| Preliminary Pricing Supplement dated November , 2024 |

Subject to Completion

Dated November 22, 2024

|

Registration Statement No. 333-275898

Filed Pursuant to Rule 424(b)(2)

|

Royal

Bank of Canada Airbag Autocallable Yield Notes

$• Notes Linked to the Common Stock of Citigroup Inc. due

on or about December 1, 2025

$• Notes Linked to the Common Stock of Oracle Corporation

due on or about December 1, 2025

The Airbag Autocallable Yield Notes (with respect to an offering, the

“Notes”) are senior unsecured debt securities issued by Royal Bank of Canada linked to the performance of a class of equity

securities of a specific company (with respect to an offering, the “Underlying”). We will pay a monthly Coupon Payment regardless

of the performance of the Underlying. We will automatically call the Notes early if the closing value of the Underlying on any quarterly

Call Observation Date is greater than or equal to the Initial Underlying Value. If the Notes are called, we will pay you the principal

amount of your Notes plus the Coupon Payment otherwise due, and no further amounts will be owed to you under the Notes. If the Notes are

not called prior to maturity and the Final Underlying Value is greater than or equal to the Conversion Price, we will pay you a cash payment

at maturity equal to the principal amount of your Notes plus the Coupon Payment otherwise due. However, if the Final Underlying Value

is less than the Conversion Price, we will pay you the Coupon Payment otherwise due and deliver to you a number of shares of the Underlying

equal to the principal amount per Note divided by the Conversion Price (the “Share Delivery Amount”) for each of your Notes,

which shares will likely worth less than your principal amount and may have no value at all. Investing

in the Notes involves significant risks. The Notes will not be automatically called if the Underlying closes below the Initial Underlying

Value on a quarterly Call Observation Date. You will likely lose some or all of your principal amount if the Final Underlying Value is

less than the Conversion Price. The contingent repayment of principal applies only at maturity. Generally, the higher the Coupon Rate

on a Note, the greater the risk of loss. Any payment on the Notes, including any repayment of principal, is subject to our creditworthiness.

If we default on our payment obligations, you may not receive any amounts owed to you under the Notes and you could lose your entire investment.

The Notes will not be listed on any securities exchange.

| Features |

|

q Coupon Payments — Regardless of the performance of

the Underlying, we will pay you a monthly Coupon Payment.

q Automatically Callable — We will automatically call

the Notes and pay you the principal amount of your Notes plus the Coupon Payment otherwise due if the closing value of the Underlying

on any quarterly Call Observation Date is greater than or equal to the Initial Underlying Value. If the Notes are not called, investors

will have the potential for downside equity market risk at maturity.

q Downside Exposure with Contingent Repayment of Principal at Maturity

— If by maturity the Notes have not been called and the Final Underlying Value is greater than or equal to the Conversion

Price, we will repay the full principal amount at maturity. However, if the Final Underlying Value is less than the Conversion Price,

at maturity we will deliver to you the Share Delivery Amount, which will likely be worth less than the principal amount of the Notes

and may have no value at all. Accordingly, you may lose some or all of the principal amount of the Notes. Any payment on the Notes, including

any repayment of principal, is subject to our creditworthiness.

|

| Trade Date |

November 26, 2024 |

| Settlement Date |

November 29, 2024 |

| Coupon Payment Dates1 |

Monthly (see page 5) |

| Call Observation Dates1 |

Quarterly (see page 5) |

| Final Valuation Date1 |

November 25, 2025 |

| Maturity Date1 |

December 1, 2025 |

| 1 Subject to postponement. See “General Terms of the Notes—Postponement of a Determination Date” and “General Terms of the Notes—Postponement of a Payment Date” in the accompanying product supplement. |

NOTICE TO INVESTORS: THE NOTES ARE SIGNIFICANTLY RISKIER THAN CONVENTIONAL

DEBT INSTRUMENTS. WE ARE NOT NECESSARILY OBLIGATED TO REPAY THE FULL PRINCIPAL AMOUNT OF THE NOTES AT MATURITY, AND THE NOTES CAN HAVE

UP TO THE FULL DOWNSIDE MARKET RISK OF THE UNDERLYING. THIS MARKET RISK IS IN ADDITION TO THE CREDIT RISK INHERENT IN PURCHASING OUR DEBT

OBLIGATIONS. YOU SHOULD NOT PURCHASE THE NOTES IF YOU DO NOT UNDERSTAND OR ARE NOT COMFORTABLE WITH THE SIGNIFICANT RISKS INVOLVED IN

INVESTING IN THE NOTES.

YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER “KEY

RISKS” BEGINNING ON PAGE 6 OF THIS PRICING SUPPLEMENT AND UNDER “RISK FACTORS” IN THE ACCOMPANYING PROSPECTUS, PROSPECTUS

SUPPLEMENT AND PRODUCT SUPPLEMENT BEFORE PURCHASING ANY NOTES. EVENTS RELATING TO ANY OF THOSE RISKS, OR OTHER RISKS AND UNCERTAINTIES,

COULD ADVERSELY AFFECT THE MARKET VALUE OF, AND THE RETURN ON, YOUR NOTES. YOU COULD LOSE SOME OR ALL OF THE PRINCIPAL AMOUNT OF YOUR

NOTES.

We are offering two separate Airbag Autocallable Yield Notes, each linked

to a different Underlying. You may participate in one or more of the offerings. Each offering has its own terms, and references in this

pricing supplement to the Notes, the Underlying or any terms of the Notes apply to each individual offering separately. The performance

of the Notes in an offering will not depend upon the performance of the Notes in any other offering. The Notes will be issued in minimum

denominations of $1,000, and integral multiples of $1,000 in excess thereof. The Initial Underlying Value and Conversion Price for each

offering will be determined and the Coupon Rate for each offering will be set on the Trade Date.

| Underlying |

Coupon Rate |

Initial Underlying Value* |

Conversion Price** |

CUSIP / ISIN |

| Common stock of Citigroup Inc. (C) |

8.25% to 8.75% per annum |

$• |

88% of the Initial Underlying Value |

78017B250 / US78017B2503 |

| Common stock of Oracle Corporation (ORCL) |

9.55% to 10.05% per annum |

$• |

85% of the Initial Underlying Value |

78017B268 / US78017B2685 |

* The closing value of the Underlying on the Trade Date

** Rounded to two decimal places

See “Additional Information about Royal Bank of Canada and

the Notes” in this pricing supplement. The Notes will have the terms specified in the prospectus dated December 20, 2023, the prospectus

supplement dated December 20, 2023, the product supplement no. 1A dated May 16, 2024 and this pricing supplement.

None of the Securities and Exchange Commission (the “SEC”),

any state securities commission or any other regulatory body has approved or disapproved of the Notes or passed upon the adequacy or accuracy

of this pricing supplement. Any representation to the contrary is a criminal offense. The Notes will not constitute deposits insured by

the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other Canadian or U.S. governmental agency

or instrumentality. The Notes are not bail-inable notes and are not subject to conversion into our common shares under subsection 39.2(2.3)

of the Canada Deposit Insurance Corporation Act.

| |

Price to Public |

Fees and Commissions (1) |

Proceeds to Us |

| Offering of the Notes |

Total |

Per Note |

Total |

Per Note |

Total |

Per Note |

| Notes Linked to the Common Stock of Citigroup Inc. |

• |

$1,000 |

• |

$15 |

• |

$985 |

| Notes Linked to the Common Stock of Oracle Corporation |

• |

$1,000 |

• |

$15 |

• |

$985 |

(1) UBS Financial Services Inc., which we refer to as UBS,

will receive a commission of $15 per Note. See “Supplemental Plan of Distribution (Conflicts of Interest)” below.

The initial estimated value of the Notes determined by us as of the

Trade Date, which we refer to as the initial estimated value, is expected to be between $932.00 and $982.00 per Note linked to the common

stock of Citigroup Inc. and between $932.00 and $982.00 per Note linked to the common stock of Oracle Corporation, each of which will

be less than the public offering price of the Notes. The final pricing supplement relating to the Notes will set forth the initial estimated

value. The market value of the Notes at any time will reflect many factors, cannot be predicted with accuracy and may be less than this

amount. We describe the determination of the initial estimated value in more detail below.

| UBS Financial

Services Inc. |

RBC Capital Markets,

LLC |

| Additional Information about Royal Bank of Canada and the Notes |

You may revoke your offer to purchase the Notes at any time prior to

the time at which we accept such offer by notifying the applicable agent. We reserve the right to change the terms of, or reject any offer

to purchase, the Notes prior to their issuance. In the event of any changes to the terms of the Notes, we will notify you and you will

be asked to accept such changes in connection with your purchase. You may also choose to reject such changes, in which case we may reject

your offer to purchase.

You should read this pricing supplement together with the prospectus

dated December 20, 2023, as supplemented by the prospectus supplement dated December 20, 2023, relating to our Senior Global Medium-Term

Notes, Series J, of which the Notes are a part, and the product supplement no. 1A dated May 16, 2024. This pricing supplement, together

with these documents, contains the terms of the Notes and supersedes all other prior or contemporaneous oral statements as well as any

other written materials, including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation,

sample structures, fact sheets, brochures or other educational materials of ours.

We have not authorized anyone to provide any information or to make

any representations other than those contained or incorporated by reference in this pricing supplement and the documents listed below.

We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

These documents are an offer to sell only the Notes offered hereby, but only under circumstances and in jurisdictions where it is lawful

to do so. The information contained in each such document is current only as of its date.

If the information in this pricing supplement differs from the information

contained in the documents listed below, you should rely on the information in this pricing supplement.

You should carefully consider, among other things, the matters set forth

in “Key Risks” in this pricing supplement and “Risk Factors” in the documents listed below, as the Notes involve

risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisers

before you invest in the Notes.

You may access these documents on the SEC website at www.sec.gov

as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

Our Central Index Key, or CIK, on the SEC website is 1000275. As used

in this pricing supplement, “Royal Bank of Canada,” the “Bank,” “we,” “our” and “us”

mean only Royal Bank of Canada.

| Selected Purchase Considerations |

The Notes may be appropriate for you if, among other considerations:

| ¨ | You fully understand the risks inherent in an investment in the Notes, including the risk of loss of your entire initial investment. |

| ¨ | You can tolerate the loss of some or all of the principal amount of the Notes and are willing to make an investment that may have

up to the full downside market risk of the Underlying. |

| ¨ | You believe that the closing value of the Underlying will be greater than or equal to the Conversion Price on the Final Valuation

Date and, if it is not, you can tolerate receiving shares of the Underlying at maturity likely to be worth less than your principal amount

and that may have no value at all. |

| ¨ | You are willing to make an investment whose return is limited to the Coupon Payments paid on the Notes, regardless of any potential

appreciation of the Underlying, which could be significant. |

| ¨ | You are willing to invest in the Notes based on the applicable minimum Coupon Rate set forth on the cover page of this pricing supplement.

(The actual Coupon Rate for each offering will be set on the Trade Date). |

| ¨ | You are willing to forgo dividends or other benefits of owning shares of the Underlying. |

| ¨ | You can tolerate fluctuations in the price of the Notes prior to maturity that may be similar to or exceed the downside fluctuations

in the value of the Underlying. |

| ¨ | You fully understand and accept the risks associated with the Underlying. |

| ¨ | You are willing to invest in Notes that may be called early and you are otherwise willing to hold the Notes to maturity and accept

that there may be little or no secondary market for the Notes. |

| ¨ | You are willing to assume our credit risk for all payments under the

Notes, and understand that if we default on our obligations, you may not receive any amounts due to you, including any repayment of principal. |

The

Notes may not be appropriate for you if, among other considerations:

| ¨ | You do not fully understand the risks inherent in an investment in the Notes, including the risk of loss of your entire initial investment. |

| ¨ | You cannot tolerate the loss of some or all of the principal amount of the Notes, and you are not willing to make an investment that

may have up to the full downside market risk of the Underlying. |

| ¨ | You believe that the closing value of the Underlying will decline during the term of the Notes and is likely to be below the Conversion

Price on the Final Valuation Date. |

| ¨ | You cannot tolerate receiving shares of the Underlying at maturity likely to be worth less than your principal amount and that may

have no value at all. |

| ¨ | You seek an investment that participates in the full appreciation in the value of the Underlying or that has unlimited return potential. |

| ¨ | You are unwilling to invest in the Notes based on the applicable minimum Coupon Rate set forth on the cover page of this pricing supplement.

(The actual Coupon Rate for each offering will be set on the Trade Date). |

| ¨ | You want to receive dividends or other distributions paid on the Underlying. |

| ¨ | You cannot tolerate fluctuations in the price of the Notes prior to maturity that may be similar to or exceed the downside fluctuations

in the value of the Underlying. |

| ¨ | You do not fully understand or accept the risks associated with the Underlying. |

| ¨ | You are unable or unwilling to hold Notes that may be called early, or you are otherwise unable or unwilling to hold the Notes to

maturity, or you seek an investment for which there will be an active secondary market. |

| ¨ | You are not willing to assume our credit risk for all payments under the Notes, including any repayment of principal. |

The considerations identified above are not exhaustive. Whether or

not the Notes are an appropriate investment for you will depend on your individual circumstances, and you should reach an investment decision

only after you and your investment, legal, tax, accounting, and other advisers have carefully considered the appropriateness of an investment

in the Notes in light of your particular circumstances. You should also review carefully the “Key Risks” in this pricing supplement

and “Risk Factors” in the accompanying prospectus, prospectus supplement and product supplement for risks related to an investment

in the Notes. For more information about the Underlying for each offering, see “Information about the Underlyings” below.

| Indicative Terms of the Notes1 |

| Issuer: |

Royal Bank of Canada |

| Principal Amount: |

$1,000 per Note |

| Term: |

Approximately one year, if not previously called |

| Underlyings: |

The common stock of Citigroup Inc. (the “C Underlying”) and the common stock of Oracle Corporation (the “ORCL Underlying”). Each offering is linked to a single Underlying. |

| Coupon Payment: |

We will pay you a Coupon Payment on each Coupon Payment Date, regardless

of the performance of the Underlying.

The Coupon Payment will be a fixed amount based upon equal monthly installments

at the Coupon Rate, which will be a per annum rate as set forth below.

|

| Coupon Rate: |

8.25% to 8.75% per annum (to be set on the Trade Date) for Notes linked

to the common stock of Citigroup Inc.

9.55% to 10.05% per annum (to be set on the Trade Date) for Notes linked

to the common stock of Oracle Corporation

|

| Automatic Call Feature: |

The Notes will be called automatically if the closing value of the Underlying on any Call Observation Date (set forth on page 5) is greater than or equal to the Initial Underlying Value. If the Notes are called, we will pay you on the corresponding Coupon Payment Date (which will be the “Call Settlement Date”) an amount per Note equal to $1,000 plus the Coupon Payment otherwise due. No further amounts will be owed to you under the Notes. |

| Payment at Maturity: |

If the Notes

are not called and the Final Underlying Value is greater than or equal to the Conversion Price, we will pay you at maturity

an amount in cash per Note equal to $1,000 plus the Coupon Payment otherwise due.

If the Notes

are not called and the Final Underlying Value is less than the Conversion Price, we will pay you the Coupon Payment otherwise

due and deliver to you at maturity a number of shares of the Underlying equal to the Share Delivery Amount. Fractional shares will be

paid in cash with a value equal to the number of fractional shares times the Final Underlying Value.

In this scenario, you will receive shares of the Underlying that

will likely be worth less than the principal amount of the Notes and may have a value equal to $0.

|

| Share Delivery Amount: |

A number of shares of the Underlying equal to $1,000 divided by the Conversion Price (rounded to four decimal places) |

| Conversion Price: |

A percentage of the Initial Underlying Value, as specified on the cover of this pricing supplement |

| Initial Underlying Value: |

The closing value of the Underlying on the Trade Date |

| Final Underlying Value: |

The closing value of the Underlying on the Final Valuation Date |

| Calculation Agent: |

RBC Capital Markets, LLC (“RBCCM”) |

| Investment Timeline |

| |

Trade Date: |

|

The Initial Underlying Value, Conversion Price and Share Delivery Amount for each offering are determined and the Coupon Rate for each offering is set. |

|

|

| |

Monthly (including at Maturity): |

|

We will pay you a Coupon Payment on each Coupon Payment Date, regardless of the performance of the Underlying. |

|

|

| |

Quarterly: |

|

The Notes will be called if the closing value of the Underlying on any Call Observation Date is greater than or equal to the Initial Underlying Value. If the Notes are called, we will pay you an amount per Note equal to $1,000 plus the Coupon Payment otherwise due. |

|

|

| |

Maturity Date: |

|

The Final Underlying Value is observed on the Final Valuation Date.

If the Notes

are not called and the Final Underlying Value is greater than or equal to the Conversion Price, we will pay you at maturity

an amount in cash per Note equal to $1,000 plus the Coupon Payment otherwise due.

If the Notes

are not called and the Final Underlying Value is less than the Conversion Price, we will pay you the Coupon Payment otherwise

due and deliver to you at maturity a number of shares of the Underlying equal to the Share Delivery Amount. Fractional shares will be

paid in cash with a value equal to the number of fractional shares times the Final Underlying Value.

In this scenario, you will receive shares of the Underlying that

will likely be worth less than the principal amount of the Notes and may have a value equal to $0.

|

Investing in the Notes involves significant risks. The Notes will

not be automatically called if the Underlying closes below the Initial Underlying Value on a quarterly Call Observation Date. You will

likely lose some or all of your principal amount if the Final Underlying Value is less than the Conversion Price. The contingent repayment

of principal applies only at maturity. Generally, the higher the Coupon Rate on a Note, the greater the risk of loss. Any payment on the

Notes, including any repayment of principal, is subject to our creditworthiness. If we default on our payment obligations, you may not

receive any amounts owed to you under the Notes and you could lose your entire investment.

1 Terms used in this pricing supplement, but not defined

herein, shall have the meanings ascribed to them in the accompanying product supplement.

| Call Observation Dates and Coupon Payment Dates* |

| Call Observation Dates |

Coupon Payment Dates |

| N/A |

December 30, 2024 |

| N/A |

January 29, 2025 |

| February 25, 2025 |

February 27, 2025 |

| N/A |

March 28, 2025 |

| N/A |

April 29, 2025 |

| May 27, 2025 |

May 29, 2025 |

| N/A |

June 30, 2025 |

| N/A |

July 29, 2025 |

| August 27, 2025 |

August 29, 2025 |

| N/A |

September 30, 2025 |

| N/A |

October 31, 2025 |

| November 25, 2025 |

December 1, 2025 |

* Subject to postponement. See “General Terms of the Notes—Postponement

of a Determination Date” and “General Terms of the Notes—Postponement of a Payment Date” in the accompanying product

supplement.

An investment in the Notes involves significant risks. We urge you to

consult your investment, legal, tax, accounting and other advisers before you invest in the Notes. Some of the risks that apply to an

investment in the Notes are summarized below, but we urge you to read also the “Risk Factors” sections of the accompanying

prospectus, prospectus supplement and product supplement. You should not purchase the Notes unless you understand and can bear the risks

of investing in the Notes.

Risks Relating to the Terms and Structure of the Notes

| ¨ | Your Investment in the Notes May Result in a Loss of Principal

— The Notes differ from ordinary debt securities in that we are not necessarily obligated to repay the full principal amount of

the Notes at maturity. If the Notes are not called and the Final Underlying Value is less than the Conversion Price, we will deliver to

you shares of the Underlying that will likely be worth less than the principal amount of the Notes and may have no value at all. Accordingly,

you could lose some or all of the principal amount of the Notes. |

| ¨ | Payments on the Notes Are Subject to Our Credit Risk, and Market Perceptions

about Our Creditworthiness May Adversely Affect the Market Value of the Notes — The Notes are our senior unsecured debt

securities, and your receipt of any amounts due on the Notes is dependent upon our ability to pay our obligations as they come due. If

we were to default on our payment obligations, you may not receive any amounts owed to you under the Notes and you could lose your entire

investment. In addition, any negative changes in market perceptions about our creditworthiness may adversely affect the market value of

the Notes. |

| ¨ | The Contingent Repayment of Principal Applies Only If You Hold the Notes

to Maturity — The contingent repayment of principal applies only at maturity. If you are able to sell your Notes in the

secondary market prior to maturity, you may have to sell them at a loss even if the value of the Underlying is above the Conversion Price

at the time of sale. |

| ¨ | You Will Not Participate in Any Appreciation of the Underlying, and Any

Potential Return on the Notes Is Limited — The return on the Notes is limited to the pre-specified Coupon Rate, regardless

of the appreciation of the Underlying. As a result, the return on an investment in the Notes could be less than the return on a direct

investment in the Underlying. Further, if the Notes are called due to the automatic call feature, you will not receive any Coupon Payments

or any other payment after the applicable Call Settlement Date. Since the Notes could be called as early as the first Call Observation

Date, the total return on the Notes could be minimal. On the other hand, if the Notes have not been previously called and if the value

of the Underlying is less than the Initial Underlying Value, as the Maturity Date approaches and the remaining number of Call Observation

Dates decreases, the Notes are less likely to be automatically called, as there will be a shorter period of time remaining for the value

of the Underlying to increase to the Initial Underlying Value. If the Notes are not called, you will be subject to the Underlying’s

risk of decline. |

| ¨ | The Coupon Rate Reflects in Part the Volatility of the Underlying and May

Not Be Sufficient to Compensate You for the Risk of Loss At Maturity — Volatility is a measure of the degree of variation

in the value of the Underlying over a period of time. The greater the volatility of the Underlying, the more likely it is that the value

of the Underlying could close below the Conversion Price on the Final Valuation Date. This risk is generally reflected in a higher Coupon

Rate for the Notes than the interest rate payable on our conventional debt securities with a comparable term. However, while the Coupon

Payment is a fixed amount, the Underlying’s volatility can change significantly over the term of the Notes. The value of the Underlying

could fall sharply, which could result in a significant loss of your principal amount. |

| ¨ | The Notes May Be Called Early and Are Subject to Reinvestment Risk

— The Notes will be called automatically if the closing value of the Underlying is greater than or equal to the Initial Underlying

Value on any Call Observation Date. In the event that the Notes are called prior to maturity, there is no guarantee that you will be able

to reinvest the proceeds from an investment in the Notes at a comparable rate of return for a similar level of risk. To the extent you

are able to reinvest your proceeds in an investment comparable to the Notes, you will incur transaction costs and the original issue price

for such an investment is likely to include certain built in costs such as dealer discounts and hedging costs. |

| ¨ | Your Return on the Notes May Be Lower Than the Return on a Conventional

Debt Security of Comparable Maturity — The return that you will receive on the Notes, which could be negative, may be

less than the return you could earn on other investments. Even if your return is positive, your return may be less than the return you

would earn if you purchased one of our conventional senior interest-bearing debt securities. |

| ¨ | The Final Payment on the Notes Will Be Determined Based on the Closing

Values of the Underlying on the Dates Specified — The final payment on the Notes will be determined based on the closing

values of the Underlying on the dates specified. You will not benefit from any more favorable value of the Underlying determined at any

other time. |

| ¨ | The Notes Will Be Subject to Risks, Including Non-Payment in Full, under

Canadian Bank Resolution Powers — Under Canadian bank resolution powers, the Canada Deposit Insurance Corporation (“CDIC”)

may, in circumstances |

where we have ceased, or are about to cease, to be viable,

assume temporary control or ownership over us and may be granted broad powers by one or more orders of the Governor in Council (Canada),

including the power to sell or dispose of all or a part of our assets, and the power to carry out or cause us to carry out a transaction

or a series of transactions the purpose of which is to restructure our business. See “Description of Debt Securities—Canadian

Bank Resolution Powers” in the accompanying prospectus for a description of the Canadian bank resolution powers. If the CDIC were

to take action under the Canadian bank resolution powers with respect to us, holders of the Notes could be exposed to losses.

| ¨ | The U.S. Federal Income Tax Consequences of an Investment in the Notes

Are Uncertain — There is no direct legal authority regarding the proper U.S. federal income tax treatment of the Notes,

and significant aspects of the tax treatment of the Notes are uncertain. Moreover, non-U.S. investors should note that persons having

withholding responsibility in respect of the Notes may withhold on any coupon paid to a non-U.S. investor, generally at a rate of 30%.

We will not pay any additional amounts in respect of such withholding. You should review carefully the section entitled “What Are

the Tax Consequences of the Notes?—United States Federal Income Tax Considerations” herein, in combination with the section

entitled “United States Federal Income Tax Considerations” in the accompanying product supplement, and consult your tax adviser

regarding the U.S. federal income tax consequences of an investment in the Notes. |

Risks Relating to the Initial Estimated Value of the Notes and

the Secondary Market for the Notes

| ¨ | There May Not Be an Active Trading Market for the Notes; Sales in the Secondary

Market May Result in Significant Losses — There may be little or no secondary market for the Notes. The Notes will not

be listed on any securities exchange. RBCCM and our other affiliates intend to make a market for the Notes; however, they are not required

to do so and, if they choose to do so, may stop any market-making activities at any time. Because other dealers are not likely to make

a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at

which RBCCM or any of our other affiliates is willing to buy the Notes. Even if a secondary market for the Notes develops, it may not

provide enough liquidity to allow you to easily trade or sell the Notes. We expect that transaction costs in any secondary market would

be high. As a result, the difference between bid and ask prices for your Notes in any secondary market could be substantial. If you sell

your Notes before maturity, you may have to do so at a substantial discount from the price that you paid for them, and as a result, you

may suffer significant losses. The Notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing

to hold your Notes to maturity. |

| ¨ | The Initial Estimated Value of the Notes Will Be Less Than the Public Offering

Price — The initial estimated value of the Notes will be less than the public offering price of the Notes and does not

represent a minimum price at which we, RBCCM or any of our other affiliates would be willing to purchase the Notes in any secondary market

(if any exists) at any time. If you attempt to sell the Notes prior to maturity, their market value may be lower than the price you paid

for them and the initial estimated value. This is due to, among other things, changes in the value of the Underlying, the internal funding

rate we pay to issue securities of this kind (which is lower than the rate at which we borrow funds by issuing conventional fixed rate

debt), and the inclusion in the public offering price of the underwriting discount, our estimated profit and the estimated costs relating

to our hedging of the Notes. These factors, together with various credit, market and economic factors over the term of the Notes, are

expected to reduce the price at which you may be able to sell the Notes in any secondary market and will affect the value of the Notes

in complex and unpredictable ways. Assuming no change in market conditions or any other relevant factors, the price, if any, at which

you may be able to sell your Notes prior to maturity may be less than your original purchase price, as any such sale price would not be

expected to include the underwriting discount, our estimated profit or the hedging costs relating to the Notes. In addition, any price

at which you may sell the Notes is likely to reflect customary bid-ask spreads for similar trades. In addition to bid-ask spreads, the

value of the Notes determined for any secondary market price is expected to be based on a secondary market rate rather than the internal

funding rate used to price the Notes and determine the initial estimated value. As a result, the secondary market price will be less than

if the internal funding rate were used. |

| ¨ | The Initial Estimated Value of the Notes Is Only an Estimate, Calculated

as of the Trade Date — The initial estimated value of the Notes is based on the value of our obligation to make the payments

on the Notes, together with the mid-market value of the derivative embedded in the terms of the Notes. See “Structuring the Notes”

below. Our estimate is based on a variety of assumptions, including our internal funding rate (which represents a discount from our credit

spreads), expectations as to dividends, interest rates and volatility and the expected term of the Notes. These assumptions are based

on certain forecasts about future events, which may prove to be incorrect. Other entities may value the Notes or similar securities at

a price that is significantly different than we do. |

The value of the Notes at any time after the Trade Date will

vary based on many factors, including changes in market conditions, and cannot be predicted with accuracy. As a result, the actual value

you would receive if you sold the Notes in any secondary market, if any, should be expected to differ materially from the initial estimated

value of the Notes.

| ¨ | The Terms of the Notes at Issuance and Their Market Value Prior to Maturity

Are Influenced by Many Unpredictable Factors — Many economic and market factors influence the terms of the Notes at issuance

and affect their value prior to maturity. These factors are similar in some ways to those that could affect the value of a combination

of instruments that might be used to replicate the payments on the Notes, including a combination of a bond with one or more options or

other derivative instruments. For the market value of the Notes, we expect that, generally, the value of the Underlying on any day will

affect the value of the Notes more than any other single factor. However, you should not expect the value of the Notes in the secondary

market to vary in proportion to changes in the value of the Underlying. The value of the Notes will be affected by a number of other factors

that may either offset or magnify each other, including: |

| ¨ | the value of the Underlying; |

| ¨ | whether the value of the Underlying is below the Conversion Price; |

| ¨ | the actual and expected volatility of the Underlying; |

| ¨ | the time remaining to maturity of the Notes; |

| ¨ | the dividend rate on the Underlying; |

| ¨ | interest and yield rates in the market generally, as well as in the markets

of the Underlying; |

| ¨ | a variety of economic, financial, political, regulatory or judicial events;

and |

| ¨ | our creditworthiness, including actual or anticipated downgrades in our credit

ratings. |

Some or all of these factors influence the terms of the Notes

at issuance and affect the price you will receive if you choose to sell the Notes prior to maturity. The impact of any of the factors

set forth above may enhance or offset some or all of any change resulting from another factor or factors.

Risks Relating to Conflicts of Interest and Our Trading Activities

| ¨ | Our, Our Affiliates’ and UBS’s Business and Trading Activities

May Create Conflicts of Interest — You should make your own independent investigation of the merits of investing in the

Notes. Our, our affiliates’ and UBS’s economic interests are potentially adverse to your interests as an investor in the Notes

due to our, our affiliates’ and UBS’s business and trading activities, and we, our affiliates and UBS have no obligation to

consider your interests in taking any actions that might affect the value of the Notes. Trading by us, UBS and our respective affiliates

may adversely affect the value of the Underlying and the market value of the Notes. See “Risk Factors—Risks Relating to Conflicts

of Interest” in the accompanying product supplement. |

| ¨ | RBCCM’s Role as Calculation Agent May Create Conflicts of Interest

— As Calculation Agent, our affiliate, RBCCM, will determine any values of the Underlying and make any other determinations necessary

to calculate any payments on the Notes. In making these determinations, the Calculation Agent may be required to make discretionary judgments,

including those described under “— Risks Relating to the Underlyings” below. In making these discretionary judgments,

the economic interests of the Calculation Agent are potentially adverse to your interests as an investor in the Notes, and any of these

determinations may adversely affect any payments on the Notes. The Calculation Agent will have no obligation to consider your interests

as an investor in the Notes in making any determinations with respect to the Notes. |

Risks Relating to the Underlyings

| ¨ | An Investment in the Notes Is Subject to Single Stock Risk —

The value of the Underlying can rise or fall sharply due to factors specific to the Underlying and its issuer, such as stock price volatility,

earnings, financial conditions, corporate, industry and regulatory developments, management changes and decisions and other events, as

well as general market factors, such as general stock market volatility and levels, interest rates and economic and political conditions.

You, as an investor in the Notes, should make your own investigation into the Underlying issuer and the Underlying for your Notes. For

additional information about the Underlying and its issuer, please see “Information about the Underlyings” in this pricing

supplement and the Underlying issuer’s SEC filings referred to in that section. We urge you to review financial and other information

filed periodically by the Underlying issuer with the SEC. |

| ¨ | You Will Not Have Any Rights to the Underlying — As an

investor in the Notes, you will not have voting rights or rights to receive dividends or other distributions or any other rights with

respect to the Underlying. |

| ¨ | Any Payment on the Notes May Be Postponed and Adversely Affected by the

Occurrence of a Market Disruption Event — The timing and amount of any payment on the Notes is subject to adjustment

upon the occurrence of a market disruption event affecting the Underlying. If a market disruption event persists for a sustained period,

the Calculation Agent may make a discretionary determination of the closing value of the Underlying. See “General Terms of the Notes—Reference

Stocks and Funds—Market Disruption Events,” “General Terms of the Notes—Postponement of a |

Determination Date” and “General Terms of the

Notes—Postponement of a Payment Date” in the accompanying product supplement.

| ¨ | Anti-dilution Protection Is Limited, and the Calculation Agent Has Discretion

to Make Anti-dilution Adjustments — The Calculation Agent may in its sole discretion make adjustments affecting any amounts

payable on the Notes upon the occurrence of certain corporate events (such as stock splits or extraordinary or special dividends) that

the Calculation Agent determines have a diluting or concentrative effect on the theoretical value of the Underlying. However, the Calculation

Agent might not make adjustments in response to all such events that could affect the Underlying. The occurrence of any such event and

any adjustment made by the Calculation Agent (or a determination by the Calculation Agent not to make any adjustment) may adversely affect

the market price of, and any amounts payable on, the Notes. See “General Terms of the Notes—Reference Stocks and Funds—Anti-dilution

Adjustments” in the accompanying product supplement. |

| ¨ | Reorganization or Other Events Could Adversely Affect the Value of the

Notes or Result in the Notes Being Accelerated — Upon the occurrence of certain reorganization or other events affecting

the Underlying, the Calculation Agent may make adjustments that result in payments on the Notes being based on the performance of (i)

cash, securities of another issuer and/or other property distributed to holders of the Underlying upon the occurrence of that event or

(ii) in the case of a reorganization event in which only cash is distributed to holders of the Underlying, a substitute security, if the

Calculation Agent elects to select one. Any of these actions could adversely affect the value of the Underlying and, consequently, the

value of the Notes. Alternatively, the Calculation Agent may accelerate the Maturity Date for a payment determined by the Calculation

Agent. Any amount payable upon acceleration could be significantly less than any amount that would be due on the Notes if they were not

accelerated. However, if the Calculation Agent elects not to accelerate the Notes, the value of, and any amount payable on, the Notes

could be adversely affected, perhaps significantly. See “General Terms of the Notes—Reference Stocks and Funds—Anti-dilution

Adjustments—Reorganization Events” in the accompanying product supplement. |

Hypothetical terms only. Actual terms may vary.

See the cover page for actual offering terms.

The examples are hypothetical and provided for illustrative purposes

only. You should not take these examples as an indication or assurance of the expected performance of the Underlying. The numbers appearing

in the examples and tables below have been rounded for ease of analysis. The following examples and tables illustrate the payment at maturity

or upon an automatic call per Note on a hypothetical offering of the Notes, based on the following hypothetical assumptions:

| Principal Amount: |

$1,000 |

| Term: |

Approximately one year |

| Hypothetical Coupon Rate*: |

6.00% per annum (or 0.50% per month) |

| Hypothetical Coupon Payment*: |

$5.00 per month |

| Coupon Payment Dates: |

Monthly |

| Call Observation Dates: |

Quarterly |

| Hypothetical Initial Underlying Value*: |

$100.00 |

| Hypothetical Conversion Price*: |

$90.00 (which is 90% of the hypothetical Initial Underlying Value) |

| Hypothetical Share Delivery Amount*: |

11.1111 shares per Note ($1,000 / hypothetical Conversion Price of $90.00, rounded to four decimal places) |

* Not the actual Coupon Rate, Initial Underlying Value, Conversion

Price or Share Delivery Amount applicable to the Notes. The actual Initial Underlying Value, Conversion Price and Share Delivery Amount

for each offering will be determined and the actual Coupon Rate for each offering will be set on the Trade Date.

Example 1 — Notes Are Called on the First Call Observation

Date.

| Payment upon Automatic Call: |

$1,005 |

| Prior Coupon Payment: |

$10 ($5 × 2 = $10) |

| Total Payment: |

$1,015 |

| Total Return on the Notes: |

1.50% |

Since the Notes are called on the

first Call Observation Date, we will pay you on the applicable Call Settlement Date a cash payment of $1,005 per Note, reflecting your

principal amount plus the applicable Coupon Payment. When added to the Coupon Payments of $10 paid in respect of the prior Coupon

Payment Dates, we will have paid you a total of $1,015 per Note, for a total return of 1.50% on the Notes. No further amounts will be

owed to you under the Notes.

Example 2 — Notes Are NOT called and the Final Underlying

Value Is at or above the Hypothetical Conversion Price.

| Final Underlying Value: |

$95.00 |

| Payment at Maturity: |

$1,005 |

| Prior Coupon Payment: |

$55 ($5 × 11 = $55) |

| Total Payment: |

$1,060 |

| Total Return on the Notes: |

6.00% |

At maturity, we will pay you a total of $1,005 per Note, reflecting

your principal amount plus the applicable Coupon Payment. When added to the Coupon Payments of $55 paid in respect of the prior

Coupon Payment Dates, we will have paid you a total of $1,060 per Note, for a total return of 6.00% on the Notes.

Example 3 — Notes Are NOT Called and the Final Underlying

Value Is below the Hypothetical Conversion Price.

| Final Underlying Value: |

$45.00 |

| Value of Payment at Maturity: |

$505 (shares of the Underlying with a value of $500 + $5) |

| Prior Coupon Payment: |

$55 ($5 × 11 = $55) |

| Value of the Total Payment: |

$560 |

| Total Return on the Notes: |

-44.00% |

Since the Notes are not called and the Final Underlying Value is less

than the hypothetical Conversion Price of $90.00, we will deliver to you at maturity a number of shares of the Underlying equal to the

Share Delivery Amount with a value, calculated as of the Final Valuation Date based on the Final Underlying Value, of $500 per Note plus

the applicable Coupon Payment otherwise due. When added to the Coupon Payments of $55 paid in respect of the prior Coupon Payment Dates,

we will have paid you (or delivered to you shares of the Underlying equivalent in value) a total of $560 per Note, for a total loss on

the Notes of 44.00%.

The Notes differ from ordinary debt securities in that we are not

necessarily obligated to repay the full principal amount of the Notes at maturity. If the Notes are not called and the Final Underlying

Value is less than the Conversion Price, we will deliver to you shares of the Underlying that will likely be worth less than the principal

amount of the Notes and may have no value at all. Accordingly, you may lose some or all of the principal amount of the Notes.

Your receipt of any amounts due on the Notes is dependent upon our

ability to pay our obligations as they come due. If we were to default on our payment obligations, you may not receive any amounts owed

to you under the Notes and you could lose your entire investment.

| What Are the Tax Consequences of the Notes? |

United States Federal Income Tax Considerations

You should review carefully the sections in the accompanying product

supplement entitled “United States Federal Income Tax Considerations—Tax Consequences to U.S. Holders—Notes Treated

as Put Options and Deposits” and, if you are a Non-U.S. Holder, “—Tax Consequences to Non-U.S. Holders.” The following

discussion, when read in combination with the section entitled “United States Federal Income Tax Considerations” in the accompanying

product supplement, constitutes the full opinion of our counsel, Davis Polk & Wardwell LLP, regarding the material U.S. federal income

tax consequences of owning and disposing of the Notes.

Generally, this discussion assumes that you purchased the Notes for

cash in the original issuance at the stated issue price and does not address other circumstances specific to you, including consequences

that may arise due to any other investments relating to the Underlying. You should consult your tax adviser regarding the effect any such

circumstances may have on the U.S. federal income tax consequences of your ownership of a Note.

Due to the lack of direct legal authority, there is substantial uncertainty

regarding the U.S. federal income tax consequences of an investment in the Notes. In the opinion of our counsel, which is based on current

market conditions, it is reasonable to treat a Note for U.S. federal income tax purposes as a put option (the “Put Option”)

written by you with respect to the Underlying, secured by a cash deposit equal to the stated principal amount of the Note (the “Deposit”),

as described in the section entitled “United States Federal Income Tax Considerations—Tax Consequences to U.S. Holders—Notes

Treated as Put Options and Deposits” in the accompanying product supplement. There is uncertainty regarding this treatment, and

the Internal Revenue Service (the “IRS”) or a court might not agree with it. Moreover, because this treatment of the Notes

and our counsel’s opinion are based on market conditions as of the date of this preliminary pricing supplement, each is subject

to confirmation on the Trade Date. A different tax treatment could be adverse to you.

Under the treatment of a Note as a Put Option and a Deposit, a portion

of each coupon made with respect to the Notes will be attributable to interest on the Deposit, and the remainder will represent premium

attributable to your grant of the Put Option (“Put Premium”). Amounts treated as interest on the Deposit should be taxed as

ordinary interest income, while the Put Premium should not be taken into account until retirement (including an early redemption) or an

earlier taxable disposition. Pursuant to this treatment, set forth below are the portions of each coupon that we have determined should

be treated as attributable to interest on the Deposit and to Put Premium:

| Offering of the Notes |

Coupon Rate per Annum(1) |

Interest on Deposit per Annum(1) |

Put Premium per Annum(1) |

| Notes Linked to the Common Stock of Citigroup Inc. |

% |

% |

% |

| Notes Linked to the Common Stock of Oracle Corporation |

% |

% |

% |

(1) To be provided in the final pricing

supplement

We do not plan to request a ruling from the IRS regarding the treatment

of the Notes. An alternative characterization of the Notes could materially and adversely affect the tax consequences of ownership and

disposition of the Notes, including the timing and character of income recognized. In addition, the U.S. Treasury Department and the IRS

have requested comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and

similar financial instruments and have indicated that such transactions may be the subject of future regulations or other guidance. Furthermore,

members of Congress have proposed legislative changes to the tax treatment of derivative contracts. Any legislation, Treasury regulations

or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment

in the Notes, possibly with retroactive effect.

Non-U.S. Holders. The U.S. federal income tax treatment of the

coupons is unclear. Subject to the discussions in the section of the accompanying product supplement entitled “United States Federal

Income Tax Considerations—Tax Consequences to Non-U.S. Holders” and assuming our treatment of the Notes as a Put Option and

a Deposit is respected, you should not be subject to U.S. federal withholding or income tax in respect of any amount paid to you with

respect to the Notes, provided that (i) income in respect of the Notes is not effectively connected with your conduct of a trade or business

in the United States, and (ii) you comply with the applicable certification requirements.

As discussed under “United States Federal Income Tax Considerations—Tax

Consequences to Non-U.S. Holders—Dividend Equivalents under Section 871(m) of the Code” in the accompanying product supplement,

Section 871(m) of the Internal

Revenue Code and Treasury regulations promulgated thereunder (“Section

871(m)”) generally impose a 30% withholding tax on dividend equivalents paid or deemed paid to Non-U.S. Holders with respect to

certain financial instruments linked to U.S. equities or indices that include U.S. equities. The Treasury regulations, as modified by

an IRS notice, exempt financial instruments issued prior to January 1, 2027 that do not have a “delta” of one. Based on certain

determinations made by us, we expect that Section 871(m) will not apply to the Notes with regard to Non-U.S. Holders. Our determination

is not binding on the IRS, and the IRS may disagree with this determination. If necessary, further information regarding the potential

application of Section 871(m) will be provided in the final pricing supplement for the Notes.

We will not be required to pay any additional amounts with respect to

U.S. federal withholding taxes.

You should consult your tax adviser regarding the U.S. federal income

tax consequences of an investment in the Notes, including possible alternative treatments, as well as tax consequences arising under the

laws of any state, local or non-U.S. taxing jurisdiction.

Canadian Federal Income Tax Consequences

For a discussion of the material Canadian federal income tax consequences

relating to an investment in the Notes, please see the section entitled “Supplemental Discussion of Canadian Tax Consequences”

in the accompanying product supplement, which you should carefully review prior to investing in the Notes.

| Information about the Underlyings |

Each Underlying is registered under the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). Companies with securities registered under the Exchange Act are required to file financial

and other information specified by the SEC periodically. Information provided to or filed with the SEC by the issuer of each Underlying

can be located on a website maintained by the SEC at https://www.sec.gov by reference to that issuer’s SEC file number provided

below. Information from outside sources is not incorporated by reference in, and should not be considered part of, this pricing supplement.

We have not independently verified the accuracy or completeness of the information contained in outside sources.

| Underlying |

Exchange Ticker |

Exchange |

SEC File Number |

| C Underlying |

C |

New York Stock Exchange |

001-09924 |

| ORCL Underlying |

ORCL |

New York Stock Exchange |

001-35992 |

According to publicly available information:

| · | Citigroup Inc. provides consumers, corporations, governments and institutions

with a range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage,

trade and securities services and wealth management. |

| · | Oracle Corporation provides products and services that address enterprise

information technology environments. |

Historical Information

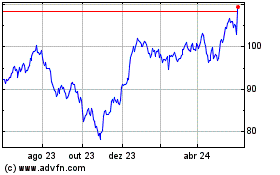

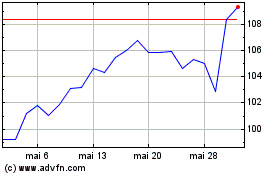

The following graphs set forth historical closing values of the Underlying

for each offering for the period from January 1, 2014 to November 21, 2024. Each solid line represents a hypothetical Conversion Price

based on the closing value of the Underlying on November 21, 2024. We obtained the information in the graphs from Bloomberg Financial

Markets, without independent investigation. The historical performance of the Underlying should not be taken as an indication of its

future performance. We cannot give you assurance that the performance of the Underlying will result in the return of all of your initial

investment.

Common Stock of Citigroup Inc.

n

Hypothetical Conversion Price = 88% of the Hypothetical Initial Underlying Value

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE

RESULTS.

Common Stock of Oracle Corporation

n

Hypothetical Conversion Price = 85% of the Hypothetical Initial Underlying Value

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE

RESULTS.

| Supplemental Plan of Distribution (Conflicts of Interest) |

We have agreed to indemnify UBS and RBCCM against liabilities under

the Securities Act of 1933, as amended, or to contribute payments that UBS and RBCCM may be required to make relating to these liabilities

as described in the prospectus supplement and the prospectus. We have agreed that UBS may sell all or a part of the Notes that it will

purchase from us to investors or to its affiliates at the price to public listed on the cover page of this pricing supplement. UBS may

allow a concession not in excess of the underwriting discount set forth on the cover page of this pricing supplement to its affiliates

for distribution of the Notes.

We or our affiliates may enter into swap agreements or related hedge

transactions with one of our other affiliates or unaffiliated counterparties in connection with the sale of the Notes and RBCCM and/or

an affiliate may earn additional income as a result of payments pursuant to the swap or related hedge transactions. See “Use of

Proceeds and Hedging” in the accompanying product supplement.

The value of the Notes shown on your account statement may be based

on RBCCM’s estimate of the value of the Notes if RBCCM or another of our affiliates were to make a market in the Notes (which it

is not obligated to do). That estimate will be based on the price that RBCCM may pay for the Notes in light of then-prevailing market

conditions, our creditworthiness and transaction costs. For a period of approximately five months after the Settlement Date, the value

of the Notes that may be shown on your account statement may be higher than RBCCM’s estimated value of the Notes at that time. This

is because the estimated value of the Notes will not include the underwriting discount or our hedging costs and profits; however, the

value of the Notes shown on your account statement during that period may initially be a higher amount, reflecting the addition of the

underwriting discount and our estimated costs and profits from hedging the Notes. This excess is expected to decrease over time until

the end of this period. After this period, if RBCCM repurchases your Notes, it expects to do so at prices that reflect their estimated

value. This period may be reduced at RBCCM’s discretion based on a variety of factors, including but not limited to, the amount

of the Notes that we repurchase and our negotiated arrangements from time to time with UBS.

RBCCM or another of its affiliates or agents may use this pricing supplement

in the initial sale of the Notes. In addition, RBCCM or another of our affiliates may use this pricing supplement in a market-making transaction

in the Notes after their initial sale. Unless we or our agent informs the purchaser otherwise in the confirmation of sale, this pricing

supplement is being used in a market-making transaction.

For additional information about the settlement cycle of the Notes,

see “Plan of Distribution” in the accompanying prospectus. For additional information as to the relationship between us and

RBCCM, see the section “Plan of Distribution—Conflicts of Interest” in the accompanying prospectus.

The Notes are our debt securities. As is the case for all of our debt

securities, including our structured notes, the economic terms of the Notes reflect our actual or perceived creditworthiness. In addition,

because structured notes result in increased operational, funding and liability management costs to us, we typically borrow the funds

under structured notes at a rate that is lower than the rate that we might pay for a conventional fixed or floating rate debt security

of comparable maturity. The lower internal funding rate, the underwriting discount and the hedging-related costs relating to the Notes

reduce the economic terms of the Notes to you and result in the initial estimated value for the Notes being less than their public offering

price. Unlike the initial estimated value, any value of the Notes determined for purposes of a secondary market transaction may be based

on a secondary market rate, which may result in a lower value for the Notes than if our initial internal funding rate were used.

In order to satisfy our payment obligations under the Notes, we may

choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives) with RBCCM and/or

one of our other subsidiaries. The terms of these hedging arrangements take into account a number of factors, including our creditworthiness,

interest rate movements, volatility and the tenor of the Notes. The economic terms of the Notes and the initial estimated value depend

in part on the terms of these hedging arrangements.

See “Key Risks—Risks Relating to the Initial Estimated Value

of the Notes and the Secondary Market for the Notes—The Initial Estimated Value of the Notes Will Be Less Than the Public Offering

Price” above.

Royal Bank of Canada (NYSE:RY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Royal Bank of Canada (NYSE:RY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024