false

0001306830

0001306830

2024-12-09

2024-12-09

0001306830

us-gaap:CommonStockMember

2024-12-09

2024-12-09

0001306830

CE:SeniorUnsecuredNotesDue2025Member

2024-12-09

2024-12-09

0001306830

CE:SeniorUnsecuredNotesDue2026Member

2024-12-09

2024-12-09

0001306830

CE:SeniorUnsecuredNotesDue2027Member

2024-12-09

2024-12-09

0001306830

CE:SeniorUnsecuredNotesDue2028Member

2024-12-09

2024-12-09

0001306830

CE:SeniorUnsecuredNotesDue2029Member

2024-12-09

2024-12-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 12, 2024 (December 9, 2024)

CELANESE

CORPORATION

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-32410 |

|

98-0420726 |

(State or other jurisdiction

of incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

222

West Las Colinas Blvd. Suite 900N, Irving,

TX 75039

(Address of Principal Executive Offices) (Zip

Code)

Registrant's telephone number, including area

code: (972) 443-4000

(Former name or former address,

if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of Each Class |

Trading

Symbol(s) |

Name

of Each Exchange on Which Registered |

| Common Stock, par value $0.0001 per share |

CE |

The New York Stock Exchange |

| 1.250%

Senior Notes due 2025 |

CE

/25 |

The New York Stock Exchange |

| 4.777%

Senior Notes due 2026 |

CE

/26A |

The New York Stock Exchange |

| 2.125%

Senior Notes due 2027 |

CE

/27 |

The New York Stock Exchange |

| 0.625%

Senior Notes due 2028 |

CE

/28 |

The New York Stock Exchange |

| 5.337%

Senior Notes due 2029 |

CE

/29A |

The New York Stock Exchange |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Amendments to Severance Benefits Plan

On December 9, 2024, the Compensation and Management Development Committee

(the “Committee”) of the Board of Directors (the “Board”) of Celanese Corporation (the “Company”)

approved changes to the Company’s Executive Severance Benefits Plan (to be renamed the Designated Roles Member Severance Benefits

Plan), effective as of January 1, 2025, that reduce the severance benefit thereunder from 150% of base salary and target bonus to 100%

of base salary and target bonus for individuals who are “executive officers” under applicable SEC rules (from 200% to 150%

in the case of the CEO) and make other clarifying changes.

The foregoing

summary of the above changes and compensatory arrangements does not purport to be complete and is qualified in its entirety by reference

to the full text of the documents, as applicable, copies of which are attached as exhibits hereto.

Item 9.01 Financial Statements and Exhibits

(d) The following exhibits are being furnished herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CELANESE CORPORATION |

| |

|

| |

By: |

/s/ Ashley B. Duffie |

| |

Name: |

Ashley B. Duffie |

| |

Title: |

Senior Vice President, General Counsel and Corporate Secretary |

| |

|

|

| |

Date: |

December 12, 2024 |

Exhibit 10.1

DESIGNATED ROLES MEMBER SEVERANCE BENEFITS

PLAN

Adopted: December 9, 2024

Effective January 1, 2025

Implementation Date: March 10, 2025 (for eligible

employees participating in the Executive Severance Benefits Plan on December 31, 2024)

Table of Contents

Page

| Table of Contents |

i |

| |

|

| Executive Severance Benefits Plan Overview |

1 |

| |

|

| Who is Eligible |

1 |

| |

|

| Covered Severance Events |

1 |

| |

|

| How the Severance Benefits Plan Works |

2 |

| |

|

| Severance Payment |

2 |

| |

|

| Continuation of Health Benefits |

3 |

| |

|

| Conditions |

3 |

| |

|

| Employees Rehired After Receiving Benefits |

4 |

| |

|

| When Coverage Ends |

4 |

| |

|

| Claims and Appeals Process |

4 |

| |

|

| Celanese Americas Benefits Committee |

6 |

| |

|

| Duration of the Plan, Ability to Amend or Terminate the Plan |

6 |

| |

|

| Appendix A - Glossary |

7 |

Designated Roles Member Severance Benefits Plan Overview

The Designated Roles Member (DRM) Severance

Benefits Plan provides a severance payment, including a Supplemental Payment, continuation of health benefits and other benefits to certain

eligible executive employees of Celanese Americas LLC and its participating affiliated companies (“Celanese”). Only executive

employees of Celanese who are designated in writing as “DRM” executive employees by the Compensation & Management Development

Committee (CMDC) of the Celanese Board of Directors shall be eligible for Severance Benefits under this Plan.

Celanese can, in certain circumstances and notwithstanding

the provisions of this Plan, in its sole discretion, provide different or enhanced severance benefits to certain employees specified on

an individual or group basis. However, the granting of such benefits shall not mean that any other individual employee or group of employees

is entitled to such benefits. You are not eligible to participate in this Plan if you are eligible to receive severance benefits under

any other plan, agreement or arrangement sponsored by Celanese except to the extent specifically set forth in such other plan, agreement

or arrangement.

Certain terms used in this Plan are defined in the

Glossary in Appendix A.

Who is Eligible

Executive employees of Celanese that have been designated

in writing by the CMDC as a Designated Role Member (DRM) are eligible to participate in this Plan.

You are not eligible to receive Severance Benefits

under this Plan unless you are classified as an “employee” on the payroll records of Celanese, regardless of whether it is

later determined that you are, or were, an “employee” of Celanese. In addition, you are not eligible to receive Severance

Benefits under this Plan if you have not been designated in writing as a DRM by the CMDC.

Covered Severance Events

If you are an eligible employee, you are eligible

for Severance Benefits if you experience a Covered Severance Event. You experience a Covered Severance Event if you are involuntarily

terminated from active employment by Celanese without Cause.

For purposes of the Plan, your termination is for

Cause if you are terminated because of:

(i) your willful failure to

perform your duties to Celanese (other than as a result of total or partial incapacity due to physical or mental illness) for a period

of 30 days following written notice by Celanese to you of such failure;

(ii) your conviction of, or a plea

of nolo contendere to (x) a felony under the laws of the United States or any state thereof or any similar criminal act in a jurisdiction

outside the United States or (y) a crime involving moral turpitude;

(iii) your willful malfeasance or willful

misconduct which is demonstrably injurious to Celanese or any of its affiliates;

(iv) your violation of Celanese’s

code of conduct;

(v) your violation of Celanese’s policies

concerning discrimination, harassment or retaliation;

(vi) your conduct that causes harm to the

business reputation of Celanese or its affiliates; or

(vii) your breach of the provisions

of any confidentiality, noncompetition or nonsolicitation obligation to which you are subject.

Enrollment is automatic.

Eligible executive employees who are involuntarily

terminated for any other reason (e.g., death, disability, retirement, termination for Cause, or who resign or retire), are not eligible

to receive severance benefits under this Plan.

How the Severance Benefits Plan Works

Eligible executive DRM employees who have had a Covered

Severance Event are eligible to receive (i) a severance payment, including a Supplemental Payment, (ii) continuation of health care benefits

and (iii) other benefits, all as further described below.

Equity Awards -This Plan does not alter the

terms of any grant of equity compensation to you. Your rights with respect to any equity compensation grant are governed by the agreement(s)

that establish the terms and conditions of your grant.

Severance Payment

Eligible executive DRM employees who have a Covered

Severance Event will receive a severance payment upon the executive’s termination of employment with Celanese and its affiliates.

For eligible executive DRM employees other than the

Chief Executive Officer of Celanese, the Severance Payment is an amount equal to the 100% of executive’s base annual salary in effect

on the date of separation plus an amount equal to the executive’s target bonus for the year of separation. For the individual holding

the Chief Executive Officer of Celanese (CEO) position, the Severance Payment shall be 150% of the CEO’s annual base salary in effect

on the date of separation plus an amount equal to 150% of the CEO’s target bonus for the year of separation. The Severance Payment

will be made as soon as practicable following the eligible executive’s termination, but in no event later than December 31 of the

year in which such termination occurs or, if later, the 15th day of the third month following such termination.

Pro-Rata Supplemental Bonus Payment

In addition to the Severance Payment, an

eligible executive who has a Covered Severance Event will be entitled to a pro rata bonus payment for the year of termination (a “Supplemental Payment”). The Supplemental Payment is an amount equal to the executive employee’s bonus payment for the year of termination

multiplied by a fraction, the numerator of which is the number of days in the year of the executive’s termination up to and

including the date of the executive’s termination and the denominator of which is 365 (or, 366, as applicable). The

Supplemental Payment (1) shall be based on actual performance of Celanese for the year of termination (with a minimum of a 1.0

personal modifier) rather than target performance, and (2) instead of being paid at the same time as the Severance Payment, shall be

paid at the same time annual bonuses are paid to other designated employees who do not terminate employment during the year but in

no event later than the 30th day of the third month of the year following such termination.

Any amounts that the eligible executive DRM owes

to Celanese will be deducted from the eligible executive DRM employee’s Severance Payment, and, if applicable, Supplemental Payment.

As an additional condition to receiving the Severance Payment, the Plan Administrator may require the eligible executive DRM employee

to execute a written agreement that authorizes Celanese to deduct any amounts the eligible executive DRM employee owes to Celanese prior

to the payment of the Severance Payment or Supplemental Payment under the Plan.

All Severance Payments, Supplemental Payments or

other benefits provided under this Plan shall be made subject to all withholdings and deductions that Celanese determines are necessary

to comply with applicable law.

Continuation of Health Benefits

Eligible executives who have a Covered Severance

Event will be eligible to elect, under COBRA, to continue to participate in the Celanese Americas Medical Plan.

If the eligible executive DRM employee is enrolled

in Company provided medical and/or dental coverage immediately before separation, such employee may continue to purchase coverage at the

active employee monthly premium rate as follows:

CEO – 18 months

Other DRMs – 12 months.

For any COBRA benefits to which the eligible executive

DRM employee may be entitled under COBRA and the terms of the Celanese plans following expiration of the applicable period set forth above,

the eligible executive employee must pay the otherwise applicable COBRA premium in accordance with COBRA and the terms of the Celanese

plans in order to continue to participate in the Medical Plan.

Health coverage will terminate when the eligible executive DRM employee

becomes eligible to participate in any other employer-sponsored health plan. You must notify Celanese when you become eligible for any

other employer-provided health care benefits.

Other

Eligible executive DRM employees

who have a Covered Severance Event will be eligible to receive outplacement services for a period of 12 months following termination with

an outplacement firm selected by Celanese and subject to any limits as Celanese may determine.

Conditions

As a condition for receiving any severance

benefits under this Plan, including but not limited to subsidized COBRA benefits, you must (1) return all property of Celanese and

its affiliates; (2) hold confidential any and all confidential information concerning Celanese and its affiliates; (3)

cooperate fully with Celanese and its affiliates; (4) execute and deliver such forms as required by Celanese; (5) comply with any

noncompetition or non-solicitation obligation to which you are subject; and (6) execute and deliver to Celanese a general

release of claims, restrictive covenants and cooperation agreement in the form provided to you by Celanese. If you fail to fully

comply with any of the obligations described in this paragraph, you are not eligible for any benefits under this Plan.

Notwithstanding any other provision of this Plan, no Severance Benefits will be paid or provided to you, including but not limited

to subsidized COBRA benefits until such release has become effective and nonrevocable. To the extent that any other provision of

this Plan would provide for a Severance Payment or Supplemental Payment earlier than such date, such Severance Payment and

Supplemental Payment shall be postponed until such date (or such later date as may be provided under the heading “Internal

Revenue Code Section 409A”). Any health care premium or outplacement benefit that would otherwise have been applicable prior

to such date shall be forfeited.

Employees Rehired After Receiving Benefits

If you are a former employee and you are applying

for rehire consideration, you will be considered with all other external candidates and have no guaranteed entitlement to a prior job

classification, level, or rate of pay. The position will reflect Celanese’s current evaluation of the position in the current organization

structure.

If you are a former employee who is rehired after

receiving benefits under this Plan, you will not receive recognition of prior service in the determination of subsequent benefits, except

to the extent provided by law. Calculation of subsequent benefits will begin as of the date you are rehired as a Celanese employee. Any

prior service previously credited will not be included for the purpose of the calculation of benefits entitlement after you are rehired.

All issues regarding the treatment of any service

time since separation from employment are to be resolved by the Plan Administrator before an individual with prior service is rehired.

When Coverage Ends

Your coverage under this Plan ends once you terminate

from Celanese or when you are no longer an eligible executive DRM employee.

Claims and Appeals Process

If you believe that you are entitled to benefits

under the Plan, you must file a claim for benefits. A claim for benefits must be made no later than one year following the date of your

termination of employment with Celanese. If you do not file a claim for benefits within one year of the date of your termination of employment

with Celanese, you will not be entitled to any benefits under the Plan.

A claim for benefits is submitted to the Plan Administrator.

The Plan Administrator has the sole discretionary authority to approve or deny each claim. In the event the Plan Administrator denies,

in whole or in part, an initial claim for benefits by a participant or his beneficiary, the Plan Administrator will furnish notice of

the adverse determination to you.

The notice will be forwarded to you within 90

days of receipt of the claim by the Plan Administrator. However, in special circumstances, the Plan Administrator may extend the

response period for up to an additional 90 days, and must notify you in writing of the extension, and will specify the reasons for

the extension. If for any reason you do not receive a response from the Plan Administrator within the time prescribed, the claim

will be deemed denied.

Within 60 days of receipt of a notice of an adverse

determination, you or your duly authorized representative may petition the Plan Administrator in writing for a full and fair review of

the adverse determination (see address below for information on how to contact the Plan Administrator). You or your duly authorized representative

will have the opportunity to submit comments in writing, documents, records, and other relevant information to the Plan Administrator.

You will also have the right to be furnished, free of charge and upon request, reasonable access to, and copies of, all documents, records

and other relevant information. Relevant information includes any information that was submitted, considered or generated in the course

of the decision regardless of whether such information was relied upon in making the benefit determination. You may also request any information

demonstrating that, where appropriate, the Plan is acting consistently with respect to other participants.

The Plan Administrator will review the denial and

will take into account all documents, records, and other information submitted by you regardless of whether such information was submitted

or considered in the initial determination. The Plan Administrator will communicate its decision and provide an explanation to you in

writing within 60 days of receipt of the petition. However, in special circumstances, the Plan Administrator may extend the response period

for up to an additional 60 days, in which event it will notify you in writing prior to the commencement of the extension and specify the

reasons for the extension. If for any reason, the written decision on review is not furnished within the time prescribed, the claim will

be deemed denied on review.

The written notice of decision by the Plan Administrator

will set forth:

| ► | The specific reasons for the adverse determination; |

| ► | A specific reference to the pertinent Plan provisions on which the adverse determination is based; |

| ► | A description of any additional information necessary for you to perfect the claim and an explanation of why such information is necessary.

In the case of a notification of an appealed claim, the notice will also include a statement that you are entitled to receive reasonable

access to and copies of all documents, records, and other relevant information with respect to the claim; and |

| ► | A description of the Plan’s review procedures (or, in the case of a notification of an appealed claim, a description of any

voluntary appeal procedures) and the time limits applicable to such procedures, including a statement of the claimant’s right to

bring a civil action under section 502 of ERISA following an adverse decision by the Plan Administrator. |

Celanese Americas Benefits Committee

The Plan Administrator is the Celanese Americas

Benefits Committee. The Benefits Committee has general responsibility and sole discretionary authority for administering the Plan

and reviewing claims for benefits and appeals or denied claims. Any determination by the Benefits Committee is final and conclusive

and will not be overturned unless it is deemed to be arbitrary and capricious. The Celanese Americas Benefits Committee can be

contacted at:

Celanese Americas Benefits Committee

c/o Benefits Department

222 W. Las Colinas Blvd., Suite 900N

Irving, TX 75039

972-443-4000

Ability to Amend or Terminate the Plan

The Plan Sponsor retains the right to amend or terminate

the Plan at any time, in its sole discretion whether before or after a Covered Severance Event.

Internal Revenue Code Section 409A

This Plan is intended to be exempt from the provisions

of Section 409A of the Internal Revenue Code (“Section 409A”) to the maximum extent possible, including, without limitation,

pursuant to Treas. Reg. Section 1.409A-1(b)(4) and Treas. Reg. Section 1.409A-1(b)(9) and otherwise to comply with Section 409A, and this

Plan shall be interpreted accordingly.

For purposes of this Plan, to the extent necessary

with respect to any applicable exemption from Section 409A or to the extent necessary to comply with Section 409A, an eligible executive

will be treated as having terminated employment only if such termination of employment constitutes a “separation from service”

within the meaning of Section 409A.

To the extent any Severance Benefits are subject

to the requirements of Section 409A and are otherwise payable upon an eligible executive’s separation from service, if such eligible

executive is a “specified employee” within the meaning of Section 409A, any such benefits the would otherwise be paid or provided

during the six month period following such eligible executive’s separation from service shall be postponed and paid or provided

on the first day of the seventh month following such separation from service.

For purposes of Section 409A, each installment of

any series of payments or benefits shall be treated as a “separate payment” for purposes of Section 409A and the regulations

thereunder.

Notwithstanding any provision of this Plan to the

contrary, in no event shall the timing of an eligible executive’s execution of the release described above directly or indirectly,

result in eligible executive’s designating the calendar year of payment of any amounts of deferred compensation subject to Section

409A, and if such a payment could be made in more than one taxable year, such payment shall be made in the later taxable year.

APPENDIX A

Glossary

Cause - See page 1 under “Covered

Severance Events.”

Celanese - Celanese Americas LLC

and its participating affiliated companies

Compensation & Management Development

Committee (CMDC). See p.2

Continuation of Health Benefits -

See page 2 under “Continuation of Health Benefits.”

Covered Severance Event - See page

1 under “Covered Severance Events.”

Designated Role Member (DRM) – Those roles deemed by the

Compensation & Management Development Committee of the Board of Directors (CMDC).

ERISA - Employee Retirement Income

Security Act of 1974, as amended.

Medical Plan - The Celanese Americas

Medical Plan

Plan - This Celanese Americas Designated

Roles Member Severance Benefits Plan

Plan Administrator - Celanese Americas

Benefits Committee

Plan Sponsor – Celanese Americas

LLC

Severance Payment – See Page

2 under “Severance Payment”

Severance Benefits - The benefits provided

under this Plan, including a Severance Payment and Continuation of Health Benefits

Page Left Intentionally Blank

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CE_SeniorUnsecuredNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CE_SeniorUnsecuredNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CE_SeniorUnsecuredNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CE_SeniorUnsecuredNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CE_SeniorUnsecuredNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

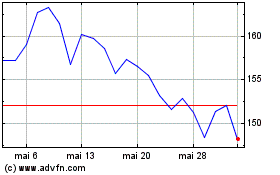

Celanese (NYSE:CE)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Celanese (NYSE:CE)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025