Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

06 Dezembro 2024 - 3:14PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the

month of December 2024

RYANAIR HOLDINGS PLC

(Translation

of registrant's name into English)

c/o Ryanair Ltd Corporate Head Office

Dublin Airport

County Dublin Ireland

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file

annual

reports

under cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities

Exchange

Act of

1934.

Yes

No ..X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant

in

connection with Rule 12g3-2(b): 82- ________

RYANAIR

HOLDINGS PLC - INTERIM DIVIDEND FOR FY25

Dividend Information

Ryanair

Holdings plc is pleased to announce that the FY25 interim dividend

of €0.223 per ordinary share will be payable to

shareholders on the register of members at close of business on 17

January, 2025. The dividend will be paid on 26 February,

2025.

Dividends Payments

Dividends

will be paid in euro to all shareholders. Shareholders holding

their shares via the central securities depository operated by

Euroclear Bank or via CREST will receive dividends electronically

via such systems.

However,

in order to avoid inconvenience to overseas shareholders, other

than those holding their shares via the central securities

depository operated by Euroclear Bank or via CREST, when

negotiating euro cheques, the Company has arranged that its

registrar, Link Registrars Limited (the "Registrar"), will provide

an International Payments Service ("IPS"), whereby dividends can be

paid to those shareholders in their local currency. If

shareholders wish to have their dividend paid in a currency other

than Euro then they must complete an IPS mandate which can be

obtained from the registrar and will be available on their

website https://www.linkgroup.eu/get-in-touch/shareholders-in-irish-companies/.

This election form must be completed and received by Link

Registrars Limited, PO Box 7117, Dublin 2, Ireland (By Post) or to

Link Registrars Limited, Suite 149, The Capel Building, Mary's

Abbey, Dublin 7, D07 DP79, Ireland (by hand during normal business

hours) by close of business on 24 January, 2025.

For

shareholders, other than those holding their shares via the central

securities depository operated by Euroclear Bank or via CREST,

dividends will be paid by cheque and will be sent by ordinary post

on 25 February, 2025. Alternatively, if you are in the Single Euro

Payments Area ("SEPA") you can update your bank details on the

Registrar's share portal www.signalshares.com.

You will need your Investor Code ("IVC") to register on the portal

and this can be found on your share certificate.

Dividend Withholding Tax (DWT) currently deducted at a

rate of 25%, must be deducted from dividends paid by an Irish

resident company, unless a shareholder is entitled to an exemption

and has submitted a properly completed exemption form to the

Registrar. Non-resident shareholders and certain Irish companies,

trusts, pension schemes, investment undertakings and charities may

be entitled to claim exemption from DWT. Copies of the form may be

obtained online from the Irish Revenue

Commissioners. Shareholders should note that DWT will be

deducted from dividends in cases where a properly completed form

has not been received by the market deadline date for a dividend,

which is Friday, 24 January 2025 in this case. Individuals who are

resident in Ireland for tax purposes are not entitled to an

exemption. If shares are held via Euroclear Bank or via CREST, the

owners of the shares will need to contact the intermediary through

whom the shares are held to ascertain their arrangements and

cut-off times for tax relief for eligible investors to be applied

at source.

Timetable

|

Date

|

Action

|

|

Ex-Dividend

Date

|

Thursday,

16 January 2025

|

|

Record

Date

|

Friday,

17 January 2025

|

|

DWT

Exemption Cut Off Date

|

Friday,

24 January 2025

|

|

Bank

Mandate / IPS Mandate Cut Off Date

|

Friday,

24 January 2025

|

|

Dividend

Post Out Date

|

Tuesday,

25 February 2025

|

|

Dividend

Payment Date

|

Wednesday,

26 February 2025

|

For further info please

contact:

Peter

Larkin

Ryanair

Holdings

plc

Tel:

+353 (0) 1 945

1212

larkinp@ryanair.com

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

Date: 06

December, 2024

|

|

By:___/s/

Juliusz Komorek____

|

|

|

|

|

|

Juliusz

Komorek

|

|

|

Company

Secretary

|

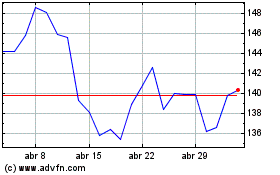

Ryanair (NASDAQ:RYAAY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

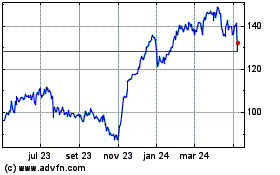

Ryanair (NASDAQ:RYAAY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024