As

filed with the Securities and Exchange Commission on December 17, 2024

Registration

No. 333-283527

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT NO. 1

TO

FORM

F-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ESGL

HOLDINGS LIMITED

(Exact

Name of Registrant as Specified in Its Charter)

| Cayman

Islands |

|

4954 |

|

Not

applicable |

(State

or Other jurisdiction

of

Incorporation or Organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

101

Tuas South Avenue 2

Singapore

637226

+65

6653 2299

(Address,

Including Zip Code, And Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Puglisi

& Associates

850

Library Avenue, Suite 204

Newark,

DE 19711

(302)

738-6680

(Name,

Address, Including Zip Code, And Telephone Number, Including Area Code, of Agent For Service)

Copies

of all correspondence to:

Mitchell

S. Nussbaum, Esq.

David

J. Levine, Esq.

Loeb

& Loeb, LLP

345

Park Avenue

New

York, NY 10154

(212)

407-4000

Fax:

(212) 407-4990

Approximate

date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth

company. ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

EXPLANATORY

NOTE

ESGL

Holdings Limited is filing this Amendment No. 1 to its Registration Statement on Form F-1 (File No. 333-283527) (the

“Registration Statement”) as an exhibit-only filing. Accordingly, this amendment consists only of the facing page,

this explanatory note, Part II of the Registration Statement, the signature page to the Registration Statement and the filed

exhibits. The remainder of the Registration Statement is unchanged and has therefore been omitted.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

6. Indemnification of Directors and Officers.

Cayman

Islands law does not limit the extent to which a company’s articles of association may provide for indemnification of officers

and directors, except to the extent any such provision may be held by the Cayman Islands courts to be contrary to public policy, such

as to provide indemnification against civil fraud or the consequences of committing a crime. Our Amended and Restated Memorandum and

Articles of Association permit indemnification of officers and directors for any liability, action, proceeding, claim, demand, costs

damages or expenses, including legal expenses, incurred in their capacities as such unless such liability (if any) arises from actual

fraud, willful neglect or willful default which may attach to such directors or officers. This standard of conduct is generally the same

as permitted under the Delaware General Corporation Law for a Delaware corporation. In addition, we entered into indemnification agreements

with our directors and executive officers that provide such persons with additional indemnification beyond that provided in our Amended

and Restated Memorandum and Articles of Association.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers or persons controlling

us under the foregoing provisions, we have been informed that, in the opinion of the SEC, such indemnification is against public policy

as expressed in the Securities Act and is therefore unenforceable.

Item

7. Recent Sales of Unregistered Securities.

We

issued the foregoing securities in transactions not involving an underwriter and not requiring registration under Section 5 of the Securities

Act of 1933, as amended, in reliance on the exemption afforded by Section 4(a)(2) thereof.

On

March 15, 2021, the Sponsor purchased an aggregate of 2,156,250 Founder Shares for an aggregate offering price of $25,000 at an average

price of approximately $0.012 per share. Such securities were issued in connection with our organization pursuant to exemption from registration

contained in section 4(a) (2) of the Securities Act. Our Sponsor is an accredited investor for purposes of Rule 501 of Regulation D.

In

addition, at the time of the IPO completed on February 17, 2022, the Sponsor purchased an aggregate of 377,331 private placement units

at a price of $10.00 per unit at a price of $10.00 per unit for an aggregate purchase price of $3,773,310. Each unit consists of one

share of GUCC Class A common stock and one Private Warrant, and each Private Warrant is exercisable to purchase one share of Class A

common stock at a price of $11.50 per whole share in a private placement that closed simultaneously with the closing of the IPO. These

issuances were made pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act. No underwriting discounts

or commissions were paid with respect to such sales.

Also

in connection with the closing of the IPO, EF Hutton, division of Benchmark Investments, LLC, the lead underwriter of GUCC purchased

43,125 shares of GUCC Class A common stock at an aggregate purchase price of $1.00. This issuance was made pursuant to the exemption

from registration under the Securities Act in reliance on Section 4(a)(2).

On

July 27, 2023, GUCC, ESGL, and ESGH entered into a Forward Purchase Agreement (the “Forward Purchase Agreement”) with Vellar

Opportunities Fund Master, Ltd (“Vellar”). On the same date, Vellar assigned and novated 50% of its rights and obligations

under the Forward Purchase Agreement to ACM ARRT K LLC (“ARRT”). On August 4, 2023, ACM ARRT K LLC delivered a pricing notice

to ESGL for 550,000 additional Ordinary Shares under the Forward Purchase Agreement, which were issued by ESGL without consideration

effective as of that date. On August 14, 2023, Vellar delivered a pricing notice to ESGL for 1,268,085 additional Ordinary Shares under

the Forward Purchase Agreement, which were issued by ESGL without consideration effective as of that date. This issuance was made pursuant

to the exemption from registration under the Securities Act in reliance on Section 4(a)(2).

On

March 27, 2024, the Company entered into a Share Purchase Agreement dated March 27, 2024 with an accredited investor, pursuant to which

the Company issued in a private placement 10,000,000 Ordinary Shares to the investor at a purchase price of US$0.25 per share. The initial

closing under the purchase agreement took place on March 28, 2024 pursuant to which the investor purchased 2,000,000 Ordinary Shares.

The second and final closing under the purchase agreement took place on April 3, 2024 pursuant to which the investor purchased 8,000,000

Ordinary Shares. The Company received gross proceeds of $2,500,000 in the private placement. This issuance was made pursuant to the exemption

from registration under the Securities Act in reliance on Section 4(a)(2).

On

August 21, 2024, the Company entered into a Share Purchase Agreement (the “Purchase Agreement”) with certain accredited investors

named therein (the “Purchasers”), pursuant to which the Company issued in an initial closing of a private placement an aggregate

of 13,800,000 Ordinary Shares to the Purchasers at a purchase price of US$0.29 per share. The initial closing of the private placement

occurred on August 22, 2024 (the “Closing Date”) and the Company received gross proceeds of $4,002,000. For a period of three

months following the Closing Date, Mr. Samuel Wu, one of the Purchasers, was granted the right to purchase up to an additional 3,441,380

Ordinary Shares for gross proceeds of $998,000 on the same and terms and conditions set forth in the Purchase Agreement (the “Second

Closing Option”). The Second Closing Option was exercised in full by such Purchaser on September 30, 2024. Accordingly, the Company

issued an aggregate of 17,241,380 Ordinary Shares in the private placement for aggregate gross proceeds to the Company of $5,000,000.

This issuance was made pursuant to the exemption from registration under the Securities Act in reliance on Section 4(a)(2).

Item

8. Exhibits and Financial Statements.

(a)

Exhibits

| Exhibit

Number |

|

Description

|

| 2.1†** |

|

Merger Agreement dated November 29, 2022 among Genesis Unicorn Capital Corp. (“GUCC”), Environmental Solutions Group Holdings Limited (“ESGH”), ESGL Holdings Limited (“ESGL”), ESGH Merger Sub Corp and the shareholder representative (incorporated by reference to Exhibit 1.1 of ESGL’s registration statement on Form F-4 (File No. 333-269078), initially filed with the SEC on December 30, 2022). |

| 3.1** |

|

Amended and Restated Memorandum and Articles of Association of ESGL (incorporated by reference to Exhibit 3.1 of Form F-1 filed by ESGL with the SEC on April 12, 2024). |

| 4.1** |

|

Specimen of ordinary share certificate of ESGL (incorporated by reference to Exhibit 4.1 of Form 20-F filed by ESGL with the SEC on August 8, 2023). |

| 4.2** |

|

Specimen of warrant certificate of ESGL (incorporated by reference to Exhibit 4.2 of Form 20-F filed by ESGL with the SEC on August 8, 2023). |

| 4.3** |

|

Warrant Agreement (incorporated by reference to Exhibit 4.1 of GUCC’s current report on Form 8-K filed with the SEC on February 17, 2022). |

| 5.1 |

|

Opinion of Maples and Calder (Cayman) LLP as to the validity of the ordinary shares of ESGL. |

| 10.1** |

|

Form of Lock-Up Agreement dated November 29, 2022 (incorporated by reference to Exhibit 10.1 to GUCC’s current report on Form 8-K filed with the SEC on November 30, 2022). |

| 10.2** |

|

Form of Registration Rights Agreement (incorporated by reference to Exhibit 10.4 to GUCC’s current report on Form 8-K filed with the SEC on November 30, 2022). |

| 10.3** |

|

Forward Purchase Agreement dated July 27, 2023, by and among GUCC, Environmental Solutions Group Holdings Limited, ESGL Holdings Limited, and Vellar Opportunities Fund Master, Ltd. (incorporated by reference to Exhibit 10.1 to GUCC’s current report on Form 8-K filed with the SEC on July 27, 2023). |

| 10.4** |

|

Non-solicitation agreement entered by and between ESGL and Quek Leng Chuang dated August 2, 2023 (incorporated by reference to Exhibit 10.4 to ESGL’s registration statement on Form F-1 filed with the SEC on September 19, 2023). |

| Exhibit

Number |

|

Description

|

| 10.5** |

|

Non-solicitation agreement entered by and between ESGL and Lee Meng Seng dated August 2, 2023 (incorporated by reference to Exhibit 10.5 to ESGL’s registration statement on Form F-1 filed with the SEC on September 19, 2023). |

| 10.6** |

|

Non-solicitation agreement entered by and between ESGL and Law Beng Hui dated August 2, 2023 (incorporated by reference to Exhibit 10.6 to ESGL’s registration statement on Form F-1 filed with the SEC on September 19, 2023). |

| 10.7** |

|

Non-solicitation agreement entered by and between ESGL and Ho Shian Ching dated August 2, 2023 (incorporated by reference to Exhibit 10.7 to ESGL’s registration statement on Form F-1 filed with the SEC on September 19, 2023). |

| 10.8†** |

|

Employment Agreement entered by and between ESGL and Quek Leng Chuang dated August 2, 2023 (incorporated by reference to Exhibit 10.8 to ESGL’s registration statement on Form F-1 filed with the SEC on September 19, 2023). |

| 10.9†** |

|

Employment Agreement entered by and between ESGL and Lee Meng Seng dated August 2, 2023 (incorporated by reference to Exhibit 10.9 to ESGL’s registration statement on Form F-1 filed with the SEC on September 19, 2023). |

| 10.10†** |

|

Employment Agreement entered by and between ESGL and Law Beng Hui dated August 2, 2023 (incorporated by reference to Exhibit 10.10 to ESGL’s registration statement on Form F-1 filed with the SEC on September 19, 2023). |

| 10.11†** |

|

Employment Agreement entered by and between ESGL and Ho Shian Ching dated August 2, 2023 (incorporated by reference to Exhibit 10.11 to ESGL’s registration statement on Form F-1 filed with the SEC on September 19, 2023). |

| 10.12** |

|

Waiver dated May 17, 2023 among GUCC, ESGL, ESGL Holdings Limited, ESGH Merger Sub Corp and the shareholder representative relating to certain requirements under the Merger Agreement (incorporated by reference to Exhibit 10.20 to the Registration Statement on Form F-4/A filed with the Securities & Exchange Commission on June 20, 2023). |

| 10.13** |

|

Form of Indemnity Agreement entered by and among ESGL Holdings Limited and the directors and officers of ESGL Holdings Limited (incorporated by reference to Exhibit 10.13 to ESGL’s registration statement on Form F-1 filed with the SEC on September 19, 2023). |

| 10.14** |

|

Form of Share Purchase Agreement dated March 27, 2024 between ESGL and the purchaser named therein (incorporated by reference to Exhibit 10.1 to ESGL’s Form 6-K filed with the SEC on April 1, 2024). |

| 10.15** |

|

Form of Share Purchase Agreement dated August 21, 2024 between ESGL and the purchasers named therein (incorporated by reference to Exhibit 10.1 to ESGL’s Form 6-K filed with the SEC on August 23, 2024). |

| 21.1** |

|

List of Principal Subsidiaries (incorporated by reference to Exhibit 21.1 of Form 20-F filed by ESGL with the SEC on August 8, 2023). |

** Previously filed.

†

Schedules and exhibits to this Exhibit omitted pursuant to Regulation S-K Item 601(b)(2). The Registrant agrees to furnish supplementally

a copy of any omitted schedule or exhibit to the SEC upon request.

Item

9. Undertakings.

(a)

The undersigned Registrant hereby undertakes:

(1)

To file, during any period in which offers or sales of the securities registered hereby are being made, a post-effective amendment to

the registration statement:

(i)

to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and

price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and

(iii)

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement;

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

To file a post-effective amendment to the registration statement to include any financial statements required by Item 8.A of Form 20-F

at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required by

Section 10(a)(3) of the Act need not be furnished, provided that the registrant includes in the prospectus, by means of a post-effective

amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information

in the prospectus is at least as current as the date of those financial statements.

(5)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule

424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other

than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the

date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is

part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement

or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first

use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement

or made in any such document immediately prior to such date of first use.

(6)

That, for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution

of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule

424;

(ii)

any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by

such undersigned Registrant;

(iii)

the portion of any other free writing prospectus relating to the offering containing material information about such undersigned Registrant

or its securities provided by or on behalf of the undersigned Registrant; and

(iv)

any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(b)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of

the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant has duly caused this registration statement to be signed

on its behalf by the undersigned, thereunto duly authorized, in Singapore on December 17, 2024.

| |

ESGL

Holdings Limited |

| |

|

| |

By: |

/s/

Quek Leng Chuang |

| |

Name:

|

Quek

Leng Chuang |

| |

Title: |

Chief

Executive Officer |

Pursuant

to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Quek Leng Chuang |

|

Chairman

of the Board and Chief Executive |

|

December

17, 2024 |

| Quek

Leng Chuang |

|

Officer

(principal executive officer) |

|

|

| |

|

|

|

|

| /s/

Ho Shian Ching |

|

Chief

Financial Officer (principal financial and

accounting

officer) |

|

December

17, 2024 |

| Ho

Shian Ching |

|

|

|

|

| |

|

|

|

|

| * |

|

Chief

Growth and Sustainability Officer and Director |

|

December

17, 2024 |

| Law

Beng Hui |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

December

17, 2024 |

| Anita

Pushparani Dorett |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

December

17, 2024 |

| Lim

Boon Yew Gary |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

December

17, 2024 |

| Yap

Chin Yee Richard |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

December

17, 2024 |

| Ernest

Fong |

|

|

|

|

* By Ho

Shian Ching, as attorney-in fact

AUTHORIZED

REPRESENTATIVE OF THE REGISTRANT

Pursuant

to the requirement of the Securities Act of 1933, the undersigned, the duly undersigned representative in the United States of ESGL Holdings

Limited, has signed this registration statement in Newark, Delaware on December 17, 2024.

| |

Puglisi

& Associates |

| |

|

| |

By: |

/s/

Donald J. Puglisi |

| |

Name:

|

Donald

J. Puglisi |

| |

Title: |

Managing

Director |

Exhibit

5.1

| Our

ref |

MAA/814115-000001/81069009v3 |

ESGL

Holdings Limited

PO

Box 309, Ugland House

Grand

Cayman

KY1-1104

Cayman

Islands

17

December 2024

ESGL

Holdings Limited

We

have acted as counsel as to Cayman Islands law to ESGL Holdings Limited (the “Company”) in connection with the Company’s

registration statement on Form S-1, including all amendments or supplements thereto, filed with the United States Securities and Exchange

Commission (the “Commission”) under the United States Securities Act of 1933, as amended (the “Act”)

(including its exhibits, the “Registration Statement”) for the purposes of, registering with the Commission under

the Act, the offering and sale to the public of

| a) | 17,241,380

ordinary shares of the Company of a par value of US$0.0001 each (“Ordinary Shares”)

pursuant to the terms of the Share Purchase Agreement, dated as of 30 September 2024, by

and among the Company and purchasers listed on the signature pages thereto (the “Purchase

Agreement”). |

This

opinion letter is given in accordance with the terms of the Legal Matters section of the Registration Statement.

We

have reviewed originals, copies, drafts or conformed copies of the following documents:

| 1.1 | The

certificate of incorporation dated 18 November 2022, the Certificate of Merger dated 2 August

2023 and the amended and restated memorandum and articles of association of the Company as

adopted on 28 July 2023 and effective on 2 August 2023 (the “Memorandum and Articles”). |

| | |

| 1.2 | The

minutes (the “Minutes”) of the meeting of the board of directors of the

Company held on 22 July 2024 (the “Meeting”) and the written resolutions

of the board of directors of the Company dated 13 December 2024 (the “Resolutions”). |

| | |

| 1.3 | A

certificate of good standing with respect to the Company issued by the Registrar of Companies

(the “Certificate of Good Standing”). |

| 1.4 | A

certificate from a director of the Company a copy of which is attached to this opinion letter

(the “Director’s Certificate”). |

| | |

| 1.5 | The

Registration Statement. |

| | |

| 1.6 | The

Purchase Agreement (the “Document”). |

| | |

| 2 | Assumptions |

The

following opinions are given only as to, and based on, circumstances and matters of fact existing and known to us on the date of this

opinion letter. These opinions only relate to the laws of the Cayman Islands which are in force on the date of this opinion letter. In

giving the following opinions, we have relied (without further verification) upon the completeness and accuracy, as at the date of this

opinion letter, of the Director’s Certificate and the Certificate of Good Standing. We have also relied upon the following assumptions,

which we have not independently verified:

| 2.1 | The

Document has been or will be authorised and duly executed and unconditionally delivered by

or on behalf of all relevant parties in accordance with all relevant laws (other than, with

respect to the Company, the laws of the Cayman Islands). |

| | |

| 2.2 | The

Document is, or will be, legal, valid, binding and enforceable against all relevant parties

in accordance with their terms under the laws of the State of New York (the “Relevant

Law”) and all other relevant laws (other than, with respect to the Company, the

laws of the Cayman Islands). |

| | |

| 2.3 | The

choice of the Relevant Law as the governing law of the Document has been made in good faith

and would be regarded as a valid and binding selection which will be upheld by the courts

of the State of New York and any other relevant jurisdiction (other than the Cayman Islands)

as a matter of the Relevant Law and all other relevant laws (other than the laws of the Cayman

Islands). |

| | |

| 2.4 | Copies

of Document, conformed copies or drafts of Document provided to us are true and complete

copies of, or in the final forms of, the originals. |

| | |

| 2.5 | All

signatures, initials and seals are genuine. |

| | |

| 2.6 | The

capacity, power, authority and legal right of all parties under all relevant laws and regulations

(other than, with respect to the Company, the laws and regulations of the Cayman Islands)

to enter into, execute, unconditionally deliver and perform their respective obligations

under the Document. |

| | |

| 2.7 | No

invitation has been or will be made by or on behalf of the Company to the public in the Cayman

Islands to subscribe for any of the Ordinary Shares. |

| | |

| 2.8 | There

is no contractual or other prohibition or restriction (other than as arising under Cayman

Islands law) binding on the Company prohibiting or restricting it from entering into and

performing its obligations under the Document. |

| | |

| 2.9 | No

monies paid to or for the account of any party under the Document or any property received

or disposed of by any party to the Document in each case in connection with the Document

or the consummation of the transactions contemplated thereby represent or will represent

proceeds of criminal conduct or criminal property or terrorist property (as defined in the

Proceeds of Crime Act (As Revised) and the Terrorism Act (As Revised), respectively). |

| 2.10 | There

is nothing under any law (other than the laws of the Cayman Islands) which would or might

affect the opinions set out below. Specifically, we have made no independent investigation

of the Relevant Law. |

| | |

| 2.11 | The

Company will receive money or money’s worth in consideration for the issue of the Ordinary

Shares and none of the Ordinary Shares were or will be issued for less than par value. |

Save

as aforesaid we have not been instructed to undertake and have not undertaken any further enquiry or due diligence in relation to the

transaction the subject of this opinion letter.

Based

upon, and subject to, the foregoing assumptions and the qualifications set out below, and having regard to such legal considerations

as we deem relevant, we are of the opinion that:

| 3.1 | The

Company has been duly incorporated as an exempted company with limited liability and is validly

existing and in good standing with the Registrar of Companies under the laws of the Cayman

Islands. |

| | |

| 3.2 | The

Ordinary Shares to be offered and issued by the Company as contemplated by the Registration

Statement have been duly authorised for issue, and when issued by the Company against payment

in full of the consideration as set out in the Registration Statement and in accordance with

the terms set out in the Registration Statement, such Ordinary Shares will be validly issued,

fully paid and non-assessable. As a matter of Cayman Islands law, a share is only issued

when it has been entered in the register of members (shareholders). |

The

opinions expressed above are subject to the following qualifications:

| 4.1 | The

obligations assumed by the Company under the Documents will not necessarily be enforceable

in all circumstances in accordance with their terms. In particular: |

| (a) | enforcement

may be limited by bankruptcy, insolvency, liquidation, reorganisation, readjustment of debts

or moratorium or other laws of general application relating to protecting or affecting the

rights of creditors and/or contributories; |

| | | |

| (b) | enforcement

may be limited by general principles of equity. For example, equitable remedies such as specific

performance may not be available, inter alia, where damages are considered to be an

adequate remedy; |

| | | |

| (c) | where

obligations are to be performed in a jurisdiction outside the Cayman Islands, they may not

be enforceable in the Cayman Islands to the extent that performance would be illegal under

the laws of that jurisdiction; and |

| | | |

| (d) | some

claims may become barred under relevant statutes of limitation or may be or become subject

to defences of set off, counterclaim, estoppel and similar defences. |

| 4.2 | To

maintain the Company in good standing with the Registrar of Companies under the laws of the

Cayman Islands, annual filing fees must be paid and returns made to the Registrar of Companies

within the time frame prescribed by law. |

| 4.3 | Under

Cayman Islands law, the register of members (shareholders) is prima facie evidence

of title to shares and this register would not record a third party interest in such shares.

However, there are certain limited circumstances where an application may be made to a Cayman

Islands court for a determination on whether the register of members reflects the correct

legal position. Further, the Cayman Islands court has the power to order that the register

of members maintained by a company should be rectified where it considers that the register

of members does not reflect the correct legal position. As far as we are aware, such applications

are rarely made in the Cayman Islands and for the purposes of the opinion given in paragraph

3.2, there are no circumstances or matters of fact known to us on the date of this opinion

letter which would properly form the basis for an application for an order for rectification

of the register of members of the Company, but if such an application were made in respect

of the Ordinary Shares, then the validity of such shares may be subject to re-examination

by a Cayman Islands court. |

| | |

| 4.4 | Except

as specifically stated herein, we make no comment with respect to any representations and

warranties which may be made by or with respect to the Company in the Document or instruments

cited in this opinion letter or otherwise with respect to the commercial terms of the transactions

the subject of this opinion letter. |

| | |

| 4.5 | In

this opinion letter the phrase “non-assessable” means, with respect to the issuance

of shares, that a shareholder shall not, in respect of the relevant shares and in the absence

of a contractual arrangement, or an obligation pursuant to the memorandum and articles of

association, to the contrary, have any obligation to make further contributions to the Company’s

assets (except in exceptional circumstances, such as involving fraud, the establishment of

an agency relationship or an illegal or improper purpose or other circumstances in which

a court may be prepared to pierce or lift the corporate veil). |

We

hereby consent to the filing of this opinion letter as an exhibit to the Registration Statement and to the references to our firm under

the headings “Legal Matters” and “Enforcement of Civil Liabilities under Cayman Islands law” in the Registration

Statement. In providing our consent, we do not thereby admit that we are in the category of persons whose consent is required under section

7 of the Act or the Rules and Regulations of the Commission thereunder.

We

express no view as to the commercial terms of the Documents or whether such terms represent the intentions of the parties and make no

comment with regard to warranties or representations that may be made by the Company.

The

opinions in this opinion letter are strictly limited to the matters contained in the opinions section above and do not extend to any

other matters. We have not been asked to review and we therefore have not reviewed any of the ancillary documents relating to the Documents

and express no opinion or observation upon the terms of any such document.

This

opinion letter is addressed to you and may be relied upon by you, your counsel and purchasers of Ordinary Shares pursuant to the Registration

Statement. This opinion letter is limited to the matters detailed herein and is not to be read as an opinion with respect to any other

matter.

Yours

faithfully

/s/

Maples and Calder (Cayman) LLP

ESGL

Holdings Limited

PO

Box 309, Ugland House

Grand

Cayman

KY1-1104

Cayman

Islands

| To: |

Maples and Calder (Cayman) LLP |

PO

Box 309, Ugland House

Grand

Cayman

KY1-1104

Cayman

Islands

17

December 2024

ESGL

Holdings Limited (the “Company”)

I,

the undersigned, being a director of the Company, am aware that you are being asked to provide an opinion letter (the “Opinion”)

in relation to certain aspects of Cayman Islands law. Unless otherwise defined herein, capitalised terms used in this certificate have

the respective meanings given to them in the Opinion. I hereby certify that:

| 1 | The

Memorandum and Articles remain in full force and effect and are unamended. |

| | |

| 2 | The

Company has not entered into any mortgages or charges over its property or assets other than

those entered in the register of mortgages and charges of the Company. |

| | |

| 3 | The

Minutes are a true and correct record of the proceedings of the Meeting, which was duly convened

and held, and at which a quorum was present throughout, in each case, in the manner prescribed

in the Memorandum and Articles. The resolutions set out in the Minutes and the Resolutions

were duly passed in the manner prescribed in the Memorandum and Articles (including, without

limitation, with respect to the disclosure of interests (if any) by directors of the Company)

and have not been amended, varied or revoked in any respect. |

| | |

| 4 | The

authorised share capital of the Company is US$50,000.00 divided into 500,000,000 Ordinary

Shares of par value US$0.0001 each. The issued share capital of the Company is 22,998,039

Ordinary Shares which have been duly authorised and are validly issued as fully-paid and

non-assessable. |

| | |

| 5 | The

shareholders of the Company (the “Shareholders”) have not restricted the

powers of the directors of the Company in any way. |

| | |

| 6 | The

directors of the Company at the date of the Resolutions and at the date of this certificate

were and are as follows: Quek Leng Chuang, Anita Pushparani Dorett, Ernest Fong, Lim Boon

Yew Gary, Law Beng Hui and Yap Chin Yee Richard. |

| | |

| 7 | The

minute book and corporate records of the Company as maintained at its registered office in

the Cayman Islands and made available to you are complete and accurate in all material respects,

and all minutes and resolutions filed therein represent a complete and accurate record of

all meetings of the Shareholders and directors (or any committee thereof) of the Company

(duly convened in accordance with the Memorandum and Articles) and all resolutions passed

at the meetings or passed by written resolution or consent, as the case may be. |

| 8 | Prior

to, at the time of, and immediately following the approval of the transactions contemplated

by the Registration Statement, the Company was, or will be, able to pay its debts as they

fell, or fall, due and has entered, or will enter, into the transactions contemplated by

the Registration Statement for proper value and not with an intention to defraud or wilfully

defeat an obligation owed to any creditor or with a view to giving a creditor a preference. |

| | |

| 9 | Each

director of the Company considers the transactions contemplated by the Registration Statement

to be of commercial benefit to the Company and has acted in good faith in the best interests

of the Company, and for a proper purpose of the Company, in relation to the transactions

which are the subject of the Opinion. |

| | |

| 10 | To

the best of my knowledge and belief, having made due inquiry, the Company is not the subject

of legal, arbitral, administrative or other proceedings in any jurisdiction and neither the

directors nor Shareholders have taken any steps to have the Company struck off or placed

in liquidation. Further, no steps have been taken to wind up the Company or to appoint restructuring

officers or interim restructuring officers, and no receiver has been appointed in relation

to any of the Company’s property or assets. |

| | |

| 11 | To

the best of my knowledge and belief, having made due inquiry, there are no circumstances

or matters of fact existing which may properly form the basis for an application for an order

for rectification of the register of members of the Company. |

| | |

| 12 | The

Registration Statement has been, or will be, authorised and duly executed and delivered by

or on behalf of all relevant parties in accordance with all relevant laws. |

| | |

| 13 | No

invitation has been made or will be made by or on behalf of the Company to the public in

the Cayman Islands to subscribe for any of the Ordinary Shares. |

| | |

| 14 | The

Ordinary Shares to be issued pursuant to the Registration Statement have been, or will be,

duly registered, and will continue to be registered, in the Company’s register of members

(shareholders). |

| | |

| 15 | The

Company is not a central bank, monetary authority or other sovereign entity of any state

and is not a subsidiary, direct or indirect, of any sovereign entity or state. |

| | |

| 16 | There

is no contractual or other prohibition or restriction (other than as arising under Cayman

Islands law) binding on the Company prohibiting or restricting it from entering into and

performing its obligations under the Documents. |

(Signature

Page follows)

I

confirm that you may continue to rely on this certificate as being true and correct on the day that you issue the Opinion unless I shall

have previously notified you in writing personally to the contrary.

| Signature: |

/s/

Law Beng Hui |

|

| Name: |

Law

Beng Hui |

|

| Title: |

Director |

|

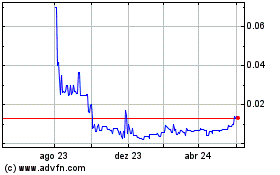

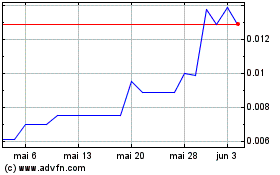

ESGL (NASDAQ:ESGLW)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ESGL (NASDAQ:ESGLW)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024