0000949870false00009498702024-12-202024-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 20, 2024 |

The Boston Beer Company, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Massachusetts |

001-14092 |

04-3284048 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

One Design Center Place Suite 850 |

|

Boston, Massachusetts |

|

02210 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 368-5000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock. $0.01 par value |

|

SAM |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On December 20, 2024, the Company issued a press release updating its financial guidance for fiscal year 2024 to reflect the impact of a negotiated cash payment under an amendment and restatement of an existing production agreement with a third-party supplier, Rauch North America Inc. (“Rauch”). The amendment and restatement is part of an ongoing initiative to optimize the Company’s supply chain. As a result of the cash payment to Rauch, the Company expects to record a pre-tax contract settlement expense of $26 million, or $1.70 after tax per diluted share impact, in the fourth quarter of 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information furnished in this Item 7.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are filed as part of this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

The Boston Beer Company, Inc. |

|

|

|

|

Date: |

December 20, 2024 |

By: |

/s/ Michael Spillane |

|

|

|

Name: Michael Spillane

Title: President & Chief Executive Officer |

|

|

|

|

Investor Relations Contact: Media Contact: |

Jennifer Larson |

|

|

Dave DeCecco |

(617) 368-5152 |

|

|

(914) 261-6572 |

jennifer.larson@bostonbeer.com |

|

|

dave.dececco@bostonbeer.com |

BOSTON BEER UPDATES 2024 FINANCIAL GUIDANCE TO REFLECT SUPPLIER CONTRACT AMENDMENT

BOSTON (December 20, 2024) – As part of its ongoing initiatives to optimize its supply chain, The Boston Beer Company, Inc. (NYSE: SAM), today announced an amendment and restatement in its entirety of an existing production agreement with a third-party supplier, Rauch North America Inc (‘Rauch’). This amendment adjusts the existing production agreement to better match the Company’s future capacity requirements and results in increased production flexibility and more favorable termination rights to the company in exchange for a $26 million cash payment to Rauch on or before December 23, 2024.

As a result of the payment, the Company expects to record a pre-tax contract settlement expense of $26 million or $1.70 after tax per diluted share impact in the fourth quarter of 2024. The full anticipated impact of the payment on the Company’s prior guidance is set forth in the chart below under Updated Full-Year 2024 Projections.

Updated Future Third Party Production Obligations

For the full year 2024, the Company continues to estimate shortfall fees will negatively impact gross margin by 65 to 75 basis points and the non-cash expense of third-party production pre-payments will negatively impact gross margins by 95 to 105 basis points.

The Company continues to work to finalize its 2025 financial plan. The company does not expect this agreement to materially impact its previously provided estimate of $14 million in 2025 shortfall fees disclosed in its third quarter 10-Q filed on October 24, 2024. The Company will provide further guidance on shortfall fees and the non-cash expense of third-party production pre-payments along with its full year 2025 financial guidance in its fourth quarter earnings report in February 2025.

The Company has regular discussions with its third-party production suppliers related to its future capacity needs and the terms of its contracts. Changes to volume estimates, future amendments or cancellations of existing contracts could accelerate or change total shortfall fees expected to be incurred.

Updated Full-Year 2024 Projections

The Company has updated its full year guidance to reflect the estimated contract settlement expense discussed above. The Company’s actual 2024 results could vary from the current projection and are highly sensitive to changes in volume projections and supply chain performance.

|

|

|

Full Year 2024 |

Current Guidance |

Prior Guidance |

Depletions and Shipments Percentage Decrease |

Down low single digits |

Down low single digits |

Price Increases |

2% |

2% |

Gross Margin |

44% to 45% |

44% to 45% |

Advertising, Promotion, and Selling Expense Year Over Year Change ($ million) |

($5) to $15 |

($5) to $15 |

Effective Tax Rate |

34% |

30% |

GAAP EPS |

$3.80 to $5.80 |

$5.50 to $7.50 |

Non-GAAP EPS |

$8.00 to $10.00 |

$8.00 to $10.00 |

Capital Spending ($ million) |

$80 to $95 |

$80 to $95 |

The non-GAAP earnings per share (Non-GAAP EPS) projection excludes the contract settlement of $26 million or $1.70 per diluted share and the impact of non-cash brand impairments of $42.6 million or $2.49 per diluted share, recognized in the third quarter of fiscal 2024 relating primarily to the Dogfish Head brand.

The increase in the estimated full year effective tax rate is due to the impact of the contract settlement which decreased estimated full year pre-tax income but did not significantly change estimated full year non-deductible expenses.

Use of Non-GAAP Measures

Non-GAAP EPS is not a defined term under U.S. generally accepted accounting principles (“GAAP”). Non-GAAP EPS, or Non-GAAP earnings per diluted share, excludes from projected GAAP EPS the estimated impact of the contract settlement of $26 million or $1.70 per diluted share to be recognized in the fourth quarter of fiscal 2024 and the impact of the non-cash asset impairment charge of $42.6 million, or $2.49 per diluted share, recognized in the third quarter of fiscal 2024 relating primarily to the Dogfish Head brand. This non-GAAP measure should not be considered in isolation or as a substitute for diluted earnings per share prepared in accordance with GAAP, and may not be comparable to calculations of similarly titled measures by other companies. Management uses this non-GAAP financial measure to make operating and strategic decisions and to evaluate the Company’s underlying business performance. Management believes this forward-looking non-GAAP measure provides meaningful and useful information to investors and analysts regarding the Company’s outlook for its ongoing financial and business performance or trends and facilitates period to period comparisons of its forecasted financial performance.

Forward-Looking Statements

Statements made in this press release that state the Company’s or management’s intentions, hopes, beliefs, expectations or predictions of the future are forward-looking statements. It is important to note that the Company’s actual results could differ materially from those projected in such forward-looking statements. Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in the Company’s SEC filings, including, but not limited to, the Company’s report on Form 10-K for the year ended December 30, 2023 and subsequent reports filed by the Company with the SEC on Forms 10-Q and 8-K. Copies of these documents are available from the SEC and may be found on the Company’s website, www.bostonbeer.com. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise any forward-looking statements.

About the Company

The Boston Beer Company, Inc. (NYSE: SAM) began brewing Samuel Adams beer in 1984 and has since grown to become one of the largest and most respected craft brewers in the United States. We consistently offer the highest-quality products to our drinkers, and we apply what we’ve learned from making great-tasting craft beer to making great-tasting and innovative “beyond beer” products. Boston Beer Company has pioneered not only craft beer but also hard cider, hard seltzer and hard tea. Our core brands include household names like Angry Orchard Hard Cider, Dogfish Head, Sun Cruiser, Truly Hard Seltzer, Twisted Tea Hard Iced Tea, and Samuel Adams. We have taprooms and hospitality locations in California, Delaware, Massachusetts, New York and Ohio. For more information, please visit our website at www.bostonbeer.com, which includes links to our respective brand websites.

Friday, December 20, 2024

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

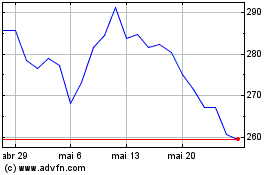

Boston Beer (NYSE:SAM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Boston Beer (NYSE:SAM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024