regulatory

Commission, or the CSRC, issued the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing

by Domestic Companies (Draft for Comments) (the “Administration Provisions”), and the Provisions of the State Council on the

Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Measures”), of

which the public comment period ended on January 23, 2022. The Administration Provisions and Measures for overseas listings lay out specific

requirements for filing documents and include unified regulation management, strengthening regulatory coordination, and cross-border regulatory

cooperation. Domestic companies seeking to list abroad must carry out relevant security screening procedures if their businesses involve

such supervision. Companies endangering national security are among those off-limits for overseas listings.

On February 17, 2023, the China Securities Regulatory

Commission (the “CSRC”) released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic

Companies (the “Trial Measures”), (《境内企业境外发行证券和上市管理试行办法》),

which has become effective on March 31, 2023. On the same date of the issuance of the Overseas Listings Rules, the CSRC circulated No.1

to No.5 Supporting Guidance Rules, the Notes on the Trial Measures, the Notice on Administration Arrangements for the Filing of Overseas

Listings by Domestic Enterprises and the relevant CSRC Answers to Reporter Questions on the official website of CSRC, or collectively,

the Guidance Rules and Notice. The Overseas Listings Rules, together with the Guidance Rules and Notice, reiterate the basic supervision

principles as reflected in the Administration Provisions and Measures by providing substantially the same requirements for filings of

overseas offering and listing by domestic companies.

Under the Trial Measures and the Guidance Rules

and Notice, domestic companies conducting overseas securities offering and listing activities, either in direct or indirect form, shall

complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following submission

of initial public offerings or listing applications. The companies that have already been listed on overseas stock exchanges or have obtained

the approval from overseas supervision administrations or stock exchanges for its offering and listing before March 31, 2023 and completed

their overseas offering and listing prior to September 30, 2023, such as us, shall be deemed to be existing issuers (the “Existing

Issuers”). Existing Issuers are not required to complete the filing procedures for listing overseas immediately, but are required

to file with the CSRC for any subsequent offerings in the same overseas market, including this offering, within 3 working days after the

offering is completed. Any failure by us to comply with such filing requirements under the Trial Measures may result in forced corrections,

warnings, and fines against us and could materially hinder our ability to offer or continue to offer our securities.

As of the date of this prospectus, neither we

nor any of the PRC operating entities have been subject to any investigation, or received any warning, or sanction from the CSRC or other

applicable government authorities related to the offering of our securities.

Permissions from the PRC Authorities

As of the date of this prospectus, we and our

PRC operating entities have received from PRC authorities all requisite licenses, permissions, and approvals needed to engage in the businesses

currently conducted in the PRC, and no such permission or approval has been denied. These licenses, permissions, and approvals, which

have been successfully obtained, are: (1) business licenses; and (2) auto dealer filings . However, in the future, if any additional

approvals or permissions are required, we cannot assure you that any of these entities will be able to receive clearance of compliance

requirements in a timely manner, or at all. Any failure to fully comply with any compliance requirements may cause our PRC operating entities,

to be unable to operate their businesses in the PRC, subject them to fines, relevant businesses or operations suspension for rectification,

or other sanctions.

On December 28, 2021, thirteen governmental departments

of the PRC, including the Cyberspace Administration of China (“CAC”), issued the revised Cybersecurity Review Measures, which

became effective on February 15, 2022. The Cybersecurity Review Measures require that any network platform operator which possesses the

personal information of at least one million users must apply for a cybersecurity review by the CAC if it intends to be listed in foreign

countries. As advised by our PRC counsel, Guantao Law Firm, since we are not an online platform operator that possesses over one million

users’ personal information, we are not subject to the cybersecurity review with the CAC under the Cybersecurity Review Measures.

However, as uncertainties remain regarding the interpretation and implementation of these laws and regulations, we cannot assure you that

we will be able to comply with such regulations in all respects, and we may be ordered to rectify or terminate any actions that are deemed

illegal by regulatory authorities. We may also become subject to fines and/or other sanctions and the costs of compliance with, and other

burdens imposed by such laws and regulations may limit the use and adoption of our products, which may have material adverse effects on

our business, operations, and financial condition.

On July 7, 2022, the CAC published the Measures

for the Security Assessment of Outbound Data Transfer (《数据出境安全评估办法》),

which became effective on September 1, 2022. The measures apply to the security assessment of important data and personal information

collected and generated during operation within the territory of the People’s Republic of China and transferred abroad by a data

handler. According to the Measures, a data handler shall file with the State Cyberspace Administration for security assessment via the

Province Cyberspace Administration if it transfers data abroad under any of the following circumstances: (i) a data handler who transfers

important data abroad; (ii) a critical information infrastructure operator, or a data handler processing the personal information of more

than one million individuals transfers personal information to abroad;(iii) since January 1 of the previous year, a data handler

cumulatively transferred abroad the personal information of more than 100,000 individuals, or the sensitive personal information of more

than 10,000 individuals; or (iv) any other circumstances where the security assessment for the outbound data transfer is required by the

State Cyberspace Administration. As advised by our PRC counsel, Guantao Law Firm, since none of our PRC operating entities is a data handler

that transfers data abroad under any of the aforementioned circumstances, the operations of the PRC operating entities, our continued

listing, and this offering are not affected by the Measures for the Security Assessment of Outbound Data Transfer.

As of the date of this prospectus, our PRC operating

entities have not received any notice from any authorities identifying the operating entities as a CIIO or requiring the operating entities

to go through cybersecurity review or network data security review by the CAC, nor have our PRC operating entities been involved in any

investigations on cybersecurity review initiated by the CAC or related governmental regulatory authorities. In addition, our PRC operating

entities have not received any inquiry, notice, warning, or sanction in such respect. We believe that our PRC operating entities are in

compliance with the aforementioned regulations and policies. However, our PRC operating entities could become subject to enhanced cybersecurity

review or investigations launched by PRC regulators in the future. Any failure or delay in the completion of the cybersecurity review

procedures or any other non-compliance with the related laws and regulations may result in fines or other penalties, including suspension

of business, website closure, and revocation of prerequisite licenses, as well as reputational damage or legal proceedings or actions

against the PRC operating entities, which may have material adverse effect on the PRC operating entities’ business, financial condition

or results of operations.

In addition, on February 17, 2023, the CSRC promulgated

the Trial Measures and five supporting guidelines, which took effect on March 31, 2023. Pursuant to the Trial Measures, PRC domestic companies

that seek to offer or list securities overseas, both directly and indirectly, shall file with the CSRC pursuant to the requirements of

the Trial Measures within three working days following submission of relevant application for listing or completion of any subsequent

offerings. If a domestic company fails to complete required filing procedures or conceals any material facts or falsifies any major content

in its filing documents, such domestic company may be subject to administrative penalties, such as an order to rectify, warnings, and

fines, and its controlling shareholders, actual controllers, and the person directly in charge and other directly liable persons may also

be subject to administrative penalties, such as warnings and fines. As of the date of this prospectus, neither we nor any of the PRC operating

entities have been subject to any investigation, or received any warning, or sanction from the CSRC or other applicable government authorities

related to the offering of our securities.

As of the date of this prospectus, we believe

that, except the filing procedures with the CSRC pursuant to the Trial Measures and supporting guidelines, neither the Company, nor the

PRC operating entities, will be required to obtain permission from any Chinese authorities to offer our securities based on PRC laws and

regulations currently in effect, and neither we nor the PRC operating entities have been denied such permission by any Chinese authorities.

However, we cannot assure you that the PRC regulatory agencies would take the same view as we do, and there is no assurance that our PRC

operating entities will always be able to successfully update or renew the licenses or permits required for the relevant business in a

timely manner or that these licenses or permits are sufficient to conduct all of their present or future business. If our PRC operating

entities (i) do not receive or maintain required permissions or approvals, (ii) inadvertently conclude that such permissions or approvals

are not required, or (iii) applicable laws, regulations, or interpretations change and our PRC operating entities, are required to obtain

such permissions or approvals in the future, they could be subject to fines, legal sanctions, or an order to suspend their relevant services,

which may materially and adversely affect our financial condition and results of operations and cause our securities to significantly

decline in value or become worthless.

Distributions and Dividends

Under Cayman Islands law, a Cayman Islands company may pay a dividend

on its shares out of either profit or a share premium amounts, provided that in no circumstances may a dividend be paid if this would

result in the company being unable to pay its debts due in the ordinary course of business. As of the date of this prospectus, (1) the

Company transferred approximately $4.60 million and $5.30 million to a subsidiary, Energy U Limited, in fiscal years 2024 and 2023, respectively,

and no other cash transfers or transfers of other assets have occurred between the Company and its subsidiaries, and (2) the Company

and its subsidiaries have not made any dividends or distributions to investors. We intend to keep any future earnings to finance

the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future. As of the date

of this prospectus, we have not installed any cash management policies that dictate how funds are transferred among the Company, its subsidiaries,

or investors.

Our PRC operating entities

receive substantially all of our revenue in RMB. Under our current corporate structure, to fund any cash and financing requirements

we may have, we may rely on dividend payments from the PRC operating subsidiaries. Under existing PRC foreign exchange regulations, payment

of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign

currencies without prior approval from State Administration of Foreign Exchange (“SAFE”) by complying with certain procedural

requirements. Therefore, our PRC subsidiaries are able to pay dividends in foreign currencies to us without prior approval from SAFE,

subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC foreign exchange

regulations, such as the overseas investment registrations by our shareholders or the ultimate shareholders of our corporate shareholders

who are PRC residents. Approval from or registration with appropriate government authorities is, however, required where the RMB is to

be converted into foreign currency and remitted out of China to pay capital expenses, such as the repayment of loans denominated in foreign

currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions.

Current PRC regulations

permit our PRC subsidiaries to pay dividends to the Company only out of their accumulated profits, if any, determined in accordance with

Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside at least 10% of

its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each such

entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the

amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used,

among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies,

the reserve funds are not distributable as cash dividends except in the event of liquidation.

Cash dividends, if any,

on our ordinary shares, will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends

we pay to our overseas shareholders may be regarded as China-sourced income and, as a result, may be subject to PRC withholding tax at

a rate of up to 10.0%. Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for the

Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be lowered

to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC project. The 5% withholding tax rate, however, does not automatically

apply and certain requirements must be satisfied, including without limitation that (a) the Hong Kong project must be the beneficial

owner of the relevant dividends; and (b) the Hong Kong project must directly hold no less than 25% share ownership in the PRC

project during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong project must

obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong

tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain

the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under

the Double Taxation Arrangement with respect to any dividends paid by WFOE, Shandong Yousheng New Energy Technology Development Co., Ltd,

to its direct Hong Kong holding company. As of the date of this prospectus, we have not applied for the tax resident certificate

from the relevant Hong Kong tax authority. Our Hong Kong subsidiaries intend to apply for the tax resident certificate if and

when our PRC subsidiaries plan to declare and pay dividends to our Hong Kong subsidiaries.

Summary of Risk Factors

Investing

in our Class A Ordinary Shares involves significant risks. You should carefully consider all of the information in this prospectus before

making an investment in our Class A Ordinary Shares. Below please find a summary of the principal risks we face, organized under relevant

headings. These risks are discussed more fully under “Item 3. Key Information—D. Risk Factors” beginning

on page 7 of the 2023 Annual Report and in the section titled “Risk Factors” beginning on page 13 of this prospectus.

Risks Relating

to Doing Business in China

Risks and uncertainties

related to doing business in China include, but are not limited to, the following:

| |

● |

Changes in China’s economic, political or social conditions, laws, regulations or governmental policies could have a material adverse effect on our business, financial conditions and results of operations. PRC laws and regulations governing our current business operations are sometimes vague and uncertain and any changes in such laws and regulations may impair our ability to operate profitably. For details, see the risk factor on page 11 of the 2023 Annual Report; |

| |

● |

Substantial uncertainties in the promulgation, interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us. For details, see the risk factor on page 12 of the 2023 Annual Report; |

| |

● |

Any actions by the Chinese government, including any decision to intervene or influence the operations of the operating entities or to exert control over any offering of securities conducted overseas and/or foreign investment in China-based issuers, may cause us to make material changes to the operations of the PRC operating entities, may limit or completely hinder our ability to offer or continue to offer securities to investors, and may cause the value of such securities to significantly decline or be worthless. For details, see the risk factor on page 12 of the 2023 Annual Report; |

| |

● |

We may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. For details, see the risk factor on page 13 of this prospectus; |

| |

● |

The M&A Rules and certain other PRC regulations may make it more difficult for us to pursue growth through acquisitions. For details, see the risk factor on page 18 of the 2023 Annual Report; |

| |

● |

To the extent cash or assets of our business, or of our PRC or Hong Kong subsidiaries, is in mainland China or Hong Kong, such cash or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong, due to interventions in or the imposition of restrictions and limitations by the PRC government to the transfer of cash or assets. For details, see the risk factor on page 21 of the 2023 Annual Report; |

| |

● |

Fluctuations in exchange rates could have a material and adverse effect on our results of operations and the value of your investment. For details, see the risk factor on page 23 of the 2023 Annual Report; |

| |

● |

Governmental control of currency conversion may limit our ability to utilize our income effectively and affect the value of your investment. For details, see the risk factor on page 23 of the 2023 Annual Report; |

| |

● |

The PRC

government exerts substantial influence over the manner in which we and our PRC subsidiaries must conduct our business activities.

We are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges, however, if we or our PRC

subsidiaries are required to obtain approval in the future and are denied permission from Chinese authorities to list on U.S.

exchanges, we will not be able to continue listing on U.S. exchanges, which would materially affect the interest of the investors.

For details, see the risk factor on page 8 of the 2023 Annual Report; |

| |

● |

The Holding Foreign Companies Accountable Act and the Accelerating Holding Foreign Companies Accountable Act call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering and listing on the Nasdaq Capital Market, and Nasdaq may determine to delist our securities if the PCAOB determines that it cannot inspect or fully investigate our auditor. For details, see the risk factor on page 25 of the 2023 Annual Report; and |

| |

● |

Changes in international trade policies, or the escalation of tensions in international relations, particularly with regard to China, may adversely impact our business and operating results. For details, see the risk factor on page 26 of the 2023 Annual Report. |

Risks Relating

to Our Business and Industry

Risks and uncertainties

related to our business and industry include, but are not limited to, the following:

| |

● |

We have incurred substantial losses in the past and may incur losses in the future. There is substantial doubt about our ability to continue as a going concern. For details, see the risk factor on page 27 of the 2023 Annual Report; |

| |

● |

We have limited operating history in an emerging and fast-growing market, and our historical financial and operating performance may not be indicative of our future prospects and results of operations. For details, see the risk factor on page 27 of the 2023 Annual Report; |

| |

● |

We face intense competition and may not be able to compete effectively. For details, see the risk factor with the same heading on page 28 of the 2023 Annual Report; |

| |

● |

We may not be able to effectively manage our growth, control expenses or implement business strategies, any of which events may cause our PRC subsidiaries to be unable to provide services or deliver products with premium quality or compete effectively. For details, see the risk factor on page 29 of the 2023 Annual Report; |

| |

● |

Any harm to our brands or reputation or any damage to the reputation of the third parties with whom we collaborate or failure to enhance brand recognition could have a material adverse effect on our results of operations and growth prospects. For details, see the risk factor on page 29 of the 2023 Annual Report; |

| |

● |

We may not be able to prevent others from unauthorized use of our intellectual property, which could harm our business and competitive position. For details, see the risk factor on page 30 of the 2023 Annual Report; |

| |

● |

Some of our patent applications on UOTTA technology are currently pending, we cannot assure you that such patents will be approved, and we may not be able to prevent others from developing or exploiting competing technologies, which could have a material and adverse effect on our business, results of operations, financial condition and prospects. For details, see the risk factor on page 31 of the 2023 Annual Report; |

| |

● |