MD false 0001471420 0001471420 2024-12-06 2024-12-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 6, 2024

Columbia Seligman Premium Technology Growth Fund, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| MARYLAND |

|

811-22328 |

|

20-0994125 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 290 Congress Street, Boston, Massachusetts |

|

02210 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (800)-937-5449

NOT APPLICABLE

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock |

|

STK |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 7 — REGULATION FD

| Item 7.01 |

Regulation FD Disclosure. |

Registrant is furnishing as Exhibit 99.1 the attached Press Release dated December 6, 2024 for Columbia Seligman Premium Technology Growth Fund, Inc.

SECTION 9 — FINANCIAL STATEMENTS AND EXHIBITS

| Item 9.01 |

Financial Statements and Exhibits. |

Registrant is furnishing as Exhibit 99.1 the attached Press Release dated December 6, 2024 for Columbia Seligman Premium Technology Growth Fund, Inc.

2

Exhibit Index

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 6, 2024

|

|

|

| COLUMBIA SELIGMAN PREMIUM TECHNOLOGY GROWTH FUND, INC. |

|

|

| By: |

|

/s/ Joseph D’Alessandro |

|

|

Joseph D’Alessandro |

|

|

Assistant Secretary |

4

|

|

|

| Stockholder contact: |

|

Matthew LeBlanc

617-580-4101

matthew.leblanc@columbiathreadneedle.com |

|

|

| Media contact: |

|

Lisa Feuerbach

617-897-9344

lisa.feuerbach@columbiathreadneedle.com |

Columbia Seligman Premium Technology Growth Fund Announces a Special Fourth Quarter Distribution

Boston, MA – December 6, 2024 – Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a special fourth

quarter distribution, beyond its typical quarterly managed distribution policy, in the amount of $3.2669 per share. A federal excise tax of 4% applies to funds that do not distribute substantially all of their annual income (including net gains)

before the end of their fiscal year. The Fund’s income for the current fiscal year exceeds the amounts previously distributed pursuant to the Fund’s quarterly managed distribution policy. The Fund is distributing this excess income so that

it will not incur the 4% federal excise tax in 2024.

The distribution will be paid on January 21, 2025 (the Payment Date) to stockholders of record

on December 16, 2024 (the Record Date). The ex-dividend date is December 16, 2024. The capital gain distribution, being a special distribution, will automatically be paid in stock except that any

Record Date stockholder may elect to receive the distribution in cash by contacting, as applicable, their financial advisor (if you hold shares through a financial intermediary, such as a broker-dealer) or the Fund’s stockholder servicing

agent, Equiniti Trust Company, LLC, whose contact information appears below (if you hold shares directly with the Fund), by 5 pm Eastern Time on January 10, 2025. It is anticipated that the Fund will make a subsequent distribution under its

managed distribution policy in the month of February.

Prior to the managed distribution policy, the Fund paid distributions pursuant to a level rate

distribution policy. Under its former distribution policy and consistent with the Investment Company Act of 1940, as amended, the Fund could not distribute long-term capital gains more often than once in any one taxable year.

In October 2010, the Fund received exemptive relief from the Securities and Exchange Commission that permits the Fund to make periodic distributions of

long-term capital gains more often than once in any one taxable year. After consideration by the Fund’s Board, the Fund adopted the current managed distribution policy which allows the Fund to make distributions of long-term capital gains more

than once in any taxable year.

The following table sets forth the estimated breakdown of the distribution noted above, on a per share basis, from the

following sources: net investment income; net realized short-term capital gains; net realized long-term capital gains; and return of capital or other capital source.

|

|

|

|

|

|

|

|

|

| |

|

Breakdown of Distribution |

|

| Sources |

|

% |

|

|

US Dollar |

|

| Net Investment Income |

|

|

0.00 |

% |

|

$ |

0.0000 |

|

| Net Realized Short-Term Capital Gains |

|

|

9.56 |

% |

|

$ |

0.3122 |

|

| Net Realized Long-Term Capital Gains |

|

|

90.44 |

% |

|

$ |

2.9547 |

|

| Return of Capital or other Capital Source |

|

|

0.00 |

% |

|

$ |

0.0000 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

100.00 |

% |

|

$ |

3.2669 |

|

|

|

|

|

|

|

|

|

|

The following table sets forth the estimated breakdown, on a per share basis, of all distributions made by

the Fund during the year-to-date period ended on the Payment Date of the above distributions (includes the distribution payment noted in the table above) from the

following sources: net investment income; net realized short-term capital gains; net realized long-term capital gains; and return of capital or other capital source.

|

|

|

|

|

|

|

|

|

| |

|

Breakdown of All Distributions Paid

Through

Year-To-Date Period Ended on the Payment Date of

the Current Distribution |

|

| Sources |

|

% |

|

|

US Dollar |

|

| Net Investment Income |

|

|

0.00 |

% |

|

$ |

0.0000 |

|

| Net Realized Short-Term Capital Gains |

|

|

6.10 |

% |

|

$ |

0.3122 |

|

| Net Realized Long-Term Capital Gains |

|

|

93.90 |

% |

|

$ |

4.8047 |

|

| Return of Capital or other Capital Source |

|

|

0.00 |

% |

|

$ |

0.0000 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

100.00 |

% |

|

$ |

5.1169 |

|

|

|

|

|

|

|

|

|

|

In certain years since the Fund’s inception, the Fund has distributed more than its income and net realized capital

gains, which has resulted in Fund distributions substantially consisting of return of capital or other capital source. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to

you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.” As of the payment date of the current distribution, all Fund

distributions paid in 2024 (as estimated by the Fund based on current information) are from the earnings and profits of the Fund and not a return of capital. This could change during the remainder of the year, as further described below.

The amounts, sources and percentage breakdown of the distributions reported above are only estimates and are not being provided for, and should not be used

for, tax reporting purposes. The actual amounts, sources and percentage breakdown of the distribution for tax reporting purposes, which may include return of capital, will depend upon the Fund’s investment experience during the remainder of its

fiscal year and may be subject to changes based on tax regulations.

The following table sets forth (i) the average annual total return of a

share of the Fund’s common stock at net asset value (NAV) for the 5-year period ended November 30, 2024 and (ii) the Fund’s annualized distribution rate, for the same period, expressed as a

percentage of the NAV price of a share of the Fund’s common stock at November 30, 2024.

|

|

|

|

|

| Average Annual Total NAV Return for the 5-year Period

Ended November 30, 2024 |

|

|

18.91 |

% |

| Annualized Distribution Rate as a Percentage of November 30, 2024 NAV Price (For the 5-year Period ended November 30, 2024) |

|

|

5.92 |

% |

The following table sets forth (i) the average annual total return of a share of the Fund’s common stock at

net asset value (NAV) for the period since inception of Fund investment operations through the period noted and (ii) the Fund’s annualized distribution rate, for the same period, expressed as a percentage of the NAV price of a share of the

Fund’s common stock at November 30, 2024. Average annual total return of a share of the Fund’s common stock at NAV for the period since inception of Fund investment operations through the period noted includes the 4.50% sales load

assessed to IPO investors.

|

|

|

|

|

| Average Annual Total NAV Return for the Period Since Inception of Investment Operations (November

30, 2009) Through November 30, 2024 |

|

|

15.22 |

% |

| Annualized Distribution Rate as a Percentage of November 30, 2024 NAV Price (For the Period

Since Inception of Investment Operations (November 30, 2009) through November 30, 2024) |

|

|

5.61 |

% |

The following table sets forth (i) the cumulative total return (at NAV) of a share of the Fund’s

common stock for the year-to-date period ended November 30, 2024 and (ii) the Fund’s distribution rate, for the same period, expressed as a percentage of

the NAV price of a share of the Fund’s common stock at November 30, 2024

|

|

|

|

|

| Cumulative Total NAV Return for the Year-to-Date Period Ended November 30, 2024 |

|

|

27.33 |

% |

| Distribution Rate as a Percentage of November 30, 2024 NAV Price (For the Year-to-Date Period Ended November 30, 2024) |

|

|

5.30 |

% |

You should not draw any conclusions about the Fund’s investment performance from the amount of the distributions noted in

the tables above or from the terms of the Fund’s distribution policy.

The Fund or your financial professional will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions on your US federal income tax return. For tax purposes, the Fund is required to report unrealized gains or losses on certain non-US investments as ordinary income or loss, respectively. Accordingly, the amount of the Fund’s total distributions that will be taxable as ordinary income may be different than the amount of the

distributions from net investment income reported above.

The Board may change the Fund’s distribution policy and the amount or timing of the

distributions, based on a number of factors, including, but not limited to, the amount of the Fund’s undistributed net investment income and net short- and long-term capital gains and historical and projected net investment income and net

short- and long-term capital gains.

The Fund is a closed-end investment company that trades on the New York Stock

Exchange.

Past performance does not guarantee future results.

Important Disclosures:

Investors should consider

the investment objectives, risks, charges, and expenses of the Fund carefully before investing. A prospectus containing information about the fund (including its investment objectives, risks, charges, expenses, and other information about the fund)

may be obtained by contacting your financial advisor or visiting columbiathreadneedleus.com. The prospectus should be read carefully before investing in the fund. For more information, please visit columbiathreadneedleus.com.

The Fund expects to receive all or some of its current income and gains from the following sources: (i) dividends received by the Fund that are paid on

the equity and equity-related securities in its portfolio; and (ii) capital gains (short-term and long-term) from option premiums and the sale of portfolio securities. It is possible that the Fund’s distributions will at times exceed the

earnings and profits of the Fund and therefore all or a portion of such distributions may constitute a return of capital as described below. A return of capital is a return of your original investment. A return of capital distribution does not

necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.” You should not draw any conclusions about the Fund’s investment performance from the amount of this distribution

or from the Fund’s distribution policy.

Distributions that qualify as a return of capital are a return of some or all of your original investment in

the Fund. A return of capital reduces a stockholder’s tax basis in his or her shares. Once the tax basis in your shares has been reduced to zero, any further return of capital may be taxable as capital gain. Shareholders should consult their

tax advisor or tax attorney for proper treatment.

Distributions may be variable, and the Fund’s distribution rate will depend on a number of factors,

including the net earnings on the Fund’s portfolio investments and the rate at which such net earnings change as a result of changes in the timing of, and rates at which, the Fund receives income from the sources noted above. As portfolio and

market conditions change, the rate of distributions on the shares and the Fund’s distribution policy could change.

Market risk may affect a

single issuer, sector of the economy, industry or the market as a whole. The products of technology companies may be subject to severe competition and rapid obsolescence, and their stocks may be subject to greater price fluctuations.

Investments in small- and mid-cap companies involve risks and volatility greater than investments in larger, more established companies. Foreign investments subject the fund to risks, including

political, economic, market, social and others within a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. As a

non-diversified fund, fewer investments could have a greater effect on performance. The Fund’s derivatives strategies may not be successful and could result in significant Fund losses.

The Fund should only be considered as one element of a complete investment program. An investment in the Fund should be considered speculative. The

Fund’s investment policy of investing in technology and technology-related companies and writing call options involves a high degree of risk.

There is no assurance that the Fund will meet its investment objectives or that distributions will be made. You could lose some or all of your investment. In

addition, closed-end funds frequently trade at a discount to their net asset values, which may increase your risk of loss.

The Fund is not insured by the FDIC, NCUA or any federal agency, is not a deposit or obligation of, or guaranteed by any financial institution, and involves

investment risks including possible loss of principal and fluctuation in value.

Columbia Threadneedle Investments (Columbia Threadneedle) is the

global brand name of the Columbia and Threadneedle group of companies.

Columbia Seligman Premium Technology Growth Fund is managed by Columbia Management

Investment Advisers, LLC.

If your Fund shares are held directly by the Fund’s stockholder servicing agent and you wish to elect a cash distribution

(in lieu of a distribution paid in stock) or otherwise want more information about the Fund, call Equiniti Trust Company, LLC, the Fund’s stockholder servicing agent, at

800-937-5449. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 8 p.m. Eastern time. Equiniti Trust Company,

LLC, which is located at 48 Wall Street, Floor 23, New York, New York, 10005, is not affiliated with the Fund, Columbia Management Investment Advisers, LLC.

If your shares are not held through Equiniti Trust Company, LLC and you wish to elect a cash distribution (in lieu of a distribution paid in stock) or

otherwise want more information about the Fund, please call your financial advisor or other financial intermediary through which you own Fund shares.

© 2024 Columbia Management Investment Advisers, LLC. All rights reserved.

columbiathreadneedleus.com

Adtrax: CTNA7403805.1-RUSH

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

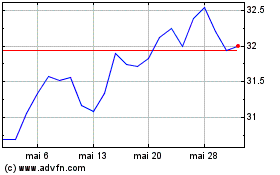

Columbia Seligman Premiu... (NYSE:STK)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Columbia Seligman Premiu... (NYSE:STK)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025