November 4, 20240000821026false00008210262024-11-042024-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of Earliest Event Reported): | November 4, 2024 |

__________________________________________

The Andersons, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Ohio | | 000-20557 | | 34-1562374 |

| (State of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

1947 Briarfield Boulevard

Maumee, Ohio 43537

(Address of principal executive offices) (Zip Code)

(419) 893-5050

(Registrant’s telephone number, including area code)

__________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[☐] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[☐] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[☐] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[☐] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

__________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol | | Name of each exchange on which registered: |

| Common stock, $0.00 par value, $0.01 stated value | | ANDE | | The NASDAQ Stock Market LLC |

__________________________________________

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

[☐] Emerging growth company

[☐] If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

The Company issued a press release announcing its third quarter 2024 earnings which is included as exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Inline XBRL for the cover page of this Current Report on Form 8-K |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | The Andersons, Inc. |

| | | |

| November 4, 2024 | | By: | /s/ Brian A. Valentine |

| | | |

| | | Brian A. Valentine |

| | | Executive Vice President

and Chief Financial Officer |

NEWS RELEASE

NEWS RELEASE

The Andersons, Inc. Reports Strong Third Quarter Results

MAUMEE, OHIO, November 4, 2024 - The Andersons, Inc. (Nasdaq: ANDE) announces financial results for the third quarter ended September 30, 2024.

Third Quarter Highlights:

•Company reported net income attributable to The Andersons of $27 million, or $0.80 per diluted share and adjusted net income of $25 million, or $0.72 per diluted share

•Adjusted EBITDA was $97 million, producing a record for the third quarter

•Renewables reported best-ever third quarter pretax income of $53 million and pretax income attributable to The Andersons of $28 million on strong operating performance and ethanol margins

•Trade generated increased year-over-year pretax income of $26 million and adjusted pretax income of $23 million

"Overall, we are pleased with our third quarter results given the lower commodity prices and reduced volatility in the ag markets. Renewables had a very strong quarter with increased ethanol production and improved yields in a period of good but softening crush margins. Trade results were significantly better than last year and include improved performance in our assets. Increased volume and margins in our specialty liquids and manufactured product lines resulted in improved results in Nutrient & Industrial," said President and CEO Bill Krueger. "Harvest is almost complete due to the near-perfect harvest weather, with both higher-than-normal quality and above trend-line yields. We have been able to buy grain at good basis values which should allow for carry opportunities into 2025. We continue to see the benefits of our portfolio mix with well-placed assets, a growing specialty ingredients business, efficient ethanol plant performance and merchandising opportunities across our businesses."

"We continue to pursue growth opportunities. Most recently, we announced the closing of an $85 million investment for a 65% ownership interest in Skyland Grain, LLC, which operates a large grain and agronomy footprint spread across Southwest Kansas, Eastern Colorado, and the Texas and Oklahoma panhandles. These assets extend our geographic footprint and support our existing merchandising presence in the region," continued Krueger. "In addition, we announced a significant investment in our leased facility at the port of Houston to improve our current grain export program and add capacity for storing and exporting soybean meal. We continue to make progress on our longer-term Renewables projects, which are focused on lowering the carbon intensity of our high-performing ethanol plants. In addition to these projects, we continue our investment philosophy to improve efficiency and add capacity at our existing plants, as well as acquisition opportunities, which are in line with our strategy and generate appropriate returns."

| | | | | | | | | | | | | | | | | | | | |

| $ in millions, except per share amounts | | | |

| Q3 2024 | Q3 2023 | Variance | YTD 2024 | YTD 2023 | Variance |

| Pretax Income | $ | 62.2 | | $ | 38.4 | | $ | 23.8 | | $ | 133.5 | | $ | 77.8 | | $ | 55.7 | |

Pretax Income Attributable to the Company1 | 38.1 | | 17.6 | | 20.5 | | 85.8 | | 73.7 | | 12.1 | |

Adjusted Pretax Income Attributable to the Company1 | 34.6 | | 10.1 | | 24.5 | | 86.1 | | 90.7 | | (4.6) | |

Trade1 | 22.7 | | 5.4 | | 17.3 | | 41.0 | | 36.3 | | 4.7 | |

Renewables1 | 28.5 | | 26.3 | | 2.2 | | 63.8 | | 65.0 | | (1.2) | |

| Nutrient & Industrial | (6.1) | | (8.5) | | 2.4 | | 15.4 | | 23.7 | | (8.3) | |

Other1 | (10.5) | | (13.1) | | 2.6 | | (34.1) | | (34.3) | | 0.2 | |

Net Income Attributable to the Company | 27.4 | | 9.7 | | 17.7 | | 68.9 | | 50.0 | | 18.9 | |

Adjusted Net Income Attributable to the Company1 | 24.7 | | 4.6 | | 20.1 | | 69.8 | | 63.7 | | 6.1 | |

| Diluted Earnings Per Share ("EPS") | 0.80 | | 0.28 | | 0.52 | | 2.01 | | 1.46 | | 0.55 | |

Adjusted EPS1 | 0.72 | | 0.13 | | 0.59 | | 2.04 | | 1.86 | | 0.18 | |

EBITDA1 | 101.0 | | 77.8 | | 23.2 | | 246.6 | | 210.4 | | 36.2 | |

Adjusted EBITDA from Continuing Operations1 | $ | 97.4 | | $ | 70.3 | | $ | 27.1 | | $ | 246.9 | | $ | 270.0 | | $ | (23.1) | |

1 Non-GAAP financial measures; see appendix for explanations and reconciliations. |

Cash, Liquidity, and Long-Term Debt Management

"Our businesses continue to generate consistent cash flows throughout the shift in ag markets, and our debt remains at a modest level," said Executive Vice President and CFO Brian Valentine. "With the strong cash flows and lower commodity prices, we continue to show a higher-than-normal cash position at this point in the year. We remain well below our long-term debt to EBITDA target of less than 2.5 times and are pleased with the strength of our balance sheet. We continue to evaluate new growth investments and acquisitions in a variety of strategic projects. We anticipate increased spending on growth projects in the fourth quarter and into 2025, in addition to the Skyland investment."

The company used cash from operating activities of $2 million and generated cash from operating activities of $489 million in the third quarter of 2024 and 2023, respectively. Cash from operations before working capital changes in the same periods was $86 million and $50 million, respectively. Cash spent on capital projects in the quarter totaled $38 million, a $4 million increase from 2023.

Third Quarter Segment Overview

Trade Results Resilient in Less Volatile Ag Markets

The Trade segment recorded pretax income of $26 million and adjusted pretax income of $23 million for the quarter compared to pretax income of $8 million and adjusted pretax income of $5 million in the third quarter of 2023.

Results from our grain asset footprint were better than the prior year, due to strong elevation margins and space income, primarily related to corn and wheat. Trade's growing specialty ingredients business continued to benefit from recent growth investments. The merchandising business remained profitable with well-supplied commodity markets and limited volatility. As expected, farmer engagement ramped up during the quarter to bring significant old crop bushels to market and forward sell new crop in anticipation of an early and robust harvest. For comparison, prior year results include a $19 million pretax loss on a foreign currency issue.

The portfolio mix of assets, ingredients and merchandising businesses provides a solid foundation to benefit from large crops and carry markets, as well as tight, demand-driven markets. Assets are well-positioned for an early and large harvest, which should allow us to buy bushels at low basis levels. Domestic specialty ingredient demand is also expected to stay solid and should continue to support recent capital growth investments.

Trade’s third quarter adjusted EBITDA was $38 million, compared to $21 million in 2023.

Renewables had Record Quarter on Efficient Operations and Favorable Ethanol Margins

The Renewables segment reported pretax income of $53 million and pretax income attributable to the company of $28 million in the third quarter. For the same period in 2023, the segment reported a pretax income of $47 million and pretax income attributable to the company of $26 million.

Margins on ethanol production improved year-over-year on significantly lower corn basis in the eastern plants, despite a reduction in ethanol board crush margins in the quarter. Production facilities continued to operate efficiently with increased volume and higher ethanol yields. Plant co-product values were lower, with feed ingredients following the overall price reduction of corn; however, feed ingredient demand improved year-over-year. Renewable diesel feedstock volumes continue to grow albeit with compressed margins on industry fundamentals. All four plants completed their semi-annual maintenance shutdowns in the third quarter. A favorable ethanol margin environment should continue, supported by exports, higher blending rates and continued lower corn basis levels in the east.

Renewables had third quarter EBITDA of $65 million in 2024, compared to $60 million in 2023.

Nutrient & Industrial Improved in Seasonally Quiet Quarter

The Nutrient & Industrial segment reported a pretax loss of $6 million, compared to a loss of $8 million in 2023. Overall volumes improved during a seasonally slow third quarter, but margins in base nutrients have reset to more normalized levels and did not repeat the outsized margin opportunities seen in recent years. The engineered granules business saw significant improvement in the quarter on higher sales volume and margins, with continued focus on operational improvements in this business. Looking forward, the fourth quarter should benefit from high yields and an early harvest, allowing for fall applications.

Nutrient & Industrial’s third quarter EBITDA was $5 million compared to breakeven EBITDA in the third quarter of 2023.

Income Taxes; Corporate

The company recorded income tax expense at an effective rate of 17% for the quarter. This rate was impacted by the tax treatment of noncontrolling interests and federal tax credits. We anticipate a full-year adjusted effective rate of approximately 14% - 18%.

Conference Call

The company will host a webcast on Tuesday, November 5, 2024, at 11 a.m. Eastern Time, to discuss its performance and provide its outlook for the remainder of 2024 and preliminary views for 2025. To access the call, please dial 888-317-6003 or 412-317-6061 (elite entry number is 2387329). It is recommended that you call 10 minutes before the conference call begins.

To access the webcast, click on the link: https://app.webinar.net/Bz3omkN6Ver and submit the requested information as directed. A replay of the call can also be accessed under the heading "Investors" on the company’s website at www.andersonsinc.com.

Forward-Looking Statements

This release contains forward-looking statements. These statements involve risks and uncertainties that could cause actual results to differ materially. Without limitation, these risks include economic, weather and regulatory conditions, competition, geopolitical risk, and the risk factors set forth from time to time in the company’s filings with the Securities and Exchange Commission. Although the company believes that the assumptions upon which the financial information and its forward-looking statements are based are reasonable, it can give no assurance that these assumptions will prove to be correct.

Non-GAAP Measures

This release contains non-GAAP financial measures. The company believes that pretax income (loss) attributable to the company; adjusted pretax income (loss) attributable to the company; adjusted pretax income (loss); adjusted net income attributable to the company; adjusted diluted earnings per share; earnings before interest, taxes, depreciation, and amortization (or EBITDA); adjusted EBITDA; and cash from operations before working capital changes provide additional information to investors and others about its operations, allowing an evaluation of underlying operating performance and liquidity and better period-to-period comparability. The above measures are not and should not be considered as alternatives to pretax income (loss) or income (loss) before income taxes, net income (loss), diluted earnings (loss) per share attributable to The Andersons, Inc. common shareholders and cash provided by (used in) operating activities as determined by generally accepted accounting principles. Reconciliations of the GAAP to non-GAAP measures may be found within this press release and the financial tables provided herein.

Company Description

The Andersons, Inc., named in 2024 to Forbes list of America’s Most Successful Small Companies, Newsweek’s list of America’s Most Responsible Companies, and one of The Americas’ Fastest Growing Companies by the Financial Times, is a diversified company rooted in agriculture that conducts business in the commodity merchandising, renewables, and nutrient & industrial sectors. Guided by its Statement of Principles, The Andersons is committed to providing extraordinary service to its customers, helping its employees improve, supporting its communities, and increasing the value of the company. For more information, please visit www.andersonsinc.com.

Investor Relations Contact

Mike Hoelter

Vice President, Corporate Controller and Investor Relations

Phone: 419-897-6715

E-mail: investorrelations@andersonsinc.com

The Andersons, Inc.

Condensed Consolidated Statements of Operations

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| (in thousands, except per share data) | 2024 | | 2023 | | 2024 | | 2023 |

| Sales and merchandising revenues | $ | 2,620,988 | | | $ | 3,635,691 | | | $ | 8,134,410 | | | $ | 11,537,112 | |

| Cost of sales and merchandising revenues | 2,443,863 | | | 3,477,990 | | | 7,653,594 | | | 11,009,463 | |

| Gross profit | 177,125 | | | 157,701 | | | 480,816 | | | 527,649 | |

| Operating, administrative and general expenses | 120,494 | | | 126,306 | | | 356,466 | | | 359,548 | |

| Asset impairment | — | | | — | | | — | | | 87,156 | |

| Interest expense, net | 8,361 | | | 8,188 | | | 21,494 | | | 38,766 | |

| Other income, net | 13,922 | | | 15,178 | | | 30,651 | | | 35,623 | |

| Income before income taxes | 62,192 | | | 38,385 | | | 133,507 | | | 77,802 | |

| Income tax provision | 10,731 | | | 7,862 | | | 16,911 | | | 23,710 | |

| Net income | 51,461 | | | 30,523 | | | 116,596 | | | 54,092 | |

| | | | | | | |

| | | | | | | |

| Net income attributable to noncontrolling interests | 24,096 | | | 20,815 | | | 47,674 | | | 4,088 | |

| Net income attributable to The Andersons, Inc. | $ | 27,365 | | | $ | 9,708 | | | $ | 68,922 | | | $ | 50,004 | |

| | | | | | | |

Earnings per share attributable to

The Andersons, Inc. common shareholders: | | | | | | | |

| Basic earnings: | $ | 0.80 | | | $ | 0.29 | | | $ | 2.03 | | | $ | 1.48 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted earnings: | $ | 0.80 | | | $ | 0.28 | | | $ | 2.01 | | | $ | 1.46 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The Andersons, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

| | | | | | | | | | | | | | | | | |

| (in thousands) | September 30, 2024 | | December 31, 2023 | | September 30, 2023 |

| Assets | | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 454,065 | | | $ | 643,854 | | | $ | 418,055 | |

| Accounts receivable, net | 756,618 | | | 762,549 | | | 816,686 | |

| Inventories | 884,339 | | | 1,166,700 | | | 985,292 | |

| Commodity derivative assets – current | 122,326 | | | 178,083 | | | 239,595 | |

| Other current assets | 113,726 | | | 55,777 | | | 67,471 | |

| Total current assets | 2,331,074 | | | 2,806,963 | | | 2,527,099 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Property, plant and equipment, net | 709,951 | | | 693,365 | | | 680,188 | |

| Other assets, net | 347,274 | | | 354,679 | | | 380,815 | |

| | | | | |

| | | | | |

| Total assets | $ | 3,388,299 | | | $ | 3,855,007 | | | $ | 3,588,102 | |

| | | | | | |

| Liabilities and equity | | | | | |

| Current liabilities: | | | | | |

| Short-term debt | $ | 14,716 | | | $ | 43,106 | | | $ | 14,138 | |

| Trade and other payables | 774,347 | | | 1,055,473 | | | 822,153 | |

| Customer prepayments and deferred revenue | 67,899 | | | 187,054 | | | 211,867 | |

| Commodity derivative liabilities – current | 85,640 | | | 90,849 | | | 142,511 | |

| Current maturities of long-term debt | 27,727 | | | 27,561 | | | 27,535 | |

| | | | | |

| Accrued expenses and other current liabilities | 207,543 | | | 232,288 | | | 189,430 | |

| Total current liabilities | 1,177,872 | | | 1,636,331 | | | 1,407,634 | |

| | | | | |

| Long-term debt, less current maturities | 542,564 | | | 562,960 | | | 569,730 | |

| | | | | |

| Other long-term liabilities | 144,855 | | | 139,329 | | | 161,652 | |

| Total liabilities | 1,865,291 | | | 2,338,620 | | | 2,139,016 | |

| Total equity | 1,523,008 | | | 1,516,387 | | | 1,449,086 | |

| Total liabilities and equity | $ | 3,388,299 | | | $ | 3,855,007 | | | $ | 3,588,102 | |

The Andersons, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited) | | | | | | | | | | | |

| | Nine months ended September 30, |

| (in thousands) | 2024 | | 2023 |

| Operating Activities | | | |

| | | |

| | | |

| Net income | $ | 116,596 | | | $ | 54,092 | |

| Adjustments to reconcile net income to cash provided by operating activities: | | | |

| Depreciation and amortization | 91,626 | | | 93,800 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Asset impairment | — | | | 87,156 | |

| | | |

| Other | 15,146 | | | 1,347 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 3,498 | | | 406,263 | |

| Inventories | 278,947 | | | 748,118 | |

| Commodity derivatives | 49,327 | | | 99,479 | |

| Other current and non-current assets | (59,376) | | | 2,048 | |

| Payables and other current and non-current liabilities | (433,069) | | | (796,216) | |

| Net cash provided by operating activities | 62,695 | | | 696,087 | |

| Investing Activities | | | |

| Purchases of property, plant and equipment and capitalized software | (93,230) | | | (108,718) | |

| Acquisition of businesses, net of cash acquired | (9,561) | | | (24,385) | |

| Insurance proceeds | 9,219 | | | — | |

| | | |

| | | |

| Proceeds from sale of a business | — | | | 10,318 | |

| | | |

| | | |

| Other | 2,980 | | | 5,522 | |

| Net cash used in investing activities | (90,592) | | | (117,263) | |

| Financing Activities | | | |

| Net payments under short-term lines of credit | (27,054) | | | (261,152) | |

| | | |

| | | |

| Payments of long-term debt | (20,649) | | | (42,734) | |

| | | |

| Distributions to noncontrolling interest owner | (87,325) | | | (44,304) | |

| | | |

| Dividends paid | (19,466) | | | (18,771) | |

| | | |

| Value of shares withheld for taxes | (8,101) | | | (6,627) | |

| | | |

| Proceeds from issuance of long-term debt | — | | | 100,000 | |

| Other | — | | | (2,258) | |

| Net cash used in financing activities | (162,595) | | | (275,846) | |

| Effect of exchange rates on cash and cash equivalents | 703 | | | (192) | |

| (Decrease) increase in cash and cash equivalents | (189,789) | | | 302,786 | |

| Cash and cash equivalents at beginning of period | 643,854 | | | 115,269 | |

| Cash and cash equivalents at end of period | $ | 454,065 | | | $ | 418,055 | |

The Andersons, Inc.

Adjusted Net Income Attributable to The Andersons, Inc.

A non-GAAP financial measure

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| (in thousands, except per share data) | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 51,461 | | | $ | 30,523 | | | $ | 116,596 | | | $ | 54,092 | |

| Net income attributable to noncontrolling interests | 24,096 | | | 20,815 | | | 47,674 | | | 4,088 | |

| Net income attributable to The Andersons, Inc. | 27,365 | | | 9,708 | | | 68,922 | | | 50,004 | |

| Adjustments: | | | | | | | |

| Gain on sale of assets | — | | | (5,643) | | | — | | | (5,643) | |

| Gain on cost method investment | — | | | (4,798) | | | — | | | (4,798) | |

| Transaction related compensation | 1,668 | | | 1,999 | | | 8,568 | | | 4,606 | |

| Gain on deconsolidation of joint venture | — | | | — | | | (3,117) | | | (6,544) | |

| Insurance recoveries | (5,204) | | | — | | | (5,204) | | | (16,080) | |

| Asset impairment | — | | | 963 | | | — | | | 45,413 | |

Income tax impact of adjustments1 | 884 | | | 2,367 | | | 632 | | | (3,255) | |

| Total adjusting items, net of tax | (2,652) | | | (5,112) | | | 879 | | | 13,699 | |

| Adjusted net income attributable to The Andersons, Inc. | $ | 24,713 | | | $ | 4,596 | | | $ | 69,801 | | | $ | 63,703 | |

| | | | | | | |

Diluted earnings per share attributable to

The Andersons, Inc. common shareholders | $ | 0.80 | | | $ | 0.28 | | | $ | 2.01 | | | $ | 1.46 | |

| | | | | | | |

| Impact on diluted earnings (loss) per share | $ | (0.08) | | | $ | (0.15) | | | $ | 0.03 | | | $ | 0.40 | |

| Adjusted diluted earnings per share | $ | 0.72 | | | $ | 0.13 | | | $ | 2.04 | | | $ | 1.86 | |

| | | | | | | |

| | | | | | | |

1 The income tax impact of adjustments is taken at the statutory tax rate of 25% with the exception of certain transaction related compensation in both 2024 and 2023, respectively.

Adjusted net income (loss) attributable to The Andersons, Inc. reflects reported net income (loss) available to The Andersons, Inc. common shareholders after the removal of specified items described above. Adjusted diluted earnings (loss) per share reflects the fully diluted EPS of The Andersons, Inc. after removal of the effect on EPS as reported of specified items described above. Management believes that Adjusted net income (loss) attributable to The Andersons, Inc. and Adjusted diluted earnings (loss) per share are useful measures of The Andersons, Inc. performance as they provide investors additional information about the operations of the company allowing better evaluation of underlying business performance and better comparability to previous periods. These non-GAAP financial measures are not intended to replace or be alternatives to Net income attributable to The Andersons, Inc. and Diluted earnings per share attributable to The Andersons, Inc. common shareholders as reported, the most directly comparable GAAP financial measures, or any other measures of operating results under GAAP. Earnings amounts described above have been divided by the company’s average number of diluted shares outstanding for each respective period in order to arrive at an adjusted diluted earnings (loss) per share amount for each specified item.

The Andersons, Inc.

Segment Data

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Trade | | Renewables | | Nutrient & Industrial | | Other | | Total |

| Three months ended September 30, 2024 | | | | | | | | | |

| Sales and merchandising revenues | $ | 1,747,715 | | | $ | 745,206 | | | $ | 128,067 | | | $ | — | | | $ | 2,620,988 | |

| Gross profit | 98,776 | | | 60,375 | | | 17,974 | | | — | | | 177,125 | |

Operating, administrative and general expenses | 75,825 | | | 8,839 | | | 24,591 | | | 11,239 | | | 120,494 | |

| Other income, net | 8,720 | | | 1,760 | | | 3,323 | | | 119 | | | 13,922 | |

| Income (loss) before income taxes | 26,266 | | | 52,583 | | | (6,132) | | | (10,525) | | | 62,192 | |

| Income attributable to noncontrolling interests | — | | | 24,096 | | | — | | | — | | | 24,096 | |

Income (loss) before income taxes attributable to The Andersons, Inc.1 | $ | 26,266 | | | $ | 28,487 | | | $ | (6,132) | | | $ | (10,525) | | | $ | 38,096 | |

Adjustments to income (loss) before income taxes2 | (3,536) | | | — | | | — | | | — | | | (3,536) | |

Adjusted income (loss) before income taxes attributable to The Andersons, Inc.1 | $ | 22,730 | | | $ | 28,487 | | | $ | (6,132) | | | $ | (10,525) | | | $ | 34,560 | |

| | | | | | | | | |

| Three months ended September 30, 2023 | | | | | | | | | |

| Sales and merchandising revenues | $ | 2,639,059 | | | $ | 868,099 | | | $ | 128,533 | | | $ | — | | | $ | 3,635,691 | |

| Gross profit | 85,997 | | | 53,045 | | | 18,659 | | | — | | | 157,701 | |

| Operating, administrative and general expenses | 79,247 | | | 8,332 | | | 26,233 | | | 12,494 | | | 126,306 | |

| Other income, net | 7,838 | | | 3,346 | | | 606 | | | 3,388 | | | 15,178 | |

| Income (loss) before income taxes | 8,073 | | | 47,096 | | | (8,452) | | | (8,332) | | | 38,385 | |

| Income attributable to noncontrolling interests | — | | | 20,815 | | | — | | | — | | | 20,815 | |

Income (loss) before income taxes attributable to The Andersons, Inc.1 | $ | 8,073 | | | $ | 26,281 | | | $ | (8,452) | | | $ | (8,332) | | | $ | 17,570 | |

Adjustments to income (loss) before income taxes2 | (2,681) | | | — | | | — | | | (4,798) | | | (7,479) | |

Adjusted income (loss) before income taxes attributable to The Andersons, Inc.1 | $ | 5,392 | | | $ | 26,281 | | | $ | (8,452) | | | $ | (13,130) | | | $ | 10,091 | |

1 Income (loss) before income taxes attributable to The Andersons, Inc. for each operating segment is defined as net sales and merchandising revenues plus identifiable other income less all identifiable operating expenses, including interest expense for carrying working capital and long-term assets and is reported net of the noncontrolling interest share of income. 2 Additional information on the individual adjustments that are included in the adjustments to income (loss) before income taxes can be found in the Reconciliation to EBITDA and Adjusted EBITDA table. |

The Andersons, Inc.

Segment Data

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| (in thousands) | Trade | | Renewables | | Nutrient & Industrial | | Other | | Total |

| Nine months ended September 30, 2024 | | | | | | | | | |

| Sales and merchandising revenues | $ | 5,399,315 | | | $ | 2,088,372 | | | $ | 646,723 | | | $ | — | | | $ | 8,134,410 | |

| Gross profit | 256,706 | | | 133,672 | | | 90,438 | | | — | | | 480,816 | |

| Operating, administrative and general expenses | 220,886 | | | 24,592 | | | 75,427 | | | 35,561 | | | 356,466 | |

| Other income (loss), net | 18,287 | | | 7,686 | | | 4,880 | | | (202) | | | 30,651 | |

| Income (loss) before income taxes | 37,615 | | | 114,574 | | | 15,437 | | | (34,119) | | | 133,507 | |

Income attributable to noncontrolling interests | — | | | 47,674 | | | — | | | — | | | 47,674 | |

Income (loss) before income taxes attributable to The Andersons, Inc.1 | $ | 37,615 | | | $ | 66,900 | | | $ | 15,437 | | | $ | (34,119) | | | $ | 85,833 | |

Adjustments to income (loss) before income taxes2 | 3,364 | | | (3,117) | | | — | | | — | | | 247 | |

Adjusted income (loss) before income taxes attributable to The Andersons, Inc.1 | $ | 40,979 | | | $ | 63,783 | | | $ | 15,437 | | | $ | (34,119) | | | $ | 86,080 | |

| | | | | | | | | |

| Nine months ended September 30, 2023 | | | | | | | | | |

| Sales and merchandising revenues | $ | 8,213,649 | | | $ | 2,585,396 | | | $ | 738,067 | | | $ | — | | | $ | 11,537,112 | |

| Gross profit | 283,886 | | | 137,140 | | | 106,623 | | | — | | | 527,649 | |

| Operating, administrative and general expenses | 220,373 | | | 24,804 | | | 79,251 | | | 35,120 | | | 359,548 | |

| Other income, net | 18,149 | | | 11,655 | | | 1,952 | | | 3,867 | | | 35,623 | |

| Income (loss) before income taxes | 52,427 | | | 31,187 | | | 23,675 | | | (29,487) | | | 77,802 | |

| Income attributable to noncontrolling interests | — | | | 4,088 | | | — | | | — | | | 4,088 | |

Income (loss) before income taxes attributable to The Andersons, Inc.1 | $ | 52,427 | | | $ | 27,099 | | | $ | 23,675 | | | $ | (29,487) | | | $ | 73,714 | |

Adjustments to income (loss) before income taxes2 | (16,154) | | | 37,906 | | | — | | | (4,798) | | | 16,954 | |

Adjusted income (loss) before income taxes attributable to The Andersons, Inc.1 | $ | 36,273 | | | $ | 65,005 | | | $ | 23,675 | | | $ | (34,285) | | | $ | 90,668 | |

1 Income (loss) before income taxes attributable to The Andersons, Inc. for each operating segment is defined as net sales and merchandising revenues plus identifiable other income less all identifiable operating expenses, including interest expense for carrying working capital and long-term assets and is reported net of the noncontrolling interest share of income. 2 Additional information on the individual adjustments that are included in the adjustments to income (loss) before income taxes can be found in the Reconciliation to EBITDA and Adjusted EBITDA table. All adjustments are consistent with the EBITDA reconciliation with the exception of a $42.7 million difference in the Renewables segment which represents the asset impairment expense attributable to the non-controlling interest that is reflected in Income attributable to the noncontrolling interest within the reconciliation above. |

The Andersons, Inc.

Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

A non-GAAP financial measure

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Trade | | Renewables | | Nutrient & Industrial | | Other | | Total | | | | |

| Three months ended September 30, 2024 | | | | | | | | | | | | | |

| Net income (loss) | $ | 26,266 | | | $ | 52,583 | | | $ | (6,132) | | | $ | (21,256) | | | $ | 51,461 | | | | | |

| Interest expense (income) | 5,405 | | | 713 | | | 2,838 | | | (595) | | | 8,361 | | | | | |

| Tax provision | — | | | — | | | — | | | 10,731 | | | 10,731 | | | | | |

| Depreciation and amortization | 9,377 | | | 11,942 | | | 8,145 | | | 944 | | | 30,408 | | | | | |

| EBITDA | 41,048 | | | 65,238 | | | 4,851 | | | (10,176) | | | 100,961 | | | | | |

| Adjusting items impacting EBITDA: | | | | | | | | | | | | | |

| Transaction related compensation | 1,668 | | | — | | | — | | | — | | | 1,668 | | | | | |

| | | | | | | | | | | | | |

| Insurance recoveries | (5,204) | | | — | | | — | | | — | | | (5,204) | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total adjusting items | (3,536) | | | — | | | — | | | — | | | (3,536) | | | | | |

| Adjusted EBITDA | $ | 37,512 | | | $ | 65,238 | | | $ | 4,851 | | | $ | (10,176) | | | $ | 97,425 | | | | | |

| | | | | | | | | | | | | |

| Three months ended September 30, 2023 | | | | | | | | | | | | | |

| Net income (loss) | $ | 8,073 | | | $ | 47,096 | | | $ | (8,452) | | | $ | (16,194) | | | $ | 30,523 | | | | | |

| Interest expense (income) | 6,515 | | | 963 | | | 1,484 | | | (774) | | | 8,188 | | | | | |

| Tax provision | — | | | — | | | — | | | 7,862 | | | 7,862 | | | | | |

| Depreciation and amortization | 9,331 | | | 12,328 | | | 7,464 | | | 2,092 | | | 31,215 | | | | | |

| EBITDA | 23,919 | | | 60,387 | | | 496 | | | (7,014) | | | 77,788 | | | | | |

| Adjusting items impacting EBITDA: | | | | | | | | | | | | | |

| Transaction related compensation | 1,999 | | | — | | | — | | | — | | | 1,999 | | | | | |

| | | | | | | | | | | | | |

| Gain on cost method investment | — | | | — | | | — | | | (4,798) | | | (4,798) | | | | | |

| Gain on sale of assets | (5,643) | | | — | | | — | | | — | | | (5,643) | | | | | |

| | | | | | | | | | | | | |

| Gain on deconsolidation of joint venture | 963 | | | — | | | — | | | — | | | 963 | | | | | |

| Total adjusting items | (2,681) | | | — | | | — | | | (4,798) | | | (7,479) | | | | | |

| Adjusted EBITDA | $ | 21,238 | | | $ | 60,387 | | | $ | 496 | | | $ | (11,812) | | | $ | 70,309 | | | | | |

Adjusted EBITDA is defined as earnings before interest, taxes and depreciation and amortization, adjusted for specified items. The company calculates adjusted EBITDA by removing the impact of specified items and adding back the amounts of interest expense, tax expense and depreciation and amortization to net income (loss). Management believes that adjusted EBITDA is a useful measure of the company’s performance as it provides investors additional information about the company’s operations allowing better evaluation of underlying business performance and improved comparability to prior periods. Adjusted EBITDA is a non-GAAP financial measure and is not intended to replace or be an alternative to net income (loss), the most directly comparable GAAP financial measure.

The Andersons, Inc.

Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

A non-GAAP financial measure

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Trade | | Renewables | | Nutrient & Industrial | | Other | | Total | | | | |

| Nine months ended September 30, 2024 | | | | | | | | | | | | | |

| Net income (loss) | $ | 37,615 | | | $ | 114,574 | | | $ | 15,437 | | | $ | (51,030) | | | $ | 116,596 | | | | | |

| Interest expense (income) | 16,492 | | | 2,192 | | | 4,454 | | | (1,644) | | | 21,494 | | | | | |

| Tax provision | — | | | — | | | — | | | 16,911 | | | 16,911 | | | | | |

| Depreciation and amortization | 27,946 | | | 35,626 | | | 23,903 | | | 4,151 | | | 91,626 | | | | | |

| EBITDA | 82,053 | | | 152,392 | | | 43,794 | | | (31,612) | | | 246,627 | | | | | |

| Adjusting items impacting EBITDA: | | | | | | | | | | | | | |

| Transaction related compensation | 8,568 | | | — | | | — | | | — | | | 8,568 | | | | | |

| Insurance recoveries | (5,204) | | | — | | | — | | | — | | | (5,204) | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Gain on deconsolidation of joint venture | — | | | (3,117) | | | — | | | — | | | (3,117) | | | | | |

| Total adjusting items | 3,364 | | | (3,117) | | | — | | | — | | | 247 | | | | | |

| Adjusted EBITDA | $ | 85,417 | | | $ | 149,275 | | | $ | 43,794 | | | $ | (31,612) | | | $ | 246,874 | | | | | |

| | | | | | | | | | | | | |

| Nine months ended September 30, 2023 | | | | | | | | | | | | | |

| Net income (loss) | $ | 52,427 | | | $ | 31,187 | | | $ | 23,675 | | | $ | (53,197) | | | $ | 54,092 | | | | | |

| Interest expense (income) | 29,235 | | | 5,648 | | | 5,649 | | | (1,766) | | | 38,766 | | | | | |

| Tax provision | — | | | — | | | — | | | 23,710 | | | 23,710 | | | | | |

| Depreciation and amortization | 26,659 | | | 39,224 | | | 21,518 | | | 6,399 | | | 93,800 | | | | | |

| EBITDA | 108,321 | | | 76,059 | | | 50,842 | | | (24,854) | | | 210,368 | | | | | |

| Adjusting items impacting EBITDA: | | | | | | | | | | | | | |

| Transaction related compensation | 4,606 | | | — | | | — | | | — | | | 4,606 | | | | | |

| Insurance recoveries | (16,080) | | | — | | | — | | | — | | | (16,080) | | | | | |

| Gain on sale of assets | (5,643) | | | — | | | — | | | — | | | (5,643) | | | | | |

| Gain on deconsolidation of joint venture | — | | | (6,544) | | | — | | | — | | | (6,544) | | | | | |

| Gain on cost method investment | — | | | — | | | — | | | (4,798) | | | (4,798) | | | | | |

| Asset impairment | 963 | | | 87,156 | | | — | | | — | | | 88,119 | | | | | |

| Total adjusting items | (16,154) | | | 80,612 | | | — | | | (4,798) | | | 59,660 | | | | | |

| Adjusted EBITDA | $ | 92,167 | | | $ | 156,671 | | | $ | 50,842 | | | $ | (29,652) | | | $ | 270,028 | | | | | |

Adjusted EBITDA is defined as earnings before interest, taxes and depreciation and amortization, adjusted for specified items. The company calculates adjusted EBITDA by removing the impact of specified items and adding back the amounts of interest expense, tax expense and depreciation and amortization to net income (loss). Management believes that adjusted EBITDA is a useful measure of the company’s performance as it provides investors additional information about the company’s operations allowing better evaluation of underlying business performance and improved comparability to prior periods. Adjusted EBITDA is a non-GAAP financial measure and is not intended to replace or be an alternative to net income (loss), the most directly comparable GAAP financial measure.

The Andersons, Inc.

Trailing Twelve Months of EBITDA and Adjusted EBITDA

A non-GAAP financial measure

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended, | | Twelve months ended September 30, 2024 |

| (in thousands) | December 31, 2023 | | March 31, 2024 | | June 30, 2024 | | September 30, 2024 | |

| Net income | $ | 78,437 | | | $ | 12,665 | | | $ | 52,470 | | | $ | 51,461 | | | $ | 195,033 | |

| Interest expense | 8,101 | | | 6,522 | | | 6,611 | | | 8,361 | | | 29,595 | |

| Tax provision | 13,324 | | | 1,303 | | | 4,876 | | | 10,731 | | | 30,234 | |

| Depreciation and amortization | 31,306 | | | 30,949 | | | 30,269 | | | 30,408 | | | 122,932 | |

| EBITDA | 131,168 | | | 51,439 | | | 94,226 | | | 100,961 | | | 377,794 | |

| Adjusting items impacting EBITDA: | | | | | | | | | |

| Transaction related compensation | 3,212 | | | 2,852 | | | 4,049 | | | 1,668 | | | 11,781 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Insurance recoveries | — | | | — | | | — | | | (5,204) | | | (5,204) | |

| Gain on deconsolidation of joint venture | — | | | (3,117) | | | — | | | — | | | (3,117) | |

| | | | | | | | | |

| Goodwill impairment | 686 | | | — | | | — | | | — | | | 686 | |

| Total adjusting items | 3,898 | | | (265) | | | 4,049 | | | (3,536) | | | 4,146 | |

| Adjusted EBITDA | $ | 135,066 | | | $ | 51,174 | | | $ | 98,275 | | | $ | 97,425 | | | $ | 381,940 | |

| | | | | | | | | |

| Three Months Ended, | | Twelve months ended September 30, 2023 |

| December 31, 2022 | | March 31, 2023 | | June 30,2023 | | September 30, 2023 | |

| Net income (loss) | $ | 21,170 | | | $ | (59,117) | | | $ | 82,686 | | | $ | 30,523 | | | $ | 75,262 | |

| Interest expense | 14,087 | | | 16,625 | | | 13,953 | | | 8,188 | | | 52,853 | |

| Tax provision (benefit) | 9,933 | | | (5,884) | | | 21,732 | | | 7,862 | | | 33,643 | |

| Depreciation and amortization | 33,476 | | | 32,220 | | | 30,365 | | | 31,215 | | | 127,276 | |

| EBITDA | 78,666 | | | (16,156) | | | 148,736 | | | 77,788 | | | 289,034 | |

| Adjusting items impacting EBITDA: | | | | | | | | | |

| Insured inventory expenses (recoveries) | 15,993 | | | (17,390) | | | 1,310 | | | — | | | (87) | |

| Transaction related compensation | — | | | 1,668 | | | 939 | | | 1,999 | | | 4,606 | |

| Gain on sale of assets | — | | | — | | | — | | | (5,643) | | | (5,643) | |

| Gain on cost method investment | — | | | — | | | — | | | (4,798) | | | (4,798) | |

| Asset impairment | 9,000 | | | 87,156 | | | — | | | 963 | | | 97,119 | |

| | | | | | | | | |

| Gain on deconsolidation of joint venture | — | | | — | | | (6,544) | | | — | | | (6,544) | |

| Total adjusting items | 24,993 | | | 71,434 | | | (4,295) | | | (7,479) | | | 84,653 | |

| Adjusted EBITDA | $ | 103,659 | | | $ | 55,278 | | | $ | 144,441 | | | $ | 70,309 | | | $ | 373,687 | |

| | | | | | | | | |

The Andersons, Inc.

Cash from Operations Before Working Capital Changes

A non-GAAP financial measure

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Cash (used in) provided by operating activities | $ | (2,112) | | | $ | 488,683 | | | $ | 62,695 | | | $ | 696,087 | |

| Changes in operating assets and liabilities | | | | | | | |

| Accounts receivable | (11,786) | | | 198,396 | | | 3,498 | | | 406,263 | |

| Inventories | (198,776) | | | 13,263 | | | 278,947 | | | 748,118 | |

| Commodity derivatives | 13,317 | | | (3,274) | | | 49,327 | | | 99,479 | |

| Other current and non-current assets | (8,789) | | | 3,295 | | | (59,376) | | | 2,048 | |

| Payables and other current and non-current liabilities | 117,728 | | | 214,870 | | | (433,069) | | | (796,216) | |

| Total changes in operating assets and liabilities | (88,306) | | | 426,550 | | | (160,673) | | | 459,692 | |

| Adjusting items impacting cash from operations before working capital changes: | | | | | | | |

| Less: Insured inventory recoveries | — | | | — | | | — | | | (16,080) | |

Less: Unrealized foreign currency losses on receivables | — | | | (12,088) | | | — | | | (12,088) | |

| Cash from operations before working capital changes | $ | 86,194 | | | $ | 50,045 | | | $ | 223,368 | | | $ | 208,227 | |

Cash from operations before working capital changes is defined as cash provided by (used in) operating activities before the impact of changes in working capital within the statement of cash flows. The Company calculates cash from operations by eliminating the effect of changes in accounts receivable, inventories, commodity derivatives, other assets, and payables and accrued expenses from the cash provided by (used in) operating activities. Management believes that cash from operations before working capital changes is a useful measure of the company’s performance as it provides investors additional information about the company’s operations allowing better evaluation of underlying business performance and improved comparability to prior periods. Cash from operations before working capital changes is a non-GAAP financial measure and is not intended to replace or be an alternative to cash provided by (used in) operating activities, the most directly comparable GAAP financial measure.

v3.24.3

Cover page

|

Nov. 04, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 04, 2024

|

| Entity Registrant Name |

Andersons, Inc.

|

| Entity Incorporation, State or Country Code |

OH

|

| Entity File Number |

000-20557

|

| Entity Tax Identification Number |

34-1562374

|

| Entity Address, Address Line One |

1947 Briarfield Boulevard

|

| Entity Address, City or Town |

Maumee

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43537

|

| City Area Code |

419

|

| Local Phone Number |

893-5050

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.00 par value, $0.01 stated value

|

| Trading Symbol |

ANDE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000821026

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

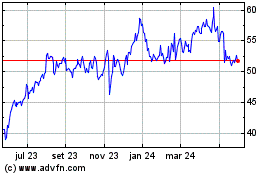

Andersons (NASDAQ:ANDE)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

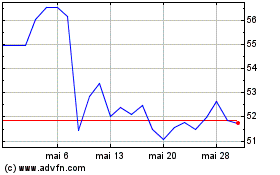

Andersons (NASDAQ:ANDE)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025