As

filed with the Securities and Exchange Commission on November 29, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

SIDUS

SPACE, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

46-0628183 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

150

N. Sykes Creek Parkway, Suite 200

Merritt

Island, FL 32953

(Address

of Principal Executive Offices) (Zip Code)

Sidus

Space, Inc. 2021 Omnibus Equity Incentive Plan

(Full

title of the plan)

Carol

Craig

Chief Executive Officer

Sidus Space, Inc.

150 N. Sykes Creek Parkway, Suite 200

Merritt

Island, FL 32953

(Name

and address of agent for service)

(321)

613-5620

(Telephone

number, including area code, of agent for service)

With

a copy to:

Jeffrey

J. Fessler, Esq.

Sean F. Reid, Esq.

Sheppard, Mullin, Richter & Hampton LLP

30

Rockefeller Plaza

New

York, NY 10012

Telephone:

(212) 653-8700

Facsimile:

(212) 653-8701

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY

NOTE

This

Registration Statement is being filed for the purpose of registering an additional 787,500 shares of Class A common stock that were reserved

for issuance under the Sidus Space, Inc. 2021 Omnibus Equity Incentive Plan (the “2021 Plan”). The Registrant previously

filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-8 on March 2, 2022 (SEC

File No. 333-263227) (the “Prior Registration Statement”), registering 1,250,000 shares of Class A common stock issuable

under the Sidus Space, Inc. 2021 Omnibus Equity Incentive Plan, which amount was reduced to 12,500 shares as a result of the Registrant’s

reverse stock split in December 2023. On June 25, 2024, the Registrant’s stockholders approved an amendment to the 2021 Plan to

increase the number of shares of Class A common stock reserved and available for awards thereunder to 800,000. This Registration Statement

relates to securities of the same class as those to which the Prior Registration Statement relates and is submitted in accordance with

General Instruction E of Form S-8 regarding Registration of Additional Securities. Pursuant to General Instruction E of Form S-8, the

contents of the Prior Registration Statement are incorporated herein by reference and made part of this Registration Statement, except

for Items 3 and 8, which are being updated by this Registration Statement.

PART

II

INFORMATION

NOT REQUIRED IN THE REGISTRATION STATEMENT

ITEM

3. INCORPORATION OF DOCUMENTS BY REFERENCE.

The

following documents filed by the Company with the Securities and Exchange Commission (“SEC”) pursuant to the Securities Act

and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated herein by reference:

| |

● |

The

Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 27, 2024, and

subsequently amended on Form 10-K/A on October 11, 2024; |

| |

|

|

| |

● |

The

Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024, filed

with the SEC on May 20, 2024, August 19, 2024 and November 14, 2024, respectively; |

| |

|

|

| |

● |

The

Company’s Current Reports on Form 8-K filed with the SEC on January 10, 2024, January 24, 2024, February 1, 2024, February 8, 2024, March 5, 2024, May 8, 2024, June 25, 2024, September 3, 2024 and November 12, 2024; |

| |

|

|

| |

● |

The

Company’s definitive proxy statement on Schedule 14A filed with the SEC on April 30, 2024; |

| |

|

|

| |

● |

The

description of our Class A common stock contained in our Registration Statement on Form 8-A12b filed with the SEC on December 10,

2021, and any amendments or reports filed updating such description; and |

| |

|

|

| |

● |

All

other reports and documents filed by the Company pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than Current

Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to such items) subsequent

to the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement that

indicates that all securities offered hereby have been sold or that deregisters all securities then remaining unsold, shall be deemed

to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing such reports and

documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to

be modified or superseded for purposes of this Registration Statement to the extent that a statement herein or in any subsequently

filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement

so modified or superseded shall not constitute a part of this Registration Statement, except as so modified or superseded. |

ITEM

8. EXHIBITS.

See

the attached Exhibit Index on the page immediately following the signature pages hereto, which is incorporated herein by reference.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Merritt Island, State of Florida, on the 29th day of November 2024.

| |

Sidus

Space, Inc. |

| |

|

|

| |

By: |

/s/

Carol Craig |

| |

|

Carol

Craig |

| |

|

Chief

Executive Officer and Chairwoman |

| |

|

(Principal

Executive Officer) |

POWER

OF ATTORNEY

We,

the undersigned officers and directors of Sidus Space, Inc., hereby severally constitute and appoint Carol Craig, our true and lawful

attorney-in-fact and agent, with full power of substitution and resubstitution, for us and in our stead, in any and all capacities, to

sign any and all amendments (including post-effective amendments) to this Registration Statement and all documents relating thereto,

and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission,

granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing necessary or advisable

to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming

all that said attorney-in-fact and agent or his substitute or substitutes, may lawfully do or cause to be done by virtue thereof.

WITNESS

our hands and common seal on the dates set forth below.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed below by the following persons in the

capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Carol Craig |

|

Chief

Executive Officer & Chairwomen |

|

November

29, 2024 |

| Carol

Craig |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Bill White |

|

Chief

Financial Officer |

|

November

29, 2024 |

| Bill

White |

|

(Principal

Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| |

|

Director |

|

November

29, 2024 |

| Dana

Kilborne |

|

|

|

|

| |

|

|

|

|

| /s/

Cole Oliver |

|

Director |

|

November

29, 2024 |

| Cole

Oliver |

|

|

|

|

| |

|

|

|

|

| /s/

Leonardo Riera |

|

Director |

|

November

29, 2024 |

| Leonardo

Riera |

|

|

|

|

| |

|

|

|

|

| /s/

Richard Berman |

|

Director

|

|

November

29, 2024 |

| Richard

Berman |

|

|

|

|

| |

|

|

|

|

| /s/

Jeffrey Shuman |

|

Director |

|

November

29, 2024 |

| Jeffrey

Shuman |

|

|

|

|

| |

|

|

|

|

| |

|

Director |

|

November

29, 2024 |

| Lavanson

C. “LC” Coffey III |

|

|

|

|

EXHIBIT

INDEX

Exhibit

5.1

|

Sheppard,

Mullin, Richter & Hampton LLP

30

Rockefeller Plaza

New

York, New York 10112-0015

212.653.8700

main

212.653.8701

fax

www.sheppardmullin.com |

November

29, 2024

VIA

ELECTRONIC MAIL

Sidus

Space, Inc.

150

N. Sykes Creek Parkway, Suite 200

Merritt

Island, FL 32953

Re:

Registration Statement on Form S-8

Ladies

and Gentlemen:

You

have requested our opinion with respect to certain matters in connection with the filing by Sidus Space, Inc., a Delaware corporation

(the “Company”), of a Registration Statement on Form S-8 (the “Registration Statement”) under the Securities

Act of 1933, as amended (the “Securities Act”), with the U.S. Securities and Exchange Commission (the “Commission”),

covering 787,500 shares (the “Shares”) of the Company’s Class A common stock, par value $0.0001 per share (the “Common

Stock”), which may be issued pursuant to the Company’s 2021 Omnibus Equity Incentive Plan, as amended (the “Plan”).

This

opinion (this “Opinion”) is being furnished in accordance with the requirements of Item 8 of Form S-8 and Item 601(b)(5)(i)

of Regulation S-K.

In

connection with this Opinion, we have reviewed and relied upon the Registration Statement, the Company’s Amended and Restated Certificate

of Incorporation, as in effect on the date hereof (the “Certificate of Incorporation”), the Company’s Amended and Restated

Bylaws, as in effect on the date hereof (the “Bylaws” and together with the Certificate of Incorporation, the “Charter

Documents”), the proceedings taken by the Company with respect to the authorization and adoption of the Plan, resolutions adopted

by the board of directors of the Company, and such other documents, records, certificates, memoranda and other instruments as we deem

necessary as a basis for this Opinion.

With

respect to the foregoing documents, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to

us as originals, and the conformity to the original of all documents submitted to us as certified or reproduced copies. We have also

assumed that the Shares will be uncertificated in accordance with Section 158 of the Delaware General Corporation Law, and the transfer

agent therefor will register the purchaser thereof as the registered owner of any uncertificated Shares on its stock transfer books and

records. We have further assumed that (a) shares of Common Stock currently reserved for issuance under the Plan will remain available

for the issuance of the Shares, and (b) neither the Company’s Charter Documents nor any of the proceedings relating to either the

Plan or any of the award agreements relating to the Shares will be rescinded, amended or otherwise modified prior to the issuance of

the Shares. We have also obtained from public officials and officers of the Company certificates or comparable documents as to certain

factual matters and, insofar as this Opinion is based on matters of fact, we have relied on such certificates and comparable documents

without independent investigation. We have made such other investigations as we have deemed relevant and necessary in connection with

the opinions hereinafter set forth.

On

the basis of the foregoing, and in reliance thereon, we are of the opinion that the Shares, when issued and sold in the manner referred

to in the Plan and against proper payment and consideration thereof and pursuant to the agreements that accompany the Plan, will be legally

and validly issued, fully paid and nonassessable.

Page 2

We

consent to the filing of this Opinion as Exhibit 5.1 to the Registration Statement. In giving such consent, we do not thereby admit that

we are included in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations

of the Commission promulgated thereunder.

We

express no opinion as to matters governed by any laws other than the Delaware General Corporation Law and reported decisions of the Delaware

courts interpreting such law.

This

Opinion is rendered as of the date first written above, and we disclaim any obligation to advise you of facts, circumstances, events

or developments which hereafter may be brought to our attention and which may alter, affect or modify the opinion expressed herein. Our

opinion is expressly limited to the matters set forth above, and we render no opinion, whether by implication or otherwise, as to any

other matters relating to the Company, the Shares, the Plan, the award agreements related to the Shares, or the Registration Statement.

Respectfully

Submitted,

/s/

Sheppard, Mullin, Richter & Hampton LLP

SHEPPARD,

MULLIN, RICHTER & HAMPTON LLP

Exhibit

23.1

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

consent to the incorporation by reference in this Registration Statement on Form S-8 of our audit report dated October 11, 2024 with

respect to the consolidated balance sheets of Sidus Space, Inc. as of December 31, 2023 and 2022, and the related consolidated statements

of operations, stockholders’ equity, and cash flows for each of the years in the two-year period ended December 31, 2023, as filed

with Form 10-K/A on October 11, 2024. Our report relating to those financial statements includes an emphasis of matter paragraph regarding

substantial doubt as to the Company’s ability to continue as a going concern.

Fruci

& Associates II, PLLC – PCAOB ID #05525

Spokane,

Washington

November

29, 2024

Exhibit

107

Calculation

of Filing Fee Tables

Form

S-8

(Form

Type)

Sidus

Space, Inc.

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered Securities

| Security

Type | |

Security

Class Title | |

Fee

Calculation

Rule | |

Amount

Registered(1) | | |

Proposed

Maximum

Offering Price

Per Unit(2) | | |

Maximum

Aggregate

Offering Price | | |

Fee

Rate | | |

Amount

of

Registration Fee | |

| Equity | |

Class

A Common Stock, $0.0001 par value | |

Other | |

| 787,500 | (3) | |

$ | 1.42 | | |

$ | 1,118,250 | | |

| 0.00015310 | | |

$ | 172 | |

| Total Offering Amount | |

| | | |

| | | |

$ | 1,118,250 | | |

| | | |

$ | 172 | |

| Total Fees Previously Paid |

| | | |

| | | |

| | | |

| | | |

| — | |

| Total Fee Offsets | |

| | | |

| | | |

| | | |

| | | |

| — | |

| Net Fee Due | |

| | | |

| | | |

| | | |

| | | |

$ | 172 | |

| (1) |

Pursuant

to Rule 416(a) under the Securities Act, this Registration Statement shall also cover an indeterminate number of additional shares

of Common Stock of the Registrant which become issuable under the Registrant’s 2021 Omnibus Equity Incentive Plan (as amended,

the “2021 Plan”) by reason of any stock dividend, stock split, recapitalization or other similar transaction that increases

the number of outstanding shares of Common Stock. |

| |

|

| (2) |

Estimated

solely for purposes of calculating the registration fee pursuant to Rules 457(c) and 457(h) of the Securities Act of 1933, as amended

(the “Securities Act”), by averaging the high and low sales prices of Amesite Inc.’s (the “Registrant’s”)

Class A common stock, par value $0.0001 per share (“Common Stock”), as reported on The Nasdaq Capital Market on November

26, 2024, which date is within five business days prior to the filing of this Registration Statement. |

| |

|

| (3) |

Represents

787,500 additional shares of Common Stock available for issuance under the 2021 Plan. On June 25, 2024, at the Registrant’s

2024 annual meeting of shareholders, the shareholders of the Registrant approved an increase in the number of shares reserved under

the 2021 Plan to 800,000 shares. |

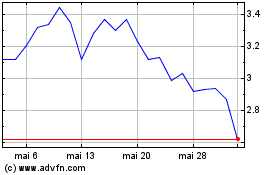

Sidus Space (NASDAQ:SIDU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Sidus Space (NASDAQ:SIDU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024