UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 5)*

Adecoagro S.A.

(Name of Issuer)

Common Shares, par value $1.50

per share

(Title of Class of Securities)

L00849106

(CUSIP Number)

Tether Holdings Limited

c/o SHRM Trustees

Trinity Chambers

Tortola, Road Town

British Virgin Islands, VG1110

+443333355842

with a copy to:

Daniel Woodard

McDermott Will & Emery LLP

One Vanderbilt Avenue

New York, New York 10017

(212) 547-5400

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

November 1, 2024

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or

13d-1(g), check the following box ¨

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d -7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. L00849106 | | Page

2 of 10 |

| 1 |

NAME OF REPORTING PERSON |

|

|

| |

Tether Holdings Limited |

|

|

| |

|

|

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

¨ |

| |

|

(b) |

¨ |

| |

|

|

|

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE OF FUNDS (See Instructions) |

|

|

| |

OO |

|

|

| |

|

|

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

x |

| |

|

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| |

British Virgin Islands |

|

|

| |

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER |

|

|

| |

0 |

|

|

| |

|

|

|

| 8 |

SHARED VOTING POWER |

|

|

| |

18,201,312 (1) |

|

|

| |

|

|

|

| 9 |

SOLE DISPOSITIVE POWER |

|

|

| |

0 |

|

|

| |

|

|

|

| 10 |

SHARED DISPOSITIVE POWER |

|

|

| |

18,201,312 (1) |

|

|

| |

|

|

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

18,201,312 (1) |

|

|

| |

|

|

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

¨ |

| |

|

|

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

17.8% (2) |

|

|

| |

|

|

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

|

|

| |

CO |

|

|

| |

|

|

|

|

|

| (1) | Includes 18,201,312 common shares, par value $1.50 per share (“Common

Shares”) of Adecoagro S.A. held by Tether Investments Limited, a wholly owned subsidiary of Tether Holdings Limited. |

| (2) | This percentage is calculated based upon 102,461,382 Common Shares outstanding

as of June 30, 2024 as set forth in the Issuer's Form 6-K filed with the Securities and Exchange Commission on August 12, 2024. |

| CUSIP No. L00849106 | | Page

3 of 10 |

| 1 |

NAME

OF REPORTING PERSON |

|

|

| |

Tether Investments Limited |

|

|

| |

|

|

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

¨ |

| |

|

(b) |

¨ |

| |

|

|

|

| 3 |

SEC

USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE

OF FUNDS (See Instructions) |

|

|

| |

WC |

|

|

| |

|

|

|

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

¨ |

| |

|

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION |

|

|

| |

British Virgin Islands |

|

|

| |

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER |

|

|

| |

0 |

|

|

| |

|

|

|

| 8 |

SHARED

VOTING POWER |

|

|

| |

18,201,312 |

|

|

| |

|

|

|

| 9 |

SOLE

DISPOSITIVE POWER |

|

|

| |

0 |

|

|

| |

|

|

|

| 10 |

SHARED

DISPOSITIVE POWER |

|

|

| |

18,201,312 |

|

|

| |

|

|

|

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

18,201,312 |

|

|

| |

|

|

|

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

¨ |

| |

|

|

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

17.8% (1) |

|

|

| |

|

|

|

| 14 |

TYPE

OF REPORTING PERSON (See Instructions) |

|

|

| |

CO |

|

|

| |

|

|

|

|

|

| (1) | This percentage is calculated based upon 102,461,382 Common Shares outstanding

as of June 30, 2024 as set forth in the Issuer's Form 6-K filed with the Securities and Exchange Commission on August 12, 2024. |

| CUSIP No. L00849106 | | Page 4 of 10 |

| 1 |

NAME

OF REPORTING PERSON |

|

|

| |

Giancarlo Devasini |

|

|

| |

|

|

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) |

¨ |

| |

|

(b) |

¨ |

| |

|

|

|

| 3 |

SEC

USE ONLY |

|

|

| |

|

|

|

| 4 |

SOURCE

OF FUNDS (See Instructions) |

|

|

| |

OO |

|

|

| |

|

|

|

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

¨ |

| |

|

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION |

|

|

| |

Italy |

|

|

| |

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER |

|

|

| |

0 |

|

|

| |

|

|

|

| 8 |

SHARED

VOTING POWER |

|

|

| |

18,201,312 (1) |

|

|

| |

|

|

|

| 9 |

SOLE

DISPOSITIVE POWER |

|

|

| |

0 |

|

|

| |

|

|

|

| 10 |

SHARED

DISPOSITIVE POWER |

|

|

| |

18,201,312 (1) |

|

|

| |

|

|

|

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| |

18,201,312 (1) |

|

|

| |

|

|

|

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

|

¨ |

| |

|

|

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| |

17.8% (2) |

|

|

| |

|

|

|

| 14 |

TYPE

OF REPORTING PERSON (See Instructions) |

|

|

| |

IN |

|

|

| |

|

|

|

|

|

| (1) | Includes 18,201,312 Common Shares held by Tether Investments Limited, a wholly owned subsidiary of

Tether Holdings Limited. Mr. Devasini has a greater than 50% voting interest in Tether Holdings Limited. The reporting person

disclaims beneficial ownership of these shares except to the extent of the reporting person’s pecuniary interest. |

| (2) | This

percentage is calculated based upon 102,461,382 Common Shares outstanding

as of June 30, 2024 as set forth in the Issuer's Form 6-K filed with the Securities and Exchange Commission on August 12, 2024. |

Explanatory Note: This statement on Schedule

13D amends the Schedule 13D of Tether Holdings Limited, a British Virgin Islands business company, Tether Investments Limited, a British

Virgin Islands business company, Ludovicus Jan Van der Velde and Giancarlo Devasini that was originally filed with the Securities and

Exchange Commission on August 16, 2024, as amended by Amendment No. 1 filed on September 9, 2024, Amendment No. 2 filed on September 20,

2024, Amendment No. 3 filed on September 30, 2024 and Amendment No. 4 filed on October 18, 2024 (as amended, the “Schedule 13D”)

with respect to the Common Shares, par value $1.50 per share (“Common Shares”) of Adecoagro S.A., a société

anonyme under the laws of the Grand Duchy of Luxembourg (the “Issuer”). This amendment to the Schedule 13D is being filed

by Tether Holdings Limited, a British Virgin Islands business company, Tether Investments Limited, a British Virgin Islands business company,

and Giancarlo Devasini (collectively, the “Reporting Persons”) and constitutes Amendment No. 5 to the Schedule 13D. Capitalized

terms used but not defined herein have the meanings given to such terms in the Schedule 13D. Except as set forth herein, the Schedule

13D is unmodified.

Item 2. Identity and Background

See the Schedule 13D, as amended, for historical

information. Item 2 of Schedule 13D is amended and supplemented as follows:

Certain information regarding Tether Holdings

Limited, Tether Investments Limited and their respective executive officers and directors is set forth on Schedule A attached hereto.

Item 3. Source and Amount of Funds or Other

Consideration

See the Schedule 13D, as amended, for historical

information. Item 3 is amended and supplemented as follows:

Tether Investments Limited used cash from its

own working capital to make the purchases of Common Shares listed on Schedule B hereto.

Item 5. Interest in Securities of Issuer

Item 5 of the Schedule 13D is amended and restated

in its entirety to read as follows:

(a) The Reporting Persons beneficially own an

aggregate of 18,201,312 shares of the Issuer’s Common Shares, representing 17.8% of the outstanding Common Shares.

(b) Each of the Reporting Persons has voting and

dispositive power with respect to the beneficially owned 18,201,312 shares. This percentage is calculated based upon 102,461,382 Common

Shares outstanding as of June 30, 2024 as set forth in the Issuer's Form 6-K filed with the Securities and Exchange Commission on August

12, 2024.

(c) Schedule B sets forth the transactions

in the Common Shares effected by the Reporting Persons during the past 60 days.

(d) None.

(e) Not applicable.

Item 7. Material to be Filed as Exhibits

1. Agreement

of filing persons relating to filing of joint statement per Rule 13d-1(k).

SIGNATURES

After reasonable inquiry and to the best of the knowledge and belief

of the undersigned, the undersigned certifies that the information set forth in this Statement on Schedule 13D is true, complete and correct.

| |

November 5, 2024 |

| |

|

| |

TETHER HOLDINGS LIMITED |

| |

|

| |

By: |

/s/ Ludovicus Jan Van der Velde |

| |

Name: |

Ludovicus Jan Van der Velde |

| |

Title: |

Director |

| |

Tether Investments Limited |

| |

|

| |

By: |

/s/ Ludovicus Jan Van der Velde |

| |

Name: |

Ludovicus Jan Van der Velde |

| |

Title: |

Director |

| |

/s/ Giancarlo Devasini |

| |

Giancarlo Devasini, individually |

Schedule A

Executive Officers and Directors

The following sets forth the name, country of citizenship, position

and principal occupation of each executive officer and member of the board of directors of Tether Holdings Limited and Tether Investments

Limited. Except as indicated below, none of the persons listed below has been convicted of a crime (other than traffic violations or similar

misdemeanors) or been subject to proceedings pertaining to violations of securities laws within the past 5 years.

Executive Officers and Directors of Tether Holdings Limited:

| Name and Citizenship |

Position and Principal Occupation |

Beneficial Ownership |

Business Address |

| Paolo Ardoino, citizen of Italy |

Chief

Executive Officer and Director |

0 |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

| Giancarlo Devasini, citizen of Italy |

Chief Financial Officer and Director |

18,201,312 (1) |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

| Ludovicus Jan Van der Velde, citizen of the Netherlands |

Director |

0 |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

Executive Officers and Directors of Tether Investments Limited:

| Name and Citizenship |

Position and Principal Occupation |

Beneficial Ownership |

Business Address |

| Paolo Ardoino, citizen of Italy |

Chief

Executive Officer and Director |

0 |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

| Giancarlo Devasini, citizen of Italy |

Chief Financial Officer and Director |

18,201,312 (1) |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

| Ludovicus Jan Van der Velde, citizen of the Netherlands |

Director |

0 |

SHRM Trustees (BVI) Limited, P.O. Box 4301, Trinity Chambers, Road Town, Tortola, British Virgin Islands, VG 1110 |

| (1) | Includes 18,201,312 common shares, par value $1.50 per share (“Common Shares”) of Adecoagro

S.A. held by Tether Investments Limited, a wholly owned subsidiary of Tether Holdings Limited. |

In October 2021, the U.S. Commodity Futures Trading

Commission (CFTC) instituted and settled regulatory proceedings against Tether Holdings Limited, Tether Limited, Tether Operations Limited,

and Tether International Limited (collectively, “Tether”) by way of an order accepting Tether’s payment of a civil monetary

penalty of $41 million without admitting or denying any of the CFTC’s findings or conclusions. The order settled CFTC allegations

that, from June 2016 to February 2019, Tether made untrue or misleading statements and omissions of material fact or omitted to state

material facts necessary to make statements made not true or misleading in connection with, among other things, whether USDT was fully

backed by U.S. Dollars held in bank accounts in Tether’s name.

In February 2021, the Office of the Attorney General

of the State of New York (NYAG) entered into an agreement with Tether and several Bitfinex (a group of companies with which Tether is

affiliated) companies to settle a 2019 proceeding brought by NYAG seeking an injunction related to, among other things, the transfer of

certain funds by and among Bitfinex and Tether. Without admitting or denying NYAG’s findings, Bitfinex and Tether agreed to settle

the NYAG proceeding by paying $18.5 million in penalties to the State of New York. The agreement further required Bitfinex and Tether

to discontinue any trading activity with New York persons or entities and to submit to mandatory reporting on certain business functions.

Schedule B

The following table lists all transactions completed by the Reporting

Persons in the Common Shares since September 6, 2024, which were all completed through open market purchases.

Tether Investments Limited:

| Date |

Shares Bought |

Price |

| September 6, 2024 |

360,000 |

11.4199 |

| September 9, 2024 |

342,500 |

11.1468 |

| September 10, 2024 |

405,000 |

11.1266 |

| September 11, 2024 |

81,000 |

11.3079 |

| September 12, 2024 |

140,000 |

11.3390 |

| September 13, 2024 |

155,000 |

11.5534 |

| September 16, 2024 |

145,410 |

11.5744 |

| September 17, 2024 |

296,294 |

11.0614 |

| September 18, 2024 |

350,000 |

11.2342 |

| September 19, 2024 |

325,000 |

11.5819 |

| September 20, 2024 |

472,000 |

11.4115 |

| September 23, 2024 |

51,000 |

11.4990 |

| September 24, 2024 |

250,000 |

11.5794 |

| September 25, 2024 |

700,000 |

11.3903 |

| September 26, 2024 |

316,796 |

11.9130 |

| October

14, 2024 |

312,170 |

11.0007 |

| October

15, 2024 |

321,655 |

11.1441 |

| October

16, 2024 |

406,051 |

11.2585 |

| October

17, 2024 |

316,371 |

11.3089 |

| October

18, 2024 |

395,094 |

11.3799 |

| October 21, 2024 |

472,159 |

11.4368 |

| October 22, 2024 |

6,537 |

11.4743 |

| October 23, 2024 |

308,364 |

11.4801 |

| October 30, 2024 |

196,689 |

11.4532 |

| October 31, 2024 |

5,112 |

11.4612 |

| November 1, 2024 |

328,561 |

11.3409 |

| November 4, 2024 |

34,300 |

11.4774 |

| November

5, 2024 |

50,000 |

11.3121 |

EXHIBIT 1

Joint Filing Agreement

In accordance with Rule 13d-1(k) promulgated under the Securities Exchange

Act of 1934, as amended, each of the persons named below agrees to the joint filing of this Amendment to Schedule 13D, including further

amendments thereto, with respect to the common shares, par value $1.50 per share, of Adecoagro S.A. and further agrees that this Joint

Filing Agreement be filed with the Securities and Exchange Commission as an exhibit to such filing; provided, however, that no person

shall be responsible for the completeness or accuracy of the information concerning the other persons making the filing unless such person

knows or has reason to believe such information is inaccurate (as provided in Rule 13d-1(k)(1)(ii)). This Joint Filing Agreement may be

executed in one or more counterparts, all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the persons named below have

executed this Joint Filing Agreement as of the date set forth below.

| |

November 5, 2024 |

| |

|

| |

TETHER HOLDINGS LIMITED |

| |

|

| |

By: |

/s/ Ludovicus Jan Van der Velde |

| |

Name: |

Ludovicus Jan Van der Velde |

| |

Title: |

Director |

| |

Tether Investments Limited |

| |

|

| |

By: |

/s/ Ludovicus Jan Van der Velde |

| |

Name: |

Ludovicus Jan Van der Velde |

| |

Title: |

Director |

| |

/s/ Giancarlo Devasini |

| |

Giancarlo Devasini, individually |

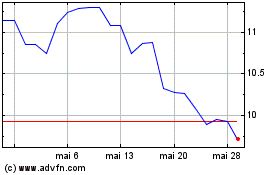

Adecoagro (NYSE:AGRO)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Adecoagro (NYSE:AGRO)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025