Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

17 Dezembro 2024 - 10:28AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number:

Kuke Music Holding Limited

Room 303

Beijing Broadcasting Tower,

No. Jia 14, Jianwaidajie

Chaoyang District, Beijing

People’s Republic of China

+86-010-6561 0392

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Kuke Music Holding Limited, a Cayman Islands exempted company, a leading

classical music service platform in China, (the “Company”) entered into a securities purchase agreement with Key Wealth Trading

Company Limited and Wah Yip International Limited, in connection with the issuance and sale 1,671,346 American Depositary Shares at a

purchase price of $0.6 per share, representing 1,671,346 Class A ordinary shares.

The information contained in this Form 6-K is hereby incorporated by

reference into the Company’s Registration Statement on Form F-3 (Registration No. 333-267655) and the Company’s

Registration Statement on Form S-8 (Registration No. 333-256982).

EXHIBITS

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Kuke Music Holding Limited |

| |

|

|

| |

By: |

/s/ Li Li |

| |

|

Name: |

Li Li |

| |

|

Title: |

Chief Financial Officer |

| |

|

Date: |

December 17, 2024 |

3

Exhibit 5.1

| CONYERS

DILL & PEARMAN

29th Floor

One Exchange Square

8 Connaught Place

Central

Hong Kong

T +852 2524 7106 | F +852 2845 9268

conyers.com |

17 December 2024

Matter No.:1003612

Doc Ref: 110492609

852 2842 9521 / 2842 9566

Flora.Wong@conyers.com

Rita.Leung@conyers.com

Kuke Music Holding Limited

Room 303 Beijing Broadcasting Tower

No. Jia 14, Jianwaidajie Chaoyang District

Beijing

People’s Republic of China

Dear Sir/Madam,

Re: Kuke Music Holding Limited (the “Company”)

We have acted as special Cayman

Islands legal counsel to the Company in connection with a registration statement on Form F-3 (File No. 333-267655), including all amendments

or supplements thereto (the “Registration Statement”), filed with and declared effective by the U.S. Securities and Exchange

Commission (the “Commission”) under the U.S. Securities Act of 1933, as amended, (the “Securities Act”)

and the prospectus supplement to the Registration Statement dated 17 December 2024 (the “Prospectus Supplement”, together

with the prospectus included in the Registration Statement, the “Prospectus”) through which the Company may offer up

to 1,671,346 class A ordinary shares of a par value US$0.001 each in the Company (the “Class A Ordinary Shares” and

such Class A Ordinary Shares being offered by the Company, the “Sale Shares”) to be represented by American depositary

shares (the “Sale ADSs”).

For the purposes of giving this opinion, we have

examined the following document(s):

| 1.1. | the Registration Statement; |

| 1.3. | a securities purchase agreement made between the Company and

Key Wealth Trading Company Limited relating to the issue and subscription of the Sale ADSs dated 29 October 2024 (the “Purchase

Agreement”). |

The documents listed in items 1.1 through 1.3

above are herein sometimes collectively referred to as the “Documents” (which term does not include any other instrument

or agreement whether or not specifically referred to therein or attached as an exhibit or schedule thereto).

Partners: Piers J. Alexander, Christopher W. H.

Bickley, Peter H. Y. Ch’ng, Anna W. T. Chong, Angie Y. Y. Chu, Vivien C. S. Fung, Richard J. Hall, Norman Hau, Wynne Lau, Paul M.

L. Lim, Ryan A. McConvey, Teresa F. Tsai, Flora K. Y. Wong, Lilian S. C. Woo, Mark P. Yeadon

Consultant: David M. Lamb

BERMUDA

| BRITISH VIRGIN ISLANDS | CAYMAN ISLANDS

We have also reviewed:

| 1.4. | a copy of the third amended and restated memorandum and articles

of association of the Company adopted by a special resolution passed by the Company on 20 September 2024, each certified by a director

of the Company on 29 October 2024 (the “Constitutional Documents”); |

| 1.5. | a copy of minutes of a meeting of its directors held on 29 October 2024 (the “Resolutions”); |

| 1.6. | a copy of a Certificate of Good Standing issued by the Registrar

of Companies in relation to the Company on 4 December 2024 (the “Certificate Date”); and |

| 1.7. | such other documents and made such enquiries as to questions

of law as we have deemed necessary in order to render the opinion set forth below. |

We have assumed:

| 2.1. | the genuineness and authenticity of all signatures and the conformity

to the originals of all copies (whether or not certified) examined by us and the authenticity and completeness of the originals from

which such copies were taken; |

| 2.2. | that where a document has been examined by us in draft form,

it will be or has been executed in the form of that draft, and where a number of drafts of a document have been examined by us all changes

thereto have been marked or otherwise drawn to our attention; |

| 2.3. | the capacity, power and authority of each of all parties, other

than the Company, to enter into and perform its respective obligations under the Purchase Agreement and the due execution and delivery

thereof by each party thereto; |

| 2.4. | the accuracy and completeness of all factual representations

made in the Documents and other documents reviewed by us; |

| 2.5. | that the Resolutions were passed at one or more duly convened,

constituted and quorate meetings or by unanimous written resolutions, remain in full force and effect and have not been rescinded or

amended; |

| 2.6. | that the Company will issue the Sale ADSs and the Sale Shares

(collectively, the “Securities”) in furtherance of its objects as set out in its memorandum of association; |

| 2.7. | that the Constitutional Documents will not be amended in any

manner that would affect the opinions expressed herein; |

| 2.8. | that Company’s incurrence and performance of its obligations

under the Purchase Agreement in accordance with the terms thereof will not violate the Constitutional Documents nor any applicable law,

regulation, order or decree in the Cayman Islands; |

| 2.9. | that the Company will have sufficient authorised but unissued

Class A Ordinary Shares at the time of issuance and allotment of the Sale Shares; |

| 2.10. | that the issuance and sale of and payment for the Securities

will be in accordance with the Purchase Agreement, the Registration Statement and the Prospectus; |

| 2.11. | that, upon the issue of the Sale Shares, the Company will receive

consideration for the final issue price thereof which shall be equal to at least the par value thereof; |

| 2.12. | that no invitation has been or will be made by or on behalf of the Company to the public in the Cayman

Islands to subscribe for any Securities, and that no Securities will be issued to residents of the Cayman Islands; |

| 2.13. | that there is no provision of the law of any jurisdiction, other

than the Cayman Islands, which would have any implication in relation to the opinions expressed herein; |

| 2.14. | the Company has not taken any action to appoint a restructuring

officer; |

| 2.15. | the validity and binding effect under the laws of the State

of New York, United States of America (the “Foreign Laws”) of the Documents which are expressed to be governed by such

Foreign Laws in accordance with their respective terms, and the Registration Statement and the Prospectus will be duly filed with the

Commission; and |

| 2.16. | that on the date of entering into the Document(s) and issuance

of the Securities, the Company is and after entering into the Documents and any such issuance by the Company, is and will be able to

pay its liabilities as they become due. |

| 3.1. | The obligations of the Company under the Documents and any Securities: |

| (a) | will be subject to the laws from time to time in effect relating to bankruptcy, insolvency, liquidation,

possessory liens, rights of set off, reorganisation, amalgamation, merger, consolidation, moratorium, bribery, corruption, money laundering,

terrorist financing, proliferation financing or any other laws or legal procedures, whether of a similar nature or otherwise, generally

affecting the rights of creditors as well as applicable international sanctions; |

| (b) | will be subject to statutory limitation of the time within which proceedings may be brought; |

| (c) | will be subject to general principles of equity and, as such, specific performance and injunctive relief,

being equitable remedies, may not be available; |

| (d) | may not be given effect to by a Cayman Islands court, whether or not it was applying the Foreign Laws,

if and to the extent they constitute the payment of an amount which is in the nature of a penalty; and |

| (e) | may not be given effect by a Cayman Islands court to the extent that they are to be performed in a jurisdiction

outside the Cayman Islands and such performance would be illegal under the laws of that jurisdiction. Notwithstanding any contractual

submission to the exclusive or non-exclusive jurisdiction of specific courts, a Cayman Islands court has inherent discretion to stay or

allow proceedings in the Cayman Islands against the Company under the Documents and any Securities if there are other proceedings in respect

of the Documents and any Securities simultaneously underway against the Company in another jurisdiction. |

| 3.2. | We express no opinion as to the enforceability of any provision

of the Documents which provides for the payment of a specified rate of interest on the amount of a judgment after the date of judgment

or which purports to fetter the statutory powers of the Company. |

| 3.3. | We have made no investigation of and express no opinion in relation

to the laws of any jurisdiction other than the Cayman Islands. This opinion is to be governed by and construed in accordance with the

laws of the Cayman Islands and is limited to and is given on the basis of the current law and practice in the Cayman Islands. This opinion

is issued solely for your benefit and use in connection with the matter described herein and is not to be relied upon by any other person,

firm or entity or in respect of any other matter. |

On the basis of and subject to the foregoing,

we are of the opinion that:

| 4.1. | The Company is duly incorporated and existing under the laws

of the Cayman Islands and, based on the Certificate of Good Standing, is in good standing as at the Certificate Date. Pursuant to the

Companies Act (“Act”), a company is deemed to be in good standing if all fees and penalties under the Act have been

paid and the Registrar of Companies has no knowledge that the company is in default under the Act. |

| 4.2. | Based solely on our review of the memorandum of association

of the Company, the Company has an authorised share capital of US$5,000,000 divided into 5,000,000,000 shares of a nominal or par value

of US$0.001 each, comprising of (i) 4,961,500,000 class A ordinary shares of a par value of US$ 0.001 each, and (ii) 38,500,000 class

B ordinary shares of a par value of US$0.001 each. |

| 4.3. | When allotted, issued and paid for in accordance with the Registration

Statement, the Prospectus and the Resolutions, the Sale Shares will be validly issued, fully paid and non-assessable (which term when

used herein means that no further sums are required to be paid by the holders thereof in connection with the issue of such shares). |

We hereby consent to the filing of this opinion

as an exhibit to the Registration Statement and to the references to our firm under the caption “Legal Matters” in the Prospectus

forming a part of the Registration Statement. In giving this consent, we do not hereby admit that we are experts within the meaning of

Section 11 of the Securities Act or that we are within the category of persons whose consent is required under Section 7 of the Securities

Act or the Rules and Regulations of the Commission promulgated thereunder.

Yours faithfully,

/s/ Conyers Dill & Pearman

Conyers Dill & Pearman

conyers.com | 4

Kuke Music (NYSE:KUKE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

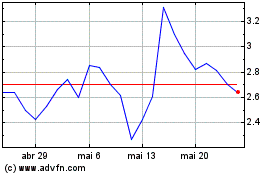

Kuke Music (NYSE:KUKE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024