false

0000034067

0000034067

2024-11-13

2024-11-13

0000034067

us-gaap:CommonStockMember

2024-11-13

2024-11-13

0000034067

boom:StockPurchaseRightsMember

2024-11-13

2024-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date of

Earliest Event Reported): November 13, 2024

DMC Global Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-14775 |

|

84-0608431 |

|

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(I.R.S.

Employer Identification No.) |

11800 Ridge Parkway, Suite 300, Broomfield,

Colorado 80021

(Address of Principal Executive Offices, Including

Zip Code)

(303) 665-5700

(Registrant’s Telephone Number, Including

Area Code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of exchange on which registered |

| Common Stock, $0.05 Par Value |

|

BOOM |

|

The Nasdaq Global Select Market |

| Stock Purchase Rights |

|

true |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On November 13, 2024, in order to reward,

retain and further incentivize certain members of the leadership team of DMC Global Inc. (the “Company”) and to continue to

maintain a strong emphasis on long-term shareholder value creation, the Compensation Committee of the Board of Directors of the Company

approved a special retention grant for each of (i) Eric Walter, Chief Financial Officer of the Company, and (ii) Michelle Shepston,

Executive Vice President, Chief Legal Officer and Secretary of the Company, respectively (each, a “Retention Grant”). Each

Retention Grant, which consists 50% of restricted stock and 50% of cash, has a grant date value equal to one times the respective officer’s

base salary and will vest eighteen (18) months from the grant date, subject to the executive officer’s continued service and the

terms of the 2016 Omnibus Incentive Plan and a restricted stock award agreement (the “RSA Retention Agreement”) (with respect

to the restricted stock award) and a cash retention letter agreement (the “Cash Retention Agreement” and together with the

RSA Retention Agreement, the “Retention Agreements”). Capitalized terms used but not defined herein shall have the meanings

ascribed to them in the Retention Agreements.

The

Retention Agreements provide that if the executive officer’s Continuous Service (i) terminates due to the executive

officer’s death or Disability, (ii) is terminated by the Company without Cause, or (iii) is terminated by the executive

officer for Good Reason, while the cash award has not vested or while the shares of restricted stock are subject to a Period of Restriction,

each award shall vest and become free of the forfeiture and transfer restrictions described in the respective Retention Agreement, on

the date of the executive officer’s termination of Continuous Service for such reason.

The

Retention Agreements also provide that if a Change in Control occurs while the cash award has not vested or the shares of restricted

stock are subject to a Period of Restriction, each award shall vest unless the cash award or the restricted stock award is assumed, converted

or replaced by the continuing entity; provided, however, that in the event that the executive officer’s Continuous Service is terminated

by the Company without Cause or by the executive officer for Good Reason within twenty-four (24) months following a Change in Control,

any such assumed, converted or replacement awards shall become immediately vested. The Retention Agreements further provide that each

award shall vest upon the termination of the executive officer’s Continuous Service by the Company without Cause or by the executive

officer for Good Reason within twenty-four (24) months following a Significant Event.

The foregoing description of the Retention Agreements

is only a summary and is qualified in its entirety by the full text of the Retention Agreements, each of which is filed herewith

as Exhibit 10.1 and Exhibit 10.2, respectively, and each of which is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

| Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| |

DMC GLOBAL INC. |

| |

|

| |

By: |

/s/ Michelle Shepston |

| |

|

Name: |

Michelle Shepston |

| |

|

Title: |

Executive Vice President and Chief Legal Officer |

Date: November 19, 2024

Exhibit 10.1

DMC GLOBAL INC.

2016 OMNIBUS INCENTIVE PLAN

RESTRICTED STOCK AWARD AGREEMENT

Notice of Restricted Stock Grant

DMC Global Inc. (the “Company”)

grants to the Grantee named below, in accordance with the terms of the DMC Global Inc. 2016 Omnibus Incentive Plan (the “Plan”)

and the Restricted Stock Award Agreement attached hereto (the “Agreement”), the following number of Shares of Restricted

Stock (the “Restricted Stock”) on the terms set forth below and in the Agreement. All capitalized terms not defined herein

or in the Agreement shall have the meanings given to such terms in the Plan.

GRANTEE: [____]

TOTAL NUMBER

OF

SHARES OF

RESTRICTED STOCK

GRANTED: [____]

DATE OF GRANT: [____], 2024

PERIOD OF

| RESTRICTION: | Subject to the Plan and the Agreement

attached hereto, the Period of Restriction shall lapse, and the Restricted Stock shall vest

and become free of forfeiture and transfer restrictions contained in the Agreement based

on the following: 100% of the Shares of Restricted Stock shall vest on the date that is 18

months from the Date of Grant, subject to the Grantee’s Continuous Service as provided

in the Agreement. |

The Grantee acknowledges receipt of a copy of

the Plan and represents that he or she is familiar with the terms and provisions thereof, and hereby accepts the Agreement attached hereto

subject to all of the terms and provisions thereof. The Grantee has reviewed the Plan, this Notice of Restricted Stock Grant, and the

Agreement in their entirety, has had an opportunity to obtain the advice of counsel prior to executing this Notice of Restricted Stock

Grant and fully understands all provisions hereof and of the Agreement. The Grantee hereby agrees to accept as binding, conclusive and

final all decisions or interpretations of the Committee upon any questions arising under the Plan, this Notice of Restricted Stock Grant,

and the Agreement. The Grantee further agrees to notify the Company upon any change in the residence address on file with the Company.

| GRANTEE: | | DMC

GLOBAL INC. |

| | | |

| By: |

| | By: |

|

| [____] | | Name: |

|

| Date: |

| | Title: |

|

| | | Date: |

|

Restricted Stock Award

Agreement

Section 1. Grant

of Restricted Stock. The Company hereby grants to the Grantee the Restricted Stock set forth in the Notice of Restricted Stock Grant,

subject to the terms, definitions and provisions of the Plan and this Agreement. All terms, provisions, and conditions applicable to

the Restricted Stock set forth in the Plan and not set forth herein are incorporated by reference. To the extent any provision hereof

is inconsistent with a provision of the Plan, the provisions of the Plan will govern. All capitalized terms that are used in this Agreement

and not otherwise defined herein (including Appendix A hereto, which contains certain definitions and is hereby incorporated into

this Agreement) shall have the meanings ascribed to them in the Plan.

Section 2. Termination

of Continuous Service.

If the Grantee’s Continuous

Service is terminated for any reason other than (i) death, (ii) Disability, (iii) termination by the Company without Cause,

or (iv) termination by the Grantee for Good Reason, the Grantee shall, for no consideration, forfeit to the Company the Shares of

Restricted Stock to the extent such Shares are subject to a Period of Restriction at the time of such termination of Continuous Service.

If the Grantee’s Continuous Service (i) terminates due to the Grantee’s death or Disability, (ii) is terminated

by the Company without Cause, or (iii) is terminated by the Grantee for Good Reason, while Shares of Restricted Stock are subject

to a Period of Restriction, the Period of Restriction with respect to such Shares shall lapse, and the Shares shall vest and become free

of the forfeiture and transfer restrictions described herein, on the date of the Grantee’s termination of Continuous Service for

such reason.

Section 3. Effects

of Change in Control or Significant Event.

a. If

a Change in Control occurs while Shares of Restricted Stock are subject to a Period of Restriction, the Period of Restriction with respect

to such Shares shall lapse, and the Shares shall vest and become free of the forfeiture and transfer restrictions described herein, unless

the Awards are assumed, converted or replaced by the continuing entity; provided, however, that in the event that the Grantee’s

Continuous Service is terminated by the Company without Cause or by the Grantee for Good Reason within twenty-four (24) months following

a Change in Control, any such assumed, converted or replacement awards shall become immediately vested.

b. The

Period of Restriction (if any remaining) with respect to the Shares shall lapse and the Shares shall vest and become free of the forfeiture

and transfer restrictions described herein, upon the termination of the Grantee’s Continuous Service by the Company without Cause

or by the Grantee for Good Reason within twenty-four (24) months following a Significant Event.

Section 4. Non-Transferability

of Restricted Stock. Except as otherwise provided in the Plan and this Agreement or as determined by the Committee, the Grantee may

not sell, assign, pledge, exchange, transfer, hypothecate or encumber any Shares of Restricted Stock until the Period of Restriction

set forth in the Notice of Restricted Stock Grant shall lapse.

Section 5. Entire

Agreement. The Plan is incorporated herein by reference. The Plan and this Agreement (including Appendix A) constitute the

entire agreement of the parties with respect to the Shares of Restricted Stock and may not be modified adversely to the Grantee's interest

except by means of a writing signed by the Company and the Grantee.

Section 6. Custody.

As soon as practicable following the Date of Grant, the Shares of Restricted Stock shall be registered in the Grantee’s name

in certificate or book-entry form. If a certificate is issued, it shall bear an appropriate legend referring to the restrictions and

it shall be held by the Company, or its agent, on behalf of the Grantee until the Period of Restriction has lapsed. If the Shares are

registered in book-entry form, the restrictions shall be placed on the book-entry registration. The Grantee may be required to execute

and return to the Company a blank stock power for each Restricted Stock certificate (or instruction letter, with respect to Shares registered

in book-entry form), which will permit transfer to the Company, without further action, of all or any portion of the Restricted Stock

that is forfeited in accordance with this Agreement.

Section 7. Voting

Rights and Dividends. Except for the transfer restrictions, and subject to such other restrictions, if any, as determined by the

Committee, the Grantee shall have all other rights of a holder of Shares, including the right to receive dividends paid (whether in cash

or property) with respect to the Restricted Stock and the right to vote (or to execute proxies for voting) such Shares. Unless otherwise

determined by the Committee, if all or part of a dividend in respect of the Restricted Stock is paid in Shares or any other security

issued by the Company, such Shares or other securities shall be held by the Company subject to the same restrictions as the Restricted

Stock in respect of which the dividend was paid.

Section 8. Release

of Restrictions. Upon the lapse of the Period of Restriction, the Shares of Restricted Stock will be released from the restrictions.

The Company or its designee will notify the Grantee in advance of the release of the restrictions and will make arrangements for the

form in which the released Shares will be issued to the Grantee.

Section 9. Taxes.

Pursuant to Section 17 of the Plan, the Committee shall have the power and the right to deduct or withhold, or require the Grantee

to remit to the Company, an amount sufficient to satisfy any applicable tax withholding requirements applicable to the Shares of Restricted

Stock. The Committee may condition the delivery of such Shares upon the Grantee's satisfaction of such withholding obligations. The Grantee

may elect to satisfy all or part of such withholding requirement by tendering previously-owned Shares or by having the Company withhold

Shares having a Fair Market Value equal to the minimum statutory tax withholding rate that could be imposed on the transaction (or such

other rate that will not result in a negative accounting impact). Such election shall be irrevocable, made in writing, signed by the

Grantee, and shall be subject to any restrictions or limitations that the Committee, in its sole discretion, deems appropriate.

Section 10. Company

Policies to Apply. The sale of any Shares received hereunder is subject to the Company’s policies regulating securities trading

by employees, all relevant federal and state securities laws and the listing requirements of any stock exchange on which the Shares are

then traded. In addition, participation in the Plan and receipt of remuneration as a result of lapse of the Period of Restriction is

subject in all respects to any Company compensation clawback policies that may be in effect from time to time.

Section 11. Miscellaneous

Provisions.

(a) Notice. Any

notice required by the terms of this Agreement shall be given in writing and shall be deemed effective upon personal delivery or upon

deposit with the United States Postal Service, by registered or certified mail, with postage and fees prepaid. Notice shall be addressed

to the Company at its principal executive office and to the Grantee at the address that he or she most recently provided in writing to

the Company.

(b) Securities Laws.

Upon the acquisition of any Shares pursuant to settlement of Restricted Stock, the Grantee shall make or enter into such written representations,

warranties and agreements as the Committee may reasonably request in order to comply with applicable securities laws or with this Agreement.

(c) Choice of Law.

THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF DELAWARE, EXCLUDING ANY CONFLICTS OR

CHOICE OF LAW RULE OR PRINCIPLE THAT MIGHT OTHERWISE REFER CONSTRUCTION OR INTERPRETATION OF THIS AGREEMENT TO THE SUBSTANTIVE LAW OF

ANOTHER JURISDICTION.

(d) Modification or

Amendment. This Agreement may only be modified or amended by written agreement executed by the parties hereto; provided, however,

that the adjustments permitted pursuant to Section 19 and 21(b) of the Plan or as required by any applicable law may be made

without such written agreement.

(e) Severability.

In the event any provision of this Agreement shall be held illegal or invalid for any reason, the illegality or invalidity shall not

affect the remaining provisions of this Agreement, and this Agreement shall be construed and enforced as if such illegal or invalid provision

had not been included.

(f) Counterparts.

This Agreement may be executed in two or more counterparts each of which shall be deemed an original, but all of which together shall

constitute one and the same instrument.

(g) References to Plan.

All references to the Plan shall be deemed references to the Plan as may be amended.

(h) Headings. The

captions used in this Agreement are inserted for convenience and shall not be deemed a part of this Agreement for construction or interpretation.

(i) Interpretation.

Any dispute regarding the interpretation of this Agreement shall be submitted by the Grantee or by the Company forthwith to the Board

or the Committee, which shall review such dispute at its next regular meeting. The resolution of such dispute by the Committee shall

be final and binding on all persons.

Appendix A

For purposes of this Agreement, the following

definitions shall apply:

| a. | “Arcadia Issuance”

means any issuance by the Company of (i) its stock in payment of the purchase price

for all or any portion (in one or more transactions) of the ownership interest in Arcadia

Products, LLC, a Colorado limited liability company (“Arcadia”), not owned

by the Company or its affiliate DMC Korea Inc., including (without limitation) in connection

with the “Put Option” (as defined in that certain Second Amended and Restated

Limited Liability Company Agreement of Arcadia (as the same may be amended, modified or supplemented));

or (ii) its stock upon conversion into shares of the Company’s common stock of

any stock issued as contemplated by clause (i) of this paragraph. |

| b. | “Disability” means

the Grantee’s entitlement to long-term disability benefits pursuant to the long-term

disability plan maintained by the Company or in which the Company’s employees participate. |

| c. | “Good Reason” means

the occurrence of any of the following without the Grantee’s written consent: (i) a

material reduction in the Grantee’s base salary; (ii) any material and adverse

change in the Grantee’s office or title, reporting relationship(s), authority, duties

or responsibilities to the Company; (iii) any assignment of duties that are materially

and adversely inconsistent with and result in a diminution of the Grantee’s position

and duties with the Company; or (iv) the Company requires that the Participant relocate

his or her principal residence and/or principal workplace by a distance of more than 50 miles

from the location of the Participant’s then-current principal residence or principal

workplace address, it being expressly understood that compliance with the terms of any workplace

location and travel or similar provisions in a Participant’s offer letter or employment

agreement shall not constitute Good Reason. Notwithstanding the foregoing, no event shall

constitute Good Reason unless (i) the Grantee notifies the Board of Directors in writing

of his or her intention to terminate for Good Reason (describing the condition(s) that

the Grantee has determined constitute Good Reason) within thirty (30) days after the Grantee

knows or has reason to know of the occurrence of any such event, (ii) the Company does

not cure said condition within fifteen (15) days after its receipt of the Grantee’s

written notice, and (iii) in the event the Company does not cure said condition, the

Grantee terminates his or her employment within thirty (30) days after the period for curing

said condition has expired. The Grantee’s determination of the existence of Good Reason

shall be conclusive in the absence of fraud, bad faith or manifest error. |

| d. | “Significant Event”

means the occurrence of either of the following: |

(i) The

acquisition by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act

(a “Person”) of beneficial ownership of at least 25% of either (1) the then

outstanding shares of common stock of the Company (the “Outstanding Company Common Stock”) or (2) the combined

voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors (the “Outstanding

Company Voting Securities”); provided, however, that the following acquisitions shall not constitute a Significant Event: (1) any

acquisition directly from the Company other than an Arcadia Issuance, (2) any acquisition by the Company, including any acquisition

which, by reducing the number of shares outstanding, is the sole cause for increasing the percentage of shares beneficially owned by

any such Person to more than the applicable percentage set forth above, (3) any acquisition by any employee benefit plan (or related

trust) sponsored or maintained by the Company or any corporation controlled by the Company, or (4) any acquisition by any corporation

pursuant to a transaction which complies with clauses (i), (ii) and (iii) of section (c) of the definition of Change in

Control.

(ii) Individuals

(other than the individual appointed in accordance with that certain Cooperation Agreement dated March 14, 2024 between the Company

and Bradley L. Radoff) who, as of the date hereof, constitute the board of directors of the Company

(the “Qualified Board”) cease for any reason within any period of 24 months to constitute at least a majority of the

Board; provided, however, that any individual becoming a director subsequent to the date hereof whose election, or nomination for election

by the Company’s stockholders, was approved by a vote of at least a majority of the directors then comprising the Qualified Board,

shall be considered as though such individual were a member of the Qualified Board, but excluding, for this purpose, any such individual

whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal

of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the board of directors

of the Company.

For purposes

of determining whether a Significant Event has occurred, with respect to any Person, for all purposes of this Agreement, any calculation

of the number of shares of common stock or voting securities outstanding at any particular time, including for purposes of determining

the particular percentage of the outstanding shares of common stock or voting securities of which such Person is the beneficial owner

for purposes of section (d)(i) of this Appendix A, shall include the number of shares of common

stock or voting securities not outstanding at the time of such calculation that such Person is otherwise deemed to beneficially own for

purposes of this Agreement, including (without limitation) shares issued or issuable in connection with an Arcadia Issuance; provided,

however, that the number of shares of common stock or voting securities not outstanding that such Person is otherwise deemed to beneficially

own for purposes of this Agreement shall not be included for the purpose of computing the percentage of the outstanding shares of common stock

or voting securities beneficially owned by any other Person (unless such other Person is also deemed to beneficially own, for purposes

of this Agreement, such shares of common stock or voting securities not outstanding).

A Person shall be deemed the “beneficial

owner”, and to have “beneficial ownership” of, and to “beneficially own”, any securities

as to which such Person or any of such Person’s affiliates or associates is or may be deemed to be the beneficial owner, directly

or indirectly, pursuant to Rules 13d-3 and 13d-5 under the Exchange Act. As used in this definition of “Significant Event”,

the terms “affiliate” and “associate” have the meanings ascribed to them in Rule 12b-2 under

the Exchange Act.

Exhibit 10.2

DMC GLOBAL INC.

CASH RETENTION LETTER AGREEMENT

NOTICE OF GRANT

This Cash Retention Letter

Agreement (this “Agreement”) is made as of the Agreement Date between DMC Global Inc. (the “Company”),

a Delaware corporation, and the Grantee.

I. Agreement Date

II. Grantee Information

| |

|

|

| Grantee: |

[_____] |

| |

|

| Grantee Address: |

|

III. Grant Information

| |

|

|

| Grant Date: |

[_____], 2024 |

| Amount of Cash Retention Award: |

|

IV. Vesting Table

| |

|

|

| Vesting Date |

Amount of Cash Retention Award that Vests |

| Cliff vest on the date that is 18 months from the Grant Date |

100% |

This Agreement includes this

Notice of Grant and the following Exhibit, which is expressly incorporated by reference in its entirety herein:

Exhibit

A – General Terms and Conditions

IN WITNESS WHEREOF, the parties

hereto have executed this Agreement as of the Agreement Date.

| DMC Global Inc. | |

Grantee: |

|

| By: |

| |

Name: |

|

| Name: |

| |

|

|

| Title: |

| |

|

|

EXHIBIT A

GENERAL

TERMS AND CONDITIONS

For valuable consideration,

receipt of which is acknowledged, the parties hereto agree as follows:

| 1. | Grant

of Cash Retention Award. |

In consideration of services

rendered and to be rendered to the Company by the Grantee, the Company has granted to the Grantee a cash retention award (the “Award”),

which represents the right to receive a cash amount equal to the amount set forth in the Notice of Grant upon vesting of the Award, subject

to the terms and conditions set forth herein. All capitalized terms that are used in this Agreement and not otherwise defined herein (including

Appendix A hereto, which contains certain definitions and is hereby incorporated into this Agreement) shall have the meanings ascribed

to them in the DMC Global, Inc. 2016 Omnibus Incentive Plan.

The Award shall vest in accordance

with the Vesting Table set forth in the Notice of Grant (the “Vesting Table”). Upon the vesting of the Award, the Company

will pay to the Grantee an amount in cash equal to the amount set forth in the Notice of Grant, subject to the payment of any taxes pursuant

to Section 6, which amount will be payable to the Grantee in a single lump sum within thirty (30) days of the vesting date.

| 3. | Termination

of Continuous Service. |

If the Grantee’s Continuous

Service is terminated for any reason other than (i) death, (ii) Disability, (iii) termination by the Company without Cause, or (iv) termination

by the Grantee for Good Reason, the Grantee shall, for no consideration, forfeit to the Company the Award to the extent the Award has

not vested. If the Grantee’s Continuous Service (i) terminates due to the Grantee’s death or Disability, (ii) is terminated

by the Company without Cause, or (iii) is terminated by the Grantee for Good Reason, while the Award have not vested, the Award shall

vest and become free of the forfeiture restrictions described herein, on the date of the Grantee’s termination of employment with

the Company.

| 4. | Effects

of Change in Control or Significant Event. |

a.

If a Change in Control occurs while the Award has not vested, the Award shall vest and become free of the forfeiture restrictions

described herein, unless the Award is assumed, converted or replaced by the continuing entity; provided, however, that in the event that

the Grantee’s Continuous Service is terminated by the Company without Cause or by the Grantee for Good Reason within twenty-four

(24) months following a Change in Control, any such assumed, converted or replacement awards shall become immediately vested.

b. The Award shall vest and become free of the forfeiture restrictions described herein, upon the termination of the Grantee’s

Continuous Service by the Company without Cause or by the Grantee for Good Reason within twenty-four (24) months following a Significant

Event.

| 5. | Restrictions

on Transfer. |

The

Grantee shall not sell, assign, transfer, pledge, hypothecate or otherwise dispose of, by operation of law or otherwise (collectively

“transfer”) the Award, or any interest therein. The Company shall not be required to pay any cash amounts to,

any transferee to whom such Award have been transferred in violation of any of the provisions of this Agreement.

a. Acknowledgments The Grantee acknowledges that he or she is responsible for obtaining the advice of the Grantee’s own

tax advisors with respect to the Award, and the Grantee is relying solely on such advisors and not on any statements or representations

of the Company or any of its agents with respect to the tax consequences relating to the Award. The Grantee understands that the Grantee

(and not the Company) shall be responsible for the Grantee’s tax liability that may arise in connection with the acquisition, vesting,

and payment of the Award.

b. Withholding. The Grantee acknowledges and agrees that the Company has the right to deduct from payments of the Award otherwise

due to the Grantee any federal, state, local or other taxes of any kind required by law to be withheld with respect to the vesting and/or

payment of the Award.

a. Authority

of Compensation Committee. In making any decisions or taking any actions with respect to the matters covered by this Agreement, the

Compensation Committee shall have all of the authority and discretion. All decisions and actions by the Compensation Committee with respect

to this Agreement shall be made in the Compensation Committee’s discretion and shall be final and binding on the Grantee.

b. No

Right to Continued Service. The Grantee acknowledges and agrees that, notwithstanding the fact that the vesting of the Award is contingent

upon his or her continued service to the Company, this Agreement does not constitute an express or implied promise of continued service

relationship with the Grantee or confer upon the Grantee any rights with respect to a continued service relationship with the Company.

c.

No Right to Interest. The Grantee acknowledges and agrees that no interest shall accrue on any of the Award that has not

vested or has not been paid to the Grantee.

d. Section

409A. The Award awarded pursuant to this Agreement are intended to be exempt from or comply with the requirements of Section 409A

of the Internal Revenue Code of 1986, as amended, and the Treasury Regulations issued thereunder (“Section 409A”).

The payment of cash on the vesting of the Award may not be accelerated or deferred unless permitted or required by Section 409A.

e. Grantee’s Acknowledgements. The Grantee acknowledges that he or she: (i) has read this Agreement; (ii) has been represented

in the preparation, negotiation and execution of this Agreement by legal counsel of the Grantee’s own choice or has voluntarily

declined to seek such counsel; (iii) understands the terms and consequences of this Agreement; and (iv) is fully aware of the legal and

binding effect of this Agreement.

f. Governing

Law. This Agreement shall be construed, interpreted and enforced in accordance with the internal laws of the State of Delaware without

regard to any applicable conflicts of laws provisions.

[signature page follows]

I hereby acknowledge that

I have read this Agreement, have received and read the Plan, and understand and agree to comply with the terms and conditions of this

Agreement and the Plan.

Appendix A

For purposes of this Agreement, the following

definitions shall apply:

| a. | “Arcadia Issuance” means any issuance by the Company of (i) its stock in payment of

the purchase price for all or any portion (in one or more transactions) of the ownership interest in Arcadia Products, LLC, a Colorado

limited liability company (“Arcadia”), not owned by the Company or its affiliate DMC Korea Inc., including (without

limitation) in connection with the “Put Option” (as defined in that certain Second Amended and Restated Limited Liability

Company Agreement of Arcadia (as the same may be amended, modified or supplemented)); or (ii) its stock upon conversion into shares of

the Company’s common stock of any stock issued as contemplated by clause (i) of this paragraph. |

| b. | “Disability” means the Grantee’s entitlement to long-term disability benefits

pursuant to the long-term disability plan maintained by the Company or in which the Company’s employees participate. |

| c. | “Good Reason” means the occurrence of any of the following without the Grantee’s

written consent: (i) a material reduction in the Grantee’s base salary; (ii) any material and adverse change in the Grantee’s

office or title, reporting relationship(s), authority, duties or responsibilities to the Company; (iii) any assignment of duties that

are materially and adversely inconsistent with and result in a diminution of the Grantee’s position and duties with the Company;

or (iv) the Company requires that the Participant relocate his or her principal residence and/or principal workplace by a distance of

more than 50 miles from the location of the Participant’s then-current principal residence or principal workplace address, it being

expressly understood that compliance with the terms of any workplace location and travel or similar provisions in a Participant’s

offer letter or employment agreement shall not constitute Good Reason. Notwithstanding the foregoing, no event shall constitute Good Reason

unless (i) the Grantee notifies the Board of Directors in writing of his or her intention to terminate for Good Reason (describing the

condition(s) that the Grantee has determined constitute Good Reason) within thirty (30) days after the Grantee knows or has reason to

know of the occurrence of any such event, (ii) the Company does not cure said condition within fifteen (15) days after its receipt of

the Grantee’s written notice, and (iii) in the event the Company does not cure said condition, the Grantee terminates his or her

employment within thirty (30) days after the period for curing said condition has expired. The Grantee’s determination of the existence

of Good Reason shall be conclusive in the absence of fraud, bad faith or manifest error. |

| d. | “Significant Event” means the occurrence of either of the following: |

(i) The

acquisition by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act (a “Person”)

of beneficial ownership of at least 25% of either (1) the then outstanding shares of common stock

of the Company (the “Outstanding Company Common Stock”) or (2) the combined voting power of the then outstanding voting

securities of the Company entitled to vote generally in the election of directors (the “Outstanding Company Voting Securities”);

provided, however, that the following acquisitions shall not constitute a Significant Event: (1) any acquisition directly from the Company

other than an Arcadia Issuance, (2) any acquisition by the Company, including any acquisition which, by reducing the number of shares

outstanding, is the sole cause for increasing the percentage of shares beneficially owned by any such Person to more than the applicable

percentage set forth above, (3) any acquisition by any employee benefit plan (or related trust) sponsored or maintained by the Company

or any corporation controlled by the Company, or (4) any acquisition by any corporation pursuant to a transaction which complies with

clauses (i), (ii) and (iii) of section (c) of the definition of Change in Control.

(ii) Individuals

(other than the individual appointed in accordance with that certain Cooperation Agreement dated March 14, 2024 between the Company and

Bradley L. Radoff) who, as of the date hereof, constitute the board of directors of the Company (the

“Qualified Board”) cease for any reason within any period of 24 months to constitute at least a majority of the Board;

provided, however, that any individual becoming a director subsequent to the date hereof whose election, or nomination for election by

the Company’s stockholders, was approved by a vote of at least a majority of the directors then comprising the Qualified Board,

shall be considered as though such individual were a member of the Qualified Board, but excluding, for this purpose, any such individual

whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal

of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the board of directors

of the Company.

For

purposes of determining whether a Significant Event has occurred, with respect to any Person, for all purposes of this Agreement, any

calculation of the number of shares of common stock or voting securities outstanding at any particular time, including for purposes of

determining the particular percentage of the outstanding shares of common stock or voting securities of which such Person is the beneficial

owner for purposes of section (d)(i) of this Appendix A, shall include the number of shares of common

stock or voting securities not outstanding at the time of such calculation that such Person is otherwise deemed to beneficially own for

purposes of this Agreement, including (without limitation) shares issued or issuable in connection with an Arcadia Issuance; provided,

however, that the number of shares of common stock or voting securities not outstanding that such Person is otherwise deemed to beneficially

own for purposes of this Agreement shall not be included for the purpose of computing the percentage of the outstanding shares of common stock

or voting securities beneficially owned by any other Person (unless such other Person is also deemed to beneficially own, for purposes

of this Agreement, such shares of common stock or voting securities not outstanding).

A Person shall be deemed the “beneficial

owner”, and to have “beneficial ownership” of, and to “beneficially own”, any securities

as to which such Person or any of such Person’s affiliates or associates is or may be deemed to be the beneficial owner, directly

or indirectly, pursuant to Rules 13d-3 and 13d-5 under the Exchange Act. As used in this definition of “Significant Event”,

the terms “affiliate” and “associate” have the meanings ascribed to them in Rule 12b-2 under the

Exchange Act.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=boom_StockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

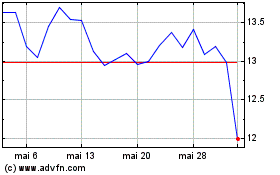

DMC Global (NASDAQ:BOOM)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

DMC Global (NASDAQ:BOOM)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024