Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

12 Dezembro 2024 - 7:21PM

Edgar (US Regulatory)

4 Year Autocallable Securities Linked to SPX

Preliminary Terms

This summary of terms is not complete and should be read with the preliminary pricing supplement below

|

Issuer:

|

Citigroup Global Markets Holdings Inc.

|

|

Guarantor:

|

Citigroup Inc.

|

|

Underlying:

|

The S&P 500® Index (ticker: “SPX”)

|

|

Pricing date:

|

December 20, 2024

|

|

Valuation dates:

|

Quarterly, beginning approximately one year after issuance

|

|

Final valuation date:

|

December 20, 2028

|

|

Maturity date:

|

December 26, 2028

|

|

Final barrier value:

|

70.00% of the initial underlying value

|

|

Automatic early redemption:

|

If on any valuation date prior to the final valuation date the closing value of the underlying is greater than or equal to the initial underlying value, the securities will be automatically redeemed for $1,000 plus the applicable premium

|

|

Premium:

|

At least 7.45% per annum*

|

|

CUSIP / ISIN:

|

17333A2Y4 / US17333A2Y47

|

|

Initial underlying value:

|

The closing value on the pricing date

|

|

Final underlying value:

|

The closing value on the final valuation date

|

|

Underlying return:

|

(Final underlying value - initial underlying value) / initial underlying value

|

|

Payment at maturity (if not autocalled):

|

•

If the final underlying value is greater than or equal to the final barrier value:

$1,000 + the premium applicable to the final valuation date

•

If the final underlying value is less than the final barrier value:

$1,000 + ($1,000 × the underlying return)

If the securities are not automatically redeemed prior to maturity and the final underlying value is less than the final barrier value, you will receive significantly less than the stated principal amount of your securities, and possibly nothing, at maturity.

All payments on the securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc.

|

|

Stated principal amount:

|

$1,000 per security

|

|

Preliminary pricing supplement:

|

|

* The actual premium will be determined on the pricing date.

Hypothetical Interim Payment per Security**

|

Valuation Date on which the Closing Value of the Underlying Equals or Exceeds Initial Underlying Value

|

Initial Underlying Value

|

Premium

|

Hypothetical Redemption

|

|

December 23, 2025

|

100.00%

|

7.45%

|

$1,074.50

|

|

March 20, 2026

|

100.00%

|

9.3125%

|

$1,093.125

|

|

June 22, 2026

|

100.00%

|

11.175%

|

$1,111.75

|

|

September 21, 2026

|

100.00%

|

13.0375%

|

$1,130.375

|

|

December 21, 2026

|

100.00%

|

14.90%

|

$1,149.00

|

|

March 22, 2027

|

100.00%

|

16.7625%

|

$1,167.625

|

|

June 21, 2027

|

100.00%

|

18.625%

|

$1,186.25

|

|

September 20, 2027

|

100.00%

|

20.4875%

|

$1,204.875

|

|

December 20, 2027

|

100.00%

|

22.35%

|

$1,223.50

|

|

March 20, 2028

|

100.00%

|

24.2125%

|

$1,242.125

|

|

June 20, 2028

|

100.00%

|

26.075%

|

$1,260.75

|

|

September 20, 2028

|

100.00%

|

27.9375%

|

$1,279.375

|

If the closing value of the underlying is not greater than or equal to the initial underlying value on any interim valuation date, then the securities will not be automatically redeemed prior to maturity and you will not receive a premium following that valuation date.

** The hypotheticals assume that the premium applicable to each valuation date will be set at the lowest value indicated in this offering summary.

Hypothetical Payment at Maturity per Security***

Assumes the securities have not been automatically redeemed prior to maturity.

|

Hypothetical Underlying Return on Final Valuation Date

|

Hypothetical Payment at Maturity

|

|

100.00%

|

$1,298.00

|

|

50.00%

|

$1,298.00

|

|

25.00%

|

$1,298.00

|

|

0.00%

|

$1,298.00

|

|

-0.01%

|

$1,298.00

|

|

-30.00%

|

$1,298.00

|

|

-30.01%

|

$699.90

|

|

-50.00%

|

$500.00

|

|

-75.00%

|

$250.00

|

|

-100.00%

|

$0.00

|

*** The hypothetical assumes that the premium on the final valuation date will be set at the lowest value indicated in this offering summary.

Selected Risk Considerations |

|

|

Additional Information |

•

You may lose a significant portion or all of your investment. Unlike conventional debt securities, the securities do not provide for the repayment of the stated principal amount at maturity in all circumstances. If the securities are not automatically redeemed prior to maturity, your payment at maturity will depend on the final underlying value. If the final underlying value is less than the final barrier value, you will lose 1% of the stated principal amount of your securities for every 1% by which the underlying has declined from the initial underlying value. There is no minimum payment at maturity on the securities, and you may lose up to all of your investment.

•

Your potential return on the securities is limited.

•

The securities do not pay interest.

•

You will not receive dividends or have any other rights with respect to the underlying.

•

The securities may be automatically redeemed prior to maturity.

•

The securities offer downside exposure, but no upside exposure, to the underlying.

•

The securities are particularly sensitive to the volatility of the closing value of the underlying on or near the valuation dates.

•

The securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. If Citigroup Global Markets Holdings Inc. defaults on its obligations under the securities and Citigroup Inc. defaults on its guarantee obligations, you may not receive anything owed to you under the securities.

•

The securities will not be listed on any securities exchange and you may not be able to sell them prior to maturity.

•

The estimated value of the securities on the pricing date will be less than the issue price. For more information about the estimated value of the securities, see the accompanying preliminary pricing supplement.

•

The value of the securities prior to maturity will fluctuate based on many unpredictable factors.

•

The issuer and its affiliates may have conflicts of interest with you.

•

The U.S. federal tax consequences of an investment in the securities are unclear.

|

|

|

Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed registration statements (including the accompanying preliminary pricing supplement, product supplement, underlying supplement, prospectus supplement and prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the accompanying preliminary pricing supplement, product supplement, underlying supplement, prospectus supplement and prospectus in those registration statements (File Nos. 333-270327 and 333-270327-01) and the other documents Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed with the SEC for more complete information about Citigroup Global Markets Holdings Inc., Citigroup Inc. and this offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, you can request these documents by calling toll-free 1-800-831-9146.

Filed pursuant to Rule 433

|

|

The above summary of selected risks does not describe all of the risks associated with an investment in the securities. You should read the accompanying preliminary pricing supplement and product supplement for a more complete description of risks relating to the securities.

|

|

|

This offering summary does not contain all of the material information an investor should consider before investing in the securities. This offering summary is not for distribution in isolation and must be read together with the accompanying preliminary pricing supplement and the other documents referred to therein, which can be accessed via the link on the first page.

|

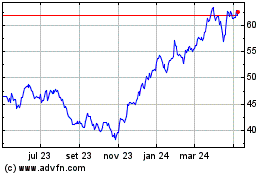

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

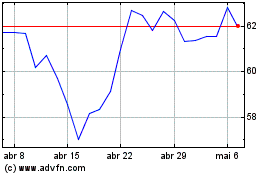

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024