false

0001928581

P5Y

0001928581

2023-07-01

2024-06-30

0001928581

dei:BusinessContactMember

2023-07-01

2024-06-30

0001928581

2024-06-30

0001928581

2023-06-30

0001928581

us-gaap:RelatedPartyMember

2024-06-30

0001928581

us-gaap:RelatedPartyMember

2023-06-30

0001928581

2022-07-01

2023-06-30

0001928581

FTEL:MerchandiseRevenueMember

2023-07-01

2024-06-30

0001928581

FTEL:MerchandiseRevenueMember

2022-07-01

2023-06-30

0001928581

FTEL:SalesOfConsumableProductsMember

2023-07-01

2024-06-30

0001928581

FTEL:SalesOfConsumableProductsMember

2022-07-01

2023-06-30

0001928581

FTEL:RevenueFromLicensingCustomersMember

2023-07-01

2024-06-30

0001928581

FTEL:RevenueFromLicensingCustomersMember

2022-07-01

2023-06-30

0001928581

us-gaap:CommonStockMember

2022-06-30

0001928581

FTEL:SubscriptionReceivableMember

2022-06-30

0001928581

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001928581

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001928581

us-gaap:RetainedEarningsMember

2022-06-30

0001928581

2022-06-30

0001928581

us-gaap:CommonStockMember

2023-06-30

0001928581

FTEL:SubscriptionReceivableMember

2023-06-30

0001928581

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001928581

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001928581

us-gaap:RetainedEarningsMember

2023-06-30

0001928581

us-gaap:CommonStockMember

2022-07-01

2023-06-30

0001928581

FTEL:SubscriptionReceivableMember

2022-07-01

2023-06-30

0001928581

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2023-06-30

0001928581

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-07-01

2023-06-30

0001928581

us-gaap:RetainedEarningsMember

2022-07-01

2023-06-30

0001928581

us-gaap:CommonStockMember

2023-07-01

2024-06-30

0001928581

FTEL:SubscriptionReceivableMember

2023-07-01

2024-06-30

0001928581

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2024-06-30

0001928581

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-07-01

2024-06-30

0001928581

us-gaap:RetainedEarningsMember

2023-07-01

2024-06-30

0001928581

us-gaap:CommonStockMember

2024-06-30

0001928581

FTEL:SubscriptionReceivableMember

2024-06-30

0001928581

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001928581

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-06-30

0001928581

us-gaap:RetainedEarningsMember

2024-06-30

0001928581

FTEL:FitellCorporationMember

2023-07-01

2024-06-30

0001928581

FTEL:FitellCorporationMember

2022-07-01

2023-06-30

0001928581

FTEL:KMASCapitalAndInvestmentPtyLtdMember

2023-07-01

2024-06-30

0001928581

FTEL:KMASCapitalAndInvestmentPtyLtdMember

2024-06-30

0001928581

FTEL:KMASCapitalAndInvestmentPtyLtdMember

2023-06-30

0001928581

FTEL:GDWellnessPtyLtdMember

2023-07-01

2024-06-30

0001928581

FTEL:GDWellnessPtyLtdMember

2024-06-30

0001928581

FTEL:GDWellnessPtyLtdMember

2023-06-30

0001928581

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

FTEL:OneVendorsMember

2023-07-01

2024-06-30

0001928581

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

FTEL:TwoVendorsMember

2023-07-01

2024-06-30

0001928581

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

FTEL:OneVendorsMember

2022-07-01

2023-06-30

0001928581

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

FTEL:TwoVendorsMember

2022-07-01

2023-06-30

0001928581

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

FTEL:ThreeVendorsMember

2022-07-01

2023-06-30

0001928581

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

FTEL:ThreeVendorsMember

2023-07-01

2024-06-30

0001928581

us-gaap:CostOfGoodsTotalMember

us-gaap:SupplierConcentrationRiskMember

FTEL:FourVendorsMember

2022-07-01

2023-06-30

0001928581

FTEL:WarrantOneMember

2024-06-30

0001928581

FTEL:WarrantTwoMember

2024-06-30

0001928581

FTEL:WarrantOneMember

2023-07-01

2024-06-30

0001928581

FTEL:WarrantTwoMember

2023-07-01

2024-06-30

0001928581

us-gaap:EquitySecuritiesMember

2024-06-30

0001928581

us-gaap:EquitySecuritiesMember

2023-06-30

0001928581

us-gaap:EquitySecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001928581

us-gaap:EquitySecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001928581

us-gaap:EquitySecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001928581

us-gaap:EquitySecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001928581

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001928581

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001928581

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001928581

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001928581

us-gaap:EquitySecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001928581

us-gaap:EquitySecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001928581

us-gaap:EquitySecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001928581

us-gaap:EquitySecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001928581

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001928581

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001928581

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001928581

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001928581

FTEL:ConvertibleNotesMember

2024-01-15

0001928581

FTEL:ConvertibleNotesMember

2024-01-15

2024-01-15

0001928581

2024-01-15

0001928581

FTEL:WarrantTwoMember

FTEL:ConvertibleNotesMember

2024-01-15

0001928581

FTEL:ConvertibleNotesMember

2023-07-01

2024-06-30

0001928581

FTEL:ConvertibleNotesMember

2024-06-30

0001928581

us-gaap:WarrantMember

2024-06-30

0001928581

us-gaap:WarrantMember

2023-07-01

2024-06-30

0001928581

us-gaap:WarrantMember

2023-06-30

0001928581

us-gaap:WarrantMember

2023-07-01

2024-06-30

0001928581

us-gaap:WarrantMember

2024-06-30

0001928581

2023-08-02

0001928581

2023-08-02

2023-08-02

0001928581

us-gaap:VehiclesMember

2024-06-30

0001928581

us-gaap:VehiclesMember

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:AUD

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

F-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Fitell

Corporation

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

2

23-25 Mangrove Lane

Taren

Point, NSW 2229

Australia

+612

95245266

(Address

and telephone number of Registrant’s principal executive offices)

Cogency

Global Inc.

122

East 42nd Street, 18th Floor

New

York, NY 10168

(800)

221-0102

(Name,

address, and telephone number of agent for service)

With

a Copy to:

Mark

E. Crone, Esq.

Liang

Shih, Esq.

The

Crone Law Group P.C.

420

Lexington Ave, Suite 2446

New

York, NY 10170

Tel:

(646) 861-7891

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of the registration statement.

If

only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the

following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act.

†The

term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board

to its Accounting Standards Codification after April 5, 2012.

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed

with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting

any offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED JANUARY 10, 2025

PRELIMINARY

PROSPECTUS

$150,000,000

of

Ordinary

Shares

Debt

Securities

Warrants

Rights

and

Units

Fitell

Corporation

We

may, from time to time, in one or more offerings, offer and sell up to $150,000,000 of our ordinary shares, par value $0.0001 per share

(the “Ordinary Shares”), debt securities, warrants, rights, and units, or any combination thereof, together or separately

as described in this prospectus. We may also offer securities of the types listed above that are convertible or exchangeable into one

or more of the securities listed above. In this prospectus, references to the term “securities” refers, collectively, to

our Ordinary Shares, debt securities, warrants, rights, and units, and securities that may be convertible or exchangeable into the foregoing.

The prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering. For general

information about the distribution of the securities offered, please see “Plan of Distribution” in this prospectus.

This

prospectus provides a general description of the securities we may offer. Each time we offer and sell securities, we will provide

you with a prospectus supplement to this prospectus that will describe the specific amounts, prices and other important

terms of such offering.

We

may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. You should read this

prospectus, any prospectus supplement, and any free writing prospectus before you invest in any of our securities. The prospectus supplement

and any related free writing prospectus may add, update, or change information contained in this prospectus. If there is any inconsistency

between the information in this prospectus and the applicable prospectus supplement and any related free writing prospectus that we may

authorize to be provided to you, you must rely on the information in the prospectus supplement and any related free writing prospectus

that we provided to you. You should read carefully this prospectus, the applicable prospectus supplement, and any related free writing

prospectus, as well as the documents incorporated or deemed to be incorporated by reference, before you invest in any of our securities.

This prospectus may not be used to offer or sell any securities unless accompanied by the applicable prospectus supplement.

Our

Ordinary Shares are listed on the Nasdaq Capital Market, or “Nasdaq,” under the symbol “FTEL.”

Investing

in our securities involves a high degree of risk. Before making an investment decision, please read the information under the heading

“Risk Factors” beginning on page 9 of this prospectus and risk factors set forth in our most recent annual report on Form

20-F, in other reports incorporated herein by reference, and in an applicable prospectus supplement under the heading “Risk Factors.”

We

may offer and sell the securities from time to time at fixed prices, at market prices, or at negotiated prices, to or through underwriters,

to other purchasers, through agents, or through a combination of these methods. If any underwriters are involved in the sale of any securities

with respect to which this prospectus or any prospectus supplements are being delivered, the names of such underwriters and any applicable

commissions or discounts will be set forth in the applicable prospectus supplement. The offering price of such securities and the net

proceeds we expect to receive from such sale will also be set forth in a prospectus supplement. See “Plan of Distribution”

elsewhere in this prospectus for a more complete description of the ways in which the securities may be sold.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved

of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is _______ __, 2025.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”)

utilizing a “shelf” registration process. Under this shelf registration process, we may, from time to time, sell the securities

described in this prospectus in one or more offerings, up to a total offering amount of $150,000,000.

This

prospectus provides you with a general description of the securities we may offer. This prospectus and any accompanying prospectus supplement

do not contain all of the information included in the registration statement. We have omitted parts of the registration statement in

accordance with the rules and regulations of the SEC. Statements contained in this prospectus and any accompanying prospectus supplement

about the provisions or contents of any agreement or other documents are not necessarily complete. If the SEC rules and regulations require

that an agreement or other document be filed as an exhibit to the registration statement, please see that agreement or document for a

complete description of these matters. This prospectus may be supplemented by a prospectus supplement that may add, update, or change

information contained or incorporated by reference in this prospectus. You should read both this prospectus and any prospectus supplement

or other offering materials together with additional information described under the headings “Where You Can Find Additional Information”

and “Incorporation of Documents by Reference.”

Each

time we sell securities under this shelf registration, we will provide a prospectus supplement that will contain certain specific information

about the terms of that offering, including a description of any risks related to the offering. A prospectus supplement may also add,

update, or change information contained in this prospectus (including documents incorporated herein by reference). If there is any inconsistency

between the information in this prospectus and the applicable prospectus supplement, you should rely on the information in the prospectus

supplement. The registration statement we filed with the SEC includes exhibits that provide more details on the matters discussed in

this prospectus. You should read this prospectus and the related exhibits filed with the SEC and the accompanying prospectus supplement

together with additional information described under the headings “Incorporation of Documents by Reference” before investing

in any of the securities offered.

The

information in this prospectus is accurate as of the date on the front cover. Information incorporated by reference into this prospectus

is accurate as of the date of the document from which the information is incorporated. You should not assume that the information contained

in this prospectus is accurate as of any other date.

You

should rely only on the information provided or incorporated by reference in this prospectus or in the prospectus supplement. We have

not authorized anyone to provide you with any information or to make any representation other than those contained or incorporated

by reference in this prospectus and the accompanying prospectus supplement. This document may only be used where it is legal to sell

these securities.

As

permitted by SEC rules and regulations, the registration statement of which this prospectus forms a part includes additional information

not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at its website or

at its offices described below under “Where You Can Find Additional Information.”

Use

of Certain Defined Terms

Unless

otherwise indicated or the context requires otherwise, references in this annual report to:

● “Articles” are to

the amended and restated articles of association of the Company as adopted by special resolution passed on 8 January 2024;

● “Articles and Memorandum”

are to the Articles and Memorandum, collectively;

●

“AUD” are to Australian Dollars, the legal currency of Australia;

●

“Companies Act” are to the Companies Act (Revised) of the Cayman Islands;

●

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

●

“FINRA” are to the Financial Industry Regulatory Authority;

●

“Fitell,” “the Company,” “we,” “us,” or “our”

refer to Fitell Corporation, a Cayman Islands exempted company incorporated under the laws of Cayman Islands on April 11, 2022,

and its consolidated subsidiaries, through which it conducts its business;

●

“FY2024” are to the financial year ended June 30, 2024;

●

“FY2023” are to the financial year ended June 30, 2023;

●

“GD” are to GD Wellness Ptd Ltd, a wholly-owned operating subsidiary of KMAS, incorporated under the laws of Australia on

July 22, 2005;

●

“IPO” are to the Company’s initial public offering which was consummated on August 10, 2023;

●

“KMAS” are to KMAS Capital and Investment Pty Ltd, a company incorporated under the laws of Australia on July 26, 2016, a

wholly-owned subsidiary of Fitell which holds all of the issued and outstanding shares of our operating subsidiary GD;

● “Memorandum” are

to the amended and restated memorandum of association of the Company as adopted by special resolution passed on 8 January 2024;

●

“$,” “U.S. dollars,” or “dollars” are to the legal currency of the United States;

●

“SEC” are to the Securities and Exchange Commission;

●

“Securities Act” are to the Securities Act of 1933, as amended;

●

“Shares”, “shares,” or “Ordinary Shares” are to the Ordinary Shares of Fitell Corporation, par value

$0.0001 per share; and

●

“SKMA”, are to a company owned by Ms. Jieting Zhao, incorporated under the laws of the British Virgin Islands.

Our

business is and has been conducted in Australia through our Australian subsidiary GD Wellness Pty Ltd since our inception, using Australian

dollars, the currency of Australia. Our financial statements are presented in United States dollars. In this annual report, we refer

to assets, obligations, commitments and liabilities in our financial statements in United States dollars. These dollar references are

based on the exchange rate of Australian dollars to United States dollars, determined as of a specific date or for a specific period.

Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars

which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements that involve risks and uncertainties, including statements relating to our future financial

performance and results, financial condition, business strategy, plans, goals and objectives, including certain projections, milestones,

targets, business trends, and other statements that are not historical facts. We use words such as anticipate, believe, plan, expect,

future, intend and similar expressions denoting uncertainty or an action that may, will or is expected to occur in the future; although

not all forward-looking statements contain these identifying words. These statements involve estimates, assumptions, known and unknown

risks, uncertainties and other factors that could cause actual results to differ. While we believe these expectations, and the estimates

and projections on which they are based, are reasonable and were made in good faith, the ultimate correctness of these forward-looking

statements depends upon a number of known and unknown risks, uncertainties, events, and other important factors, which include, but are

not limited to, the risks disclosed in the Risk Factors section of the Annual Report on Form 20-F for the year ended June 30, 2024, filed

with the SEC on November 15, 2024 (the “Annual Report”), this prospectus and any subsequent reports to Annual Report filed

with the SEC and the other documents which are incorporated by reference in this prospectus. The actual results could differ materially

from our forward-looking statements. Any of these risk factors could cause our actual results, performance or achievements, or industry

results to differ materially from those expressed or implied in our forward-looking statements. Consequently, you should not rely on

any of these forward-looking statements. In addition, we cannot assess the impact of each factor on our business or the extent

to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements.

Readers

are urged to carefully review and consider the various disclosures made by us in this prospectus, any subsequently filed prospectus supplement

and our other filings with the SEC. This prospectus, any subsequently filed prospectus supplement and our annual and current reports

attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations

and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except

as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations

or future events.

Prospectus

Summary

This

prospectus summary highlights certain information about us and selected information contained elsewhere in or incorporated by reference

into this prospectus. This prospectus summary is not complete and does not contain all of the information that you should consider before

making an investment decision. For a more complete understanding of the Company, you should read and consider carefully the more detailed

information included or incorporated by reference in this prospectus and any applicable prospectus supplement or amendment, including

the factors described under the heading “Risk Factors,” beginning on page 9 of this prospectus, as well as the information

incorporated herein by reference, before making an investment decision.

History

and Development of the Company

We

are a holding company incorporated in the Cayman Islands under Cayman Islands Law on April 11, 2022 under the name “Fitell Corporation”.

We have no substantive operations other than holding all of the issued and outstanding shares of KMAS, which holds all of the issued

and outstanding shares of our operating subsidiary, GD. The address and telephone number of our principal business office is 23-25

Mangrove Lane, Taren Point, NSW 2229, Australia, +612 95245266 and the name, address and telephone number of our US agent is Cogency

Global Inc., 122 East 42nd Street, 18th Floor, New York, NY 10168, (800) 221-0102. Our website address is https://www.fitellcorp.com/.

Information contained on, or that can be accessed through, our website does not constitute a part of this prospectus and is not

incorporated by reference herein. We have included our website address in this prospectus solely for informational purposes. The

SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers, such

as we, that file electronically, with the SEC at www.sec.gov.

Our

wholly owned operating subsidiary, GD, was founded in 2005. Upon our reorganization, on May 4, 2022, the Company issued 280,000 Ordinary

Shares each to L&H Investment Management Limited, a company incorporated under the laws of the British Virgin Islands, and PRMD Investment

Consultation Company Limited, a company incorporated under the laws of the British Virgin Islands, representing issuances to our co-founders.

In addition, one (1) Ordinary Share was transferred to SKMA from the registered office service provider in the setup of the Company.

On

May 5, 2022, we entered into a Share Exchange Agreement (“Share Exchange Agreement”) with KMAS, which holds all of the issued

and outstanding shares of GD, and SKMA, which holds all of the issued and outstanding shares of KMAS, pursuant to which the Company shall

acquire all of the shares in KMAS from SKMA in exchange for the Company issuing 6,439,999 Ordinary Shares to SKMA in accordance with

the terms of the Share Exchange Agreement.

Initial

Public Offering

On

August 10, 2023, the Company closed the IPO. The Ordinary Shares were priced at $5.00 per share,

and the offering was conducted on a firm commitment basis. The aggregate gross proceeds of the Offering were US$15 million before

deducting underwriting discounts, commissions and other related expenses. In addition, Fitell has granted the underwriters a 45-day option

to purchase up to an additional 450,000 ordinary shares at the public offering price, less underwriting discount and commissions. The

shares began trading on the Nasdaq Capital Market on August 8, 2023 under the symbol “FTEL.”

Business

Overview

Founded

in 2005 and headquartered in New South Wales, Australia, GD is a wholly owned subsidiary of Fitell. We operate in Australia and are an

online retailer of gym and fitness equipment both under our proprietary brands and other brand names. Our mission is to build an ecosystem

with a whole fitness and wellness experience powered by technology to our customers. GD has served over 100,000 customers with large

portions of sales from repeat customers over the years, which we believe to be a testament of our product quality and brand loyalty.

Our brand portfolio can be categorized into three proprietary brands under our Gym Direct brand: Muscle Motion, Rapid Motion, and FleetX,

in approximately 2,000 stock-keeping units (SKUs).

In

addition to our all-around fitness equipment portfolio to individual and commercial customers, we launched three new business verticals

with integration of technology in 2021.

| |

1. |

Smart

Connected Equipment: Still in development and initiated in May 2021, our smart fitness equipment is a natural extension of our

core business and includes interactive exercise bikes and workout mirrors. We expect commercial launch in April 2025, with

retail products being available in March 2025. |

| |

|

|

| |

2. |

1FinalRound:

Our AI-powered interactive platform with our proprietary online training content and capability to be interactive with personal

trainers, follow members and track workout progress. |

| |

|

|

| |

3. |

Boutique

Fitness Clubs Licensing: Leveraging our years of experience in the fitness and wellness industry servicing both businesses and

individual customers, we launched our licensing business in late 2021. mYSTEPS Training Clinic, a new concept fitness club chain,

is our first licensee and dedicated to helping fitness-savvy and health-conscious consumers with higher disposable incomes achieve

a motivating and healthy lifestyle with an engaging and dynamic fitness community in both online and offline settings. |

Sales

and Marketing

In

our fitness equipment business segment, we sell our products directly to customers through online or offline platforms. Revenue from

our own e-commerce website accounted for approximately 58.72% of our total sales for the fiscal year ended June 30, 2024, with the remaining

sales derived from commercial sale orders, our showroom and phone orders as well as third party channels, such as Bunnings Marketplace

and eBay. Our marketing strategy focuses on delivering fitness equipment to our customers and, in the future, to our licensees and their

members and raising awareness of our brand through a broad range of channels. These channels include Google Search (organic and paid),

Google Shopping Campaign, Google Ads word, affiliate partners programs, social media such as Facebook and Instagram, e-mail marketing,

SMS marketing, E catalogue, and First Australia Fitness Mobile App. We utilize a multi-prong marketing strategy focused on attracting

and educating prospective customers and licensees, driving demand with new and existing customers and increasing general awareness and

affinity for our brand. Our loyalty program Gym Direct Lion Rewards Club is used to encourage both repeat purchases and order sizes and

enhance brand loyalty.

Online

In

our online business, we predominately sell our fitness products directly to consumers through our website GymDirect.com.au, which was

first launched in 2007. Customers can find the three proprietary brands of Gym Direct along with other fitness equipment retail brands

on our e-commerce website. All of our products are listed on our website, which is also a key channel for our customer acquisition.

Offline

Our

offline business is conducted through phone, e-mail, and showroom sales for large and repeat customers. We generally provide opportunities

for our commercial or repeat customers (including fitness studios, gyms, and government institutions) to view our products prior to ordering

to help secure large customer orders. Alternatively, we often customize the combination of products to our commercial customers based

on their budgets and actual floor plans. Our showroom carries a large variety of strength and cardio equipment and other fitness equipment/machines

as well as accessories. In addition, we offer programs that provide price promotion to incentivize sales, such as our Lion Loyalty Reward

Program and Special EDM campaign that target different groups of customers on a regular basis.

Licensing

Business Marketing

Propelled

by the momentum of our first licensee, our primary focus for marketing to prospective licensees includes a mix of social, digital, search,

referral, and experiential marketing. We offer prospective licensees a turnkey solution with our high-quality products and license our

trademarks, including Gym Direct, Muscle Motion, FleetX, and Rapid Motion, which cover the functional needs of the studios as well as

enable users to access the one-stop shop of Gym Direct via website or application.

In

addition, with the introduction of 1FinalRound and smart connected fitness equipment via our corporate website and application, which

are accessible to our licensees, we are able to broaden our marketing coverage virtually as well as with our physical branded products.

We believe the coverage of the brand awareness extends beyond the physical locations of our licensees and penetrates into wider markets

and segments of fitness consumers.

Product

Design and Innovation

To

provide our customers with high quality user experience, we constantly search for creativity and innovation to expand and diversify our

product portfolio by leveraging different resources and channels. Our procurement team identifies trends and popular fitness equipment

development locally and globally to create on-trend fitness equipment and content for our customers and users. Our customer team also

conducts surveys periodically to obtain feedback for product modification and improvement. After identifying new trends or product types,

we will consult with our in-house product development advisors and engineer designers from suppliers to co-develop such fitness equipment.

Our suppliers will then complete the manufacturing and provide sample products for inspection and testing. After this process, we will

confirm the purchase order with our suppliers for the newly developed product.

Suppliers

and Customers

We

enjoy a broad network of our product suppliers and customers. In addition, searching for qualified alternative suppliers and manufacturers

has been our priority, which we believe will limit the risks of single source of supply, and we have developed contingency plans for

supply disruptions. We currently have 27 suppliers, 12 of which are Australian suppliers and 15 are overseas suppliers.

Approximately

85% of our products come from overseas suppliers and they predominantly manufacture made-to-order products, such as commercial machine

equipment XRFM series and FT1009 under our proprietary brands Muscle Motion and Rapid Motion and FX AB03 bike and FleetX Rower are under

our proprietary brand FleetX. Payment terms with our suppliers vary.

Below

is a tabular summary of our relationships with suppliers that represent over 5% of our supplies:

| Supplier

Name |

|

Product

Name |

|

Terms |

| Kynson

Limited (23.68%) |

|

Motion

Bikes and Spin Bikes |

|

Payment

within 7 days from invoice date |

| |

|

|

|

|

| Nantong

Tengtai Sporting Fitness (16.83%) |

|

Rubber

Hex Dumbbells |

|

Payment

paid against copy of B/L.

Seller

releases the B/L to buyer after

receiving

payment. |

| |

|

|

|

|

| Nantong

Duro Fitness Co., Ltd. (7.09%) |

|

Weight

Plates |

|

Payment

within 14 days from receiving goods. |

| |

|

|

|

|

| Qingdao

Imbell Sporting Goods Co., Ltd (8.58%) |

|

Strength

Products |

|

Payment

paid against copy of B/L.

Seller

releases the B/L to buyer after

receiving

payment. |

| |

|

|

|

|

| Morgan

Imports Pty Ltd (5.23%) |

|

Boxing

& MMA products |

|

1st

of the following month. |

The

top four suppliers representing over 5% of the Company’s supplies are based in China. The Company has not entered into any written

agreements with these four suppliers, but places purchase orders with these three suppliers as needed. The remaining supplier is based

in Australia. The company has not entered into any written agreements with this supplier, but places purchase orders with it. The Company

has no material affiliations or relationships with any of the above five suppliers.

In

the twelve-month period ended June 30, 2024, we received 17,926 orders and 26,266 customers, an increase of 18.0% and an increase of

13.1%, respectively, compared to the same period in 2023. In the twelve-month period ended June 30, 2023, we received 15,189 orders and

23,231 customers, a decrease of 42.6% and a decrease of 41% respectively, compared to the same period in 2022. This was primarily due

to the management has strategically lower the selling prices or our products in order to cope with the recent economic conditions in

Australia.

Our

e-commerce conversion rates have decreased by 1.37% from 0.73% in fiscal year 2023 to 0.72% in fiscal year 2024. Approximately 34.4%

of orders were from existing customers and the average purchase frequency was 2.2 across all customers in fiscal year 2024. The number

of our repeat customers increased from 3,793 in fiscal year 2023 to 3,937 in fiscal year 2024. Based on our database, customers stood

at 198,163 members by end of fiscal year 2024, compared to 171,897 members at the end of fiscal year 2023, which we believe reflects

the ability of the business to respond in economic downturn with challenging obstacles.

Below

is a tabular summary of our online customer purchase data:

| Status | |

# of

Customers | | |

Average

Size of Order | | |

Average

Total Spending | |

| First time Customers FY2024 | |

| 12,261 | | |

| 1.3

Units | | |

$ | 254.13 | |

| Return Customers FY2024 | |

| 3,937 | | |

| 4.6

Units | | |

$ | 304.77 | |

We

received 17,926 orders and acquired 26,266 customers in fiscal year 2024, an increase of 18.0% and 13.1%, respectively, compared to the

same period of fiscal year 2023.

In

addition to our retail customers, our commercial customers include chains of fitness gyms and studios, government agencies, schools,

healthcare providers and educational institutions.

Below

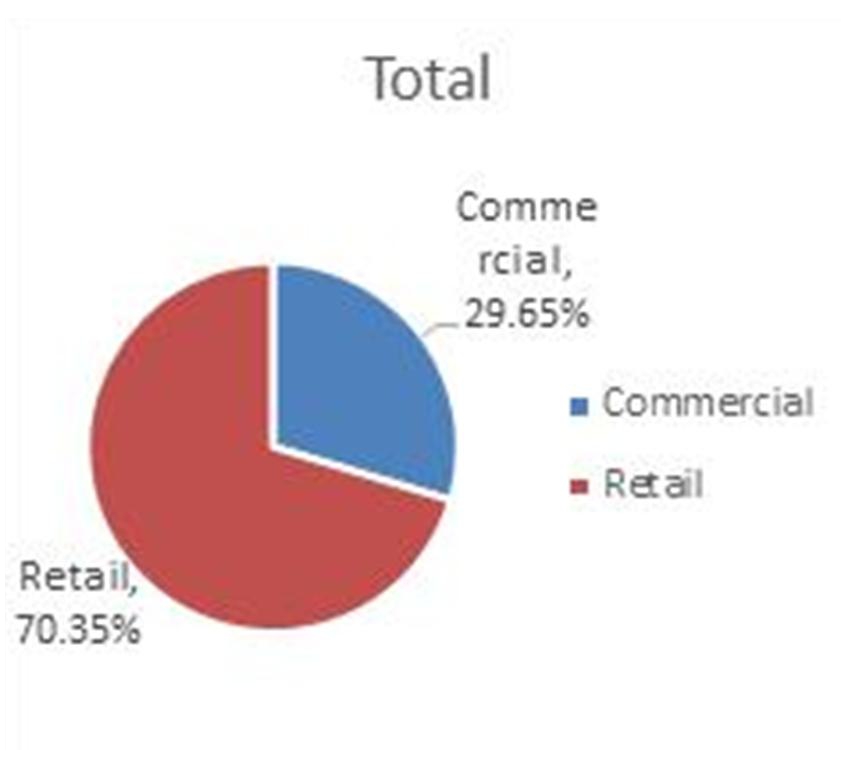

is the graph summary of revenue by customer type:

Growth

Strategy

Our

goal is to grow our fitness equipment business segment while continuing to engage and retain our loyal community of customers and fitness

platform members. Our business development and expansion strategies over the next two to three years are as follows:

Increase

Fitness Equipment Product Marketing

| |

● |

We

currently rely primarily on organic traffic through search engine optimization to achieve customer acquisition. Leveraging our

high-ranking position in search engine result pages, we intend to expand our strategic investment on marketing campaigns in Key

Opinion Leaders (KOLs), sponsoring sports events and outdoor advertisement. |

Development

of Private-Label Cardio Equipment

| |

● |

The

profit margin for cardio fitness equipment is higher than that of strength and weight equipment. We intend to develop our proprietary

branded cardio equipment to increase our profitability in the market. |

Development

of Gym Direct Mobile Application

| |

● |

Traditionally,

we only use our e-commerce website as a platform to sell our products and communicate with our retail customers. We are now developing

a native mobile application to further expand the marketing platform and provide easy, repeatable and convenient shopping experiences

for customers, which will also be beneficial in tracking consumer trends and purchasing data. The beta versions of these platforms

have been in trial stages since March 2022 and the official version has been launched since November 2023. |

Development

of Smart Connected Equipment and Digital Fitness Program

| |

● |

Digital

subscription-based machines have led the trend in the U.S. market, such as Mirror, Peloton, Tonal, where the demand for

interactive fitness applications has risen. We plan to expand into this market in Australia and Southeast Asia where the

concept of the home gym has not been fully deployed. |

| |

|

|

| |

● |

Growing

brand awareness. |

| |

|

|

| |

● |

Improving

member experience. |

| |

|

|

| |

● |

Leveraging

our database of customers which we have accumulated from the sales of fitness equipment to increase interactive cardio

equipment sales and subscription revenues. |

| |

|

|

| |

● |

Continuing

to launch new and innovative content and products. |

Opportunities

to Explore Other Revenue Streams

| |

● |

Leveraging

our expertise in targeting health-conscious consumer audiences, we plan to develop a host of solutions for white-label

functional health supplement products, including muscle building beverages, vitamins and other sports nutrition products

in Australia and Asia-Pacific regions. We have engaged an Australian pharmaceutical company to develop formulas for muscle

protein powder, multi-vitamins and post-exercise drinks. These products are developed based on the existing data and feedback

we received from our customers and intend to target these health-conscious consumers. |

| |

|

|

| |

● |

Leveraging

our expertise in developing and marketing fitness equipment, there is the opportunity for us to expand our businesses

into used fitness equipment sales (e-commerce), including used home cardio machines and other domestic used fitness equipment. |

| |

|

|

| |

● |

In

addition, we also intend to expand our business segments to target the health and fitness needs of our target consumers

in the following cross selling opportunities: apparel, niche sports and health equipment, and sporting footwear, among

others, which widen the shopping choices to fitness-conscious or generic consumers. |

Supply

Chain Challenges and Strategies

| |

● |

Buying

cost remain stable: |

| |

|

|

| |

|

Subsequent

to the COVID-19 pandemic, the cost of raw materials has remained relatively stable in the last one to two years. Our buying

cost in the fiscal year ended June 30, 2024 has remained relatively constant, as compared to the fiscal year ended June

30, 2023. |

| |

|

|

| |

● |

Leading

time remain stable: |

| |

|

|

| |

|

Subsequent

to the COVID-19 pandemic, the leading time of manufacturing and logistics has been stabilized and back to normal. The

Sea freight in the fiscal year ended 2024 and 2023, usually took approximately 3 to 4 weeks, as compared to up 6 to 8

weeks during the COVID-19 pandemic. |

| |

|

|

| |

● |

Logistics

cost increase: |

| |

|

|

| |

|

During

the fiscal year 2024, sea freight costs increased dramatically by approximately 190.5%, the significant increase in logistic

cost was due to the drop in supply of available shipping vessels on a global basis, due to recent geopolitical tensions. |

| |

● |

Delivery

time remain stable: |

| |

|

|

| |

|

Subsequent

to the COVID-19 pandemic, delivery time was back to normal and was approximately 1 to 2 business days to metro and NSW

areas in Sydney, Australia, 2 to 3 business days in transit for interstate or other metro cities, and approximately 5

business days to remote areas in the fiscal year ended June 30, 2024 and 2023. |

| |

● |

Strategies

for Possible Out-of-Stock Products |

| |

|

|

| |

|

Due

to the increased sea freight cost and the delays in shipment, we increased our minimum order quantity (MOQ) to ensure

sufficient stock. In the meantime, we also intend to engage with a third party logistic (3PL) service provider overseas

as a satellite warehouse to improve stock availability to meet in-time delivery. As the peak of the pandemic eased, stock

returned to usual levels by April 2022 when the pandemic effects around the world became more stable. |

| |

|

|

| |

● |

Actions

and Initiatives to Mitigate Challenge |

| |

○ |

We

believe the establishment of 3PLs in both overseas locations and interstate locations will significantly reduce our logistic

costs while maintaining higher efficiency rates with sound procurement procedures; |

| |

|

|

| |

○ |

“Catch

me if you can” strategy: Constant launch of innovative and unique products to ensure healthy and above-average gross

profit margins; |

| |

|

|

| |

○ |

Natural

hedging strategy with expansion of licensing business in South-East Asia; |

| |

|

|

| |

○ |

Frequent

pricing review procedures to ensure our competitiveness while avoiding any pricing wars by strategically bringing new

offers of services and products; |

| |

|

|

| |

○ |

The

position of GD, with both virtual training modules and physical products offerings, gives competitive advantages to our

business while mitigating the objective challenges. |

Competition

The

market for all fitness-related products is highly competitive. However, we believe our quality, innovation, pricing and loyal

customers position us competitively in the marketplace. We are not only involved in at-home fitness equipment but also in commercial

equipment solutions by both offline selling and e-commerce platforms.

Our

principal competitors include Nautilus, Peloton, ICON Health & Fitness (NordicTrack), Johnson Health Tech, Technogym, Echelon, Mirror,

Hydrow, Tonal, JaxJox and Tempo. We also compete with marketers of smart device applications focused on fitness training and coaching,

such as Peloton, Zwift, Strava, Mirror, BeachBody, Apple Fitness+, NeoU, Equinox+, FitScope, FitOn, Fulgaz Video Cycling, Sufferfest

Training Systems, At Home Workouts by Daily Burn, and NIKE® Training Club. Additional marketers of competitive products include the

following: activity trackers and content-driven physical activity products, such as Fitbit®, Garmin vivofit®, Whoop, and Oura;

group fitness, such as cross-fit classes; and gym memberships, each of which offers alternative solutions for a fit and healthy lifestyle.

Competitive

Strengths

We

believe that there are several competitive strengths that differentiate us from our competitors.

Proprietary

Brands and Diversified Product Portfolio

| |

● |

Our

three proprietary brands – Muscle Motion, Rapid Motion, and FleetX – provide both in-home options and commercial

solutions. Our product portfolio of these three diversified brands spans a variety of popular fitness and workout verticals,

including weightlifting, stretch, yoga, boxing, running and cycling. We believe that our diversification represents competitive

advantages compared to other competitors in the market. With the development of the integrated fitness equipment and virtual

platform, we believe we will be able to create more valuable opportunities for business expansion. |

Innovative

Smart Connected Equipment

| |

● |

Our

connected equipment, which has been the global trend for the fitness and gym industry, is also under development. Initiated in May

2021, our development concept includes interactive exercise bikes and workout mirrors. We expect that the interactive gym equipment

will be commercially launched in April 2025 and believe that our new product will better serve both retail and commercial

customers and accelerate our business growth. |

Virtual

Training Platform with Cutting Edge Content

| |

● |

Leveraging

our years of experience in the fitness and wellness industry, we have developed an online proprietary training platform

– 1FinalRound – which will be pre-built into our connected equipment that allows our customers to maintain engagement

with us during any potential temporary closures of gyms and studios. This model allows flexibility for both online and

offline users to participate in training either on their own schedules or via livestreaming to interact with other subscribed

members to encourage more interactive, engaging and motivating lifestyles. The platform will provide an extensive offline

library with high production value or various online live stream experiences. Moreover, based on the large, consolidated

dataset we received from our fitness equipment customers, we believe we will be able to create and develop on-trend fitness

content for our users. |

Consolidated

Database with Loyal Customer Base

| |

● |

GD

has served over 190,000 customers with large portions of sales coming from repeat customers over the years. We believe

that our sales strategies also create inventive solutions for existing customers and drive loyalty. As of June 30, 2024,

34.41% of our orders are from existing customers, the average purchase frequency is 2.2 across all customers. We believe

that we will be able to deepen our customer loyalty through our newly developed Gym Direct mobile application and 1FinalRound. |

Compelling

and Scalable Licensing Model

Intellectual

Property

Trademarks,

patents and other forms of intellectual property are vital to the success of our business and are an essential factor in maintaining

our competitive position in the health and fitness industry. We own the following trademarks: Gym Direct, Muscle Motion, Rapid Motion

and FleetX. We regularly monitor commercial activity in our industry to identify potential infringement of our intellectual property.

We protect our proprietary rights and attempt to take prompt, reasonable actions to prevent counterfeit products and other infringement

on our intellectual property.

Regulations

We

must comply with various federal, state and local regulations in Australia, including regulations relating to consumer products and consumer

protection, advertising and marketing, labor and employment, data protection and privacy, intellectual property, the environment and

tax. Ensuring our compliance with these various laws and regulations, and keeping abreast of changes to the legal and regulatory landscape

present in our industry, may cause us to expend considerable resources. Summarized below are a number of Australian regulation aspects

to which our business is subject.

Consumer

controls

We

sell products to Australian consumers online and therefore are subject to the requirements of the Competition and Consumer Act 2010

(Cth) (CCA) and the Australian Competition & Consumer Commission’s oversight. The CCA regulates anti-competitive behavior,

misleading and deceptive conduct and price-fixing. In addition, the Australian Consumer Law, which is set out in Schedule 2 of the CCA

regulates unfair contract terms, guarantees consumer rights when buying goods and services and applies product safety standards. Breaches

of the CCA, including the Australian Consumer Law may result in criminal or civil pecuniary penalties, infringement notices, or more

formal legal action in the courts.

Privacy

We

operate in the Australian online market and therefore are required to comply with the privacy regime as outlined in the Privacy Act

1988 (Cth), which includes the Australian Privacy Principles (APPs) and the Office of the Australian Information Commissioner’s

oversight. The 13 APPs prescribe responsibilities for maintaining personal information privacy, including around collection, use, disclosure

and access to data, as well as the publication of a clearly expressed and up-to-date privacy policy. A breach of those requirements may

result in investigations, enforceable undertakings, injunctions, or civil penalty orders.

Regulation

of electronic communications

We

operate in the Australian online market and use telecommunication services to publish and distribute electronic marketing material. Such

operations of ours are subject to the Spam Act 2003 (Cth) (Spam Act) and the Spam Regulations 2021 (Cth)(Spam Regulations),

which the Australian Communications and Media Authority (ACMA) can enforce through court action. Breaches of the Spam Act or Spam Regulations

may result in the ACMA issuing a formal warning, giving an infringement notice, requiring the party in breach to accept enforceable undertaking

or taking the matter to the Federal Court, which can impose significant penalties.

Implications

of Being an Emerging Growth Company

We

qualify as an “emerging growth company” pursuant to the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An

emerging growth company may take advantage of specified reduced reporting and other requirements compared to those that are otherwise

applicable generally to public companies. These provisions include exemption from the auditor attestation requirement under Section 404

of the Sarbanes-Oxley Act of 2002 in the assessment of the emerging growth company’s internal control over financial reporting.

The JOBS Act also provides that an emerging growth company does not need to comply with any new or revised financial accounting standards

until such date that a private company is otherwise required to comply with such new or revised accounting standards. However, we have

elected to “opt out” of this provision and, as a result, we will comply with new or revised accounting standards as required

when they are adopted for public companies. This decision to opt out of the extended transition period under the JOBS Act is irrevocable.

We

will remain an emerging growth company until the earliest of (a) the last day of the fiscal year during which we have total annual gross

revenues of at least US$1.235 billion; (b) the last day of our fiscal year following the fifth anniversary of the completion of

the initial public offering pursuant to an effective registration statement under the Securities Act; (c) the date

on which we have, during the preceding three-year period, issued more than US$1.0 billion in non-convertible debt; or (d) the date on

which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended, or the Exchange

Act, which would occur if the market value of our Shares that are held by non-affiliates exceeds US$700 million as of the last business

day of our most recently completed second fiscal quarter. Once we cease to be an emerging growth company, we will not be entitled to

the exemptions provided in the JOBS Act discussed above.

Implications

of Our Foreign Private Issuers Status

We

are incorporated under the laws of the Cayman Islands and are considered a “foreign private issuer” under U.S. securities

laws. Because of our status as a foreign

private issuer under the Exchange Act, we are exempt from certain provisions of the securities rules and regulations in the United States

that are applicable to U.S. domestic issuers, including: (i) the rules under the Exchange Act requiring the filing of quarterly reports

on Form 10-Q or current reports on Form 8-K with the SEC; (ii) the sections of the Exchange Act regulating the solicitation of proxies,

consents, or authorizations in respect of a security registered under the Exchange Act; (iii) the sections of the Exchange Act requiring

insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made

in a short period of time; and (iv) the selective disclosure rules by issuers of material nonpublic information under Regulation FD.

We

are required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we publish our semi-annual

results through press releases, distributed pursuant to Nasdaq rules and regulations. Press releases

relating to financial results and material events are also be furnished to the SEC on Form 6-K. However, the information we are required

to file with or furnish to the SEC is less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic

issuers. As a result, you may not be afforded the same protections or information, which would be made available to you, were you investing

in a U.S. domestic issuer.

In

accordance with the rules and regulations of Nasdaq, we may choose to comply with home country governance requirements and certain exemptions

thereunder rather than complying with Nasdaq corporate governance standards. We may choose to take advantage of the following exemptions

afforded to foreign private issuers:

| ● | Exemption

from filing quarterly reports on Form 10-Q, from filing proxy solicitation materials on Schedule

14A or 14C in connection with annual or special meetings of shareholders, or from providing

current reports on Form 8-K disclosing significant events within four (4) days of their occurrence,

and from the disclosure requirements of Regulation FD. |

| ● | Exemption

from Section 16 rules regarding sales of Ordinary Shares by insiders, which will provide

less data in this regard than shareholders of U.S. companies that are subject to the Exchange

Act; |

| ● | Exemption

from the Nasdaq rules applicable to domestic issuers requiring disclosure within four (4)

business days of any determination to grant a waiver of the code of business conduct and

ethics to directors and officers. Although we will require board approval of any such waiver,

we may choose not to disclose the waiver in the manner set forth in the Nasdaq rules, as

permitted by the foreign private issuer exemption. |

Furthermore,

Nasdaq Rule 5615(a)(3) provides that a foreign private issuer, such as us, may rely on our home country corporate governance practices

in lieu of certain of the rules in the Nasdaq Rule 5600 Series and Rule 5250(d), provided that we nevertheless comply with Nasdaq’s

Notification of Non-compliance requirement (Rule 5625), the Voting Rights requirement (Rule 5640) and that we have an audit committee

that satisfies Rule 5605(c)(3), consisting of committee members that meet the independence requirements of Rule 5605(c)(2)(A)(ii). If

we rely on our home country corporate governance practices in lieu of certain of the rules of Nasdaq, our shareholders may not have the

same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of Nasdaq. If

we choose to do so, we may utilize these exemptions for as long as we continue to qualify as a foreign private issuer.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. In addition to the risks described below, you should carefully consider

the discussion of risks under the heading “Item 3. Key Information—D. Risk Factors” in our Annual Report, any subsequent

reports to Annual Report filed with the SEC and the other documents which are incorporated by reference in this prospectus, before making

an investment in our securities. Please see the sections of this prospectus entitled “Where You Can Find Additional Information

and “Information Incorporated by Reference.” In addition, you should also consider carefully the risks set forth under the

heading “Risk Factors” in any prospectus supplement before investing in the securities offered by this prospectus. The occurrence

of one or more of those risk factors could adversely impact our business, financial condition or results of operations. This prospectus

also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those

anticipated in the forward-looking statements as a result of the risks discussed in the documents incorporated by reference in this prospectus.

If any such risks were to actually occur, then our business, prospects, financial condition, results of operations

and cash flow could be materially and adversely affected, thus potentially causing the trading price of any or all of our securities

to decline and you could lose all or part of your investment.

Such

risks are not exhaustive. We may face additional risks that are presently unknown to us or that we believe to be immaterial as of the

date of this prospectus. Known and unknown risks and uncertainties may significantly impact and impair our business operations.

CAPITALIZATION

AND INDEBTEDNESS

Our

capitalization will be set forth in the applicable prospectus supplement subsequently filed with the SEC or in a report of foreign issuer

on Form 6-K subsequently furnished to the SEC and specifically incorporated by reference into this prospectus.

DILUTION

If

required, we will set forth in a prospectus supplement the following information regarding any material dilution of the equity interests

of investors purchasing securities in an offering under this prospectus:

| |

● |

the

net tangible book value per share of our equity securities before and after the offering; |

| |

● |

the

amount of the increase in such net tangible book value per share attributable to the cash payments made by purchasers in the offering;

and |

| |

|

|

| |

● |

the

amount of the immediate dilution from the public offering price which will be absorbed by such purchasers. |

USE

OF PROCEEDS

We

intend to use net proceeds from the sale of securities as set forth in the applicable prospectus supplement, which may include general

corporate purposes, asset purchases, debt repayment and strategic transactions.

DESCRIPTION

OF SHARE CAPITAL

The

following description of our share capital and provisions of our Articles and Memorandum are summaries and do not purport

to be complete. Reference is made to our Articles and Memorandum, copies of which are filed as exhibits to this registration

statement of which this prospectus is a part (and which is referred to in this section as, respectively, the “Articles” and

the “Memorandum”).

We

were incorporated as an exempted company with limited liability under the Companies Act. A Cayman Islands exempted company is a company that conducts its business

mainly outside the Cayman Islands and:

| |

● |

may

issue shares with no par value; |

| |

|

|

| |

● |

is

prohibited from making any invitation to the public in the Cayman Islands to subscribe for any of its securities; |

| |

|

|

| |

● |

is

prohibited from trading in the Cayman Islands with any person, firm or corporation except in furtherance of the business

of the exempted company carried on outside the Cayman Islands (and for this purpose can affect and conclude contracts

in the Cayman Islands and exercise in the Cayman Islands all of its powers necessary for the carrying on of its business

outside the Cayman Islands); |

| |

● |

does

not have to hold an annual general meeting; |

| |

● |

does

not have to make its register of members open to inspection by shareholders of that company; |

| |

● |

may

obtain an undertaking against the imposition of any future taxation; |

| |

● |

may

register by way of continuation in another jurisdiction and be deregistered in the Cayman Islands; |

| |

● |

may

register as a limited duration company; and |

| |

● |

may

register as a segregated portfolio company. |

Ordinary

Shares

Our

Ordinary Shares are issued in book entry form and are issued when registered in our register of members. Our shareholders who are non-residents

of the Cayman Islands may freely hold and vote their shares.

As

of the date of this prospectus, the authorized share capital of the Company is $50,000 divided into 500,000,000 Ordinary Shares of $0.0001

par value each. Subject to the provisions of the Companies Act and the provisions, if any, of the Articles, and any directions given

by any ordinary resolution and the rights attaching to any class of existing shares, the directors may issue, allot, grant options over

or otherwise dispose of shares (including any fractions of Shares) and other securities of our company at such times, to such persons,

for such consideration and on such terms as the directors may determine. Such authority could be exercised by the directors to allot

shares which carry rights and privileges. No share may be issued at a discount except in accordance with the provisions of the Companies

Act. Where the shares in question are not listed on or subject to the rules of any Designated Stock Exchange (as defined in the Articles),

the directors may in their absolute discretion decline to register any transfer of such shares which are not fully paid up or on which

the Company has a lien.

Listing

Our

Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “FTEL,” and began trading on August 8, 2023.

Transfer

Agent and Registrar

The

transfer agent and registrar for the Ordinary Shares is Vstock Transfer, LLC.

Dividends

Subject

to the provisions of the Companies Act and any rights attaching to any class or classes of shares under and in accordance with

the Articles, the holders of our Ordinary Shares are entitled to such dividends as may be declared by our board of directors. In addition,

our shareholders may by ordinary resolution declare a final dividend, but no dividend may exceed the amount recommended by our directors.

Subject to the Companies Act requirements regarding the application of a company’s share premium account and with the sanction

of an ordinary resolution, dividends may also be declared and paid out of any share premium account. The directors when paying dividends

to shareholders may make such payment either in cash or in specie, and unless provided for by the rights attached to a share, no dividend

or other monies payable by the Company in respect of a Share shall bear interest.

Voting

Rights

Any

action required or permitted to be taken by the shareholders must be taken at a duly called and quorate general meeting of the shareholders

entitled to vote on such action, or in lieu of a general meeting, be effected by a resolution in writing. On a show of hands each shareholder

is entitled to one vote or, on a poll, each shareholder is entitled to one vote for each ordinary share, voting together as a single

class, on all matters that require a shareholder’s vote. Voting at any shareholders’ meeting is by show of hands unless a

poll is demanded. A poll may be demanded by the chairman of such meeting or one or more shareholders present in person or by proxy entitled

to vote and who, individually or collectively, hold at least 10 percent of the voting rights of all those who have a right to vote on

the resolution.

A

quorum required for a meeting of shareholders consists of one shareholder present if the Company only has one shareholder and two shareholders

present if the Company has more than one shareholder. Shareholders may be present in person or by proxy or, if the shareholder is a legal

entity, by its duly authorized representative. Shareholders’ meetings may be convened by our board of directors on its own initiative

or upon a request to the directors by shareholders holding at least 10 percent of the rights to vote at such general meeting. Advance

notice of at least five clear days is required for the convening of our annual general shareholders’ meeting and any other general

shareholders’ meeting.

Election

of directors

Directors

may be appointed by an ordinary resolution of our shareholders or by the directors of the Company.

Meetings

of directors

At

any meeting of directors, a quorum will be present if two directors are present, unless otherwise fixed by the directors. If there is

a sole director, that director shall be a quorum. A person who holds office as an alternate director shall be counted in the quorum.

A director who also acts as an alternate director shall be counted twice towards the quorum. An action that may be taken by the directors

at a meeting may also be taken by a resolution of directors consented to in writing by all of the directors.

Transfer

of Ordinary Shares

Subject

to compliance of the Articles and the applicable rules of the Designated Stock Exchange, any

of our shareholders may transfer all or any of his or her Ordinary Shares by an instrument of transfer in the usual or common form or

in a form prescribed by the Designated Stock Exchange or any other form approved by our board of directors. Where the shares in

questions are not listed on or subject to the rules of any Designated Stock Exchange, our board of directors may, in its absolute

discretion, decline to register any transfer of any Ordinary Share whether or not it is fully paid up without assigning any reason for

doing so. If our directors refuse to register a transfer of any Shares not listed on a Designated Stock Exchange, they shall,

within one months after the date on which the instrument of transfer was lodged, send to each of the transferor and the transferee

notice of such refusal.

The

registration of transfers may, on 14 days’ notice being given by advertisement in such one or more newspapers or by Electronic

means, be suspended and the register closed at such times and for such periods as our board of directors may from time to time determine,

provided, however, that the registration of transfers shall not be suspended nor the register closed for more than 30 days in any year.

Liquidation

On

a return of capital on winding up, the shareholders may, subject to the Articles and any other sanction required by the Companies Act,

pass a special resolution allowing the liquidator to do either or both of the following: (a) to divide in specie among the shareholders

the whole or any part of the assets of the Company and, for that purpose, to value any assets and to determine how the division shall

be carried out as between the shareholders or different classes of shareholders; and (b) to vest the whole or any part of the assets

in trustees for the benefit of shareholders and those liable to contribute to the winding up.

Calls

on Shares and Forfeiture of Shares

Our

board of directors may from time to time make calls upon shareholders for any amounts unpaid on their shares in a notice served to such

shareholders at least 14 clear days prior to the specified time and place of payment. The shares that have been called upon and

remain unpaid are subject to forfeiture.

Share

Premium Account

The

directors shall establish a share premium account and shall carry the credit of such account from time to time to a sum equal to the

amount or value of the premium paid on the issue of any shares as required by the Companies Act.

Redemption

of Shares

Subject

to the Companies Act, we may by our directors:

| |

(a) |

issue

shares that are to be redeemed or liable to be redeemed, at our option on the terms and in the manner its directors determine before

the issue of those shares; |

| |

|

|

| |

(b) |

with

the consent by special resolution of the shareholders holding shares of a particular class, vary the rights attaching to that class

of shares so as to provide that those shares are to be redeemed or are liable to be redeemed at our option on the terms and in the

manner which the directors determine at the time of such variation; and |

| |

|

|

| |

(c) |

purchase

all or any of our own shares of any class including any redeemable shares on the terms and in the manner which the directors determine

at the time of such purchase and agree with the shareholder. |

We may make a payment in respect of the redemption

or purchase of its own shares in any manner authorized by the Companies Act, including out of any combination of capital, our profits

and the proceeds of a fresh issue of shares.

When making a payment in respect of the redemption

or purchase of shares, the directors may make the payment in cash or in specie (or partly in one and partly in the other) if so authorized

by the terms of the allotment of those shares or by the terms applying to those shares, or otherwise by agreement with the shareholder

holding those shares.

Variations

of Rights of Shares

Whenever