false

0000065770

0000065770

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

DATE

OF REPORT (DATE OF EARLIEST EVENT REPORTED) November 7, 2024

MicroVision,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-34170 |

|

91-1600822 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

18390

NE 68th Street

Redmond,

Washington 98052

(Address

of principal executive offices) (Zip code)

(425)

936-6847

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

|

MVIS |

|

The

NASDAQ Stock Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

The

information in this Current Report is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current

Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933,

as amended.

On

November 7, 2024, MicroVision, Inc. issued a press release announcing its third quarter 2024 results. A copy of the press release is

attached as Exhibit 99.1 and is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(c)

Exhibits.

Pursuant

to the rules and regulations of the SEC, the attached exhibit is deemed to have been furnished to, but not filed with, the SEC.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MICROVISION,

INC. |

| |

|

|

| |

By: |

/s/

Drew G. Markham |

| |

|

Drew

G. Markham |

| |

|

Senior

Vice President, General Counsel and Secretary |

Dated:

November 7, 2024

Exhibit

99.1

MicroVision

Announces Third Quarter 2024 Results

REDMOND,

WA / ACCESSWIRE / November 7, 2024 / MicroVision, Inc. (NASDAQ:MVIS), a leader in MEMS-based solid-state automotive lidar and ADAS solutions,

today announced its third quarter 2024 results.

Key

Business Highlights for Q3 2024

| ● | Actively

engaged with top-tier global automotive OEMs, with seven high-volume RFQs for passenger vehicles

and custom development opportunities. |

| ● | Actively

engaged with multiple leading industrial companies for the opportunity to provide an integrated

lidar hardware and software solution in the heavy equipment vertical. |

| ● | Sequential

improvement in cash burn in the third quarter of 2024 positioned the Company well to leverage

near-term hardware and software sales to industrial customers. |

“We

believe the recently executed $75 million capital commitment positions us well to secure additional revenue opportunities for 2025 and

beyond with our integrated MOVIA L and software solution with multiple industrial customers in the heavy equipment segment,” said

Sumit Sharma, MicroVision’s Chief Executive Officer. “In addition, MAVIN and MOVIA S, combined with our integrated perception

software, continue to offer compelling solutions to automotive OEMs at attractive price points. Given automotive OEMs’ latest start-of-production

timelines, the opportunity to ramp revenues in 2025 with our industrial customers puts MicroVision in a strong position in the marketplace.”

“With

a watchful eye on our operating expenses, we are pleased with the steady improvement in our cash burn, showing sequential reductions

for the first three quarters of 2024,” continued Sharma. “We expect to continue scaling resources, both internally and with

third party vendors and suppliers, as we remain engaged with automotive OEMs and responsive to their evolving timelines.”

Key

Financial Highlights for Q3 2024

| ● | Revenue

for the third quarter of 2024 was $0.2 million, compared to $1.0 million for the third quarter

of 2023, with the year-over-year fluctuation driven by a delayed order, as well as the 2023

sale of MOSAIK software to a leading Asian automotive OEM. |

| ● | Net

loss for the third quarter of 2024 was $15.5 million, or $0.07 per share, which includes

$2.4 million of non-cash, share-based compensation expense, compared to a net loss of $23.5

million, or $0.12 per share, which includes $4.7 million of non-cash, share-based compensation

expense, for the third quarter of 2023. |

| ● | Adjusted

EBITDA for the third quarter of 2024 was an $11.7 million loss, compared to a $16.9 million

loss for the third quarter of 2023. |

| ● | Cash

used in operations in the third quarter of 2024 was $14.1 million, compared to cash

used in operations in the third quarter of 2023 of $20.4 million. |

| ● | The

Company ended the third quarter of 2024 with $43.2 million in cash and cash equivalents,

including investment securities, compared to $73.8 million at December 31, 2023. |

Subsequent

to the third quarter, the Company strengthened its financial position by closing on a two-year $75.0 million senior secured convertible

note facility in October 2024. After giving effect to the net proceeds from the first $45.0 million tranche of the financing transaction,

the Company expects to have approximately $81 million in cash and cash equivalents and access to $153 million of additional capital,

including $123 million under its existing ATM, or at-the-market, facility and $30 million from the remaining commitment pursuant to the

convertible note facility.

Conference

Call and Webcast: Q3 2024 Results

MicroVision

will host a conference call and webcast, consisting of prepared remarks by management, a slide presentation, and a question-and-answer

session at 1:30 PM PT/4:30 PM ET on Thursday, November 7, 2024 to discuss the financial results and provide a business update. Analysts

and investors may pose questions to management during the live webcast on November 7, 2024.

The

live webcast and slide presentation can be accessed on the Company’s Investor Relations website under the Events tab at https://ir.microvision.com/events.

The webcast will be archived on the website for future viewing.

About

MicroVision

With

offices in the U.S. and Germany, MicroVision is a pioneering company in MEMS-based laser beam scanning technology that integrates MEMS,

lasers, optics, hardware, algorithms and machine learning software into its proprietary technology to address existing and emerging markets.

The Company’s integrated approach uses its proprietary technology to provide automotive lidar sensors and solutions for advanced

driver-assistance systems (ADAS) and for non-automotive applications including industrial, smart infrastructure and robotics. The Company

has been leveraging its experience building augmented reality micro-display engines, interactive display modules, and consumer lidar

modules.

For

more information, visit the Company’s website at www.microvision.com, on Facebook at www.facebook.com/microvisioninc,

and LinkedIn at https://www.linkedin.com/company/microvision/.

MicroVision,

MAVIN, MOSAIK, and MOVIA are trademarks of MicroVision, Inc. in the United States and other countries. All other trademarks are the properties

of their respective owners.

Non-GAAP

information

To

supplement MicroVision’s condensed financial statements presented in accordance with GAAP, the Company presents investors with

the non-GAAP financial measures “adjusted EBITDA” and “adjusted Gross Profit.” Adjusted EBITDA consists of GAAP

net income (loss) excluding the impact of the following: interest income and interest expense; income tax expense; depreciation and amortization;

bargain purchase gain; share-based compensation; impairment charges; and restructuring costs. Adjusted Gross Profit is calculated as

GAAP gross profit before share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

MicroVision

believes that the presentation of adjusted EBITDA and adjusted Gross Profit provides important supplemental information to management

and investors regarding financial and business trends, provides consistency and comparability with MicroVision’s past financial

reports, and facilitates comparisons with other companies in the Company’s industry, many of which use similar non-GAAP financial

measures to supplement their GAAP results. Internally, management uses these non-GAAP measures when evaluating operating performance

because the exclusion of the items described above provides an additional useful measure of the Company’s operating results and

facilitates comparisons of the Company’s core operating performance against prior periods and its business objectives. Externally,

the Company believes that adjusted EBITDA and adjusted Gross Profit are useful to investors in their assessment of MicroVision’s

operating performance and the valuation of the Company.

Adjusted

EBITDA and adjusted Gross Profit are not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute

for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they

do not reflect all of the costs associated with the operations of MicroVision’s business as determined in accordance with GAAP.

The Company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from

its non-GAAP financial measures should not be construed as an inference that these costs are unusual or infrequent.

The

Company compensates for limitations of the adjusted EBITDA measure by prominently disclosing GAAP net income (loss), which the Company

believes is the most directly comparable GAAP measure, and providing investors with a reconciliation from GAAP net income (loss) to adjusted

EBITDA.

Similarly

for adjusted Gross Profit, the Company compensates for limitations of the measure by prominently disclosing GAAP gross profit which is

the difference between Revenue and Cost of revenue, which the Company believes is the most directly comparable GAAP measure, and providing

investors with a reconciliation by backing out share-based compensation expense and the amortization of acquired intangibles included

in cost of revenue.

Forward-Looking

Statements

Certain

statements contained in this release, including customer engagement and the likelihood of success; opportunities for revenue and cash;

expense reduction; market position; product portfolio; product and manufacturing capabilities; capital-raising opportunities; and expected

revenue, expenses and cash usage are forward-looking statements that involve a number of risks and uncertainties that could cause actual

results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially

from those projected in such forward-looking statements include the risk its ability to operate with limited cash or to raise additional

capital when needed; market acceptance of its technologies and products or for products incorporating its technologies; the failure of

its commercial partners to perform as expected under its agreements; its financial and technical resources relative to those of its competitors;

its ability to keep up with rapid technological change; government regulation of its technologies; its ability to enforce its intellectual

property rights and protect its proprietary technologies; the ability to obtain customers and develop partnership opportunities; the

timing of commercial product launches and delays in product development; the ability to achieve key technical milestones in key products;

dependence on third parties to develop, manufacture, sell and market its products; potential product liability claims; its ability to

maintain its listing on The Nasdaq Stock Market, and other risk factors identified from time to time in the Company’s SEC reports,

including the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. These

factors are not intended to represent a complete list of the general or specific factors that may affect the Company. It should be recognized

that other factors, including general economic factors and business strategies, may be significant, now or in the future, and the factors

set forth in this release may affect the Company to a greater extent than indicated. Except as expressly required by federal securities

laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information,

future events, changes in circumstances or any other reason.

Investor

Relations Contact

Jeff

Christensen

Darrow

Associates Investor Relations

MVIS@darrowir.com

Media

Contact

Marketing@MicroVision.com

Source:

MicroVision, Inc.

Microvision,

Inc.

Consolidated

Balance Sheet

(In

thousands)

(Unaudited)

| | |

September 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Assets | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 16,523 | | |

$ | 45,167 | |

| Investment securities, available-for-sale | |

| 26,679 | | |

| 28,611 | |

| Restricted cash, current | |

| 270 | | |

| 3,263 | |

| Accounts receivable, net of allowances | |

| 232 | | |

| 949 | |

| Inventory | |

| 4,486 | | |

| 3,874 | |

| Other current assets | |

| 4,857 | | |

| 4,890 | |

| Total current assets | |

| 53,047 | | |

| 86,754 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 7,668 | | |

| 9,032 | |

| Operating lease right-of-use assets | |

| 12,090 | | |

| 13,758 | |

| Restricted cash, net of current portion | |

| 1,572 | | |

| 961 | |

| Intangible assets, net | |

| 12,563 | | |

| 17,235 | |

| Other assets | |

| 1,322 | | |

| 1,895 | |

| Total assets | |

$ | 88,262 | | |

$ | 129,635 | |

| | |

| | | |

| | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,487 | | |

$ | 2,271 | |

| Accrued liabilities | |

| 5,893 | | |

| 8,640 | |

| Accrued liability for Ibeo business combination | |

| - | | |

| 6,300 | |

| Contract liabilities | |

| 180 | | |

| 300 | |

| Operating lease liabilities, current | |

| 2,149 | | |

| 2,323 | |

| Other current liabilities | |

| 902 | | |

| 669 | |

| Total current liabilities | |

| 10,611 | | |

| 20,503 | |

| | |

| | | |

| | |

| Operating lease liabilities, net of current portion | |

| 11,662 | | |

| 12,714 | |

| Other long-term liabilities | |

| 134 | | |

| 614 | |

| Total liabilities | |

| 22,407 | | |

| 33,831 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| Shareholders’ Equity | |

| | | |

| | |

| Common stock at par value | |

| 213 | | |

| 195 | |

| Additional paid-in capital | |

| 896,424 | | |

| 860,765 | |

| Accumulated other comprehensive income | |

| 344 | | |

| 210 | |

| Accumulated deficit | |

| (831,126 | ) | |

| (765,366 | ) |

| Total shareholders’ equity | |

| 65,855 | | |

| 95,804 | |

| Total liabilities and shareholders’ equity | |

$ | 88,262 | | |

$ | 129,635 | |

MicroVision,

Inc.

Consolidated

Statement of Operations

(In

thousands, except earnings per share data)

(Unaudited)

| | |

Three months ended

September 30, | | |

Nine months ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 190 | | |

$ | 1,047 | | |

$ | 3,046 | | |

$ | 2,158 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 583 | | |

| 625 | | |

| 3,414 | | |

| 1,870 | |

| Gross profit (loss) | |

| (393 | ) | |

| 422 | | |

| (368 | ) | |

| 288 | |

| | |

| | | |

| | | |

| | | |

| | |

| Research and development expense | |

| 8,736 | | |

| 15,584 | | |

| 40,251 | | |

| 42,127 | |

| Sales, marketing, general and administrative expense | |

| 6,599 | | |

| 8,743 | | |

| 23,423 | | |

| 27,172 | |

| Impairment of intangible assets | |

| - | | |

| - | | |

| 3,027 | | |

| - | |

| Gain on disposal of fixed assets | |

| (22 | ) | |

| (10 | ) | |

| (22 | ) | |

| (25 | ) |

| Total operating expenses | |

| 15,313 | | |

| 24,317 | | |

| 66,679 | | |

| 69,274 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (15,706 | ) | |

| (23,895 | ) | |

| (67,047 | ) | |

| (68,986 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Bargain purchase gain, net of tax | |

| - | | |

| - | | |

| - | | |

| 1,706 | |

| Other income, net | |

| 297 | | |

| 637 | | |

| 1,713 | | |

| 4,846 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss before taxes | |

$ | (15,409 | ) | |

$ | (23,258 | ) | |

$ | (65,334 | ) | |

$ | (62,434 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| (108 | ) | |

| (211 | ) | |

| (426 | ) | |

| (671 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (15,517 | ) | |

$ | (23,469 | ) | |

$ | (65,760 | ) | |

$ | (63,105 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic and diluted | |

$ | (0.07 | ) | |

$ | (0.12 | ) | |

$ | (0.32 | ) | |

$ | (0.35 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average shares outstanding - basic and diluted | |

| 213,004 | | |

| 188,306 | | |

| 206,164 | | |

| 180,156 | |

Microvision,

Inc.

Consolidated

Statement of Cash Flows

(In

thousands)

(Unaudited)

| | |

Nine months ended September 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash flows from operating activities | |

| | | |

| | |

| Net loss | |

$ | (65,760 | ) | |

$ | (63,105 | ) |

| Adjustments to reconcile net loss to net cash used in operations | |

| | | |

| | |

| Depreciation and amortization | |

| 5,246 | | |

| 6,288 | |

| Bargain purchase gain, net of tax | |

| - | | |

| (1,706 | ) |

| Gain on disposal of fixed assets | |

| (22 | ) | |

| (25 | ) |

| Impairment of intangible assets | |

| 3,027 | | |

| - | |

| Impairment of operating lease right-of-use assets | |

| 406 | | |

| - | |

| Impairment of property and equipment | |

| - | | |

| 12 | |

| Inventory write-down | |

| 127 | | |

| 61 | |

| Share-based compensation expense | |

| 9,522 | | |

| 11,506 | |

| Net accretion of premium on short-term investments | |

| (776 | ) | |

| (986 | ) |

| Change in: | |

| | | |

| | |

| Accounts receivable | |

| 717 | | |

| (740 | ) |

| Inventory | |

| (723 | ) | |

| (619 | ) |

| Other current and non-current assets | |

| 606 | | |

| (3,214 | ) |

| Accounts payable | |

| (784 | ) | |

| 896 | |

| Accrued liabilities | |

| (2,747 | ) | |

| 4,321 | |

| Contract liabilities and other current liabilities | |

| 109 | | |

| (1,405 | ) |

| Operating lease liabilities | |

| (1,944 | ) | |

| (1,813 | ) |

| Other long-term liabilities | |

| (488 | ) | |

| 17 | |

| Net cash used in operating activities | |

| (53,484 | ) | |

| (50,512 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Sales of investment securities | |

| 28,311 | | |

| 61,700 | |

| Purchases of investment securities | |

| (25,570 | ) | |

| (27,101 | ) |

| Cash paid for Ibeo business combination | |

| (6,300 | ) | |

| (11,233 | ) |

| Purchases of property and equipment | |

| (271 | ) | |

| (1,981 | ) |

| Net cash (used in) provided by investing activities | |

| (3,830 | ) | |

| 21,385 | |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Principal payments under finance leases | |

| - | | |

| (19 | ) |

| Proceeds from stock option exercises | |

| 62 | | |

| 175 | |

| Net proceeds from issuance of common stock | |

| 26,093 | | |

| 60,607 | |

| Net cash provided by financing activities | |

| 26,155 | | |

| 60,763 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | |

| 133 | | |

| - | |

| | |

| | | |

| | |

| Net increase (decrease) in cash and cash equivalents | |

| (31,026 | ) | |

| 31,636 | |

| Cash, cash equivalents and restricted cash at beginning of period | |

| 49,391 | | |

| 21,954 | |

| | |

| | | |

| | |

| Cash, cash equivalents and restricted cash at end of period | |

$ | 18,365 | | |

$ | 53,590 | |

The following table provides

a reconciliation of the cash, cash equivalents, and restricted cash balances as of September 30, 2024 and 2023:

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | |

| Cash and cash equivalents | |

$ | 16,523 | | |

$ | 49,366 | |

| Restricted cash, current | |

| 270 | | |

| 3,263 | |

| Restricted cash, net of current portion | |

| 1,572 | | |

| 961 | |

| Cash, cash equivalents and restricted cash | |

$ | 18,365 | | |

$ | 53,590 | |

MicroVision,

Inc.

Reconciliation

of GAAP to Non-GAAP Measures

(In

thousands)

(Unaudited)

| | |

Three months ended

September 30, | | |

Nine months ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Reconciliation of Non-GAAP Gross Profit (Loss): | |

| | | |

| | | |

| | | |

| | |

| Gross profit (loss) | |

$ | (393 | ) | |

$ | 422 | | |

$ | (368 | ) | |

$ | 288 | |

| Share-based compensation expense | |

| - | | |

| - | | |

| - | | |

| - | |

| Amortization of acquired intangibles | |

| 361 | | |

| 387 | | |

| 1,135 | | |

| 1,029 | |

| Adjusted Gross Profit (Loss) | |

$ | (32 | ) | |

$ | 809 | | |

$ | 767 | | |

$ | 1,317 | |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation of Non-GAAP Loss: | |

| | | |

| | | |

| | | |

| | |

| GAAP Net loss | |

$ | (15,517 | ) | |

$ | (23,469 | ) | |

$ | (65,760 | ) | |

$ | (63,105 | ) |

| Interest, net | |

| (462 | ) | |

| (509 | ) | |

| (1,570 | ) | |

| (1,725 | ) |

| Income taxes | |

| 108 | | |

| 211 | | |

| 426 | | |

| 671 | |

| Depreciation and amortization | |

| 1,676 | | |

| 2,137 | | |

| 5,246 | | |

| 6,288 | |

| Bargain purchase gain, net of tax | |

| - | | |

| - | | |

| - | | |

| (1,706 | ) |

| Share-based compensation expense | |

| 2,426 | | |

| 4,691 | | |

| 9,522 | | |

| 11,506 | |

| Impairment of operating lease right-of-use assets | |

| 13 | | |

| - | | |

| 406 | | |

| - | |

| Impairment of intangible assets | |

| - | | |

| - | | |

| 3,027 | | |

| - | |

| Restructuring costs | |

| 90 | | |

| - | | |

| 5,804 | | |

| - | |

| Adjusted EBITDA | |

$ | (11,666 | ) | |

$ | (16,939 | ) | |

$ | (42,899 | ) | |

$ | (48,071 | ) |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

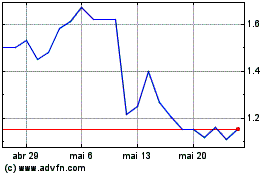

Microvision (NASDAQ:MVIS)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Microvision (NASDAQ:MVIS)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025