false

0000310354

0000310354

2024-12-06

2024-12-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 6, 2024

STANDEX INTERNATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

1-7233

|

31-0596149

|

|

(State or other jurisdiction of

|

(Commission

|

(IRS Employer

|

|

incorporation or organization)

|

File Number)

|

Identification No.)

|

|

23 Keewaydin Drive, Salem, New Hampshire

|

03079

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code: (603) 893-9701

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, Par Value $1.50 Per Share

|

SXI

|

New York Stock Exchange

|

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Emerging growth company ☐

If an emerging growth company, indicates by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Standex International Corporation

SECTION 2 – FINANCIAL INFORMATION

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On December 6, 2024, Standex entered into a Second Amendment to Third Amended and Restated Credit Agreement (the “Amendment”) among

Standex, Citizens Bank, N.A., a national banking association, as Administrative Agent (the “Agent”) and the lenders party thereto, amending the Third Amended and Restated Credit Agreement dated as of February 2, 2023, as amended by the First Amendment to Third Amended and Restated Credit Agreement dated October 28, 2024, collectively the “Revolving Credit Agreement”). Under the Amendment, the Lenders (as defined in the Revolving Credit Agreement) make available to Standex an additional $325,000,000 under the Initial Revolving Credit Commitment (as defined in the Revolving Credit Agreement). The effective result of this Amendment is to expand the total available credit under the Revolving Credit Agreement from $500 million to $825 million. In addition to increasing the Initial Revolving Credit Commitment, the Amendment adds two additional lenders: PNC Bank, National Association and The Huntington National Bank, with PNC Bank, National Association also being add as a Co-Documentation Agent. Other than the increase to the Initial Revolving Credit Commitment and the addition of the additional lenders, the material terms and conditions of the Revolving Credit Agreement remain unchanged and in full force and effect.

Immediately upon execution of the Amendment, Standex utilized a portion of the additional available funding under the Revolving Credit Agreement to payoff and terminate the $250 million Term Loan Credit Agreement (the “Term Loan Credit Agreement”) by and among Citizens Bank, N.A., as administrative agent, lead arranger and book runner, each of the lenders party thereto from time to time (the “Term Loan Lenders”) and Standex. Pursuant to the terms of the Term Loan Credit Agreement, the Term Loan Lenders had advanced to Standex a $250,000,000 term loan (the “Term Loan”). The Term Loan Funds were used to fund a portion of the Amran Transaction and the Narayan Transaction previously reported, along with the execution of the Term Loan Credit Agreement, in the Company’s current report on Form 8-K filed on October 31, 2024.

The foregoing description of the Amendment is only a summary and is qualified in its entirety by reference to the complete texts of the Amendment which is filed as Exhibits 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 – Financial Statements and Exhibits.

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

10.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

STANDEX INTERNATIONAL CORPORATION

(Registrant)

| /s/ Ademir Sarcevic |

|

Ademir Sarcevic

Chief Financial Officer

Date: December 12, 2024

Signing on behalf of the registrant and as principal financial officer

|

Exhibit 10.1

SECOND AMENDMENT

THIS SECOND AMENDMENT (this “Amendment”) is entered into as of December 6, 2024 by and among STANDEX INTERNATIONAL CORPORATION, a Delaware corporation (the “Borrower”), CITIZENS BANK, N.A., a national banking association, as Administrative Agent (the “Administrative Agent”) and Lender, and the other Lenders party hereto. Capitalized terms not otherwise defined herein shall have the meanings ascribed to them in the Credit Agreement.

R E C I T A L S

WHEREAS, Administrative Agent, Citizens Bank, N.A., as Multicurrency Administrative Agent, Bank of America, N.A., as Co‑Syndication Agent, Joint Lead Arranger and Joint Book Runner, TD Bank, N.A., as Co‑Syndication Agent, Joint Lead Arranger and Joint Book Runner, JPMorgan Chase Bank, N.A., as Co-Documentation Agent and Truist Bank, as Co Documentation Agent, Borrower, and the Lenders have previously entered into a Third Amended and Restated Credit Agreement dated as of February 2, 2023, as amended by a First Amendment dated October 28, 2024 (the “Credit Agreement”);

WHEREAS, from and after the Second Amendment Effective Date (as defined below), Truist Bank shall be a Co-Syndication Agent, and Truist Securities, Inc. shall be a Joint Lead Arranger and Joint Book Runner;

WHEREAS, PNC Bank, National Association and The Huntington National Bank (collectively, the “New Lenders”) are being added as Lenders under the Credit Agreement, with PNC Bank, National Association also being added as a Co-Documentation Agent;

WHEREAS, Borrower has requested an Incremental Revolving Credit Commitment of $325,000,000.00, which the Lenders acknowledge is greater than the maximum amount set forth in Section 2.01(b) of the Credit Agreement, and Administrative Agent and the Lenders have agreed to such changes pursuant to the terms and conditions set forth herein;

NOW THEREFORE, in consideration of the foregoing premises and the mutual benefits to be derived by Borrower, the Administrative Agent, and Lenders from a continuing relationship under the Credit Agreement and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

A. Amendments to Credit Agreement.

1. The following defined term appearing in Section 1.1 of the Credit Agreement is hereby amended and restated to read as follows:

“Initial Revolving Credit Commitment” means an aggregate principal amount at any one time outstanding not to exceed the amount set forth opposite such Lender’s name on Schedule 2.01 under the caption “Initial Revolving Credit Commitment” or opposite such caption in the Assignment and Assumption pursuant to which such Lender becomes a party hereto, as applicable, as such amount may be adjusted from time to time in accordance with this Agreement. The aggregate Initial Revolving Credit Commitments on the Second Amendment Effective Date is $825,000,000.00.

2. The following new defined term is hereby added to Section 1.1 of the Credit Agreement:

“Second Amendment Effective Date” means December 6, 2024.

3. Section 2.01(b)(1) of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

(b) Increase of Initial Revolving Credit Commitments. (1) From and after the Second Amendment Effective Date, the Borrower may, by written notice to the Administrative Agent, request that the Initial Revolving Credit Commitment be increased by an amount (the “Incremental Revolving Credit Commitment”) not to exceed $250,000,000.00, in the aggregate, for all such increases from the Closing Date until the date that is 180 days prior to the Maturity Date; provided that no Default or Event of Default has occurred and is continuing at the time of such request and on the date of any such increase. The Administrative Agent shall deliver a copy of such request to each Lender. The Borrower shall set forth in such request the amount of the requested increase in the Initial Revolving Credit Commitment (which shall be in a minimum amount of $25,000,000.00 and in minimum increments thereafter of $5,000,000.00) and the date on which such increase is requested to become effective (which shall be not less than 10 Business Days nor more than 60 days after the date of such notice and that, in any event, must be at least 180 days prior to the Maturity Date), and shall offer each Lender the opportunity to increase its Initial Revolving Credit Commitment by its Applicable Percentage of the proposed increased amount. Each Lender shall, by written notice to the Borrower and the Administrative Agent given not more than 10 days after the date of delivery by the Administrative Agent of the Borrower’s request referred to above, either agree to increase its Initial Revolving Credit Commitment by all or a portion of the offered amount (each such Lender so agreeing being an “Increasing Lender”) or decline to increase its Revolving Credit Commitment (and any such Lender that does not deliver such a notice within such period of 10 days shall be deemed to have declined to increase its Revolving Commitment and each Lender so declining or being deemed to have declined being a “Non-Increasing Lender”). If on the 10th day after the Administrative Agent shall have delivered a copy of a request by the Borrower as set forth above, the Increasing Lenders shall have agreed pursuant to the preceding sentence to increase their Initial Revolving Credit Commitments by an aggregate amount less than the increase in the Initial Revolving Credit Commitment so requested by the Borrower, the Borrower may arrange for one or more banks or other entities that are Eligible Assignees, in each case reasonably acceptable to the Borrower and the Administrative Agent (each such Person so agreeing being an “Augmenting Lender”), to commit to making Revolving Credit Loans pursuant to a Revolving Credit Commitment hereunder in an amount no less than $10,000,000.00, and the Borrower and each Augmenting Lender shall execute all such documentation as the Administrative Agent shall reasonably specify to evidence such Augmenting Lender’s Revolving Credit Commitment and/or its status as a Lender with a Revolving Credit Commitment hereunder. Any increase in the Initial Revolving Credit Commitment may be made in an amount that is less than the increase requested by the Borrower if the Borrower is unable to arrange for, or chooses not to arrange for, Augmenting Lenders.

4. Schedule 2.01 of the Credit Agreement is hereby amended in its entirety by Schedule 2.01 attached herewith.

B. Representations and Warranties. Borrower represents and warrants to Administrative Agent and the Lenders that: (a) Borrower has the full power and authority to execute, deliver and perform its obligations under the Credit Agreement, as amended by this Amendment, (b) the execution and delivery of this Amendment have been duly authorized by all necessary action on behalf of Borrower; and (c) the representations and warranties contained or referred to in Article V of the Credit Agreement are true and accurate in all material respects as of the date of this Amendment, unless such representations or warranties specifically refer to a prior date; and (d) no Default or Event of Default has occurred and is continuing or will result after giving effect to this Amendment and the transactions contemplated by this Amendment and the Credit Agreement.

C. New Lenders. Each of the New Lenders hereby agrees, as to itself, that by execution of this Amendment and delivery of this Amendment to the Administrative Agent, effective as of the Second Amendment Effective Date, such New Lender shall be deemed to be a Lender under the Credit Agreement and the other Loan Documents and, effective as of the Second Amendment Effective Date, (i) each New Lender shall comply with, and be subject to, and have the benefit of, all of the terms, conditions, covenants, agreements and obligations set forth in the Credit Agreement and the other Loan Documents and (ii) each New Lender hereby makes each representation and warranty required from such Lender pursuant to the Loan Documents.

D. Other.

1. This Amendment shall take effect as of the Effective Date upon:

(a) the receipt by the Administrative Agent of this Amendment duly executed by the Borrower, the Administrative Agent, and Lenders;

(b) the receipt by the Administrative Agent of Third Amended and Restated Revolving Credit Notes in favor of each Lender (excluding the New Lenders) increasing their Revolving Credit Commitment in the maximum principal amount of their increased Revolving Credit Commitment upon giving effect to this Amendment (collectively, the “Restated Notes”) and receipt by each New Lender that requests the same, a promissory note in the maximum principal amount of its Revolving Credit Commitment upon giving effect to this Amendment (the “New Lender Notes”; collectively with the Restated Notes, the “Subject Notes”);

(c) the receipt by the Administrative Agent of evidence that the proceeds of the Revolving Credit Loans extended as of the date of this Amendment shall fully satisfy all outstanding obligations under the 2024 Acquisition Credit Facility;

(d) payment of all fees owing pursuant to the Engagement Letter dated September 26, 2024, as modified;

(e) evidence of the authority of the Borrower to execute and deliver this Amendment and the Subject Notes and to perform its obligations hereunder and thereunder; and

(f) payment of all reasonable costs and expenses (including, without limitation, the reasonable costs and expenses of the Administrative Agent’s counsel) incurred by the Administrative Agent in connection with this Second Amendment.

2. This Amendment is executed as an instrument under seal and shall be governed by and construed in accordance with the laws of the State of New York without regard to its conflicts of law rules. All parts of the Credit Agreement not affected by this Amendment are hereby ratified and affirmed in all respects, provided that if any provision of the Credit Agreement shall conflict or be inconsistent with this Amendment, the terms of this Amendment shall supersede and prevail. Upon the execution of this Amendment, all references to the Credit Agreement in that document, or in any related document, shall mean the Credit Agreement as amended by this Amendment. Except as expressly provided in this Amendment, the execution and delivery of this Amendment does not and will not amend, modify or supplement any provision of, or constitute a consent to or a waiver of any noncompliance with the provisions of the Credit Agreement, and, except as specifically provided in this Amendment, the Credit Agreement shall remain in full force and effect. This Amendment may be executed in one or more counterparts with the same effect as if the signatures hereto and thereto were upon the same instrument.

[SIGNATURE PAGES FOLLOW]

IN WITNESS WHEREOF, each of Borrower, the Administrative Agent and the undersigned Lenders, in accordance with the provisions of the Credit Agreement, has caused this Amendment to be executed and delivered by their respective duly authorized officers under seal as of the date set forth in the preamble on page one of this Amendment.

| |

STANDEX INTERNATIONAL

CORPORATION, as the Borrower

By:

Name:

Title:

|

[Signature Page to Second Amendment]

| |

CITIZENS BANK, N.A., as Administrative Agent

and as a Lender

By:

Name: Michael Makaitis

Title: Senior Vice President

|

[Signature Page to Second Amendment]

| |

CITIZENS BANK, N.A., Swing Line Lender,

an L/C Issuer, Joint Lead Arranger and Joint Book

Runner

By:

Name: Michael Makaitis

Title: Senior Vice President

|

[Signature Page to Second Amendment]

| |

BANK OF AMERICA, N.A., as a Lender,

Co‑Syndication Agent, Joint Lead Arranger and

Joint Book Runner

By:

Name:

Title:

|

[Signature Page to Second Amendment]

| |

TD BANK, N.A., as a Lender, Co‑Syndication

Agent, Joint Lead Arranger and Joint Book Runner

By:

Name:

Title:

|

[Signature Page to Second Amendment]

| |

JPMORGAN CHASE BANK, N.A., as a Lender

and Co-Documentation Agent

By:

Name:

Title:

|

[Signature Page to Second Amendment]

| |

TRUIST BANK, as a Lender and Co-Syndication

Agent

By:

Name:

Title:

|

[Signature Page to Second Amendment]

| |

SANTANDER BANK, N.A., as a Lender

By:

Name:

Title:

|

[Signature Page to Second Amendment]

| |

PNC BANK, NATIONAL ASSOCIATION, as a

Lender and Co-Documentation Agent

By:

Name:

Title:

|

[Signature Page to Second Amendment]

| |

THE HUNTINGTON NATIONAL BANK, as a

Lender

By:

Name:

Title:

|

[Signature Page to Second Amendment]

Agreed and Acknowledged by the undersigned guarantors as of the date first set forth above:

| |

TENIBAC-GRAPHION, INC.,

a Michigan corporation

By:

Name:

Title:

|

| |

CUSTOM HOISTS, INC., an Ohio corporation

By:

Name:

Title:

|

| |

HORIZON SCIENTIFIC, INC., a South Carolina

corporation

By:

Name:

Title:

|

| |

STANDEX ELECTRONICS, INC., a Delaware

corporation

By:

Name:

Title:

|

| |

STANDEX ELECTRONICS MAGNETICS, INC.,

a Delaware corporation

By:

Name:

Title:

|

[Signature Page to Second Amendment]

| |

GENIUS SOLUTIONS ENGINEERING

COMPANY, an Ohio corporation

By:

Name:

Title:

|

| |

RENCO ELECTRONICS, INC.,

a Florida corporation

By:

Name:

Title:

|

| |

AMRAN, LLC, a Texas limited liability company

By:

Name:

Title:

|

[Signature Page to Second Amendment]

SCHEDULE 2.01

COMMITMENTS AND APPLICABLE PERCENTAGES

|

Lender

|

Revolving Credit

Commitment

|

Applicable Percentage

|

|

Citizens Bank, N.A.

|

$150,000,000.00

|

18.181818%

|

|

Bank of America, N.A.

|

$150,000,000.00

|

18.181818%

|

|

TD Bank, N.A.

|

$150,000,000.00

|

18.181818%

|

|

Truist Bank

|

$125,000,000.00

|

15.151516%

|

|

JPMorgan Chase Bank, N.A.

|

$75,000,000.00

|

9.090909%

|

|

PNC Bank, National Association

|

$75,000,000.00

|

9.090909%

|

|

Santander Bank, N.A.

|

$50,000,000.00

|

6.060606%

|

|

The Huntington National Bank

|

$50,000,000.00

|

6.060606%

|

|

Total:

|

$825,000,000.00

|

100.000000%

|

|

Multicurrency Lender

|

Multicurrency Revolving

Credit Subcommitment

(which is a portion of the

total Revolving Credit

Commitment above)

|

Applicable Percentage

|

|

Citizens Bank, N.A.

|

$9,090,909.00

|

18.181818%

|

|

Bank of America, N.A.

|

$9,090,909.00

|

18.181818%

|

|

TD Bank, N.A.

|

$9,090,909.00

|

18.181818%

|

|

Truist Bank

|

$7,575,758.00

|

15.151516%

|

|

JPMorgan Chase Bank, N.A.

|

$4,545,454.50

|

9.090909%

|

|

PNC Bank, National Association

|

$4,545,454.50

|

9.090909%

|

|

Santander Bank, N.A.

|

$3,030,303.00

|

6.060606%

|

|

The Huntington National Bank

|

$3,030,303.00

|

6.060606%

|

|

Total:

|

$50,000,000.00

|

100.000000%

|

v3.24.3

Document And Entity Information

|

Dec. 06, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

STANDEX INTERNATIONAL CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 06, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

1-7233

|

| Entity, Tax Identification Number |

31-0596149

|

| Entity, Address, Address Line One |

23 Keewaydin Drive

|

| Entity, Address, City or Town |

Salem

|

| Entity, Address, State or Province |

NH

|

| Entity, Address, Postal Zip Code |

03079

|

| City Area Code |

603

|

| Local Phone Number |

893-9701

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SXI

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000310354

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

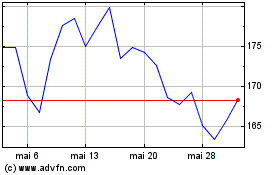

Standex (NYSE:SXI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Standex (NYSE:SXI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024