false

0001093691

0001093691

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 7, 2024

Plug Power Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-34392 |

|

22-3672377 |

| (State

or other jurisdiction |

|

(Commission

File |

|

(IRS

Employer |

| of

incorporation) |

|

Number) |

|

Identification

No.) |

| |

|

|

|

|

125 Vista Boulevard,

Slingerlands, New York |

|

12159 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone

number, including area code: (518)

782-7700

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which

registered |

| Common

Stock, par value $0.01 per share |

|

PLUG |

|

The

Nasdaq Capital

Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, Plug Power Inc. (the “Company”)

entered into an At Market Issuance Sales Agreement (the “Original Agreement”), dated January 17, 2024, as amended by Amendment

No. 1 to the Original Agreement, dated February 23, 2024 (“Amendment No. 1” and together with the Original Agreement, the

“Sales Agreement”), with B. Riley Securities, Inc. (“B. Riley”), pursuant to which the Company may, from time

to time, offer and sell shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), through or

to B. Riley, as sales agent or principal, having an aggregate gross sales price of up to $1.0 billion in an “at the market offering”

as defined in Rule 415 promulgated under the Securities Act of 1933, as amended (the “Securities Act”). On November 7, 2024,

the Company and B. Riley entered into Amendment No. 2 to the Sales Agreement (“Amendment No. 2”) to increase the aggregate

gross sales price of shares of Common Stock available for issuance under the Sales Agreement. As of November 7, 2024, the Company had

offered and sold 219,835,221 shares of Common Stock having an aggregate gross sales price of approximately $677,245,001 under the Sales

Agreement. Amendment No. 2 increased the aggregate gross sales price of Common Stock the Company may offer and sell pursuant to the Sales

Agreement by approximately $375,171,995 to $1 billion.

In addition, Amendment No. 2 provides that from

and after the date hereof, through and including February 7, 2025, the Company will have the right, but not the obligation, from time

to time at its sole discretion, to direct B. Riley on any day to act on a principal basis and purchase from the Company up to $11,000,000

(the “Maximum Commitment Advance Purchase Amount”), and to purchase in principal transactions (including any shares sold by

B. Riley in agency transactions) in any calendar week up to $55,000,000 (the “Maximum Commitment Advance Purchase Amount Cap”),

subject to certain conditions. If the Company’s market capitalization is less than $1,000,000,000 on and after February 8, 2025,

the Maximum Commitment Advance Purchase Amount shall be decreased to $10,000,000 and the Maximum Commitment Advance Purchase Amount Cap

shall be decreased to $30,000,000.

The Company’s right to direct B. Riley to

act on a principal basis and purchase from the Company the Maximum Commitment Advance Purchase Agreement under the Sales Agreement was

extended from July 17, 2025 to December 31, 2025 under Amendment No. 2.

The Company has agreed to reimburse B. Riley for

its legal expenses in an amount not to exceed $25,000 in connection with Amendment No. 2.

The material terms and conditions

of the Sales Agreement otherwise remain unchanged.

The Shares will be issued pursuant to the Company’s

automatic shelf registration statement on Form S-3 (File No. 333- 265488), which became effective upon filing with the SEC on June 8,

2023, the prospectus supplement, dated and filed with the SEC pursuant to Rule 424(b) under the Securities Act on January 17, 2024, Amendment

No. 1 to the prospectus supplement dated and filed with the SEC pursuant to Rule 424(b) under the Securities Act on February 23, 2024

and Amendment No. 2 to the prospectus supplement dated and filed with the SEC pursuant to Rule 424(b) under the Securities Act on November

7, 2024.

The foregoing description of Amendment No. 2 does

not purport to be complete and is qualified in its entirety by reference to the full text of Amendment No. 2, which is filed herewith

as Exhibit 1.1 and incorporated by reference herein. A copy of the full text of the Original Agreement was filed as Exhibit 1.1 to the

Company’s Current Report on Form 8-K with the SEC on January 17, 2024 and a copy of the full text of Amendment No. 1 was filed as

Exhibit 1.1 to the Company’s Current Report on Form 8-K with the SEC on February 23, 2024. A copy of the opinion of Goodwin Procter

LLP with respect to the validity of the shares of Common Stock that may be offered and sold pursuant to the Sales Agreement is filed herewith

as Exhibit 5.1.

This Current Report shall not constitute an offer

to sell or the solicitation of an offer to buy any securities of the Company, nor shall there be any sale of such securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Plug Power Inc. |

| |

|

|

| Date: November 7, 2024 |

By: |

/s/ Paul Middleton |

| |

|

Name: Paul Middleton |

| |

|

Title: Chief Financial Officer |

Exhibit 1.1

AMENDMENT NO.

2 TO AT MARKET ISSUANCE SALES AGREEMENT

November

7, 2024

B. Riley Securities, Inc.

299 Park Avenue, 21st Floor

New York, NY 10171

Ladies and Gentlemen:

Plug Power Inc., a Delaware

corporation (the “Company”), and B. Riley Securities, Inc. (the “Agent”), are parties to that certain

At Market Issuance Sales Agreement dated January 17, 2024 (the “Original Agreement”), as amended by Amendment No. 1 to the

At Market Issuance Sales Agreement, dated February 23, 2024 (the “Amendment No. 1” and together with the Original Agreement,

the “Sales Agreement”). All capitalized terms not defined herein shall have the meanings ascribed to them in the Sales

Agreement. The Company and Agent desire to amend the Sales Agreement as set forth in this Amendment No. 2 thereto (this “Amendment

No. 2”) as follows:

1.

As of the date hereof, the references to “Prospectus Supplement” shall refer to the prospectus supplement relating

to the offering and sale of the Shares filed by the Company with the Commission pursuant to Rule 424(b) on January 17, 2024, as amended

by the prospectus supplements filed by the Company on February 23, 2024 and on the date hereof, in the form furnished by the Company to

the Agent in connection with the offering of the Placement Shares.

2. As

of the date hereof, through and including February 7, 2025 and subject to Section 4 below, all references to the Maximum Commitment Advance

Purchase Amount shall mean the Increased Maximum Commitment Advance Purchase Amount.

3.

Section 4 of Amendment No. 1 is amended and restated in its entirety as follows:

On and after February 8, 2025, so long

as the Company has a Market Capitalization (defined below) of not less than $1,000,000,000 at the applicable Commitment Advance Notice

Date, all references to the Maximum Commitment Advance Purchase Amount shall mean the Increased Maximum Commitment Advance Purchase Amount.

If at any applicable Commitment Advance Notice Date on and after February 8, 2025, the Company has a Market Capitalization of less than

$1,000,000,000, the Company shall instead be subject to the Maximum Commitment Advance Purchase Amount unless and until such time as the

Company’s Market Capitalization is not less than $1,000,000,000.

For purposes hereof, “Market

Capitalization” means, as of any applicable Commitment Advance Notice Date, the product of (a) the total number of issued and

outstanding shares of Common Stock (exclusive, for the avoidance of doubt, of any shares of Common Stock issuable upon the exercise of

options or warrants or conversion of any convertible securities), multiplied by the Closing Sale Price on the Trading Day immediately

prior to the applicable Commitment Advance Notice Date.

4.

As of the date hereof, each of the Maximum Amount and the Aggregate Commitment Advance Amount shall mean $1,000,000,000, exclusive

of any sales pursuant to the Sales Agreement prior to the date hereof.

5.

All references to “January 17, 2024” set forth in Schedule 1, Schedule 2(b) and Exhibit 7(l) of the Original Agreement

are revised to read “January 17, 2024 (as amended by Amendment No. 1, dated February 23, 2024 and Amendment No. 2 dated November

7, 2024)”.

6.

Section 13(d) of the Original Agreement is amended and restated in its entirety as follows:

“Unless earlier terminated pursuant

to this Section 13, this Agreement shall automatically terminate upon the earlier to occur of (i) the 24-month anniversary

of the date hereof and (ii) the issuance and sale of all of the Placement Shares through B. Riley on the terms and subject to the

conditions set forth herein, except that the provisions of Section 9 (Payment of Expenses), Section 11 (Indemnification

and Contribution), Section 12 (Representations and Agreements to Survive Delivery), Section 18 (Governing

Law and Time; Waiver of Jury Trial) and Section 19 (Consent to Jurisdiction) hereof shall remain in full force and

effect notwithstanding such termination. Notwithstanding the foregoing, the Company’s right to submit a Commitment Advance Notice

shall terminate on December 31, 2025.”

7.

The Company will pay fees and disbursements of counsel to the Agent of up to $25,000 incurred in connection with this Amendment

No. 2 and other related documents.

8.

Except as specifically set forth herein, all other provisions of the Sales Agreement shall remain in full force and effect.

9. This

Amendment No. 2, together with the Original Agreement and Amendment No. 1 (including all exhibits attached thereto), constitutes the

entire agreement and supersedes all other prior and contemporaneous agreements and undertakings, both written and oral, among the parties

hereto with regard to the subject matter hereof. Neither this Amendment No. 2 nor any term hereof may be amended except pursuant to a

written instrument executed by the Company and the Agent. In the event that any one or more of the provisions contained herein, or the

application thereof in any circumstance, is held invalid, illegal or unenforceable as written by a court of competent jurisdiction, then

such provision shall be given full force and effect to the fullest possible extent that it is valid, legal and enforceable, and the remainder

of the terms and provisions herein shall be construed as if such invalid, illegal or unenforceable term or provision was not contained

herein, but only to the extent that giving effect to such provision and the remainder of the terms and provisions hereof shall be in

accordance with the intent of the parties as reflected in this Amendment No. 2. All references in the Original Agreement to the “Agreement”

shall mean the Original Agreement as amended by Amendment No. 1 and this Amendment No. 2; provided, however, that all references

to “date of this Agreement” in the Original Agreement shall continue to refer to the date of the Original Agreement.

10.

THIS AMENDMENT NO. 2 AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS AMENDMENT NO. 2 SHALL BE GOVERNED BY,

AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF, THE STATE OF NEW YORK WITHOUT REGARD TO ITS CHOICE OF LAW PROVISIONS. THE COMPANY AND THE

AGENT EACH HEREBY IRREVOCABLY WAIVE, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL

PROCEEDING ARISING OUT OF OR RELATING TO THIS AMENDMENT NO. 2 OR THE TRANSACTIONS CONTEMPLATED HEREBY.

11. EACH PARTY HEREBY IRREVOCABLY SUBMITS TO THE NON-EXCLUSIVE JURISDICTION OF THE STATE AND FEDERAL COURTS SITTING IN THE CITY

OF NEW YORK, BOROUGH OF MANHATTAN, FOR THE ADJUDICATION OF ANY DISPUTE UNDER OR IN CONNECTION WITH THIS AMENDMENT NO. 2 OR ANY TRANSACTION

CONTEMPLATED HEREBY, AND HEREBY IRREVOCABLY WAIVES, AND AGREES NOT TO ASSERT IN ANY SUIT, ACTION OR PROCEEDING, ANY CLAIM THAT IT IS NOT

PERSONALLY SUBJECT TO THE JURISDICTION OF ANY SUCH COURT, THAT SUCH SUIT, ACTION OR PROCEEDING IS BROUGHT IN AN INCONVENIENT FORUM OR

THAT THE VENUE OF SUCH SUIT, ACTION OR PROCEEDING IS IMPROPER. EACH PARTY HEREBY IRREVOCABLY WAIVES PERSONAL SERVICE OF PROCESS AND CONSENTS

TO PROCESS BEING SERVED IN ANY SUCH SUIT, ACTION OR PROCEEDING BY MAILING A COPY THEREOF (CERTIFIED OR REGISTERED MAIL, RETURN RECEIPT

REQUESTED) TO SUCH PARTY AT THE ADDRESS IN EFFECT FOR NOTICES TO IT UNDER THE SALES AGREEMENT AND AGREES THAT SUCH SERVICE SHALL CONSTITUTE

GOOD AND SUFFICIENT SERVICE OF PROCESS AND NOTICE THEREOF. NOTHING CONTAINED HEREIN SHALL BE DEEMED TO LIMIT IN ANY WAY ANY RIGHT TO SERVE

PROCESS IN ANY MANNER PERMITTED BY LAW.

12.

This Amendment No. 2 may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together

shall constitute one and the same instrument. Delivery of an executed amendment by one party to the other may be made by facsimile transmission

or electronic transmission (e.g., PDF).

[Remainder of Page Intentionally Blank]

If the foregoing correctly

sets forth the understanding between the Company and the Agent, please so indicate in the space provided below for that purpose, whereupon

this Amendment No. 2 shall constitute a binding amendment to the Sales Agreement between the Company and the Agent.

| |

Very truly yours, |

| |

|

| |

|

PLUG POWER, INC. |

| |

|

| |

|

By: |

/s/ Paul B. Middleton |

| |

|

|

Name: Paul B. Middleton |

| |

|

|

Title: Chief Financial Officer |

| |

|

| |

ACCEPTED as of the date first-above

written: |

| |

|

| |

|

B. RILEY SECURITIES, INC. |

| |

|

|

| |

|

By: |

/s/ Matt Feinberg |

| |

|

|

Name: Matt Feinberg |

| |

|

|

Title: Senior Managing Director |

[Signature Page to Amendment

No. 2 to Sales Agreement]

Exhibit 5.1

|

|

Goodwin Procter LLP

The New York Times Building

620 Eighth Avenue

New York, NY 10018

goodwinlaw.com

+1 212 813 8800 |

November 7, 2024

Plug Power Inc.

125 Vista Boulevard

Slingerlands, NY 12159

Re: Securities

Registered under Registration Statement on Form S-3

We have acted as counsel to you in connection with

your filing of a Registration Statement on Form S-3 (File No. 333-265488) (as amended or supplemented, the “Registration

Statement”) filed on June 8, 2022 with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities

Act of 1933, as amended (the “Securities Act”), relating to the registration of the offering by Plug Power Inc., a Delaware

corporation (the “Company”), of any combination of securities of the types specified therein. The Registration Statement became

effective upon filing with the Commission on June 8, 2022. Reference is made to our opinion letter dated June 8, 2022 and included as

Exhibit 5.1 to the Registration Statement. We are delivering this supplemental opinion letter in connection with the prospectus supplement

filed on January 17, 2024 by the Company with the Commission pursuant to Rule 424 under the Securities Act, as amended by Amendment

No. 1 to the prospectus supplement filed on February 23, 2024 by the Company with the Commission pursuant to Rule 424 under the Securities

Act, as amended by Amendment No. 2 to the prospectus supplement filed on November 7, 2024 by the Company with the Commission pursuant

to Rule 424 under the Securities Act (collectively, the “Prospectus Supplement”). The Prospectus Supplement relates to

the offering by the Company of up to $1,000,000,000 in aggregate offering price of shares (the “Shares”) of the Company’s

common stock, par value $0.01 per share (“Common Stock”), covered by the Registration Statement. The Shares are being offered

and sold by the sales agent named in, and pursuant to, the At Market Issuance Sales Agreement, dated as of January 17, 2024, as amended

on February 23, 2024 and November 7, 2024, between the Company and such sales agent.

We have reviewed such documents and made such examination

of law as we have deemed appropriate to give the opinion set forth below. We have relied, without independent verification, on certificates

of public officials and, as to matters of fact material to the opinion set forth below, on certificates of officers of the Company.

For purposes of the opinion set forth below, we

have assumed that the Shares are issued for a price per share equal to or greater than the minimum price authorized by the Company’s

board of directors prior to the date hereof (the “Minimum Price”) and that no event occurs that causes the number of authorized

shares of Common Stock available for issuance by the Company to be less than the number of then unissued Shares that may be issued for

the Minimum Price.

Plug Power Inc.

November 7, 2024

Page 2

For purposes of the opinion set forth below, we

refer to the following as “Future Approval and Issuance”: (a) the approval by the Company’s board of directors (or a

duly authorized committee of the board of directors) of the issuance of the Shares (the “Approval”) and (b) the issuance of

the Shares in accordance with the Approval and the receipt by the Company of the consideration (which shall not be less than the par value

of such Shares) to be paid in accordance with the Approval.

The opinion set forth below is limited to the Delaware

General Corporation Law.

Based on the foregoing, we are of the opinion that

the Shares have been duly authorized and, upon Future Approval and Issuance, will be validly issued, fully paid and nonassessable.

This opinion is being furnished to you for submission

to the Commission as an exhibit to the Company’s Current Report on Form 8-K relating to the Shares (the “Current Report”),

which is incorporated by reference in the Registration Statement. We hereby consent to the filing of this opinion letter as an exhibit

to the Current Report and its incorporation by reference and the reference to our firm in that report. In giving our consent, we do not

admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations

thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ GOODWIN PROCTER LLP |

| |

|

| |

GOODWIN PROCTER LLP |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

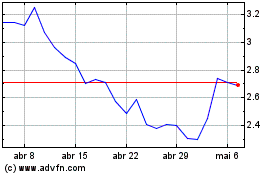

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Plug Power (NASDAQ:PLUG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024