false

0001031308

0001031308

2025-01-07

2025-01-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 7, 2025

BENTLEY SYSTEMS, INCORPORATED

(Exact name of registrant as specified in its charter)

| Delaware |

001-39548 |

95-3936623 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| |

|

|

| 685 Stockton Drive |

|

|

| Exton, Pennsylvania |

|

19341 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (610) 458-5000

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Class B

common stock, par value $0.01 per share |

|

BSY |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Chief Operating Officer

Effective January 13, 2025,

James Lee was appointed the Chief Operating Officer of Bentley Systems, Incorporated (the “Company”).

Mr. Lee, 45, joined Google

in 2020 and has served as the general manager of the startups and AI business at Google Cloud, an infrastructure and platform services

business, since 2023. Prior to joining Google, Mr. Lee worked at SAP, an enterprise software solutions company, from 2008 to 2020, most

recently serving as Chief Operating Officer for SAP Ariba and Fieldglass. Mr. Lee earned a Master of Business Administration from Harvard

Business School, a Bachelor of Commerce from the University of British Columbia and a Diploma in Piano Performance from the Royal Conservatory

of Music.

As part of Mr. Lee’s

hiring, the Company and Mr. Lee entered into an at-will employment agreement (the “Employment Agreement”) that provides

as follows:

Cash Compensation

Mr. Lee will receive a base

salary of $400,000 (prorated for 2025) and will have an initial annual cash incentive compensation (“OTI”) target of

$400,000 (prorated for Mr. Lee’s start date with the Company). The OTI payments will be paid to Mr. Lee in the Company’s sole

discretion, based on a combination of Mr. Lee’s individual performance and the attainment of business unit goals.

Equity Compensation

Mr. Lee will receive a one-time

grant of time-based restricted stock units (“RSUs”) with respect to the Company’s Class B Common Stock having

an aggregate value of $7.5 million. The RSUs will be granted pursuant to the Company’s 2020 Omnibus Incentive Plan (the “Plan”)

and will vest as follows: 14% four months after Mr. Lee’s start date; 14% on December 15, 2025; and 18% on each subsequent December

15 through 2029.

As part of the Company’s

annual equity awards to executives in 2025, Mr. Lee will also receive Plan-based grants of RSUs consisting of: (i) time-based RSUs having

an aggregate value of $488,889, vesting in four substantially equal annual installments; and (ii) performance-based RSUs having an aggregate

value of $488,889, which shall vest in accordance with the performance criteria communicated to Mr. Lee at the time of grant.

All RSUs noted above will

be subject to the Company’s “change in control” vesting policy as described in the Company’s 2024 Definitive Proxy

Statement filed with the Securities and Exchange Commission on April 12, 2024.

Other Benefits

Following Mr. Lee’s

start date, it is expected that he will become: (i) a participant in the Company’s Career Stock Program at a participation percentage

equal to one-half of the participation percentage applicable to the Company’s Chief Executive Officer; and (ii) a “Covered

Executive” under the Company’s Severance Policy for Key Executives (the “Severance Policy”). Each of the

Career Stock Program and the Severance Policy is described in the Company’s Form 8-K/A filed with the Securities and Exchange Commission

on June 28, 2024.

Compensation Upon Termination

The Company may terminate

Mr. Lee’s employment at any time with or without Cause (as defined in the Severance Policy). In addition, Mr. Lee may terminate

his employment with the Company at any time, including for Good Reason (as defined in the Severance Policy). To the extent the Company

terminates Mr. Lee’s employment without Cause or Mr. Lee terminates his employment for Good Reason, Mr. Lee shall be entitled to

receive the compensation provided for in the Severance Policy, namely: (x) payments for the 12 months following his termination of an

amount equal to the average of the base salary and cash incentive compensation actually paid to Mr. Lee in the two prior full calendar

years; (y) payment of premiums by the Company for 12 months of continuing coverage for Mr. Lee and his family of medical benefits; and

(z) payment for accrued vacation and other perquisites through the date of termination.

There are no other arrangements

or understandings between Mr. Lee and any other persons pursuant to which Mr. Lee will be appointed as the Company’s Chief Operating

Officer. Mr. Lee does not have any family relationship with any of the Company’s directors or executive officers or any persons

nominated or chosen by the Company to be a director or executive officer. Mr. Lee does not have any direct or indirect interest in any

transaction or proposed transaction required to be reported under Item 404(a) of Regulation S-K.

Transition of Chief Product Officer

In connection with the Company’s

elimination of the position of Chief Product Officer, on January 7, 2025, the Company and Michael M. Campbell entered into a Mutual Separation

Agreement and General Release (the “Separation Agreement”), pursuant to which Mr. Campbell will leave the Company on

January 21, 2025.

Under the terms of the Separation

Agreement, in return for a general release of claims against the Company and its affiliates, Mr. Campbell will receive a cash severance

payment of $1.5 million (subject to applicable withholding) and will remain eligible to receive his cash OTI payment for the fourth quarter

of 2024 and any shares of Class B Common Stock issuable in connection with the vesting, if any, of Mr. Campbell’s performance-based

RSUs granted in 2024 (in each case, subject to applicable withholding). Mr. Campbell is also subject to customary post-employment confidentiality,

non-disparagement and non-solicitation restrictive covenants.

Item 7.01 Regulation FD Disclosure.

On January 13, 2025, the Company

issued a press release announcing the above executive changes. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated

herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

Bentley Systems, Incorporated |

| |

|

|

| Date: January 13, 2025 |

By: |

/s/ David R. Shaman |

| |

Name: |

David R. Shaman |

| |

Title: |

Chief Legal Officer and Secretary |

Exhibit 99.1

Bentley Systems Welcomes James Lee as Chief

Operating Officer

Also consolidating product development and technology

strategy under

Chief Technology Officer Julien Moutte

EXTON, Pa., January 13, 2025 – Bentley

Systems, Incorporated (Nasdaq: BSY), the infrastructure engineering software company, today announced the appointment of

James Lee as Chief Operating Officer. Lee joins Bentley from Google, where he served as General Manager for startups and artificial intelligence

at Google Cloud.

Prior to joining Google in 2020, Lee spent 12

years at SAP, including as Chief Operating Officer for SAP Ariba and Fieldglass, and as Chief Operating Officer and General Manager of

Sales for SAP Greater China. He holds a Master of Business Administration degree from Harvard University and a Bachelor of Commerce degree

from the University of British Columbia, and is based in the Pacific Northwest.

Lee will strengthen Bentley’s cross-functional

alignment across planning and execution, will drive operational excellence, and will oversee China, Japan, and portfolio development including

growth initiatives such as Bentley Asset Analytics.

Nicholas Cumins said, “I am excited to welcome

James, a world-class operational leader, to Bentley. His energy and experience managing operations and investment initiatives at SAP and

Google will be instrumental to Bentley as we continue to scale up and drive our ambitious growth agenda.”

To accelerate innovation and better align product

execution with technology strategy, Bentley also announced that the responsibility for product development has been consolidated under

Chief Technology Officer Julien Moutte. As a result, the Chief Product Officer role has become redundant, and by mutual agreement Mike

Campbell will leave the company.

“I would like to thank Mike for his leadership

and many accomplishments as Chief Product Officer during the last two years, and wish him much success in his future endeavors,”

Cumins added.

“Streamlining our organizational reporting

structure and consolidating product development under Julien puts us in a stronger position to capture the many growth opportunities that

we have opened up with infrastructure AI and that are incremental to our core business and consistent momentum. Without a doubt, AI is

our generation’s paradigm shift and has huge potential for improving infrastructure delivery and performance.”

Reporting to Cumins, alongside Lee and Moutte,

are Chief Revenue Officer Brock Ballard, corporate functions including Marketing, Finance, Legal, and Colleague Success, as well as Seequent,

Bentley’s subsurface company.

# # #

Image:

Caption: James Lee joins Bentley Systems

as Chief Operating Officer.

(Image of James Lee, 2023, courtesy of Bentley

Systems)

About Bentley Systems

Bentley Systems (Nasdaq: BSY) is the infrastructure

engineering software company. We provide innovative software to advance the world’s infrastructure – sustaining both

the global economy and environment. Our industry-leading software solutions are used by professionals, and organizations of every size,

for the design, construction, and operations of roads and bridges, rail and transit, water and wastewater, public works and utilities,

buildings and campuses, mining, and industrial facilities. Our offerings, powered by the iTwin Platform for infrastructure digital

twins, include MicroStation and Bentley Open applications for modeling and simulation, Seequent’s software for geoprofessionals,

and Bentley Infrastructure Cloud encompassing ProjectWise for project delivery, SYNCHRO for construction management, and AssetWise for

asset operations. Bentley Systems’ 5,200 colleagues generate annual revenues of more than $1 billion in 194 countries.

© 2025 Bentley Systems, Incorporated.

Bentley, the Bentley logo, Bentley Open, AssetWise, iTwin, MicroStation, ProjectWise, and SYNCHRO are either registered or unregistered

trademarks or service marks of Bentley Systems, Incorporated or one of its direct or indirect wholly owned subsidiaries.

For more information, contact:

Press: Jim Dobbs, PR@news.bentley.com

Investors: Eric Boyer, ir@bentley.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

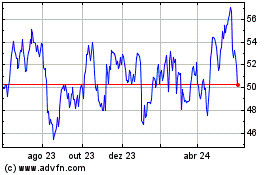

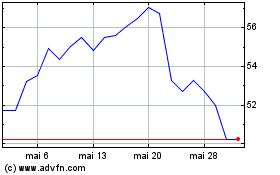

Bentley Systems (NASDAQ:BSY)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Bentley Systems (NASDAQ:BSY)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025