As filed with the Securities and Exchange Commission on December 17, 2024

Registration Statement No. 333-283304

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Evaxion Biotech A/S

(Exact name of Registrant as specified in its charter)

| |

The Kingdom of Denmark

(State or other jurisdiction of

incorporation or organization)

|

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

|

Not applicable

(IRS Employer

Identification Number)

|

|

Dr. Neergaards Vej 5F 2970

Hørsholm Denmark

Telephone: +45 31 31 97 53

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Christian Kanstrup Chief

Executive Officer Evaxion

Biotech A/S Dr. Neergaards

Vej 5F 2970 Hørsholm

Denmark

Telephone: +45 31 31 97 53

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy of all communications including communications sent to agent for service, should be sent to:

| |

Michael D. Baird

Duane Morris LLP

230 Park Avenue

Suite 1130

New York, NY 10169

Telephone: (212) 818-9200

|

|

|

Lars Lüthjohan

Mazanti-Andersen

AdvokatPartnerselskab

Amaliegade 10

DK-1256 Copenhagen K

Denmark

Telephone: +45 3314 3536

|

|

|

David Danovitch

Aaron Schleicher

Sullivan & Worcester LLP

1251 Avenue of the Americas

New York, NY 10020

Telephone: (212) 660-3000

|

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (as amended, the “Securities Act”), check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act. Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a) may determine.

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

(Subject to completion, Dated December 17, 2024)

UP TO 7,640,845 AMERICAN DEPOSITARY SHARES REPRESENTING 76,408,450 ORDINARY

SHARES AND UP TO 7,640,845 PRE-FUNDED WARRANTS TO PURCHASE UP TO 7,640,845

AMERICAN DEPOSITARY SHARES AND UP TO 7,640,845 WARRANTS TO PURCHASE

UP TO 7,640,845 AMERICAN DEPOSITARY SHARES

(and 7,640,845 American Depositary Shares representing 76,408,450 ordinary shares issuable upon exercise

of the Pre-Funded Warrants and 7,640,845 American Depositary Shares representing 76,408,450

ordinary shares issuable upon exercise of the Warrants)

Evaxion Biotech A/S

We are offering on a best efforts basis up to 7,640,845 American Depositary Shares (“ADSs”) representing an aggregate of 76,408,450 ordinary shares, DKK 1 nominal value per share, together with warrants to purchase up to 7,640,845 ADSs representing 76,408,450 ordinary shares (the “Warrants”). The ADSs and Warrants will be sold in a fixed combination, with each ADS accompanied by one Warrant to purchase one ADS. The ADSs and Warrants are immediately separable and will be issued separately in this offering, but must be purchased together in this offering. The Warrants will have an exercise price per share of $ and will be immediately exercisable for a term of five (5) years from the date of issuance. The assumed public offering price for each ADS and accompanying Warrant is $1.42, which is based upon the DKK 1 nominal value of each of the ten ordinary shares underlying each ADS. The actual public offering per ADS (or pre-funded warrants in lieu thereof) and accompanying warrant will be determined through negotiation between us, the Placement Agent and investors based upon a number of factors, including our history and our prospects, the industry in which we operate, our past and present operating results, the previous experience of our executive officers and the general condition of the securities markets at the time of this offering.

We are also offering to certain purchasers whose purchase of ADSs in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding ordinary shares, including ordinary shares represented by ADSs immediately, following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, 7,640,845 pre-funded warrants, in lieu of ADSs that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of the ADSs. The public offering price of each pre-funded warrant will be equal to the price at which an ADS is sold to the public in this offering, minus an amount in US dollars equal to DKK 10 at the time of pricing of this offering, which amount is equal to $1.42 as of the date of this prospectus, and the exercise price of each pre-funded warrant will be DKK 10 equal to $1.42 per ADS, provided that such exercise price shall not be less than the USD equivalent to DKK 10 at the time of exercise, and such exercise price may be pre-funded and held in escrow until exercise thereof. The pre-funded warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. For each pre-funded warrant we sell, the number of ADSs we are offering will be decreased on a one-for-one basis. This prospectus also relates to the ADSs issuable upon exercise of the Warrants and any pre-funded warrants sold in this offering.

There is no established public trading market for the Warrants or pre-funded warrants, and we do not expect a market to develop. We do not intend to apply for listing of the Warrants or pre-funded warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the warrants will be limited.

This offering will terminate on January 31, 2025, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We will have one closing for all the securities purchased in this offering.

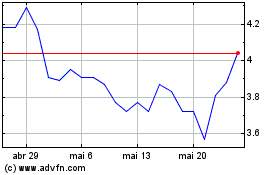

The ADSs are listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “EVAX”. On December 13, 2024, the closing trading price for the ADSs, as reported on Nasdaq, was $1.14 per ADS.

We have engaged Lake Street Capital Markets, LLC (the “Placement Agent”) to act as our exclusive Placement Agent in connection with this offering. The Placement Agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The Placement Agent is not purchasing or selling any of the securities we are offering and the Placement Agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount. We have agreed to pay to the Placement Agent the Placement Agent Fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus. There is no minimum offering requirement as a condition of closing of this offering. Because there is no minimum offering amount required as a condition to closing this offering, we may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us. The investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue our business goals described in this prospectus. In addition, investors could be in a position where they have invested in our company, but we are unable to fulfill all of our contemplated objectives due to a lack of interest in this offering. Further, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. We will bear all costs associated with the offering. See “Plan of Distribution” on page of this prospectus for more information regarding these arrangements.

We are a “foreign private issuer,” and an “emerging growth company” each as defined under the federal securities laws, and, as such, we are subject to reduced public company reporting requirements. See the section entitled “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information.

Investing in our securities involves a high degree of risk. Before buying any ADSs, you should carefully read the discussion of material risks of investing in the ADSs and the company. See “Risk Factor Summary” beginning on page 20 for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

|

|

Per ADS and accompanying Warrant

|

|

|

Per Pre-Funded

Warrant and

accompanying

Warrant

|

|

|

Total(4)

|

|

|

Public offering price

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

Placement Agent Fees(1)

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

Proceeds to us (before expenses)(2)(3)

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

(1)

Pre-Funded Warrant public offering price of $ calculated to include the exercise price of DKK 10 equal to $ in addition to the public offering price of $ .

(2)

We have agreed to pay the Placement Agent cash fee equal to 7.0% of the gross proceeds raised in this offering. We have also agreed to reimburse the Placement Agent its legal fees and expenses in an amount up to $100,000, See “Plan of Distribution” for additional information and a description of the compensation payable to the Placement Agent.

(3)

We estimate the total expenses of this offering payable by us, excluding the Placement Agent fee, will be approximately $0.7 million. Because there is no minimum number of securities or amount of proceeds required as a condition to closing in this offering, the actual public offering amount, Placement Agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above. For more information, see “Plan of Distribution.”

(4)

Gross proceeds assumes exercise in full of Pre-Funded Warrants.

We anticipate that delivery of the securities against payment will be made on or about , 2024, subject to satisfaction of customary closing conditions.

Lake Street

Prospectus dated, 2024

TABLE OF CONTENTS

| |

|

|

|

|

|

v |

|

|

| |

|

|

|

|

|

vii |

|

|

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

20 |

|

|

| |

|

|

|

|

|

40 |

|

|

| |

|

|

|

|

|

40 |

|

|

| |

|

|

|

|

|

41 |

|

|

| |

|

|

|

|

|

42 |

|

|

| |

|

|

|

|

|

44 |

|

|

| |

|

|

|

|

|

45 |

|

|

| |

|

|

|

|

|

108 |

|

|

| |

|

|

|

|

|

111 |

|

|

| |

|

|

|

|

|

114 |

|

|

| |

|

|

|

|

|

132 |

|

|

| |

|

|

|

|

|

140 |

|

|

| |

|

|

|

|

|

151 |

|

|

| |

|

|

|

|

|

154 |

|

|

| |

|

|

|

|

|

157 |

|

|

| |

|

|

|

|

|

157 |

|

|

| |

|

|

|

|

|

157 |

|

|

| |

|

|

|

|

|

157 |

|

|

| |

|

|

|

|

|

159

|

|

|

Neither we nor the Placement Agent have authorized anyone to provide information different from that contained in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus prepared by us or on our behalf. Neither we nor the Placement Agent take any responsibility for, and can provide no assurance as to the reliability of, any information other than the information in this prospectus, any amendment or supplement to this prospectus, and any free writing prospectus prepared by us or on our behalf. Neither the delivery of this prospectus nor the sale of the ADSs means that information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy the ADSs in any circumstances under which such offer or solicitation is unlawful.

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the Placement Agent have

authorized anyone to provide you with information that is different. We and the Placement Agent are offering to sell the ADSs, and seeking offers to buy the ADSs, only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the ADSs.

For investors outside of the United States: Neither we nor the Placement Agent have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to this offering and the distribution of this prospectus outside the United States.

ABOUT THIS PROSPECTUS

Unless the context requires otherwise, in this prospectus Evaxion Biotech A/S and its subsidiaries (“Subsidiar(y/ies)”) shall collectively be referred to as “EVAX,”, “Evaxion”, “the Company,” “the Group”, “we,” “us,” and “our” unless otherwise noted.

This prospectus contains our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021 and the related notes, prepared in accordance with International Financial Reporting Standards or IFRS, as issued by the International Accounting Standards Board, or IASB and our unaudited condensed consolidated interim financial statements as of June 30, 2024, and for the three and six months ended June 30, 2024 and 2023 and the related notes and our unaudited condensed consolidated financial information as of September 30, 2024, for the three and nine months ended September 30, 2024 and 2023. The unaudited condensed consolidated interim financial statements of the Company are prepared in accordance with International Accounting Standard 34, “Interim Financial Reporting”. Certain information and disclosures normally included in the annual consolidated financial statements prepared in accordance with IFRS have been condensed or omitted. Accordingly, these unaudited condensed consolidated interim financial statements should be read in conjunction with the Company’s audited annual consolidated financial statements as of and for the year ended December 31, 2023.

All references in this Prospectus to “$” mean U.S. dollars and all references to “DKK” mean Danish Kroner.

Our financial information is presented in our presentation currency, U.S. Dollar, or USD. Our functional currency is the Danish Krone, or DKK. Certain Danish Krone amounts in this prospectus have been translated solely for convenience into USD at an assumed exchange rate of DKK 6.7447 per $1.00, which was the rounded official exchange rate of such currencies as of December 31, 2023. We used an assumed exchange rate of DKK 6.9664 per $1.00, which was the official rounded exchange rate of such currencies as of June 30, 2024 for the unaudited interim periods ended June 30, 2024 and an assumed exchange rate of DKK 6.6595 per $1.00, which was the official rounded exchange rate of such currencies as of September 30, 2024 for the unaudited interim periods ended September 30, 2024.

Foreign currency transactions are translated into our functional currency, DKK, using the exchange rates prevailing at the dates of the transactions. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at year-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognized as financial income or financial expenses in the consolidated statements of comprehensive loss. Non-monetary items in foreign currency, which are measured at cost at the consolidated statements of financial position date are translated into our functional currency, DKK, using the exchange rates at the date of the transaction. Such DKK translated amounts are not necessarily indicative of the amounts of DKK that could have actually been purchased with the underlying currency being exchanged into DKK at the dates indicated.

Assets and liabilities in our functional currency are translated to our presentation currency, USD, at the exchange rates applicable on December 31, 2023, June 30, 2024 and September 30, 2024 for the respective period. Income and expenses in our functional currency are translated to USD at the average exchange rate, which corresponds to an approximation of the exchange rates prevailing on each individual transaction date. Translation differences arising in the translation to presentation currency are recognized in other comprehensive income. Such USD amounts are not necessarily indicative of the amounts of USD that could actually have been purchased upon exchange of DKK at the dates indicated.

We have made rounding adjustments to some of the figures contained in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be exact arithmetic aggregations of the figures that preceded them.

On January 22, 2024, we effected a change to the ratio of the ADSs to our ordinary shares from one ADS representing one (1) ordinary share to one ADS representing ten (10) ordinary shares (the “ADS Ratio Change”). Except as otherwise indicated, all information in this prospectus gives retroactive effect to the ADS Ratio Change.

We have made rounding adjustments to reach some of the figures included in this prospectus. As a result, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

This prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information contained in such publications. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the “Risk Factor Summary” and in the Form 20-F for the fiscal year ended December 31, 2023 as filed with the Securities and Exchange Commission (the “2023 Form 20-F”) incorporated by reference in this prospectus. These and other factors could cause our future performance to differ materially from our assumptions and estimates.

Some of our trademarks and trade names are used in this prospectus, which are intellectual property owned by the Company. This prospectus also includes trademarks, trade names, and service marks that are the property of other organizations. Solely for convenience, our trademarks and trade names referred to in this prospectus appear without the TM symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and trade names.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Company discusses in this prospectus its business strategy, market opportunity, capital requirements, product introductions and development plans and the adequacy of the Company’s funding. Other statements contained in this prospectus, which are not historical facts, are also forward-looking statements. The Company has tried, wherever possible, to identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and other comparable terminology.

The Company cautions investors that any forward-looking statements presented in this prospectus, or that the Company may make orally or in writing from time to time, are based on the beliefs of, assumptions made by, and information currently available to, the Company. These statements are based on assumptions, and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are beyond its control or ability to predict. Although the Company believes that its assumptions are reasonable, they are not a guarantee of future performance, and some will inevitably prove to be incorrect. As a result, its actual future results can be expected to differ from its expectations, and those differences may be material. Accordingly, investors should use caution in relying on forward-looking statements, which are based only on known results and trends at the time they are made, to anticipate future results or trends. Certain risks are discussed in this prospectus and also from time to time in the Company’s other filings with the Securities and Exchange Commission (“SEC”).

This prospectus and all subsequent written and oral forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. The Company does not undertake any obligation to release publicly any revisions to its forward-looking statements to reflect events or circumstances after the date of this prospectus.

In particular, you should consider the risks provided under “Risk Factors Summary” in this prospectus and in the 2023 Form 20-F incorporated by reference in this prospectus.

PROSPECTUS SUMMARY

The following summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in our securities. Before deciding to invest in the ADSs, you should read this entire prospectus carefully, including information incorporated by reference in this prospectus and any free writing prospectus prepared by us or on our behalf, including the section entitled “Risk Factor Summary” in this prospectus, “Item 3. Key Information”, Item 5 “Operating and Financial Review and Prospects”; Item 7 Major Shareholders and Related Party Transactions; Item 8, “Financial Information” in our 2023 Form 20-F and incorporated by reference in this prospectus; the sections titled “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the other sections of the documents incorporated by reference in this prospectus and the financial statements and the related notes incorporated by reference in this prospectus,. Unless otherwise indicated, all share amounts and prices assume the consummation of the ADS Ratio Change.

The Company

Corporate Overview

Evaxion Biotech A/S is a pioneering clinical-stage TechBio company based upon the Artificial Intelligence (AI) platform: AI-Immunology™. The AI-Immunology™ platform consists of five proprietary and scalable AI prediction models harnessing the power of data, machine learning and artificial intelligence to decode the human immune system. This enables the development of novel vaccines for the treatment of cancer as well as bacterial and viral infections.

We believe we are the first in the world to demonstrate a correlation between the predictive power of AI and clinical response in patients, as evidenced by a clear association between AI-Immunology™ predictions and progression free survival in metastatic melanoma cancer patients. AI-Immunology™ allows for fast and effective discovery, design and development of novel vaccines and offers a strong value proposition to both existing and potential pharma partners. The value proposition is supported by AI-Immunology™ being preclinically and clinically validated, adaptable, scalable to other disease areas and, we believe, significantly reduces development costs and risks. Partnerships are essential to realizing the full value of the opportunities AI-Immunology™ offers and we have a strong focus on partnering as part of our strategy execution. Our recently announced significantly expanded partnership with MSD validates this approach and confirms the value of the AI-Immunology™ platform seen from an external perspective. Further, we have developed a clinical-stage cancer pipeline of novel personalized therapeutic vaccines and a preclinical prophylactic vaccine pipeline for bacterial and viral diseases with high unmet medical needs based on AI-Immunology™ identified vaccine targets. Evaxion is committed to transforming patients’ lives by providing innovative and targeted treatment options through AI-Immunology™. Our purpose is saving and improving lives with AI-Immunology™.

The Evaxion Strategy

The Evaxion strategy centers around our AI-Immunology™ platform, which has been continuously developed and refined over the past 15 years. This has provided us with a pioneering and differentiated position within AI-based vaccine target discovery and further led to the design and development of novel vaccine candidates. The strong potential of AI-Immunology™ is evidenced by both the preclinical and clinical data we have generated as well as through existing partnerships. The AI-Immunology™ platform holds the potential to generate one new vaccine target every 24 hours, is delivery modality-agnostic, and easily adaptable to partner needs. The platform is currently trained in cancer and infectious diseases and is scalable to other therapeutic areas. The high throughput, combined with a very flexible model, offers a strong value proposition for both existing and future partners.

The AI-Immunology™ platform contains five interrelated proprietary AI prediction models: (i) PIONEER™, our cancer neoantigen prediction model, (ii) ObsERV™, our endogenous retrovirus (ERV) tumor antigen prediction model, (iii) EDEN™, our B-cell antigen prediction model, (iv) RAVEN™, our T-cell antigen prediction model and (v) AI-DeeP™ our responder prediction model. The platform features a unique modular architecture where the same building blocks are used across different AI prediction models. This means that improvements in individual building blocks will lead to improvements in all the AI

prediction models where the building block is used. This, we believe, serves to further enhance the predictive capabilities of AI-Immunology™ and to ensure we will retain a differentiated position going forward. The building block-based architecture also gives a high scalability to other therapeutic areas which is offering attractive long-term opportunities for Evaxion.

In parallel with the AI-Immunology™ platform development, we have been building a strong multidisciplinary capability set spanning the full value chain from target discovery to early clinical development. Our state of art wet-lab and animal facility gives us a unique opportunity for rapidly validating our AI predictions in pre-clinical models thereby, generating proprietary data as well as new pipeline assets. Further, it offers partners a flexible and adaptable one stop shop for discovery and development of new vaccine candidates.

The AI-Immunology™ platform together with our multidisciplinary capability set drives a clear differentiation for our AI driven approach to development of novel vaccine candidates and provides a strong value proposition towards potential partners. The differentiation is illustrated in Figure 1 below.

Figure 1

A clearly differentiated position with AI based drug discovery and development.

With AI-Immunology™ at the core, and further building upon our strong multidisciplinary capability set, our focus is on pursuing value realization of our AI platform and pipeline via a multi-partner approach. This is being executed through our three-pronged business model focusing on vaccine target discovery collaborations using our AI-Immunology™ platform (Targets), advancing our proprietary pipeline of vaccine candidates (Pipeline) and using our core data and predictive capabilities to develop responder models (Responders). Please see Figure 2 below for an overview of the Evaxion three-pronged business model.

Figure 2

The Evaxion three-pronged business model.

For the Target part of our three-pronged business model, the multi-partner approach to value realization means that we have a strong focus on establishing partnerships where we bring our multidisciplinary capabilities and the unique predictive capabilities of AI-Immunology™ to partners with the objective of developing novel vaccine candidates. The EVX-B3 agreement with MSD from September 2023, which in September 2024 resulted in a significantly expanded collaboration with an option and license agreement, covering both EVX-B3 and EVX-B2, with potential milestones of USD 592 million per product, is a good example of what we aim at achieving in the Target part of our three-pronged business model. For EVX-B3, we teamed up with MSD in September 2023 to utilize AI-Immunology™ to discover and develop a novel vaccine for a bacterial infectious disease, where no vaccine is available today. We are excited about this collaboration with MSD and are thrilled to see it continuing into the next phase, a collaboration which now also includes EVX-B2. We are also very pleased with the level of interest we are seeing from other potential partners in establishing similar partnerships within other infectious disease areas and are excited about the potential for addressing significant unmet needs in collaboration with partners within the Target part of our strategy. To further develop the predictive capabilities of AI-Immunology™, and hence further strengthen the value proposition to existing and potential partners, we are excited to have launched an upgraded version of EDEN™, EDEN™ 5.0, which took place at the European Conference on Computational Biology (ECCB) conference in September 2024.

Within the Pipeline part of our three-pronged business model, we are advancing our own select high value programs to key value inflection points following which we will pursue partnering. With our multidisciplinary capabilities and the predictive capabilities of AI-Immunology™, we have strong potential for quickly advancing proprietary high value programs into preclinical and clinical development. However, we do not intend to run larger scale clinical trials ourselves. Within the Pipeline part of the strategy, we are very excited about the convincing EVX-01 Phase 2 one-year clinical data we presented at ESMO in September. The convincing data already makes us look forward to the two-year clinical readout in Q3, 2025. The one-year clinical data was a very important milestone for our lead pipeline candidate, and we are excited about the commercial potential of EVX-01. We will also partner pipeline assets before entering clinical development if this makes sense from a strategic and financial point of view. The agreement with MSD on EVX-B2 (as well as EVX-B3), containing potential milestones of up to USD 592 million per product, which we announced in September 2024 is a good example of such early partnering strategy.

Within the Responder part of our strategy, which focuses on harnessing our data and predictive capabilities to develop responder models, we obtained Proof of Principle for our Checkpoint Inhibitor

responder model in late 2023. We have now defined a high-level development plan and a preliminary commercial model. The plan remains to bring our Checkpoint Inhibitor responder model forward in a partnership-based structure.

Hence, in summary, we are seeing continued strong progress on our strategy as executed via our three-pronged business model. We are excited about having delivered successfully on most of our 2024 key milestones as can be seen in Figure 3 below. We are also thrilled about the interest we are seeing from potential partners in both the establishment of new vaccine discovery and development collaborations as well as in our existing pipeline assets and excited about our significantly expanded vaccine collaboration with MSD and the financial and strategic value it brings While we will not be able to meet the original business development ambition of generating USD 14 million in business development income or cash in for 2024, due to certain business development discussions moving into 2025, we are pleased with the USD 3.2 million already secured in 2024 via the MSD agreement as well as the potential up to USD 10 million for 2025, contingent upon if MSD exercises the option for one or both vaccine candidates. Further, the business development discussions having moved into 2025 enhances the potential for generation of business development income in 2025. Finally, we remain on track for meeting our milestone on preclinical Proof-of-Concept for our ERV based precision vaccine in 2024.

![[MISSING IMAGE: tb_milestones-4c.jpg]](https://www.sec.gov/Archives/edgar/data/1828253/000110465924129424/tb_milestones-4c.jpg)

Figure 3

2024 company milestones.

The strong strategy execution in 2024 makes us excited about the prospects for 2025. Focus for 2025 will be a continuation of the multi-partner approach to value realization via execution upon our business development strategy, continuation of the ongoing EVX-01 phase 2 trial, the ongoing strengthening of our AI-Immunology™ platform and further advancement of our research activities, including progressing our ERV based precision vaccine concept towards clinical development. Finally, the focus is of course on advancing our existing partnerships including bringing the MSD collaboration to option exercise. Please see the table below for an overview of 2025 company milestones.

Figure 4

2025 company milestones.

Financial Update

Our cash and cash equivalents were $4.6 million as of September 30, 2024, not including the $3.2 million upfront from the MSD agreement received in October 2024. The amount is unaudited and is not necessarily indicative of any future period and should be read together with “Risk Factors Summary,” “Cautionary Note Regarding Forward-Looking Statements,” and our financial statements and related notes contained in this prospectus and our 2023 Form 20-F.

Our AI-Immunology™ Platform

Our AI-Immunology™ platform is the core of Evaxion. The platform has been developed and refined over the past 15 years. The AI-Immunology™ platform holds following key features:

•

Consists of five AI prediction models and has a unique modular architecture based upon building blocks used across models

•

AI prediction models applied in cancer and infectious diseases with a demonstrated correlation between the predictive power of AI and clinical response in patients

•

Vaccine target discovery, design and development of personalized and precision therapeutic cancer vaccine candidates

•

Vaccine target discovery, design and development of prophylactic bacterial and viral vaccine candidates

•

Potential for one new target every 24 hours

•

Platform is delivery modality agnostic

•

Unique predictive capabilities

•

Adaptability to partner needs

•

Scalable to other therapeutic areas

•

90%+ cheaper target discovery vs. reverse vaccinology

•

80% fewer targets needs testing

The AI prediction models in AI-Immunology™ each offer unique predictive capabilities in their respective areas and an overview can be seen below.

Figure 5

The AI-Immunology™ platform.

Our PIONEER™ Model

PIONEER™ is our proprietary AI prediction model for the rapid discovery and design of patient-specific neoantigens used to derive cancer vaccines. It has been shown that neoantigens, which arise from patient-specific tumor mutations, play a critical role in T-cell mediated antitumor immune response. Neoantigens, being absent in normal tissues, are, we believe, ideal cancer vaccine targets because they distinguish themselves from germline proteins and can be recognized as non-self by the immune system. We believe our AI building blocks within PIONEER™ enable us to efficiently identify and select those neoantigens that will generate a de novo T-cell response leading to significant antitumor effect in each patient. By combining these neoantigens with a purposefully selected delivery modality believed to further enhance this antitumor effect, we design and deliver our vaccines to patients, effectively training their immune systems to target and kill cancer cells with no or very limited adverse effects on healthy non-cancer cells.

Our proprietary AI building blocks identifying neoantigens within PIONEER™ have been trained using gradient-boosted decision trees, transformers and a conditional generative adversarial network approach on our internally generated data as well as other data, including, but not limited to, next generation sequencing data from tumor samples, mass spectrometry immunopeptidomics, peptide-MHC-binding affinity data, T-cell immunogenicity data and peptide-MHC-binding stability data. We have demonstrated that development and iterative training of our AI building blocks improves its predictive power in identifying and selecting therapeutic neoantigens.

The strong predictive capabilities of PIONEER™ have been proven in a clinical trial setting, where we in the EVX-01 Phase 1 trial demonstrated a clear link between quality of the predictions from PIONEER™ and Progression Free Survival in metastatic melanoma patients. We believe that we are the first in the world to establish a link between AI prediction and clinical outcomes.

Our ObsERV™ Model

ObsERV™ is our proprietary AI model for the discovery of patient-specific virus-derived sequences, so-called ERVs (endogenous retroviruses), expressed in cancer. Targeting this novel class of tumor antigens may allow for developing a completely new type of immunotherapy against immunologically cold tumors with low response rates to immunotherapy. ObsERV™ can rapidly discover ERV tumor antigens and design personalized and precision vaccines containing these antigens. Our proprietary AI building blocks within ObsERV™, for the prediction of antigen-specific T-cell responses have been trained using transformers and a conditional generative adversarial network approach. This allows us to efficiently identify and select those ERV- antigens that we believe are most likely to generate a strong, de novo T-cell response leading to significant antitumor effect in each patient. The goal of our ObsERV™ model derived cancer vaccines is to

deliver therapeutic ERV-antigens to patients in a way that trains the patients’ own immune system to target and kill tumor cells with no or very limited adverse effects on healthy non-cancer cells.

We have preclinically demonstrated complete tumor eradication in animal models when targeting ObsERV™ identified ERVs. Hence, we believe such ERV-based therapies will induce a directed T-cell dependent immune response leading to tumor eradication. Our EVX-03 development candidate contains a combination of PIONEER predicted neoantigens and ObsERV™ predicted ERV-antigens.

We believe that ObsERV™ will allow us to develop therapeutic cancer vaccines benefitting a broader range of cancer patients for which no or limited treatment options exist. This includes providing novel treatment solutions for cancer patients that are unlike to respond to immunotherapy and cancer vaccines that targets neoantigens.

At the ASH conference in December 2023, we showcased a novel usage of ERVs for hematological cancers offering potential for a completely novel treatment paradigm. A key 2024 milestone is to establish preclinical proof-of-concept for an ERV based precision vaccine candidate, which we remain on track to deliver.

Our EDEN™ Model

EDEN™ is our proprietary AI prediction model that rapidly identifies novel, highly protective B-cell targets for use in pathogen-specific prophylactic vaccines against bacteria and virus, including antimicrobial resistant bacteria. Our proprietary algorithms in EDEN™ allow us to predict and identify antigens that we believe will trigger a robust, protective immune response against almost any pathogen. The core of our EDEN™ model is a proprietary machine learning ensemble of artificial neural networks trained using a feed-forward backpropagation approach to interpret immunological-relevant information in relation to bacterial antigens that incur protection in a vaccine setting. EDEN™ has been trained on our own curated data set derived by trawling through publicly available patents and publications with reported truly protective and non-protective antigens tested in clinical and pre-clinical settings. The input to the artificial neural network ensemble is a feature transformation of the protein data set, in which several global and sequence-resolved properties are extracted. These structural and functional features have been selected for their relevance in protein chemistry, immunology and protein structure and their ability to guide the network in discriminating protective versus non-protective antigens.

We believe our approach can be used to target almost any pathogenic infection and rapidly enables the discovery and development of vaccine product candidates. We have applied EDEN™ in seven bacteria pathogens to test its predictive power. For each pathogen, EDEN™ identified novel vaccine antigens which were subsequently expressed as proteins and tested in pre-clinical, mouse infection models, demonstrating protection against all seven pathogens.

EDEN™ forms the basis for several pipeline compounds. The EDEN™ AI prediction model is already the basis for three existing partnerships, and we see great potential for further partnerships based upon the unique predictive capabilities of EDEN™.

Our RAVEN™ Model

RAVEN™ is our AI model that rapidly identifies T-cell epitopes in pathogenic virus and bacteria for the use in prophylactic infectious disease vaccines. The RAVEN™ model synergizes with EDEN™ as RAVEN™ identified T-cell antigens can be used either as a stand-alone or incorporated into known or novel EDEN™ identified B-cell antigens. We believe that a vaccine comprising both RAVEN™ and EDEN™ identified antigens will elicit both an antibody and a T-cell response. This may result in highly efficacious and broadly protective vaccines through robust memory T-cell populations. The RAVEN™ model is a transformer-based neural network, trained using a conditional generative adversarial network approach. The algorithm is adjustable and can be used to ensure the broadest possible response across human tissue types and entire virus species, or alternatively to target specific human populations with common tissue types and/or selected viral strains in outbreaks. In a study using 17 T-cell epitopes identified by RAVEN™ across the SARS-CoV-2 genome, 15 epitopes (88%) induced T-cell activation and provided significant protection against lethal SARS-CoV-2 challenge in a mouse model. Moreover, T-cell epitope enrichment

involving engraftment of CD4+ T-cell epitopes from hemagglutinin genetic information across numerous influenza species improved antibody response in pre-clinical studies. Hemagglutinin, a viral fusion protein like the spike protein in coronaviruses, plays a crucial role in cellular entry. Enrichment of hemagglutinin significantly enhanced antibody response, resulting in 5-10 times better neutralization compared to non-enriched hemagglutinin. These identified antigens can be administered by any established vaccine delivery technology such as protein, DNA or mRNA.

We have applied RAVEN™ in our current pre-clinical vaccine program; EVX-V1, targeting CMV and in our EVX-B3 bacteria vaccine development.

Our AI-DeeP™ Model

AI-DeeP™ is our proprietary AI model designed to predict if patients respond to cancer immunotherapies and is an instrumental part for the Responder part of our strategy. It utilizes immunogenomic expression profiles as well as neoantigen and ERV-antigen burden to differentiate between patients who could benefit from these therapies and those who may not.

Initially, the model’s effectiveness was highlighted through a clinical trial (EVX-01) where it successfully retrospectively predicted patient outcomes based on immunogenomic profiles from tumor biopsies. This prediction was statistically significant and shows promise in identifying patient response to immunotherapy.

Furthermore, AI-DeeP™ was improved by incorporating additional features, including neoantigen and ERV- antigen burden, resulting AI-DeeP™ outperforming classical biomarkers in identifying non-responding patients. It showcased the ability to pinpoint 10 – 30% of non-responsive cases with a precision of 95%, compared to 70 – 80% precision achieved by traditional biomarkers tumor mutational burden, or TMB and PD-L1 tumor expression.

This AI model shows promise in reducing clinical development risks and enhancing benefits for patients and healthcare payers by stratifying patients based on their predicted likelihood to respond to immunotherapy. Hence, it holds great promise for improving outcomes and addressing the significant healthcare burden. Ongoing efforts aim to further refine and validate AI-DeeP™ by accumulating more data, enhancing its sensitivity, and increasing predictive accuracy.

We presented Proof of Principle for our Responding model in November 2023 at Biomarkers & Precision Oncology Europe conference.

Our Pipeline

The immune system is generally considered nature’s strongest weapon to fight disease. When the immune system is engaged, people are often able to fully eliminate a disease or infection from the body. Using our deep understanding of the human immune system and our proprietary AI-Immunology™ technology, we can mimic the human immune system in silico and predict whether certain stimuli induce an immune response. Our predictive power relies on our ability to process and interpret vast amounts of immune-related data, a process known as computational immunology. Using our in-silico AI models, we are able to transform such data into advanced algorithms that we believe can accurately predict cellular interactions within the immune system and identify the right vaccine targets that will stimulate a relevant response. To translate the identified targets into product candidates, we test multiple delivery modalities and move the most promising forward. We believe this process allows us to discover new product candidates and move them into the clinic without spending time and resources on clinical development of product candidates that may ultimately fail to produce a therapeutic or prophylactic response.

Based upon the AI-Immunology™ platform we have established a broad pre-clinical and clinical pipeline within cancer and infectious diseases. Our pipeline candidates are a mix of proprietary and partnered programs. Please see the chart below for an overview of the current Evaxion pipeline.

Figure 6

The Evaxion pipeline.

Patent Portfolio and Intellectual Property

To protect and maintain exclusivity to our products and AI-Immunology™ platform, we have developed what we believe is a strong portfolio of patents and trade-secrets. Our strategy for protecting our AI-Immunology™ platform is to pursue patent protection on some essential features while keep other essential features as trade secrets. The strategy allows us to obtain patent protection on essential features and protect our technology against copying. We believe this strategy effectively protects our proprietary position and exclude competitors from utilizing our technology.

In addition, we pursue patent protection for our pipeline products focusing on obtaining patent rights covering; composition of matter, methods, and use of same. We own thirty (30) patent families; twenty-six (27) granted patents and seventy (82) patent applications. In general, our strategy is to file a priority document with the European Patent office (EPO) followed by a Patent Co-operation Treaty (PCT) application and subsequently national or regional filings, e.g. Unites States, Europe (EPO), Japan, China, Australia, and Canada.

We will continue to capture value of our innovation by patenting and trade-secrets following our strategy on intellectual property. These assets will continue to build and strengthen our position within AI, infectious disease, cancer vaccines and cancer treatment response predictions.

Our Management Team

To deliver on our objectives, we have built an experienced and broadly skilled management team.

Our Chief Executive Officer, Christian Kanstrup joined on September 1, 2023. Christian Kanstrup has more than 25 years of experience in the life science industry, coming from a position of Executive Vice President at Mediq before joining Evaxion. Prior to that, Christian held a broad range of senior management roles at Novo Nordisk A/S, most recently as Senior Vice President and global head of Biopharm Operations, and previously held other senior leadership roles within commercial, strategy and corporate development roles. Christian also holds various board and advisory positions in the life science industry, advising on corporate strategy and company growth.

Our Chief Science Officer Dr. Birgitte Rønø joined in 2017 and was appointed CSO in 2021. Dr. Rønø has more than 20 years’ experience in biopharmaceutical drug discovery from academia and industry and

received her PhD in experimental oncology and immunology from National Institutes of Health, Bethesda, USA, and Copenhagen University Hospital, Denmark. Prior to joining Evaxion, Birgitte Rønø served as a specialist, team leader and project manager at Novo Nordisk A/S, where she led early drug discovery projects, evaluating in-licensing opportunities, and supporting drug development projects with pre-clinical and biomarker expertise.

Jesper Nyegaard Nissen joined as Chief Operating Officer in 2022 and was also appointed interim Chief Financial Officer in 2023. For over 25 years, Jesper Nyegaard Nissen has worked broadly across the pharma value chain in global operations positions at Novo Nordisk anchored in research, development and finance. He has covered business areas across a variety of focus points, including finance operation, external innovation and collaborations, digitalization of business process optimization, development and shaping of organizational capacities, and implementation of performance and process improvement structures. On July 31, 2024, he tendered his resignation as the Interim Chief Financial Officer and Chief Operating Officer, to be effective October 31, 2024. Mr. Nissen’s resignation was for personal reasons and was not a result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

The Company has appointed Thomas Frederik Schmidt to assume Mr. Nissen’s responsibilities as the Interim Chief Financial Officer. Mr. Schmidt brings more than 29 years of financial management experience from across different industries with more than 25 years of these being based in the life science industry including roles as country Managing Director and country Chief Financial Officer in Roche and Group CFO in Ambu, a MedTech company listed on the Nasdaq Copenhagen Stock Exchange. Mr. Schmidt holds a Master of Science in Business Economics and Auditing from Copenhagen Business School and has undergone training and preparation for State Authorized Public Accountant (CPA) exam. Mr. Schmidt has succeeded Mr. Nissen as the Company’s Interim CFO as of November 1, 2024.

Andreas Holm Mattsson serves as Chief AI Officer at Evaxion Biotech, where he’s been at the forefront in silico-based vaccine target discovery. He has played a key role in developing Evaxion’s innovative AI-Immunology platform, a proprietary AI technology for identifying novel vaccine targets for cancer and infectious diseases. Andreas brings a strong educational background in bioinformatics from the Technical University of Denmark and has previously worked at Novo Nordisk. Since founding Evaxion in 2008, he has been an essential part of the company’s growth, serving in various executive roles.

Company Structure

We have been building strong in-house multidisciplinary capabilities spanning the full value chain from AI target discovery to early clinical development. However, a lot of our development is done via CDMOs/CROs to focus our limited internal resources in strategic core areas where we have an edge over our competitors. The research we do in-house is mainly focused on AI-Immunology™ platform development, pre-clinical mouse studies and clinical translational activities, i.e. our core scientific areas. Other scientific activities, like manufacturing of new drug product leads, toxicology studies, clinical trial management and regulatory affairs are outsourced to CDMOs/CROs, where we internally have experienced managers/scientists to manage these. Our organizational strategy for now, is to continue with this setup to maintain flexibility and limit our fixed cash burn rate and at the same time develop and stay at the forefront within AI-Immunology™.

Our Strengths

Since our inception, we have applied our advanced data, AI, and machine learning capabilities to transform complex biological data into tangible AI-Immunology™ powered vaccines. We believe that we were one of the first companies to challenge status quo in drug discovery and development using AI technology. By building our multidisciplinary capabilities, gathering data and developing our AI prediction models, we hold a pioneering position with our AI-Immunology™ platform.

Our key strengths include:

•

Our flexible, modular, scalable and adaptable AI-Immunology™ platform offers a strong value proposition toward existing and potential partners

•

Our five AI models PIONEER™, ObsERV™, AI-DEEP™, EDEN™ and RAVEN™ ingrained in the AI-Immunology™ platform, have allowed us to generate numerous pipeline candidates within both cancer and infectious diseases, all with first-in-class potential and with our first two cancer product candidates in clinical development

•

We are seeing a strong external interest in both our AI-Immunology™ platform and our pipeline and the significantly expanded vaccine collaboration with MSD signed in September 2024, containing potential milestones of USD $592 million for each of EVX-B2 and EVX-B3, validates our approach

•

Our AI-Immunology™ platform offers the potential to expand our partnerships and product candidate portfolio and allows for entering into additional therapy areas

•

Our AI-Immunology™ platform facilitates the identification of novel effective vaccine targets, enhancing the potential for clinical success

•

Our in-house capabilities for experimental screening and testing of novel targets/product leads allow us to move rapidly from target/product lead identification to pre-clinical development and further into clinical development

•

Our model for iterative training allows for continuous improvement of our AI-Immunology™ platform as data are generated throughout the drug development stages

•

We have established a direct link between the predictive power of our AI-Immunology™ platform and preclinical and clinical outcome

•

Our existing collaborations are confirming the strength of our AI-Immunology™ platform

•

Our strong ties with MSD Global Health Innovation Fund (MSD GHI), a corporate venture capital arm of Merck & Co., Inc., Rahway, NJ, USA as our single largest shareholder holding approximately 13% (see Share Ownership — Major Shareholders)

Risks Associated with Our Business

Our business is subject to several risks of which you should be aware before making an investment decision. These risks are discussed more fully in the section of this prospectus titled “Risk Factors” immediately following this prospectus summary. These risks include, but are not limited to, the following:

•

On May 7, 2024, we received a notification from Nasdaq that we are not in compliance with the Nasdaq requirement to maintain a minimum equity of USD $2.5 million. We were granted an extension until November 4, 2024, to demonstrate compliance with the Nasdaq listing requirements. On November 11, 2024 we received a delisting notice from Nasdaq Capital Markets, which we appealed on November 12, 2024 and will pursue an additional 180-day exemption allowing time for securing compliance in a balanced way. The appeal will stay any trading suspension of the ADSs until completion of the Nasdaq hearing process and expiration of any additional extension period granted by the panel following the hearing. During any additional extension, we intend to regain compliance and maintain our Nasdaq listing, however there is no guarantee that we will be able to regain compliance. We are in constructive dialogue with Nasdaq on the matter, however no guarantees can be made that additional 180-days exemption will be given. If appeal isn’t successful, the continued non-compliance would result in delisting from Nasdaq Capital Markets. Such a delisting would likely have a negative effect on the price of the ADSs and would impair your ability to sell or purchase the ADSs when you wish to do so. In the event of a delisting, any action taken by us to restore compliance with listing requirements may not i) allow the ADSs to become listed again, ii) stabilize the market price or iii) improve the liquidity of the ADSs, iv) prevent the ADSs from dropping below the Nasdaq minimum bid price requirement or v) prevent future non-compliance with the listing requirements of Nasdaq.

•

We are a clinical stage AI-Immunology company with only two product candidates in the early stages of clinical trials.

•

We have incurred significant losses since our inception, and we anticipate that we will continue to incur significant losses for the foreseeable future, however reduced due to our strategic focus on partnerships.

•

We will require substantial additional financing to achieve our goals which may not be available.

•

We will need to develop our company, and we may encounter difficulties in managing this development and expansion, which could disrupt our operations.

•

Pharmaceutical product development is inherently uncertain, and there is no guarantee that any of our product candidates will receive marketing approval.

•

No vaccine has been approved using our technology, and none may ever be approved.

•

Our product candidates may not work as intended, may cause undesirable side effects or may have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label or result in significant negative consequences following marketing approval, if any.

•

Our business model is based upon partnering and there is no guarantee that we will be able to secure needed partnerships to be able to monetize our platform and assets. Our future partners, if any, may not be able to obtain regulatory approval for products, if any, derived from our product candidates under applicable US, European and other international regulatory requirements.

•

We face significant competition in an environment of rapid technological and scientific change, and our failure to effectively compete would prevent us from achieving our goals.

•

Even if products derived from our product candidates receive regulatory approval, such products may not gain market acceptance and our future partners, if any, may not be able to effectively commercialize them.

•

If we are not successful in developing our product candidates and our future partners, if any, are not successful in commercializing any products derived from our product candidates, our ability to expand our business and achieve our strategic objectives will be impaired.

•

We rely on third parties in the conduct of significant aspects of our pre-clinical studies and clinical trials and intend to rely on pharma partners in the conduct of future clinical trials. If these third parties/pharma partners do not successfully carry out their contractual duties, fail to comply with applicable regulatory requirements and/or fail to meet expected deadlines, we may face delays and/or be unable to obtain regulatory approval for our product candidates.

•

Enrolling patients in clinical trials may be difficult for many reasons, including high screen failure, manufacturing capacity for personalized products, timing, proximity and availability of clinical sites, perceived risks, and publicity about the success or lack of success in the methods of treatment.

•

Our future partners, if any, may encounter difficulties in manufacturing to supply clinical studies and the market.

•

Certain of our product candidates may be uniquely manufactured for each patient and we and/or our future partners may encounter difficulties in manufacturing, particularly with respect to the scaling-up of manufacturing capabilities.

•

If our efforts to obtain, maintain, protect, defend and/or enforce the intellectual property related to our product candidates and technologies are not adequate, we may not be able to compete effectively in our market.

•

We may be involved in lawsuits to protect or enforce our intellectual property or the intellectual property of our licensors, or to defend against third-party claims that we infringe, misappropriate or otherwise violate such third party’s intellectual property.

Corporate Information

We were incorporated under the laws of the Kingdom of Denmark on August 11, 2008, as a private limited liability company (in Danish: Anpartsselskab, or ApS) and are registered with the Danish Business Authority (in Danish: Erhvervsstyrelsen) in Copenhagen, Denmark under registration number 31762863. On March 29, 2019, our company was converted into a public limited liability company (in Danish: Aktieselskab, or A/S). Our principal executive offices are located at Dr. Neergaards Vej 5F, 2970 Hørsholm,

Denmark and our telephone number is +45 31 31 97 53. Our website address is www.evaxion-biotech.com. The information on, or that can be accessed through, our website is not part of and is not incorporated by reference into this prospectus. We have included our website address as an inactive textual reference only.

Implications of Being an “Emerging Growth Company”

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act. As such, we are eligible to, and intend to, take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not “emerging growth companies” such as not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. We could remain an “emerging growth company” for up to five years, or until the earliest of (a) the last day of the first fiscal year in which our annual gross revenue exceeds $1.235 billion, (b) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of all our ordinary shares, including those represented by the ADSs, that are held by non- affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in nonconvertible debt during the preceding three-year period.

Recent Developments

ADS Ratio Change

Our board of directors approved the change in the ratio of ADSs evidencing ordinary shares from one (1) ADS representing one (1) ordinary share to one (1) ADS representing ten (10) ordinary shares, which resulted in a one for ten (10) reverse split of the issued and outstanding ADSs (the “ADS Ratio Change”). The ADS Ratio Change was effective on January 22, 2024. All ADS and related warrant information presented in this prospectus, including our financial statements and accompanying footnotes, has been retroactively adjusted to reflect the reduced number of ADSs resulting from the ADS Ratio Change, unless otherwise noted.

Receipt of Nasdaq Notification

On May 7, 2024, the Nasdaq Stock Market LLC (“Nasdaq”) Listing Qualifications Department notified us that the Company no longer complied with Nasdaq Listing Rule 5550(b)(1) (the “Rule”). Under the Rule, companies listed on Nasdaq must maintain stockholders’ equity of at least $2,500,000 (the “Stockholders’ Equity Requirement”). The Company’s stockholders’ equity of $(4,729,000) for the period ended December 31, 2023 was below the Stockholders’ Equity Requirement for continued listing.

On May 31, 2024, we submitted a plan to the staff at the Nasdaq Listing Qualifications Department (the “Staff”) to regain compliance with the Stockholders’ Equity Requirement (the “Compliance Plan”), and on June 13, 2024, the Staff notified the Company (the “Letter”) that it would be granted an extension until November 4, 2024, to demonstrate compliance with the Rule to meet the continued listing requirements of Nasdaq, conditioned upon the Company evidencing compliance with the Rule.

On November 11, 2024 we received a delisting notice from Nasdaq Capital Markets, which we appealed on November 12, 2024 and will pursue an additional 180-day exemption allowing time for securing compliance in a balanced way. The appeal will stay any trading suspension of the ADSs until completion of the Nasdaq hearing process and expiration of any additional extension period granted by the panel following the hearing. During any additional extension, we intend to regain compliance and maintain our Nasdaq listing, however there is no guarantee that we will be able to regain compliance. We are in constructive dialogue with Nasdaq on the matter, however no guarantees can be made that additional 180-days exemption will be given. If appeal isn’t successful, the continued non-compliance would result in delisting from Nasdaq Capital Markets.

Business Updates

On September 9, 2024, Evaxion announced it had obtained pre-clinical Proof-of-Concept (PoC) for novel mRNA Gonorrhea vaccine candidate EVX-B2, achieving another company milestone. New pre-clinical

data demonstrated the ability of EVX-B2 in eliminating gonorrhea bacteria by triggering a targeted immune response, providing strong PoC for the mRNA-based version of EVX-B2 in a pre-clinical setting. EVX-B2 was initially designed as a protein-based prophylactic vaccine candidate for which pre-clinical PoC had already been obtained. The novel pre-clinical data for the mRNA-version of the vaccine substantiates that AI-Immunology™ identified vaccine antigens are delivery modality agnostic and can be applied across different vaccine modalities.

On September 16, 2024, Evaxion announced convincing one-year data from an ongoing phase 2 trial on its lead clinical asset, AI-designed personalized cancer vaccine EVX-01. Presenting phase 2 efficacy data for an AI-designed vaccine was a major milestone for Evaxion.

The data demonstrated 69% Overall Response Rate, reduction in tumor target lesions in 15 out of 16 patients, an immunogenicity rate of 79%, and a positive correlation between our AI-Immunology™ platform predictions and immune responses induced by the individual neoantigens in the EVX-01 vaccine (p=0.00013). The observed immunogenicity rate means that 79% of EVX-01’s vaccine targets triggered a targeted immune response, which compares very favorably to what is seen with other approaches.

These clinical findings underscore the significant therapeutic potential of EVX-01 and are yet another validation of the AI-Immunology™ platform as a leading AI technology for fast and effective vaccine target discovery and design. The data was presented at the renowned European Society for Medical Oncology (ESMO) Congress 2024.

On September 19, 2024, Evaxion launched an improved version of its AI-Immunology™ platform for vaccine antigen prediction. Among other improvements, the platform can now predict toxin antigens, allowing for the development of improved bacterial vaccines. The upgrade will expectedly improve Evaxion’s ability to fast and effectively discover AI-derived novel vaccines and is expected to further solidify the strong interest seen in AI-Immunology™ from potential partners.

On September 26, 2024, Evaxion announced a significant expansion of its vaccine development collaboration with MSD (tradename of Merck & Co., Inc., Rahway, NJ, USA) in a transformative deal carrying substantial value for Evaxion.

Under the terms of the agreement, Evaxion has granted MSD an option to exclusively license Evaxion’s preclinical vaccine candidates EVX-B2 and EVX-B3. EVX-B2 is a protein-based candidate for Gonorrhea and EVX-B3 targets an undisclosed infectious agent. In return, Evaxion receives an upfront payment of $3.2 million and up to $10 million in 2025, contingent upon MSD exercising its option to license either one or both candidates. In addition, Evaxion is eligible for development, regulatory and sales milestone payments with a potential value of up to $592 million per product, as well as royalties on net sales.

Evaxion and MSD have been collaborating on EVX-B3 since 2023. Also in 2023, MSD, through its Global Health Innovation Fund (MGHIF), led a private placement round of financing for Evaxion to become the company’s single largest shareholder. MGHIF also participated in Evaxion’s public offering in February 2024.

On November 12, 2024, Evaxion announced positive preclinical data for its cytomegalovirus (CMV) vaccine program EVX-V1. The data demonstrates that CMV antigens identified with Evaxion’s AI-Immunology™ platform trigger targeted immune responses. Results also showcases the successful design of a proprietary prefusion glycoprotein B (gB) antigen with ability to neutralize the virus. Evaxion is advancing these new findings to develop a multi-component CMV vaccine candidate.

On December 2, 2024, Evaxion announced that it would present data from preclinical studies with its precision cancer vaccine concept targeting non-conventional ERV (endogenous retrovirus) tumor antigens shared across patients at the ESMO Immuno-Oncology Congress, taking place from December 11-13, 2024, in Geneva, Switzerland. The data provides preclinical Proof-of-Concept for the concept.

On December 17, 2024, Evaxion announced that it is currently in advanced discussions with the European Investment Bank (EIB) about conversion of €3.5 million out of Evaxion’s €7 million loan with EIB into an equity-type instrument. A conversion is expected to increase Evaxion’s equity by $3.7 million (€3.5 million) immediately upon completion and constitutes an important part of Evaxion’s plan to ensure

ongoing compliance with the Nasdaq listing requirements, although there is no guarantee that a final agreement will be reached. Evaxion has no debt besides the EIB-loan, so the conversion would also substantially reduce the company’s overall liabilities, simplify its balance sheet and improve its financial flexibility and cash flow.

An agreement between Evaxion and EIB would be subject to certain conditions. Such agreement is expected to be finalized and implemented in the first quarter of 2025.

The Offering

Up to 7,640,845 ADSs representing 76,408,450 ordinary shares or up to 7,640,845 pre-funded warrants to purchase 7,640,845 ADSs representing 76,408,450 ordinary shares, and accompanying Warrants to purchase up to 7,640,845 ADSs representing 7,640,845 ordinary shares. The ADSs and Warrants are immediately separable and will be issued separately in this offering but must initially be purchased together in this offering. Each Warrant has an exercise price of $ per ADS, is immediately exercisable and will expire 5 years from the date of issuance. See “Description of Securities”. We are also registering the ADSs issuable upon exercise of the pre-funded warrants and the Warrants.

Each ADS represents 10 ordinary shares. As a holder of ADSs, we will not treat you as one of our shareholders. The depositary will be the holder of the ordinary shares underlying the ADSs, and you will have the rights of a holder of ADSs or beneficial owner (as applicable) as provided in the deposit agreement among us, the depositary and owners and holders of ADSs from time to time. To better understand the terms of the ADSs you should read the section herein entitled “Description of Share Capital and Articles of Association” in this prospectus. We also encourage you to read the deposit agreement, the form of which is filed as an exhibit to the registration statement of which this prospectus forms a part.

Each Warrant will be immediately exercisable, will expire five (5) years from the date of issuance and have an exercise price of $ , subject to adjustment as set forth therein.

Pre-Funded Warrants Offered