UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

December, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 9th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras informs about the form of distribution

of remuneration to shareholders related to 3Q24

—

Rio de Janeiro, December 10, 2024

– Petróleo Brasileiro S.A. – Petrobras, following up on the Material Fact from November 7, 2024, informs that the distribution

of remuneration to shareholders, approved on that date by the Board of Directors, in the amount of R$ 17.12 billion, equivalent to R$

1.32820661 per common and preferred share in circulation, will be paid as follows, according to the decision of the Executive Board on

December 6, 2024:

(i) the

first installment, in the amount of R$ 0.66410331 per common and preferred share in circulation, will be paid on February 20, 2025, entirely

in the form of interest on equity (JCP).

(ii) the

second installment, in the amount of R$ 0.66410330 per common and preferred share in circulation, will be paid on March 20, 2025, of which

R$ 0.01053822 in the form of JCP and R$ 0.65356508 in the form of dividends.

The other information remains unchanged,

as per the Material Fact from November 7, 2024.

It's important to notice that the

values of each installment will be updated by the variation of the Selic rate from December 31, 2024, until the date of each payment;

Furthermore, on the amount paid in the form of interest on equity (JCP), income tax will apply, according to current legislation. Finally,

these payments will be included in the proposal for remuneration to shareholders to be approved at the 2025 Annual General Meeting for

the 2024 fiscal year.

The Shareholder

Remuneration Policy can be accessed on the IR company's website <Petrobras | Investor Relations >.

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

Email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9th floor –

20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 10, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Fernando Sabbi Melgarejo

______________________________

Fernando Sabbi Melgarejo

Chief Financial Officer and Investor Relations

Officer

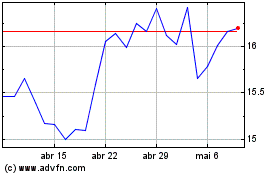

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025