false

0000029534

0000029534

2024-12-05

2024-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): December 5, 2024

| DOLLAR GENERAL CORPORATION |

| (Exact name of registrant as specified in its charter) |

| Tennessee |

|

001-11421 |

|

61-0502302 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

100 MISSION RIDGE

GOODLETTSVILLE, TN |

|

37072 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (615) 855-4000

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on

which registered |

| Common Stock, par value $0.875 per share |

DG |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION. |

On

December 5, 2024, Dollar General Corporation (the “Company”) issued a news release regarding results of operations

and financial condition for the fiscal 2024 third quarter (13 weeks) ended November 1, 2024. The news release is furnished as Exhibit

99 hereto and is incorporated herein by reference.

The information contained

within this Item 2.02, including the information in Exhibit 99, shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference into any filing under the Securities

Act of 1933, as amended.

| ITEM 7.01 | REGULATION FD DISCLOSURE. |

The information set forth

in Item 2.02 above is incorporated herein by reference. The news release also:

| · | sets

forth statements regarding, among other things, the Company’s outlook, as well as the

Company’s planned conference call to discuss the reported financial results, the Company’s

outlook, and certain other matters; and |

| · | announces

that on December 4, 2024, the Board declared a quarterly cash dividend of $0.59 per share

on the Company’s outstanding common stock payable on or before January 21, 2025 to

shareholders of record on January 7, 2025. |

The information contained

within this Item 7.01, including the information in Exhibit 99, shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference into any filing under the Securities

Act of 1933, as amended.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS. |

| (a) | Financial statements of businesses acquired. N/A |

| (b) | Pro forma financial information. N/A |

| (c) | Shell company transactions. N/A |

| (d) | Exhibits. See Exhibit Index to this report. |

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: December 5, 2024 |

DOLLAR GENERAL CORPORATION |

| |

|

|

| |

By: |

/s/ Rhonda M. Taylor |

| |

|

Rhonda M. Taylor |

| |

|

Executive Vice President and General Counsel |

Exhibit 99

Dollar

General Corporation Reports Third Quarter 2024 Results

Updates

Financial Guidance for Fiscal Year 2024; Provides Fiscal Year 2025 Real Estate Growth Plan

GOODLETTSVILLE,

Tenn.--(BUSINESS WIRE)-- Dollar General Corporation (NYSE: DG) today reported financial results for its fiscal 2024 third quarter (13

weeks) ended November 1, 2024.

| · | Net

Sales Increased 5.0% to $10.2 Billion |

| · | Same-Store

Sales Increased 1.3% |

| · | Selling,

General and Administrative Expenses (“SG&A”) Included $32.7 Million of Hurricane-Related

Expenses |

| · | Operating

Profit Decreased 25.3% to $323.8 Million |

| · | Diluted

Earnings Per Share (“EPS”) Decreased 29.4% to $0.89 |

| · | Year-to-Date

Cash Flows From Operations Increased 52.2% to $2.2 Billion |

| · | Company

Announces Project Elevate Initiative to Expand Mature Store Remodel Program |

| · | Board

of Directors Declares Quarterly Cash Dividend of $0.59 Per Share |

“We

are pleased with our team’s execution in the third quarter, particularly in light of multiple hurricanes that impacted our business,”

said Todd Vasos, Dollar General’s chief executive officer. “We are proud of the way our team responded to serve our communities,

demonstrating the commitment and dedication to fulfilling our mission of Serving Others that is pervasive throughout our organization.”

“While

we continue to operate in an environment where our core customer is financially constrained, we delivered same-store sales near the top

end of our expectations for the quarter. We believe our Back to Basics efforts contributed to these results, as we have continued to

improve our execution and the customer experience in our stores.”

“Looking

ahead, we are excited about our robust real estate plans for 2025. We believe our balance of new store growth and a significantly increased

number of projects impacting our mature store base will further solidify Dollar General as an essential partner to communities in rural

America, while strengthening our foundation to drive long-term sustainable growth and shareholder value.”

Third

Quarter 2024 Highlights

Net

sales increased 5.0% to $10.2 billion in the third quarter of 2024 compared to $9.7 billion in the third quarter of 2023. The net sales

increase was driven by positive sales contributions from new stores and growth in same-store sales, partially offset by the impact of

store closures. Same-store sales increased 1.3% compared to the third quarter of 2023, reflecting increases of 1.1% in average transaction

amount and 0.3% in customer traffic. Same-store sales in the third quarter of 2024 included growth in the consumables category, partially

offset by declines in each of the home, seasonal, and apparel categories.

Gross

profit as a percentage of net sales was 28.8% in the third quarter of 2024 compared to 29.0% in the third quarter of 2023, a decrease

of 18 basis points. This gross profit rate decrease was primarily attributable to increased markdowns, increased inventory damages and

a greater proportion of sales coming from the consumables category; partially offset by higher inventory markups, lower shrink and decreased

transportation costs.

SG&A

as a percentage of net sales were 25.7% in the third quarter of 2024 compared to 24.5% in the third quarter of 2023, an increase of 111

basis points. The primary expenses that were a greater percentage of net sales in the current year quarter were hurricane-related costs,

retail labor, and depreciation and amortization; partially offset by a decrease in professional fees. The 2024 period results include

$32.7 million of hurricane-related costs, the majority of which were store inventory and property losses.

Operating

profit for the third quarter of 2024 decreased 25.3% to $323.8 million compared to $433.5 million in the third quarter of 2023.

Net

interest expense for the third quarter of 2024 decreased 17.5% to $67.8 million compared to $82.3 million in the third quarter of 2023.

The

effective income tax rate for the third quarter of 2024 was 23.2% compared to 21.3% in the third quarter of 2023. This higher effective

income tax rate was primarily due to a decreased benefit from federal tax credits, offset by the effect of certain rate-impacting items

on lower earnings before taxes.

The

Company reported net income of $196.5 million for the third quarter of 2024, a decrease of 28.9% compared to $276.2 million in the third

quarter of 2023. Diluted EPS decreased 29.4% to $0.89 for the third quarter of 2024 compared to diluted EPS of $1.26 in the third quarter

of 2023.

Merchandise

Inventories

As

of November 1, 2024, total merchandise inventories, at cost, were $7.1 billion compared to $7.4 billion as of November 3, 2023,

a decrease of 7.0% on a per-store basis.

Capital

Expenditures

Total

additions to property and equipment in the 39-week period ended November 1, 2024 were $1.0 billion, including approximately: $451

million for improvements, upgrades, remodels and relocations of existing stores; $288 million for distribution and transportation-related

projects; $259 million related to store facilities, primarily for leasehold improvements, fixtures and equipment in new stores; and $31

million for information systems upgrades and technology-related projects. During the third quarter of 2024, the Company opened 207 new

stores, remodeled 434 stores, and relocated 27 stores.

Share

Repurchases

In

the third quarter of 2024, as planned, the Company did not repurchase any shares under its share repurchase program. The total remaining

authorization for future repurchases was $1.4 billion at the end of the third quarter of 2024.

Under

the authorization, repurchases may be made from time to time in open market transactions, including pursuant to trading plans adopted

in accordance with Rule 10b5-1 of the Securities Exchange Act of 1934, as amended, or in privately negotiated transactions. The

timing, manner and number of shares repurchased will depend on a variety of factors, including price, market conditions, compliance with

the covenants and restrictions under the Company’s debt agreements, cash requirements, excess debt capacity, results of operations,

financial condition and other factors. The authorization has no expiration date. See also “Fiscal Year 2024 Financial Guidance

and Store Growth Outlook.”

Dividend

On

December 4, 2024, the Company’s Board of Directors declared a quarterly cash dividend of $0.59 per share on the Company’s

common stock, payable on or before January 21, 2025 to shareholders of record on January 7, 2025. While the Board of Directors

currently intends to continue regular cash dividends, the declaration and amount of future dividends are subject to the sole discretion

of the Board and will depend upon, among other things, the Company’s results of operations, cash requirements, financial condition,

contractual restrictions, excess debt capacity, and other factors the Board may deem relevant in its sole discretion.

Fiscal

Year 2024 Financial Guidance and Store Growth Outlook

The

Company is updating its financial guidance provided on August 29, 2024. The updated guidance includes the negative impact of hurricane-related

expenses of $32.7 million in the third quarter, and an estimated fourth-quarter negative impact of approximately $10 million, in each

case related to the hurricanes that occurred in the third quarter.

The

Company now expects the following for fiscal year 2024:

| · | Net

sales growth in the range of approximately 4.8% to 5.1%, compared to its previous expectation

of approximately 4.7% to 5.3% |

| · | Same-store

sales growth in the range of approximately 1.1% to 1.4%, compared to its previous expectation

in the range of 1.0% to 1.6% |

| o | Diluted

EPS in the range of approximately $5.50 to $5.90, compared to its previous expectation of

approximately $5.50 to $6.20 |

| o | Diluted

EPS guidance continues to assume an effective tax rate of approximately 23% |

The

Company continues to expect the following for fiscal year 2024:

| · | Capital

expenditures, including those related to investments in the Company’s strategic initiatives,

in the range of $1.3 billion to $1.4 billion |

| · | 2,435

real estate projects, including 730 new store openings, 1,620 remodels, and 85 store relocations |

The

Company’s financial guidance also continues to assume no share repurchases in fiscal year 2024.

Fiscal

Year 2025 Store Growth Outlook

“We

are excited about our significant increase in planned real estate projects for 2025,” said Kelly Dilts, Dollar General’s

chief financial officer. “In particular, we are enthusiastic about Project Elevate, which introduces an incremental remodel initiative

within our mature store base. This initiative is aimed at our mature stores that are not yet old enough to be part of the full remodel

pipeline. We believe we will enhance the customer experience with a lighter-touch remodel, including customer-facing physical asset updates

and planogram optimizations and expansions across the store. Ultimately, our goal is to further enhance the associate and customer experience

in our mature stores, while also driving incremental sales growth.”

For

the fiscal year ending January 30, 2026 (“fiscal year 2025”), the Company plans to execute approximately 4,885 real

estate projects, including opening approximately 575 new stores in the U.S., (as well as up to 15 new stores in Mexico), fully remodeling

approximately 2,000 stores, remodeling approximately 2,250 stores through Project Elevate, and relocating approximately 45 stores.

Conference

Call Information

The

Company will hold a conference call on December 5, 2024 at 8:00 a.m. CT/9:00 a.m. ET, hosted by Todd Vasos, chief executive

officer, and Kelly Dilts, chief financial officer. To participate via telephone, please call (877) 407-0890 at least 10 minutes before

the conference call is scheduled to begin. The conference ID is 13749885. There will also be a live webcast of the call available at

https://investor.dollargeneral.com under “News & Events, Events & Presentations.” A replay of the conference

call will be available through January 2, 2025, and will be accessible via webcast replay or by calling (877) 660-6853. The conference

ID for the telephonic replay is 13749885.

Forward-Looking

Statements

This

press release contains forward-looking information within the meaning of the federal securities laws, including the Private Securities

Litigation Reform Act. Forward-looking statements include those regarding the Company’s outlook, strategy, initiatives, plans,

intentions or beliefs, including, but not limited to, statements made within the quotations of Mr. Vasos and Ms. Dilts, and

in the sections entitled “Share Repurchases,” “Dividend,” “Fiscal Year 2024 Financial Guidance and Store

Growth Outlook,” and “Fiscal Year 2025 Store Growth Outlook.” A reader can identify forward-looking statements because

they are not limited to historical fact or they use words such as “accelerate,” “aim,” “anticipate,”

“assume,” “believe,” “beyond,” “can,” “committed,” “confident,”

“continue,” “could,” “drive,” “estimate,” “expect,” “focus on,”

“forecast,” “future,” “goal,” “guidance,” “intend,” “investments,”

“likely,” “long-term,” “looking ahead,” “look to,” “may,” “moving forward,”

“near-term,” “ongoing,” “opportunities,” “outcome,” “outlook,” “plan,”

“position,” “potential,” “predict,” “project,” “prospects,” “seek,”

“should,” “subject to,” “target,” “uncertain,” “will,” or “would,”

and similar expressions that concern the Company’s outlook, strategies, plans, initiatives, intentions or beliefs about future

occurrences or results. These matters involve risks, uncertainties and other factors that may change at any time and may cause actual

results to differ materially from those which the Company expected. Many of these statements are derived from the Company’s operating

budgets and forecasts as of the date of this release, which are based on many detailed assumptions and estimates that the Company believes

are reasonable. However, it is very difficult to predict the effect of known factors on future results, and the Company cannot anticipate

all factors that could affect future results that may be important to an investor. All forward-looking information should be evaluated

in the context of these risks, uncertainties and other factors. Important factors that could cause actual results to differ materially

from the expectations expressed in or implied by such forward-looking statements include, but are not limited to:

| · | economic

factors, including but not limited to employment levels; inflation (and the Company’s

ability to adjust prices sufficiently to offset the effect of inflation); pandemics (such

as the COVID-19 pandemic); higher fuel, energy, healthcare, housing and product costs; higher

interest rates, consumer debt levels, and tax rates; lack of available credit; tax law changes

that negatively affect credits and refunds; decreases in, or elimination of, government assistance

programs or subsidies such as unemployment and food/nutrition assistance programs, student

loan repayment forgiveness and economic stimulus payments; commodity rates; transportation,

lease and insurance costs; wage rates (including the heightened possibility of increased

federal, and further increased state and/or local minimum wage rates/salary levels); foreign

exchange rate fluctuations; measures that create barriers to or increase the costs of international

trade (including increased import duties or tariffs); and changes in laws and regulations

and their effect on, as applicable, customer spending and disposable income, the Company’s

ability to execute its strategies and initiatives, the Company’s cost of goods sold,

the Company’s SG&A expenses (including real estate costs), and the Company’s

sales and profitability; |

| · | failure

to achieve or sustain the Company’s strategies, initiatives and investments, including

those relating to merchandising (including those related to non-consumable products), real

estate and new store development, international expansion, store formats and concepts, digital,

marketing, shrink, damages, sourcing, private brand, inventory management, supply chain,

private fleet, store operations, expense reduction, technology, pOpshelf, self-checkout,

and DG Media Network; |

| · | competitive

pressures and changes in the competitive environment and the geographic and product markets

where the Company operates, including, but not limited to, pricing, promotional activity,

expanded availability of mobile, web-based and other digital technologies, and alliances

or other business combinations; |

| · | failure

to timely and cost-effectively execute the Company’s real estate projects or to anticipate

or successfully address the challenges imposed by the Company’s expansion, including

into new countries or domestic markets, states, or urban or suburban areas; |

| · | levels

of inventory shrinkage and damages; |

| · | failure

to successfully manage inventory balances and in-stock levels, as well as to predict customer

trends; |

| · | failure

to maintain the security of the Company’s business, customer, employee or vendor information

or to comply with privacy laws, or the Company or one of its vendors falling victim to a

cyberattack (which risk is heightened as a result of political uncertainty involving China,

the conflict between Russia and Ukraine and the conflict in the Middle East) that prevents

the Company from operating all or a portion of its business; |

| · | damage

or interruption to the Company’s information systems as a result of external factors,

staffing shortages or challenges in maintaining or updating the Company’s existing

technology or developing, implementing or integrating new technology; |

| · | a

significant disruption to the Company’s distribution network, the capacity of the Company’s

distribution centers or the timely receipt of inventory; increased fuel or transportation

costs; issues related to supply chain disruptions or seasonal buying pattern disruptions;

or delays in constructing, opening or staffing new distribution centers (including temperature-controlled

distribution centers); |

| · | risks

and challenges associated with sourcing merchandise from suppliers, including, but not limited

to, those related to international trade (for example, political uncertainty involving China,

disruptive political events such as the conflict between Russia and Ukraine and the conflict

in the Middle East, and port labor disputes/agreements); |

| · | natural

disasters, unusual weather conditions (whether or not caused by climate change), pandemic

outbreaks or other health crises (for example, the COVID-19 pandemic), political or civil

unrest, acts of war, violence or terrorism, and disruptive global political events (for example,

political uncertainty involving China, the conflict between Russia and Ukraine and the conflict

in the Middle East); |

| · | product

liability, product recall or other product safety or labeling claims; |

| · | incurrence

of material uninsured losses, excessive insurance costs or accident costs; |

| · | failure

to attract, develop and retain qualified employees while controlling labor costs (including

the heightened possibility of increased federal, and further increased state and/or local

minimum wage rates/salary levels, including the effects of regulatory changes related to

the overtime exemption under the Fair Labor Standards Act if implemented as currently written)

and other labor issues, including employee safety issues and employee expectations and productivity; |

| · | loss

of key personnel or inability to hire additional qualified personnel, ability to successfully

execute management transitions within the Company’s senior leadership; or inability

to enforce non-compete agreements that we have in place with management personnel or enter

into new non-compete agreements; |

| · | risks

associated with the Company’s private brands, including, but not limited to, the Company’s

level of success in improving their gross profit rate at expected levels; |

| · | failure

to protect the Company’s reputation; |

| · | seasonality

of the Company’s business; |

| · | the

impact of changes in or noncompliance with governmental regulations and requirements, including,

but not limited to, those dealing with the sale of products, including without limitation,

product and food safety, marketing, labeling or pricing; information security and privacy;

labor and employment; employee wages, salary levels and benefits (including the heightened

possibility of increased federal, and further increased state and/or local minimum wage rates

and the effects of regulatory changes related to the overtime exemption under the Fair Labor

Standards Act if implemented as currently written); health and safety; real property; public

accommodations; imports and customs; transportation; intellectual property; bribery; climate

change; and environmental compliance (including required public disclosures related thereto),

as well as tax laws (including those related to the federal, state or foreign corporate tax

rate), the interpretation of existing tax laws, or the Company’s failure to sustain

its reporting positions negatively affecting the Company’s tax rate, and developments

in or outcomes of private actions, class actions, multi-district litigation, arbitrations,

derivative actions, administrative proceedings, regulatory actions or other litigation or

of inquiries from federal, state and local agencies, regulatory authorities, attorneys general,

committees, subcommittees and members of the U.S. Congress, and other local, state, federal

and international governmental authorities; |

| · | new

accounting guidance or changes in the interpretation or application of existing guidance; |

| · | deterioration

in market conditions, including market disruptions, adverse conditions in the financial markets

including financial institution failures, limited liquidity and interest rate increases,

changes in the Company’s credit profile (including any downgrade to our credit ratings),

compliance with covenants and restrictions under the Company’s debt agreements, and

the amount of the Company’s available excess capital; |

| · | the

factors disclosed under “Risk Factors” in the Company’s most recent Annual

Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q;

and |

| · | such

other factors as may be discussed or identified in this press release. |

All

forward-looking statements are qualified in their entirety by these and other cautionary statements that the Company makes from time

to time in its SEC filings and public communications. The Company cannot assure the reader that it will realize the results or developments

the Company anticipates or, even if substantially realized, that they will result in the consequences or affect the Company or its operations

in the way the Company expects. Forward-looking statements speak only as of the date made. The Company undertakes no obligation, and

specifically disclaims any duty, to update or revise any forward-looking statements as a result of new information, future events or

circumstances, or otherwise, except as otherwise required by law. As a result of these risks and uncertainties, readers are cautioned

not to place undue reliance on any forward-looking statements included herein or that may be made elsewhere from time to time by, or

on behalf of, the Company.

Investors

should also be aware that while the Company does, from time to time, communicate with securities analysts and others, it is against the

Company’s policy to disclose to them any material, nonpublic information or other confidential commercial information. Accordingly,

shareholders should not assume that the Company agrees with any statement or report issued by any securities analyst regardless of the

content of the statement or report. Furthermore, the Company has a policy against confirming projections, forecasts or opinions issued

by others. Thus, to the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports

are not the Company’s responsibility.

About

Dollar General Corporation

Dollar

General Corporation (NYSE: DG) is proud to serve as America’s neighborhood general store. Founded in 1939, Dollar General lives

its mission of Serving Others every day by providing access to affordable products and services for its customers, career opportunities

for its employees, and literacy and education support for its hometown communities. As of November 1, 2024, the Company’s

20,523 Dollar General, DG Market, DGX and pOpshelf stores across the United States and Mi Súper Dollar General stores in Mexico

provide everyday essentials including food, health and wellness products, cleaning and laundry supplies, self-care and beauty items,

and seasonal décor from our high-quality private brands alongside many of the world’s most trusted brands such as Coca Cola,

PepsiCo/Frito-Lay, General Mills, Hershey, J.M. Smucker, Kraft, Mars, Nestlé, Procter & Gamble and Unilever.

DOLLAR

GENERAL CORPORATION AND SUBSIDIARIES

Condensed

Consolidated Balance Sheets

(In

thousands)

| | |

(Unaudited) | | |

| |

| | |

November 1, | | |

November 3, | | |

February 2, | |

| | |

2024 | | |

2023 | | |

2024 | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 537,257 | | |

$ | 365,447 | | |

$ | 537,283 | |

| Merchandise inventories | |

| 7,118,974 | | |

| 7,356,065 | | |

| 6,994,266 | |

| Income taxes receivable | |

| 115,698 | | |

| 197,555 | | |

| 112,262 | |

| Prepaid expenses and other current

assets | |

| 404,587 | | |

| 352,011 | | |

| 366,913 | |

| Total current

assets | |

| 8,176,516 | | |

| 8,271,078 | | |

| 8,010,724 | |

| Net property and equipment | |

| 6,349,376 | | |

| 5,848,385 | | |

| 6,087,722 | |

| Operating lease assets | |

| 11,337,191 | | |

| 10,904,323 | | |

| 11,098,228 | |

| Goodwill | |

| 4,338,589 | | |

| 4,338,589 | | |

| 4,338,589 | |

| Other intangible assets, net | |

| 1,199,700 | | |

| 1,199,700 | | |

| 1,199,700 | |

| Other assets, net | |

| 59,043 | | |

| 62,551 | | |

| 60,628 | |

| Total assets | |

$ | 31,460,415 | | |

$ | 30,624,626 | | |

$ | 30,795,591 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Current portion of long-term obligations | |

$ | 519,351 | | |

$ | 750,000 | | |

$ | 768,645 | |

| Current portion of operating lease

liabilities | |

| 1,445,071 | | |

| 1,355,316 | | |

| 1,387,083 | |

| Accounts payable | |

| 4,045,404 | | |

| 3,651,778 | | |

| 3,587,374 | |

| Accrued expenses and other | |

| 1,086,412 | | |

| 1,020,759 | | |

| 971,890 | |

| Income taxes payable | |

| 14,459 | | |

| 9,237 | | |

| 10,709 | |

| Total current

liabilities | |

| 7,110,697 | | |

| 6,787,090 | | |

| 6,725,701 | |

| Long-term obligations | |

| 5,723,053 | | |

| 6,440,845 | | |

| 6,231,539 | |

| Long-term operating lease liabilities | |

| 9,878,707 | | |

| 9,540,573 | | |

| 9,703,499 | |

| Deferred income taxes | |

| 1,138,086 | | |

| 1,152,125 | | |

| 1,133,784 | |

| Other liabilities | |

| 267,287 | | |

| 252,109 | | |

| 251,949 | |

| Total liabilities | |

| 24,117,830 | | |

| 24,172,742 | | |

| 24,046,472 | |

| | |

| | | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Shareholders' equity: | |

| | | |

| | | |

| | |

| Preferred stock | |

| - | | |

| - | | |

| - | |

| Common stock | |

| 192,435 | | |

| 192,053 | | |

| 192,206 | |

| Additional paid-in capital | |

| 3,802,436 | | |

| 3,732,376 | | |

| 3,757,005 | |

| Retained earnings | |

| 3,344,211 | | |

| 2,527,201 | | |

| 2,799,415 | |

| Accumulated other

comprehensive income (loss) | |

| 3,503 | | |

| 254 | | |

| 493 | |

| Total shareholders'

equity | |

| 7,342,585 | | |

| 6,451,884 | | |

| 6,749,119 | |

| Total liabilities and shareholders'

equity | |

$ | 31,460,415 | | |

$ | 30,624,626 | | |

$ | 30,795,591 | |

DOLLAR

GENERAL CORPORATION AND SUBSIDIARIES

Consolidated

Statements of Income

(In

thousands, except per share amounts)

(Unaudited)

| | |

For

the Quarter Ended | |

| | |

November 1, | | |

%

of Net | | |

November 3, | | |

%

of Net | |

| | |

2024 | | |

Sales | | |

2023 | | |

Sales | |

| Net sales | |

$ | 10,183,428 | | |

| 100.00 | % | |

$ | 9,694,082 | | |

| 100.00 | % |

| Cost of goods sold | |

| 7,247,128 | | |

| 71.17 | | |

| 6,881,554 | | |

| 70.99 | |

| Gross profit | |

| 2,936,300 | | |

| 28.83 | | |

| 2,812,528 | | |

| 29.01 | |

| Selling, general

and administrative expenses | |

| 2,612,498 | | |

| 25.65 | | |

| 2,379,054 | | |

| 24.54 | |

| Operating profit | |

| 323,802 | | |

| 3.18 | | |

| 433,474 | | |

| 4.47 | |

| Interest expense,

net | |

| 67,849 | | |

| 0.67 | | |

| 82,289 | | |

| 0.85 | |

| Income before income taxes | |

| 255,953 | | |

| 2.51 | | |

| 351,185 | | |

| 3.62 | |

| Income tax expense | |

| 59,424 | | |

| 0.58 | | |

| 74,939 | | |

| 0.77 | |

| Net income | |

$ | 196,529 | | |

| 1.93 | % | |

$ | 276,246 | | |

| 2.85 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.89 | | |

| | | |

$ | 1.26 | | |

| | |

| Diluted | |

$ | 0.89 | | |

| | | |

$ | 1.26 | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 219,921 | | |

| | | |

| 219,480 | | |

| | |

| Diluted | |

| 219,997 | | |

| | | |

| 219,799 | | |

| | |

| | |

For the

39 Weeks Ended | |

| | |

November 1, | | |

% of Net | | |

November 3, | | |

% of Net | |

| | |

2024 | | |

Sales | | |

2023 | | |

Sales | |

| Net sales | |

$ | 30,307,810 | | |

| 100.00 | % | |

$ | 28,833,095 | | |

| 100.00 | % |

| Cost of goods sold | |

| 21,319,882 | | |

| 70.34 | | |

| 20,020,407 | | |

| 69.44 | |

| Gross profit | |

| 8,987,928 | | |

| 29.66 | | |

| 8,812,688 | | |

| 30.56 | |

| Selling, general

and administrative expenses | |

| 7,568,060 | | |

| 24.97 | | |

| 6,946,042 | | |

| 24.09 | |

| Operating profit | |

| 1,419,868 | | |

| 4.68 | | |

| 1,866,646 | | |

| 6.47 | |

| Interest expense,

net | |

| 208,412 | | |

| 0.69 | | |

| 249,664 | | |

| 0.87 | |

| Income before income taxes | |

| 1,211,456 | | |

| 4.00 | | |

| 1,616,982 | | |

| 5.61 | |

| Income tax expense | |

| 277,420 | | |

| 0.92 | | |

| 357,521 | | |

| 1.24 | |

| Net income | |

$ | 934,036 | | |

| 3.08 | % | |

$ | 1,259,461 | | |

| 4.37 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 4.25 | | |

| | | |

$ | 5.74 | | |

| | |

| Diluted | |

$ | 4.24 | | |

| | | |

$ | 5.73 | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 219,857 | | |

| | | |

| 219,359 | | |

| | |

| Diluted | |

| 220,038 | | |

| | | |

| 219,953 | | |

| | |

DOLLAR

GENERAL CORPORATION AND SUBSIDIARIES

Consolidated

Statements of Cash Flows

(In

thousands)

(Unaudited)

| | |

For the

39 Weeks Ended | |

| | |

November 1, | | |

November 3, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 934,036 | | |

$ | 1,259,461 | |

| Adjustments to reconcile net income

to net cash from operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 718,093 | | |

| 625,817 | |

| Deferred income taxes | |

| 4,302 | | |

| 91,158 | |

| Noncash share-based compensation | |

| 48,695 | | |

| 40,704 | |

| Other noncash (gains) and losses | |

| 50,351 | | |

| 79,001 | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Merchandise inventories | |

| (147,512 | ) | |

| (661,611 | ) |

| Prepaid expenses and other current

assets | |

| (37,952 | ) | |

| (50,846 | ) |

| Accounts payable | |

| 494,807 | | |

| 108,757 | |

| Accrued expenses and other liabilities | |

| 137,937 | | |

| 3,802 | |

| Income taxes | |

| 314 | | |

| (61,462 | ) |

| Other | |

| (7,908 | ) | |

| 7,238 | |

| Net cash provided

by (used in) operating activities | |

| 2,195,163 | | |

| 1,442,019 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (1,037,097 | ) | |

| (1,240,507 | ) |

| Proceeds from

sales of property and equipment | |

| 2,127 | | |

| 4,963 | |

| Net cash provided

by (used in) investing activities | |

| (1,034,970 | ) | |

| (1,235,544 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Issuance of long-term obligations | |

| - | | |

| 1,498,260 | |

| Repayments of long-term obligations | |

| (765,625 | ) | |

| (14,362 | ) |

| Net increase (decrease) in commercial

paper outstanding | |

| - | | |

| (1,303,800 | ) |

| Borrowings under revolving credit facilities | |

| - | | |

| 500,000 | |

| Repayments of borrowings under revolving

credit facilities | |

| - | | |

| (500,000 | ) |

| Costs associated with issuance of debt | |

| (2,320 | ) | |

| (12,438 | ) |

| Payments of cash dividends | |

| (389,237 | ) | |

| (388,381 | ) |

| Other equity and

related transactions | |

| (3,037 | ) | |

| (1,883 | ) |

| Net cash provided

by (used in) financing activities | |

| (1,160,219 | ) | |

| (222,604 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash and

cash equivalents | |

| (26 | ) | |

| (16,129 | ) |

| Cash and cash equivalents,

beginning of period | |

| 537,283 | | |

| 381,576 | |

| Cash and cash

equivalents, end of period | |

$ | 537,257 | | |

$ | 365,447 | |

| | |

| | | |

| | |

| Supplemental cash flow information: | |

| | | |

| | |

| Cash paid for: | |

| | | |

| | |

| Interest | |

$ | 287,544 | | |

$ | 295,915 | |

| Income taxes | |

$ | 268,665 | | |

$ | 325,580 | |

| Supplemental schedule of non-cash

investing and financing activities: | |

| | | |

| | |

| Right of use assets obtained in exchange

for new operating lease liabilities | |

$ | 1,321,389 | | |

$ | 1,248,662 | |

| Purchases of property and equipment

awaiting processing for payment, included in Accounts payable | |

$ | 111,360 | | |

$ | 140,724 | |

DOLLAR

GENERAL CORPORATION AND SUBSIDIARIES

Selected

Additional Information

(Unaudited)

Sales

by Category (in thousands)

| | |

For

the Quarter Ended | | |

| |

| | |

November 1, | | |

November 3, | | |

| |

| | |

2024 | | |

2023 | | |

%

Change | |

| Consumables | |

$ | 8,445,659 | | |

$ | 7,940,527 | | |

| 6.4 | % |

| Seasonal | |

| 940,233 | | |

| 940,632 | | |

| 0.0 | % |

| Home products | |

| 522,355 | | |

| 534,471 | | |

| -2.3 | % |

| Apparel | |

| 275,181 | | |

| 278,452 | | |

| -1.2 | % |

| Net sales | |

$ | 10,183,428 | | |

$ | 9,694,082 | | |

| 5.0 | % |

| | |

For the

39 Weeks Ended | | |

| |

| | |

November 1, | | |

November 3, | | |

| |

| | |

2024 | | |

2023 | | |

% Change | |

| Consumables | |

$ | 25,053,726 | | |

$ | 23,445,031 | | |

| 6.9 | % |

| Seasonal | |

| 2,958,509 | | |

| 2,979,474 | | |

| -0.7 | % |

| Home products | |

| 1,481,369 | | |

| 1,582,305 | | |

| -6.4 | % |

| Apparel | |

| 814,206 | | |

| 826,285 | | |

| -1.5 | % |

| Net sales | |

$ | 30,307,810 | | |

$ | 28,833,095 | | |

| 5.1 | % |

Store

Activity

| | |

For

the 39 Weeks Ended | |

| | |

November 1, | | |

November 3, | |

| | |

2024 | | |

2023 | |

| Beginning store count | |

| 19,986 | | |

| 19,104 | |

| New store openings | |

| 617 | | |

| 690 | |

| Store closings | |

| (80 | ) | |

| (68 | ) |

| Net new stores | |

| 537 | | |

| 622 | |

| Ending store count | |

| 20,523 | | |

| 19,726 | |

| Total selling square

footage (000's) | |

| 156,169 | | |

| 148,644 | |

| Growth rate

(square footage) | |

| 5.1 | % | |

| 5.9 | % |

Contacts

Investor

Contact:

investorrelations@dollargeneral.com

Media

Contact:

dgpr@dollargeneral.com

Source:

Dollar General Corporation

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

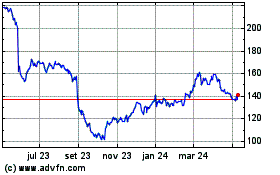

Dollar General (NYSE:DG)

Gráfico Histórico do Ativo

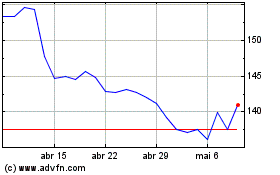

De Nov 2024 até Dez 2024

Dollar General (NYSE:DG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024