false

--12-31

0001346830

0001346830

2024-12-30

2024-12-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

December 30, 2024

CARA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36279 |

|

75-3175693 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

|

400 Atlantic Street

Suite 500

Stamford, Connecticut |

|

|

|

06901 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

| |

|

|

|

|

| Registrant's telephone number, including area code: (203) 406-3700 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which

registered |

| Common Stock, par value $0.001 per share |

CARA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

(a) Amendment of Amended and Restated Certificate of Incorporation

to Effect Reverse Stock Split and Shares Reduction

On December 30, 2024,

Cara Therapeutics, Inc. (the “Company”) filed a Certificate of Amendment to its Amended and Restated Certificate

of Incorporation (the “Amendment”) with the Secretary of State of the State of Delaware to effect a one-for-twelve

(1-for-12) reverse stock split (the “Reverse Stock Split”) of its outstanding common stock and a reduction in

the total number of authorized shares of its common stock from 200,000,000 to 16,666,667 (the “Shares Reduction”).

The Amendment will be effective at 5:00 p.m. Eastern Time on December 30, 2024. A series of alternate amendments to effect (i) a

reverse stock split and (ii) a reduction in the total number of authorized shares of the Company’s common stock was approved

by the Company’s stockholders at the Company’s 2024 Annual Meeting of Stockholders held on June 4, 2024, and the specific

one-for-twelve (1-for-12) Reverse Stock Split and corresponding Shares Reduction was subsequently approved by the Company’s board

of directors on December 19, 2024.

The Amendment provides that,

at the effective time of the Amendment, every twelve (12) shares of the Company’s issued and outstanding common stock will automatically

be combined into one (1) issued and outstanding share of common stock and the authorized shares of the Company’s common stock

will reduce from 200,000,000 to 16,666,667, without any change in par value per share. The Reverse Stock Split will affect all shares

of the Company’s common stock outstanding immediately prior to the effective time of the Amendment. As a result of the Reverse Stock

Split, proportionate adjustments will be made to the per share exercise price and/or the number of shares issuable upon the exercise or

vesting of all stock options issued by the Company and outstanding immediately prior to the effective time of the Amendment, which will

result in a proportionate decrease in the number of shares of the Company’s common stock reserved for issuance upon exercise or

vesting of such stock options and a proportionate increase in the exercise price of all such stock options. In addition, the number of

shares reserved for issuance under the Company’s equity compensation plans immediately prior to the effective time of the Amendment

will be reduced proportionately.

No fractional shares will

be issued as a result of the Reverse Stock Split. Stockholders of record who would otherwise be entitled to receive a fractional share

will receive a cash payment in lieu thereof. The Reverse Stock Split will affect all stockholders proportionately and will not affect

any stockholder’s percentage ownership of the Company’s common stock (except to the extent that the Reverse Stock Split results

in any stockholder owning only a fractional share).

The Company’s common

stock will begin trading on The Nasdaq Capital Market on a split-adjusted basis when the market opens on Tuesday, December 31, 2024.

The new CUSIP number for the Company’s common stock following the Reverse Stock Split is 140755 208.

The foregoing description

is qualified in its entirety by the Amendment, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

Additional Information and Where to Find It

This Current Report on Form 8-K relates to a proposed acquisition

transaction between the Company and Tvardi Therapeutics, Inc. (“Tvardi”). In connection with the proposed transaction,

the Company has filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form

S-4 that contains a proxy statement and prospectus. The Company may also file other documents with the SEC regarding the proposed transaction.

THE COMPANY URGES INVESTORS AND STOCKHOLDERS TO READ THESE MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, TVARDI, THE PROPOSED TRANSACTION AND RELATED MATTERS. Stockholders are and

will be able to obtain free copies of the proxy statement, prospectus and other documents filed by the Company with the SEC (when they

become available) through the website maintained by the SEC at www.sec.gov. In addition,

stockholders are or will be able to obtain free copies of the proxy statement, prospectus and other documents filed by the Company with

the SEC by contacting Investor Relations by email at investor@caratherapeutics.com. Stockholders

are urged to read the proxy statement, prospectus and the other relevant materials when they become available before making any voting

or investment decision with respect to the proposed transaction.

Participants in the Solicitation

The Company and Tvardi, and each of their respective directors and

executive officers and certain of their other members of management and employees, may be deemed to be participants in the solicitation

of proxies in connection with the proposed transaction. Information about the Company’s directors and executive officers, consisting

of Helen M. Boudreau, Jeffrey L. Ives, Ph.D., Christopher Posner, Susan Shiff, Ph.D., Martin Vogelbaum, Lisa von Moltke, M.D., Ryan Maynard

and Scott Terrillion, including a description of their interests in the Company, by security holdings or otherwise, can be found under

the captions, “Security Ownership of Certain Beneficial Owners and Management,” “Executive Compensation” and “Director

Compensation” contained in the definitive proxy statement on Schedule 14A for the Company’s 2024 annual meeting of stockholders,

filed with the SEC on April 22, 2024 (the “2024 Cara Proxy Statement”). To the extent that the Company’s

directors and executive officers and their respective affiliates have acquired or disposed of security holdings since the applicable “as

of” date disclosed in the 2024 Cara Proxy Statement, such transactions have been or will be reflected on Statements of Change in

Beneficial Ownership on Form 4 filed with the SEC. Additional information regarding the persons who may be deemed participants in the

proxy solicitation, including the information about the directors and executive officers of Tvardi, and a description of their direct

and indirect interests, by security holdings or otherwise, are also included in a registration statement filed on Form S-4 that contains

a proxy statement (and prospectus and other relevant materials) filed with the SEC. Investors should read the registration statement,

proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision

with respect to the proposed transaction. These documents can be obtained free of charge from the sources indicated above.

Non-Solicitation

This Current Report on Form 8-K shall not constitute an offer to sell

or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction. No public offer of securities shall be made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CARA THERAPEUTICS, INC. |

|

| |

|

| By: |

/s/ RYAN MAYNARD |

|

| |

Ryan Maynard |

|

| |

Chief Financial Officer |

|

Date: December 30, 2024

Exhibit 3.1

CERTIFICATE OF AMENDMENT

TO

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

CARA THERAPEUTICS, INC.

Cara Therapeutics, Inc.

(the “Company”), a corporation organized and existing under and by virtue of the General Corporation Law of

the State of Delaware (the “DGCL”), does hereby certify that:

First: The

name of this corporation is Cara Therapeutics, Inc., and the date on which the Certificate of Incorporation of this corporation was

originally filed with the Secretary of State of the State of Delaware was July 2, 2004, under the original name Cara Therapeutics, Inc.

Second: The

Board of Directors of the Company (the “Board”), acting in accordance with the provisions of Sections 141 and

242 of the DGCL, adopted resolutions amending its Certificate of Incorporation (the “Certificate of Incorporation”),

as follows:

1. Effective as of the effective

time of 5:00 p.m., Eastern Time, on December 30, 2024 (the “Effective Time”), each twelve (12)

shares of the Company’s Common Stock, par value $0.001 per share, issued and outstanding immediately prior to the Effective

Time shall, automatically and without any action on the part of the Company or the respective holders thereof, be combined into one

(1) share of Common Stock without increasing or decreasing the par value of each share of Common Stock (the

“Reverse Split”); provided, however, no fractional shares of Common Stock shall be issued as a result of

the Reverse Split and, in lieu thereof, upon receipt after the Effective Time by the exchange agent selected by the Company of a

properly completed and duly executed transmittal letter and, where shares are held in certificated form, the surrender of the stock

certificate(s) formerly representing shares of pre-Reverse Split Common Stock, any stockholder who would otherwise be entitled

to a fractional share of post-Reverse Split Common Stock as a result of the Reverse Split, following the Effective Time (after

taking into account all fractional shares of post-Reverse Split Common Stock otherwise issuable to such stockholder), shall be

entitled to receive a cash payment (without interest) equal to the fractional share of post-Reverse Split Common Stock to which such

stockholder would otherwise be entitled multiplied by the average of the closing sales prices of a share of the Company’s

Common Stock (as adjusted to give effect to the Reverse Split) on The Nasdaq Stock Market for each of the five (5) consecutive

trading days immediately preceding the date this Certificate of Amendment is filed with the Secretary of State of the State of

Delaware. Each stock certificate that, immediately prior to the Effective Time, represented shares of pre-Reverse Split Common Stock

shall, from and after the Effective Time, automatically and without any action on the part of the Company or the respective holders

thereof, represent that number of whole shares of post-Reverse Split Common Stock into which the shares of pre-Reverse Split Common

Stock represented by such certificate shall have been combined (as well as the right to receive cash in lieu of any fractional

shares of post-Reverse Split Common Stock as set forth above; provided, however, that each holder of record of a certificate that

represented shares of pre-Reverse Split Common Stock shall receive, upon surrender of such certificate, a new certificate

representing the number of whole shares of post-Reverse Split Common Stock into which the shares of pre-Reverse Split Common Stock

represented by such certificate shall have been combined pursuant to the Reverse Split, as well as any cash in lieu of

fractional shares of post-Reverse Split Common Stock to which such holder may be entitled as set forth above. The Reverse Split

shall be effected on a record holder-by-record holder basis, such that any fractional shares of post-Reverse Split Common Stock

resulting from the Reverse Split and held by a single record holder shall be aggregated.

2.

Section A of Article IV of the Certificate of Incorporation is amended and restated to read in its entirety as

follows:

“A. The

Company is authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.”

The total number of shares which the Company is authorized to issue is 21,666,667 shares, consisting of (i) 16,666,667 shares of

Common Stock, $0.001 par value per share, and (ii) 5,000,000 shares of Preferred Stock, $0.001

par value per share.”

Third: The

foregoing amendment to the Certificate of Incorporation was duly approved by the Board.

Fourth:

Thereafter, pursuant to a resolution of the Board, this Certificate of Amendment was submitted to the stockholders of the Company for

their approval, and was duly adopted in accordance with the provisions of Section 242 of the DGCL.

Fifth:

This amendment to the Certificate of Incorporation shall be effective on and as of as of the effective time of 5:00 p.m., Eastern Time,

on December 30, 2024.

[Signature

Page Follows]

In

Witness Whereof, Cara Therapeutics, Inc. has caused this Certificate of Amendment to be executed by its Chief Executive

Officer as of December 30, 2024.

| |

By: |

/s/ Christopher Posner |

| |

|

Christopher Posner |

| |

|

Chief Executive Officer |

v3.24.4

Cover

|

Dec. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 30, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-36279

|

| Entity Registrant Name |

CARA THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001346830

|

| Entity Tax Identification Number |

75-3175693

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400 Atlantic Street

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Stamford

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06901

|

| City Area Code |

203

|

| Local Phone Number |

406-3700

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CARA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

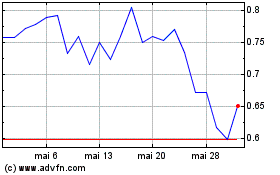

Cara Therapeutics (NASDAQ:CARA)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Cara Therapeutics (NASDAQ:CARA)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025