UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF

1934

For the month of November 2024

Commission File Number 001-33060

DANAOS CORPORATION

(Translation of registrant’s name into English)

Danaos Corporation

c/o Danaos Shipping Co. Ltd.

14 Akti Kondyli

185 45 Piraeus

Greece

Attention: Secretary

011 030 210 419 6480

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

*****

This report on Form 6-K is hereby incorporated

by reference into the Company’s (i) Registration Statement on Form F-3 (Reg. No. 333-237284) filed with the SEC on March 19, 2020, (ii) the post effective Amendment to Form F-1 in the Registration Statement on Form F-3 (Reg. No. 333-226096) filed with the SEC on March 6, 2019, (iii) Registration Statement on Form F-3 (Reg. No. 333-174494) filed with the SEC on May 25, 2011, (iv) Registration Statement on Form F-3 (Reg. No. 333-147099), the related prospectus

supplements filed with the SEC on December 17, 2007, January 16, 2009 and March 27, 2009, (v) Registration Statement

on Form S-8 (Reg. No. 333-233128) filed with the SEC on August 8, 2019 and the reoffer prospectus, dated August 8,

2019, contained therein, (vi) Registration Statement on Form S-8 (Reg. No. 333-138449) filed with the SEC on November 6, 2006 and the reoffer prospectus, dated November 6, 2006, contained therein, (vii) Registration Statement on Form F-3 (Reg. No. 333-169101) filed with the SEC on October 8, 2010, (viii) Registration Statement on Form F-3 (Reg. No. 333-255984) filed with the SEC on May 10, 2021 and (ix) Registration Statement on Form F-3 (Reg. No. 333-270457) filed with the SEC on March 10, 2023.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date:

November 12, 2024

| |

DANAOS CORPORATION |

| |

|

|

| |

By: |

/s/ Evangelos Chatzis |

| |

Name: |

Evangelos Chatzis |

| |

Title: |

Chief Financial Officer |

EXHIBIT 99.1

DANAOS CORPORATION

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

The following discussion

and analysis should be read in conjunction with our interim condensed consolidated financial statements (unaudited) and the notes thereto

included elsewhere in this report.

Results of Operations

Three months ended September 30, 2024 compared to three

months ended September 30, 2023

During

the three months ended September 30, 2024, Danaos Corporation (”Danaos or the “Company”) had an average of 71.1

container vessels and 9.9 Capesize drybulk vessels compared to 68.0 container vessels and no drybulk vessels during the three

months ended September 30, 2023. Our container vessels utilization remained stable at 97.7% in each of the three months ended September 30,

2024 and September 30, 2023.

Operating Revenues

Operating revenues increased

by 7.1%, or $17.0 million, to $256.2 million in the three months ended September 30, 2024 from $239.2 million in the three months

ended September 30, 2023.

Operating revenues of our

container vessels segment decreased by 1.5%, or $3.6 million, to $235.6 million in the three months ended September 30, 2024 from

$239.2 million in the three months ended September 30, 2023, analyzed as follows:

| · | a

$14.0 million increase in revenues in the three months ended September 30, 2024 compared

to the three months ended September 30, 2023 as a result of vessel additions; |

| · | a

$7.1 million increase in revenues in the three months ended September 30, 2024 compared

to the three months ended September 30, 2023 due to higher non-cash revenue recognition

in accordance with US GAAP; |

| · | a

$17.9 million decrease in revenues in the three months ended September 30, 2024 compared

to the three months ended September 30, 2023 as a result of lower charter rates; |

| · | a

$2.4 million decrease in revenues in the three months ended September 30, 2024 compared

to the three months ended September 30, 2023 due to vessel disposals; and |

| · | a

$4.4 million decrease in revenues in the three months ended September 30, 2024 compared

to the three months ended September 30, 2023 due to decreased amortization of assumed

time charters. |

Operating revenues of our

drybulk vessels segment added an incremental $20.6 million of revenues in the three months ended September 30, 2024 compared to

no such operating revenues in the three months ended September 30, 2023.

Voyage Expenses

Voyage expenses increased

by $8.0 million to $17.0 million in the three months ended September 30, 2024 from $9.0 million in the three months ended September 30,

2023 primarily as a result of the $9.2 million in voyage expenses related to our recently acquired 10 Capesize drybulk vessels, which

generated revenue partially from voyage charter agreements, compared to no such expenses related to our drybulk vessels in the three

months ended September 30, 2023.

Voyage expenses of container

vessels segment decreased by $1.2 million to $7.8 million in the three months ended September 30, 2024 from $9.0 million in the

three months ended September 30, 2023.

Voyage expenses of drybulk

vessels segment were $9.2 million in the three months ended September 30, 2024 compared to no voyage expenses in the three months

ended September 30, 2023. Total voyage expenses of drybulk vessels comprised $1.2 million commissions and $8.0 million other voyage

expenses, mainly bunkers consumption and port expenses, in the three months ended September 30, 2024.

Vessel Operating Expenses

Vessel operating expenses

increased by $10.4 million to $49.9 million in the three months ended September 30, 2024 from $39.5 million in the three

months ended September 30, 2023, primarily as a result of the increase in the average number of vessels in our fleet due to recent

container vessel newbuilds deliveries and dry bulk vessels acquisitions and the increase in average daily operating cost of our vessels

to $6,860 per vessel per day for the three months ended September 30, 2024 compared to $6,499 per vessel per day for the three months

ended September 30, 2023. Management believes that our daily operating costs remain among the most competitive in the industry.

Depreciation

Depreciation expense increased

by 19.8%, or $6.4 million, to $38.7 million in the three months ended September 30, 2024 from $32.3 million in the three months

ended September 30, 2023 mainly due to depreciation expense related to 10 recently acquired Capesize drybulk vessels and 5 recently

delivered container vessel newbuilds.

Amortization of Deferred Drydocking and Special

Survey Costs

Amortization of deferred

dry-docking and special survey costs increased by $2.7 million to $7.5 million in the three months ended September 30, 2024 from

$4.8 million in the three months ended September 30, 2023.

General and Administrative

Expenses

General and administrative

expenses increased by $3.9 million, to $11.0 million in the three months ended September 30, 2024 from $7.1 million in the three

months ended September 30, 2023. The increase was mainly attributable to increased stock-based compensation and management fees.

Net Gain on Disposal/Sale of Vessels

In March 2024, we sold

for scrap the vessel Stride, which had been off-hire since January 8, 2024 due to damage from a fire in the engine room that

was subsequently contained. We collected $9.9 million net insurance proceeds for total loss of vessel and recognized a gain on disposal

of this vessel amounting to $7.1 million in the six months ended June 30, 2024. In the three months ended September 30, 2024,

we recognized $0.4 million of expenses related to this vessel disposal, which reduced the total gain to $6.7 million in the nine months

ended September 30, 2024. The proceedings with the insurers are in progress as of September 30, 2024, and any additional gain

will be recognized upon their finalization.

Interest Expense and Interest Income

Interest expense increased

by $3.7 million, to $8.0 million in the three months ended September 30, 2024 from $4.3 million in the three months ended September 30,

2023. The increase in interest expense is a result of:

| · | a

$4.2 million increase in interest expense due to an increase in our average indebtedness

by $224.7 million between the two periods, which was partially offset by a decrease in our

debt service cost by approximately 0.26%, mainly as a result of a reduction in the financing

margin cost. Average indebtedness was $646.8 million in the three months ended September 30,

2024, compared to average indebtedness of $422.1 million in the three months ended September 30,

2023; |

| · | a

$0.1 million increase in the amortization of deferred finance costs; which were partially

offset by |

| · | a

$0.6 million decrease in interest expense due to an increase in capitalized interest expense

on our vessels under construction in the three months ended September 30, 2024. |

As of September 30,

2024, our outstanding debt, gross of deferred finance costs, was $689.5 million, which included $262.8 million principal amount of our

Senior Notes. These balances compare to debt of $417.4 million, which included $262.8 million principal amount of our Senior Notes as

of September 30, 2023. The increase in our outstanding debt is mainly due to loans drawn down to partially finance our container

vessel newbuildings.

Interest income remained

stable at $3.1 million in each of the three months ended September 30, 2024 and September 30, 2023.

Gain on Investments

Following the all-stock merger

of Eagle Bulk Shipping Inc. with Star Bulk Carriers Corp. (“SBLK”) completed on April 9, 2024, we currently own 4,070,214

shares of common stock of SBLK. The loss on investments of $2.8 million in the three months ended September 30, 2024 represents

the change in fair value of these marketable securities. This compares to a $9.3 million loss on marketable securities in the three months

ended September 30, 2023.

Dividend Income

Dividend income of $2.8 million

was recognized on SBLK common shares in the three months ended September 30, 2024 compared to $0.9 million dividend income in the

three months ended September 30, 2023.

Equity Loss on Investments

Equity loss on investments

amounting to $1.2 million and $0.5 million in the three months September 30, 2024 and September 30, 2023, respectively, relates

to our share of initial expenses of Carbon Termination Technologies Corporation (“CTTC”), currently engaged in the research

and development of decarbonization technologies for the shipping industry.

Other Finance Expenses

Other finance expenses decreased

by $0.3 million to $0.9 million in the three months ended September 30, 2024 compared to $1.2 million in the three months ended

September 30, 2023.

Loss on Derivatives

Amortization of deferred

realized losses on interest rate swaps remained stable at $0.9 million in each of the three months ended September 30, 2024 and

September 30, 2023.

Other Income/(expenses),

net

Other expenses, net amounted

to $0.7 million in the three months ended September 30, 2024 compared to $1.1 million other income, net in the three months ended

September 30, 2023.

Nine months ended September 30, 2024

compared to nine months ended September 30, 2023

During

the nine months ended September 30, 2024, Danaos had an average of 69.3 container vessels and 8.2 Capesize drybulk vessels

compared to 68.1 container vessels and no drybulk vessels during the nine months ended September 30, 2023. Our container vessels

utilization for the nine months ended September 30, 2024 was 97.4% compared to 97.8% for the nine months ended September 30,

2023.

Operating Revenues

Operating revenues increased

by 4.4%, or $31.6 million, to $755.9 million in the nine months ended September 30, 2024 from $724.3 million in the nine months

ended September 30, 2023.

Operating revenues of our

container vessels segment decreased by 3.4%, or $24.7 million, to $699.6 million in the nine months ended September 30, 2024 from

$724.3 million in the nine months ended September 30, 2023, analyzed as follows:

| · | a

$18.9 million increase in revenues in the nine months ended September 30, 2024 compared

to the nine months ended September 30, 2023 as a result of vessel additions; |

| · | a

$20.5 million decrease in revenues in the nine months ended September 30, 2024 compared

to the nine months ended September 30, 2023 mainly as a result of lower charter rates

and decreased vessel utilization; |

| · | a

$7.5 million decrease in revenues in the nine months ended September 30, 2024 compared

to the nine months ended September 30, 2023 due to vessel disposals; |

| · | a

$12.3 million decrease in revenues in the nine months ended September 30, 2024 compared

to the nine months ended September 30, 2023 due to decreased amortization of assumed

time charters; and |

| · | a

$3.3 million decrease in revenues in the nine months ended September 30, 2024 compared

to the nine months ended September 30, 2023 due to lower non-cash revenue recognition

in accordance with US GAAP. |

Operating revenues of our

drybulk vessels segment added an incremental $56.3 million of revenues in the nine months ended September 30, 2024 compared to no

such operating revenues in the nine months ended September 30, 2023.

Voyage Expenses

Voyage expenses increased

by $24.8 million to $50.0 million in the nine months ended September 30, 2024 from $25.2 million in the nine months ended September 30,

2023 primarily as a result of the $25.5 million in voyage expenses related to our recently acquired 10 Capesize drybulk vessels, which

generated revenue partially from voyage charter agreements, compared to no such expenses related to drybulk vessels in the nine months

ended September 30, 2023.

Voyage expenses of container

vessels segment decreased by $0.7 million to $24.5 million in the nine months ended September 30, 2024 from $25.2 million in the

nine months ended September 30, 2023 mainly due to decreased other voyage expenses. Total voyage expenses of container vessels comprised

$24.3 million commissions and $0.2 million other voyage expenses in the nine months ended September 30, 2024.

Voyage expenses of drybulk

vessels segment were $25.5 million in the nine months ended September 30, 2024 compared to no voyage expenses in the nine months

ended September 30, 2023. Total voyage expenses of drybulk vessels comprised $3.4 million commissions and $22.1 million other voyage

expenses, mainly bunkers consumption and port expenses, in the nine months ended September 30, 2024.

Vessel Operating Expenses

Vessel operating expenses

increased by $18.1 million to $140.1 million in the nine months ended September 30, 2024 from $122.0 million in the nine

months ended September 30, 2023, primarily as a result of the increase in the average number of vessels in our fleet due to recent

container vessel newbuilds and dry bulk vessels acquisitions, while the average daily operating cost of our vessels remained stable at

$6,775 per vessel per day for the nine months ended September 30, 2024 compared to $6,758 per vessel per day for the nine months

ended September 30, 2023. Management believes that our daily operating costs remain among the most competitive in the industry.

Depreciation

Depreciation expense increased

by 12.7%, or $12.2 million, to $108.0 million in the nine months ended September 30, 2024 from $95.8 million in the nine months

ended September 30, 2023 mainly due to depreciation expense related to 10 recently acquired Capesize drybulk vessels and 5 recently

delivered container vessel newbuilds.

Amortization of Deferred Drydocking and Special

Survey Costs

Amortization of deferred

dry-docking and special survey costs increased by $6.8 million to $19.9 million in the nine months ended September 30, 2024 from

$13.1 million in the nine months ended September 30, 2023.

General and Administrative Expenses

General and administrative

expenses increased by $11.4 million, to $32.5 million in the nine months ended September 30, 2024 from $21.1 million in the nine

months ended September 30, 2023. The increase was mainly attributable to increased stock-based compensation and management fees.

Net Gain on Disposal/Sale of Vessels

In March 2024, we sold

for scrap the vessel Stride, which had been off-hire since January 8, 2024 due to damage from a fire in the engine room that

was subsequently contained. We collected $9.9 million net insurance proceeds for total loss of vessel and recognized a gain on disposal

of this vessel amounting to $7.1 million in the six months ended June 30, 2024. In the three months ended September 30, 2024,

we recognized $0.4 million expenses related to this vessel disposal, which reduced the total gain to $6.7 million in the nine months

ended September 30, 2024. The proceedings with the insurers are in progress as of September 30, 2024, and any additional gain

will be recognized upon their finalization.

In

January 2023, we completed the sale of the container vessel Amalia C for net proceeds of $4.9 million resulting in a gain

of $1.6 million.

Interest Expense and Interest Income

Interest expense decreased

by $0.7 million, to $16.2 million in the nine months ended September 30, 2024 from $16.9 million in the nine months ended September 30,

2023. The decrease in interest expense is a result of:

| · | a

$4.8 million decrease in interest expense due to an increase in capitalized interest expense

on our vessels under construction in the nine months ended September 30, 2024; and |

| · | a

$0.2 million decrease in the amortization of deferred finance costs; which were partially

offset by |

| · | a

$4.3 million increase in interest expense due to an increase in our debt service cost by

approximately 0.15% as a result of higher SOFR rates, partially offset by a reduction in

our financing margin cost, and by an increase in our average indebtedness by $61.7 million

between the two periods. Average indebtedness was $524.6 million in the nine

months ended September 30, 2024, compared to average indebtedness of $462.9 million

in the nine months ended September 30, 2023. |

As of September 30,

2024, our outstanding debt, gross of deferred finance costs, was $689.5 million, which included $262.8 million principal amount of our

Senior Notes. These balances compare to debt of $417.4 million, which included $262.8 million principal amount of our Senior Notes as

of September 30, 2023. The increase in our outstanding debt is mainly due to loans drawn down to partially finance our container

vessel newbuildings.

Interest income decreased

by $0.4 million to $9.0 million in the nine months ended September 30, 2024 compared to $9.4 million in the nine months ended September 30,

2023.

Gain on Investments

Following

the all-stock merger of Eagle Bulk Shipping Inc. with Star Bulk Carriers Corp. (“SBLK”) completed on April 9, 2024,

we currently own 4,070,214 shares of common stock of SBLK. The gain on investments of $10.4 million in the nine months ended September 30,

2024 represents the change in fair value of these marketable securities. This compares to a $2.9 million loss on marketable securities

in the nine months ended September 30, 2023.

Dividend Income

Dividend income of $6.8 million

was recognized on marketable securities in the nine months ended September 30, 2024 compared to $0.9 million in the nine months

ended September 30, 2023.

Loss on Debt Extinguishment

A

$2.3 million loss on early extinguishment of our leaseback obligations in the nine months ended September 30, 2023 compares to no

such loss in the nine months ended September 30, 2024.

Equity Loss on Investments

Equity loss on investments

amounting to $1.4 million and $3.9 million in the nine months September 30, 2024 and September 30, 2023, respectively, relates

to our share of initial expenses of CTTC, currently engaged in the research and development of decarbonization technologies for the shipping

industry.

Other Finance Expenses

Other finance expenses decreased

by $0.7 million to $2.7 million in the nine months ended September 30, 2024 compared to $3.4 million in the nine months ended September 30,

2023.

Loss on Derivatives

Amortization of deferred

realized losses on interest rate swaps remained stable at $2.7 million in each of the nine months ended September 30, 2024 and September 30,

2023.

Other Income/(expenses),

net

Other expenses, net amounted

to $0.6 million in each of the nine months ended September 30, 2024 and September 30, 2023.

Liquidity and Capital Resources

Our principal source of funds

has been operating cash flows, vessel sales, and long-term bank borrowings, as well as equity provided by our stockholders from our initial

public offering in October 2006; common stock sales in August 2010 and the fourth quarter of 2019, the capital contribution

of Danaos Investment Limited as Trustee of the 883 Trust (“DIL”) on August 10, 2018 and dividends and sales proceeds

from our divested investment in ZIM ordinary shares in 2022. In February 2021, we sold $300 million of 8.500% senior unsecured notes

due 2028 (the “Senior Notes”). In December 2022, we repurchased $37.2 million aggregate principal amount of our Senior

Notes in a privately negotiated transaction. We may also at any time and from time to time, seek to retire or purchase our outstanding

debt securities through cash purchases, in open-market purchases, privately negotiated transactions or otherwise. Our principal uses

of funds have been capital expenditures to establish, grow and maintain our fleet, including our expansion into the drybulk shipping

sector, comply with international shipping standards, environmental laws and regulations and to fund working capital requirements and

repayment of debt.

Our short-term liquidity

needs primarily relate to the funding of our vessel operating expenses, drydocking costs, installment payments for our contracted containership

newbuildings, debt interest payments, servicing our debt obligations, payment of dividends and repurchases of our common stock. Our long-term

liquidity needs primarily relate to installment payments for our contracted newbuildings and any additional vessel acquisitions in the

containership or drybulk sectors and debt repayment. We anticipate that our primary sources of funds will be cash from operations and

equity or debt financings. We currently expect that the sources of funds available to us will be sufficient to meet our known short-term

liquidity and long-term liquidity requirements.

Under our existing multi-year

charters as of September 30, 2024, we had $3.2 billion of total contracted cash revenues, with $225.0 million for the remainder

of 2024, $858.3 million for 2025, $700.6 million for 2026 and $1.4 billion thereafter. Although these contracted cash revenues are

based on contracted charter rates, we are dependent on the ability and willingness of our charterers to meet their obligations under

these charters. In May 2022, we received a $238.9 million charter hire prepayment related to charter contracts for 15 of our vessels,

representing partial prepayment of charter hire payable during the period from May 2022 through January 2027. This prepayment

is recorded as unearned revenue on our balance sheet and recognized as revenue in our income statement over the term of the applicable

charters.

As of September 30,

2024, we had cash and cash equivalents of $384.3 million. As of September 30, 2024, there was $303.75 million of remaining borrowing

availability under our Citibank $382.5 mil. Revolving Credit Facility and $151.0 million under our Syndicated $450.0 million Facility.

As of September 30, 2024, we had $689.5 million of outstanding indebtedness (gross of deferred finance costs), including $262.8

million relating to our Senior Notes. As of September 30, 2024, we were obligated to make quarterly fixed amortization payments,

totaling $31.7 million to September 30, 2025, related to the long-term bank debt. We are also obligated to make certain payments

to our Manager, Danaos Shipping, under our management agreement which has a term through December 31, 2025, as described in Note

14, Related Party Transactions, in the unaudited condensed consolidated financial statements included elsewhere in this report.

In March 2024, we entered

into a syndicated loan facility agreement of up to $450 million (“Syndicated $450.0 million Facility”), which is secured

by eight of our newbuilding container vessels. An amount of $299.0 million was drawn down until September 30, 2024 and subsequent

to September 30, 2024 we drew down an additional $63.0 million related to a delivery of a newbuilding vessel. This facility is repayable

in quarterly instalments up to September 2030. The facility bears interest at SOFR plus a margin of 1.85%. In June 2022, we

drew down $130.0 million under a new senior secured term loan facility from BNP Paribas and Credit Agricole, which is secured by six

5,466 TEU sister vessels acquired in 2021. This facility is repayable in 8 quarterly instalments of $5.0 million, followed by 12 quarterly

instalments of $1.9 million together with a balloon payment of $67.2 million payable over five-year term. An amount of $88.1 million

is outstanding as of September 30, 2024. In December 2022, we early extinguished the remaining $437.75 million of the Citibank/Natwest

$815 mil. Facility and replaced it with the $382.5 mil. Revolving Credit Facility with Citibank, out of which nil is drawn down as of

September 30, 2024 and with the Alpha Bank $55.25 mil. Facility, which was drawn down in full and under which $42.1 million is outstanding

as of September 30, 2024. The Citibank $382.5 mil. Revolving Credit Facility is reducing and repayable over 5 years in 20 quarterly

reductions of $11.25 million each together with a final reduction of $157.5 million at maturity in December 2027. We pay a commitment

fee at a rate of 0.8% per annum on the undrawn amount of this facility. The Alpha Bank $55.25 mil. Facility is repayable over 5 years

with 20 consecutive quarterly instalments of $1.875 million each, together with a balloon payment of $17.75 million at maturity in December 2027.

In

April 2022, we entered into contracts for the construction of four 8,000 TEU container vessels, of which two were delivered to us

from the shipyard in the second quarter of 2024, one was delivered in the third quarter of 2024 and one was delivered in October 2024.

In March 2022, we entered into contracts for the construction of two 7,100 TEU container vessels, of which one was delivered to

us from the shipyard in the second quarter of 2024 and one in the third quarter of 2024. In April 2023, we entered into contracts

for the construction of two 6,000 TEU container vessels with expected vessels delivery in 2025. In June 2023, we entered

into contracts for the construction of two 8,200 TEU container vessels with expected vessels delivery in 2026. In February and March 2024,

we entered into contracts for the construction of four 8,200 TEU container vessels with expected vessels deliveries in 2026 through 2027.

In June and July 2024, we entered into contracts for the construction of five 9,200 TEU container vessels and one 8,200 TEU

container vessel with expected deliveries in 2027 and 2028. As of September 30, 2024, the aggregate purchase price of the 15 remaining

vessel construction contracts amounts to $1,389.7 million, out of which $186.3 million, $57.7 million and $36.5 million was paid in the

nine months ended September 30, 2024 and in the years ended December 31, 2023 and 2022, respectively. The remaining contractual

commitments under these 15 vessel construction contracts are analyzed as follows as of September 30, 2024 (in millions of U.S. dollars):

| Payments due by period ended | |

| |

| December 31, 2024 | |

$ | 68.5 | |

| December 31, 2025 | |

| 137.0 | |

| December 31, 2026 | |

| 354.7 | |

| December 31, 2027 | |

| 454.5 | |

| December 31, 2028 | |

| 94.5 | |

| Total contractual commitments | |

$ | 1,109.2 | |

In February 2024, we

entered into agreements to acquire three Capesize bulk carriers built in 2010 through 2011 that aggregate 529,704 DWT for a total purchase

price of $79.8 million. Two of these vessels were delivered to us in the second quarter of 2024 and one in July 2024.

Additionally, a supervision

fee of $850 thousand per newbuilding vessel is payable to Danaos Shipping Company Limited (the “Manager”) over the construction

period starting from steel cutting. Supervision fees totaling $2.6 million and $3.0 million were charged by the Manager and capitalized

to the vessels under construction in the nine months ended September 30, 2024 and in the year ended December 31, 2023, respectively.

Interest expense amounting to $16.8 million, $17.4 million and $5.0 million was capitalized to the vessels under construction in the

nine months ended September 30, 2024 and in the years ended December 31, 2023 and 2022, respectively.

In November 2024, we

declared a dividend of $0.85 per share of common stock payable on December 4, 2024 to holders of record on November 25, 2024.

We intend to pay a regular quarterly dividend on our common stock, which will have an impact on our liquidity. Payments of dividends

are subject to the discretion of our board of directors, provisions of Marshall Islands law affecting the payment of distributions to

stockholders and the terms of our credit facilities, which permit the payment of dividends so long as there has been no event of default

thereunder nor would occur as a result of such dividend payment, finance leases and Senior Notes, which include limitations on the amount

of dividends and other restricted payments that we may make, and will be subject to conditions in the container and drybulk shipping

industries, our financial performance and us having sufficient available excess cash and distributable reserves.

In June 2022, we announced

a share repurchase program of up to $100 million of our common stock. A $100 million increase to the existing share repurchase program,

for a total aggregate amount of $200 million, was approved by our Board of Directors on November 10, 2023. We repurchased 85,386

shares of our common stock in the open market for $6.3 million in the nine months ended September 30, 2024; 1,131,040 shares for

$70.6 million in the year ended December 31, 2023 and 466,955 shares for $28.6 million in the period ended December 31, 2022.

As of November 7, 2024, we had repurchased a total of 1,893,803 shares of common stock for $123.2 million under our share purchase

program. All purchases have been made on the open market within the safe harbor provisions of Regulation 10b-18 under the Exchange

Act. Under the share repurchase program, shares of our common stock may be purchased in open market or privately negotiated transactions,

at times and prices that are considered to be appropriate by the Company, and the program may be suspended or discontinued at any time.

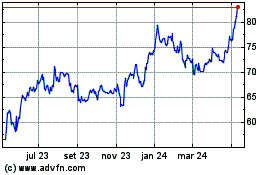

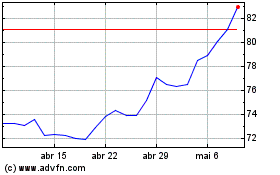

Star Bulk Carriers Corp. Securities

In

June 2023, we acquired marketable securities of Eagle Bulk Shipping Inc., which was an owner of bulk carriers listed on the New

York Stock Exchange (Ticker: EGLE) consisting of 1,552,865 shares of common stock for $68.2 million (out of which $24.4 million from

Virage International Ltd., our related company). As of December 31, 2023, these marketable securities were fair valued at

$86.0 million and we recognized a $17.9 million gain on these marketable securities reflected under “Gain on investments”

in the condensed consolidated statement of income in the period ended December 31, 2023. On December 11, 2023, Star Bulk Carriers

Corp. (Ticker: SBLK), a NASDAQ-listed owner and operator of drybulk vessels and EGLE announced that both companies had entered into a

definitive agreement to combine in an all-stock merger, which was completed on April 9, 2024. Under the terms of the agreement,

EGLE shareholders received 2.6211 shares of SBLK common stock in exchange for each share of EGLE common stock owned. As a result, we

own 4,070,214 shares of common stock of Star Bulk Carriers Corp. fair valued at $96.4 million as of September 30, 2024. We recognized

a $10.4 million gain on marketable securities and dividend income on these securities amounting to $6.8 million in the nine months ended

September 30, 2024.

Carbon Termination Technologies Corporation

In March 2023, we invested

$4.3 million in the common shares of a newly established company Carbon Termination Technologies Corporation (“CTTC”), incorporated

in the Republic of the Marshall Islands, which represents our 49% ownership interest. CTTC currently engages in research and development

of decarbonization technologies for the shipping industry. In July 2024, the Company provided a $1.2 million loan to CTTC repayable

in one year. Equity method of accounting is used for this investment. Our share of CTTC’s initial expenses amounted to $1.4 million

and $4.0 million and is presented under “Equity loss on investments” in the condensed consolidated statements of income in

the nine months ended September 30, 2024 and in the period ended December 31, 2023, respectively.

Impact of the Wars in Ukraine and Gaza on the Company’s Business

The current conflict between

Russia and Ukraine, and related sanctions imposed by the U.S., EU and others, adversely affect the crewing operations of our Manager,

which has crewing offices in St. Petersburg, Odessa and Mariupol (damaged by the war), and trade patterns involving ports in the Black

Sea or Russia, and as well as impacting world energy supply and creating uncertainties in the global economy, which in turn impact containership

and drybulk demand. The extent of the impact will depend largely on future developments.

The

war between Israel and Hamas in the Gaza Strip, conflict with Hezbollah and potential disruption of shipping routes such as Houthi

attacks in the Red Sea and the Gulf of Aden, has not affected the Company’s business to date; however, an escalation of these conflicts

could have reverberations on the regional and global economies that could have the potential to adversely affect demand for cargoes and

the Company’s business.

Impact of Inflation and Interest Rates Risk on our Business

We continue to see near-term

impacts on our business due to elevated inflation in the United States of America, Eurozone and other countries, including ongoing global

prices pressures in the wake of the war in Ukraine, driving up energy prices and commodity prices, which continue to affect our operating

expenses. Interest rates have increased rapidly and substantially as central banks in developed countries raised interest rates in an

effort to subdue inflation. The eventual long-term implications of tight monetary policy, and higher long-term interest rates may continue

to drive a higher cost of capital for our business, particularly as our level of indebtedness may increase as we finance the acquisition

cost of our contracted containership newbuildings and other vessel acquisitions.

Segments

Until the acquisition of

the drybulk vessels in 2023, we reported financial information and evaluated our operations by total charter revenues. Since 2023, for

management purposes, we are organized based on operating revenues generated from container vessels and drybulk vessels and have two reporting

segments: (1) a container vessels segment and (2) a drybulk vessels segment. The container vessels segment owns and operates

container vessels which are primarily chartered on multi-year, fixed-rate time charter and bareboat charter agreements. The drybulk vessels

segment owns and operates drybulk vessels to provide drybulk commodities transportation services.

Our chief operating decision

maker monitors and assesses the performance of the container vessels segment and the drybulk vessels segment based on net income. Items

included in the applicable segment’s net income are directly allocated to the extent that the items are directly or indirectly

attributable to the segments. With regards to the items that are allocated by indirect calculations, their allocation is commensurate

to the utilization of key resources. Investments in marketable securities and investments in affiliates accounted for using the equity

method of accounting are not allocated to any of our reportable segments.

The following table summarizes

our selected financial information for the nine months ended and as of September 30, 2024, by segment (in thousands):

| | |

Container

vessels segment | | |

Drybulk

vessels

segment | | |

Total | |

| Operating revenues | |

$ | 699,567 | | |

$ | 56,364 | | |

$ | 755,931 | |

| Voyage expenses | |

| (24,548 | ) | |

| (25,471 | ) | |

| (50,019 | ) |

| Vessel operating expenses | |

| (122,949 | ) | |

| (17,121 | ) | |

| (140,070 | ) |

| Depreciation | |

| (100,775 | ) | |

| (7,194 | ) | |

| (107,969 | ) |

| Amortization of deferred drydocking and special survey costs | |

| (19,062 | ) | |

| (847 | ) | |

| (19,909 | ) |

| Interest income | |

| 8,960 | | |

| - | | |

| 8,960 | |

| Interest expense | |

| (16,243 | ) | |

| - | | |

| (16,243 | ) |

| | |

| | | |

| | | |

| | |

| Net income per segment | |

$ | 396,144 | | |

$ | 2,689 | | |

$ | 398,833 | |

| Gain on investments,

dividend income and equity loss on investments | |

| | | |

| | | |

| 15,813 | |

| Net income | |

| | | |

| | | |

$ | 414,646 | |

| | |

Container

vessels segment | | |

Drybulk

vessels

segment | | |

Total | |

| Total assets per segment | |

$ | 3,890,116 | | |

$ | 267,199 | | |

$ | 4,157,315 | |

| Marketable securities | |

| | | |

| | | |

| 96,423 | |

| Receivables from

affiliates | |

| | | |

| | | |

| 80 | |

| Total assets | |

| | | |

| | | |

$ | 4,253,818 | |

The following table

summarizes the Company’s selected financial information for the nine months ended September 30, 2023, by segment (in thousands):

| | |

Container

vessels segment | | |

Drybulk

vessels

segment | | |

Total | |

| Operating revenues | |

$ | 724,268 | | |

| - | | |

$ | 724,268 | |

| Voyage expenses | |

| (25,241 | ) | |

| - | | |

| (25,241 | ) |

| Vessel operating expenses | |

| (121,951 | ) | |

$ | (43 | ) | |

| (121,994 | ) |

| Depreciation | |

| (95,754 | ) | |

| (10 | ) | |

| (95,764 | ) |

| Amortization of deferred drydocking and special survey

costs | |

| (13,109 | ) | |

| - | | |

| (13,109 | ) |

| Interest income | |

| 9,410 | | |

| - | | |

| 9,410 | |

| Interest expense | |

| (16,909 | ) | |

| - | | |

| (16,909 | ) |

| | |

| | | |

| | | |

| | |

| Net income/(loss) per segment | |

$ | 432,283 | | |

$ | (59 | ) | |

$ | 432,224 | |

| Loss on investments, dividend income

and equity loss on investments | |

| | | |

| | | |

| (5,846 | ) |

| Net income | |

| | | |

| | | |

$ | 426,378 | |

Cash Flows

| | |

Nine Months | | |

Nine Months | |

| | |

ended | | |

ended | |

| | |

September 30,

2024 | | |

September 30,

2023 | |

| | |

| | |

| |

| | |

| |

| | |

(In thousands) | |

| Net cash provided by operating activities | |

$ | 465,111 | | |

$ | 430,112 | |

| Net cash used in investing activities | |

$ | (572,237 | ) | |

$ | (198,551 | ) |

| Net cash provided by/(used in) financing activities | |

$ | 219,653 | | |

$ | (192,939 | ) |

Net Cash Provided by Operating Activities

Net cash flows provided by

operating activities increased by $35.0 million, to $465.1 million provided by operating activities in the nine months ended September 30,

2024 compared to $430.1 million provided by operating activities in the nine months ended September 30, 2023. This increase is attributed

to (i) a $68.4 million increase in net operating revenues, (ii) a $2.4 million decrease in net finance costs, (iii) a

$5.9 million increase in dividend income from investments and (iv) a $7.0 million change in working capital, which were partially

offset by (i) a $41.6 million increase in operating expenses and (ii) $7.1 million increase in payments for drydocking and

special survey costs.

Net Cash Used in Investing

Activities

Net cash flows used in investing

activities increased by $373.7 million, to $572.2 million used in investing activities in the nine months ended September 30, 2024

compared to $198.5 million used in investing activities in the nine months ended September 30, 2023. The increase was due to

(i) a $393.9 million increase in advance payments for vessels under construction including capitalized interest, (ii) a $51.9

million increase in advances and payments for vessel acquisitions and (iii) a $7.4 million increase in additions to vessel cost,

which were partially offset by (i) a $73.2 million decrease in investments and (ii) a $6.3 million increase in net sale and

insurance proceeds received from vessel disposals in the nine months ended September 30, 2024 compared to the nine months ended

September 30, 2023.

Net Cash Provided by/(Used

in) Financing Activities

Net cash flows provided by/(used

in) financing activities increased by $412.6 million, to $219.7 million provided by financing activities in the nine months ended September 30,

2024 compared to $192.9 million used in financing activities in the nine months ended September 30, 2023 mainly due to (i) $299.0

million new bank debt proceeds drawn down in the nine months ended September 30, 2024, (ii) $73.5 million decrease in loan

payments and payments of leaseback obligations that were fully repaid in the second quarter of 2023 and (iii) a $46.6 million decrease

in repurchase of our common stock, which were partially offset by (i) a $5.2 million increase in finance costs and (ii) a $1.3

million increase in dividend payments on our common stock.

Non-GAAP Financial Measures

We report our financial results

in accordance with U.S. generally accepted accounting principles (GAAP). Management believes, however, that certain non-GAAP financial

measures used in managing the business may provide users of this financial information additional meaningful comparisons between current

results and results in prior operating periods. Management believes that these non-GAAP financial measures can provide additional meaningful

reflection of underlying trends of the business because they provide a comparison of historical information that excludes certain items

that impact the overall comparability. Management also uses these non-GAAP financial measures in making financial, operating and planning

decisions and in evaluating our performance. See the table below for supplemental financial data and corresponding reconciliation to

GAAP financial measures. The non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported

results prepared in accordance with GAAP. The non-GAAP financial measures as presented below may not be comparable to similarly titled

measures of other companies in the shipping or other industries.

EBITDA and Adjusted

EBITDA

EBITDA represents net income

before interest income and expense, taxes, depreciation, as well as amortization of deferred drydocking & special survey costs,

amortization of assumed time charters, amortization of deferred realized losses of cash flow interest rate swaps, amortization of finance

costs and commitment fees. Adjusted EBITDA represents net income before interest income and expense, taxes other than withholding taxes

on dividends received, depreciation, amortization of deferred drydocking & special survey costs, amortization of assumed time

charters, amortization of deferred realized losses of cash flow interest rate swaps, amortization of finance costs and commitment fees,

gain on investments, net gain on disposal/sale of vessels and stock-based compensation. We believe that EBITDA and Adjusted EBITDA assist

investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not

believe are indicative of our core operating performance. EBITDA and Adjusted EBITDA are also used: (i) by prospective and current

customers as well as potential lenders to evaluate potential transactions; and (ii) to evaluate and price potential acquisition

candidates. Our EBITDA and Adjusted EBITDA may not be comparable to that reported by other companies due to differences in methods of

calculation.

EBITDA and Adjusted EBITDA

have limitations as analytical tools, and should not be considered in isolation or as a substitute for analysis of our results as reported

under U.S. GAAP. Some of these limitations are: (i) EBITDA/Adjusted EBITDA does not reflect changes in, or cash requirements for,

working capital needs; and (ii) although depreciation and amortization are non-cash charges, the assets being depreciated and amortized

may have to be replaced in the future, and EBITDA/Adjusted EBITDA do not reflect any cash requirements for such capital expenditures.

In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same as or similar to some of

the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results

will be unaffected by unusual or non-recurring items. Because of these limitations, EBITDA/Adjusted EBITDA should not be considered as

principal indicators of our performance.

Reconciliation of Net Income to EBITDA and

Adjusted EBITDA

| | |

Nine Months | | |

Nine Months | |

| | |

ended | | |

ended | |

| | |

September 30, 2024 | | |

September 30, 2023 | |

| | |

| | |

| |

| | |

| |

| | |

(In thousands) | |

| Net income | |

$ | 414,646 | | |

$ | 426,378 | |

| Depreciation | |

| 107,969 | | |

| 95,764 | |

| Amortization of deferred drydocking & special survey costs | |

| 19,909 | | |

| 13,109 | |

| Amortization of assumed time charters | |

| (4,534 | ) | |

| (16,806 | ) |

| Amortization of deferred realized losses of cash flow interest rate swaps | |

| 2,719 | | |

| 2,709 | |

| Amortization of finance costs and commitment fees | |

| 3,534 | | |

| 3,965 | |

| Interest income | |

| (8,983 | ) | |

| (9,410 | ) |

| Interest expense excluding amortization of finance costs | |

| 14,674 | | |

| 15,174 | |

| EBITDA | |

| 549,934 | | |

| 530,883 | |

| Gain/(loss) on investments | |

| (10,395 | ) | |

| 2,895 | |

| Loss on debt extinguishment | |

| - | | |

| 2,254 | |

| Net gain on disposal/sale of vessels | |

| (6,651 | ) | |

| (1,639 | ) |

| Adjusted EBITDA | |

$ | 532,888 | | |

$ | 534,393 | |

EBITDA increased by $19.0

million, to $549.9 million in the nine months ended September 30, 2024 from $530.9 million in the nine months ended September 30,

2023. This increase was mainly attributed to (i) a $19.2 million change in fair value of our investment and dividend income, (ii) a

$43.9 million increase in operating revenues (excluding $12.3 million decrease in amortization of assumed time charters), (iii) a

$5.0 million increase in net gain on disposal/sale of vessels, (iv) a $2.4 million decrease in equity loss on investments and (v) a

$2.2 million decrease in loss on debt extinguishment, which were partially offset by a $53.7 million increase in total operating expenses

in the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023.

Adjusted EBITDA decreased

by $1.5 million, to $532.9 million in the nine months ended September 30, 2024 from $534.4 million in the nine months ended September 30,

2023. This decrease was mainly attributed to a $53.7 million increase in total operating expenses, which were partially offset by (i) a

$43.9 million increase in operating revenues (excluding $12.3 million decrease in amortization of assumed time charters), (ii) a

$2.4 million decrease in equity loss on investments and (iii) a $5.9 million increase in dividend income in the nine months ended

September 30, 2024. Adjusted EBITDA for the nine months ended September 30, 2024 is adjusted for a $10.4 million change in

fair value of our investments and a $6.7 million net gain on disposal/sale of vessels.

Net Income Reconciliation

to Adjusted EBITDA per segment (in thousands):

| | |

Nine Months

Ended | | |

Nine Months

Ended | |

| | |

September 30,

2024 | | |

September 30,

2023 | |

| | |

Container

Vessels | | |

Drybulk

Vessels | | |

Other | | |

Total | | |

Container

Vessels | | |

Drybulk

Vessels | | |

Other | | |

Total | |

| Net

income | |

$ | 396,144 | | |

$ | 2,689 | | |

$ | 15,813 | | |

$ | 414,646 | | |

$ | 432,283 | | |

$ | (59 | ) | |

$ | (5,846 | ) | |

$ | 426,378 | |

| Depreciation | |

| 100,775 | | |

| 7,194 | | |

| - | | |

| 107,969 | | |

| 95,754 | | |

| 10 | | |

| - | | |

| 95,764 | |

| Amortization

of deferred drydocking & special survey costs | |

| 19,062 | | |

| 847 | | |

| - | | |

| 19,909 | | |

| 13,109 | | |

| - | | |

| - | | |

| 13,109 | |

| Amortization

of assumed time charters | |

| (4,534 | ) | |

| - | | |

| - | | |

| (4,534 | ) | |

| (16,806 | ) | |

| - | | |

| - | | |

| (16,806 | ) |

| Amortization

of deferred finance costs and commitment fees | |

| 3,534 | | |

| - | | |

| - | | |

| 3,534 | | |

| 3,965 | | |

| - | | |

| - | | |

| 3,965 | |

| Amortization

of deferred realized losses on interest rate swaps | |

| 2,719 | | |

| - | | |

| - | | |

| 2,719 | | |

| 2,709 | | |

| - | | |

| - | | |

| 2,709 | |

| Interest

income | |

| (8,960 | ) | |

| - | | |

| (23 | ) | |

| (8,983 | ) | |

| (9,410 | ) | |

| - | | |

| - | | |

| (9,410 | ) |

| Interest

expense excluding amortization of finance costs | |

| 14,674 | | |

| - | | |

| - | | |

| 14,674 | | |

| 15,174 | | |

| - | | |

| - | | |

| 15,174 | |

| Change in

fair value of investments | |

| - | | |

| - | | |

| (10,395 | ) | |

| (10,395 | ) | |

| - | | |

| - | | |

| 2,895 | | |

| 2,895 | |

| Loss on

debt extinguishment | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,254 | | |

| - | | |

| - | | |

| 2,254 | |

| Net

gain on disposal/sale of vessels | |

| (6,651 | ) | |

| - | | |

| - | | |

| (6,651 | ) | |

| (1,639 | ) | |

| - | | |

| - | | |

| (1,639 | ) |

| Adjusted

EBITDA(1) | |

$ | 516,763 | | |

$ | 10,730 | | |

$ | 5,395 | | |

$ | 532,888 | | |

$ | 537,393 | | |

$ | (49 | ) | |

$ | (2,951 | ) | |

$ | 534,393 | |

Time Charter Equivalent

Revenues and Time Charter Equivalent US$/day per segment

Time charter equivalent revenues

represent operating revenues less voyage expenses excluding commissions presented per container vessels segment and drybulk vessels segment

separately. Time charter equivalent US$/per day (“TCE rate”) represents the average daily TCE rate of our container vessels

segment and drybulk vessels segment calculated dividing time charter equivalent revenues of each segment by operating days of each segment.

Operating days of each segment is calculated by deducting vessels off-hire days of each segment from total ownership days of each segment.

TCE rate is a measure of the average daily net revenue performance of our vessels in each segment. TCE rate is a standard shipping industry

performance measure used primarily to compare period to period changes in a shipping company’s performance despite changes in the

mix of charter types i.e., voyage charters, time charters, bareboat charters under which its vessels may be employed between the periods.

Our method of computing TCE rate may not necessarily be comparable to TCE rates of other companies due to differences in methods of calculation.

We include TCE rate, a non- GAAP measure, as it provides additional meaningful information in conjunction with operating revenues, the

most directly comparable GAAP measure, and it assists our management in making decisions regarding the deployment and use of our operating

vessels and assists investors and our management in evaluating our financial performance.

Container vessels fleet utilization

| | |

Three months

ended | | |

Three months

ended | | |

Nine months

ended | | |

Nine months

ended | |

| | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | |

| Vessel Utilization (No. of Days) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Ownership Days | |

| 6,540 | | |

| 6,256 | | |

| 18,978 | | |

| 18,594 | |

| Less Off-hire Days: | |

| | | |

| | | |

| | | |

| | |

| Scheduled Off-hire Days | |

| (127 | ) | |

| (119 | ) | |

| (289 | ) | |

| (349 | ) |

| Other Off-hire Days | |

| (26 | ) | |

| (22 | ) | |

| (195 | ) | |

| (68 | ) |

| Operating Days(1) | |

| 6,387 | | |

| 6,115 | | |

| 18,494 | | |

| 18,177 | |

| Vessel Utilization | |

| 97.7 | % | |

| 97.7 | % | |

| 97.4 | % | |

| 97.8 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Revenues (in '000s of US$) | |

$ | 235,570 | | |

$ | 239,215 | | |

$ | 699,567 | | |

$ | 724,268 | |

| Less: Voyage Expenses excluding commissions (in '000s of US$) | |

| 757 | | |

| (479 | ) | |

| (179 | ) | |

| (1,225 | ) |

| Time Charter Equivalent Revenues (in '000s of US$) | |

| 236,327 | | |

| 238,736 | | |

| 699,388 | | |

| 723,043 | |

| Time Charter Equivalent US$/per day(2) | |

$ | 37,001 | | |

$ | 39,041 | | |

$ | 37,817 | | |

$ | 39,778 | |

Drybulk vessels fleet utilization

| | |

Three months

ended | | |

Three months

ended | | |

Nine months

ended | | |

Nine months

ended | |

| | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | |

| Vessel Utilization (No. of Days) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Ownership Days | |

| 913 | | |

| 5 | | |

| 2,244 | | |

| 5 | |

| Less Off-hire Days: | |

| | | |

| | | |

| | | |

| | |

| Scheduled Off-hire Days | |

| (119 | ) | |

| (5 | ) | |

| (240 | ) | |

| (5 | ) |

| Other Off-hire Days | |

| (16 | ) | |

| - | | |

| (26 | ) | |

| - | |

| Operating Days(1) | |

| 778 | | |

| - | | |

| 1,978 | | |

| - | |

| Vessel Utilization | |

| 85.2 | % | |

| - | | |

| 88.1 | % | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Revenues (in '000s of US$) | |

$ | 20,606 | | |

| - | | |

$ | 56,364 | | |

| - | |

| Less: Voyage Expenses excluding commissions (in '000s of US$) | |

| (8,019 | ) | |

| - | | |

| (22,115 | ) | |

| - | |

| Time Charter Equivalent Revenues (in '000s of US$) | |

| 12,587 | | |

| - | | |

| 34,249 | | |

| - | |

| Time Charter Equivalent US$/per day(2) | |

$ | 16,179 | | |

| - | | |

$ | 17,315 | | |

| - | |

| 1. | We define Operating Days as the total number

of Ownership Days net of Scheduled off-hire days (days associated with scheduled repairs,

drydockings or special or intermediate surveys) and net of off-hire days associated

with unscheduled repairs or days waiting to find employment but including days our vessels

were sailing for repositioning. The shipping industry uses Operating Days to measure the

number of days in a period during which vessels actually generate revenues or are sailing

for repositioning purposes. Our definition of Operating Days may not be comparable to that

used by other companies in the shipping industry. |

| 2. | Time charter equivalent US$/per day (“TCE

rate”) represents the average daily TCE rate of our container vessels segment and drybulk

vessels segment calculated dividing time charter equivalent revenues of each segment by operating

days of each segment. TCE rate is a standard shipping industry performance measure used primarily

to compare period to period changes in a shipping company’s performance despite changes

in the mix of charter types i.e., voyage charters, time charters, bareboat charters under

which its vessels may be employed between the periods. Our method of computing TCE rate may

not necessarily be comparable to TCE rates of other companies due to differences in methods

of calculation. We include TCE rate, a non- GAAP measure, as it provides additional meaningful

information in conjunction with operating revenues, the most directly comparable GAAP measure,

and it assists our management in making decisions regarding the deployment and use of our

operating vessels and assists investors and our management in evaluating our financial performance. |

Credit Facilities

We,

as borrower or guarantor, and certain of our subsidiaries, as borrowers or guarantors, have entered into a number of credit facilities

in connection with financing the acquisition of certain vessels in our fleet. Our existing credit facilities are secured by, among other

things, our vessels (as described below). The following summarizes certain terms of our credit facilities and our Senior Notes as of

September 30, 2024:

| Credit Facility | |

Outstanding

Principal

Amount

(in millions) | | |

Collateral Vessels |

| BNP Paribas/Credit Agricole $130.0 mil. Facility | |

$ | 88.1 | | |

The Wide Alpha, the Stephanie C, the Euphrates (ex Maersk Euphrates), the Wide Hotel, the Wide India and the Wide Juliet |

| Alpha Bank $55.25 mil. Facility | |

$ | 42.1 | | |

The Bremen and the Kota Santos |

| Syndicated $450.0 mil. Facility | |

$ | 296.5 | | |

The Interasia Accelerate, the Interasia Amplify, the Catherine C, the Greenland, the Greenville, the Hull No. HN4012, the Hull No. CV5900-07 and the Hull No. CV5900-08 |

| Citibank $382.5 mil. Revolving Credit Facility | |

$ | - | | |

The Express Berlin, the Express Rome, the Express Athens, the Kota Plumbago (ex Hyundai Smart), the Speed (ex Hyundai Speed), the Ambition (ex Hyundai Ambition), the Pusan C, the Le Havre, the Europe, the America, the CMA CGM Musset, the Racine (ex CMA CGM Racine), the CMA CGM Rabelais, the CMA CGM Nerval, the YM Maturity and the YM Mandate |

| Senior Notes | |

$ | 262.8 | | |

None |

As of September 30,

2024, there was $303.75 million of remaining borrowing availability under our Citibank $382.5 mil. Revolving Credit Facility and $151.0

million under our Syndicated $450.0 million Facility. As of September 30, 2024, 43 of our container vessels and 10 Capesize drybulk

carriers were unencumbered. See Note 8 “Long-term Debt, net” to our unaudited condensed consolidated financial statements

included in this report for additional information regarding our outstanding debt and the related repayment schedule.

Senior Notes

On February 11, 2021,

we consummated an offering of $300 million aggregate principal amount of 8.500% Senior Notes due 2028 of Danaos Corporation, which

we refer to as the Senior Notes. The Senior Notes are general senior unsecured obligations of Danaos Corporation.

The Senior Notes were issued

pursuant to an Indenture, dated as of February 11, 2021, between the Company and Citibank, N.A., London Branch, as trustee, paying

agent, registrar and transfer agent. The Senior Notes bear interest at a rate of 8.500% per year, payable in cash on March 1 and

September 1 of each year, commencing September 1, 2021. The Senior Notes will mature on March 1, 2028.

In December 2022, we

repurchased $37.2 million aggregate principal amount of our Senior Notes in a privately negotiated transaction. For additional details

regarding the Senior Notes please refer to Note 8, “Long-term Debt, net” in the unaudited condensed consolidated financial

statements included elsewhere in this report and “Item 5. Operating and Financial Review and Prospects –Senior Notes”

in our Annual Report on Form 20-F for the year ended December 31, 2023 filed with the Securities and Exchange Commission on

February 29, 2024.

Qualitative and Quantitative Disclosures about Market Risk

Interest Rate Swaps

In the past, we entered into

interest rate swap agreements converting floating interest rate exposure into fixed interest rates in order to hedge our exposure to

fluctuations in prevailing market interest rates, as well as interest rate swap agreements converting the fixed rate we paid in connection

with certain of our credit facilities into floating interest rates in order to economically hedge the fair value of the fixed rate credit

facilities against fluctuations in prevailing market interest rates. All of these interest rate swap agreements have expired and we do

not currently have any outstanding interest rate swap agreements. Refer to Note 9, “Financial Instruments”, to our unaudited

condensed consolidated financial statements included in this report.

Foreign Currency Exchange

Risk

We did not enter into derivative

instruments to hedge the foreign currency translation of assets or liabilities or foreign currency transactions during the nine months

ended September 30, 2024 and 2023.

Impact of Inflation

and Interest Rates Risk on our Business

We continue to see near-term

impacts on our business due to elevated inflation in the United States of America, Eurozone and other countries, including ongoing global

prices pressures in the wake of the war in Ukraine, driving up energy and commodity prices, which continue to affect our operating expenses.

Interest rates have increased rapidly and substantially as central banks in developed countries raise interest rates in an effort to

subdue inflation. The eventual implications of tighter monetary policy, and potentially higher long-term interest rates may drive a higher

cost of capital for our business.

Capitalization and Indebtedness

The table below sets forth

our consolidated capitalization as of September 30, 2024.

| · | on an actual basis; and |

| · | on

an as adjusted basis to reflect, in the period from October 1, 2024 to November 7,

2024, a $63.0 million drawdown on Syndicated $450.0 million Facility related to a delivery

of a newbuilding vessel and repurchases of 210,422 shares of our common stock for an aggregate

purchase price of $17.8 million. |

Other than these

adjustments, there have been no other material changes to our capitalization from debt or equity issuances, re-capitalizations, special

dividends, or debt repayments as adjusted in the table below between October 1, 2024 and November 7, 2024.

| | |

As of September 30, 2024 | |

| | |

Actual | | |

As adjusted | |

| | |

| | |

| |

| | |

| |

| | |

(US Dollars in thousands) | |

| Debt: | |

| | |

| |

| Senior unsecured notes | |

$ | 262,766 | | |

$ | 262,766 | |

| BNP Paribas/Credit Agricole $130 mil. Facility | |

| 88,100 | | |

| 88,100 | |

| Alpha Bank $55.25 mil. Facility | |

| 42,125 | | |

| 42,125 | |

| Syndicated $450.0 mil. Facility | |

| 296,485 | | |

| 359,485 | |

| Citibank $382.5 mil. Revolving Credit Facility | |

| - | | |

| - | |

| Total debt (1)(2) | |

$ | 689,476 | | |

$ | 752,476 | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, par value $0.01 per share; 100,000,000 preferred shares authorized and none issued; actual and as adjusted | |

| - | | |

| - | |

| Common stock, par value $0.01 per share; 750,000,000 shares authorized; 25,355,981 shares issued and 19,333,329 shares outstanding actual and 19,122,907 shares as adjusted | |

| 193 | | |

| 191 | |

| Additional paid-in capital | |

| 688,649 | | |

| 670,896 | |

| Accumulated other comprehensive loss | |

| (72,472 | ) | |

| (72,472 | ) |

| Retained earnings (3) | |

| 2,770,070 | | |

| 2,770,070 | |

| Total stockholders’ equity | |

| 3,386,440 | | |

| 3,368,685 | |

| Total capitalization | |

$ | 4,075,916 | | |

$ | 4,121,161 | |

| (1) | All

of the indebtedness reflected in the table, other than Danaos Corporation’s unsecured

senior notes due 2028 ($262.8 million on an actual basis), is secured and is guaranteed by

Danaos Corporation, in the case of loan obligations of our subsidiaries ($42.1 million on

an actual basis), or by our subsidiaries, in the case of indebtedness of Danaos Corporation

($384.6 million on an actual basis). See Note 8 “Long-Term Debt, net” to our

unaudited condensed consolidated financial statements included elsewhere in this report. |

| (2) | Total

debt is presented gross of deferred finance costs, which amounted to $10.5 million. |

| (3) | Does not reflect dividend of $0.85 per

share of common stock declared by the Company payable on December 4, 2024 to holders

of record as of November 25, 2024. |

Our Fleet

The

following table describes in detail our container vessels deployment profile as of November 7, 2024:

| Vessel Details |

Charter Arrangements |

| Vessel Name |

Year

Built |

Size

(TEU) |

Expiration of

Charter (1) |

Contracted

Employment

through (2) |

Charter

Rate (3) |

Extension Options (4) |

| Period |

Charter

Rate |

| Ambition (ex Hyundai Ambition) |

2012 |

13,100 |

April 2027 |

April 2027 |

$51,500 |

|

+ 6 months

+ 10.5 to 13.5 months

+ 10.5 to 13.5 months |

$51,500 $51,500 $51,500 |

| Speed (ex Hyundai Speed) |

2012 |

13,100 |

March 2027 |

March 2027 |

$51,500 |

|

+ 6 months

+ 10.5 to 13.5 months

+ 10.5 to 13.5 months |

$51,500 $51,500 $51,500 |

| Kota Plumbago (ex Hyundai Smart) |

2012 |

13,100 |

July 2027 |

July 2027 |

$54,000 |

|

+ 3 to 26 months |

$54,000 |

| Kota Primrose (ex Hyundai Respect) |

2012 |

13,100 |

April 2027 |

April 2027 |

$54,000 |

|

+ 3 to 26 months |

$54,000 |

| Kota Peony (ex Hyundai Honour) |

2012 |

13,100 |

March 2027 |

March 2027 |

$54,000 |

|

+ 3 to 26 months |

$54,000 |

| Express Rome |

2011 |

10,100 |

May 2027 |

May 2027 |

$37,000 |

|

+ 6 months |

$37,000 |

| Express Berlin |

2011 |

10,100 |

August 2026 |

August 2026 |

$33,000 |

|

+ 4 months |

$33,000 |

| Express Athens |

2011 |

10,100 |

May 2027 |

May 2027 |

$37,000 |

|

+ 6 months |

$37,000 |

| Le Havre |

2006 |

9,580 |

June 2028 |

June 2028 |

$58,500 |

|

+ 4 months |

$58,500 |

| Pusan C |

2006 |

9,580 |

May 2028 |

May 2028 |

$58,500 |

|

+ 4 months |

$58,500 |

| Bremen |

2009 |

9,012 |

January 2028 |

January 2028 |

$56,000 |

|

+ 4 months |

$56,000 |

| C Hamburg |

2009 |

9,012 |

January 2028 |

January 2028 |

$56,000 |

|

+ 4 months |

$56,000 |

| Niledutch Lion |

2008 |

8,626 |

May 2026 |

May 2026 |

$47,500 |

|

+ 4 months |

$47,500 |

| Belita |

2006 |

8,533 |

July 2026 |

July 2026 |

$45,000 |

|

+ 6 months |

$45,000 |

| Kota Manzanillo |

2005 |

8,533 |

February 2026 |

February 2026 |

$47,500 |

|

+ 4 months |

$47,500 |

| CMA CGM Melisande |

2012 |

8,530 |

January 2028 |

January 2028 |

$34,500 |

|

+ 3 to 13.5 months |

$34,500 |

| CMA CGM Attila |

2011 |

8,530 |

May 2027 |

May 2027 |

$34,500 |

|

+ 3 to 13.5 months |

$34,500 |

| CMA CGM Tancredi |

2011 |

8,530 |

July 2027 |

July 2027 |

$34,500 |

|

+ 3 to 13.5 months |

$34,500 |

| CMA CGM Bianca |

2011 |

8,530 |

September 2027 |

September 2027 |

$34,500 |

|

+ 3 to 13.5 months |

$34,500 |

| CMA CGM Samson |

2011 |

8,530 |

November 2027 |

November 2027 |

$34,500 |

|

+ 3 to 13.5 months |

$34,500 |

| America |

2004 |

8,468 |

April 2028 |

April 2028 |

$56,000 |

|

+ 4 months |

$56,000 |

| Europe |

2004 |

8,468 |

May 2028 |

May 2028 |

$56,000 |

|

+ 4 months |

$56,000 |

| Kota Santos |

2005 |

8,463 |

August 2026 |

August 2025 August 2026 |

$55,000 $50,000 |

|

+ 4 months |

$55,000 |

| Catherine C (6) |

2024 |

8,010 |

May 2027 |

May 2027 |

$42,000 |

|

+ 3 months |

$42,000 |

| Greenland (6) |

2024 |

8,010 |

June 2027 |

June 2027 |

$42,000 |

|

+ 3 months |

$42,000 |

| Greenville (7) |

2024 |

8,010 |

August 2027 |

August 2027 |

$42,000 |

|

+ 3 months |

$42,000 |

| Greenfield (8) |

2024 |

8,010 |

October 2027 |

October 2027 |

$42,000 |

|

+ 3 months |

$42,000 |

| Interasia Accelerate (6) |

2024 |

7,165 |

April 2027 |

April 2027 |

$36,000 |

|

+ 4 months

+ 22 to 26 months |

$36,000 $40,000 |

| Interasia Amplify (7) |

2024 |

7,165 |

September 2027 |

September 2027 |

$36,000 |

|

+ 4 months

+ 22 to 26 months |

$36,000 $40,000 |

| CMA CGM Moliere |

2009 |

6,500 |

March 2027 |

March 2027 |

$55,000 |

|

+ 2 months |

$55,000 |

| CMA CGM Musset |

2010 |

6,500 |

September 2025 |

September 2025 |

$60,000 |

|

+ 2 months

+ 23 to 25 months |

$60,000 $55,000 |

| CMA CGM Nerval |

2010 |

6,500 |

November 2025 |

November 2025 |

$40,000 |

|

+ 2 months

+ 23 to 25 months |

$40,000 $30,000 |

| CMA CGM Rabelais |

2010 |

6,500 |

January 2026 |

January 2026 |

$40,000 |

|

+ 2 months

+ 23 to 25 months |

$40,000 $30,000 |

| Racine |

2010 |

6,500 |

April 2026 |

April 2026 |

$32,500 |

|

+ 2 months |

$32,500 |

| YM Mandate |

2010 |

6,500 |

January 2028 |

January 2028 |

$26,890 |

(5) |

+ 8 months |

$26,890 |

| YM Maturity |

2010 |

6,500 |

April 2028 |

April 2028 |

$26,890 |

(5) |

+ 8 months |

$26,890 |

| Dimitra C |

2002 |

6,402 |

April 2027 |

April 2025 April 2027 |

$23,000 $35,000 |

|

+ 2 months

+ 11 to 13 months |

$35,000 $35,000 |

| Savannah (ex ZIM Savannah) |

2002 |

6,402 |

June 2027 |

August 2025 June 2027 |

$25,650 $40,000 |

|

+ 1.5 months

+ 10.5 to 13.5 months |

$40,000 $30,000 |

| Kota Lima |

2002 |

5,544 |

September 2025 |

November 2024 September 2025 |

$39,999 $27,500 |

|

+4 months

+ 10 to 12 months |

$27,500 $24,000 |

| Suez Canal |

2002 |

5,610 |

April 2026 |

April 2026 |

$27,500 |

|

+ 2 months |

$27,500 |

| Wide Alpha |

2014 |

5,466 |

July 2027 |

August 2025 July 2027 |

$20,750 $34,000 |

|

+ 3 months |

$34,000 |

| Stephanie C |

2014 |

5,466 |

May 2028 |

June 2025 May 2028 |

$55,500 $33,750 |

|

+2 months

+23 to 25 months |

$33,750 $33,750 |

| Euphrates (ex Maersk Euphrates) |

2014 |

5,466 |

September 2028 |

October 2025 September 2028 |

$20,500 $33,750 |

|

+2 months

+23 to 25 months |

$33,750 $33,750 |

| Wide Hotel |

2015 |

5,466 |

September 2027 |

October 2025 September 2027 |

$20,750 $34,000 |

|

+ 3 months |

$34,000 |

| Wide India |

2015 |

5,466 |

October 2028 |

November 2025 October 2028 |

$53,500 $33,750 |

|

+ 2 months

+ 23 to 25 months |

$33,750 $33,750 |

| Wide Juliet |

2015 |

5,466 |

September 2025 |

September 2025 |

$24,750 |

|

+ 4 months

+ 7 to 9 months