UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

November

14, 2024

Commission

File Number 001-37974

VIVOPOWER

INTERNATIONAL PLC

(Translation

of registrant’s name into English)

The

Scalpel, 18th Floor, 52 Lime Street

London

EC3M 7AF

United

Kingdom

+44-203-667-5158

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form

20- F ☒ Form 40-F ☐

LONDON,

14 November 2024 – VivoPower (“the Company”) announced that its Board of Directors has approved an execution plan for

its subsidiary, Caret Digital, to develop up to 55MW of its solar farm portfolio for Dogecoin and Litecoin mining. This

follows a proposal from a Canadian counterparty for a reverse merger with Caret Digital, with negotiations underway to

finalize a definitive agreement. Caret Digital has potential to generate up to US$150 million in annual revenue from

Dogecoin and Litecoin mining, based on current prices and Antminer GPU costs, with capital expenditure to be funded independently through equity and debt post-spin-off. VivoPower shareholders approved a potential spin-off of

Caret Digital and a special dividend at the December 2023 Annual General Meeting. The Company will provide further

updates on the spin-off progress and its impact on VivoPower and its stakeholders, including any special dividends for shareholders.

A

copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

This

Report on Form 6-K, including Exhibit 99.1, is hereby incorporated by reference into the Company’s Registration Statements on Form

S-8 (File Nos. 333-227810, 333-251546, 333-268720, 333-273520) and Form F-3 (File No. 333-276509).

Forward-Looking

Statements

This

communication includes certain statements that may constitute “forward-looking statements” for purposes of the U.S. federal

securities laws. Forward-looking statements include, but are not limited to, statements that refer to projections, forecasts or other

characterisations of future events or circumstances, including any underlying assumptions. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. Forward-looking statements may include, for example, statements about the achievement

of performance hurdles, or the benefits of the events or transactions described in this communication and the expected returns therefrom.

These statements are based on VivoPower’s management’s current expectations or beliefs and are subject to risk, uncertainty,

and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes

in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of VivoPower’s

business. These risks, uncertainties and contingencies include changes in business conditions, fluctuations in customer demand, changes

in accounting interpretations, management of rapid growth, intensity of competition from other providers of products and services, changes

in general economic conditions, geopolitical events and regulatory changes, and other factors set forth in VivoPower’s filings

with the United States Securities and Exchange Commission. The information set forth herein should be read in light of such risks. VivoPower

is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements whether as a result

of new information, future events, changes in assumptions or otherwise.

No

Offer or Solicitation

This

Report on Form 6-K shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect

of the proposed transaction. This Report on Form 6-K shall also not constitute an offer to sell or the solicitation of an offer to buy

any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall

be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption

therefrom.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date:

November 14, 2024 |

VivoPower

International PLC |

| |

|

| |

/s/

Kevin Chin |

| |

Kevin

Chin |

| |

Executive

Chairman |

Exhibit 99.1

VivoPower’s

Caret Digital to develop up to 55MW of its solar farm portfolio for digital asset mining, including Dogecoin

and Litecoin, with potential annual revenues of up to US$150m

Spin-off

of Caret Digital previously approved by shareholders and subsequently confirmed in December 2023

Caret

Digital approached with proposal to mine Dogecoin and Litecoin on its assets, ahead of a potential definitive agreement to enter into reverse merge spin-off with

a Canadian counterparty

Economics

of Dogecoin and Litecoin mining have improved markedly

Dogecoin and Litecoin

mining use case consistent with Caret Digital’s previously announced Power-to-X strategy

LONDON,

14 November 2024 – VivoPower (“the Company”) announced today that its Board of Directors has approved an execution

plan for its wholly owned subsidiary, Caret Digital, to develop up to 55MW of its solar farm asset portfolio for Dogecoin and Litecoin mining purposes. This follows a proposal from a Canadian group seeking to

enter into a reverse merger with Caret Digital, with the Company currently progressing negotiations to finalise a definitive agreement.

Based on current Dogecoin and Litecoin prices and Antminer GPU costs, there is potential for Caret Digital to generate

annual revenues of approximately US$150 million from Dogecoin and Litecoin mining. Capital expenditure would be funded through a combination of equity and debt to be raised independently by Caret Digital following any reverse merger

spin-off.

VivoPower

shareholders had previously approved a spin-off of Caret Digital, in whole or part, as well as a special dividend during the Annual General Meeting held in December

2023.

The

Company will provide further updates in relation to the progress of the spin-off via a reverse merger and the consequences for VivoPower and

its stakeholders, including any special dividend shares for VivoPower shareholders.

About

VivoPower

Established

in 2014 and listed on Nasdaq since 2016, VivoPower is an award-winning global sustainable energy solutions B Corporation company focussed

on electric solutions for off-road and on-road customised and ruggedised fleet applications as well as ancillary financing, charging,

battery and microgrids solutions. VivoPower’s core purpose is to provide its customers with turnkey decarbonisation solutions that

enable them to move toward net-zero carbon status. VivoPower has operations and personnel covering Australia, Canada, the Netherlands,

the United Kingdom, the United States, the Philippines, and the United Arab Emirates.

Forward-Looking

Statements

This

communication includes certain statements that may constitute “forward-looking statements” for purposes of the U.S. federal

securities laws. Forward-looking statements include, but are not limited to, statements that refer to projections, forecasts or other

characterisations of future events or circumstances, including any underlying assumptions. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. Forward-looking statements may include, for example, statements about the achievement

of performance hurdles, or the benefits of the events or transactions described in this communication and the expected returns therefrom.

These statements are based on VivoPower’s management’s current expectations or beliefs and are subject to risk, uncertainty,

and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes

in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of VivoPower’s

business. These risks, uncertainties and contingencies include changes in business conditions, fluctuations in customer demand, changes

in accounting interpretations, management of rapid growth, intensity of competition from other providers of products and services, changes

in general economic conditions, geopolitical events and regulatory changes, and other factors set forth in VivoPower’s filings

with the United States Securities and Exchange Commission. The information set forth herein should be read in light of such risks. VivoPower

is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements whether as a result

of new information, future events, changes in assumptions or otherwise.

Contact

Shareholder

Enquiries

shareholders@vivopower.com

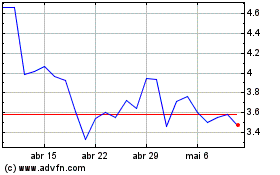

VivoPower (NASDAQ:VVPR)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

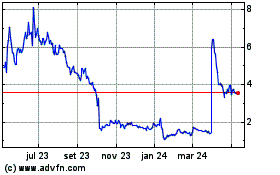

VivoPower (NASDAQ:VVPR)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024