false

--09-30

0001435064

0001435064

2024-11-21

2024-11-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 21, 2024

Cemtrex

Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-37464 |

|

30-0399914 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

135

Fell Court

Hauppauge,

NY |

|

11788 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (631) 756-9116

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4I under the Exchange Act (17 CFR 240.13I(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol |

|

Name

of each exchange on which registered |

| Common

Stock |

|

CETX |

|

Nasdaq

Capital Market |

CURRENT

REPORT ON FORM 8-K

Cemtrex,

Inc.

Item

3.03. Material Modification to Rights of Security Holders.

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated

by reference herein.

Item

5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The

Board of Directors of Cemtrex, Inc., a Delaware corporation (the “Company”), has approved a reverse stock split of the Company’s

issued and outstanding shares of common stock, par value $0.001 per share (“Common Stock”), at a ratio of 1-for-35 (the “Reverse

Split”). The Reverse Split will become effective on Tuesday, November 26, 2024 at 12:01 a.m. Eastern Time (the “Effective

Time”).

As

previously disclosed, by written consent dated October 17, 2024, the Company’s stockholders approved the Reverse Split, at a specific

ratio, within a fixed range, to be determined by the Board in its sole discretion.

Reason

for the Reverse Split

The

Company is effecting the Reverse Split in order to regain compliance with the continued listing requirements for the Capital Market of

The Nasdaq Stock Market LLC (“Nasdaq”).

As

previously disclosed, on June 14, 2024, the Company received a notification letter from the Nasdaq Listing Qualifications Department

stating that, for the prior 30 consecutive business days, the closing bid price of the Company’s common stock had been below the

minimum of $1 per share required for continued listing on the Nasdaq Capital Market under Nasdaq Listing Rule 5550(a)(2). The notification

letter stated that the Company would be afforded 180 calendar days (until December 11, 2024) to regain compliance, and that the Company

could be eligible for additional time.

By

effecting the Reverse Split, the Company expects that the closing bid price of the Common Stock will increase above $1 per share. In

order to regain compliance with Nasdaq Listing Rule 5550(a)(2), the closing bid price of the Company’s common stock must remain

above $1 per share for a minimum of ten consecutive business days. Although no assurances can be provided, the Company further believes

that Reverse Split will enable the Company to maintain its Nasdaq listing.

Effects

of the Reverse Split

Effective

Time; Symbol; CUSIP Number

The

Reverse Split will become effective at the Effective Time and the Common Stock will began trading on a split-adjusted basis at the open

of business on November 26, 2024. In connection with the Reverse Split, the CUSIP number for the Common Stock will change to 15130G881.

The trading symbol for the Company’s common stock, “CETX,” will remain unchanged.

Split

Adjustment; Treatment of Fractional Shares

At

the Effective Time, the total number of shares of Common Stock held by each stockholder of the Company will be converted automatically

into the number of shares of Common Stock equal to the number of issued and outstanding shares of Common Stock held by each such stockholder

immediately prior to the Effective Time divided by 35. The Company will issue one whole share of the post-Reverse Split Common Stock

to any stockholder who otherwise would have been entitled to receive a fractional share as a result of the Reverse Split. As a result,

no fractional shares will be issued post-split. For any shareholder that held at least one (1) whole share pre-split on the Effective

Date, any post-split fractional shares will be rounded up to the nearest whole share. For any shareholder that held less than one (1)

share pre-split on the Effective Date, the post-split fractional shares will be rounded down. Any request related to fractional share

handling may be submitted to the Company’s transfer agent, ClearTrust, LLC.

The

principal effect of the Reverse Split will be that (i) the number of shares of common stock issued and outstanding will be reduced to

one-thirty-fifth that amount, and (ii) all outstanding options and warrants (other than the Adjustable Warrants defined below) entitling

the holders thereof to purchase shares of common stock will enable such holders to purchase, upon exercise of their options or warrants,

one-twentieth of the number of shares of common stock which such holders would have been able to purchase upon exercise of their options

or warrants, immediately preceding the Reverse Split at an exercise price equal to 35 times the exercise price specified before the Reverse

Split, resulting in essentially the same aggregate price being required to be paid therefor upon exercise thereof immediately preceding

the Reverse Split. Other awards under our 2020 Equity Compensation Plan would be subject to proportionate adjustments.

We

have outstanding Adjustable Warrants to purchase 19,026,954 shares of common stock at an exercise price of $0.7446 per share (the “Adjustable

Warrants”) that provide that upon the completion of the Reverse Split the exercise price of warrants will be reduced to the lowest

daily volume weighted average price during the five consecutive trading days prior to the date of such Reverse Split and the five consecutive

trading days after the date of such Reverse Split, and the number of warrant shares issuable shall be increased such that the aggregate

exercise price payable thereunder, after taking into account the decrease in the exercise price, shall be equal to the aggregate exercise

price on the date of issuance. This provision will result in the post-split exercise price of the Adjustable Warrants being reduced and

the number of shares of common stock underlying the Adjustable Warrants being significantly increased.

Delaware

State Filing

On

November 21, 2024, the Company filed a Certificate of Amendment to its Certificate of Incorporation (the “Charter Amendment”)

with the Secretary of State of the State of Delaware, pursuant to which, effective at 12:01 a.m. Eastern Time on November 26, 2024, the

Reverse Split will be effected. A copy of the Charter Amendment is attached to this Current Report as Exhibit 3.1 and is incorporated

herein by reference.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CEMTREX,

INC. |

| |

|

| Date:

November 21, 2024 |

By: |

/s/

Saagar Govil |

| |

|

Saagar

Govil |

| |

|

Chairman,

President, and Chief Executive Officer |

Exhibit 3.1

FORM

OF CERTIFICATE OF AMENDMENT TO

CERTIFICATE

OF INCORPORATION

OF

CEMTREX, INC.

Cemtrex,

Inc.

| 2.

|

The

articles have been amended as follows (provide article numbers, if available): |

Fourth

Article:

Effective

at 12:01 a.m. on November 26, 2024 (the “Effective Time”), every thirty-five (35) shares of common stock issued and outstanding

immediately prior to the Effective Time (“Old Common Stock”) shall automatically be combined, without any action on the part

of the holder thereof, into one (1) validly issued, fully paid and non-assessable share of common stock (“New Common Stock”),

subject to the treatment of fractional share interests as described below (the “Reverse Stock Split”). No fractional shares

of common stock shall be issued in connection with the Reverse Stock Split. No stockholder of the Corporation shall transfer any fractional

shares of common stock. The Corporation shall not recognize on its stock record books any purported transfer of any fractional share

of common stock. No certificates representing fractional shares of New Common Stock will be issued in connection with the Reverse Stock

Split. Holders prior to the Reverse Stock Split who have held at least (1) one whole share of common stock and who otherwise would be

entitled to receive fractional share interests of New Common Stock because they hold a number of shares not evenly divisible by the Reverse

Stock Split ratio will automatically be entitled to receive an additional fraction of a share of New Common Stock to round up to the

next whole share of New Common Stock in lieu of any fractional share created as a result of such Reverse Stock Split. On the other hand,

holders prior to the Reverse Stock Split who have held less than one (1) whole share of common stock shall not be entitled to receive

an additional fraction of a share and will be automatically rounded down. Each certificate that immediately prior to the Effective Time

represented shares of Old Common Stock (“Old Certificates”), shall thereafter represent that number of shares of New Common

Stock into which the shares of Old Common Stock represented by the Old Certificate shall have been combined.

| 3.

|

The

vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power,

or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required

by the provisions of the articles of incorporation have voted in favor of the amendment is: 348 shares of common stock, 50,000 shares

Series C Preferred Stock and 153,153 shares of Series 1 Preferred Stock, voting as a single class, for 88.43% of the voting capital

of the Corporation. |

| |

|

| 4.

|

Effective

date of filing (optional): to be effective at 12:01 a.m. on November 26, 2024 |

| |

|

| 5.

|

Officer

Signature (Required): |

| /s/

Saagar Govil |

|

| Saagar

Govil, Chairman, President and Executive Officer |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

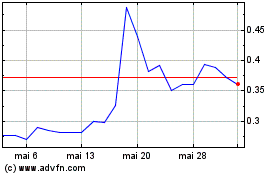

Cemtrex (NASDAQ:CETX)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Cemtrex (NASDAQ:CETX)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024