Form 8-K - Current report

13 Janeiro 2025 - 10:30AM

Edgar (US Regulatory)

false

0001067294

0001067294

2025-01-13

2025-01-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event

reported): January 13, 2025

CRACKER BARREL OLD COUNTRY STORE, INC.

(Exact Name of Registrant as Specified in its Charter)

| Tennessee |

|

001-25225 |

|

62-0812904 |

(State or

Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

| (IRS Employer

Identification No.) |

| |

|

|

|

|

305 Hartmann Drive, Lebanon, Tennessee 37087

(Address of Principal Executive Offices) (Zip code)

(615) 444-5533

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

|

Common Stock (Par Value $0.01)

Rights to Purchase Series A Junior Participating

Preferred Stock (Par Value $0.01) |

|

CBRL |

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. | Regulation FD Disclosure. |

On January 13-15, 2025,

members of management of Cracker Barrel Old Country Store, Inc. (the “Company”) will be meeting with members of the investment

community in conjunction with the 2025 ICR Conference, an annual industry event. A copy of the presentation deck (the “Presentation”)

to be referred to by management at such meetings, which includes matters of potential interest to investors, is attached hereto as Exhibit 99.1

and is incorporated herein by reference.

The information furnished

under Item 7.01 in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section

and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the

Exchange Act, except as set forth by specific reference in such filing.

Cautionary Note Regarding Forward-Looking Statements

All statements made in the

Presentation and incorporated by reference herein other than statements of historical fact are “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, and are provided

under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. You should not place undue reliance

on forward-looking statements, all of which involve known and unknown risks and uncertainties and other important factors that could cause

the Company’s actual results, performance or achievements, or those of the industries and markets in which the Company participates,

to differ materially from the Company’s expectations of future results, performance or achievements expressed or implied by these

forward-looking statements. The Company’s past results of operations do not necessarily indicate its future results, and the Company’s

future results may differ materially from the Company’s past results and from the expectations and plans of the Company expressed

in the Presentation due to various risks and uncertainties, including the risk factors discussed in the “Risk Factors” section

of the Company’s Annual Report on Form 10-K for the fiscal year 2024 filed on September 27, 2024, and other risk factors

detailed from time to time in the Company’s filings with the Securities and Exchange Commission. The Presentation and the forward-looking

statements contained therein speak only as of the date thereof. Except as otherwise required by applicable laws, the Company undertakes

no obligation to publicly update or revise any forward-looking or other statements included in the Presentation, whether as a result of

new information, future events, changed circumstances or any other reason.

| Item 9.01. | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| Date: January 13, 2025 |

CRACKER BARREL OLD COUNTRY STORE, INC. |

| |

|

| |

By: |

/s/ Richard M. Wolfson |

| |

Name: |

Richard M. Wolfson |

| |

Title: |

Senior Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

| 1 |

| Forward-looking statements and safe harbor treatment

All statements made by Cracker Barrel Old Country Store, Inc. (“the Company”) in this Presentation and in any commentary provided by the

Company’s management in connection herewith other than statements of historical fact are “forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are

provided under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended.

A reader or listener should not place undue reliance on forward-looking statements, all of which involve known and unknown risks and

uncertainties and other important factors that could cause the Company's actual results, performance or achievements, or those of the

industries and markets in which the Company participates, to differ materially from the Company's expectations of future results, performance

or achievements expressed or implied by these forward-looking statements.

The Company's past results of operations do not necessarily indicate its future results, and the Company’s future results may differ materially

from the Company’s past results and from the expectations and plans of the Company expressed in this presentation and management’s

commentary due to various risks and uncertainties, including the risk factors discussed in the “Risk Factors” section of the Company’s Annual

Report on Form 10-K for the fiscal year 2024 filed on September 27, 2024, and other risk factors detailed from time to time in the Company’s

filings with the Securities and Exchange Commission.

This presentation and the forward-looking statements contained therein and in management’s commentary speak only as of January 13,

2024. Except as otherwise required by applicable laws, the Company undertakes no obligation to publicly update or revise any forward-looking or other statements included in this presentation or management’s commentary, whether as a result of new information, future

events, changed circumstances or any other reason.

2 |

| Cracker Barrel is a

brand that holds a place

in people’s hearts…

Since 1969, guests have trusted Cracker Barrel

as a destination for genuine service, rich comfort food, and

a sense of classic country tradition.

For those that love it, it’s a brand that makes people smile,

and for many, the place where treasured

family memories were made. |

| 44 658 $3.4B ~20% $14.05 ~70K

States Stores Revenue Retail

Revenue

Average

restaurant check

Employees

4

Note: Data is for FY24. Revenue is on a 52-week basis.

Cracker Barrel by the numbers |

| Laura Daily

Chief Merchant

Mgmt Tenure: 13 years

Outstanding leadership team

Julie Masino

Chief Executive Officer

Mgmt Tenure: 1 year

Chris Edwards

Chief Strategy Officer

Mgmt Tenure: <1 year

Craig Pommells

Chief Financial Officer

Mgmt Tenure: 3 years

Cammie Spillyards-Schaefer

Chief Operations Officer

Mgmt Tenure: 3 years

Donna Roberts

Chief Human Resources Officer

Mgmt Tenure: 5 years

Mark Spurgin

Chief Restaurant Supply Chain

Officer

Mgmt Tenure: 2 years

Rich Wolfson

General Counsel & Corporate

Secretary

Mgmt Tenure: 7 years

Bruce Hoffmeister

Chief Information Officer

Mgmt Tenure: 4 years

Sarah Moore

Chief Marketing Officer

Mgmt Tenure : <1 year

5 |

| 6

REFINE THE

BRAND

ENHANCE

THE MENU

EVOLVE THE

STORE &

GUEST

EXPERIENCE

WIN IN

DIGITAL &

OFF-PREMISE

ELEVATE

THE

EMPLOYEE

EXPERIENCE

5

PILLARS

DRIVE

RELEVANCY

DELIVER FOOD &

EXPERIENCE

GUESTS LOVE

GROW

PROFITABILITY

3

IMPERATIVES

4

ENABLERS

Tech Modernization

Transformation System

Margin Optimization

Testing

Transformation framework |

| Building momentum with early wins

REFINE THE

BRAND

ENHANCE THE

MENU

EVOLVE THE

STORE & GUEST

EXPERIENCE

WIN IN DIGITAL &

OFF-PREMISE

ELEVATE THE

EMPLOYEE

EXPERIENCE

Finalize brand

positioning & platform

Completed

comprehensive retail &

restaurant guest journey

mapping

Accelerated menu

innovation

Strengthened value

proposition

Optimized pricing

delivering strong

flowthrough

600 bps YOY

improvement in Q1

dinner traffic

BOH optimization

launched to first full

region

Improvements in key

operating metrics most

correlated with SSSG

Making progress on

“defensive” investments

in maintenance capex to

bring stores to brand

standards in key areas

Completed 19 “full”

remodels and 12

“refreshes” as part of our

remodel test

6M+ Cracker Barrel

Rewards members

Cracker Barrel Rewards

delivering incremental

sales & traffic

Improvements in off-premise profitability and

guest experience

Hourly turnover improved

17 p.p. in Q1 vs. prior

year

Implemented

foundational human

capital management

system

7 |

| 8

Menu innovation wins:

Strengthening the pipeline

1) Increasing dinner preference with new craveworthy, ownable items

2) Leaning into breakfast expanding core platforms with new news

3) Upgrading product quality to ensure best-in-class core menu offerings |

| Expanding the pipeline

Pot Roast & Dumplings

9

Nashville Hot Southern

Fried Chicken

Dumpling Chips &

Skillet Dip

Breakfast Patty Melt Sausage & Egg

Hashbrown Casserole Fresh Berry Salad |

| 1Q25 financial results demonstrate progress

Q: How are the green shoots translating into financial results? [Craig]

Targeted time: ~1 minute 10

Revenue

Growth

vs. prior year Q1

Total

Revenue

$845.1M +2.6%

Comp

Restaurant

Sales

vs. prior year Q1

+2.9%

+290 bps

Comparable store sales

outperformed Black Box

Casual Dining Industry

4

Quarters of sequential

improvements in dinner traffic

“We delivered positive comp

sales performance for the 2nd

consecutive quarter, driven by

improved traffic and strong

average check growth.”

10 |

| 11

Transformation expected to deliver meaningful improvement to

financial performance

Sales:

$3.4B

FY24*

Adj.

EBITDA:

$206M

Sales:

$3.4B to

$3.5B

FY25

Guidance

Adj.

EBITDA:

$200M to

$215M

Note*: 52-week basis. Net income for FY24 was $40.9M on a 53-week basis and $35.4M on a 52-week basis.

FY27

Guidance

Sales:

$3.8B to

$3.9B

Adj.

EBITDA:

$375M to

$425M

Meaningful improvement in

2H26 & further acceleration in

FY27

11

Key Drivers to Achieve FY27 Targets

Traffic

Drivers

• Menu innovation/optimized

marketing/Cracker Barrel

Rewards

• Improved guest experience

• Remodels

Non-Traffic

Drivers

• Strategic pricing

• Cost savings and margin

optimization ($50M to $60M) |

| 12

Strategic investments will drive value-creating growth

Potential Capital Expenditures by Year

FY25 FY26 FY27

Baseline Capex $125M $125M $125M

Strategic

Investments* $35M to $55M $55M to $95M $135M to $175M

Total Capex $160M to $180M $180M to $220M $260M to $300M

*Strategic investments include two categories:

1) Growth investments such as remodels and technology

2) Defensive investments related to maintenance |

| 14 |

| Thank you!

15 |

| DENTSU CREATIVE

Non-GAAP reconciliation

16

In the accompanying presentation and the below reconciliation tables, the Company makes reference to EBITDA and adjusted EBITDA. The Company defines EBITDA as net income, calculated in accordance with GAAP, excluding

depreciation and amortization, interest expense and tax expense. The Company further adjusts EBITDA to exclude, to the extent the following items occurred during the periods presented: (i) expenses related to share-based

compensation, (ii) impairment charges and store closing costs, (iii) the proxy contest in connection with the Company’s 2024 annual meeting of shareholders, (iv) goodwill impairment charges, (v) the Company’s CEO transition, (vi)

expenses associated with the Company’s strategic transformation initiative, (vii) a corporate restructuring charge, and (viii) an employee benefits policy change. The Company believes that presentation of EBITDA and adjusted

EBITDA provides investors with an enhanced understanding of the Company's operating performance and debt leverage metrics and enhances comparability with the Company’s historical results, and that the presentation of this

non-GAAP financial measure, when combined with the primary presentation of net income, is beneficial to an investor’s complete understanding of the Company’s operating performance. This information is not intended to be

considered in isolation or as a substitute for net income prepared in accordance with GAAP. The Company is not able to reconcile the forward-looking estimate of adjusted EBITDA set forth in the accompanying presentation to a

forward-looking estimate of net income, the most directly comparable estimated measure calculated in accordance with GAAP, without unreasonable efforts because the Company is unable to predict, forecast or determine the

probable significance of certain items impacting these estimates, including interest expense, taxes, closure and impairment charges and share-based compensation, with a reasonable degree of accuracy. Accordingly, the most

directly comparable forward-looking GAAP estimate is not provided.

FY 2024 53rd Week Impact

GAAP Net Income $40,930 $5,498

(+) Depreciation & amortization 111,746 0

(+) Interest expense 20,933 402

(+) Income tax benefit (16,744) (119)

EBITDA $156,865 $5,781

Adjustments

Share-based compensation, net 5,584 0

Restructuring expenses 1,643 0

CEO transition expenses 8,574 0

Strategic transformation expenses 16,603 0

Employee benefits policy change (5,284) 0

Impairments and store closing costs 22,942 0

Goodwill impairment 4,690 0

Adjusted Reported EBITDA $211,617 $5,781

1Q25

GAAP Net Income $4,844

(+) Depreciation & amortization 29,154

(+) Interest expense 5,822

(+) Income tax benefit (3,595)

EBITDA $36,225

Adjustments

Share-based compensation, net 2,625

Strategic transformation expenses 3,298

Impairments and store closing costs 700

Proxy contest expenses 2,958

Adjusted Reported EBITDA $45,806 |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

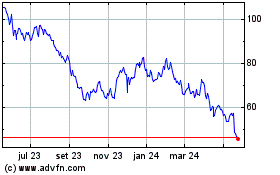

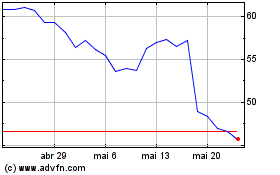

Cracker Barrel Old Count... (NASDAQ:CBRL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Cracker Barrel Old Count... (NASDAQ:CBRL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025