0001495231false00014952312024-11-142024-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

_____________________________________________________________________________________

Date of Report (Date of earliest event reported): November 14, 2024

IZEA WORLDWIDE, INC.

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

Nevada | | 001-37703 | | 37-1530765 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

1317 Edgewater Dr #1880 Orlando, Florida | | 32804 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (407) 674-6911

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.0001 per share | | IZEA | | The Nasdaq Capital Market |

| Series A Junior Participating Preferred Stock Purchase Rights | | - | | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 14, 2024, IZEA Worldwide, Inc. (the “Company”) issued a press release disclosing the financial results for its third quarter ended September 30, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item by reference.

The information in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section. This information shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference therein.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

Exhibit No. | Description |

99.1 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | IZEA WORLDWIDE, INC. |

| | |

| | |

Date: November 14, 2024 | | By:/s/ Patrick Venetucci Patrick Venetucci

Chief Executive Officer |

IZEA Reports Q3 2024 Revenue of $8.8 Million

ORLANDO, Fla. (November 14, 2024) - IZEA Worldwide, Inc. (NASDAQ: IZEA), a premier provider of influencer marketing technology, data, and services for the Creator Economy, reported its financial and operational results for the third quarter ended September 30, 2024.

Q3 2024 Financial Summary Compared to Q3 2023

•Total revenue increased 12% to $8.8 million, compared to $7.9 million

•Managed Services bookings increased 11% to $7.9 million, compared to $7.1 million

•Managed Services revenue increased 10% to $8.6 million, compared to $7.8 million

•Total costs and expenses increased 73% to $18.2 million, including a $4.0 million non-cash charge for goodwill impairment, compared to $10.5 million

•Net loss was $8.8 million compared to a net loss of 2.0 million

•Adjusted EBITDA* for the quarter was $(2.8) million, compared to $(1.5) million

•Cash, cash equivalents, and investments on September 30, 2024 totaled $54.4 million

Q3 2024 Operational Highlights

•IZEA’s work for the Barbie movie won 2024 Global Influencer Marketing Awards, The Global

Agency Awards, and Global Digital Excellence Awards

•IZEA Flex named Best Influencer Marketing Platform in 2024 MarTech Breakthrough Awards

•Earned multiple Comparably Awards for Benefits, Work-Life Balance, and Employee Happiness

•IZZY, a groundbreaking AI assistant is now available to users of IZEA Flex

* Adjusted EBITDA is a non-GAAP financial measure. Refer to the definition and reconciliation of this measure under “Use of Key Metrics and Non-GAAP Financial Measures."

Management Commentary

“We saw another healthy increase in managed services bookings and revenue in Q3,” commented Patrick Venetucci, CEO. “With the effect of the non-recurring customer fully behind us, we expect to report year-over-year growth in the last quarter. We won new business from Nestlé, Danone, Coursera, and NHTSA. We produced exciting new work for one of the largest auto manufacturers, and our vibrant work launching the Barbie movie won numerous awards. We advanced our tech product by launching IZZY, a cutting-edge AI assistant for marketers making creator campaigns. And IZEA continued to be recognized as being a great place to work.”

Q3 2024 Financial Results

Total revenue in the third quarter of 2024 increased 12% to $8.8 million, compared to $7.9 million in the third quarter of 2023, with revenue from Managed Services increasing by 10% to $8.6 million in the third quarter of 2024. Excluding revenues from our non-recurring customer that we parted ways with in 2023, Managed Services revenue increased $1.7 million or 25% over the prior-year quarter. Revenue from SaaS Services increased by 260% to $205,870 in the third quarter of 2024 compared to the third quarter of 2023.

Revenue from SaaS Services increased by $148,694, or 260%, in the third quarter of 2024 compared to the third quarter of 2023, with most of these customers actively utilizing IZEA's AI tools.

Cost of revenue increased to $5.2 million in the third quarter of 2024, or 59% of revenue, compared to $4.7 million, or 59%, in the prior-year quarter. The percentage cost decline represents improved margins from our ongoing customer base.

Costs and expenses other than the cost of revenue totaled $13.0 million for the third quarter of 2024, $7.1 million or 122% above the prior-year quarter. Sales and marketing costs were $2.9 million during the third quarter of 2024, $0.2 million or 7% higher than the prior-year quarter, primarily due to higher costs for compensation offset by a decrease in spending on demand generation activities. General and administrative costs totaled $5.8 million during the quarter, $2.8 million or 93% higher than the prior-year quarter. The rise in expenses this quarter was largely due to increased human capital costs, primarily from accrued severance expenses related to the departure of two company executives. The company also experienced higher costs from professional fees related to the management transition and cooperation agreement with GP Investments, along with additional contractor expenses. We determined that goodwill related to a 2019 acquisition was impaired, leading to a $4.0

million non-cash charge in the current quarter.

Net loss in the third quarter of 2024 was $8.8 million, or $(0.52) per share, as compared to a net loss of $2.0 million, or $(0.13) per share in the third quarter of 2023, based on 17.0 million and 15.5 million average shares outstanding, respectively.

Adjusted EBITDA (as defined below, a non-GAAP measure management uses as a proxy for operating cash flow) totaled a loss of $2.8 million in the third quarter of 2024, compared with a loss of $1.5 million in the comparative period, decreasing $1.3 million due primarily to lower revenues. Adjusted EBITDA as a percentage of revenue in the third quarter of 2024 was a loss of 32% compared to a loss of 20% in the third quarter of 2023.

We previously announced our commitment to buy $10.0 million of our stock in the open market, subject to some restrictions. On September 30, 2024, we adopted a safe-harbor 10b5-1 plan to purchase the shares without restrictions related to our periodic insider restrictive window, which became active on November 1, 2024, following the required quiet period. As of November 11, 2024, we have purchased 51,503 shares at an average share price of $2.74 under our program for an aggregate investment of $142,273.

As of September 30, 2024, our cash, cash equivalents, and investments totaled $54.4 million. The company has no outstanding long-term debt.

Conference Call

IZEA will hold a conference call to discuss its third quarter 2024 results on Thursday, November 14, 2024, at 5:00 p.m. EST. IZEA's CEO Patrick Venetucci and CFO Peter Biere will host the call, followed by a question and answer period.

Date: Thursday, November 14, 2024

Time: 5:00 p.m. EST

Toll-free dial-in number: 1-877-407-4018

International dial-in number: 1-201-689-8471

Please call the conference telephone number five (5) minutes before the start time. An operator will register your name and organization. A call replay will be made available approximately 3 hours after the conference ends until Thursday, November 21, 2024, at 11:59 p.m. EST.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13749635

About IZEA Worldwide, Inc.

IZEA Worldwide, Inc. (“IZEA”), is a marketing technology company providing software and professional services that enable brands to collaborate and transact with the full spectrum of today’s top social influencers and content creators. The company serves as a champion for the growing Creator Economy, enabling individuals to monetize their content, creativity, and influence. IZEA launched the industry’s first-ever influencer marketing platform in 2006 and has since facilitated nearly 4 million transactions between online buyers and sellers. Leading brands and agencies partner with IZEA to increase digital engagement, diversify brand voice, scale content production, and drive a measurable return on investment.

Use of Key Metrics and Non-GAAP Financial Measures

Managed Services bookings measure all sales orders received during a period less cancellations received, or refunds given during the same period. Sales order contracts vary in complexity with each customer and range from custom content delivery to integrated marketing services; our contracts generally run from several months for smaller contracts to twelve months for larger contracts. We recognize revenue from our Managed Services contracts based on a percentage of completion basis as we deliver the content or services over time, which can vary greatly from a few weeks to a year. For this reason, Managed Services bookings, while an overall indicator of the health of our business, may not be used to predict quarterly revenues and could be subject to future adjustments.

Managed Services bookings is a useful metric as it reflects the amount of orders received in one period, even though revenue may be reflected over time. Management uses the Managed Services bookings metric to plan its operating staff, identify key customer group trends, enlighten go-to-market activities, and inform its product development efforts.

"Adjusted EBITDA" is a non-GAAP financial measure under the Securities and Exchange Commission rules. EBITDA is

commonly defined as "earnings before interest, taxes, depreciation, and amortization." IZEA defines “Adjusted EBITDA” as earnings or loss before interest, taxes, depreciation and amortization, non-cash stock-based compensation, gain or loss on asset disposals or impairment, and certain other unusual or non-cash income and expense items such as gains or losses on settlement of liabilities and exchanges, and changes in the fair value of derivatives, if applicable.

We believe that Adjusted EBITDA provides useful information to investors as it primarily excludes non-cash transactions, and it provides consistency to facilitate period-to-period comparisons.

All companies do not calculate bookings and Adjusted EBITDA in the same manner. These metrics and financial measures, as presented by IZEA, may not be comparable to those presented by other companies. Moreover, these metrics and financial measures have limitations as analytical tools. You should not consider them in isolation or as a substitute for an analysis of our results of operations as reported under GAAP. A reconciliation of adjusted EBITDA to the most directly comparable GAAP measure is presented in the financial tables included in this press release.

Safe Harbor Statement

All statements in this release that are not based on historical fact are “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies, and expectations, can generally be identified by the use of forward-looking terms such as “may,” “will,” “would,” “could,” “should,” “expect,” “anticipate,” “hope,” “estimate,” “optimistic,” “believe,” “intend,” “ought to,” "likely," "projects," “plans,” "pursue," "strategy" or "future," or the negative of these words or other words or expressions of similar meaning. Examples of forward-looking statements include, among others, statements we make regarding expectations concerning product development and platform launches, future financial performance and operating results, including regarding recognition of bookings as revenues, the share repurchase authorization and any use of such authorization, growth, or maintenance of customer relationships, and expectations concerning IZEA’s business strategy. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements as a result of various factors, including, among others, the following: competitive conditions in the content and social sponsorship segment in which IZEA operates; failure to popularize one or more of the marketplace platforms of IZEA; our ability to maintain disclosure controls and procedures and internal control over financial reporting; our ability to satisfy the requirements for continued listing of our common stock on the Nasdaq Capital Market; changing economic conditions that are less favorable than expected; and other risks and uncertainties described in IZEA’s periodic reports filed with the Securities and Exchange Commission. The forward-looking statements made in this release speak only as of the date of this release, and IZEA assumes no obligation to update any such forward-looking statements to reflect actual results or changes in expectations, except as otherwise required by law.

Press Contact

Nicole O'Hara

IZEA Worldwide, Inc.

Phone: 407-674-6911

Email: ir@izea.com

IZEA Worldwide, Inc.

Unaudited Consolidated Balance Sheets

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 45,958,100 | | | $ | 37,446,728 | |

| Accounts receivable, net | 6,488,379 | | | 5,012,373 | |

| Prepaid expenses | 1,640,517 | | | 739,988 | |

| Short term investments | 8,419,252 | | | 17,126,057 | |

| Other current assets | 212,526 | | | 26,257 | |

| Total current assets | 62,718,774 | | | 60,351,403 | |

| | | |

| Property and equipment, net of accumulated depreciation | 136,923 | | | 205,377 | |

| Goodwill | 1,263,337 | | | 5,280,372 | |

| Intangible assets, net of accumulated depreciation | 1,654,958 | | | 1,749,441 | |

| Digital assets | — | | | 162,905 | |

| Software development costs, net of accumulated amortization | 2,361,896 | | | 2,056,972 | |

| Long term investments | — | | | 9,618,996 | |

| Total assets | $ | 68,135,888 | | | $ | 79,425,466 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | 1,276,088 | | | 1,504,348 | |

| Accrued expenses | 4,074,480 | | | 3,083,460 | |

| Contract liabilities | 9,119,560 | | | 8,891,205 | |

| Contingent liability | 41,012 | | | 114,400 | |

| Total current liabilities | 14,511,140 | | | 13,593,413 | |

| | | |

| Finance obligation, less current portion | 18,881 | | | 63,419 | |

| Deferred purchase price, less current portion | 51,015 | | | 60,600 | |

| Deferred tax liability | 265,962 | | | 394,646 | |

| Total liabilities | 14,846,998 | | | 14,112,078 | |

| | | |

| Commitments and Contingencies | — | | | — | |

| | | |

| Stockholders’ equity: | | | |

| Preferred stock; $.0001 par value; 10,000,000 shares authorized; no shares issued and outstanding | — | | | — | |

Common stock; $0.0001 par value; $50,000,000 shares authorized; shares issued: $17,310,106 and $16,602,155, respectively, shares outstanding: $16,922,268 and $16,236,300, respectively. | 1,731 | | | 1,660 | |

Treasury stock at cost: 387,838 and 365,855 shares at September 30, 2024 and December 31, 2023, respectively | (1,077,568) | | | (1,019,997) | |

| Additional paid-in capital | 154,159,944 | | | 152,027,110 | |

| Accumulated deficit | (99,673,791) | | | (85,444,794) | |

| Accumulated other comprehensive income (loss) | (121,426) | | | (250,591) | |

| Total stockholders’ equity | 53,288,890 | | | 65,313,388 | |

| Total liabilities and stockholders’ equity | $ | 68,135,888 | | | $ | 79,425,466 | |

IZEA Worldwide, Inc.

Unaudited Consolidated Statements of Operations

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | Nine Months Ended September 30, |

| 2024 | | 2023 | 2024 | | 2023 |

| Revenue | $ | 8,831,794 | | | $ | 7,894,901 | | $ | 24,878,493 | | | $ | 27,321,682 | |

| | | | | | |

| Costs and expenses: | | | | | | |

| Cost of revenue | 5,210,104 | | | 4,685,437 | | 14,355,679 | | | 16,900,116 | |

| Sales and marketing | 2,879,320 | | | 2,700,301 | | 9,142,590 | | | 7,936,801 | |

| General and administrative | 5,840,027 | | | 3,032,759 | | 12,995,910 | | | 9,604,308 | |

| Impairment of goodwill | 4,016,722 | | | — | | 4,016,722 | | | — | |

| Depreciation and amortization | 239,849 | | | 117,544 | | 669,783 | | | 574,238 | |

| Total costs and expenses | 18,186,022 | | | 10,536,041 | | 41,180,684 | | | 35,015,463 | |

| | | | | | |

| Loss from operations | (9,354,228) | | | (2,641,140) | | (16,302,191) | | | (7,693,781) | |

| | | | | | |

| Other income (expense): | | | | | | |

Change in the fair value of digital assets | (51,702) | | | — | | 28,414 | | | — | |

| Interest expense | (1,654) | | | (1,654) | | (5,654) | | | (6,373) | |

| Other income (expense), net | 605,644 | | | 659,856 | | 1,909,735 | | | 1,877,451 | |

| Total other income (expense), net | 552,288 | | | 658,202 | | 1,932,495 | | | 1,871,078 | |

| | | | | | |

Net loss before income taxes | $ | (8,801,940) | | | $ | (1,982,938) | | $ | (14,369,696) | | | $ | (5,822,703) | |

Tax benefit | 33,621 | | | — | | 140,699 | | | — | |

Net loss | (8,768,319) | | | (1,982,938) | | (14,228,997) | | | (5,822,703) | |

| | | | | | |

| Weighted average common shares outstanding – basic and diluted | 16,956,497 | | | 15,463,334 | | 17,024,645 | | | 15,525,636 | |

| Basic and diluted loss per common share | $ | (0.52) | | | $ | (0.13) | | $ | (0.84) | | | $ | (0.38) | |

IZEA Worldwide, Inc.

Unaudited Consolidated Statements of Comprehensive Loss

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended September 30, | Nine Months Ended September 30, |

| | | | | 2024 | | 2023 | 2024 | | 2023 |

| Net loss | | | | | $ | (8,768,319) | | | $ | (1,982,938) | | $ | (14,228,997) | | | $ | (5,822,703) | |

| | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | |

| Unrealized (gain) loss on securities held | | | | | (84,855) | | | (131,198) | | (235,662) | | | (267,478) | |

| Unrealized (gain) loss on currency translation | | | | | 94,195 | | | — | | 106,497 | | | — | |

| Total other comprehensive income (loss) | | | | | 9,340 | | | (131,198) | | (129,165) | | | (267,478) | |

| | | | | | | | | | |

| Total comprehensive income (loss) | | | | | $ | (8,777,659) | | | $ | (1,851,740) | | $ | (14,099,832) | | | $ | (5,555,225) | |

IZEA Worldwide, Inc.

Revenue Details

Revenue details by type:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | |

| 2024 | 2023 | $ Change | | % Change |

| Managed Services Revenue | $ | 8,625,924 | | 98 | % | $ | 7,837,725 | | 99 | % | $ | 788,199 | | | 10 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| SaaS Services Revenue | 205,870 | | 2 | % | 57,176 | | 1 | % | 148,694 | | | 260 | % |

| | | | | | | |

| Total Revenue | $ | 8,831,794 | | 100 | % | $ | 7,894,901 | | 100 | % | $ | 936,893 | | | 12 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, | |

| 2024 | 2023 | $ Change | | % Change |

| Managed Services Revenue | $ | 24,172,929 | | 97 | % | $ | 26,958,860 | | 99 | % | $ | (2,785,931) | | | (10) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| SaaS Services Revenue | 705,564 | | 3 | % | 362,822 | | 1 | % | 342,742 | | | 94 | % |

| | | | | | | |

| Total Revenue | $ | 24,878,493 | | 100 | % | $ | 27,321,682 | | 100 | % | $ | (2,443,189) | | | (9) | % |

IZEA Worldwide, Inc.

Reconciliation of GAAP Net loss to Non-GAAP Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | Nine Months Ended September 30, |

| 2024 | | 2023 | 2024 | | 2023 |

| Net loss | $ | (8,768,319) | | | $ | (1,982,938) | | $ | (14,228,997) | | | $ | (5,822,703) | |

| Impairment of goodwill and intangible assets | 4,016,722 | | | — | | 4,016,722 | | | — | |

| Adjustment to fair market value of digital assets | 51,702 | | | — | | (28,414) | | | — | |

| Non-cash stock-based compensation | 1,579,236 | | | 239,353 | | 2,328,356 | | | 642,752 | |

| Non-cash stock issued for payment of services | 79,057 | | | 75,003 | | 229,063 | | | 225,012 | |

| Interest expense | 1,654 | | | 1,654 | | 5,654 | | | 6,373 | |

| Depreciation and amortization | 239,849 | | | 117,544 | | 669,783 | | | 574,238 | |

| Other non-cash items | $ | — | | | $ | 304 | | $ | — | | | $ | 304 | |

Tax benefit | $ | (33,621) | | | $ | — | | $ | (140,699) | | | $ | — | |

| Adjusted EBITDA | $ | (2,833,720) | | | $ | (1,549,080) | | $ | (7,148,532) | | | $ | (4,374,024) | |

| | | | | | |

| Revenue | $ | 8,831,794 | | | $ | 7,894,901 | | $ | 24,878,493 | | | $ | 27,321,682 | |

| Adjusted EBITDA as a % of Revenue | (32)% | | (20)% | (29)% | | (16)% |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

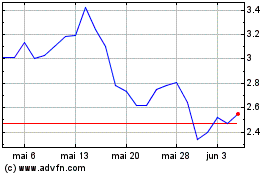

IZEA Worldwide (NASDAQ:IZEA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

IZEA Worldwide (NASDAQ:IZEA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025