0001737287FALSE00017372872024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

_______________________

Allogene Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

____________________________ | | | | | | | | |

| Delaware | 001-38693 | 82-3562771 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

210 East Grand Avenue, South San Francisco, California 94080

(Address of principal executive offices including zip code)

Registrant’s telephone number, including area code: (650) 457-2700

(Former name or former address, if changed since last report.)

________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. of Form 8-K): | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | ALLO | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, Allogene Therapeutics, Inc. (the “Company”) provided a corporate update and announced its financial results for the quarter ended September 30, 2024 in the press release attached hereto as Exhibit 99.1, which is incorporated herein by reference.

The information in this Item 2.02, including the attached Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits. | | | | | | | | |

| (d) | | |

Exhibit Number | | Description |

| 99.1 | | |

| 104 | | The cover page of this report has been formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | |

| | | |

| ALLOGENE THERAPEUTICS, INC. | |

| | |

| By: | /s/ David Chang, M.D., Ph.D. | |

| | David Chang, M.D., Ph.D. | |

| | President, Chief Executive Officer | |

Dated: November 7, 2024

Exhibit 99.1

Allogene Therapeutics Reports Third Quarter 2024 Financial Results and Business Update

•Cemacabtagene Ansegedleucel (Cema-Cel): 1L Consolidation Large B-Cell Lymphoma (LBCL)

◦Pivotal Phase 2 ALPHA3 Trial Continuing with Site Activation and Patient Screening/Enrollment

◦Lymphodepletion Selection Planned for Mid-2025

◦Enrollment Completion Expected in 1H 2026 with Primary EFS Data by YE 2026

◦Potential BLA Submission in 2027

•ALLO-329 in Autoimmune Disease (AID)

◦Pre-Clinical Data Highlighting the Potential of ALLO-329 to be Presented at the American College of Rheumatology (ACR) Convergence

◦CD19/CD70 Dual CAR is Specifically Designed to Address Both the B-cell and T-cell Dysfunction Implicated in Autoimmune Diseases

◦CD70 CAR with Clinically Validated Dagger® Technology Aims to Reduce or Eliminate the Need for Lymphodepletion

◦Investigational New Drug (IND) Application Targeted for Q1 2025

◦Proof-of-Concept Data Expected by YE 2025

•ALLO-316 in Renal Cell Carcinoma (RCC)

◦Company Announced Presentation of Positive Phase 1 Data Demonstrating the Potential of ALLO-316 in Pretreated Patients with Advanced Renal Cell Carcinoma at SITC and IKCS

◦Phase 1 TRAVERSE Trial Demonstrated a Single Infusion of ALLO-316 Can Yield an Overall Response Rate of 50% and Confirmed Response Rate of 33% in Patients with CD70 Tumor Proportion Score (TPS) Greater than 50%

◦CD70 Dagger® Technology Promoted Robust Expansion and Persistence of ALLO-316 with Standard Lymphodepletion, Supporting its Potential as the Next Generation Allogeneic Platform

◦ALLO-316 Demonstrated a Manageable Safety Profile; Newly Implemented Diagnostic and Management Algorithm Appears Highly Effective in Abating IEC-HS While Preserving CAR T Efficacy

◦Data from the TRAVERSE Trial Supported the FDA's Recent RMAT Designation for ALLO-316 as a Potential Treatment for Advanced or Metastatic RCC

•Ended Q3 2024 with $403.4 Million in Cash, Cash Equivalents and Investments; Cash Runway Continues to be Projected into 2H 2026

•Conference Call and Webcast Scheduled for Today at 2:00 PM PT/5:00 PM ET

SOUTH SAN FRANCISCO, Calif., November 7, 2024 – Allogene Therapeutics, Inc. (Nasdaq: ALLO), a clinical-stage biotechnology company pioneering the development of allogeneic CAR T (AlloCAR T™) products for cancer and autoimmune disease, today provided corporate updates and reported financial results for the quarter ended September 30, 2024.

“We are proud of the progress made in the third quarter of 2024 to advance our investigational allogeneic cell products in key “firsts” – our first-line consolidation trial in large B-cell lymphoma with cema-cel, ALLO-316 as the first allogeneic CAR T product candidate to demonstrate positive results in solid tumors, and the first CD19/CD70 dual CAR T candidate specifically designed for autoimmune disease,” said David Chang, M.D., Ph.D., President, Chief Executive Officer and Co-Founder of Allogene. “We believe these efforts have the potential to redefine treatment paradigms, tailoring therapies to meet the unique needs of large patient populations and enabling broader real-world adoption. Allogene remains dedicated to driving innovation that improves outcomes for patients with both cancer and autoimmune diseases.”

Program Updates

Cema-Cel: Pivotal ALPHA3 1L Consolidation Trial in Large B Cell Lymphoma (LBCL)

The pivotal Phase 2 ALPHA3 trial is the main focus for the Company. The trial was initiated in June 2024 and now has almost 30 sites activated and screening for patients with minimal residual disease (MRD).

This groundbreaking study is evaluating the use of cemacabtagene ansegedleucel (cema-cel) as part of the first line (1L) treatment regimen for patients with LBCL who are likely to relapse after standard 1L treatment. ALPHA3 is the first pivotal trial to offer CAR T as part of 1L treatment consolidation.

This innovative ALPHA3 trial will identify patients at high risk for relapse after 1L treatment by utilizing Foresight CLARITY™ powered by PhasED-Seq™, a novel and highly accurate Investigational Use Only (IUO) test for MRD. This randomized trial will enroll approximately 240 patients and is designed to demonstrate a meaningful improvement in event free survival (EFS) in patients treated with cema-cel relative to patients who receive the current standard of care (observation). ALPHA3 is expected to complete enrollment in 1H 2026.

Efficacy analyses are expected to occur in 2026 and will include an interim EFS analysis monitored by the independent Data Safety Monitoring Board (DSMB) in 1H 2026 and the data readout of the primary EFS analysis by YE 2026. A potential biologics license application (BLA) submission is targeted for 2027.

ALLO-329: CD19/CD70 Dual CAR with Dagger® Technology in Autoimmune Disease (AID)

The Company will present pre-clinical data for its next-generation investigational AlloCAR T candidate for autoimmune indications, ALLO-329, at the American College of Rheumatology’s annual meeting, ACR Convergence 2024, November 18, 2024, in Washington, D.C.

ALLO-329 offers a novel approach to treating autoimmune diseases as the first allogeneic CD19/CD70 dual CAR T product specifically designed to target CD19+ B-cells and CD70+ activated T-cells, both of which are key players in autoimmune diseases. The investigational product utilizes CRISPR-based site-specific integration and incorporates the Company’s clinically validated Dagger® technology, which aims to reduce or eliminate the need for lymphodepletion, believed to be a potentially significant obstacle to the wider adoption of CAR T therapies in autoimmune applications.

The Company plans to file an investigational new drug (IND) application in Q1 2025 and expects to have proof-of-concept by YE 2025.

ALLO-316: TRAVERSE Trial in Renal Cell Carcinoma (RCC)

The Company will present an update to the ongoing Phase 1 TRAVERSE trial in an oral presentation at the 2024 International Kidney Cancer Symposium (IKCS, November 8, 2024) and at a poster session at the Society for Immunotherapy of Cancer's (SITC) Annual Meeting (November 9, 2024). The trial evaluates ALLO-316, the Company’s first AlloCAR T™ product candidate for the treatment of solid tumors. The Phase 1 TRAVERSE trial is enrolling patients with advanced or metastatic renal cell carcinoma (RCC) who have progressed following treatment with an immune checkpoint inhibitor and VEGF-targeting therapy. These presentations highlight strong evidence of anti-tumor activity of ALLO-316 following standard FC (fludarabine (30 mg/m2) and cyclophosphamide (500 mg/m2)) lymphodepletion in patients with CD70 positive RCC tumors.

As of the October 14, 2024 data cutoff, 39 patients had been enrolled in the ongoing Phase 1 trial, of which 26 were confirmed to have CD70 positive RCC and were evaluable for efficacy outcomes. The median time from enrollment to the start of therapy was five days. Data from dose escalation cohorts as well as a newly opened Phase 1b expansion cohort are included in the presentations. The Phase 1b expansion cohort is evaluating safety and efficacy of ALLO-316 at DL2 (80M CAR T cells) following a standard FC lymphodepletion.

Following a single infusion of ALLO-316 in heavily pretreated patients, the trial demonstrated best Overall Response Rate (ORR) of 50% and Confirmed Response Rate of 33% in those patients with CD70 Tumor Proportion Score (TPS) of ≥50% who received the Phase 1b expansion regimen. Patients with a TPS of ≥50% represent the majority of patients with advanced or metastatic RCC. Of those with a TPS ≥50, 76% (16/21) experienced a reduction in tumor burden. Two of six (33%) patients with high TPS who received the Phase 1b expansion regimen showed durable responses ongoing at ≥4 months.

The most common all-grade adverse events were cytokine release syndrome (CRS) (with only one grade ≥3), fatigue (59%), neutropenia (56%), decreased white blood cell count (54%), anemia (51%), and nausea (51%). Immune effector cell-associated neurotoxicity syndrome (ICANS) was minimal at 8% and no graft-versus-host disease (GvHD) occurred.

Two dose limiting toxicity (DLT) events of autoimmune hepatitis and cardiogenic shock were reported. Each event occurred in two separate participants who received FCA (FC plus ALLO-647) lymphodepletion and DL2 of ALLO-316. Three Grade 5 treatment-related adverse events were reported: 1) cardiogenic shock, which was one of the two DLT events; 2) sepsis from multi-drug resistant Klebsiella pneumoniae in a participant who received DL4 of ALLO-316 - this participant had a prior episode of muscle abscess and bacteremia from the same multi-drug resistant Klebsiella and was receiving anakinra and dexamethasone for hyperinflammation; and 3) failure to thrive in a participant 16 months after treatment with ALLO-316 - this subject had tumor response of stable disease (SD) at month 12 and no interval scans to evaluate disease status prior to death.

On October 29, 2024, the Company announced that it had received Regenerative Medicine Advanced Therapy (RMAT) designation for ALLO-316 for adult patients with advanced or metastatic RCC. The RMAT designation was based on Phase 1 clinical data from the TRAVERSE trial indicating the potential of ALLO-316 to address the unmet need for patients with difficult-to-treat RCC who have failed multiple standard RCC therapies, including an immune checkpoint inhibitor and a VEGF-targeting therapy.

2024 Third Quarter Financial Results

•Research and development expenses were $44.7 million for the third quarter of 2024, which includes $5.6 million of non-cash stock-based compensation expense.

•General and administrative expenses were $16.3 million for the third quarter of 2024, which includes $7.8 million of non-cash stock-based compensation expense.

•Net loss for the third quarter of 2024 was $66.3 million, or $0.32 per share, including non-cash stock-based compensation expense of $13.4 million and $10.7 million in non-cash impairment of long-lived asset expense.

•The Company had $403.4 million in cash, cash equivalents, and investments as of September 30, 2024.

Based on its cash, cash equivalents and investments as of September 30, 2024, the Company continues to expect its cash runway to fund operations into the second half of 2026. Guidance remains unchanged from the most recent update with an expectation of a decrease in cash, cash equivalents, and investments of approximately $200 million in 2024. GAAP Operating Expenses are expected to be approximately $300 million, including estimated non-cash stock-based compensation expense of approximately $60 million. These estimates exclude any impact from potential business development activities.

Conference Call and Webcast Details

Allogene will host a live conference call and webcast today at 2:00 p.m. Pacific Time /5:00 p.m. Eastern Time to discuss financial results and provide a business update. If you would like the option to ask a question on the conference call, please use this link to register. Upon registering for the conference call, you will receive a personal PIN to access the call, which will identify you as the participant and allow you the option to ask a question. The listen-only webcast will be made available on the Company's website at www.allogene.com under the Investors tab in the News and Events section. Following the live audio webcast, a replay will be available on the Company's website for approximately 30 days.

About Allogene Therapeutics

Allogene Therapeutics, with headquarters in South San Francisco, is a clinical-stage biotechnology company pioneering the development of allogeneic chimeric antigen receptor T cell (AlloCAR T™) products for cancer and autoimmune disease. Led by a management team with significant experience in cell therapy, Allogene is developing a pipeline of “off-the-shelf” CAR T cell product candidates with the goal of delivering readily available cell therapy on-demand, more reliably, and at greater scale to more patients. For more information, please visit www.allogene.com, and follow Allogene Therapeutics on X and LinkedIn.

Cautionary Note on Forward-Looking Statements

This press release contains forward-looking statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The press release may, in some cases, use terms such as “targeted,” “ongoing,” “likely to,” “believes,” “potential,” “continue,” “estimates,” “expects,” “plans,” “project,” “anticipate,” “intends,” “designed to,” “aims to,” “advance,” “can,” “become,” “may,” “could,” “will,” “should” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Forward-looking statements include statements regarding intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things: the potential for Allogene’s product candidates, including cema-cel, ALLO-329, and ALLO-316, to achieve clinical success, receive regulatory approval, impact commercial markets or be commercially successful; expectations regarding trial design, timelines, and anticipated data readouts, including expectations that ALPHA3 will be a pivotal trial; plans and timelines for regulatory submissions, including a potential BLA for Cema-Cel in 2027 and an IND application for ALLO-329 in Q1 2025; the expected dosing regimen for ALLO-316 for ALLO-316 if it were to proceed into Phase 2; anticipated outcomes related to Allogene’s product candidates and technology, including efficacy and safety outcomes and the ability to manage adverse events; potential applications of Allogene’s product candidates in treating cancer and autoimmune diseases; expectations regarding achieving data to establish proof-of-concept; Allogene’s projected financial position, including 2024 financial guidance and cash runway; and other statements related to future events or conditions. Various factors may cause material differences between Allogene’s expectations and actual results, including, risks and uncertainties related to: our novel technology and potential adverse effects; the success, cost, and timing of Allogene’s product development activities and clinical trials; the regulatory approval process; the ability of Allogene to obtain and maintain regulatory approval of its product candidates; potential delays or difficulties in product manufacturing; competition from other biopharmaceutical companies; obtaining additional funding to develop Allogene’s product candidates and implement its operating plans; and general economic and market conditions. These and other risks are discussed in greater detail in Allogene’s filings with the Securities and Exchange Commission (SEC), including without limitation under the “Risk Factors” heading in its Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, being filed with the SEC today. Any forward-looking statements that are made in this press release speak only as of the date of this press release. Allogene assumes no obligation to update the forward-looking statements whether as a result of new information, future events or otherwise, after the date of this press release.

Caution should be exercised regarding statements comparing autologous CAR T data. There are differences in the clinical trial design, patient populations, published data, follow-up times and the product candidates themselves, and the results from the clinical trials of autologous products may have no interpretative value on our existing or future results.

AlloCAR T™ and Dagger® are trademarks of Allogene Therapeutics, Inc.

CLARITY™ and PhasED-Seq™ are trademarks of Foresight Diagnostics.

Allogene’s investigational AlloCAR T™ oncology products utilize Cellectis technologies. The anti-CD19 oncology products are developed based on an exclusive license granted by Cellectis to Servier. Servier, which has an exclusive license to the anti-CD19 AlloCAR T™ investigational products from Cellectis, has granted Allogene exclusive rights to these products in the U.S., all EU Member States and the United Kingdom. The anti-CD70 AlloCAR T program is licensed exclusively from Cellectis by Allogene and Allogene holds global development and commercial rights to this AlloCAR TTM program. ALLO-329 (CD19/CD70) in autoimmune disease uses CRISPR gene-editing technology.

ALLOGENE THERAPEUTICS, INC.

SELECTED FINANCIAL DATA

(unaudited; in thousands, except share and per share data)

STATEMENTS OF OPERATIONS | | | | | | | | | | | |

| Three Months Ended September 30, |

| 2024 | | 2023 |

| Collaboration revenue - related party | $ | — | | | $ | 22 | |

| Operating expenses: | | | |

| Research and development | $ | 44,713 | | | $ | 45,977 | |

| General and administrative | 16,333 | | | 17,041 | |

| Impairment of long-lived assets | 10,728 | | | — | |

| Total operating expenses | 71,774 | | | 63,018 | |

| Loss from operations | (71,774) | | | (62,996) | |

| Other income (expense), net: | | | |

| Interest and other income, net | 6,705 | | | 6,205 | |

| Interest expense | (100) | | | — | |

| Other income and expense, net | (1,124) | | | (5,496) | |

| Total other income (expense), net | 5,481 | | | 709 | |

| Net loss | (66,293) | | | (62,287) | |

| Net loss per share, basic and diluted | $ | (0.32) | | | $ | (0.37) | |

| Weighted-average number of shares used in computing net loss per share, basic and diluted | 209,188,551 | | | 167,649,010 | |

SELECTED BALANCE SHEET DATA | | | | | | | | | | | |

| As of September 30, 2024 | | As of December 31, 2023 |

| Cash, cash equivalents and investments | $ | 403,385 | | | $ | 448,697 | |

| Total assets | 589,120 | | | 642,837 | |

| Total liabilities | 125,372 | | | 130,604 | |

| Total stockholders’ equity | 463,748 | | | 512,233 | |

Allogene Media/Investor Contact:

Christine Cassiano

EVP, Chief Corporate Affairs & Brand Strategy Officer

Christine.Cassiano@allogene.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

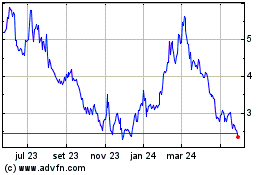

Allogene Therapeutics (NASDAQ:ALLO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

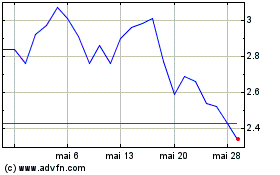

Allogene Therapeutics (NASDAQ:ALLO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024