0001408710FALSE00014087102024-11-042024-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

November 4, 2024

______________________

Fabrinet

(Exact name of registrant as specified in its charter)

______________________

| | | | | | | | |

| Cayman Islands | 001-34775 | 98-1228572 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

c/o Intertrust Corporate Services

One Nexus Way, Camana Bay

Grand Cayman

KY1-9005

Cayman Islands

(Address of principal executive offices, including zip code)

+66 2-524-9600

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Ordinary Shares, $0.01 par value | | FN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 4, 2024, Fabrinet issued a press release regarding its financial results for its fiscal quarter ended September 27, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information in this Item 2.02 and the press release attached hereto as Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | FABRINET |

| | |

| By: | /s/ CSABA SVERHA |

| | Csaba Sverha |

| | Executive Vice President, Chief Financial Officer |

| | |

Date: November 4, 2024 | | |

Exhibit 99.1

Fabrinet Announces First Quarter Fiscal Year 2025 Financial Results

•Record First Quarter Revenue Exceeds Guidance Range

BANGKOK, Thailand – November 4, 2024 – Fabrinet (NYSE: FN), a leading provider of advanced optical packaging and precision optical, electro-mechanical and electronic manufacturing services to original equipment manufacturers of complex products, today announced its financial results for its fiscal first quarter ended September 27, 2024.

Seamus Grady, Chief Executive Officer of Fabrinet, said, “We started fiscal year 2025 with significant momentum across our business. Record revenue of $804 million increased 17% from a year ago and was above our guidance range. We saw revenue growth from every product area, including our first telecom revenue growth in several quarters. Strong margins coupled with our revenue performance helped produce earnings per share at the upper end of our guidance range. We are optimistic that our strong business momentum and execution will extend into the fiscal second quarter as we continue to expand on our leadership in the market.”

First Quarter Fiscal Year 2025 Financial Highlights

GAAP Results

•Revenue for the first quarter of fiscal year 2025 was $804.2 million, compared to $685.5 million for the first quarter of fiscal year 2024.

•GAAP net income for the first quarter of fiscal year 2025 was $77.4 million, compared to $65.1 million for the first quarter of fiscal year 2024.

•GAAP net income per diluted share for the first quarter of fiscal year 2025 was $2.13, compared to $1.78 for the first quarter of fiscal year 2024.

Non-GAAP Results

•Non-GAAP net income for the first quarter of fiscal year 2025 was $86.9 million, compared to $72.8 million for the first quarter of fiscal year 2024.

•Non-GAAP net income per diluted share for the first quarter of fiscal year 2025 was $2.39, compared to $2.00 for the first quarter of fiscal year 2024.

Business Outlook

Based on information available as of November 4, 2024, Fabrinet is issuing guidance for its second fiscal quarter ending December 27, 2024, as follows:

•Fabrinet expects second quarter revenue to be in the range of $800 million to $820 million.

•GAAP net income per diluted share is expected to be in the range of $2.20 to $2.28, based on approximately 36.4 million fully diluted shares outstanding.

•Non-GAAP net income per diluted share is expected to be in the range of $2.44 to $2.52, based on approximately 36.4 million fully diluted shares outstanding.

Guidance for non-GAAP net income per diluted share excludes share-based compensation expenses and certain non-recurring items. A reconciliation of non-GAAP net income per diluted share to the corresponding GAAP measure is available at the end of this press release.

Conference Call Information

| | | | | | | | |

| What: | | Fabrinet First Quarter Fiscal Year 2025 Financial Results Call |

| When: | | November 4, 2024 |

| Time: | | 5:00 p.m. ET |

| Live Call and Replay: | | https://investor.fabrinet.com/events-and-presentations/events |

A recorded version of this webcast will be available approximately two hours after the call and accessible at http://investor.fabrinet.com. The webcast will be archived on Fabrinet’s website for a period of one year.

About Fabrinet

Fabrinet is a leading provider of advanced optical packaging and precision optical, electro-mechanical, and electronic manufacturing services to original equipment manufacturers of complex products, such as optical communication components, modules and subsystems, automotive components, medical devices, industrial lasers and sensors. Fabrinet offers a broad range of advanced optical and electro-mechanical capabilities across the entire manufacturing process, including process design and engineering, supply chain management, manufacturing, advanced packaging, integration, final assembly and testing. Fabrinet maintains engineering and manufacturing resources and facilities in Thailand, the United States of America, the People’s Republic of China, and Israel. For more information visit: www.fabrinet.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include: (1) our optimism that numerous drivers position us to extend our track record of success into the fiscal second quarter; and (2) all of the statements under the “Business Outlook” section regarding our expected revenue, GAAP and non-GAAP net income per share, and fully diluted shares outstanding for the second quarter of fiscal year 2025. These forward-looking statements involve risks and uncertainties, and actual results could vary materially from these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: changes in general economic conditions, either globally or in our markets, and the risk of recession or an economic downturn; continued disruption to our supply chain, which could increase our costs and affect our ability to procure parts and materials; less customer demand for our products and services than forecasted; less growth in the optical communications, automotive, industrial lasers and sensors markets than we forecast; difficulties expanding into additional markets, such as the semiconductor processing, biotechnology, metrology and materials processing markets; increased competition in the optical manufacturing services markets; difficulties in delivering products and services that compete effectively from a price and performance perspective; our reliance on a small number of customers and suppliers; difficulties in managing our operating costs; difficulties in managing and operating our business across multiple countries (including Thailand, the People’s Republic of China, Israel and the U.S.); and other important factors as described in reports and documents we file from time to time with the Securities and Exchange Commission (SEC), including the factors described under the section captioned “Risk Factors” in our Annual Report on Form 10-K filed with the SEC on August 20, 2024. We disclaim any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise.

Non-GAAP Financial Measures

In addition to reporting financial results in accordance with GAAP, we provide investors with certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. We believe these non-GAAP financial measures provide investors with useful supplemental information to: (1) measure company performance against historical results, (2) facilitate comparisons to our competitors’ operating results, and (3) allow greater transparency with respect to information used by management in making financial and operational decisions. In addition, we use some of these non-GAAP financial measures to measure company performance for the purposes of determining employee incentive plan compensation.

Non-GAAP gross profit, non-GAAP operating profit, non-GAAP net income and non-GAAP net income per diluted share exclude: share-based compensation expenses; severance payment and others; restructuring and other related costs; and amortization of deferred debt issuance costs. We have excluded these items in order to enhance investors’ understanding of our underlying operations.

Non-GAAP free cash flow is net cash provided by (used in) operating activities, minus capital expenditures (purchase of property, plant and equipment). We use free cash flow to measure our ability to generate additional cash from our business operations.

There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. We urge you to review the reconciliations of our non-GAAP financial measures to the most directly comparable GAAP financial measures, and not to rely on any single financial measure to evaluate our business.

Investor Contact:

Garo Toomajanian

ir@fabrinet.com

FABRINET

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| (in thousands of U.S. dollars, except share data and par value) | September 27,

2024 | | June 28,

2024 |

| (unaudited) | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 400,684 | | | $ | 409,973 | |

| | | |

| Short-term investments | 508,193 | | | 448,630 | |

| Trade accounts receivable, net of allowance for expected credit losses of $1,954 and $1,629, respectively | 662,692 | | | 592,452 | |

| | | |

| Inventories | 440,405 | | | 463,206 | |

| Prepaid expenses | 9,426 | | | 10,620 | |

| Other current assets | 87,538 | | | 87,810 | |

| Total current assets | 2,108,938 | | | 2,012,691 | |

| Non-current assets | | | |

| | | |

| Property, plant and equipment, net | 311,241 | | | 307,240 | |

| Intangibles, net | 2,201 | | | 2,321 | |

| Operating right-of-use assets | 5,133 | | | 5,336 | |

| Deferred tax assets | 10,902 | | | 10,446 | |

| Other non-current assets | 598 | | | 485 | |

| Total non-current assets | 330,075 | | | 325,828 | |

| Total Assets | $ | 2,439,013 | | | $ | 2,338,519 | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities | | | |

| | | |

| Trade accounts payable | 427,892 | | | 441,835 | |

| Fixed assets payable | 10,166 | | | 14,380 | |

| | | |

| | | |

| Operating lease liabilities, current portion | 1,416 | | | 1,355 | |

| Income tax payable | 4,377 | | | 3,937 | |

| Accrued payroll, bonus and related expenses | 26,658 | | | 22,116 | |

| Accrued expenses | 30,519 | | | 19,916 | |

| Other payables | 74,950 | | | 54,403 | |

| Total current liabilities | 575,978 | | | 557,942 | |

| Non-current liabilities | | | |

| | | |

| Deferred tax liability | 2,023 | | | 4,895 | |

| | | |

| Operating lease liability, non-current portion | 3,434 | | | 3,635 | |

| Severance liabilities | 28,053 | | | 24,093 | |

| Other non-current liabilities | 2,925 | | | 2,209 | |

| Total non-current liabilities | 36,435 | | | 34,832 | |

| Total Liabilities | 612,413 | | | 592,774 | |

| | | |

| Shareholders’ equity | | | |

| Preferred shares ($5,000,000 shares authorized, $0.01 par value; no shares issued and outstanding as of September 27, 2024 and June 28, 2024) | — | | | — | |

| Ordinary shares ($500,000,000 shares authorized, $0.01 par value; 39,579,859 shares and 39,457,462 shares issued as of September 27, 2024 and June 28, 2024, respectively; and 36,267,639 shares and 36,145,242 shares outstanding as of September 27, 2024 and June 28, 2024, respectively) | 396 | | | 395 | |

| Additional paid-in capital | 210,505 | | | 222,044 | |

| Less: Treasury shares (3,312,220 shares as of September 27, 2024 and June 28, 2024) | (234,323) | | | (234,323) | |

| Accumulated other comprehensive income (loss) | 11,858 | | | (3,141) | |

| Retained earnings | 1,838,164 | | | 1,760,770 | |

| Total Shareholders’ Equity | 1,826,600 | | | 1,745,745 | |

| Total Liabilities and Shareholders’ Equity | $ | 2,439,013 | | | $ | 2,338,519 | |

FABRINET

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (UNAUDITED)

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| (in thousands of U.S. dollars, except per share data) | | | | | September 27,

2024 | | September 29,

2023 |

| | | | | | | |

| Revenues | | | | | $ | 804,228 | | | $ | 685,477 | |

| Cost of revenues | | | | | (705,202) | | | (601,073) | |

| Gross profit | | | | | 99,026 | | | 84,404 | |

| Selling, general and administrative expenses | | | | | (22,031) | | | (20,429) | |

| Restructuring and other related costs | | | | | (57) | | | — | |

| Operating income | | | | | 76,938 | | | 63,975 | |

| Interest income | | | | | 10,933 | | | 5,898 | |

| Interest expense | | | | | — | | | (45) | |

| Foreign exchange gain (loss), net | | | | | (7,095) | | | 415 | |

| Other income (expense), net | | | | | (19) | | | (80) | |

| Income before income taxes | | | | | 80,757 | | | 70,163 | |

| Income tax expense | | | | | (3,363) | | | (5,074) | |

| Net income | | | | | 77,394 | | | 65,089 | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Change in net unrealized gain (loss) on available-for-sale securities | | | | | 6,818 | | | 948 | |

| Change in net unrealized gain (loss) on derivative instruments | | | | | 8,533 | | | (561) | |

| Change in net retirement benefits plan – prior service cost | | | | | — | | | 126 | |

| Change in foreign currency translation adjustment | | | | | (352) | | | 100 | |

| Total other comprehensive income (loss), net of tax | | | | | 14,999 | | | 613 | |

| Net comprehensive income | | | | | $ | 92,393 | | | $ | 65,702 | |

| Earnings per share | | | | | | | |

| Basic | | | | | $ | 2.14 | | | $ | 1.80 | |

| Diluted | | | | | $ | 2.13 | | | $ | 1.78 | |

| Weighted-average number of ordinary shares outstanding (in thousands of shares) | | | | | | | |

| Basic | | | | | 36,203 | | | 36,256 | |

| Diluted | | | | | 36,408 | | | 36,481 | |

FABRINET

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | | | | |

| Three Months Ended |

| (in thousands of U.S. dollars) | September 27,

2024 | | September 29,

2023 |

| | | |

| Cash flows from operating activities | | | |

| Net income for the period | $ | 77,394 | | | $ | 65,089 | |

| Adjustments to reconcile net income to net cash provided by operating activities | | | |

| Depreciation and amortization | 12,752 | | | 11,961 | |

| | | |

| (Gain) loss on disposal of property, plant and equipment and intangibles | 10 | | | 12 | |

| | | |

| Amortization of discount (premium) of short-term investments | (1,087) | | | (596) | |

| | | |

| (Reversal of) allowance for expected credit losses | 325 | | | 803 | |

| Unrealized loss (gain) on exchange rate and fair value of foreign currency forward contracts | 6,204 | | | (52) | |

| | | |

| Amortization of fair value at hedge inception of interest rate swaps | — | | | (88) | |

| Share-based compensation | 8,682 | | | 7,733 | |

| Deferred income tax expense (benefit) | (2,721) | | | 1,377 | |

| Other non-cash expenses | 9 | | | 222 | |

| Changes in operating assets and liabilities | | | |

| Trade accounts receivable | (69,396) | | | (4,138) | |

| | | |

| Inventories | 22,801 | | | 79,481 | |

| Other current assets and non-current assets | 1,205 | | | 3,238 | |

| Trade accounts payable | (17,412) | | | (24,397) | |

| | | |

| Income tax payable | 467 | | | 963 | |

| Accrued expenses | 21,902 | | | 2,668 | |

| Other payables | 18,236 | | | 543 | |

| Severance liabilities | 639 | | | 706 | |

| Other current liabilities and non-current liabilities | 3,172 | | | (476) | |

| Net cash provided by operating activities | 83,182 | | | 145,049 | |

| Cash flows from investing activities | | | |

| Purchase of short-term investments | (95,572) | | | (77,692) | |

| | | |

| Proceeds from maturities of short-term investments | 43,914 | | | 35,909 | |

| Purchase of property, plant and equipment | (20,250) | | | (11,435) | |

| Purchase of intangibles | (122) | | | (180) | |

| Proceeds from disposal of property, plant and equipment | 36 | | | 318 | |

| Net cash used in investing activities | (71,994) | | | (53,080) | |

| Cash flows from financing activities | | | |

| Repayment of long-term borrowings | — | | | (3,047) | |

| | | |

| | | |

| Withholding tax related to net share settlement of restricted share units | (20,220) | | | (12,147) | |

| Net cash used in financing activities | (20,220) | | | (15,194) | |

| Net increase (decrease) in cash and cash equivalents | $ | (9,032) | | | $ | 76,775 | |

| Movement in cash and cash equivalents | | | |

| Cash and cash equivalents at the beginning of period | $ | 409,973 | | | $ | 231,368 | |

| Increase (decrease) in cash and cash equivalents | (9,032) | | | 76,775 | |

| Effect of exchange rate on cash and cash equivalents | (257) | | | 195 | |

| Cash and cash equivalents at the end of period | $ | 400,684 | | | $ | 308,338 | |

| Non-cash investing and financing activities | | | |

| Construction, software and equipment-related payables | $ | 10,166 | | | $ | 9,313 | |

FABRINET

RECONCILIATION OF GAAP MEASURES TO NON-GAAP MEASURES (UNAUDITED)

Reconciliation of GAAP Gross Profit and GAAP Gross Margin to Non-GAAP Gross Profit and Non-GAAP Gross Margin

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| (in thousands of U.S. dollars) | | | | | September 27,

2024 | | September 29,

2023 |

| Revenues | | | | | | | | | $ | 804,228 | | | | | $ | 685,477 | | | |

| | | | | | | | | | | | | | | |

| Gross profit (GAAP) | | | | | | | | | $ | 99,026 | | | 12.3 | % | | $ | 84,404 | | | 12.3 | % |

| Share-based compensation expenses | | | | | | | | | 2,898 | | | | | 2,165 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Gross profit (Non-GAAP) | | | | | | | | | $ | 101,924 | | | 12.7 | % | | $ | 86,569 | | | 12.6 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Reconciliation of GAAP Operating Profit and GAAP Operating Margin to Non-GAAP Operating Profit and Non-GAAP Operating Margin

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| (in thousands of U.S. dollars) | | | | | September 27,

2024 | | September 29,

2023 |

| Revenues | | | | | | | | | $ | 804,228 | | | | | $ | 685,477 | | | |

| | | | | | | | | | | | | | | |

| Operating profit (GAAP) | | | | | | | | | $ | 76,938 | | | 9.6 | % | | $ | 63,975 | | | 9.3 | % |

| Share-based compensation expenses | | | | | | | | | 8,682 | | | | | 7,733 | | | |

| Severance payment and others | | | | | | | | | 730 | | | | | — | | | |

| Restructuring and other related costs | | | | | | | | | 57 | | | | | — | | | |

| | | | | | | | | | | | | | | |

| Operating profit (Non-GAAP) | | | | | | | | | $ | 86,407 | | | 10.7 | % | | $ | 71,708 | | | 10.5 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

FABRINET

RECONCILIATION OF GAAP MEASURES TO NON-GAAP MEASURES (UNAUDITED)

Reconciliation of GAAP Net Income and EPS to Non-GAAP Net Income and EPS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | September 27,

2024 | | September 29,

2023 |

| (in thousands of U.S. dollars, except per share data) | | | | | | | | | Net income | | Diluted EPS | | Net income | | Diluted EPS |

| GAAP measures | | | | | | | | | $ | 77,394 | | | $ | 2.13 | | | $ | 65,089 | | | $ | 1.78 | |

| Items reconciling GAAP net income & EPS to non-GAAP net income & EPS: | | | | | | | | | | | | | | | |

| Related to cost of revenues: | | | | | | | | | | | | | | | |

| Share-based compensation expenses | | | | | | | | | 2,898 | | | 0.08 | | | 2,165 | | | 0.06 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total related to cost of revenues | | | | | | | | | 2,898 | | | 0.08 | | | 2,165 | | | 0.06 | |

| Related to selling, general and administrative expenses: | | | | | | | | | | | | | | | |

| Share-based compensation expenses | | | | | | | | | 5,784 | | | 0.16 | | | 5,568 | | | 0.16 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Severance payment and others | | | | | | | | | 730 | | | 0.02 | | | — | | | — | |

| Total related to selling, general and administrative expenses | | | | | | | | | 6,514 | | | 0.18 | | | 5,568 | | | 0.16 | |

| Related to other income and expense: | | | | | | | | | | | | | | | |

| Restructuring and other related costs | | | | | | | | | 57 | | | 0.00 | | | — | | | — | |

| Amortization of deferred debt issuance costs | | | | | | | | | — | | | — | | | 8 | | | 0.00 | |

| Total related to other income and expense | | | | | | | | | 57 | | | 0.00 | | | 8 | | | 0.00 | |

| Total related to net income & EPS | | | | | | | | | 9,469 | | | 0.26 | | | 7,741 | | | 0.22 | |

| | | | | | | | | | | | | | | |

| Non-GAAP measures | | | | | | | | | $ | 86,863 | | | $ | 2.39 | | | $ | 72,830 | | | $ | 2.00 | |

| Shares used in computing diluted net income per share (in thousands of shares) | | | | | | | | | | | | | | | |

| GAAP diluted shares | | | | | | | | | | | 36,408 | | | | | 36,481 | |

| Non-GAAP diluted shares | | | | | | | | | | | 36,408 | | | | | 36,481 | |

FABRINET

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW (UNAUDITED)

| | | | | | | | | | | | | | | | | | |

| (in thousands of U.S. dollars) | | | | Three Months Ended |

| | | | | | September 27,

2024 | | September 29,

2023 |

| Net cash provided by operating activities | | | | | | $ | 83,182 | | | $ | 145,049 | |

| Less: Purchase of property, plant and equipment | | | | | | (20,250) | | | (11,435) | |

| Non-GAAP free cash flow | | | | | | $ | 62,932 | | | $ | 133,614 | |

FABRINET

GUIDANCE FOR QUARTER ENDING DECEMBER 27, 2024

RECONCILIATION OF GAAP MEASURES TO NON-GAAP MEASURES

| | | | | |

| Diluted EPS |

| GAAP net income per diluted share | $2.20 to $2.28 |

| Related to cost of revenues: | |

| Share-based compensation expenses | 0.08 |

| Total related to cost of revenues | 0.08 |

| Related to selling, general and administrative expenses: | |

| Share-based compensation expenses | 0.16 |

| |

| Total related to selling, general and administrative expenses | 0.16 |

| |

| |

| |

| Total related to net income & EPS | 0.24 |

| Non-GAAP net income per diluted share | $2.44 to $2.52 |

Cover

|

Nov. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 04, 2024

|

| Entity Registrant Name |

Fabrinet

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity File Number |

001-34775

|

| Entity Tax Identification Number |

98-1228572

|

| Entity Address, Address Line One |

c/o Intertrust Corporate Services

|

| Entity Address, City or Town |

Grand Cayman

|

| Entity Address, Postal Zip Code |

KY1-9005

|

| Entity Address, Country |

KY

|

| City Area Code |

66 2

|

| Local Phone Number |

524-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary Shares, $0.01 par value

|

| Trading Symbol |

FN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001408710

|

| Entity Addresses [Line Items] |

|

| Entity Address, City or Town |

Grand Cayman

|

| Entity Address, Country |

KY

|

| Entity Address, Address Line Two |

One Nexus Way, Camana Bay

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

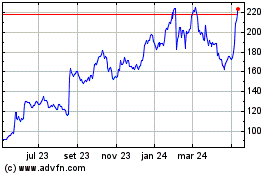

Fabrinet (NYSE:FN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

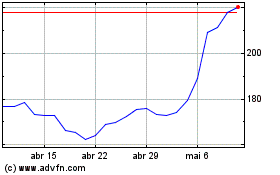

Fabrinet (NYSE:FN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025